You launch a startup — investors love your idea, traction begins, but managing finances becomes chaotic. Multiple team members need company cards, vendors demand payments, reimbursements pile up, and investors want expense reports. Traditional banks are slow and rigid. You need something built for fast-paced startups and modern businesses — not old-school banking systems.

That’s exactly where Brex comes in.

Founded in 2017 in the USA, Brex is a corporate card and spend management platform built for startups, e-commerce brands, and growing businesses. It offers instant virtual cards, automated expense tracking, real-time budgets, travel solutions, and financial dashboards — all powered by modern fintech infrastructure.

Brex has become a favorite among startup founders, SaaS companies, venture-backed businesses, remote teams, and global enterprises because it helps them run finance like a tech company, not a traditional bank.

In this guide, you’ll understand:

- What Brex really is

- How Brex works (from card issuing to spend control)

- Its business model & pricing

- Key features and technology behind it

- Why Brex became a fintech success story

- Why entrepreneurs are exploring Brex-style platforms

What Is Brex? – The Simple Explanation

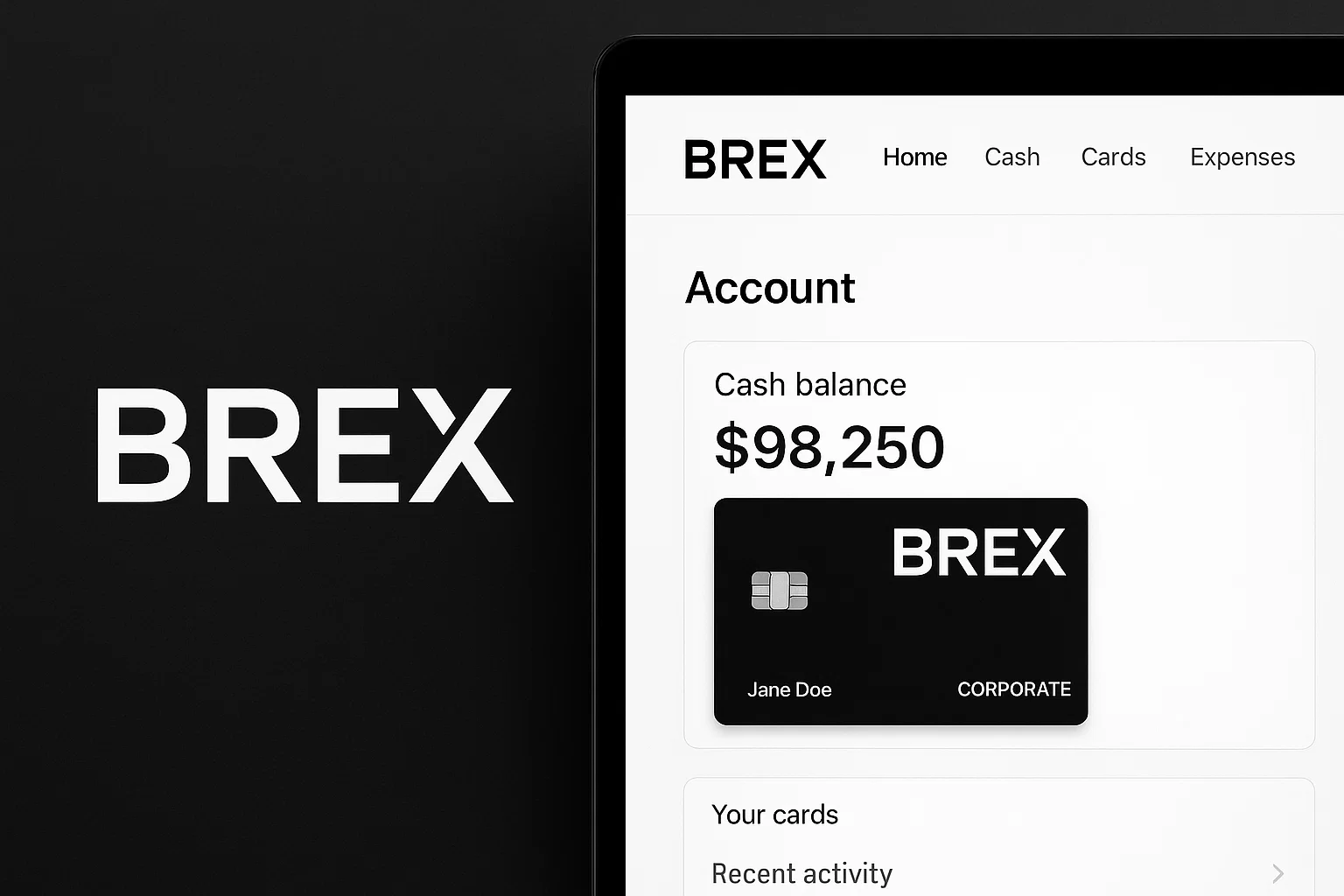

Brex is a corporate card and spend management platform designed for startups, fast-scaling companies, and modern businesses. Instead of waiting for traditional banks and manual paperwork, Brex allows companies to issue virtual and physical corporate cards instantly, track expenses in real time, manage budgets, automate reimbursements, and monitor spending across departments — all in one dashboard.

It’s not just a card provider — it’s a financial operating system for businesses.

