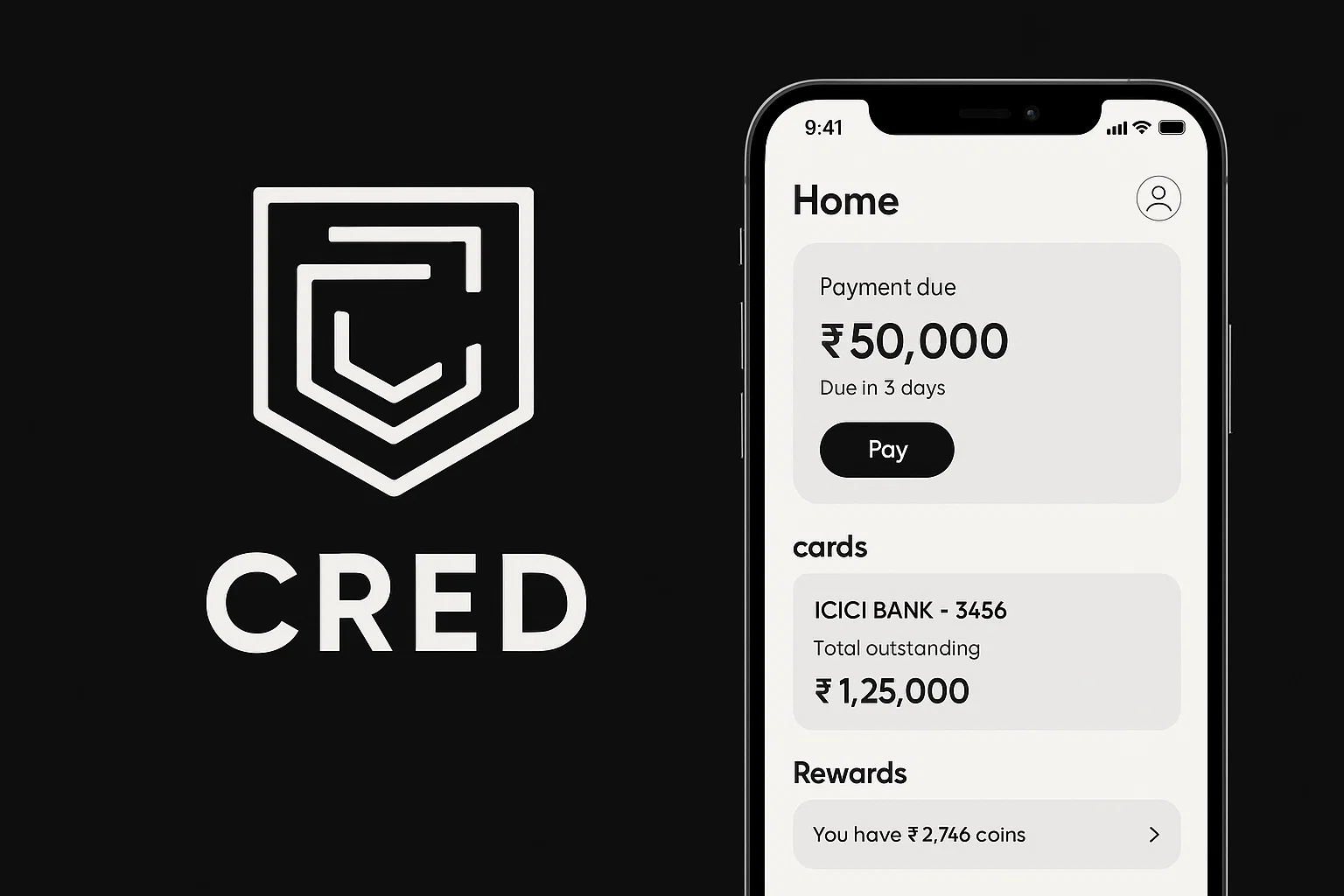

Imagine paying your credit card bill and actually getting rewarded for it — cashback, exclusive offers, access to premium brands, and better control over your credit score. That’s the experience CRED created for urban Indian users.

Launched in 2018 by Kunal Shah, CRED started as an invite-only app that rewarded users for paying their credit card bills on time. Over the years, it has evolved into a full credit lifestyle and payments ecosystem, offering rewards, short-term lending (CRED Cash), rent payments, Scan & Pay, UPI, and tools to monitor and improve credit scores.

