Banking is no longer about long queues, complicated paperwork, and that one pen tied to the counter. It’s about slick mobile apps, instant transfers, real-time insights—and most importantly, freedom from the old system. Enter neobanks. And if you’re thinking of launching one, you’re not alone.

2026 is shaping up to be a breakout year for digital-only banks. But building your own Revolut or N26-style app from the ground up? That’s a mountain of compliance, tech, and UX hurdles. The good news? You don’t have to reinvent the fintech wheel. A neobank clone script can help you go live fast—with all the modern bells and whistles users expect.

At Miracuves, we help ambitious fintech founders get to market without blowing their runway on engineering sprints. If launching a digital bank is your goal this year, this post will help you find the best neobank clone script to do it right—without missing your window.

What is a Neobank Clone Script?

A neobank clone script is a ready-made digital banking platform modeled after successful players like Revolut, Monzo, or N26. It allows you to launch a fully functional, mobile-first bank without building the infrastructure from scratch.

It typically includes:

- KYC-compliant onboarding

- Virtual and physical card management

- Peer-to-peer payments

- Spending analytics and budgeting tools

- Currency exchange and multi-currency wallets

- API integrations with banking partners

It’s like plugging your business idea into a fintech engine that already works. Just add branding, customize features, and launch.

Read More : Neobank App Features List: What Every Modern Digital Bank Must Have

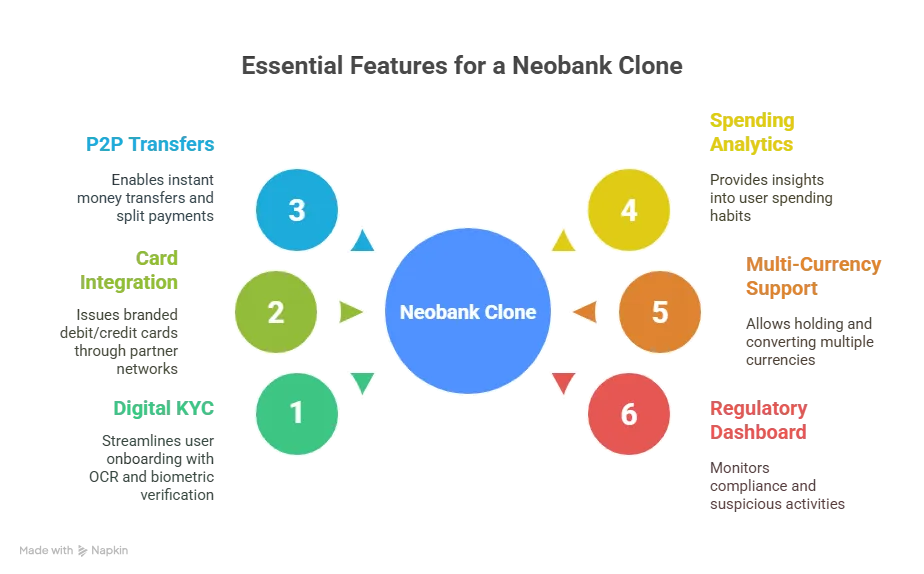

Must-Have Features in a Neobank Clone (2026 Edition)

If you’re going to compete in this digital-first, regulation-heavy space, your clone script has to be world-class out of the box.

1. Digital KYC with OCR and Face Verification

Frictionless onboarding is table stakes. Integrate OCR document scanning and biometric verification for instant account creation.

2. Virtual & Physical Card Integration

Issue branded debit/credit cards through partner banks or card networks like Visa, Mastercard, or local players.

3. P2P Transfers & Split Payments

Let users transfer money instantly, request payments, and split bills in-app with social UX.

4. Smart Spending Analytics

Pie charts, category tagging, expense alerts, and savings nudges help users manage their money better—and keep using your app.

5. Multi-Currency & FX Tools

Support for holding and converting multiple currencies is crucial for travelers and freelancers.

6. Regulatory Dashboard for Admins

Admins need to monitor KYC compliance, suspicious activity, user limits, and audit trails—all in one place.

