Let’s cut to the chase—if you’ve been flirting with the idea of launching a neobank app, you’ve probably wondered: “Is this going to burn a hole in my pocket?” The truth? It depends. I’ve seen startups blow six figures before they even find product-market fit, while some bootstrapped founders manage to hack together MVPs for a fraction of the cost. It’s like shopping for a car—sure, you can go for the flashy sports model, but do you need it, or is a reliable sedan good enough for now?

The rise of neobanks isn’t a fluke. It’s a byproduct of the mobile-first, on-the-go generation that’s tired of clunky banking apps and outdated services. From freelancers juggling side gigs to Gen Z creators building personal brands, everyone craves faster payments, simpler interfaces, and that elusive “wow” factor. And yes, there’s money in it—Statista predicts the neobank market could hit $722 billion by 2028. That’s no small change.

But here’s the kicker: while the opportunities are vast, so are the challenges. From compliance headaches to UI design snags, the development journey isn’t always smooth sailing. At Miracuves, we’ve been in the trenches, helping startups and creators build lean, mean, fintech machines that don’t just look good but work. Let’s break down the real costs, the hidden traps, and how to stretch your budget without cutting corners.

Read more: What is a Neobank App and How Does It Work?

Why Are Neobank Apps So Popular? The Market’s Shiny New Toy

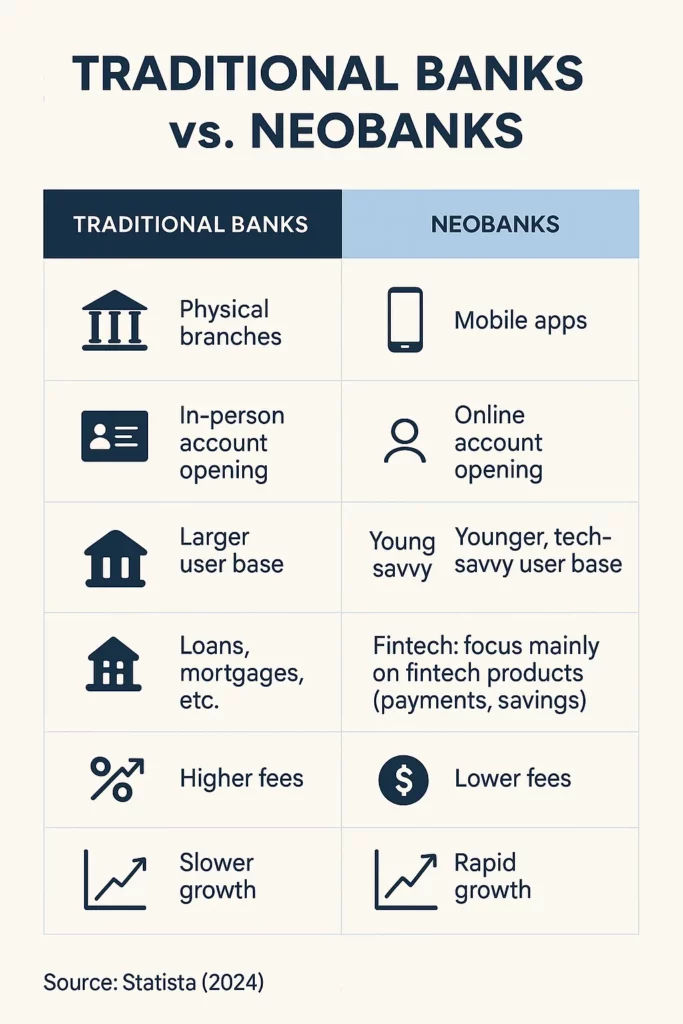

Let’s face it—traditional banks are like your grandpa’s rotary phone in a world of iPhones. People want instant transfers, savings insights, and even AI-driven spending tips—and they want it yesterday. That’s where neobanks shine: they blend financial services with slick, mobile-first design, ditching the brick-and-mortar legacy.

Think Monzo, Revolut, N26—these aren’t just apps; they’re experiences. They simplify banking, gamify saving, and often throw in goodies like cashback rewards or budgeting tools. The trick is: building a neobank isn’t just about slapping together a payments gateway. It’s about creating an ecosystem of features—like KYC, account management, analytics, and even crypto integrations.

How Much Does It Really Cost to Develop a Neobank App?

