Imagine buying a laptop, flight ticket, or furniture and splitting the cost into simple monthly payments with no hidden fees, no surprises, and complete transparency. Affirm made this possible by reinventing how Americans shop and pay.

Founded in 2012 by Max Levchin (co-founder of PayPal), Affirm started as a mission to bring honesty and clarity to consumer finance. Instead of confusing interest structures or revolving credit, Affirm introduced straightforward BNPL (buy now, pay later) installments that customers can understand at a glance.

In 2025, Affirm is one of the biggest BNPL platforms in the United States, partnered with thousands of major retailers across fashion, electronics, travel, and healthcare. Millions of users rely on Affirm to split purchases into interest-free or low-interest plans while keeping full visibility of costs.

By the end of this article, you’ll understand what Affirm is, how it works, how it makes money, its features, and how you can build an Affirm-like BNPL platform.

What is Affirm? The Simple Explanation

Affirm is a U.S.-based Buy Now, Pay Later (BNPL) platform that allows customers to split purchases into easy monthly payments with clear, upfront pricing and no hidden fees. Instead of using credit cards with revolving debt, Affirm lets users choose a fixed repayment plan at checkout — often 0% interest for eligible purchases.

The main problem Affirm solves is high-interest credit and unclear payment terms. Traditional credit cards charge compounding interest, late fees, and confusing penalties. Affirm offers transparent, predictable installment plans that help users budget better and avoid debt traps.

Its target users include online shoppers, young adults, and budget-conscious consumers who want flexible payments without credit card stress. Merchants use Affirm to increase conversions, average order value, and customer loyalty.

As of 2025, Affirm partners with thousands of brands — including Amazon, Walmart, Target, Nike, Peloton, and Shopify stores — reaching tens of millions of active users across the U.S. It remains one of America’s most trusted BNPL apps thanks to transparency, merchant integrations, and responsible lending models.

How Does Affirm Work? Step-by-Step Breakdown

Affirm works as a buy now, pay later (BNPL) financing platform that lets customers split purchases into smaller payments while merchants get paid upfront. It sits between the user and the retailer, offering fast credit approval with clear, simple terms.

For Users

1. Account Creation

Users sign up using their email and phone number. Affirm verifies identity using personal details and performs a soft credit check (which does not affect credit score).

2. Checkout Process

When users shop online or in-store at partner retailers, they choose “Affirm” at checkout. Affirm instantly assesses eligibility and provides payment plan options.

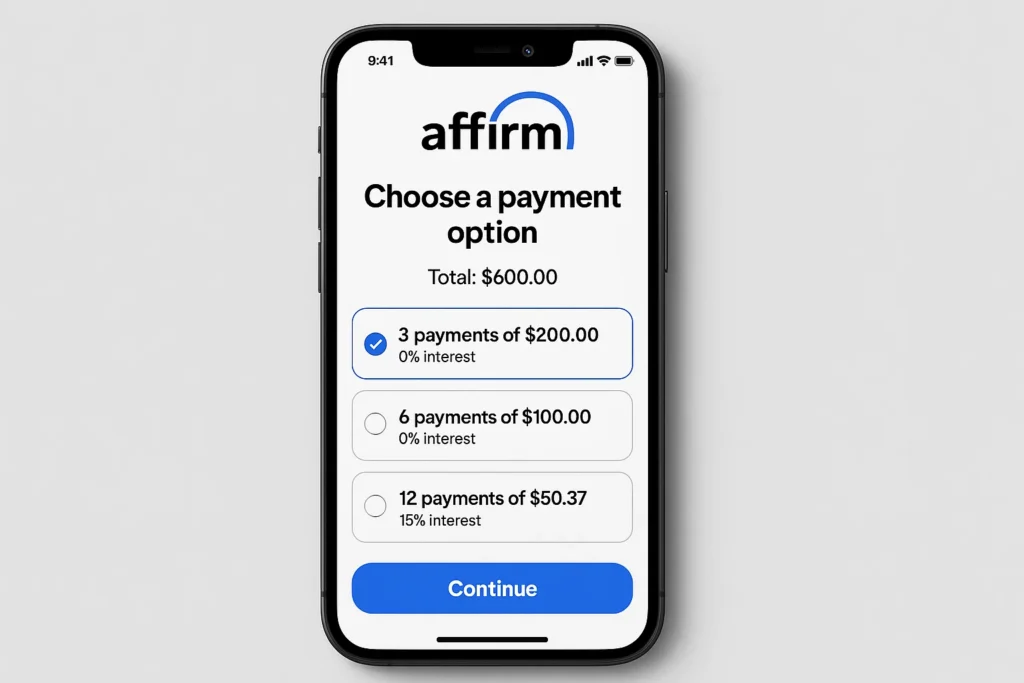

3. Payment Plan Options

Depending on the order and credit profile, users may see:

- 4 interest-free payments

- Monthly installments (3, 6, 12, or 24 months)

- APR ranging from 0% to 36% depending on merchant offers and creditworthiness

The exact loan terms are shown clearly upfront, with no hidden fees.