Read More : Neobank App Marketing Strategy: How to Build Buzz and Bank Big

Cost Factors & Pricing Breakdown

Neobank-Style Digital Banking Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Neobank MVP | KYC onboarding, single-currency account, basic card support, P2P transfers, simple FX (if any), notifications, basic admin & compliance panel | $60,000 |

| 2. Full-Feature Neobank Platform | Multi-currency accounts, advanced KYC/AML, savings vaults, budgeting tools, bill payments, virtual & physical cards, fee engine, referral rewards, dispute management, multi-role admin & compliance dashboards | $150,000 |

| 3. Enterprise-Grade Digital Banking Ecosystem | Multi-region licensing-ready architecture, partner APIs, white-label programs, multi-entity support, treasury tools, liquidity & risk engines, audit trails, real-time analytics, high-availability cloud infra | $300,000+ |

These prices reflect the global development cost of building a Neobank-style digital banking platform — including regulated onboarding flows, secure payment processing, multi-currency wallet logic, card issuing, and scalable financial infrastructure.

Miracuves Pricing for a Neobank-Style Platform

Miracuves Price: Starts at $21,999

Miracuves provides a ready-to-launch Neobank-style digital banking solution featuring KYC onboarding, multi-currency wallet options, P2P transfers, card management, fee & limits engine, user analytics, and powerful admin/compliance panels — all built on a stable, high-performance PHP architecture.

Note

This package includes full non-encrypted source code, backend/API setup, admin panel configuration, deployment assistance, and web/mobile builds — giving you a complete digital banking ecosystem ready to go live.

Launch your Neobank-style platform with Miracuves and go live in days instead of months.

Delivery Timeline for a Neobank-Like Platform with Miracuves

Estimated deployment timeline: 3–9 days, depending on:

- KYC flows, verification tiers, and approval rules

- Wallet structure, currency support, and FX logic

- Card issuing, spending limits, and security features

- Pricing, fees, and revenue model configuration

- Branding, UI personalization, and mobile app scope

Tech Stack

Built using PHP + MySQL with secure APIs and modular services — enabling reliable transactions, scalable account management, real-time notifications, and optimized performance for modern digital-only banking use cases.

Build vs. Buy: Should You Use a Clone Script?

Let’s cut through the romanticism of building from scratch. In banking, every delay equals lost trust and rising costs.

| Factor | Build from Scratch | Clone Script (Miracuves) |

|---|---|---|

| Time to Market | 12–18 months | 3–9 days |

| Development Cost | $150,000+ | $21999 |

| Regulatory Headaches | All yours | Mitigated via modules |

| Tested UI/UX | Needs design work | Pre-built and optimized |

| Ongoing Maintenance | Dev team needed | Covered by provider |

Read More : Neobank vs Binance Business Model | Guide for Startup Founders

Trends in Digital Banking for 2026

- Embedded finance is letting platforms offer banking services within e-commerce or ride-hailing apps.

- Open banking APIs are enabling smarter integrations across industries.

- AI-based fraud detection is the new standard for user safety.

- Sustainable banking is becoming a value proposition—think carbon tracking per transaction.

Your clone script must support these trends if you want to scale or attract investor interest.

Source:

TechCrunch – The Future of Neobanks

Conclusion

Launching a digital bank may sound intimidating—but with the right tools, it doesn’t have to be. A powerful, compliant, user-friendly neobank clone script can get you to market fast and give users the financial freedom they’re looking for.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Still have questions about neobank clone scripts? Let’s clear them up.

Can I legally launch a neobank with a clone script?

Yes, but you’ll still need banking partnerships, licenses, and compliance approval in your operating region.

How secure is the Miracuves clone?

We follow PCI DSS standards, use end-to-end encryption, and offer 2FA, biometric login, and anti-fraud AI.

Can I issue my own debit or credit cards?

Yes. We integrate with third-party providers so you can issue branded cards to your users.

What about compliance and KYC?

We provide built-in KYC, AML, and audit trail modules so you can stay aligned with local regulations.

Is multi-currency support included?

Absolutely. Users can hold, send, and convert currencies in-app, with transparent exchange rates.

How long does it take to launch?

With Miracuves, you can go live in 3–9 days depending on custom features and integrations.

Related Articles