Cryptocurrencies are no longer fringe tech—they’re a financial revolution. And in 2025, peer-to-peer (P2P) crypto marketplaces are redefining how we trade digital assets. Why? Because users want freedom, control, and privacy—something traditional centralized exchanges often struggle to offer.

Whether you’re an entrepreneur chasing the next big fintech disruptor or a startup founder exploring Web3 ventures, the time to build a P2P crypto marketplace is now. These platforms are more than trading hubs—they’re ecosystems of trustless transactions, borderless payments, and community-driven liquidity.

I remember using a P2P crypto app in early 2021—clunky, full of KYC hassles, and poor UX. Fast-forward to now? Platforms like Paxful, LocalBitcoins, and Binance P2P have leveled up big time. But there’s still room to innovate, especially with region-specific models, niche tokens, and lightning-fast onboarding.

In this blog, I’ll break down everything you need to know—from architecture to features, tech stacks to monetization models. Whether you’re hiring devs or DIY-ing with a no-code stack, this guide’s got your back.

What is a P2P Cryptocurrency Marketplace?

A P2P crypto marketplace is a platform where users buy or sell cryptocurrencies directly with each other, without a centralized intermediary. The platform facilitates:

- Trade matching

- Dispute resolution

- Escrow management

- Wallet integration

Think of it like OLX meets crypto trading—the app provides the infrastructure, but the transaction happens between users.

Read more: How to Start a P2P Crypto Exchange Platform Business

Step-by-Step Development Process

1. Market Research and Target Audience

Before jumping into design or tech, know your battlefield:

