Drizly has reshaped how people buy alcohol offering a seamless, legal, and fast way to get wine, beer, and spirits delivered to your doorstep. Operating as an on-demand alcohol marketplace, Drizly connects users with local liquor stores and enables real-time delivery across major cities in the U.S. and Canada.

Founded in 2012 and acquired by Uber for $1.1 billion in 2021, Drizly built a scalable business around strict alcohol regulations, hyper-local logistics, and a tech-powered storefront. Today, it remains a leader in the niche but growing segment of legal alcohol eCommerce — especially after the pandemic boosted demand for home delivery.

In this blog, we’ll break down how Drizly makes money, why its revenue model is thriving in 2025, and how startups can replicate this profitable framework with a ready-made Drizly clone from Miracuves.

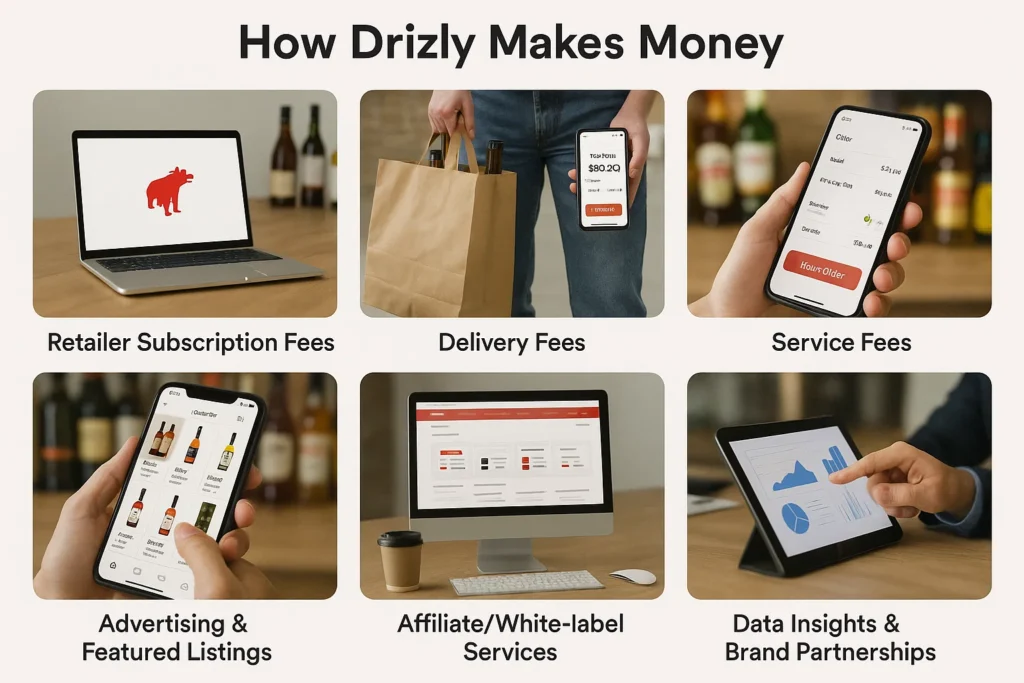

How Drizly Makes Money

Drizly doesn’t operate like a traditional retailer. Instead, it acts as a tech-enabled intermediary between consumers and local liquor stores — monetizing its platform in several smart ways:

- Retailer Subscription Fees – Liquor stores pay a monthly fee to be listed on Drizly’s marketplace.

- Delivery Fees – End-users are charged a small convenience/delivery fee on each order.

- Service Fees – Drizly adds a percentage-based service fee to orders, passed on to consumers.

- Advertising & Featured Listings – Retailers and alcohol brands can pay for better visibility on the app.

- Affiliate/White-label Services – Drizly provides white-labeled eCommerce infrastructure to retailers wanting their own online store.

- Data Insights & Brand Partnerships – Collaborations with major alcohol brands for consumer data and campaign targeting.

This multi-stream model gives Drizly a predictable revenue foundation with additional upside from premium listings and enterprise partnerships.

Read More :-What is Drizly App and How Does It Work?

Detailed Breakdown of Revenue Channels

Retailer Subscription Fees

Drizly operates on a B2B SaaS-style model where local liquor retailers pay a monthly subscription fee — typically between $100 and $300 — to be featured on the platform. This guarantees them access to Drizly’s user base and marketing tools, making it a core revenue driver.

- Who Pays? Partner liquor stores

- Why It Scales? Monthly recurring revenue independent of order volume

Delivery Fees

While Drizly doesn’t deliver directly (local retailers do), the platform charges users a small delivery fee per order. This can vary by location and store but generally ranges from $4.99 to $7.99.

- Who Pays? End customers

- Why It Scales? Scales with every transaction, adding margin without inventory or logistics costs

Service Fees

Drizly also adds a percentage-based service fee (typically 5–10%) on every transaction. This is separate from the delivery fee and goes directly to Drizly, helping to maintain the platform and fund operations.

- Who Pays? Consumers, as a percentage of total cart value

- Why It Scales? High-margin, volume-based revenue that grows with order size

Advertising and Featured Listings

Retailers and alcohol brands can pay Drizly for premium placement — such as top-of-list rankings, homepage banners, or sponsored categories. These native ads enhance visibility and conversions while providing non-transactional income.