By 2025, CRED has tens of millions of high-credit-profile users and a strong brand presence among India’s top spenders. It sits at the intersection of payments, rewards, and credit management — partnering with leading banks, lenders, and lifestyle brands.

By the end of this article, you’ll understand what CRED is, how it works, how it makes money, and how you can build a CRED-like rewards and credit platform with Miracuves’ ready-to-launch fintech solution, deployable in just 30–90 days.

What is CRED? The Simple Explanation

CRED is an Indian fintech platform that rewards users for paying their credit card bills on time. It provides a member-only app where users with a good credit score (typically above 750) can access exclusive rewards, cashback offers, lifestyle benefits, and financial tools.

The problem CRED solves is credit bill management and financial discipline. Many users forget their bill due dates, pay late fees, and damage their credit scores. CRED makes paying bills rewarding, smart, and effortless.

Its primary users are salaried professionals, entrepreneurs, and financially responsible individuals who hold one or more credit cards. By turning timely payments into rewards, CRED promotes responsible credit usage while offering premium brand deals, personal loans, and spending insights.

As of 2025, CRED has over 12 million members, processes massive bill payments monthly, and has evolved into a full financial ecosystem — including CRED Cash (instant loans), CRED RentPay (rent payments via credit cards), CRED Pay (checkout solution), and CRED Mint (P2P lending).

CRED became successful because it gamified financial discipline, built a premium brand image, and focused on user experience rather than traditional banking models.

How Does CRED Work? Step-by-Step Breakdown

CRED works like a rewards club layered on top of your existing credit cards. You don’t replace your bank or card – you simply connect your cards to CRED, and every time you pay your credit card bill through the app, you earn rewards, offers, or “CRED coins” that can be redeemed later. Over time, CRED has grown into a full ecosystem with bill payments, lending, BNPL, and shopping.

For Users

1. Account creation and eligibility

- Download the CRED app and sign up using your mobile number.

- CRED checks your credit score and profile in the background.

- Only users with a good credit profile (typically 700+ score) are allowed in. This “members-only” gate is part of CRED’s brand positioning.

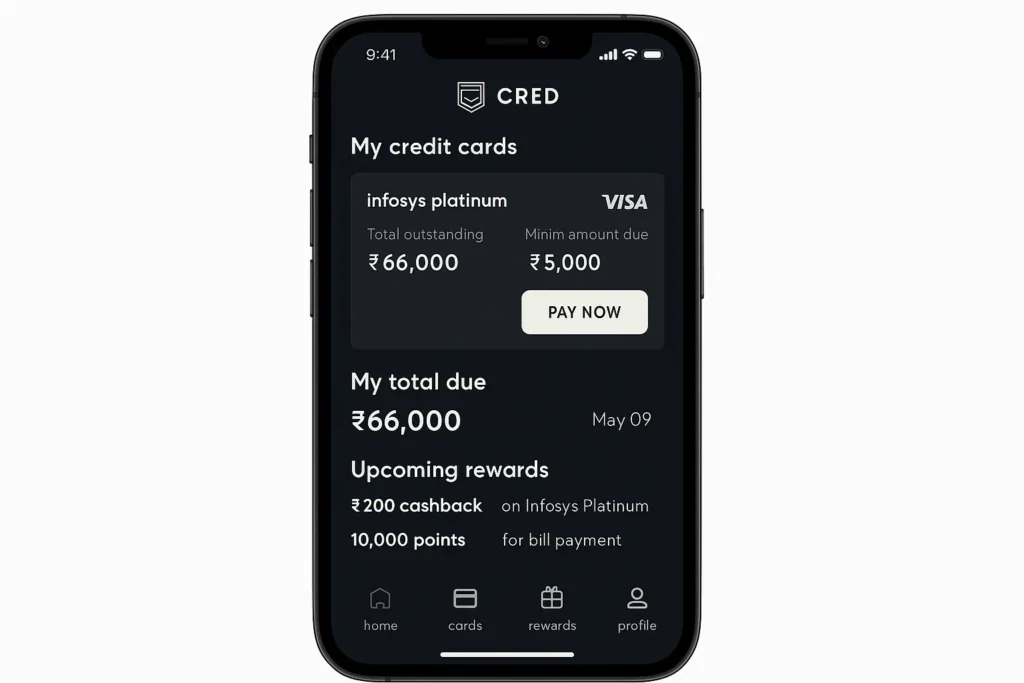

2. Adding credit cards

- Once approved, you add your existing Indian credit cards to CRED.

- The app fetches card statements securely via integrations and email/OTP-based flows.

- You can see due dates, total due, and minimum due for all cards in one place.

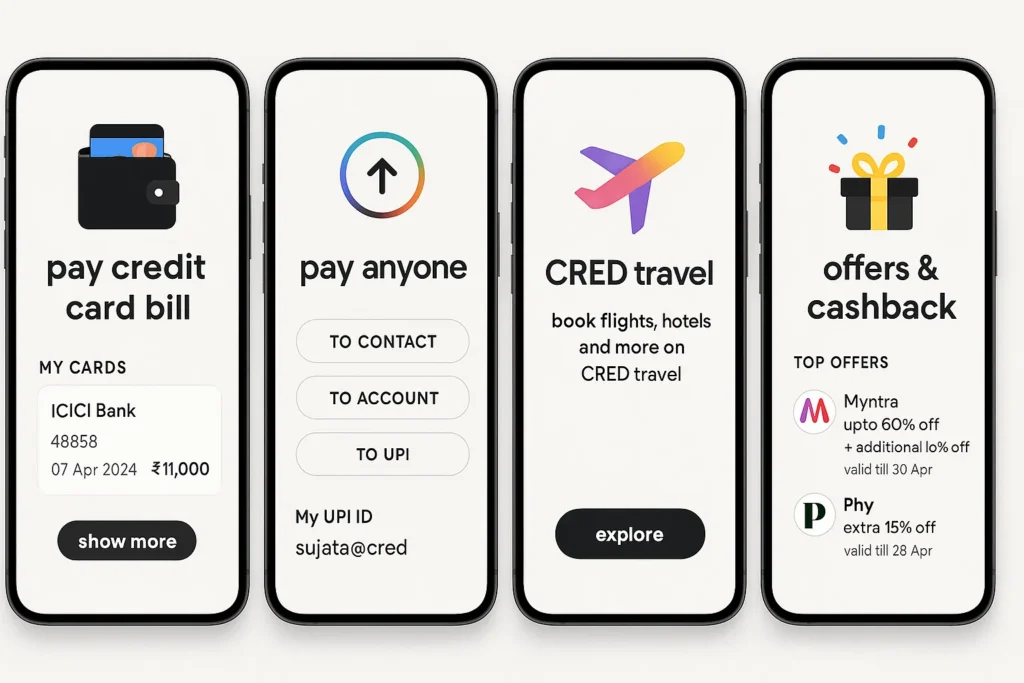

3. Paying credit card bills and earning rewards

- You pay your card bills through CRED using UPI, net banking, or other supported payment modes.

- Each successful payment earns you “CRED coins” or access to special jackpots, cashback, and deals.

- These coins can be redeemed for:

- Brand vouchers and discounts

- Cashbacks

- Access to exclusive “CRED Store” deals

4. CRED Store and experiences

- Inside the app, there is a curated marketplace of brands in categories like lifestyle, gadgets, wellness, travel, and D2C products.

- You can redeem CRED coins or pay directly to buy products at discounted or member-only prices.

5. CRED Cash (lending) and other credit products

- Eligible users see instant loan offers (CRED Cash) based on their repayment history and card usage.

- The approval is almost instant, with funds credited quickly to the bank account and EMIs managed from within the app.

- Over time, CRED has also tested BNPL-style offers and rent payment credit flows.

6. Rent payments and utility payments

- Users can pay house rent via credit card through CRED, earning points while paying a nominal fee.

- The app also supports some utility or recurring payments, keeping it positioned as a “high-intent payment” layer for affluent users.

7. Credit score tracking

- CRED lets users check their credit score, track changes, and understand factors affecting it.

- This makes the app not just a rewards platform, but also a financial wellness tool for credit-active users.