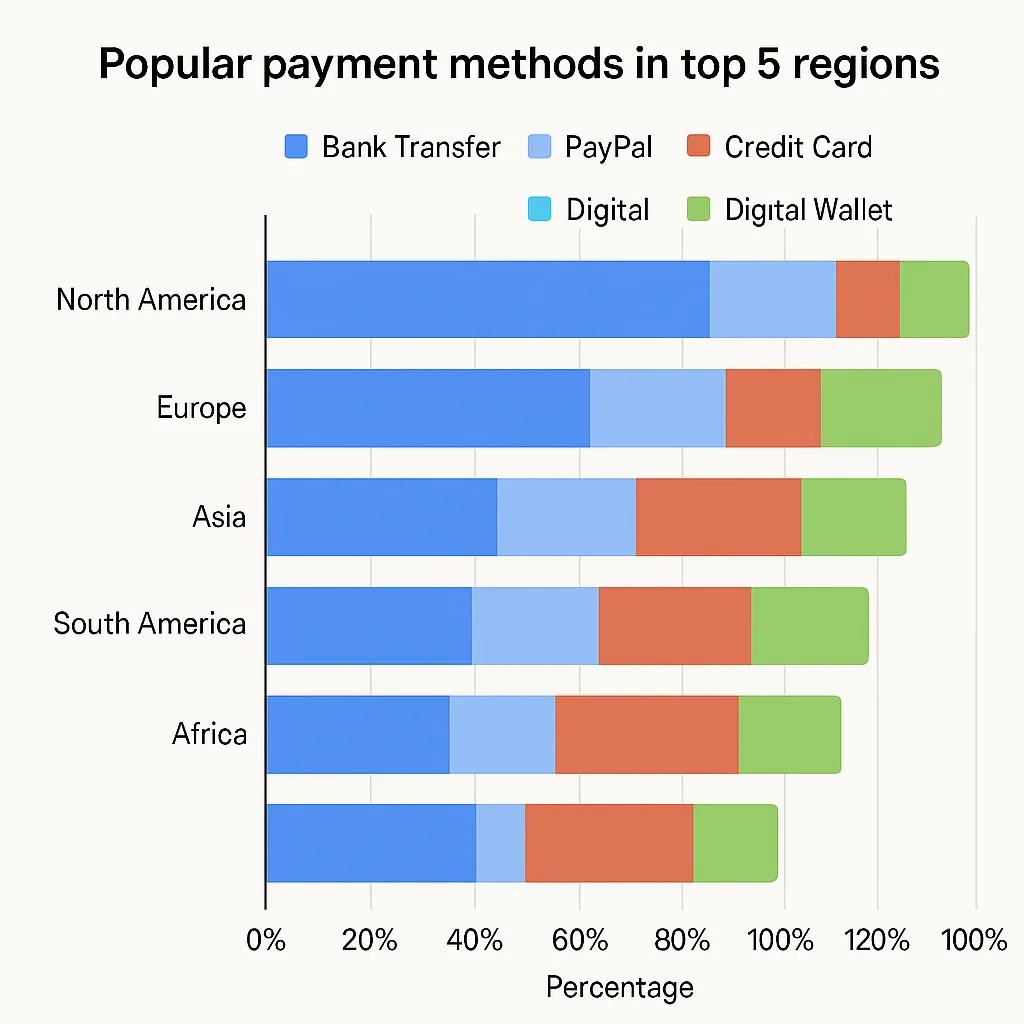

- Are you targeting emerging markets like India, Africa, or LATAM?

- Will you focus on Bitcoin-only, or multi-token support?

- Are your users seasoned traders or crypto newbies?

2. Define Core Features

Here’s what your MVP should include:

User Panel

- Registration/login (email/2FA)