Core Problem Brex Solves

Traditional corporate banking is slow, complex, and mostly built for large enterprises. Startups and digital-first companies need:

- Flexible spending limits

- Instant virtual cards

- Automated receipt matching

- Team-wise budgets

- Travel & reimbursement tracking

- Multi-currency support

- Real-time visibility into company finances

Brex solves all of this with modern, software-driven infrastructure.

Who Uses Brex?

| User Type | Purpose |

|---|---|

| Startups & SaaS Companies | Issue cards & manage expenses |

| E-commerce Brands | Pay vendors & track marketing spends |

| Remote Teams | Handle reimbursements & travel |

| Enterprises | Control spending across departments |

| Venture-backed Businesses | Manage capital efficiently |

Why Brex Became Popular

- No personal guarantee for founders

- Instant virtual cards

- Automated spend tracking

- Easy integration with QuickBooks, NetSuite, Xero & more

- Real-time budgeting & card controls

- Travel booking & expense policies built-in

Market Position in 2025

- Used by thousands of startups and SMBs

- Valued at $6B+ (est.)

- Competes with Ramp, Divvy, Stripe, American Express, Airbase

- Evolving into a full financial OS with banking, payments & expense automation

Brex is not a replacement for banks — it’s a layer on top of business finance, built for the speed of tech companies.

How Brex Works – Step-by-Step Breakdown

Brex combines corporate cards + spend control + finance automation into one streamlined platform. Here’s how it works for different types of users:

For Businesses & Teams (User Flow)

1. Sign Up & Verification

Businesses create an account and verify company details. Once approved, virtual cards can be issued immediately — no personal guarantee required.

