As the travel and leisure tech space explodes post-pandemic, two major players have emerged as benchmarks in the boat rental and chartering domain: Dream Yacht Charter and GetMyBoat. Both offer unique business models catering to distinct segments of maritime tourism and leisure, but for startup founders and app entrepreneurs, the big question in 2025 is:

“Which business model is more scalable, profitable, and startup-friendly in today’s experience-driven economy?”

With the global boat rental market projected to surpass $28 billion by 2030, choosing the right platform model is critical for app-based ventures targeting the marine and travel verticals. This comprehensive comparison dives into the inner workings, revenue mechanics, partner strategies, and market data behind Dream Yacht Charter vs GetMyBoat—giving you the insights to choose the right blueprint for your own venture.

What is Dream Yacht Charter?

Dream Yacht Charter (DYC) is one of the world’s largest yacht charter companies, founded in 2000. It offers bareboat, skippered, and fully crewed charters in over 60+ global destinations. The company owns and operates its own fleet, targeting both vacationers and sailing enthusiasts who prefer premium or bespoke sailing experiences.

Key Characteristics:

- Operates a fleet of over 900 yachts worldwide.

- Offers fractional ownership, crewed experiences, and sailing itineraries.

- Focused on end-to-end control, owning and maintaining its boats.

- Targets the luxury tourism and adventure travel audience.

What is GetMyBoat?

GetMyBoat, launched in 2013, brands itself as the “Airbnb for Boats.” It’s a peer-to-peer boat rental platform where users can find, book, or list boats—whether it’s a kayak or a luxury yacht—in 190+ countries.

Key Characteristics:

- Operates a marketplace model (does not own any boats).

- Offers all kinds of watercraft—from paddleboards to mega yachts.

- Enables instant booking, user reviews, insurance, and payment processing.

- Focused on accessibility, scalability, and mass-market reach.

Dream Yacht Charter Business Model Breakdown

Revenue Model

- Direct Rental Income: Revenue from daily/weekly charters.

- Fractional Ownership Sales: Selling boat shares to customers.

- Maintenance & Management Fees: Additional income from managing investor-owned boats.

- Premium Packages: Including skippers, crew, provisioning, and insurance.

Cost Structure

- High CapEx: Fleet acquisition and maintenance.

- Operational Expenses: Docking, staff, logistics, and destination management.

- Insurance & Compliance: Global boating regulations and liabilities.

- Marketing: Targeting high-net-worth individuals and agencies.

Key Partnerships

- Marinas & Ports

- Tour Operators

- Boat Manufacturers like Lagoon, Fountaine Pajot

- Luxury Travel Agencies

Growth Strategy

- Expanding into new sailing destinations (Asia-Pacific, South America).

- Fleet innovation with catamarans, eco-boats.

- Selling investment opportunities to aspiring boat owners.

- Partnerships with resorts and luxury lifestyle brands.

Learn More: Dream Yacht Charter App Features You Need

GetMyBoat Business Model Breakdown

Revenue Model

- Commission-Based: 8%–15% on every booking.

- Listing Fees: Some premium features for boat owners.

- Add-on Sales: Insurance, trip protection, and equipment rental.

Cost Structure

- Platform Development: Scalable tech infrastructure.

- Customer Support & Vetting: Ensuring quality and safety.

- Marketing Spend: Heavy focus on paid search and influencer content.

- Insurance Partnerships: Integrated boat insurance offers.

Key Partnerships

- Payment Providers like Stripe

- Insurance Companies

- Local Operators for supply aggregation

- Travel Aggregators (for exposure)

Growth Strategy

- Geographic expansion using localized onboarding.

- Mobile-first design for on-demand rentals.

- Partnering with tourism boards and Instagram influencers.

- AI-powered matching and smart pricing features.