4. Automatic Payments

Payments are auto-deducted from the user’s bank account or card. The Affirm app displays repayment schedules, due dates, and remaining balances.

5. Affirm Card & Virtual Card

Users can apply for the Affirm Debit+ card or generate a temporary virtual card for purchases at non-partner stores. Payment plans work the same way as checkout financing.

For Merchants (Businesses)

1. Onboarding

Retailers integrate Affirm through APIs or plugins (Shopify, BigCommerce, WooCommerce). Once active, they can offer Affirm as a payment option on all qualifying products.

2. Increased Sales & Conversion

Merchants see:

- Higher average cart value

- Lower cart abandonment

- More repeat purchases

Affirm pays merchants the full amount upfront (minus a small fee), eliminating credit risk.

3. Reporting & Tools

The merchant dashboard tracks performance, repayments, and customer usage analytics.

Technical Overview (Simple)

Affirm uses modern financial and risk-scoring technology:

- Real-time machine learning models for credit decisions

- Soft credit checks to evaluate affordability

- Automated loan generation and repayment scheduling

- Secure cloud-based infrastructure to manage millions of transactions

- APIs that connect merchants, banks, and users seamlessly

Affirm also partners with originating banks to issue loans, enabling nationwide BNPL coverage.

Read More :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Affirm’s Business Model Explained

Affirm’s business model is built around transparent, interest-based installment loans, partnerships with merchants, and financial products that help consumers split purchases into manageable payments. Unlike credit cards, Affirm positions itself as a “no hidden fees, no surprises” financing solution.

1. Merchant Fees (Primary Revenue Source)

Affirm earns most of its revenue by charging merchants a fee every time a customer uses Affirm at checkout.

Merchants pay because:

- Affirm boosts conversion rates

- Customers tend to buy higher-priced items

- It reduces cart abandonment

Depending on the industry, merchant fees can range between 2% to 6% of the transaction.

2. Consumer Interest

Some Affirm plans come with 0% APR, while others include interest ranging from 10%–36% APR, depending on creditworthiness and loan type.

This interest becomes a major revenue channel for Affirm.

3. Interchange Fees via Affirm Debit+ Card

Affirm’s Debit+ card earns interchange revenue whenever users make purchases.

Unlike traditional credit cards, Debit+ connects to bank accounts and offers flexible pay-over-time options.

4. Loan Securitization

Affirm bundles consumer loans and sells them to institutional investors.

This allows Affirm to:

- Raise capital

- Reduce risk

- Grow lending volume

5. Interest Spread

Affirm earns money from the difference between:

- The interest it pays to investors

- The interest it collects from borrowers

This financial margin becomes additional revenue.

6. Partnerships and Platform Integrations

Affirm partners with major brands such as Amazon, Walmart, Shopify, Expedia, and Peloton.

These deals strengthen merchant fee revenue and boost lending volume.

Market Performance (2024–2025)

- Affirm serves 17+ million users in the U.S.

- Its total merchant network includes over 250,000 stores

- GMV (Gross Merchandise Volume) continues to grow as more consumers prefer pay-later options

Affirm’s business model thrives because it:

- Appeals to credit-averse younger users

- Helps merchants increase sales

- Offers flexible financial options

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Key Features That Make Affirm Successful

Affirm grew quickly because it gives shoppers a simple, transparent way to pay over time without hidden fees. Here are the features that make it stand out in the U.S. BNPL market.

1. Instant Loan Approval

Users get real-time loan decisions at checkout within seconds. Affirm evaluates credit, purchase amount, and repayment history instantly, making the approval process smooth and fast.

2. No Hidden Fees

Affirm has no late fees, no service fees, no prepayment penalties, and no surprises. Users see the full cost upfront, which builds trust and reduces financial anxiety.

3. Flexible Repayment Plans

Customers can choose from multiple repayment options:

- Pay in 4 (interest-free)

- 3, 6, or 12-month plans

- Longer plans for high-ticket items

This flexibility helps users manage large purchases more comfortably.