2. Issue Cards Instantly

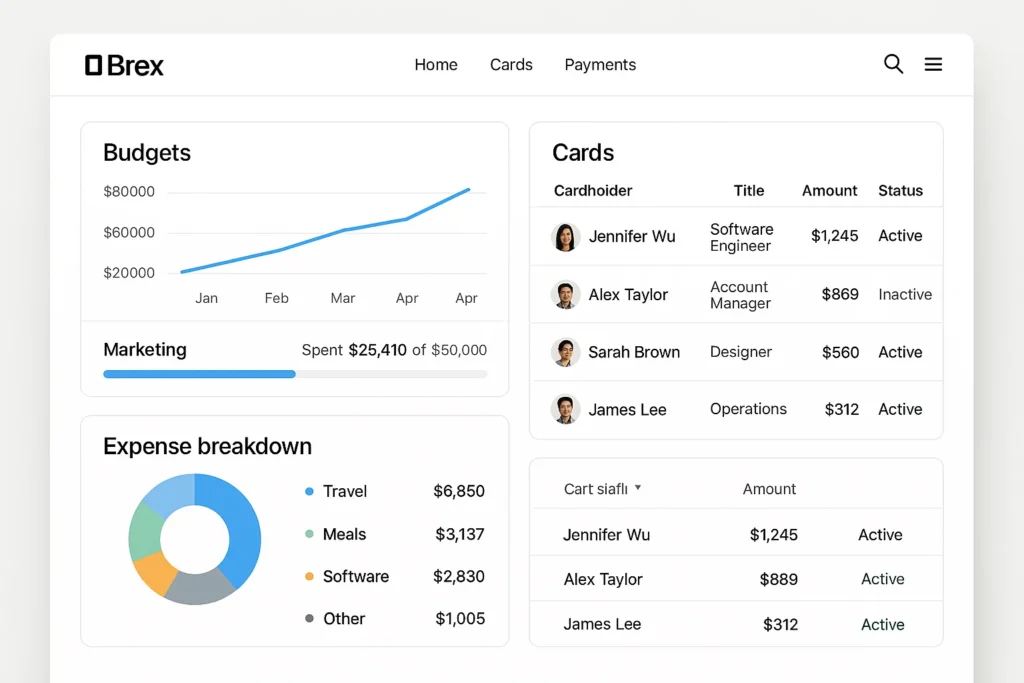

Admins can create virtual or physical corporate cards for team members with:

- Custom spend limits

- Approval policies

- Department-wise budgets

- Vendor-specific cards (for ads, SaaS tools, travel, etc.)

3. Real-Time Spend Tracking

Every transaction is tracked instantly — categorized automatically and linked to receipts using AI.

4. Reimbursements & Travel

Employees can submit expenses via app → managers approve with one click → funds reimbursed automatically.

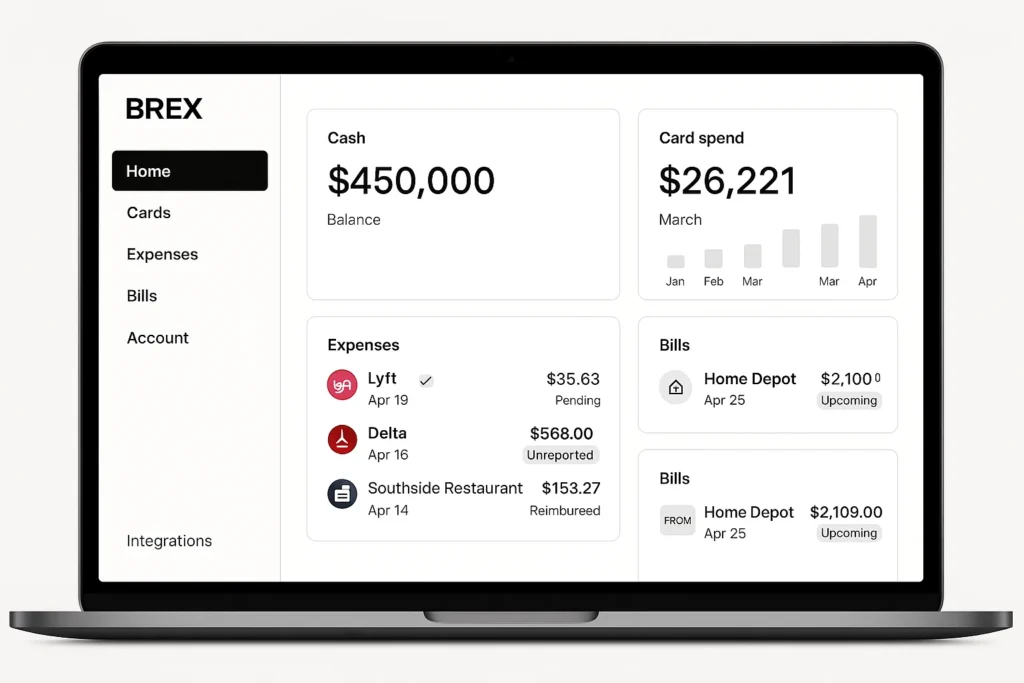

5. Finance Dashboard

Company sees spend analytics, department budgets, travel data, and cash flow in real time.

For Admins / Finance Teams

Brex gives full control over:

✔ Spend policies

✔ Budget allocation

✔ Card limits

✔ Vendor tracking

✔ Invoice payments

✔ Accounting integrations

Admins can freeze, adjust, or cancel cards instantly — even for remote teams.

Business Example (Typical User Journey)

A startup spends heavily on ads. Instead of one shared card, Brex issues individual cards for Google Ads, Meta Ads, SaaS tools, influencer campaigns.

Each has its own limit — making finance tracking clean and automated.

Technical Overview (Simplified)

Brex relies on a secure, API-driven infrastructure:

| Component | Purpose |

|---|---|

| Card Issuing API | Creates virtual & physical cards instantly |

| Spend Control Engine | Sets budgets & permissions |

| AI Receipt Matching | Converts bills & photos into records |

| Real-Time Dashboard | Tracks spending company-wide |

| Accounting Integrations | Connects to Xero, QuickBooks, Netsuite, etc. |

Brex turns financial operations into software — not paperwork.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Brex’s Business Model Explained

Brex is a B2B SaaS + financial services company. It doesn’t just earn from card swipe fees like a bank — it makes money from a mix of interchange, software subscriptions, and value-added financial tools.

How Brex Makes Money

1. Interchange Revenue

Every time a Brex card is used, the merchant pays a small fee to the card network (Visa/Mastercard).

A portion of that fee (interchange) goes to Brex.

Because Brex targets high-spend startups and companies, this adds up quickly.

2. Software & Platform Fees

Brex now offers spend management and finance tools that can be charged on a SaaS basis for:

- Advanced budgeting

- Multi-entity and multi-currency support

- Approvals & workflows

- Advanced reporting and analytics

Larger companies pay for these premium features as a monthly or annual subscription.

3. Brex Business Accounts (Cash & Banking Layer)

Brex also offers business accounts (cash management + payments).

Here it can earn from:

- Float (interest on pooled balances)

- FX margins on international payments

- Payment-related fees for certain transfers

4. Partner & Ecosystem Revenue

Brex partners with:

- Travel platforms

- Software tools

- Cloud providers

Sometimes it earns referral or partnership fees while offering extra rewards and discounts to card users.

Pricing & Fees – Simple View

For most startups, Brex feels like a “free” card + platform, because:

- No personal guarantee

- No annual card fee in many cases

- Rewards and cashback on spend

But behind the scenes, revenue comes from:

- Interchange on every transaction

- Optional paid software tiers (for bigger teams)

- Financial product margins

Why This Model Works

- Startups and tech companies spend a lot on ads, SaaS, travel, and contractors → high interchange volume

- Finance teams are happy to pay for better control + automation → spend management SaaS

- Brex becomes “sticky” because once your entire company runs on it (cards, budgets, approvals, reporting), switching away is painful

So Brex is not just “issuing cards” — it is building a recurring, scalable financial OS for businesses.

Key Features That Make Brex Successful

Corporate Cards Built for Modern Teams

Brex issues virtual and physical corporate cards that can be created, activated, and controlled in minutes.

Finance teams can:

- Set individual limits

- Restrict cards to certain categories (e.g., “only SaaS” or “only ads”)

- Create vendor-specific cards (for Google Ads, Meta, AWS, etc.)

This reduces fraud risk and makes reconciliation much cleaner.

Real-Time Spend Management & Budgets

Brex turns spending into a real-time dashboard, not a month-end surprise.

You can:

- Create department-wise budgets (Marketing, Sales, Engineering)

- Set per-team and per-project limits

- See every spend as it happens

- Get alerts when teams are close to budget

This gives finance leaders live control over company cash burn.

Automated Expense Tracking & Receipts

With Brex, employees don’t need to keep piles of paper bills. The platform:

- Sends a notification after each transaction

- Lets users snap and upload receipts in-app

- Uses AI to auto-categorize expenses

- Syncs directly with accounting platforms

This removes a huge operational headache for both employees and finance teams.

Travel & Reimbursement in One Flow

Brex includes tools for travel booking and reimbursements so teams can:

- Book flights, hotels, and trips using corporate policies

- Submit out-of-pocket expenses via mobile

- Get approvals and reimbursements quickly

All travel and reimbursement data flows into the same spend system, instead of scattered tools.

Integrations with Accounting & Finance Stack

Brex connects smoothly with tools like:

- QuickBooks

- Xero

- NetSuite

- ERP and payroll systems

Transactions are mapped to the right categories and ledgers automatically, helping close books faster and reducing manual entry errors.

Rewards Designed for Startups & Digital Businesses

Unlike traditional cards focusing on airport lounges only, Brex rewards are optimized for:

- Online ads (Google, Meta, etc.)

- SaaS and cloud services

- Rideshare and remote-work expenses

This makes rewards more relevant for tech-first companies that spend heavily on software and growth.

Global & Remote-Friendly Controls

For globally distributed teams, Brex offers:

- Support for distributed team cards

- Multi-entity and multi-currency setups (in higher tiers)

- Card freezing, limit changes, and policy edits in seconds

This makes it easier to manage remote teams, contractors, and international offices from one central place.

Security, Compliance & Control

Brex includes:

- Real-time fraud monitoring

- Instant card lock/unlock

- Role-based access and approvals

- Policy-based spend rules

So finance teams get bank-grade safety with the flexibility of modern software.

What Truly Sets Brex Apart

Brex’s strength is that it doesn’t act like a bank app. It behaves like a modern SaaS platform that just happens to do cards, budgets, travel, and expenses extremely well.

For fast-moving companies, that difference is huge — it turns financial operations from a bottleneck into a growth enabler.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Brex

Modern, API-Driven Architecture

Brex is built like a modern SaaS product, not a legacy bank core. Under the hood, it typically uses:

- Frontend: React / Next.js for dashboards, React Native / native apps for mobile

- Backend: Microservices built with languages like Go, Java, Node.js, or Python

- Databases: Combination of relational (PostgreSQL/MySQL) and NoSQL stores for scale

- Cloud Infrastructure: Deployed on major cloud providers with container orchestration (Kubernetes) for high availability and elasticity

This modular, service-based architecture lets Brex ship features quickly, scale individual components, and maintain strong reliability even as transaction volume grows.

Real-Time Card Processing & Spend Engine

Brex’s core engine has to approve, decline, and categorize card transactions in real time. To do this, it relies on:

- High-throughput card authorization services connected to networks (Visa/Mastercard)

- Rules engines that apply spend policies, category limits, and risk checks instantly

- Message queues and event streams so every transaction flows into analytics, alerts, and accounting in seconds

This is how Brex can immediately show a spend in the dashboard, trigger a receipt notification, and update budgets right after a swipe or online payment.

Data, AI & Automation

Brex uses data systems and ML models to:

- Automatically categorize expenses (e.g., ads, SaaS, travel)

- Detect unusual spending patterns or potential fraud

- Match receipts with card transactions

- Generate insights on team burn, vendor concentration, and runway

This turns Brex from “just a card tool” into an analytics layer for company spending.

Security & Compliance

Because Brex touches payments and financial data, it must operate at bank-grade security:

- End-to-end encryption (in transit and at rest)

- Tokenization of card details

- Role-based access control and audit logs

- Compliance with PCI-DSS for card data handling

- Strict permissions around who can view, approve, or export financial data

This ensures that even as Brex behaves like a SaaS app, it still meets the standards expected of financial institutions.

Integrations & APIs

Brex connects deeply with the tools finance teams already use. Its integration layer includes:

- Accounting platforms: QuickBooks, Xero, NetSuite, and others

- HR & payroll tools: To sync employee lists and cost centers

- Travel tools: For bookings and policy enforcement

- Custom APIs: So larger companies can plug Brex data into internal finance systems or data warehouses

Because of this, Brex can fit into an existing finance stack rather than forcing teams to start from scratch.

Mobile + Web Experience

- Web dashboard: Designed for CFOs, controllers, and finance teams to manage policies, budgets, entities, and reports

- Mobile app: Built for employees and managers to view cards, submit receipts, track transactions, and approve on the go

Both surfaces talk to the same backend services, so any policy or limit change on web is reflected immediately on cards and mobile.

Why This Tech Stack Matters for Businesses

- Real-time controls mean fewer budget surprises

- Automation reduces manual finance work and errors

- Robust integrations speed up month-end closing

- Scalable infrastructure supports rapid company growth

- Security and compliance keep investors and auditors comfortable

In short, Brex’s technology turns what used to be slow, spreadsheet-heavy finance work into a live, software-driven system that actually matches the speed of modern startups.

Brex’s Impact & Market Opportunity

Brex didn’t just launch another corporate card — it reframed how startups and modern companies run their finance stack. By turning cards, budgets, reimbursements, and travel into one connected system, it helped finance teams move from reactive bookkeeping to proactive spend control.

How Brex Changed the Game

- From bank-first to software-first

Traditional corporate cards come from banks with clunky portals. Brex flipped this by starting as a software platform that happens to offer cards, banking-like features, and automation on top. - From “one shared card” to many smart cards

Instead of one or two cards passed around or shared online, Brex lets companies issue many controlled cards with specific limits, vendors, and budgets — making fraud and chaos much harder. - From month-end surprises to real-time visibility

Finance teams no longer wait for statements. With Brex, they see live spending by person, department, and project — and can adjust policies instantly.