For Partners and Service Providers

On the other side, CRED works with:

- Brands that want to reach high-credit-score, high-spend customers via offers and curated campaigns

- Banks and NBFCs that want to lend to a high-quality, low-risk base through CRED Cash and related products

- Payment partners and infrastructure providers that power UPI, card, and net banking flows

CRED monetizes this by charging partners for access, promotions, and leads, while maintaining a premium consumer experience.

Technical Overview (Simple)

Behind the scenes, CRED functions as a layer on top of existing banking and payment infrastructure:

- Mobile apps (Android/iOS) connect to CRED’s backend via secure APIs.

- The backend integrates with payment gateways, UPI rails, credit bureaus, email parsers, and lending partners.

- Statement data is parsed and organized into a clean dashboard (due dates, spends, categories).

- A rules engine calculates rewards, eligibility for offers, and loan pre-approvals.

- Risk and fraud systems monitor unusual activity and verify that payments, card data, and loan flows remain secure and compliant.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

CRED’s Business Model Explained

CRED’s business model is built around one big idea: if you aggregate a large base of high-credit-score, high-spending users and get visibility into their credit behavior, you can build multiple profitable products on top of that data.

Instead of charging users directly for paying credit card bills, CRED makes money from financial products, commissions, and partnerships wrapped around those payments.

1. Lead Generation for Banks and Lenders

CRED’s users are mostly premium, high-income, high-credit-score customers. This makes them extremely valuable for:

- Credit card issuers

- Personal loan providers

- BNPL and EMI products

- Insurance and wealth products

When a CRED user takes a loan, converts a bill to EMI, or signs up for a new financial product via CRED, the brand or bank pays CRED a commission or referral fee.

2. CRED Cash (Loans) and EMIs

CRED Cash offers pre-approved personal loans to selected users, in partnership with NBFCs and banks. CRED earns:

- A commission or revenue-share on the interest

- Fees for origination and risk evaluation

Similarly, when users convert large spends into EMIs or pay via partner finance products, CRED gets a slice of the value of those transactions.

3. CRED Pay and Commerce

CRED Pay lets users pay on partner e-commerce sites using stored cards, CRED Coins, and rewards. Here, CRED earns via:

- Transaction fees or MDR-like commissions from merchants

- Co-marketing campaigns

- Higher visibility placements for partner brands inside CRED’s app

This turns CRED into a performance marketing channel for premium brands targeting affluent users.

4. CRED Mint and Investment Products

With CRED Mint and similar offerings, users can lend money to borrowers (through partner NBFCs), while CRED earns:

- Platform/arranger fees

- Spread on interest or revenue-share with lending partners

Over time, as more wealth / investment products appear inside CRED, these “marketplace” and distribution fees become an important revenue pillar.

5. Brand Campaigns and Rewards Marketplace

CRED’s gamified rewards model (CRED Coins, jackpots, offers on bill payment) is funded by brands who want access to CRED’s premium audience. CRED charges:

- Campaign fees for listing offers

- Performance-based fees for claim, click, or conversion events

So the user sees it as “free rewards”, but behind the scenes it’s an ad/offer marketplace.

6. Late Fee Avoidance and Stickiness

By nudging users to pay on time (reminders, gamified experience), CRED builds strong retention. High retention means:

- More bill payment volume

- More data over time

- Higher probability of cross-selling loans, EMIs, and partner products

This increases lifetime value per customer without increasing acquisition cost proportionally.

7. Data, Risk Scoring, and Cross-Sell Engine

Because CRED only accepts users with a good credit score and has visibility into their repayment behavior, it can:

- Help partners price risk better

- Build custom credit limits and dynamic offers

- Pre-approve users for products with lower default risk

That makes CRED a powerful distribution and underwriting layer in India’s consumer credit ecosystem.

Key Features That Make CRED Successful

CRED built its reputation by combining finance with lifestyle. Instead of acting like a typical bill payment platform, it positioned itself as an exclusive rewards community for responsible credit card users.

1. Credit Card Bill Payments

Users can pay their monthly credit card bills directly through the app. In return, they earn CRED Coins — a reward mechanism that encourages timely payments and builds loyalty.

2. CRED Coins & Rewards Marketplace

Every bill payment earns users CRED Coins, which can be redeemed for discounts, gift vouchers, travel deals, gadgets, and offers from premium brands. This system turns a basic habit into a rewarding experience.