Ah, the million-dollar question (sometimes literally). The cost of building a neobank app can swing wildly depending on your approach. Let’s break it down:

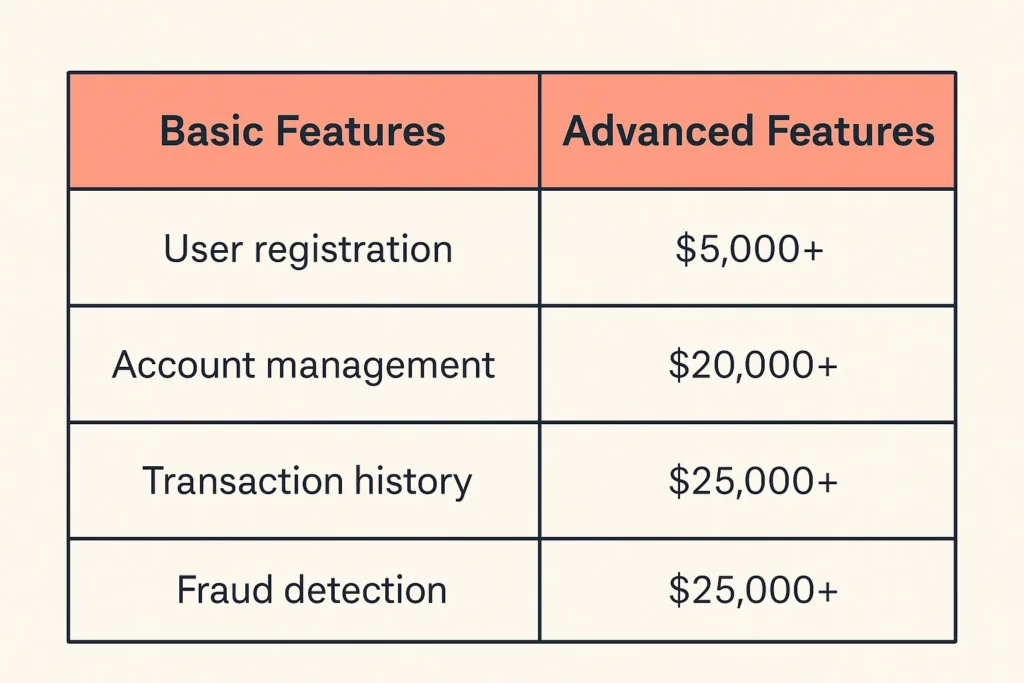

1. Core Features—What You Can’t Skip

Your MVP (Minimum Viable Product) should include:

- User registration & KYC onboarding (regulations, remember?)

- Digital wallets & payment gateways (Stripe, Razorpay, etc.)

- Transaction history & analytics dashboards

- Security & compliance layers (think PCI-DSS, GDPR)

- In-app notifications & support chat

Just these essentials can set you back $40,000–$80,000 if done right. Add AI features like expense categorization or fraud detection? You’re looking at an extra $10,000–$20,000.

Read more: Must-Have Features in a Neobank Clone App

2. Design & User Experience—Looks Matter

Let’s be honest—no one wants to bank on an ugly app. A smooth UX with intuitive flows can make or break user retention. A well-designed interface, tailored for smartphones, costs anywhere from $8,000–$15,000. Want custom animations, seamless transitions, or that buttery-smooth swipe? That’ll add up.

3. Backend Development & APIs—The Engine Room

Neobank apps aren’t just pretty faces; they’re powered by complex APIs, third-party integrations, and server infrastructure. This part’s non-negotiable and often the priciest chunk, ranging from $50,000–$120,000, depending on:

- Your tech stack (Flutter? React Native? Kotlin?)

- Cloud hosting (AWS, GCP, or Azure)

- The number of external services you plug in (Plaid, Twilio, etc.)

4. Compliance & Security—Not Optional

This is the part many underestimate. Building a neobank means dealing with financial regulations, KYC/AML compliance, and data privacy laws. Budget at least $10,000–$25,000 just for legal, audit, and security expenses.

