If you’ve ever tried trading crypto and thought, “Why is this harder than ordering a pizza?” — you’re not alone. Many creators and startups are looking to decentralize everything, and trading platforms are top of the list. Enter GMX: the decentralized perpetual exchange that’s changing the game.

The rise of GMX is no fluke. It taps into something deeper — a desire for control, transparency, and yes, fewer fees. It’s like going from a gated community (centralized exchanges) to owning your land in a borderless world. And now, GMX clones are sprouting faster than NFTs in 2021.

If you’re wondering how a GMX app works, and more importantly, how to build one that doesn’t suck — keep reading. At Miracuves, we help launch DeFi platforms that don’t just work — they win.

What Is GMX? (And Why It’s a Big Deal)

GMX is a decentralized spot and perpetual exchange. Translation? It lets people trade crypto tokens with leverage — without relying on a centralized broker or middleman.

It’s built on Arbitrum and Avalanche, offering lightning-fast, low-fee transactions. Unlike order book systems (think Binance), GMX uses multi-asset pools to enable swaps and leverage. This creates a seamless trading experience that’s also permissionless — no KYC, no gatekeeping.

GMX Features at a Glance:

- Up to 50x leverage

- Low swap fees

- Price feeds from Chainlink

- Community-based governance via GMX tokens

- Dual-token model (GMX + GLP)

Read Also :-Best GMX Clone Scripts in 2025: Features & Pricing Compared

What Is a GMX App?

A GMX app is a ready-made decentralized exchange platform built to replicate the core features of GMX — including perpetual swaps, leverage trading, liquidity pools, and more.

It’s not a cheap copy-paste. Done right, it’s your shortcut to launching a powerful DeFi product, faster and without reinventing smart contract wheels.

Why App GMX?

- Faster Launch: Skip building from scratch

- Proven Model: GMX’s success = blueprint worth copying

- Customization: Add your branding, fees, reward system

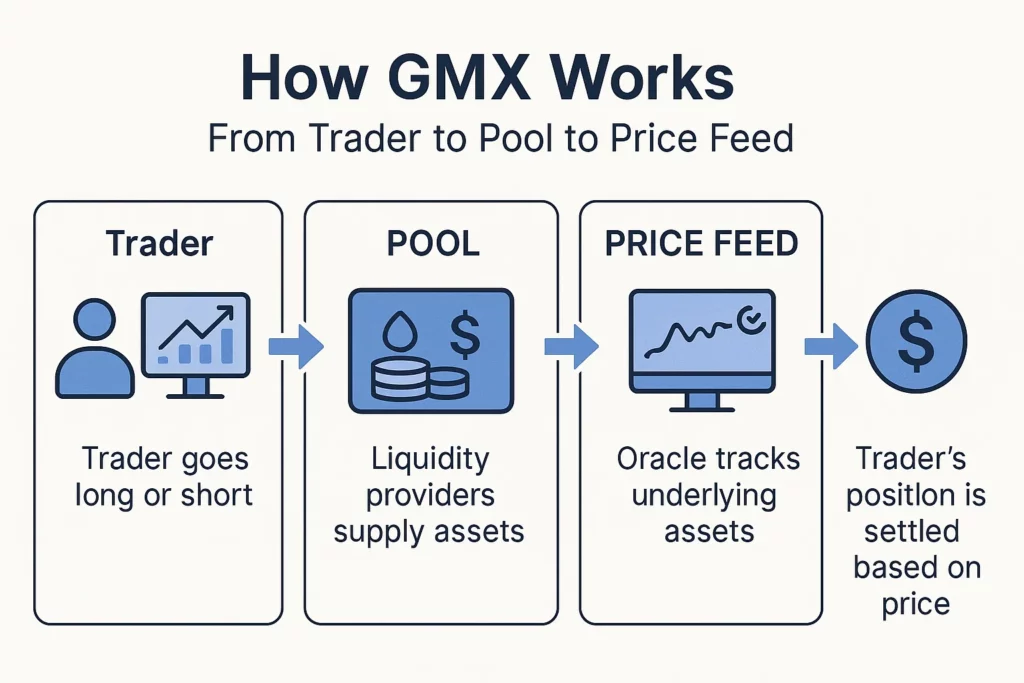

How a GMX App Works – Under the Hood

1. Decentralized Smart Contracts

Everything runs on audited smart contracts — from trading to staking to yield distribution. Users interact directly with code, not a third-party admin.

2. Multi-Asset Liquidity Pools

Traders deposit into GLP (or equivalent token) pools, which serve both spot and leveraged trades. Liquidity providers earn fees while enabling frictionless swaps.

3. Price Oracles & Risk Management

Clone platforms use Chainlink or similar oracles to get real-time price data. Risk parameters (like liquidation thresholds) keep trades and pools secure.

Features You Can Pack Into a GMX App

1. Leverage Trading with On-Chain Transparency

Give users the thrill of 50x leverage while making it transparent and decentralized. No shady liquidation bots — just smart contract rules.

2. Dual Token Rewards System

Incentivize liquidity providers and token holders. GMX clones typically adopt a dual token model (e.g., GMX + LP token).

3. Staking & Yield Farming Modules

Let users stake native tokens and earn protocol fees. Reward loyal traders with yield boosts and LP incentives.

4. Analytics Dashboard

Give users real-time stats on open interest, pool ratios, funding rates, and their own profit/loss.

Learn More :-Reasons startup choose our gmx clone over custom development

Monetization Models for GMX App

Let’s talk cheddar. Your GMX clone can rake in profits through:

- Trading Fees: Percentage per trade (e.g., 0.1%)

- Liquidation Penalties: Small fee from auto-liquidations

- Staking Rewards Tax: Protocol fee on rewards

- Token Sale/IEO: Launch your native token

Tech Stack for Building a GMX App

You don’t need to be Vitalik. But you do need a solid dev stack:

- Smart Contracts: Solidity (Ethereum/Arbitrum)

- Front-End: React, Web3.js, Ethers.js

- Backend: Node.js, IPFS (optional for file hosting)

- Wallet Integration: MetaMask, WalletConnect

Who Should Launch a GMX Clone?

Startups & Entrepreneurs

Want to own the next unicorn in DeFi? GMX clone gives you a head start.

Web3 Communities & DAOs

Launch a governance-driven trading platform for your members.

Fintech Builders

Add leveraged crypto trading to your existing app or platform.

Read more :-Pre-launch vs Post-launch Marketing for GMX Clone Startups

Conclusion

If you’re bullish on crypto and tired of centralized platforms holding all the keys, building a GMX clone might just be your next power move.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Is building a GMX clone legal?

Yes, as long as you’re not copying trademarked branding or violating open-source licenses. Focus on using original branding and unique UX.

Can I customize a GMX clone with my token?

Absolutely. Most clones support custom native tokens for staking, rewards, and governance.

How long does it take to build a GMX clone?

With the right team, a functional MVP can be built in 4–6 weeks. Customizations may take longer.

What makes GMX better than other DEXs?

Its on-chain leverage, low fees via Arbitrum, and unique GLP liquidity model give it a strong edge.

Do I need my own liquidity to launch?

Ideally, yes. But you can bootstrap with farming incentives or third-party LPs.

How does Miracuves help with GMX clone development?

We handle smart contracts, front-end, tokenomics, and even post-launch support. You bring the idea; we bring the execution.