The wild west of crypto may have cooled down from its 2021 highs, but don’t be fooled—DeFi is far from over. If anything, it’s evolving. Today’s users aren’t just hunting memecoins—they’re farming yields, staking, swapping, and experimenting with community tokens. And one of the most powerful gateways to this ecosystem? Decentralized exchanges like Uniswap clone scripts .

Uniswap changed the game with its AMM (Automated Market Maker) model. No middlemen, no sign-ups, and no listing bureaucracy—just pure peer-to-peer token swapping. Now imagine owning that experience, rebranded, localized, and monetized. That’s where Uniswap clone scripts come in.

Whether you’re launching your own DeFi protocol, building a niche token exchange, or starting a DEX for a specific region or blockchain, a Uniswap clone can save you months of dev time. At Miracuves, we’ve helped DeFi innovators build safe, scalable, and feature-rich exchanges using best-in-class clone architecture.

What Is a Uniswap Clone Script?

A Uniswap clone script is a ready-made, customizable version of the Uniswap DEX. It enables you to deploy your own decentralized exchange on Ethereum, BNB Chain, Polygon, or any EVM-compatible network.

But don’t confuse “clone” with “copy-paste.” A modern Uniswap clone script doesn’t just replicate the swap interface—it provides core smart contracts, liquidity pool modules, admin tools, custom UI, and often even support for farming, staking, and analytics dashboards.

You’re not just launching a DEX—you’re building the infrastructure for community-driven finance.

Read More :Reasons startup choose our Uniswap clone over custom development

Must-Have Features in a Modern Uniswap Clone Script

If you’re serious about launching a DEX that people will trust, here’s what your script needs to deliver:

1. Automated Market Maker (AMM)

The core engine that enables token swaps without order books. Should support constant product formula (x*y=k) and dynamic fee adjustments.

2. Liquidity Pools and Incentives

Enable users to deposit token pairs and earn swap fees. LP token management and APR tracking are essential.

3. Token Swapping Interface

Clean UI, slippage tolerance, token import, and custom route finding for complex swaps.

4. Multi-Wallet Integration

Users should be able to connect via MetaMask, Trust Wallet, WalletConnect, Coinbase Wallet, and hardware wallets.

5. Governance Module

For community votes, proposals, and decentralized decision-making via DAO tokens.

6. Analytics Dashboard

Real-time stats on pool volume, liquidity, fees, top tokens, and protocol growth.

7. Security Modules

Time-locks for admin functions, multi-sig for contract upgrades, and thorough audit support.

8. Revenue Features

Swap fees, listing charges, governance token economics, and farming incentives to boost retention.

Read More ;The Future of Decentralized Finance (DeFi) Apps: Trends to Watch in 2025 and Beyond

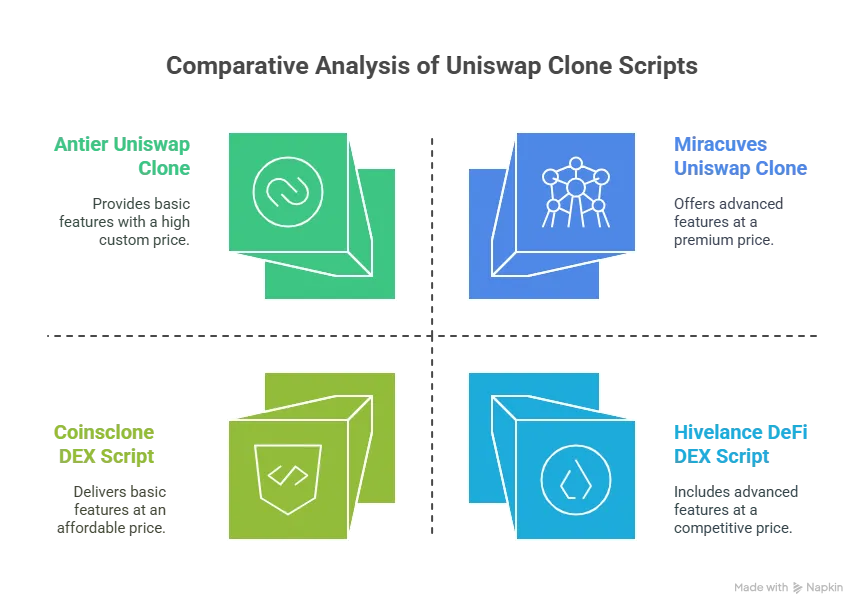

Top Uniswap Clone Scripts in 2025 (Compared)

Let’s break down the best options this year based on features, tech quality, and pricing.

1. Miracuves Uniswap Clone

- Blockchain Support: Ethereum, BNB Chain, Polygon, Arbitrum

- Smart Contract Quality: Audited, gas-optimized, upgrade-ready

- Liquidity Tools: Incentive pools, farming dashboards, auto-rebalancing

- Wallets: Supports 10+ wallets out of the box

- Extras: DAO builder, Launchpad module, multi-language UI

2. Hivelance DeFi DEX Script

- Blockchain Support: Ethereum and BNB Chain only

- Smart Contract Quality: Basic, manual audits needed

- Liquidity Tools: Included but lacks staking

- Wallets: MetaMask and WalletConnect only

- Extras: No DAO tools, basic charts

3. Antier Uniswap Clone

- Blockchain Support: Multi-chain

- Smart Contract Quality: Strong, but closed-source for clients

- Liquidity Tools: Included with farming

- Wallets: Multiple supported

- Extras: Comes with consulting package

4. Coinsclone DEX Script

- Blockchain Support: Ethereum-based only

- Smart Contract Quality: Needs external audit

- Liquidity Tools: Only swap and LPs

- Wallets: Basic integration

- Extras: Limited UI theming

Cost Factors & Pricing Breakdown

Uniswap-Like Decentralized Exchange Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic DEX MVP | Wallet connection, token swap interface, liquidity pools, basic smart contract setup, transaction history, and an admin console for monitoring. | $50,000 |

| 2. Mid-Level DeFi Trading Platform | Web UI/UX, automated market maker (AMM), liquidity provider dashboard, slippage controls, multi-token support, analytics, and blockchain explorer integration. | $120,000 |

| 3. Advanced Uniswap-Level DEX | Multi-chain support, advanced AMM logic, governance tokens, staking & rewards, security audits, gas optimization, analytics dashboards, and enterprise-grade scalability. | $240,000+ |

These figures reflect the typical global development cost for building a production-grade decentralized exchange similar to Uniswap — including smart contracts, frontend, and blockchain integrations.

Miracuves Pricing for a Uniswap-Like Platform

Miracuves Price: Starts at $15,999

This includes a complete decentralized trading platform with wallet integration, token swap functionality, liquidity pool management, smart contract deployment, frontend interface, analytics, and a unified admin environment — fully customizable and ready for launch under your brand.

Note:

Includes full source code, smart contract setup, frontend & backend configuration, admin configuration, API integrations, and deployment assistance — enabling you to operate a Uniswap-style DEX with full ownership and scalability.

Launch Your Uniswap-Style Decentralized Exchange — Contact Us Today

Delivery Timeline for a Uniswap-Like Platform with Miracuves

A typical delivery timeline is 30–90 days, depending on:

- Number of blockchains and tokens supported

- AMM and liquidity logic complexity

- Governance, staking, or rewards modules

- UI/UX customization and branding

- Security audits and performance optimization

- Third-party blockchain integrations

Tech Stack

Built using a JS-based architecture, ideal for modern DeFi applications — supporting wallet connections, real-time blockchain interactions, scalable frontends, and modular smart contract integration.

Real-World Use Cases for a Uniswap Clone

- Token communities launching their own DEXes to support micro-economies

- NFT marketplaces with ERC-20 support offering integrated swaps

- Regional DeFi hubs providing localized trading experiences

- Launchpads that offer immediate token liquidity post-IDO

- Crypto influencers creating branded, whitelisted token swaps

If you’ve got an engaged community, launching your own DEX isn’t just smart—it’s strategic.

Common Mistakes to Avoid

Some DeFi founders rush into launch without checking critical issues. Don’t be one of them. Watch out for:

- Unverified contracts: Trust dies when users see “Unverified” on Etherscan

- No audit history: Vulnerabilities can wipe liquidity overnight

- Gas-guzzling code: Poor optimization means costly swaps and lost users

- Centralized admin control: If users sense foul play, they’ll flee

- Missing DAO support: Decentralization without governance is just branding

DeFi users are savvy. Earn their trust with transparency and rock-solid code.

Read More : How to Start a Decentralized Finance (DeFi) Platform Business

Final Thoughts

Decentralized exchanges aren’t just trading platforms—they’re programmable finance protocols. Launching your own Uniswap-like DEX isn’t a “nice to have” for modern crypto communities—it’s a moat.

Whether you’re building the future of DAOs, launching a community token, or enabling safe token swaps, a Uniswap clone script can fast-track your vision. But you need real tech, not just flashy UI.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Still have questions about Uniswap clone scripts? Let’s clear them up.

Is a Uniswap clone script legal?

Yes—as long as your contracts are original and your operations comply with your local regulations, it’s completely legal to deploy.

Can I add my own token to the DEX?

Definitely. You can deploy custom tokens, liquidity pairs, and even incentivize trading for them.

How do liquidity providers earn money?

They earn a percentage of trading fees based on the liquidity they provide to each pool.

Does a Uniswap clone require KYC?

No. Most decentralized platforms are KYC-free, but you can add optional modules for compliance if needed.

Is it possible to launch on chains like Polygon or Arbitrum?

Yes. Modern clone scripts are built to support multiple EVM-compatible chains.

What’s the difference between Uniswap v2 and v3 functionality?

v2 uses a constant product AMM; v3 introduces concentrated liquidity and better capital efficiency. Your script should support at least v2, if not both.

Related Articles

- Best SushiSwap Clone Scripts in 2025: Features & Pricing Compared

- Best MakerDAO Clone Scripts in 2025: Features & Pricing Compared

- Best Pinksale Clone Scripts in 2025: Features & Pricing Compared

- Best Metamask Wallet Clone Scripts in 2025: Features & Pricing Compared

- Best PancakeSwap Clone Scripts in 2025: Features & Pricing Compared