- KYC/AML verification

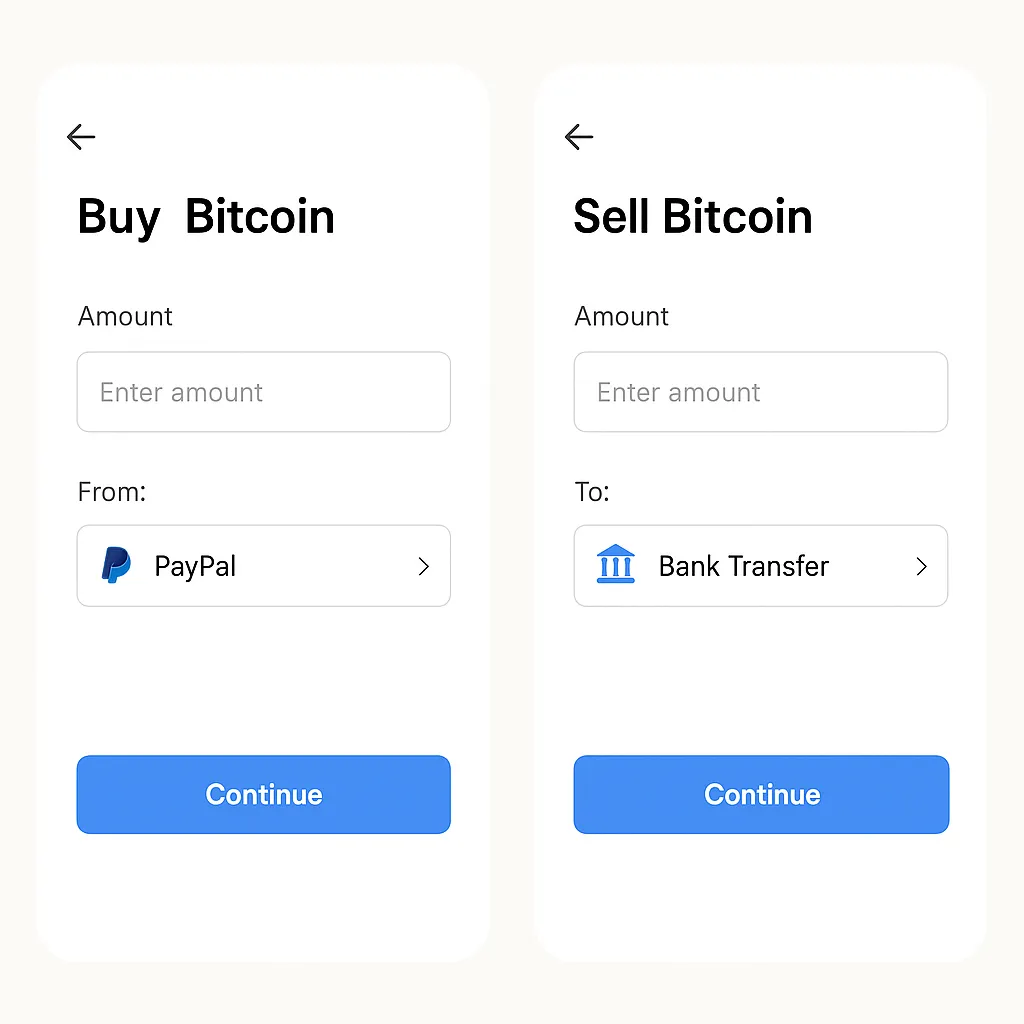

- Buy/sell dashboard

- Wallet integration

- Order history

- Ratings and reviews

Admin Panel

- User management

- Dispute handling

- Fee control

- Transaction monitoring

Advanced Features (Post-MVP)

- AI-based fraud detection

- Escrow smart contracts

- Chat between buyers/sellers

- Multi-language/localization

- Referral rewards

3. Choose the Right Blockchain and Token Support

You’re not building a new blockchain (unless you want to). But you must integrate blockchain services to:

- Validate transactions

- Store trading records

- Power escrow mechanisms

Popular integrations:

- Ethereum (for ERC20 tokens)

- Binance Smart Chain

- Polygon

- Bitcoin Lightning Network

Use blockchain APIs like Infura, Alchemy, or QuickNode for smooth node connectivity.

4. Design the UI/UX for Trust and Speed

Your UI needs to scream security and speed. Here’s how:

- Use a clean, minimal trading dashboard

- Display real-time exchange rates

- Add trust indicators (rating, last seen, successful trades)

- Use color-coding for buy/sell offers

Don’t underestimate dark mode—it’s practically mandatory for crypto apps.