4. Wide Merchant Network

Affirm is integrated with 200,000+ merchants across categories like travel, electronics, fashion, furniture, and health services. This broad acceptance drives user adoption.

5. Transparent Pricing

Before confirming a loan, Affirm clearly displays:

- Monthly payment amounts

- Total repayment cost

- Interest rate (if any)

- Due dates

There are no hidden charges anywhere in the process.

6. Pay-in-4 (Zero Interest)

For smaller purchases, Affirm’s Pay-in-4 option lets users split payments into four equal installments at 0% interest — a major competitor to Klarna and Afterpay.

7. Virtual Card for Any Store

Affirm offers a virtual one-time-use card that users can create in-app and use at checkout for stores that don’t directly integrate Affirm.

8. Affirm Debit Card

A physical card that lets shoppers pay upfront or split their purchases into installments. This expands Affirm’s scope beyond merchant integration.

9. Smart Credit Decision Engine

Affirm uses real-time underwriting models that factor in:

- Credit score

- User behavior

- Purchase type

- Merchant category

- Income and repayment history

This ensures safer lending and reduces default risk.

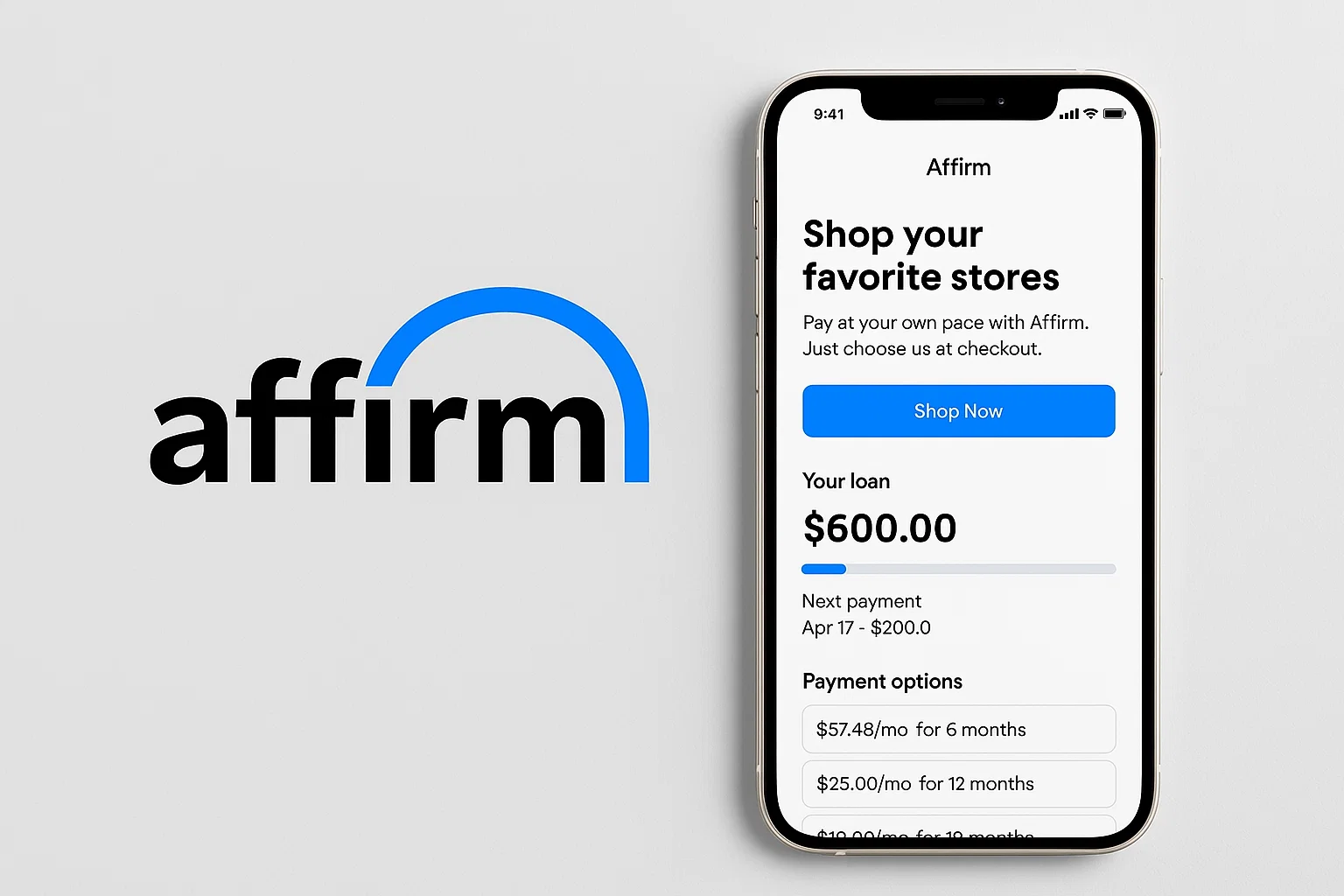

10. Mobile App for Full Control

The Affirm app gives users access to:

- Upcoming payments

- Purchase history

- Spending limits

- Virtual cards

- Merchant discounts

- Budgeting and reminders

2025 Updates

Affirm recently added:

- AI-based shopping recommendations

- Subscription financing options

- “Pay-Monthly Everywhere” virtual card expansion

- BNPL for healthcare and auto services

- Improved fraud detection using machine learning

Affirm’s Impact and Market Opportunity

Affirm has reshaped the U.S. consumer finance landscape by making transparent, interest-known-up-front installment loans a mainstream alternative to credit cards. Its “no hidden fees, no compounding interest” promise built trust among younger shoppers who prefer clarity over traditional revolving credit.

Industry Disruption

Before Affirm, most point-of-sale (POS) financing options were tied to banks, had confusing terms, or required high credit scores. Affirm disrupted this by:

- Allowing approvals in seconds

- Offering clear repayment timelines

- Eliminating late fees and hidden charges

- Partnering directly with online and offline retailers

This shifted consumer preference toward BNPL over credit cards, especially for purchases between $50–$2,000.

Market Statistics and Growth

As of 2025:

- BNPL usage in the U.S. surpassed $150 billion annually

- Affirm partners with 200,000+ merchants, including Amazon, Walmart, and Shopify

- It serves millions of active users

- Over 60% of users are under 35, highlighting strong adoption among younger demographics

The BNPL sector is expected to grow at 20%+ CAGR through 2030.

User Demographics and Behavior

Affirm is popular among:

- Millennials and Gen Z

- Online shoppers

- Budget-conscious families

- Users avoiding traditional credit cards

Users prefer Affirm because they see the exact total cost upfront, with no surprises.

Geographic Presence

Affirm primarily operates in the United States, with selected expansion through merchant partners in Canada and U.K.-based retailers. Its model can scale globally through digital merchant integrations.

Future Projections

By 2030, Affirm aims to expand into:

- Subscription-based credit

- Everyday purchases (groceries, bills)

- AI-driven spending insights

- Cross-border merchant financing

- Integrated credit + debit hybrid products

BNPL is becoming a core component of e-commerce checkout flows, and Affirm remains one of the strongest players due to its transparency and durable merchant network.

Opportunities for Entrepreneurs

The rapid rise of BNPL opens opportunities for businesses to build:

- Region-specific BNPL apps

- Sector-focused financing (travel, healthcare, education)

- Merchant-integrated financing tools

- Credit-lite installment systems for emerging markets

With Affirm Clone Script, entrepreneurs can launch a ready-to-operate BNPL platform — complete with merchant dashboards, underwriting engines, repayment modules, and risk scoring.

Building Your Own Affirm-Like Platform

Affirm’s success shows how powerful transparent, flexible financing can be when combined with modern technology and customer-first design. Its model has inspired a new wave of BNPL (Buy Now, Pay Later) platforms around the world — giving consumers more control and merchants higher conversion rates.

Why Businesses Want Affirm Clones

A platform like Affirm helps businesses and startups:

- Offer flexible pay-over-time options

- Increase checkout conversions and reduce cart abandonment

- Attract customers who can’t or don’t want to use credit cards

- Build an alternative credit ecosystem with fair interest rates

- Provide transparent installment plans with no hidden fees

- Create long-term user trust through responsible lending

BNPL usage is booming in 2025, especially among Gen Z and millennials — making this one of the fastest-growing fintech categories.