CB Insights on neobank regulatory challenges: Read More

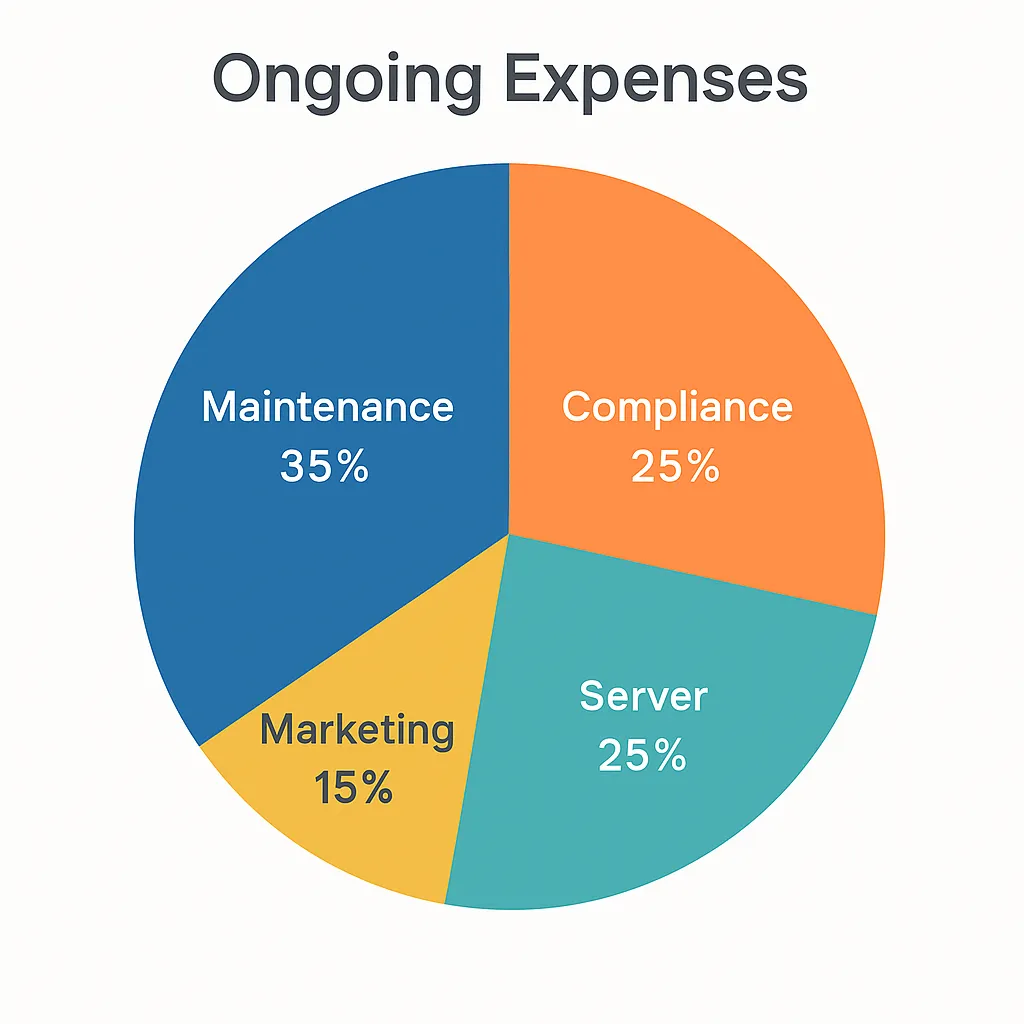

5. Ongoing Costs—The Hidden Monsters

Even after launch, there’s no coasting. Expect monthly server costs, security audits, feature updates, and customer support expenses to bite into your budget. A good rule of thumb? Set aside 15–20% of initial development costs per year for maintenance.

Can You Build a Neobank App on a Budget?

Absolutely—but it’s all about prioritizing. Don’t get caught up in shiny features you don’t need at launch. Focus on a lean MVP, test your market, and scale features once you know what users actually want. Remember: Moj didn’t start with filters; they added those once they had traction.

At Miracuves, we’ve helped clients build cost-effective neobank clones that punch above their weight—without breaking the bank. Whether you’re eyeing a full-featured platform or a sleek MVP, we tailor solutions that match your go-to-market strategy.

Want to see how we helped others? Check out our Clone App Development.

Read more: Reasons startup choose our neobank clone over custom development

Final Thoughts

Building a neobank app isn’t cheap—but it’s also not a luxury reserved for the deep-pocketed few. By understanding the real costs, making smart choices, and working with the right partner, you can build a neobank that’s lean, user-focused, and ready to disrupt the market.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 How long does it take to develop a neobank app?

On average, building a solid neobank MVP takes 4–6 months, depending on complexity and compliance hurdles.

Q:2 Do I need a license to launch a neobank?

Yes. In most countries, you’ll need a banking or EMI license. This is a critical part of your go-to-market plan.

Q:3 Can I start small and add features later?

Absolutely. Many successful neobanks launch with a core feature set and expand based on user feedback.

Q:4 Is it better to build from scratch or use a white-label solution?

If speed is your goal, white-label is a great option. For a fully customized, unique brand, building from scratch makes sense.

Q:5 What are the hidden costs in neobank development?

Compliance, third-party integrations, and ongoing maintenance costs often catch founders off guard. Always budget for the unexpected.

Q:6 Can Miracuves help with compliance and legal support?

While we’re not a legal firm, we partner with experts who can guide you through KYC, AML, and data privacy requirements during development.

Related Articles: