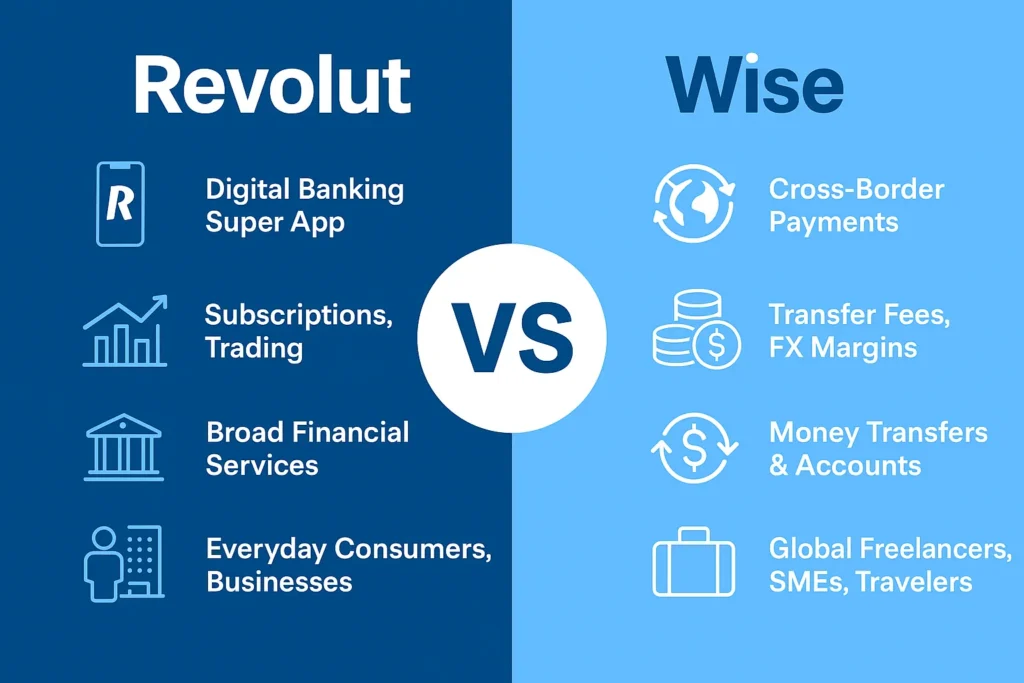

In 2025, fintech continues to revolutionize global finance, driven by digital-first consumers, borderless economies, and rapid innovation in banking infrastructure. Among the top players leading this disruption are Revolut and Wise—two companies redefining how money is managed, moved, and multiplied across the globe.

For startup founders and app entrepreneurs, understanding the key differences between the Revolut and Wise business models is more than market research—it’s a strategic necessity. Whether you’re building a digital bank, a remittance platform, or a multi-currency wallet, the operational models of these fintech giants offer clear insights into scalability, compliance, monetization, and product development.

In this detailed guide, we’ll explore how each platform operates, earns revenue, manages costs, and builds partnerships—so you can determine which blueprint is better for your startup vision in 2025.

What is Revolut?

Revolut is a super app for financial services. Launched in 2015 in the UK, Revolut started as a multi-currency prepaid card and evolved into a full-spectrum neobank offering banking, crypto, stock trading, budgeting, savings, and travel perks.

Key Highlights:

- Licensed as a bank in the EU and expanding licenses globally

- Serves individuals and businesses in 40+ countries

- Offers services like crypto trading, stock investing, travel insurance, salary advances, and budgeting tools

- Operates as an all-in-one finance app

What is Wise?

Wise (formerly TransferWise), founded in 2011, is a money transfer and multi-currency account platform focused on low-cost, transparent cross-border payments. Unlike Revolut, Wise is laser-focused on remittances, global accounts, and business payments.

Key Highlights:

- Provides real exchange rates with upfront fees

- Supports multi-currency accounts for individuals and businesses

- Licensed under regulatory frameworks in 60+ countries

- Known for transparency, speed, and low fees in global money transfers

Business Model of Revolut

Revolut’s business model is built on diversified financial services, with the app acting as a hub for personal and business banking, trading, travel perks, and fintech automation.

Revenue Streams:

- Interchange Fees from card payments

- Subscription Plans: Standard, Plus, Premium, and Metal

- Trading Commissions: Crypto, stocks, commodities

- FX Markups: Weekend and free-tier foreign exchanges

- Business Account Fees: SaaS-style pricing

- Lending Products: Credit, salary advance, BNPL

- Ancillary Services: Travel insurance, disposable virtual cards

Cost Structure:

- Banking infrastructure & licensing compliance

- Customer support and fraud monitoring

- Third-party integrations (insurance, FX engines, crypto liquidity)

- Marketing and user acquisition

- R&D in app features, security, and scalability

Key Partners:

- Mastercard, Visa (for cards and payments)

- Banking-as-a-Service providers (in expansion markets)

- Crypto exchanges & custodians

- Insurers and investment brokers

- Local regulators (for banking licenses)

Growth Strategy:

- Expand regulated services globally

- Offer high-margin financial products

- Build a super app ecosystem (subscriptions + finance + lifestyle)

- Focus on B2B fintech (Revolut Business)

Learn More: Business Model of Revolut : Key Features and Revenue

Business Model of Wise

Wise focuses on cost-effective, transparent money movement. It uses a peer-to-peer model in some markets and local settlement accounts globally to reduce fees.

Revenue Streams:

- Transfer Fees based on amount and currency pair

- Wise Accounts: Business and personal multi-currency wallets

- ATM Fees & Card Usage

- Foreign Exchange Markups (on non-GBP/EUR/USD routes)

- API Integration Fees: B2B payments infrastructure for platforms

- Interest Income (on held funds in some markets)

Cost Structure:

- Local banking infrastructure across 70+ countries

- Compliance with AML/KYC across regions

- Security, fraud detection, and customer support

- FX hedging & treasury operations

- Payment rail maintenance and settlements

Key Partners:

- Local banks and payment processors

- FX engines & liquidity providers

- API clients (banks, neobanks, SaaS tools)

- Regulators and compliance providers

- Card networks for Wise debit card

Growth Strategy:

- Focus on B2B APIs and platform integrations

- Increase volume per user via Wise Business

- Expand to more currencies and instant payout routes

- Leverage reputation for transparency and low cost

Learn More: Business Model of Wise: Reinventing Global Money Transfers

Comparison Table: Revolut vs Wise

| Feature | Revolut | Wise |

|---|---|---|

| Founded | 2015 | 2011 |

| Core Focus | Digital banking super app | Cross-border payments |

| Primary Revenue | Subscriptions, trading, FX, cards | Transfer fees, FX margins, business APIs |

| Product Range | Banking, crypto, investing, budgeting | Remittances, multi-currency wallets |

| Target Users | Everyday consumers + businesses | Global freelancers, SMEs, travelers |

| B2B Offering | Revolut Business | Wise Business + API |

| License Footprint | Banking licenses in EU, expanding | Payment licenses in 60+ countries |

| Cost Base | High (diverse product lines) | Moderate (streamlined infrastructure) |

| Market Position | All-in-one fintech platform | Leader in transparent cross-border FX |

Pros & Cons of Revolut Model

Pros:

- Diverse revenue sources = stronger monetization

- High user engagement through super app strategy

- Recurring income from subscriptions

- Brand loyalty via lifestyle integrations

Cons:

- Expensive to scale across jurisdictions

- Regulatory compliance is complex (especially with crypto & lending)

- User trust sensitive to over-extension

- Thin margins on basic FX and card services

Pros & Cons of Wise Model

Pros:

- Streamlined operations = lower costs

- High trust due to transparent pricing

- Scalable global infrastructure

- API monetization via B2B

Cons:

- Limited service scope (vs. Revolut)

- Margin pressure due to ultra-low fees

- Less daily user interaction = lower stickiness

- Heavily regulated FX landscape

Market Data: Growth, Revenue & Funding (2025)

| Metric | Revolut | Wise |

|---|---|---|

| Users (2025) | 40M+ | 16M+ |

| Revenue (2024) | ~$2.2B | ~$1.2B |

| Valuation (2025) | $40B+ | $10B+ |

| Global Presence | 40+ countries | 70+ countries |

| Business Customers | 500,000+ | 400,000+ |

| Public Status | Private (as of now) | Public (listed on LSE) |

| Top Strength | Product diversification | FX transparency & B2B scale |

Which Model is Better for Startups in 2025?

It depends on what kind of fintech startup you’re building:

- Revolut-style models suit founders aiming to build super apps, neobanks, or subscription-based digital finance ecosystems.

- Wise-style models are perfect for startups solving cross-border money movement, API payments, or remittance use cases.

Choose Revolut if your goal is product breadth and high engagement. Choose Wise if your focus is cost-efficiency, FX automation, and global scalability.

Choose Revolut-style if…

- You want to build an all-in-one neobank or finance super app

- You’re targeting millennials, freelancers, and startups

- You plan to offer subscriptions, crypto, and trading tools

Launch with Miracuves’ Revolut Clone

Choose Wise-style if…

- You want to create a low-cost, global money transfer app

- Your customers include SMEs, expats, or remote teams

- You want to scale using FX APIs and transparent pricing

Build your platform with Miracuves’ Wise Clone

Conclusion

Whether you’re inspired by Revolut’s product-rich ecosystem or Wise’s no-frills efficiency, Miracuves provides the tools to launch fast and scale confidently.

From neobank development to cross-border wallet architecture, our white-label fintech solutions include everything you need to build a secure, scalable, and feature-packed app in 2025.

Let’s build your fintech future—Talk to Miracuves today

FAQs

Is Revolut more profitable than Wise?

Revolut has more revenue streams, but also higher costs. Wise maintains stronger margins on core services like transfers.

Can I combine both models in one app?

Yes, but expect higher regulatory and tech complexity. A hybrid approach requires strong product architecture.

Which model is easier to launch for startups?

Wise-style models are easier to start with due to narrow focus and lighter infrastructure. Revolut’s model needs more capital and compliance.

Does Revolut offer APIs like Wise?

Revolut focuses more on the app experience; Wise monetizes its API more aggressively for B2B cross-border use cases.

Which model is better for emerging markets?

Wise-style models work better in remittance-heavy or freelance-rich economies, while Revolut suits urbanized, digital-first consumers.