Neobanks—also known as digital-only banks—have redefined how people manage money, save, and spend. With no physical branches and a mobile-first experience, these fintech disruptors are attracting millions of users globally, especially younger, tech-savvy consumers. But with many of their services offered for free, a common question arises: how do neobanks actually make money?

Understanding the revenue model of neobanks isn’t just fascinating—it’s essential if you’re a startup founder or entrepreneur planning to enter the fintech space. In this blog, we’ll break down the core monetization strategies that power neobanks like Chime, Monzo, N26, and Revolut. We’ll also show you how Miracuves can help you replicate this proven business model with a custom-built Neobank clone.

Let’s explore how neobanks generate sustainable revenue, even while offering fee-free banking to users.

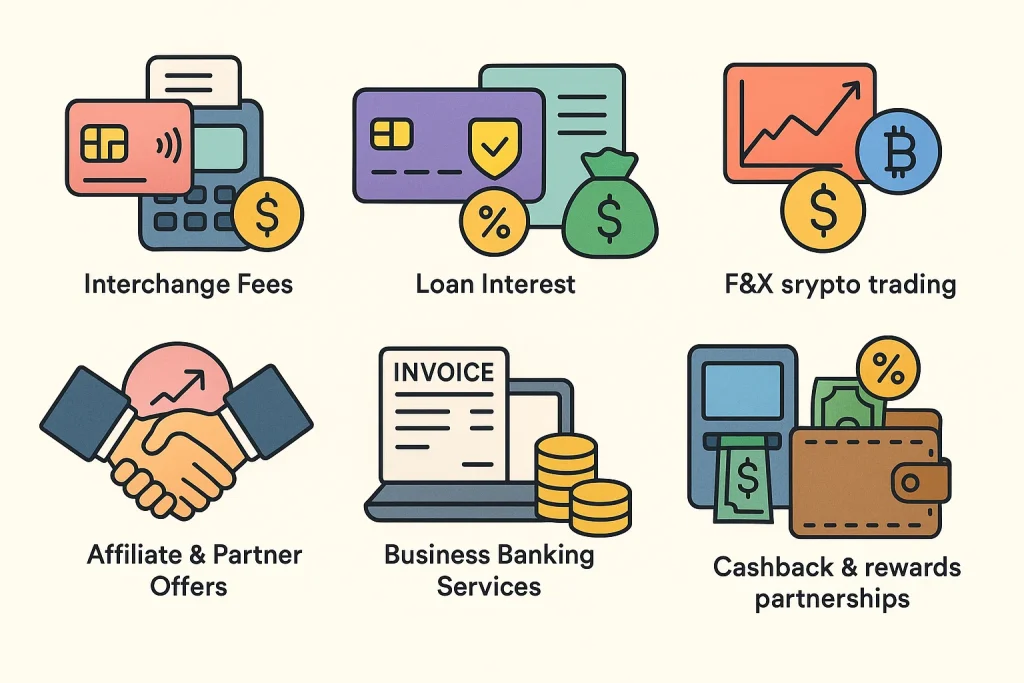

Despite offering low-cost or even zero-cost banking to users, neobanks have created multiple strong and scalable revenue streams. Here’s how they do it:

- Interchange Fees: Earnings from merchant fees when users spend via debit or prepaid cards.

- Subscription Plans: Premium accounts with added features like travel insurance, higher withdrawal limits, or crypto access.

- Loan Interest: Revenue from personal loans, overdrafts, or credit lines.

- FX & Crypto Trading Margins: Profits from foreign exchange markups or crypto trading spreads.

- Affiliate & Partner Offers: Commissions earned through referrals to insurance, investment, or BNPL products.

- Business Banking Services: Fees from SME accounts, invoicing tools, and expense management.

- ATM Withdrawal Fees: Charges for out-of-network or international ATM usage.

- Cashback & Rewards Partnerships: Sponsored deals where merchants fund customer rewards.

