Fiverr-like freelance marketplaces generated over $370M+ in quarterly revenue last year, fueled by the explosive global expansion of remote work, digital outsourcing, and the rising demand for micro-services across industries. With businesses of all sizes—from startups to global enterprises—now relying on freelance talent for design, development, marketing, content, and automation tasks, online gig marketplaces have become one of the fastest-growing digital business models of the decade.

This shift isn’t temporary—it’s a structural evolution in how work gets done. Companies want flexible talent. Freelancers want global reach. Entrepreneurs want scalable digital income. A Fiverr-style platform sits right at the center of this transformation, enabling smooth transactions, standardized pricing, fast delivery, and secure payments.

For founders and platform builders, understanding this revenue model is essential. Fiverr’s success proves that you don’t need to offer services yourself to build a high-earning business—you just need to connect the right buyers and sellers. With multiple revenue layers like commissions, subscriptions, promoted gigs, payment fees, and premium tools, a Fiverr clone can quickly evolve into a highly profitable marketplace with recurring revenue and strong margins.

And with ready-to-launch solutions from Miracuves, entrepreneurs can tap into this proven business model of fiverr without spending years in development, allowing them to enter the booming freelance economy faster and more efficiently than ever.

Fiverr Clone Revenue Overview – The Big Picture

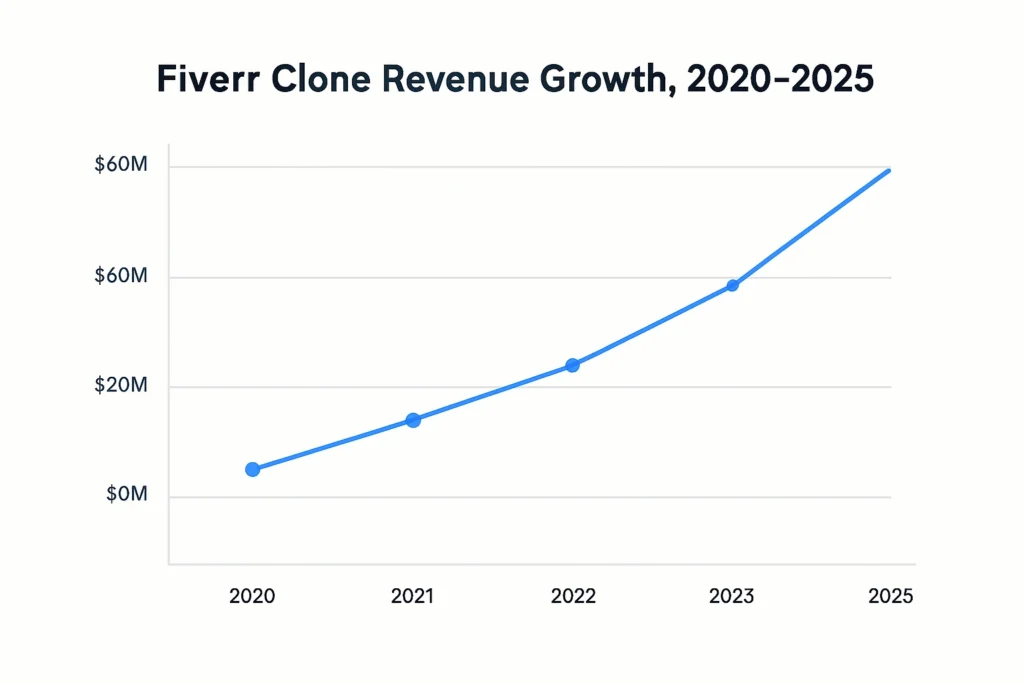

A Fiverr-style freelance marketplace operating in 2025 can generate $5M–$80M+ annually, depending on user acquisition and niche specialization.

Industry revenue snapshot (2024–2025):

• Global freelance economy: $4.3 trillion

• Fiverr annual revenue: $361M+

• YOY growth: 13%–18% in digital service marketplaces

• Top regions: North America 41%, Europe 32%, Asia-Pacific growing fastest at 24%

Profit margins: 22%–38% because marketplace models scale with minimal operational cost.

Market position vs competitors:

• Fiverr focuses on micro-gigs

• Upwork focuses on long-term projects

• Freelancer.com targets global low-cost hiring

• Fiverr clones can enter niches (design-only, AI tasks, crypto gigs, etc.) to dominate faster

Read More: Fiverr App Explained – Features, Benefits & How It Works

Primary Revenue Streams Deep Dive

Revenue Stream #1: Commissions on Transactions

The core monetization engine.

How it works:

Platform takes a percentage from seller earnings and/or buyer payments.

Percentage of total revenue:

55%–70%

Typical rates:

• Seller commission: 10%–20%

• Buyer fee: 5%–10%

• Service fee on high-value orders: 3%–5%

Example:

If your platform processes $10M GMV yearly and charges 15% → $1.5M revenue.

Revenue Stream #2: Seller Subscription Plans (Pro Accounts)

Paid plans offering more visibility and tools.