Who Benefits the Most

- Venture-backed startups that scale quickly and need flexible finance

- SaaS & tech companies with remote teams and lots of tool subscriptions

- E-commerce brands spending heavily on ads and inventory

- Global teams managing multiple currencies, entities, and locations

For these companies, Brex becomes a central nervous system for spending — instead of dozens of scattered cards, receipts, and spreadsheets.

Market Opportunity in 2025 and Beyond

The space Brex operates in — corporate cards + spend management + fintech OS — is still expanding fast. There is huge room for:

- Regional versions of Brex (for India, MENA, LatAm, SE Asia, etc.)

- Vertical-specific Brex clones (for agencies, logistics, healthcare, construction, creator economy, etc.)

- Hybrid tools that combine cards + payments + invoicing + subscriptions management for SMBs

Every business that spends money (which is… all of them) needs better visibility and control. That means:

- Massive TAM (Total Addressable Market)

- Strong demand for software-driven finance

- Lots of room for specialized players, not just one global winner

Why This Excites Entrepreneurs

Brex proved three powerful ideas:

- Finance can be UX-first and still compliant.

- Owning the spend layer gives strong long-term revenue and retention.

- You can start with cards and grow into a full finance operating system.

For founders, that opens options like:

- “Brex for logistics fleets”

- “Brex for creator businesses”

- “Brex for agencies / freelancers / marketplaces”

Each of these niches has its own workflows, policies, and financial pain points — and each could support its own Brex-style platform.

Building Your Own Brex-Like Platform

Brex proved that financial tools don’t have to feel like banks — they can behave like modern software, giving businesses real-time control over spending, budgets, and approvals. This creates a massive opportunity for entrepreneurs to build Brex-style platforms for specific regions, industries, or business types.

Why Businesses Want a Brex-Like Platform

✔ Rising demand for financial automation

✔ Remote teams & multi-entity businesses need smart spend tools

✔ SaaS & e-commerce companies spend heavily on digital services

✔ Traditional banks are too slow for startup workflows

✔ Real-time finance is becoming the new standard

Who Could Be Your Target Market?

| Industry / Segment | Opportunity |

|---|---|

| Logistics & Fleets | Fuel cards, tolls, driver spending |

| Creative Agencies | Client-wise budgets & approvals |

| Freelancers & Remote Teams | Subscription and travel tracking |

| Construction Businesses | Material & vendor budgets |

| Healthcare Companies | Regulated expense compliance |

| Startups in Emerging Markets | Local language + regional banks |

Cost Factors & Pricing Breakdown

Brex-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Corporate Card & Spend MVP | Company signup, admin & employee accounts, basic virtual card issuing (via your card-issuing partner), simple spend limits, category tagging, basic receipts upload, transaction feed, web admin dashboard, simple reports (per user, per card, per category) | $80,000 |

| Mid-Level Spend Management Platform | Multi-entity support, physical & virtual cards, advanced limits & controls, multi-level approvals, richer policy engine, automated receipt matching, GL export (CSV/API), basic ERP/accounting integrations, mobile apps for employees, analytics dashboard for finance teams | $150,000 |

| Advanced Brex-Level Corporate Card Ecosystem | Full-scale corporate card & spend management suite, multi-currency support, deep ERP integrations (NetSuite, Xero, etc.), automated workflows, budgets & projects, travel & expenses modules, advanced risk/credit logic (via your issuer), real-time insights, granular roles & permissions, scalable cloud-native architecture | $250,000+ |

Brex-Style Corporate Card & Spend Management Development

The prices above reflect the global market cost of developing a Brex-like corporate card and spend management platform — typically ranging from $80,000 to over $250,000, with a delivery timeline of around 4–12 months for a full custom build. This usually covers secure card and transaction handling, policy and approval engines, analytics, complex role structures, deep accounting integrations, and the infrastructure needed to support high-growth businesses at scale.

Miracuves Pricing for a Brex-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, JS-based Brex-style corporate card and spend management platform that covers virtual/physical card journeys (via your issuer), company and employee accounts, spend controls and approvals, transaction feeds with tagging and receipt upload, core analytics with ERP exports, and a modern web admin portal plus employee-facing web/mobile apps. From there, it can be scaled into multi-entity setups, deeper ERP integrations, budget management, travel & expense modules, and richer automation as your finance stack grows.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational corporate card & spend management ecosystem ready for launch and future expansion.