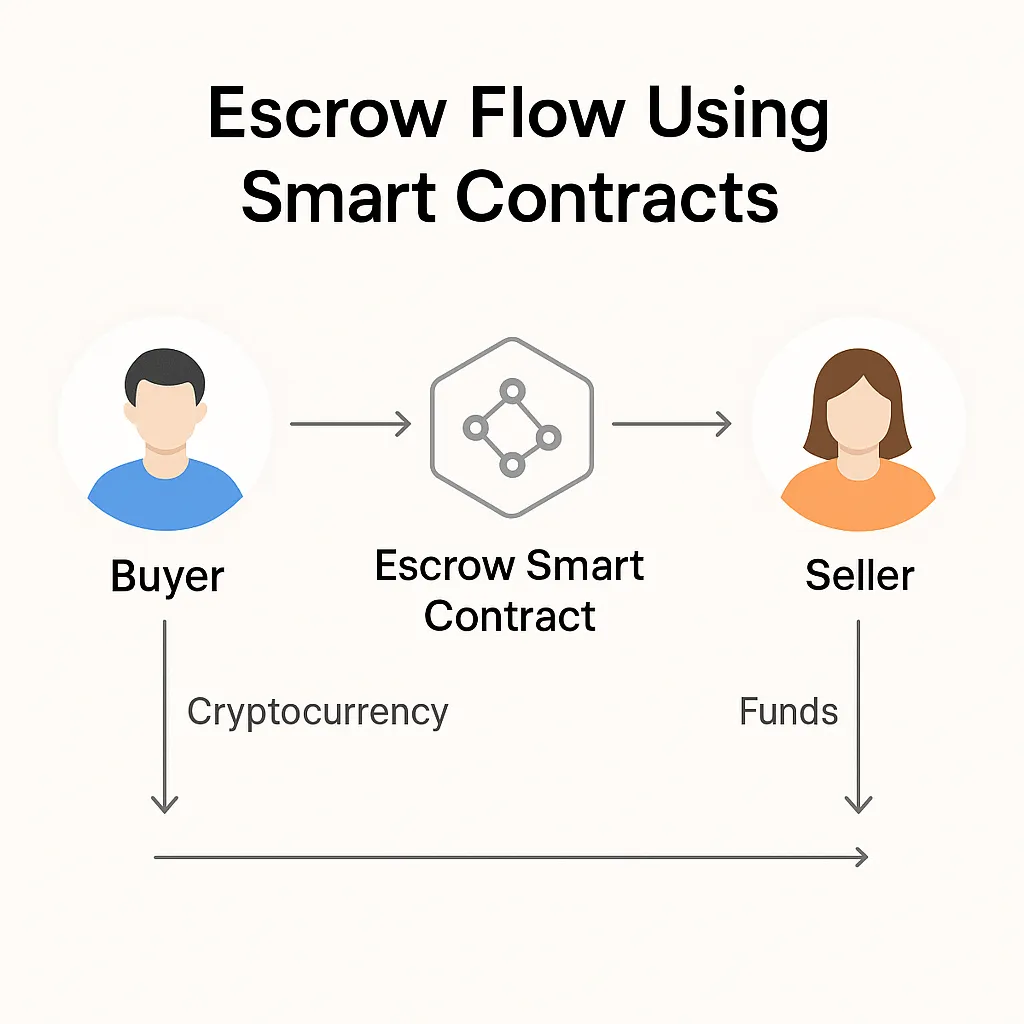

5. Escrow & Smart Contract Logic

This is the heartbeat of your platform. Escrow protects both parties.

Here’s how it works:

- Buyer places order → crypto locked in escrow.

- Seller confirms payment received.

- Platform releases crypto to buyer.

For true decentralization, smart contracts handle this logic. If not, a centralized escrow module (like in early Paxful) still works for MVPs.

6. Authentication & Security Protocols

Crypto apps are hacker magnets. Here’s what to bake in from Day 1:

- Two-Factor Authentication (2FA)

- Biometric login (optional)

- End-to-end encryption (E2EE)

- Cold/hot wallet separation

- Rate limiting & anti-DDoS layers

7. Payment Gateways and Fiat Support

Even in P2P, people trade fiat.

Common payment methods:

- UPI / Paytm (India)

- Bank transfers

- PayPal / Skrill / Revolut

- Cash-in-person (yes, it still happens)

Integrate payment confirmation triggers to validate receipt before releasing escrow.

8. Build or Buy? Tech Stack Options

Custom Development

Backend: Node.js / Python (Django/Flask)

Frontend: React / Vue.js

Database: PostgreSQL, MongoDB

Blockchain: Ethereum SDK, Web3.js, Bitcoin Core

Mobile: Flutter / React Native

White-label Solutions

If speed > control, consider platforms like:

- HollaEx

- ChainBits

- Miracuves P2P Exchange Script

9. Legal Compliance (Don’t Skip This)

Even decentralized platforms need to play by rules.

- Follow KYC/AML protocols (Integrate with Onfido, Jumio, etc.)

- Add Terms of Service, Privacy Policy, Refund Policy

- Secure licenses depending on jurisdiction (FCA UK, FinCEN US, etc.)

10. Monetization Models

You’re not building this for charity. Here’s how to monetize:

- Trading fee: 0.5% – 1% per transaction

- Premium account perks: Faster listing, higher visibility

- Ad placements: Feature top traders

- Escrow fee

- Affiliate/referral bonuses

Read more: How to Market a P2P Cryptocurrency Marketplace App Successfully After Launch