Percentage of total revenue:

10%–18%

Pricing structure:

Basic: $9/month

Pro: $29/month

Elite: $59/month

Features include analytics, lower commission, premium listing badges.

Example:

2,000 sellers on $29/month → $58,000/month.

Revenue Stream #3: Promoted Gigs / Sponsored Listings

How it works:

Sellers pay to rank higher in search or category pages.

Percentage contribution:

7%–15%

Pricing:

CPC model ($0.20–$1/click)

Daily budgets ($5–$50/day)

Real example:

Top freelancers spend $80–$200/month on ads.

Revenue Stream #4: Payment Processing Fees

How it works:

Charging a fee for secure payouts, conversions, PayPal, Stripe, etc.

Percentage:

4%–7%

Fees include:

• Withdrawal fee ($1–$3)

• Currency conversion (1%–3%)

• Instant payout charge ($2–$5)

Revenue Stream #5: Course Marketplace / Learning Hub

How it works:

Selling digital courses for freelancers.

Contribution:

2%–5%

Examples:

Skill-building, client management, AI work tutorials.

Read More: Business Model of Fiverr : Strategy Breakdown 2025

Revenue Streams Percentage Breakdown Table

| Revenue Stream | Percentage of Total Revenue |

|---|---|

| Commissions | 55%–70% |

| Seller Subscriptions | 10%–18% |

| Promoted Gigs | 7%–15% |

| Payment Fees | 4%–7% |

| Courses/Other Add-ons | 2%–5% |

The Fee Structure Explained

User-Side Fees (Buyers)

• Platform fee: 5%–10% per order

• Small-order fee: $2–$3

• Currency conversion: 1%–3%

Provider-Side Fees (Sellers)

• Commission on each sale: 10%–20%

• Withdrawal fee: $1–$3

• Subscription fee (optional): $9–$59/month

• Boosting gigs (ads): $10–$100/month

Hidden Revenue Tactics

• Priority ranking for premium users

• Instant payout charges

• Placement in trending categories

• Handling fees on dispute resolution

Regional Pricing Differences

• Developing markets: lower buyer fees

• US/EU: highest commission tolerance

• Middle East demand growing for niche freelance platforms

Complete Fee Structure Table

| User Type | Fees |

|---|---|

| Buyers | 5%–10% service fee |

| Sellers | 10%–20% commission |

| Small Orders | $2–$3 |

| Cash-out | $1–$3 |

| Promoted Gigs | CPC or daily budget |

| Subscriptions | $9–$59/month |

How a Fiverr Clone Maximizes Revenue Per User

User segmentation:

New sellers, top-rated sellers, enterprise buyers, agencies.

Upselling:

• Encourage subscriptions

• Promote high-margin categories

• Sell feature upgrades

Cross-selling:

• Courses

• Business packages

• Marketing add-ons

• Gig automation packages

Dynamic pricing:

AI-driven pricing suggestions

Peak-hour visibility boosts

Retention monetization:

• Seller ranking systems

• Faster payouts for premium plans

• Repeat buyer incentives

Lifetime value optimization:

• Platform-level messaging tools

• Client-seller relationship continuity

• Buyer credits for reorders

Psychological pricing:

• $5 starter gigs

• $19 middle-tier gigs

• Premium add-ons at $9–$29

Example:

If each seller buys just one $10 add-on per month → huge additional revenue.