Delivery Timeline for a Brex-Like Platform with Miracuves

For a Brex-style, JS-based custom build, the typical delivery timeline with Miracuves is approximately 30–90 days, depending on:

- Depth of card features, spend controls, and approval workflows

- Number and complexity of issuer, banking, and accounting/ERP integrations

- Complexity of analytics dashboards, reporting, and automation logic

- Scope of web admin portal, employee apps, branding, and multi-entity support

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Core Features to Include in a Brex-Like App

A strong Brex-style platform should include:

- Virtual & physical corporate cards

- Real-time spend limits

- Department/project budgets

- Travel & expense tracking

- Receipt scanning & AI categorization

- Reimbursements & approvals

- Accounting integrations

- Multi-entity & multi-currency support

- Advanced analytics & reporting

Development Roadmap (Conceptual)

| Stage | Goal | Features |

|---|---|---|

| MVP | Card issuing + spend tracking | Virtual cards + basic limits |

| Growth | Travel + reimbursements | AI receipt matching + policy workflows |

| Scale | Full finance OS | Accounting/API integrations + analytics |

A clone-based approach lets you move faster — instead of building from zero, you start with a strong core and add your strategy on top.

Read More :- Read the complete guide on fintech app development costs

Conclusion

Brex showed that if you treat finance as a software problem, not just a banking product, everything changes for fast-moving companies. Instead of chasing receipts, guessing budgets, and waiting for end-of-month statements, teams get live visibility, smart controls, and automation wrapped into one platform. That’s why Brex feels less like a card provider and more like a financial operating system for modern businesses.

As more startups, agencies, e-commerce brands, and global teams look for Brex-style control over spending, the opportunity to build niche, region-specific, or industry-focused versions is only getting bigger. With the right mix of cards, policies, dashboards, and integrations, your Brex-like platform can become the central nerve system for how a whole segment of businesses handles money.

FAQs :-

How does Brex make money?

Brex earns from interchange fees every time a Brex card is used, plus software revenue from its spend management platform, and margins from financial services like business accounts, payments, and FX.

Is Brex a bank?

No. Brex is not a bank. It’s a fintech and software company that partners with licensed banks to provide card issuing and account services, while Brex focuses on cards, software, and spend control.

Who is Brex best for?

Brex is designed mainly for:

Startups and venture-backed companies

SaaS and tech businesses

E-commerce and online brands

Remote and global teams that need many controlled corporate cards

Does Brex require a personal guarantee from founders?

One of Brex’s early differentiators is no personal guarantee for founders (subject to eligibility). Approval is based more on company profile, funding, and cash flows rather than founder’s personal credit.

What makes Brex different from a normal corporate card?

Brex combines:

Instant virtual & physical cards

Real-time spend limits & budgets

Automated expense tracking & receipts

Travel, reimbursements, and approvals

Deep accounting integrations

It behaves more like a finance software platform than a simple card.

Can Brex replace my accounting software?

No. Brex doesn’t replace tools like QuickBooks, Xero, or NetSuite — it integrates with them. Brex handles spend, cards, and approvals, then pushes clean data into your accounting system.

Does Brex support remote and global teams?

Yes. Brex is built to work with distributed teams and multi-entity setups (in higher tiers), offering local cards, policies, and budgets across regions in a single platform.

Is Brex free to use?

Brex cards often have no annual fee and feel “free” at the card level, because revenue comes from interchange. However, advanced spend management features and enterprise setups may be on paid software tiers.

Can I build an app or platform similar to Brex?

Yes. You can build a Brex-like platform for:

A specific country or region

A specific industry (logistics, agencies, construction, creators, etc.)

SMBs that need simple spend + card control

Using a clone-style base and modern fintech APIs can reduce time and cost.

Can Miracuves help me launch a Brex-style solution?

Yes. Miracuves can provide a Brex-like spend management + card platform with:

Card modules (virtual/physical via partner APIs)

Spend limits, approvals, and budgets

Receipt OCR & AI categorization

Dashboards for finance teams

Accounting & payout integrations

Delivered as a ready-to-launch solution in 30-90 days, with full customization.

Related Articles :-