Neobanks cleverly blend traditional banking margins with modern SaaS-style revenue streams, giving them more flexibility and lower operational costs than legacy banks.

Detailed Breakdown of Revenue Channels

Let’s take a closer look at each revenue stream and how it works at scale for neobanks:

Interchange Fees

Every time a user swipes their debit or prepaid card, the merchant pays a small fee to the card network. Neobanks earn a portion of this fee, typically between 0.2% and 0.4% in regulated markets and even higher in others. Since card usage is frequent, this passive stream adds up—especially with a large user base.

Who pays? Merchants via card networks

Why it scales: More users = more transactions = more interchange revenue

Subscription Plans

Freemium is common, but many neobanks offer paid tiers ($5–$20/month) with premium benefits like higher ATM limits, budgeting tools, or travel perks. Revolut, for example, has multiple tiers: Standard (free), Plus, Premium, and Metal.

Who pays? Users looking for added value

Why it scales: Predictable monthly recurring revenue (MRR) with low churn

Loan Interest

Some neobanks offer personal loans, overdrafts, or buy-now-pay-later (BNPL) services. Interest earned here can be a major revenue driver—especially when paired with AI-based risk scoring and underwriting.

Who pays? Borrowers

Why it scales: High-margin returns with responsible lending

FX & Crypto Trading Margins

Neobanks often offer foreign exchange and cryptocurrency features. They earn by adding a small spread (margin) on every trade or conversion. This works well for users who travel or invest frequently.

Who pays? Users making currency swaps or crypto trades

Why it scales: High transaction volume with minimal overhead

Affiliate & Partner Offers

Neobanks integrate third-party services—like life insurance, stock trading, or tax filing—earning affiliate commissions when users sign up. These partnerships drive non-banking income and boost customer lifetime value.

Who pays? Partners and service providers

Why it scales: Zero-cost inventory with revenue-share upside

Business Banking Services

SMEs and freelancers use neobanks for invoicing, payroll, and accounting integrations. These tools are often bundled into a paid plan or charged à la carte, generating B2B income.

Who pays? Business account holders

Why it scales: Higher ARPU (Average Revenue Per User) than retail banking

ATM Withdrawal Fees

While basic withdrawals are free, many neobanks charge fees for international or excessive ATM usage. These small fees generate incremental revenue without hurting the core user experience.

Who pays? Users withdrawing cash outside policy

Why it scales: High margin, minimal risk

Cashback & Rewards Partnerships

Neobanks team up with brands to offer in-app deals. When a user redeems an offer or gets cashback, it’s typically funded by the merchant, while the neobank earns a cut.

Who pays? Partner merchants

Why it scales: Engagement + monetization in one

Neobanks win customer trust with speed, security, and simplicity. Explore the neobank app features list and see what every digital bank must include.

Why This Revenue Model Works in 2025

The neobank revenue model isn’t just surviving—it’s thriving in 2025. Here’s why this model remains highly viable and scalable in today’s fintech landscape:

1. Mobile-First Banking Is the Norm

With over 3.8 billion smartphone users globally, digital-native customers expect banking to be fast, mobile, and intuitive. Traditional banks struggle to adapt, but neobanks are built for this era—offering convenience and accessibility that matches user expectations.

2. Decline in Cash, Rise in Card & Digital Payments

As digital payments overtake cash worldwide, interchange fee revenue is growing in parallel. Neobanks benefit directly from this shift, turning everyday card transactions into recurring revenue streams without charging users upfront.

3. Subscriptions Are Mainstream

From Netflix to Notion, people are comfortable paying for premium experiences. The same applies to banking—where customers now willingly pay for smart budgeting tools, wealth insights, and lifestyle perks. This makes neobanks’ tiered subscription models future-proof.

4. Embedded Finance and APIs Are Expanding

Open banking regulations and fintech APIs have lowered the barrier to offer loans, insurance, crypto, and investments—without building from scratch. Neobanks are tapping into this by integrating third-party services and earning via affiliate and partner models.

5. AI-Driven Personalization

AI is enabling neobanks to personalize user experiences, automate credit risk assessment, detect fraud, and upsell better. Whether it’s smart savings goals or predictive expense tracking, these features add value and justify premium pricing.

6. Globalization of Digital Banking

From Latin America to Southeast Asia, unbanked populations are coming online. Neobanks are rapidly entering emerging markets with lean cost structures and mobile-first onboarding, expanding the revenue base with minimal infrastructure.

The best neobanks don’t just launch—they market smart. Discover the neobank app marketing strategy that builds buzz and drives growth.

Can Startups Replicate Neobank’s Revenue Model?

Absolutely—but not without challenges. While the neobank model is highly profitable and scalable, replicating it from scratch involves significant hurdles in technology, compliance, and market readiness.

The Challenges

- Building from Zero: Developing a secure, scalable fintech app with payment processing, KYC, analytics, and user-friendly design is a time- and cost-intensive process.

- Banking Infrastructure: You’ll need APIs for payments, cards, loans, and foreign exchange—and they must be compliant with regional regulations.

- Monetization Logic: Designing dynamic pricing tiers, managing commission flows, and tracking usage-based metrics requires thoughtful planning and tested frameworks.

- Time-to-Market Pressure: Fintech is moving fast. Startups that delay product launch to build everything from the ground up often lose first-mover advantage.

How Miracuves Makes It Easier

At Miracuves, we specialize in ready-made Neobank clone app solutions that let you skip the build-from-scratch phase. With our white-label digital banking platform, you get:

- Pre-built Monetization Features: Interchange integration, premium tiering, affiliate modules, and FX spread management

- Customizable UI & Workflows: Tailored user journeys for retail and business banking

- Faster Launch: Go to market in days not weeks, not months—perfect for testing and scaling

- Regulatory-Ready Frameworks: Built to align with compliance needs, regionally adaptable

Whether you’re targeting millennials, freelancers, or SMEs, our clone solution replicates the successful revenue models of top neobanks—giving you a proven path to profitability.

The NeoBank Clone by Miracuves is priced at $4,099, offering a fully customizable, AI-driven digital banking solution ready to go live within 3–9 days.

Building a digital bank takes the right balance of technology and strategy—whether you go custom or with ready-made scripts. Explore our practical neobank startup guide and best neobank clone scripts in 2025 to launch smarter and faster.

Conclusion

Neobanks have proven that it’s possible to offer free or low-cost banking while still building a highly profitable business. From interchange fees and subscriptions to FX spreads and affiliate partnerships, their revenue model is a masterclass in fintech innovation.

As digital banking continues to boom in 2025, the neobank model is not just relevant—it’s thriving. For startups, this presents a massive opportunity to tap into the same monetization strategies without reinventing the wheel.

With Miracuves’ Neobank clone solution, you can fast-track your launch, plug into battle-tested revenue streams, and start building a next-gen digital bank with confidence.

FAQs

How does a neobank generate revenue?

Neobanks earn money through interchange fees, premium subscriptions, loans, FX/crypto trading spreads, partner commissions, and business banking services.

Is the neobank business model profitable in 2025?

Yes, the model is highly scalable and profitable in 2025 thanks to lower overheads, increased digital payments, and the rise of subscription-based banking.

What are the main income sources for a neobank?

Primary income sources include card transaction fees, paid account tiers, lending interest, currency exchange markups, and third-party affiliate partnerships.

Can startups use the same revenue model as neobanks?

Definitely. While it’s complex to build from scratch, startups can replicate the model using white-label neobank solutions like the one offered by Miracuves.

Does Miracuves offer a neobank clone with monetization features?

Yes, Miracuves provides a fully customizable neobank clone with built-in revenue features like interchange support, subscription billing, and partner integrations.