- Who Pays? Retailers, breweries, distilleries, and distributors

- Why It Scales? Recurring ad budgets from large alcohol brands

White-label and Affiliate Services

Drizly offers white-labeled storefront solutions for individual liquor stores that want to build their own branded online presence while using Drizly’s tech and logistics network. This opens a new B2B revenue stream.

- Who Pays? Liquor store owners and regional chains

- Why It Scales? Additional SaaS layer with low customer acquisition costs

Data Monetization & Brand Partnerships

Drizly partners with alcohol brands for data-driven campaigns, new product launches, and market intelligence. The platform’s insights into consumer behavior, regional preferences, and seasonal trends are a goldmine for beverage marketers.

- Who Pays? Beverage companies and alcohol marketing agencies

- Why It Scales? Proprietary data with high strategic value

Also Read :-Drizly Business model : how it generates revenue

Why This Revenue Model Works in 2025

Drizly’s revenue model is not only resilient — it’s perfectly positioned for the evolving regulatory, consumer, and digital trends shaping alcohol commerce in 2025.

Shift Toward Legalized Alcohol Delivery

As more states and countries relax restrictions around alcohol delivery, Drizly’s model benefits from expanded market reach. In 2025, over 40 U.S. states now allow home delivery of alcohol — a major tailwind for platforms like Drizly.

Consumer Preference for Convenience

Post-pandemic, convenience continues to reign supreme. Consumers are more willing to pay service and delivery fees for the ease of home delivery. This makes Drizly’s fee-based model highly sustainable, with users showing low price sensitivity when it comes to delivery time and convenience.

Brand Competition and Advertising Demand

As alcohol brands face increasing competition, many are turning to platforms like Drizly to reach customers at the point of purchase. The result? Increased spending on featured listings, banners, and data-driven promotions — directly fueling Drizly’s ad revenue.

Recurring B2B Revenue

Drizly’s subscription and white-label services ensure predictable monthly income from retailers — regardless of demand spikes or seasonality. This recurring B2B revenue stabilizes the business even in off-peak seasons.

AI-Powered Insights and Targeting

With AI now integrated into consumer targeting and product recommendation engines, Drizly can offer more personalized experiences, increasing order sizes and conversion rates. This benefits every part of the revenue model — from fees to advertising ROI.

Learn More :- Drizly App Features Every Startup Should Know

Can Startups Replicate Drizly’s Revenue Model?

Yes — and faster than ever, thanks to turnkey clone solutions.

Drizly’s success is rooted in its smart monetization layers and regulatory compliance. But building a similar platform from scratch is a massive undertaking. You’d need to:

- Integrate with age-verification tools and local compliance systems

- Enable real-time inventory syncing for multiple stores

- Build reliable geo-based delivery systems

- Offer flexible monetization settings (fees, subscriptions, ads)

- Manage partnerships with both retailers and brands

All of this takes time, capital, and technical know-how.

That’s where Miracuves comes in.

With our ready-made Drizly Clone, entrepreneurs and digital agencies can launch a feature-rich alcohol delivery platform — fully equipped with Drizly’s monetization features — in weeks, not months. Our clone includes:

- Retailer subscription setup

- Dynamic service and delivery fee configurations

- Ad and banner placement modules

- White-label storefront support

- AI-powered analytics and real-time order tracking

- Built-in compliance features (like age verification)

Instead of building everything from zero, you get a launch-ready product that lets you focus on partnerships, branding, and scaling revenue — just like Drizly.

The Drizly Clone by Miracuves is priced at $2,899, crafted for seamless, legal, and on-demand alcohol delivery businesses.

Empower your brand with full customization, real-time tracking, and secure white-label branding.

Go live in just 3–9 days with complete source codes included.

Read More :- Reasons startup choose our drizly clone over custom development

Conclusion

Drizly has proven that the alcohol delivery niche can be both legally compliant and highly profitable. Its revenue model — built on retailer subscriptions, service fees, delivery charges, advertising, and white-label tech — creates multiple income streams while keeping overhead low.

In 2025, this model thrives due to shifts in regulation, convenience-first consumer behavior, and the rise of AI-powered personalization. Whether you’re a founder, agency, or local entrepreneur, there’s a clear opportunity to tap into this high-demand space.

With Miracuves’ Drizly Clone, you can replicate this exact monetization framework — without the years of backend development or legal headaches. Our white-label solution empowers you to launch fast, scale smart, and earn from day one.

FAQs

How does Drizly generate revenue?

Drizly earns revenue through retailer subscription fees, service and delivery charges on orders, advertising from alcohol brands, and white-label solutions for liquor stores. It also monetizes data through strategic brand partnerships.

Is Drizly profitable in 2025?

While exact profit figures are private, Drizly’s recurring B2B revenue, surge in alcohol eCommerce, and Uber’s backing suggest strong financial performance and scalability in 2025.

What are the main income sources for Drizly?

Its main income sources include monthly retailer subscriptions, service fees, delivery charges, paid promotions from brands, and software solutions offered to individual stores or chains.

Can startups use the same revenue model as Drizly?

Yes, but building the tech and compliance framework from scratch is complex. A Drizly clone from Miracuves provides a faster, more cost-effective way to launch with the same monetization power.

Does Miracuves offer a Drizly clone with monetization features?

Absolutely. The Drizly clone from Miracuves includes subscription management, fee control, ads, white-label storefronts, and regulatory tools — all optimized for scalable revenue generation.