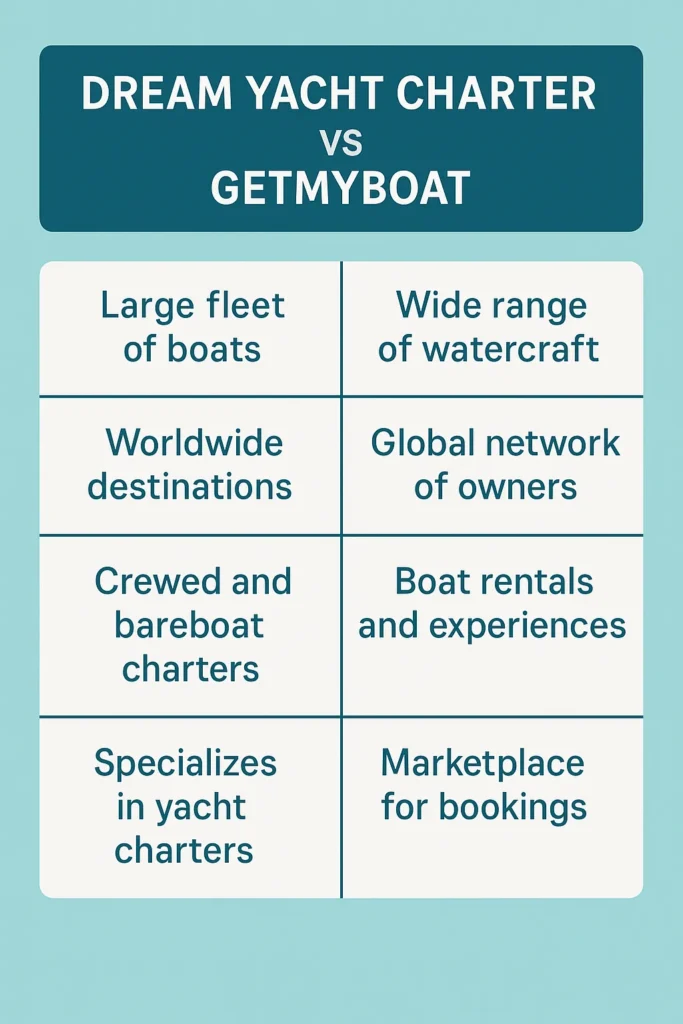

Dream Yacht Charter vs GetMyBoat – Comparison Table

| Feature | Dream Yacht Charter | GetMyBoat |

| Business Type | Asset-heavy (Fleet Ownership) | Asset-light (Marketplace Platform) |

| Revenue Model | Rentals + Ownership + Management | Commission on Peer Listings |

| Startup Costs | High CapEx and OpEx | Low CapEx, High Tech Investment |

| Scalability | Limited by fleet & operations | Highly scalable globally |

| Customer Segment | Premium/Luxury Travelers | Mass Market + Budget/Leisure Travelers |

| Geographic Reach | 60+ destinations | 190+ countries |

| Tech Infrastructure | Moderate | Advanced AI & App-first |

| Insurance & Safety | In-house & partner dependent | Integrated third-party solutions |

| Best For | Premium Travel & Fractional Models | Scalable P2P Rental Startups |

Pros & Cons of Dream Yacht Charter Model

Pros:

- Full control over customer experience.

- Predictable income streams from owned assets.

- Strong branding and high customer loyalty.

- Fractional ownership adds diversified revenue.

Cons:

- High upfront investment.

- Limited scalability.

- Operational complexity.

- Requires local licenses and compliance across regions.

Pros & Cons of GetMyBoat Model

Pros:

- Asset-light and capital efficient.

- Rapid scalability across global markets.

- Community-driven growth.

- Diverse inventory (paddleboards to yachts).

Cons:

- Quality assurance challenges.

- Dependent on third-party supply.

- Competitive landscape with low switching cost.

- Seasonal and location-sensitive demand.

Market Data: Growth, Revenue & Funding

Dream Yacht Charter

- Founded: 2000

- Fleet Size: 900+ yachts

- Revenue (Est.): $120M+ annually

- Funding: Privately funded, with ownership stake sold to NextStage AM

- Market: Dominates European and Caribbean premium charters

GetMyBoat

- Founded: 2013

- Listings: 150,000+ watercraft

- Revenue (Est.): $50M+ GMV in 2023, projected to double by 2025

- Funding: Backed by Yamaha Motor Co.

- Users: 1 million+ app downloads

Which Model Is Better for Startups in 2025?

The ideal model for your startup depends on your capital, target market, and scalability goals.

- If you’re aiming for long-term brand equity, high margins, and can handle asset management—Dream Yacht Charter’s vertically integrated model is for you.

- If you’re launching with a lean team, tech-first vision, and want to build a marketplace for boat owners and renters—GetMyBoat’s platform model offers faster global traction.

Choose Dream Yacht Charter-Style If…

- You want to own and operate a premium fleet.

- You’re targeting luxury travelers and HNIs.

- You’re building a fractional ownership model with real assets.

- You want a stable, high-ticket revenue stream.

Launch a Yacht Charter Business like Dream Yacht Charter with Miracuves

Choose GetMyBoat-Style If…

- You want to build a peer-to-peer marketplace.

- You’re focused on scalability and tech-driven growth.

- You prefer low CapEx, high automation, and user-generated supply.

- You’re entering diverse, multi-demographic global markets.

Build a Boat Rental App like GetMyBoat with Miracuves

Conclusion

Whether you lean towards asset ownership or asset-light scalability, the success of your marine startup lies in execution. At Miracuves, we help visionary founders like you build, launch, and scale charter and rental platforms with fully customizable Dream Yacht Charter clones and GetMyBoat-style apps.

With features like real-time bookings, secure payments, fleet or listing management, and geo-targeted marketing built-in, you get everything needed to navigate your startup toward success in 2025.

Let Miracuves be your growth engine on water.

FAQs

1. Which model is more profitable for bootstrapped startups?

GetMyBoat’s marketplace model is more suited for bootstrapped teams due to low upfront costs and high scalability.

2. Does Dream Yacht Charter offer a franchise or white-label model?

Not publicly. But Miracuves can help you build a clone with a similar fleet ownership & rental system.

3. Can I monetize a GetMyBoat-style app without owning boats?

Absolutely. You earn via commission, add-ons, and featured listings—without owning inventory.

4. Which model works better for tier-2 or regional tourism markets?

GetMyBoat’s decentralized model adapts better to local operators and fragmented regional markets.

5. How long does it take to build a platform like these?

With Miracuves’ ready-to-launch clones, you can go live in just 3–6 days with guaranteed delivery, regardless of features or customizations.