In 2025, the decentralized fundraising landscape is thriving more than ever. With the continued rise of Web3 projects, DeFi protocols, and token-based ecosystems, launchpads like Pinksale and BSCpad have become the cornerstone for blockchain startups seeking to raise capital and build communities.

As a startup founder or app entrepreneur, choosing the right launchpad model is critical to your platform’s success. Should you go with Pinksale’s permissionless, community-centric launch model, or adopt BSCpad’s tier-based, vetted investment ecosystem?

This blog offers a comprehensive, EEAT-compliant breakdown of the Pinksale vs BSCpad business model, helping you determine which approach aligns best with your product vision, revenue goals, and operational strategy in 2025.

Let’s explore how each model works and how you can replicate them with powerful white-label solutions like those offered by Miracuves.

What is Pinksale?

Pinksale is a decentralized launchpad and IDO (Initial DEX Offering) platform built on multiple chains like BNB Chain, Ethereum, Polygon, and more. pinksale allows any project to launch a token and conduct a presale without coding, and with minimal KYC requirements.

Key Highlights:

- No-code token creation and presale tools

- Integrated liquidity locking, token vesting, and audit services

- Highly permissionless model

- Runs on multi-chain networks

- Used by thousands of projects for fast fundraising

What is BSCpad?

BSCpad is a tier-based, decentralized IDO platform originally designed for projects launching on the Binance Smart Chain. Unlike Pinksale, BSCpad focuses on vetting projects, ensuring KYC compliance, and rewarding long-term token holders with guaranteed allocations.

Key Highlights:

- Tiered token staking system to access IDOs

- Focus on quality control and investor protection

- Projects are screened and vetted by the platform

- Offers guaranteed allocations based on staking tier

- Backed by a strong community of retail and institutional investors

Business Model of Pinksale

Pinksale operates as a decentralized self-service launchpad. It monetizes by charging small fees on the token presale process, offering premium tools, and building an ecosystem around launch services.

Revenue Streams:

- Presale Fees (BNB, ETH, etc. — percentage of raised amount)

- Token Listing Fees (for DEX listings via integrated tools)

- Service Fees for audits, KYC, liquidity locks

- Premium Presale Spots and promotion services

- NFT Launchpad and DAO participation tools

Cost Structure:

- Smart contract maintenance and multi-chain integration

- Platform development and security audits

- DAO governance and community rewards

- Infrastructure for liquidity locking, vesting, and automation

- Marketing and developer relations

Key Partners:

- Blockchain networks (BNB Chain, ETH, AVAX)

- KYC and audit providers (like SolidProof)

- DEXs like PancakeSwap for liquidity provisioning

- Wallet providers (MetaMask, Trust Wallet)

Growth Strategy:

- Expand support to emerging chains (zkSync, Base, Linea)

- Launch Pinksale Pro for more serious projects

- Promote NFT presales and DAO fundraising

- Integrate AI tools for tokenomics validation

Learn More: Business Model of PinkSale : Launchpad Earns Millions

Business Model of BSCpad

BSCpad uses a tiered token staking model to create a gated but curated IDO platform. It focuses on quality over quantity, monetizing via platform fees, token value appreciation, and deal access.

Revenue Streams:

- Platform Fees on successful fundraises (in BNB, USDT, etc.)

- Staking Rewards and deflationary mechanics via BSCPAD token

- Project Onboarding & Advisory Fees

- Premium Deal Flow for VC Partners

- Cross-chain launch support and bridging tools

Cost Structure:

- Smart contract audits and chain integrations

- Team operations and legal compliance (especially KYC)

- Project evaluation and listing processes

- Community incentivization and staking rewards

- Partner management and business development

Key Partners:

- BNB Chain, Ethereum, and other supported L1s

- Venture capital funds and incubators

- Legal and compliance service providers

- Exchanges and market makers for post-IDO listing

- Cross-chain bridges and on-ramp services

Growth Strategy:

- Expand into Regulated IDOs and Launch-as-a-Service

- Build cross-chain allocation pools

- Launch a Web3 fund incubator

- Increase staking utility and introduce new token tiers

Learn More: Business Model of BSCPad: Crypto Launchpad Explained

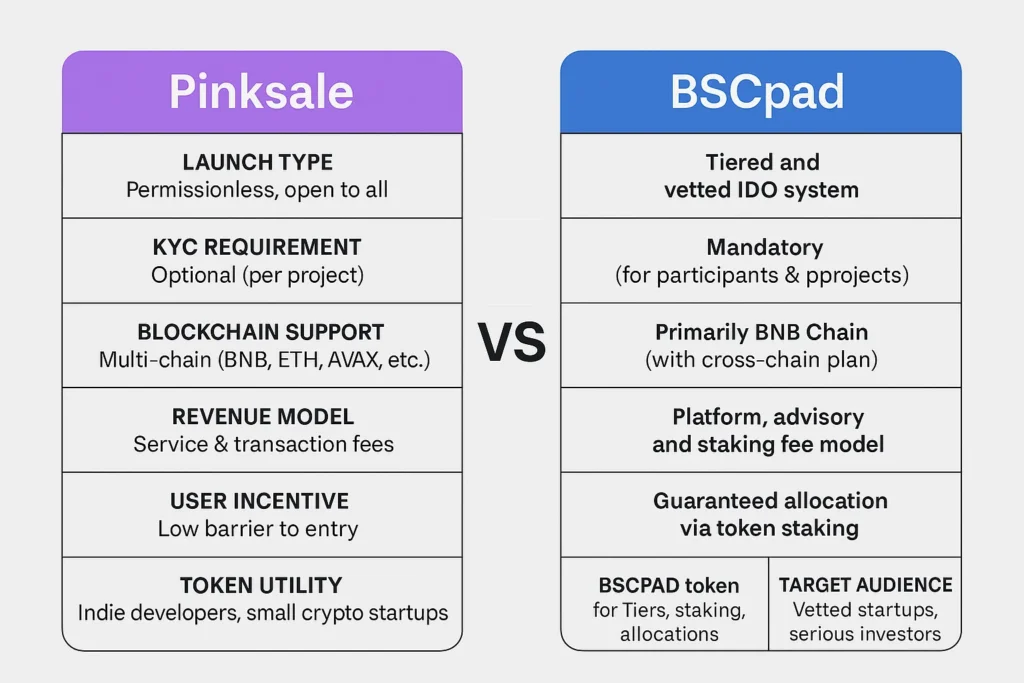

Comparison Table: Pinksale vs BSCpad

| Feature | Pinksale | BSCpad |

|---|---|---|

| Launch Type | Permissionless, open to all | Tiered and vetted IDO system |

| KYC Requirement | Optional (per project) | Mandatory (for participants & projects) |

| Blockchain Support | Multi-chain (BNB, ETH, AVAX, etc.) | Primarily BNB Chain (with cross-chain plans) |

| Revenue Model | Service & transaction fees | Platform, advisory, and staking fee model |

| User Incentive | Low barrier to entry | Guaranteed allocation via token staking |

| Token Utility | PINKSALE token for governance and discounts | BSCPAD token for tiers, staking, allocations |

| Target Audience | Indie developers, small crypto startups | Vetted startups, serious investors |

| Listing Model | Self-service + automation | Curated & incubated |

Pros & Cons of Pinksale Model

Pros:

- Rapid onboarding for token projects

- Developer-friendly with automation tools

- Generates high platform traffic

- Encourages experimentation and innovation

Cons:

- Risk of scams or rug pulls due to low entry barriers

- Less appealing to institutional or serious investors

- Reputation challenges due to project failure rate

- Requires constant moderation and updates

Pros & Cons of BSCpad Model

Pros:

- Strong investor confidence via vetting

- Guaranteed allocation = high retention

- More appealing to venture partners

- Clear utility for native token (BSCPAD)

Cons:

- Slower onboarding process

- Higher technical and compliance overhead

- Limited to projects with solid documentation and pitch decks

- Risk of whale dominance in staking tiers

Market Data: Growth, Revenue & Funding

| Metric | Pinksale | BSCpad |

|---|---|---|

| Active Projects | 12,000+ launches since inception | 500+ curated IDOs |

| Chains Supported | 10+ chains | 4+ major chains |

| Monthly Volume (2024 est.) | $100M+ | $30M+ |

| Token Market Cap (2025) | ~$50M (PINKSALE) | ~$40M (BSCPAD) |

| Launch Fees | ~2% to 5% depending on features | Flat platform fees + token staking |

| Notable Projects | Degenhaus, BabyDoge Presale | AIOZ Network, NFTLaunch |

| Community Focus | Open participation | Staking-based loyalty ecosystem |

Which Model is Better for Startups in 2025?

- Choose Pinksale-style if your focus is on speed, simplicity, and mass accessibility. Great for early-stage projects, meme tokens, and builders with smaller teams.

- Choose BSCpad-style if you’re building a quality-driven platform for vetted Web3 startups, VC-backed projects, or regulated launchpads.

It comes down to your target audience, tokenomics, and compliance appetite.

Choose Pinksale-style if…

- You’re targeting grassroots developers, NFT artists, or indie token creators

- You want a low-code, fast-to-market IDO tool

- You prefer open systems with automated governance

Launch your IDO platform with Miracuves’ Pinksale Clone

Choose BSCpad-style if…

- You’re building a curated, compliant fundraising platform

- You aim to attract serious investors and long-term holders

- You want a token-based tiered allocation model

Build your decentralized launchpad with Miracuves’ BSCpad Clone

Conclusion

The rise of Web3 requires smarter, safer, and more scalable launchpads. Whether you align with Pinksale’s permissionless culture or BSCpad’s structured funding model, Miracuves has the ready-to-deploy solution for your needs.

From smart contract development to tokenomics planning, we’ll help you bring your launchpad idea to life—quickly and securely.

Get started with Miracuves—Talk to us today

FAQs

Which model is more beginner-friendly?

Pinksale is more beginner-friendly due to its no-code setup and minimal requirements.

Can I add KYC and vetting to a Pinksale-style platform?

Yes, with Miracuves’ customizations, you can integrate KYC, audit, and moderation tools into a Pinksale-style platform.

Which model attracts VCs and institutional investors?

BSCpad is more aligned with investor requirements due to its tier system and project vetting.

What are the risks of using a permissionless launchpad?

Without vetting, there is a risk of rug pulls, scams, or non-serious projects, which can affect platform trust.

Is it possible to combine both models?

Absolutely. A hybrid model can offer both open and curated launch options based on project type.