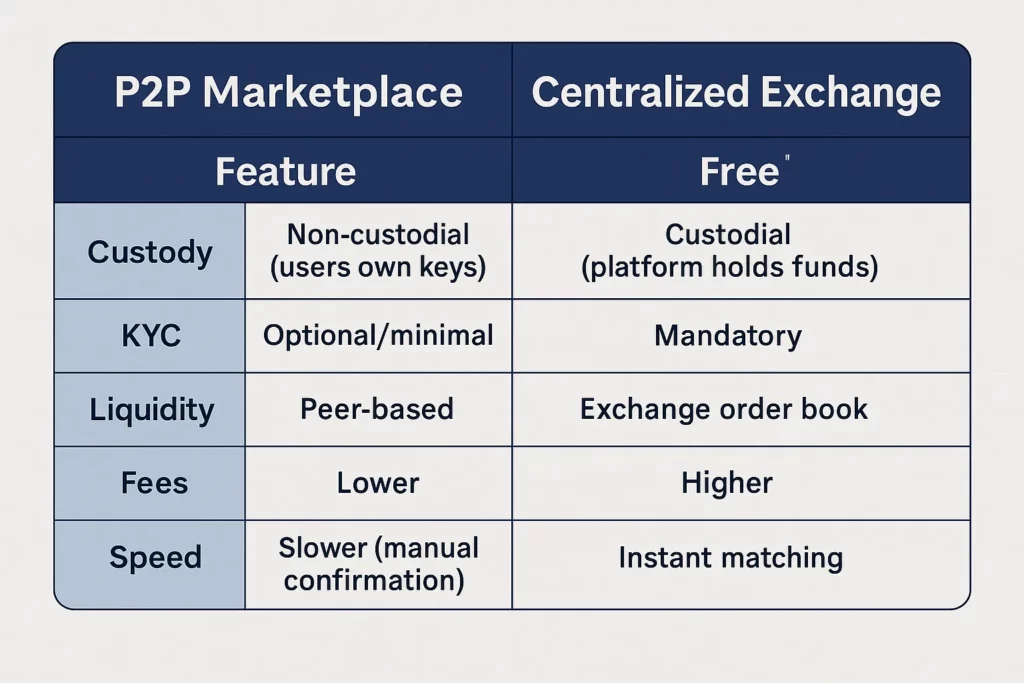

How P2P Platforms Differ From Centralized Exchanges

| Feature | P2P Marketplace | Centralized Exchange |

| Custody | Non-custodial (users own keys) | Custodial (platform holds funds) |

| KYC | Optional/minimal | Mandatory |

| Liquidity | Peer-based | Exchange order book |

| Fees | Lower | Higher |

| Speed | Slower (manual confirmation) | Instant matching |

Challenges You Should Prepare For

- Scams & fake payment proofs

- Poor dispute handling

- Low initial liquidity

- High friction onboarding (especially with KYC)

- Regulatory uncertainty

You’ll need a tight community + transparent support system to build long-term trust.

Discover our end-to-end cryptocurrency development solutions tailored for launching secure and scalable blockchain platforms.

Conclusion:

Developing a P2P cryptocurrency marketplace app in 2025 isn’t just about hopping on a trend. It’s about redefining how financial freedom looks, especially in emerging economies. With the right strategy, tech stack, and user-first approach, your platform could become a go-to for thousands (or millions) of crypto traders globally.

Whether you’re coding from scratch or customizing a script, the goal is the same: secure, simple, self-sovereign crypto trading.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs:

Q1: How long does it take to build a P2P crypto app?

An MVP takes around 3–5 months depending on features. Using white-label solutions can cut this down to 4–6 weeks.

Q2: Do I need a license to run a crypto exchange in India?

India lacks clear regulations, but staying RBI-compliant, collecting PAN/Aadhaar, and tax reporting is crucial.

Q3: Which payment methods should I support?

UPI, IMPS, NEFT, and wallets like Paytm are popular in India. Globally, consider Revolut, PayPal, and Wise.

Q4: Can I add NFTs later to a P2P platform?

Absolutely. If built modularly, you can integrate NFT buying/selling using standards like ERC-721 or ERC-1155.

Q5: Is it profitable to run a P2P platform?

Yes, with high-volume trading and low overhead, platforms can be very profitable, especially in underserved regions.

Q6: What’s better—custom or white-label development?

Custom is great for scalability and uniqueness. White-label is ideal if speed and lower cost are your top priorities.

Realted Articles: