What if every time you bought a coffee, a few spare cents were automatically invested toward your future? That’s the simple but powerful idea behind Acorns — an app that helps everyday users grow wealth effortlessly.

Founded in 2014 in California, Acorns popularized micro-investing, letting users round up spare change from daily purchases and invest it automatically in diversified portfolios. The app’s goal is to make saving and investing accessible to everyone, regardless of income or experience.

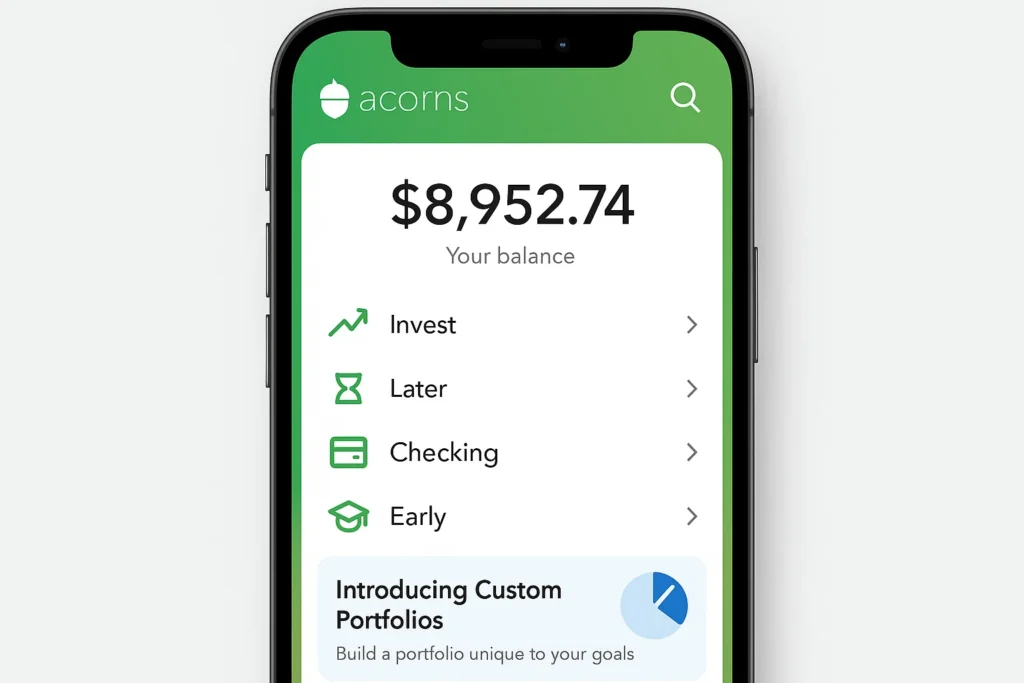

By 2025, Acorns has become one of America’s leading personal finance platforms, offering automated investing, retirement accounts, banking, and family savings plans. It focuses on building good financial habits through automation rather than requiring expert-level knowledge.

By the end of this article, you’ll understand what Acorns is, how it works, how it makes money, and how you can build your own Acorns-like investing app.

What is Acorns? The Simple Explanation

Acorns is a U.S.-based micro-investing and savings app that helps users grow wealth automatically by investing spare change from everyday purchases. Whenever you buy something using a linked debit or credit card, Acorns rounds up the transaction to the nearest dollar and invests the difference into a diversified portfolio.

The core problem Acorns solves is the difficulty of consistent saving and investing. Many people struggle to invest regularly or don’t know where to start. Acorns automates that process — turning small, frequent contributions into long-term investments.

Its primary users include students, young professionals, and first-time investors who want to build financial habits with minimal effort.

As of 2025, Acorns manages over $9 billion in assets for millions of users and has grown into a complete financial wellness platform. It now offers retirement accounts, checking accounts, and family investment plans — all designed to simplify money management.

Acorns succeeded because it removes friction. It made investing as effortless as spending, helping users save without even thinking about it.

How Does Acorns Work? Step-by-Step Breakdown

Acorns operates by connecting to your debit or credit card, rounding up each purchase to the nearest dollar, and investing the leftover change into diversified portfolios managed by experts. It’s designed to make investing automatic and painless.

For Users

1. Account Setup

Users download the Acorns app, create an account, and link their spending card or bank account. The setup takes just a few minutes, and Acorns immediately starts tracking purchases for round-ups.

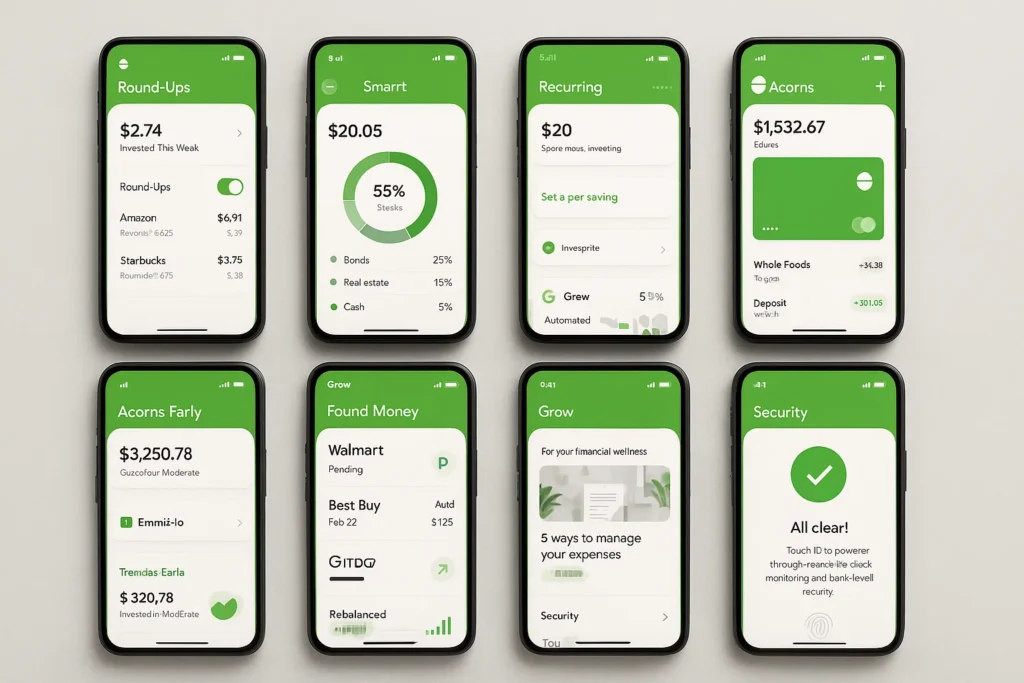

2. Round-Ups and Auto-Investments

When a purchase is made — say, $3.60 for coffee — Acorns rounds it to $4.00 and invests the $0.40 difference into an ETF-based investment portfolio. Users can also set recurring deposits or one-time boosts.

3. Portfolio Selection

Acorns offers five risk-based portfolios: Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive. Each portfolio includes ETFs from trusted providers like Vanguard and BlackRock.

4. Acorns Later (Retirement)

Acorns Later lets users open an IRA (Traditional, Roth, or SEP) and automatically invest in tax-advantaged accounts based on income and goals.

5. Acorns Checking

The Acorns Checking account includes a debit card that integrates with round-ups, direct deposits, and automatic investing — combining banking and investing in one.

6. Acorns Early (Family Accounts)

Parents can set up custodial investment accounts for children, teaching them about saving and wealth growth from an early age.

7. Education and Insights

Through the “Grow” section, Acorns provides educational content to improve users’ financial literacy.

For Service Providers / Partners

Acorns partners with financial institutions, merchants, and ETF providers to manage portfolios, process payments, and offer brand-based cashback (“Found Money”) when users shop with participating companies.

Technical Overview (Simplified)

Acorns runs on a cloud-based, API-driven platform using secure banking integrations to connect user accounts and automate investments. Transactions are processed through PCI-compliant gateways, and investments are executed via registered brokers and custodians.

Machine learning helps personalize portfolio recommendations and analyze user spending behavior to optimize savings potential.

Read More :- How to Develop an Investment App Like Acorns: Types, Features, and Cost

Acorns’ Business Model Explained

Acorns makes money by combining subscription-based revenue with partnerships, interchange fees, and investment-related income — all while keeping the app free of hidden charges. Its business model focuses on scale and automation, generating profit from millions of small investors rather than large accounts.

1. Subscription Plans

Acorns offers a tiered monthly subscription model that gives users access to different features:

- Personal ($3/month): Includes Invest, Later, and Checking accounts.

- Family ($5/month): Adds Acorns Early for kids’ investment accounts.

These predictable monthly fees make up the core of Acorns’ revenue stream.

2. Interchange Revenue

When users spend with the Acorns Visa debit card, the company earns a small percentage from merchants through interchange fees — just like traditional banks do.

3. Found Money Partnerships

Acorns partners with brands such as Nike, Walmart, and Airbnb. When users shop through Acorns, these brands invest a small percentage of the purchase amount back into the user’s Acorns account. Acorns earns a commission for facilitating these referrals.

4. Management and Advisory Fees

While Acorns doesn’t charge direct trading commissions, it earns through small advisory and management fees included in its subscription plans.

5. Interest on Cash Balances

Acorns earns interest on the uninvested cash held in user accounts before it’s deployed into investments.

6. Acorns Later and Early

By expanding into IRAs and family accounts, Acorns attracts long-term customers who increase recurring revenue and retention rates.

7. Scale Efficiency

With millions of users and automated systems, Acorns runs on minimal operational costs compared to traditional investment firms, leading to higher margins.

As of 2025, Acorns generates tens of millions in monthly recurring revenue, driven primarily by subscription growth and partnerships.

Read More :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Key Features That Make Acorns Successful

Acorns stands out because it automates investing and simplifies wealth-building for users who might otherwise never start. Its design, features, and financial philosophy center around effortless growth.

1. Round-Up Investing

Every purchase is rounded up to the nearest dollar, and the difference is automatically invested. This “invest your spare change” concept is the heart of Acorns’ success.

2. Smart Portfolios

Acorns builds portfolios using ETFs from top firms like Vanguard and BlackRock. Each portfolio is diversified across stocks, bonds, and real estate, based on the user’s risk level.

3. Recurring Investments

Users can schedule daily, weekly, or monthly contributions to grow their investments automatically — no manual effort required.

4. Acorns Later (Retirement Accounts)

Acorns Later helps users save for retirement through IRAs (Traditional, Roth, SEP). It automates contributions and adjusts investment strategies based on the user’s age and goals.

5. Acorns Checking

A fully integrated checking account with a debit card that links to round-ups, making spending and investing seamless.

6. Acorns Early (For Families)

Parents can open custodial investment accounts for their children to start investing on their behalf. It’s a unique feature that encourages generational wealth-building.

7. Found Money

Partner brands automatically invest cash back into the user’s account whenever they shop, creating a passive bonus investment stream.

8. Financial Education (Grow)

Acorns includes articles, tips, and market updates to help users learn about money management and investing.

9. Automated Rebalancing

The app automatically adjusts portfolios to maintain the target asset allocation as markets change.

10. Security and Simplicity

All accounts are protected with bank-level encryption, and the interface is clean, friendly, and beginner-focused.

2025 Updates:

Acorns introduced enhanced AI-based savings recommendations, carbon-neutral investing options, and better integration with payroll direct deposits to increase recurring contributions.

The Technology Behind Acorns

Acorns runs on a modern, secure, and scalable financial technology infrastructure designed to automate micro-investing for millions of users seamlessly. Its system combines banking integration, automated investing algorithms, and cloud-based scalability.

Tech Stack Overview (Simplified)

Acorns uses a cloud-native architecture with:

- AWS for hosting and serverless operations

- Node.js and Python for backend automation

- React Native for mobile app development

- PostgreSQL and MongoDB for user data and financial transactions

- Secure banking APIs for real-time fund transfers and investment execution

This setup allows Acorns to process thousands of micro-investments every second while keeping the user experience smooth and responsive.

Real-Time Processing

Every transaction — whether a purchase, round-up, or recurring deposit — is processed instantly. The app updates balances, initiates fund transfers, and invests automatically without user input.

Security and Compliance

As a registered investment adviser and broker-dealer, Acorns complies with SEC and FINRA regulations. It uses:

- Bank-level encryption

- Multi-factor authentication

- Tokenized API calls

- SOC 2-compliant data storage

- FDIC insurance for banking deposits

Automation and AI Integration

Acorns uses automation and AI for:

- Portfolio selection and rebalancing

- User behavior insights

- Round-up prediction and optimization

- Personalized financial tips through the Grow content engine

Scalability and Reliability

Microservices architecture enables independent scaling of components like transactions, investments, and notifications. The platform maintains high uptime even during peak activity.

API and Partner Ecosystem

Acorns connects with payment processors, ETF custodians, and financial partners through secure APIs. This modular structure allows rapid feature expansion — like integrating new ETFs or merchant offers.

Data and Insights

Big data tools like Snowflake and Kafka help Acorns analyze user habits, spending trends, and investment outcomes to continuously improve recommendations.

Acorns’ technology is what enables its effortless experience — automating what used to be complex investment behavior into a simple, hands-off habit for users.

Acorns’ Impact and Market Opportunity

Acorns has transformed how people think about saving and investing. It removed the intimidation factor associated with finance and replaced it with simplicity, automation, and habit-building.

Industry Disruption

Before Acorns, investing was often limited to individuals with extra income, financial literacy, or brokerage experience. Acorns changed that by creating a micro-investing model that required no financial background. It turned spare change into long-term wealth for millions of Americans, influencing banks and fintech startups to adopt similar “round-up” and automation concepts.

Market Statistics and Growth

As of 2025, Acorns manages over $9 billion in assets under management (AUM) and serves 10+ million users. The global micro-investing market continues to grow, expected to surpass $15 billion by 2030.

User Demographics and Behavior

Acorns attracts younger audiences — mostly millennials and Gen Z — who want to save and invest automatically without managing complex portfolios. The average user invests less than $50 a month but maintains consistent engagement.

Geographic Presence

Acorns currently operates in the U.S., but similar models inspired by it are growing in Canada, Australia, and Europe. Its localized versions are finding success in emerging economies where financial literacy and saving habits are developing.

Future Projections

By 2030, Acorns aims to expand internationally and integrate AI-powered personalized saving plans, carbon-conscious investing options, and partnerships with payroll systems for seamless saving.

Opportunities for Entrepreneurs

The demand for accessible, automated investing platforms is booming. Entrepreneurs can capture new markets by building micro-investing apps tailored for regional currencies, reward systems, or demographics such as students and small business owners.

With Acorns Clone Script, you can launch a fully automated micro-investing app — complete with round-up investing, AI-driven portfolios, and real-time analytics, fully customizable for your target market.

Building Your Own Acorns-Like Platform

Acorns’ incredible success proves that people crave simplicity in money management. By focusing on automation, accessibility, and habit-based investing, it turned micro-saving into a mainstream financial trend. Building a similar app can open the door to serving millions of first-time investors in your region.

Why Businesses Want Acorns Clones

A platform like Acorns lets companies or startups:

- Target users who don’t actively invest yet.

- Help customers save and invest automatically.

- Earn recurring revenue through subscriptions.

- Integrate branded cashback (“Found Money”) partnerships.

- Expand into retirement, education, or family finance markets.

- Create stronger user retention through daily financial engagement.

Key Considerations for Development

To build an Acorns-style micro-investing app, focus on:

- Seamless card and bank integrations (round-up logic).

- Automated investment engine with ETF or mutual fund support.

- Secure financial data handling and encryption.

- Regulatory compliance (SEC/FINRA or equivalent regionally).

- Real-time balance tracking and performance insights.

- Integration with partner programs and cashback rewards.

- AI-driven personalization for financial habits and tips.

Cost Factors & Pricing Breakdown

Acorns-Like Micro-Investing App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Micro-Investing MVP | Round-up savings, recurring investments, basic KYC, simple portfolios, funding/withdrawals, transaction history, standard admin panel | $35,000 |

| Mid-Level Micro-Investing Platform | Goal-based portfolios, risk profiling, automated rebalancing, bank/card integrations, enhanced KYC/AML, alerts, richer analytics dashboard | $80,000 |

| Advanced Acorns-Level Platform | Multi-account/family features, premium tiers, tax-efficient strategies, advanced analytics, referral system, multi-region compliance, web + native apps | $200,000+ |

Acorns-Style Micro-Investing Platform Development

The prices above reflect the global market cost of developing an Acorns-like micro-investing / robo-advisor platform—typically ranging from around $35,000 to over $200,000, with a delivery timeline of 3–12 months depending on features, integrations, security, and regulatory/compliance requirements.

Miracuves Pricing for an Acorns-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, Acorns-style micro-investing platform (round-up and recurring investments, basic robo-advisor logic, goal-based portfolios, secure onboarding/KYC, investor dashboards, and mobile apps), with room to extend into more advanced premium tiers, analytics, and international compliance as needed.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational micro-investing ecosystem ready for launch and future expansion.

Delivery Timeline for an Acorns-Like Platform with Miracuves

For an Acorns-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Scope of investment logic and portfolio automation

- Number of bank/payment integrations and data providers

- Depth of KYC/AML and compliance workflows

- Required analytics, reporting, and premium feature set

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js / Nest.js / Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.

Read More :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Conclusion

Acorns has proven that even the smallest amounts can grow into something meaningful when combined with consistency and automation. Its approach to micro-investing changed how millions of people think about saving, showing that building wealth doesn’t require large sums or complex strategies — just steady action and smart technology.

In 2025, Acorns remains a leader in helping users invest effortlessly, combining psychology, automation, and user-friendly design to make finance approachable. Its success story is a lesson in how empathy-driven innovation can transform financial behavior at scale.

For startups and businesses, the Acorns model is a golden opportunity. There’s an enormous market of users seeking simple, trustworthy, and goal-based financial apps. With Acorns Clone Script, you can create your own automated investing platform, ready to serve this growing global audience.

Micro-investing isn’t just a trend — it’s the future of financial inclusion. The next Acorns-style success story could be yours.

A well-executed idea can become a scalable business with the right support — and Miracuves can help you make it a reality.

FAQs :-

How does Acorns make money?

Acorns earns through monthly subscription fees ($3 for Personal, $5 for Family), interchange fees from its debit card, Found Money brand partnerships, and interest from uninvested cash balances.

Is Acorns safe to use?

Yes. Acorns uses bank-level encryption, multi-factor authentication, and is regulated by the SEC and FINRA. Banking deposits are FDIC-insured up to $250,000, and investments are SIPC-protected up to $500,000.

How much does Acorns charge?

Acorns charges $3 per month for individual users and $5 per month for family accounts. There are no trading or commission fees.

Can I use Acorns for retirement?

Yes. Acorns Later provides automated IRAs (Traditional, Roth, SEP) where users can save for retirement with automatic deposits and smart portfolio allocation.

How do Acorns’ round-ups work?

When you make a purchase with a linked card, Acorns rounds the transaction up to the nearest dollar and invests the difference automatically.

Can kids use Acorns?

Yes, through Acorns Early, parents can open custodial investment accounts for their children, helping them build wealth from a young age.

What kind of investments does Acorns use?

Acorns invests in diversified ETF portfolios across stocks, bonds, and real estate from providers like Vanguard and BlackRock.

How many users does Acorns have?

As of 2025, Acorns has over 10 million active users managing more than $9 billion in assets.

What makes Acorns different from other investing apps?

Its round-up investing, automation, family accounts, and educational focus make it ideal for beginners who prefer set-it-and-forget-it investing.

Can I build an app like Acorns?

Yes. With Acorns Clone Script, you can create a fully automated micro-investing and savings platform — with round-ups, banking integrations, and AI-based insights , customized to your target audience.

Related Articles :-