In 2025, the real estate tech sector is more competitive and dynamic than ever. Platforms that simplify property rental, buying, or investment are seeing skyrocketing adoption — especially among digitally-savvy millennials and Gen Z buyers and renters.

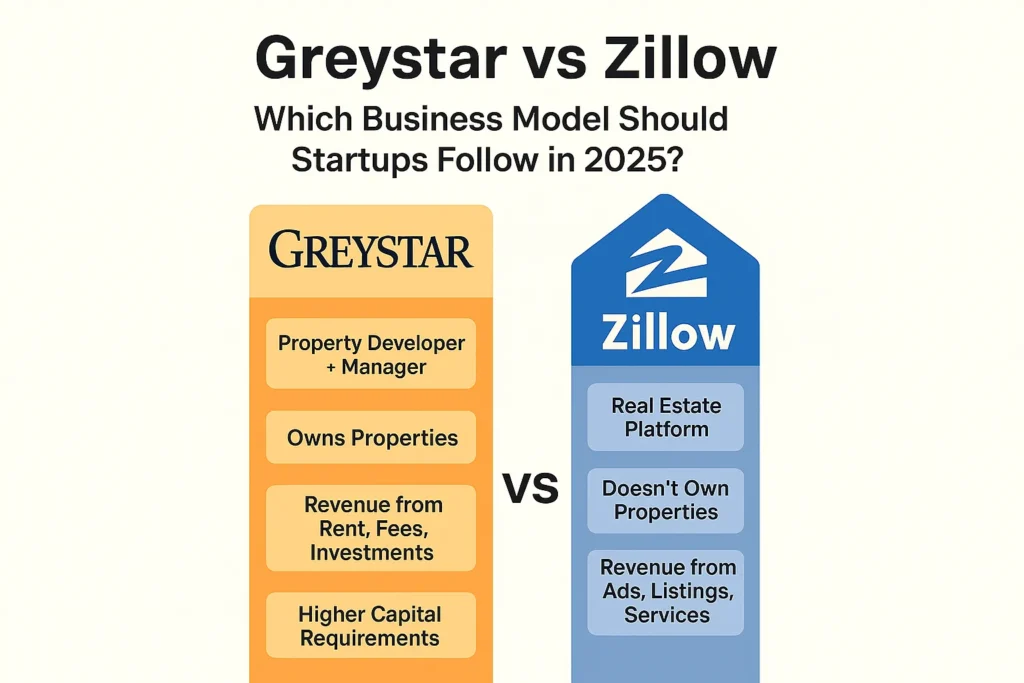

Two of the industry’s giants — Greystar and Zillow — represent radically different approaches to the same problem: making real estate more accessible, efficient, and profitable. Whether you’re building a real estate marketplace, a rental management app, or a proptech SaaS solution, understanding these models can shape your go-to-market, monetization, and scaling strategies.

This blog provides a detailed, EEAT-compliant, long-form comparison of the Greystar business model vs Zillow business model, designed specifically for startup founders and app entrepreneurs. By the end, you’ll know which model better suits your vision—and how to get started.

What is Greystar?

Greystar Real Estate Partners is a global leader in rental housing property management, development, and investment. Headquartered in the U.S., Greystar manages hundreds of thousands of multifamily units globally.

But unlike most tech platforms, Greystar owns or operates the physical real estate. Think of it as a vertically integrated rental ecosystem, covering:

- Development: Designing and building residential properties.

- Investment: Owning or co-owning real estate assets.

- Property Management: Handling everything from leasing to maintenance.

- Technology: Using proprietary tech to streamline operations.

In essence, Greystar is a hybrid of a traditional property company and a modern operational-tech firm.

What is Zillow?

Zillow Group Inc. is a leading real estate technology company best known for its U.S. property listing portal, Zillow.com. With over 200 million monthly users, it revolutionized real estate by bringing transparency to listings, prices, and agent connections.

Zillow doesn’t own properties. Instead, it monetizes its data and digital real estate. Its primary functions include:

- Property Search: Buy, rent, or sell homes via listings.

- Agent Marketplace: Connects users with real estate agents.

- Zillow Offers (sunset in 2021): Previously dabbled in iBuying.

- Zillow Home Loans: Facilitates mortgages.

- Advertising: From realtors, builders, and rental managers.

Zillow is the ultimate real estate platform-as-a-service model.

Business Model of Greystar

Revenue Streams

- Property Management Fees: Monthly fee from landlords or real estate investors.

- Rental Income: Direct income from owned or managed units.

- Development Returns: Revenue from building new multifamily communities.

- Real Estate Investment: Institutional investor partnerships.

Cost Structure

- Property Maintenance and Staffing

- Development Costs (land, construction, permits)

- Technology Development (proprietary tools for residents and staff)

- Marketing and Leasing

Key Partners

- Institutional Investors (e.g., pension funds)

- Construction firms

- City councils and real estate regulators

- Technology vendors for CRM and leasing

Growth Strategy

- Expanding into urban international markets (e.g., Europe, APAC)

- Investing in student housing and senior living

- Scaling tech platforms for property automation

- Co-investing in large development projects

Business Model of Zillow

Revenue Streams

- Premier Agent Program: Realtors pay to appear in search results.