3. Credit Score Monitoring

CRED allows free credit score tracking from bureau sources like Experian and CRIF. Users can monitor their score, receive improvement tips, and understand their credit health in real time.

4. CRED Cash (Instant Loans)

Eligible users can avail instant, pre-approved personal loans with minimal documentation and fast disbursal. The lending amount depends on a user’s credit profile and payment history.

5. CRED RentPay

Users can pay house rent with their credit card — even if the landlord doesn’t accept card payments — while earning reward points and credit score benefits.

6. CRED Store

The in-app store features curated offers from lifestyle brands, allowing users to spend their CRED Coins on premium products and experiences.

7. CRED Protect

An AI-driven feature that scans and verifies credit card statements to detect fraud, hidden charges, or billing errors — increasing transparency and financial safety.

8. CRED Mint (P2P Lending)

CRED introduced P2P lending where high-credit-score users can invest money and earn interest by lending to other eligible users. This helps create a community-driven wealth ecosystem.

9. Exclusive Membership Experience

CRED admits only users with high credit scores (typically above 750). This exclusivity strengthens the brand identity and builds a premium audience.

10. Smart UX and Personalization

CRED’s minimalist design, gamification elements, and personalized offers create an engaging experience that encourages habit-forming financial behavior.

2025 Updates:

Recent updates include AI-based spending insights, auto-pay bill reminders, improved P2P lending analytics, and corporate partnerships for rewards and cashback programs.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind CRED

Tech stack overview (simplified)

CRED is built as a modern, cloud-native fintech platform. While the company doesn’t publish a fully detailed stack, its architecture generally follows this pattern:

- A microservices backend using high-performance languages like Java / Kotlin and Node.js for payments, rewards, and offers engines

- Cloud infrastructure (commonly AWS / GCP) for scalability and resilience

- Modern frontend frameworks like React / Next.js for web, and native or React Native for mobile apps

- Relational databases (such as PostgreSQL or MySQL) for core financial data, combined with distributed caches like Redis for speed

This modular architecture lets CRED ship new features (rewards, Pay, Mint, UPI, travel, BNPL-style offers) without slowing down the core bill-payment experience.

Real-time features and user experience

CRED relies heavily on real-time processing for:

- Fetching and updating credit card outstanding amounts

- Sending payment status updates and reminders

- Showing live rewards, cashback, and offer eligibility

- Handling instant UPI flows and fast bill payments

Event-driven systems and message queues ensure every action (like a bill payment or reward redemption) triggers immediate UI updates, notifications, and ledger changes.

Data handling and privacy

Because CRED deals with sensitive credit card and financial information, it follows strict security practices:

- Encrypted communication (TLS) between app, APIs, and partners

- Tokenization of sensitive identifiers where possible

- Strong authentication with OTPs, mobile verification, and device binding

- Compliance with Indian data and payment regulations (RBI, NPCI norms for UPI, etc.)

Internally, access to financial data is tightly permissioned, and logs / analytics are anonymized or aggregated to protect individual users.

Scalability approach

CRED serves millions of affluent, high-spend users who pay multiple credit card bills every month, often during peak billing dates. To manage this:

- Microservices are auto-scaled horizontally based on load

- Critical services like payments and notifications run on separate, isolated infrastructure to avoid cascading failures

- Rate-limiting and circuit-breaker patterns protect the platform from overload or third-party slowness

- Observability stacks (metrics, logs, tracing) help detect issues early and maintain high uptime during peak bill-payment windows

Mobile app vs web platform

CRED is primarily mobile-first, with core journeys optimized for the app:

- Mobile app: Full experience – onboarding, credit card linking, CIBIL checks, payments, rewards, UPI, D2C shopping, travel, and experiences

- Web: Used more for informational and marketing purposes, with selective deep-linking into the mobile app

The mobile-first approach allows CRED to deeply integrate with device features (push notifications, secure storage, app-based OTP autofill) and keep the engagement loop tight.

API integrations

CRED depends on a rich network of integrations to deliver its experience:

- Bank and card-network partners (through aggregators / direct rails) to fetch statement data and process bill payments

- UPI infrastructure via NPCI-compliant PSP/banks for CRED UPI and Pay features

- Credit bureaus for credit score checks and eligibility (e.g., onboarding only high-score users)

- Brand, D2C, and travel partners for rewards, offers, and curated experiences

- Analytics, marketing, and communication APIs (SMS, email, push) to run campaigns and lifecycle journeys

These are all wrapped behind internal API gateways so the mobile app talks only to CRED’s own APIs, not directly to external services.