Key Considerations for Development

To build a high-performing Affirm-style BNPL platform, you’ll need to focus on:

- Instant KYC and credit checks

- Risk-scoring algorithms to determine loan eligibility

- Merchant integrations (Shopify, WooCommerce, Magento)

- Automated repayment scheduling

- Clear loan terms and transparency

- Fraud detection and identity validation

- PCI-compliant payment processing

- Secure handling of customer financial data

- Mobile-first seamless checkout experience

Cost Factors & Pricing Breakdown for Affirm-Like BNPL App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic (MVP BNPL System) | User registration, basic merchant module, simple loan creation, repayment tracking, notifications | $25,000 |

| Intermediate Level | Automated approval logic, improved merchant panel, payouts, analytics dashboards, basic credit-scoring | $45,000 |

| Advanced (Full-Scale BNPL Platform) | Credit-risk engine, underwriting logic, advanced KYC/AML, merchant APIs, wallet system, multi-region support | $80,000+ |

Affirm-Style BNPL Platform Development

The prices above reflect the global market cost of developing a BNPL platform similar to Affirm — typically ranging from $25,000 to over $80,000, with delivery timelines of 3–10 months depending on credit-risk logic, compliance layers, and fintech integrations.

Miracuves Pricing for an Affirm-Like Custom Platform

Miracuves Price: Starts at $15,999

This pricing tier is positioned for a feature-rich, finance-grade BNPL system including merchant tools, automated repayment engine, credit assessment flows, underwriting logic foundations, and mobile app enablement. It gives founders a scalable, secure architecture that can be extended into more advanced enterprise-grade modules when required.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational BNPL ecosystem ready for launch and future expansion.

Delivery Timeline for an Affirm-Like Platform with Miracuves

For a BNPL-focused, JS-based custom fintech build, the typical delivery timeline is 30–90 days, depending on:

- Depth of credit assessment and underwriting logic

- Number of merchant tools and payout workflows

- Integration requirements (KYC, AML, payment gateways, banks)

- Level of reporting, analytics, and automation required

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms. Other technology stacks can be discussed and arranged upon request during the consultation phase.

Building an Affirm-style Buy Now Pay Later (BNPL) platform involves credit assessment workflows, automated repayment cycles, merchant dashboards, risk engines, and compliance-ready fintech architecture. The global development market typically prices BNPL systems at a premium because they require high-grade security, data accuracy, fraud control, and multi-party financial logic.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.

Read More :- Read the complete guide on fintech app development costs

Conclusion

Affirm has transformed the way Americans pay for purchases by making credit more transparent, predictable, and accessible. Its simple “pay over time” model resonates with users who want financial control without dealing with hidden fees, revolving credit traps, or compounding interest.

In 2025, Affirm remains a leader in the buy-now-pay-later space by offering interest-free installments, virtual cards, and responsibly underwritten loans. Its partnerships with top retailers and ecommerce platforms make it an integral part of the modern checkout experience.

For entrepreneurs, Affirm proves that trust, clarity, and user-centered design can redefine an entire industry. The BNPL market is still growing worldwide, especially in emerging regions where traditional credit adoption is low.

FAQs :-

How does Affirm make money?

Affirm earns through interest on installment loans, merchant fees when shoppers use “Buy Now, Pay Later,” and its virtual card transactions. Some loans have 0% APR, while others include interest depending on the merchant and user profile.

Is Affirm safe to use?

Yes. Affirm uses encryption, identity verification, and strict underwriting models. It does not charge hidden fees, late fees, or penalties, making it transparent compared to traditional credit.

Does Affirm charge interest?

Some Affirm payment plans come with 0% APR, while others range from 10% to 36% APR depending on creditworthiness, merchant agreements, and loan terms.

Can Affirm affect my credit score?

Affirm performs a soft credit check for most purchases, which does not impact credit score. However, certain longer-term loans may involve a hard pull and could affect credit depending on repayment behavior.

Where is Affirm available?

Affirm is available across the United States at thousands of online and in-store retailers, including travel, electronics, fashion, and household brands.

Does Affirm charge late fees?

No. Affirm is known for its no-late-fee policy, though missing payments may affect loan eligibility and certain credit-based evaluations.

What makes Affirm different from Klarna or Afterpay?

Affirm focuses on transparent installment loans with no hidden charges. It offers longer payment terms, higher credit limits, and is often chosen for big-ticket items like travel, electronics, and furniture.

How many users does Affirm have?

As of 2025, Affirm has 15+ million active users and partnerships with over 200,000 merchants, continuing to lead the U.S. BNPL (Buy Now, Pay Later) market.

What technology powers Affirm?

Affirm uses machine learning underwriting models, cloud-native architecture, real-time fraud detection, and encrypted financial APIs to manage loans and payments securely.

Can I build an app like Affirm?

Yes. With Miracuves, you can launch a BNPL platform with loan automation, merchant dashboards, risk scoring, and seamless checkout integration in, fully customizable for your market.

Related Articles :-