Remember the last time you stood in a long queue at a bank just to update your email address? Yeah, not exactly the future we were promised. Today, the banking world is doing a major glow-up — going fully digital, mobile-first, and user-obsessed. Enter: neobanks. They’re like your traditional bank, only without the brick walls, paperwork piles, or bored tellers. Just pure fintech finesse on your smartphone.

Now, imagine launching your own neobank platform without spending years building from scratch. That’s where neobank clones come in — your shortcut to launching a sleek, secure, and fully-loaded digital banking app like N26, Chime, or Revolut. They’re not some half-baked copycats. These clones are battle-tested templates ready to roll with your custom twist.

If you’re dreaming of launching the next-gen bank that Gen Z and mobile-first users can’t stop raving about, Miracuves is your ticket to make that happen — fast, smart, and monetization-ready.

What Exactly is a Neobank App?

A neobank clone is a ready-made digital banking platform that mimics the core features of popular neobanks like Revolut, Chime, N26, and Monzo — but with the freedom to rebrand, customize, and monetize your way. Think of it as the Spotify clone of fintech. You get:

- Mobile-first interface

- Account opening, KYC, and verification

- Virtual & physical cards

- Instant transfers & budgeting tools

- Multi-currency wallets

- Investment, savings, crypto integrations (optional)

But unlike traditional banks, there’s no need to own a physical branch or mainframe systems. You integrate with APIs, fintech partners, or licensed backend providers to handle the banking part — while you focus on experience and scale.

Read More :-Best Neobank Clone Scripts in 2025: Features & Pricing Compared

Why Are Neobank Clones in High Demand?

The banking game is going the Uber route — zero inventory, all experience. Millennials and Gen Z don’t care about mahogany desks or free lollipops. They want speed, clarity, and control over their money.

Let the numbers speak:

- As per Statista, digital-only banking users will surpass 400 million globally by 2026

- Neobanks like Chime raised over $2.5 billion, with over 14 million users

- Traditional banks lose 30% of users under 35 to mobile-only competitors

That’s your opportunity. A neobank clone lets you ride this wave without reinventing the wheel.

Core Features of a Neobank App

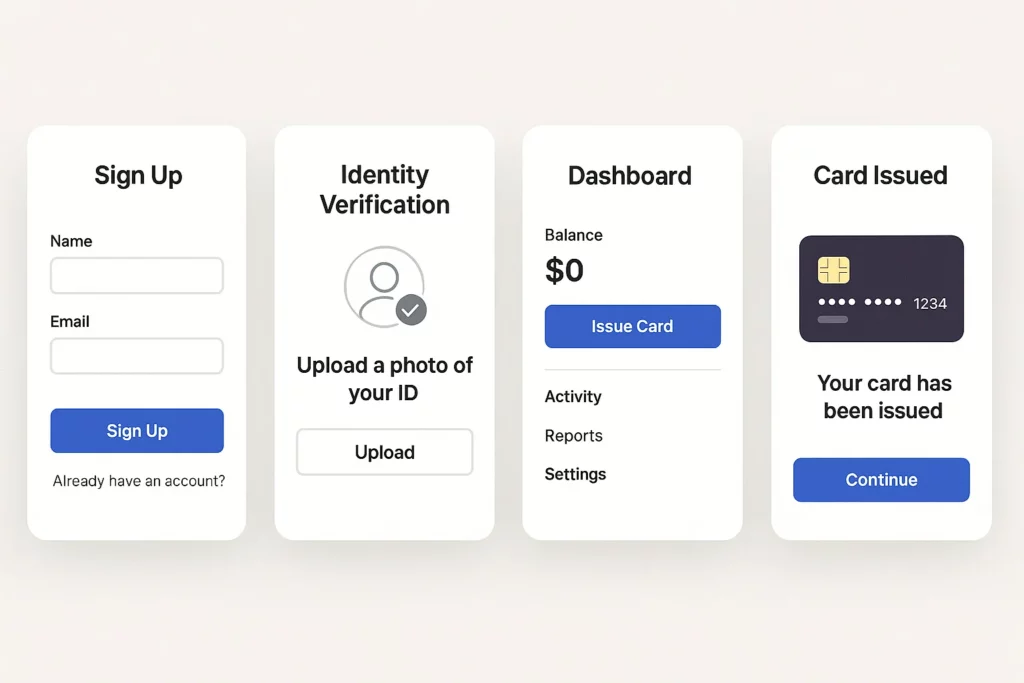

1. Instant Account Creation & KYC

Let users onboard in minutes using mobile verification, OCR scans, and face match. No paperwork, no waiting.

2. Smart Cards (Virtual & Physical)

Issue digital cards for online spending, in-app top-ups, and even integrate with Apple Pay or Google Pay.

3. Money Transfers & Bill Payments

Send money across accounts or to friends instantly. Pay bills, recharge phones, and manage utilities.

4. Spending Insights & Budgeting

Track where your money’s going. Auto-categorize expenses, set savings goals, and get nudges to stay on track.

5. Multi-Currency & Crypto Wallets

Let users hold, convert, or spend in multiple currencies. Add crypto support for advanced users.

Also Read :-Reasons startup choose our neobank clone over custom development

How Does a Neobank App Work Behind the Scenes?

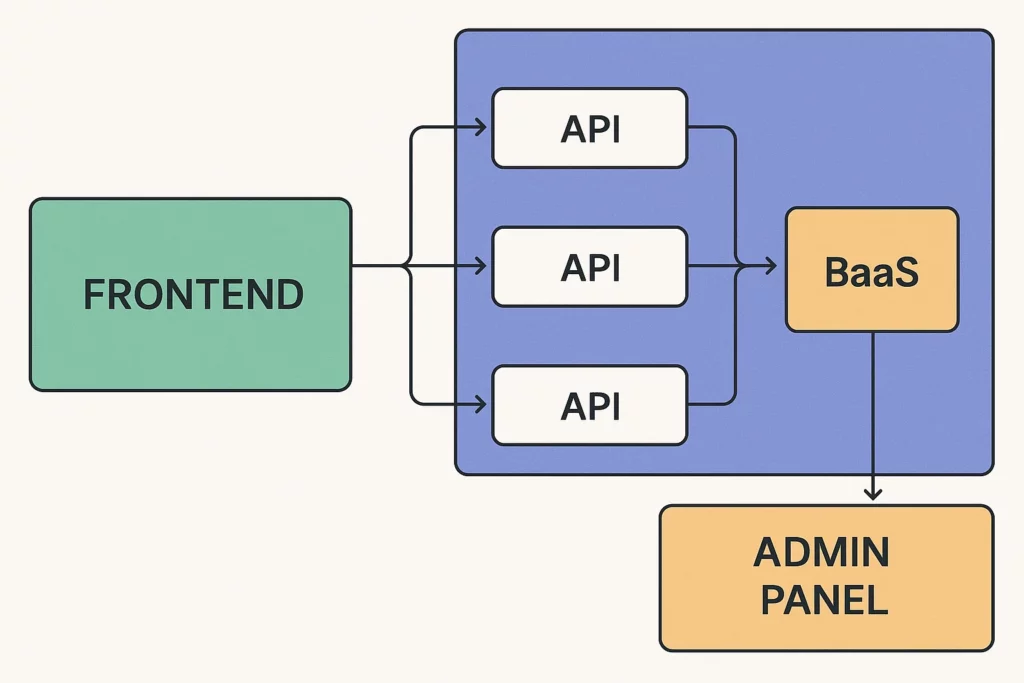

Let’s demystify the tech stack and flow.

- Frontend Interface

– Mobile app (iOS/Android)

– Admin dashboard for your team - Middleware/API Layer

– Connects to core banking system

– Integrates with KYC, AML, card issuing APIs (like Galileo, Synapse, Mambu) - Banking-as-a-Service (BaaS)

– A licensed partner provides the regulatory and financial infrastructure

– You don’t need a banking license yourself - Backend Admin Panel

– Manage users, transactions, fraud checks, card limits, etc.

The clone handles all this out-of-the-box — you just brand it, tweak features, and launch.

Monetization Strategies for Your Neobank App

1. Card Interchange Fees

Every time a user swipes their card, you get a cut of the transaction fee.

2. Premium Plans

Offer free and paid tiers. Add perks like higher withdrawal limits, travel insurance, crypto access, or instant support.

3. FX & Crypto Spread

Charge a small margin on foreign currency or crypto conversions — users rarely mind.

4. Loan & Credit Products

Partner with lenders and offer micro-loans, salary advances, or buy-now-pay-later services.

5. Affiliate Offers

Recommend products, services, or subscriptions and earn commission per referral.

Who Should Launch a Neobank Clone?

This isn’t just for fintech geeks. If you’re:

- A startup targeting underserved communities (students, freelancers, remote workers)

- An influencer looking to launch a branded card

- A telco, travel agency, or e-commerce platform wanting to add banking features

You’ve got a shot. Neobank clones open up the fintech frontier to creators and disruptors, not just suits in skyscrapers.

Why Build with Miracuves?

Let’s be honest — building a secure, scalable, compliant banking app from scratch? That’s not a weekend project. But with Miracuves, it’s way more doable (and budget-friendly) than you’d think.

We offer:

- Ready-to-launch neobank clones modeled after top players

- Full branding, customization, and feature add-ons

- Support for third-party API integrations (cards, KYC, FX, crypto)

- Built-in admin panel, analytics, and monetization tools

Learn More :-Is Developing a Neobank App Expensive? A Deep Dive Into Development Costs

Conclusion

Neobank clones aren’t just tech — they’re your fast-pass into the world of modern banking. With a smart launch strategy, strong niche focus, and the right development partner, you can compete with giants and build a money-moving machine.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Can I launch a neobank without a banking license?

Yes, by partnering with licensed BaaS providers who handle the regulatory side while you focus on UX and branding.

How much does it cost to build a neobank clone?

It varies based on features, regions, and design — but a solid MVP with Miracuves can be launched at a fraction of building from scratch.

Is a neobank clone secure?

Absolutely — Miracuves includes features like encryption, tokenization, 2FA, and fraud detection systems.

Can I add crypto features to my neobank?

Yes! You can integrate crypto wallets, trading tools, or conversion modules depending on your audience.

How do I make money from my neobank app?

Interchange fees, premium subscriptions, currency spreads, loans, and affiliate partnerships are just a few of the monetization options.

How long does it take to launch?

With a clone base, you can launch in weeks, not years — especially when you work with a skilled team like Miracuves.