- Display Advertising: Builders, mortgage lenders, and other services.

- Zillow Rentals: Landlords pay for promoted listings.

- Zillow Home Loans: Commissions on loan origination.

- Marketplace Services: Title, escrow, closing services.

Cost Structure

- R&D and Platform Maintenance

- User Acquisition (SEO, paid ads)

- Sales Teams (for Premier Agent)

- Customer Support and Onboarding

Key Partners

- Real estate agents and brokers

- Builders and property managers

- Mortgage lenders and banks

- Title and escrow firms

Growth Strategy

- AI-driven personalization for listings and financing

- Expanding mortgage and closing tools

- Integrating AR/VR for virtual tours

- Expanding rental marketplace features

Learn More: Business Model of Zillow : Revenue, Features & Strategy

Comparison Table: Greystar vs Zillow

| Feature | Greystar | Zillow |

|---|---|---|

| Business Type | Property Developer + Manager | Real Estate Tech Platform |

| Asset Ownership | Yes | No |

| Revenue Model | Rent, Management Fees, Investments | Ads, Agent Listings, Loans, Rentals |

| Tech Focus | Operations & Property Management | User Experience & Data Monetization |

| Target Customers | Renters, Property Owners, Investors | Renters, Buyers, Sellers, Agents |

| Geographic Presence | Global | Primarily U.S. |

| Capital Intensity | High (Real Estate Assets & Development) | Low (Digital Platform & Marketing) |

| Scalability | Slower due to physical asset dependency | High due to digital-only nature |

Pros & Cons of Greystar’s Business Model

Pros

- Predictable recurring revenue from rent

- Strong asset-backed valuation

- End-to-end control over quality and operations

- High entry barriers protect from competition

Cons

- Capital-intensive and slower to scale

- Market exposure to real estate downturns

- Lower agility in testing new tech innovations

Pros & Cons of Zillow’s Business Model

Pros

- Highly scalable and capital-light

- Diverse monetization through data and ads

- Flexible platform—can pivot faster

- Strong brand presence in U.S. market

Cons

- Relies heavily on external agents and partners

- High competition from niche listing apps

- Monetization can fluctuate with market demand

Market Data: Growth, Revenue, Funding (2025 Snapshot)

| Metric | Greystar | Zillow |

|---|---|---|

| Estimated Annual Revenue | $4.2B+ (includes rent, management, etc.) | $2.1B (ad revenue, mortgages, services) |

| Employees | 24,000+ | 5,700+ |

| Global Units Managed | 800,000+ | N/A (does not manage) |

| Active Monthly Users | 1M+ tenants | 200M+ users |

| Valuation (Est. 2025) | $18B+ | $10B+ (publicly traded) |

Which Model is Better for Startups in 2025?

Zillow’s business model is generally more startup-friendly. It requires less capital, is more scalable, and leans heavily on data, content, and network effects — all elements that tech startups can master quickly.

However, Greystar’s model is highly lucrative for entrepreneurs who have access to real estate partnerships or want to build a tech-enabled property management empire.

Ideal Business Model Depends On:

| Startup Goal | Suggested Model |

|---|---|

| Build a SaaS/Marketplace | Zillow-style |

| Invest in & manage properties | Greystar-style |

| Monetize data/traffic | Zillow-style |

| Build long-term passive income | Greystar-style |

Choose Greystar-style if…

- You’re targeting urban rentals, student housing, or luxury apartments.

- You want long-term control and stable recurring income.

- You have access to capital or partnerships in real estate development.

Launch Your Greystar-Style Platform with Our Clone Solution

Choose Zillow-style if…

- You’re building a real estate tech startup, marketplace, or listing aggregator.

- You prefer a lean, scalable platform with advertising, SaaS, or transaction revenue.

- You want to operate without owning real estate assets.

Launch Your Zillow-Style Platform with Our Clone Solution

Conclusion

Whether you’re leaning toward Greystar’s operational empire or Zillow’s tech-first platform, one thing’s certain the real estate space in 2025 is ripe for innovation.

At Miracuves, we specialize in clone app development, MVPs, and custom solutions for real estate entrepreneurs. From rental marketplaces to agent tools and property management systems, we can bring your vision to life — faster, better, and at scale.

FAQs

1. What is the key difference between Greystar and Zillow’s business models?

Greystar owns and manages properties, while Zillow monetizes digital listings and services without owning real estate.

2. Is Greystar’s model suitable for tech startups?

Not directly — it’s capital intensive. However, tech startups can build tools or SaaS platforms that support similar operations.

3. Can I build a Zillow-style platform without agent partners?

Yes, but agent participation enhances monetization. Many startups begin with landlord listings or FSBO (For Sale By Owner) features.

4. Which model scales faster globally?

Zillow’s model is faster to scale due to its digital nature and low capital requirements.

5. Does Miracuves offer ready-made clone solutions?

Yes. Miracuves offers Zillow clone and Greystar clone solutions tailored for real estate tech entrepreneurs.