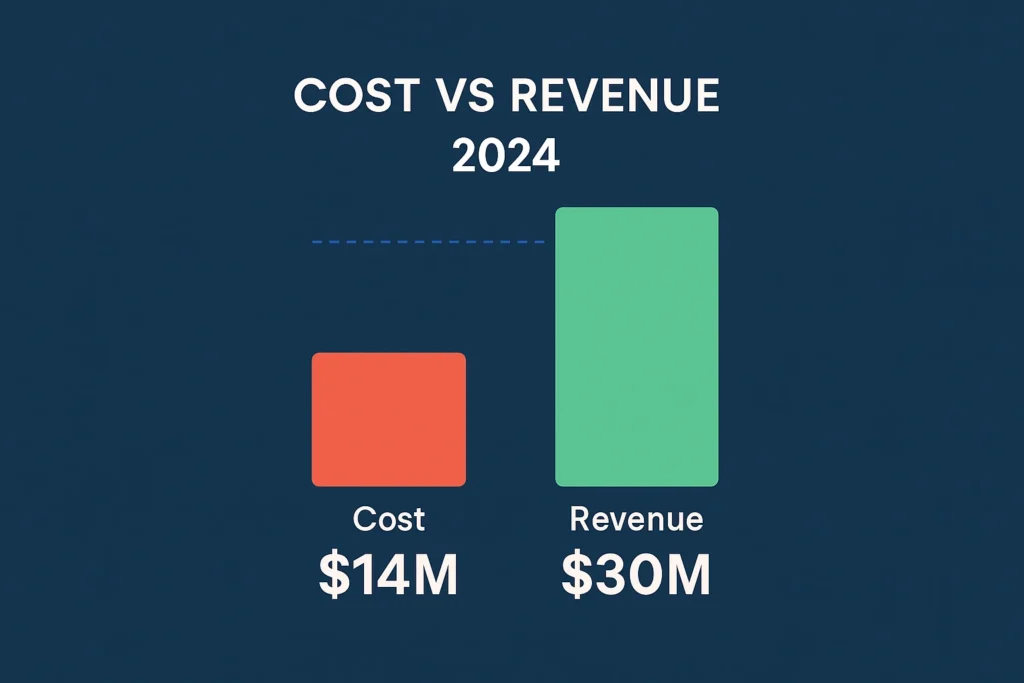

Cost Structure & Profit Margins

Major cost drivers:

• Hosting & server scaling

• AI-based search/recommendation engine

• Payment gateway integrations

• Support and moderation teams

• Marketing/CAC

• Security & compliance (fraud prevention, KYC)

Unit economics:

CAC: $8–$25

Average revenue per order: $4–$12

Payback period: 1–2 months

Path to profitability:

Commission + recurring subscriptions = strongest profit formula.

Margin enhancement strategies:

• Reduce fraud costs with automation

• Promote self-service features

• Introduce ad-based monetization

Future Revenue Opportunities & Innovations

New revenue streams emerging in 2025:

• AI-generated gigs

• AI-assisted seller tools

• Automated gig fulfillment

• B2B freelancer subscription packages

• Marketplace for pre-built digital assets

AI/ML potential:

• Personalized gig recommendations

• Dynamic commission pricing

• Risk scoring for fraud prevention

Expansion markets:

• Africa (fastest-growing freelancer adoption)

• Middle East (high demand for skilled gig work)

• South Asia (mass freelancer supply)

Emerging monetizable features:

• Pay-per-lead system

• Subscription-only job categories

• Virtual workspace collaboration

Threats:

• High competition

• Price wars

• AI replacing low-cost gigs

Why this opens opportunity:

Niche Fiverr clones outperform general marketplaces because specialized demand is skyrocketing.

Lessons for Entrepreneurs & Your Opportunity

Key takeaways:

• Commission marketplaces have unbeatable scalability

• Subscriptions add predictable recurring revenue

• Ad monetization increases seller competitiveness

• Payment fees boost margin without extra work

• Diversification through courses and add-ons increases LTV

Market gaps to exploit:

• Niche categories (AI gigs, crypto gigs, design-only, coding-only)

• Region-specific freelancer marketplaces

• Verified-pro sellers marketplace

• AI-assisted buyer–seller matchmaking

Revenue innovations possible:

• Tiered commissions

• Membership bundles

• Hybrid SaaS + marketplace model

Want to build a platform with Fiverr’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating freelance marketplaces with built-in monetization systems. Our Fiverr Clone script includes customizable revenue models, seller tools, and AI-driven features. Many clients start earning within 30 days. Get a free consultation to plan your revenue strategy.

Final Thought

A Fiverr clone can become a highly scalable marketplace business with strong recurring revenue, global reach, and minimal operating overhead—if monetized strategically with commissions, subscriptions, promoted listings, and AI-driven seller tools. The freelance economy continues to accelerate, and platforms that solve real problems for both buyers and sellers—speed, trust, affordability, and skill matching—are positioned to grow exponentially over the next several years.

With the right pricing structure, growth strategy, and value-added tools such as AI-powered gig creation, analytics dashboards, workflow automation, and instant payouts, your marketplace can achieve long-term profitability and high retention. As more businesses shift toward freelance outsourcing, the opportunity to establish a niche or regional freelance marketplace has never been stronger.

Backed by Miracuves’ ready-to-launch Fiverr Clone solution, entrepreneurs can enter the market faster, operate with lower risk, and scale with confidence. Your platform could be the next big destination for creators, businesses, and global talent—if you build it with the right vision and monetization strategy.

FAQs

1. How much does a Fiverr clone make per transaction?

Usually 10%–20% commission + buyer fee 5%–10%.

2. What’s the most profitable revenue stream?

Commissions + seller subscriptions.

3. How does its pricing compare to competitors?

It is more flexible than Upwork and Freelancer — and with Miracuves, you can build such a freelancing platform starting at just $2899.

4. What percentage does a Fiverr clone take from providers?

Typically 10%–20%.

5. How has the revenue model evolved?

Shift to subscriptions, ads, AI tools, and instant payout fees.

6. Can small platforms use similar models?

Yes—niche markets perform even better.

7. What’s the minimum scale for profitability?

5,000–7,000 monthly active users.

8. How to implement similar revenue models?

Use commission layers, subscriptions, ads, and payment fees.

9. What are alternatives to this model?

Lead-based fees, SaaS tools, or hybrid gig-subscription models.

10. How quickly can similar platforms monetize?

With Miracuves, many platforms monetize within 30 days