Why this tech matters for business

CRED’s technology choices directly support its business model:

- Reliable, low-latency payments build trust with high-value, credit-sensitive users

- Rich data pipelines and analytics enable better credit risk insight, personalized offers, and monetization through brands and financial partners

- A modular, cloud-native architecture lets CRED quickly experiment with new verticals like loans, travel, D2C commerce, and wealth products without rebuilding the core platform

In short, the tech stack is designed not just to “run an app,” but to power a high-value, data-driven ecosystem around India’s most creditworthy users.

CRED’s Impact & Market Opportunity

CRED didn’t just make credit card payments easier — it reshaped how financial discipline, rewards, and premium user experiences work in India. By targeting only users with a credit score above 750, it positioned itself as a fintech platform for India’s top 20% consumers — a bold strategy that proved incredibly successful.

Industry Disruption

- Before CRED, there was no app dedicated solely to premium credit card users.

- Bill payments were handled via banking apps or websites, often cluttered and confusing.

- Reward redemption was fragmented and hard to track.

- CRED made financial responsibility feel rewarding, not stressful.

Result → Millions of users started paying credit card bills on time just to earn rewards, indirectly improving financial discipline across the country.

Key Market Stats (2025)

- India has 110+ million credit cards in circulation.

- Only 30–35% of users have a 750+ credit score → CRED’s target market.

- India’s fintech sector is expected to reach $200B+ by 2030.

- Digital lending apps, including CRED, are experiencing 25–40% year-on-year growth.

- UPI transactions have crossed 14 billion per month in 2025 — CRED benefits heavily from this shift.

User Demographics & Behavior

| Category | Typical CRED User |

|---|---|

| Age | 25–45 |

| Annual Income | ₹8 lakh – ₹30 lakh+ |

| Lifestyle | Premium, digital-first |

| Motivation | Rewards, convenience, credit health |

| Repeat Usage | 2–4 times monthly |

CRED has effectively become a lifestyle finance brand, not just a bill payment app.

Geographic Presence

- Strongest in Tier 1 & Tier 2 cities

- Focus on urban professionals & corporate employees

- Emerging adoption in real estate, rent payments, and SME payments

Future Projections

- CRED is likely to transition further into lending, insurance & investments

- AI-based personal finance coaching is expected to be introduced

- Partnerships with banks and NBFCs will get deeper

- Potential to become India’s premium digital bank in the long term

Opportunity for Entrepreneurs

There’s strong scope for CRED-like apps in specific domains:

- Credit score tracking + financial advice

- Rent payment automation for landlords

- Reward-based EMI or loan repayment

- B2B credit management for small businesses

- Niche UPI-based reward programs

- Crypto / investment + credit-linked systems

This is exactly why entrepreneurs today are actively exploring CRED-like platforms — the fintech premium niche still has huge space to grow.

This growing demand is pushing founders to explore CRED clone apps with built-in credit scoring, reward engines, and UPI integration. With the right tech partner, launching a similar solution is now faster than ever.

Building Your Own CRED-Like Platform

CRED proved that if you combine credit discipline + rewards + a premium UX, you can build a powerful fintech brand around a very specific audience. That’s why so many founders now want to launch CRED-style apps in other regions, niches, or segments of finance.

Why Businesses Want CRED-Like Apps

- To target high-credit, high-income users with focused financial products

- To build a loyal, engaged user base through bill payments, UPI and rewards

- To create a closed ecosystem for lending, insurance, investments and commerce

- To position themselves as a premium finance brand instead of a generic payments app

- To tap into recurring, high-value transactions like card bills, rent, EMIs, and UPI

Key Considerations Before You Build

Before starting, a founder should be clear about:

- Target users: only prime credit users, or also mass market?

- Core hook: rewards, credit score tracking, cashback, or lifestyle benefits?

- Core flows: bill payment, UPI, rent, EMI, subscriptions, or all of them?

- Risk & compliance: KYC, credit bureau integration, data privacy, RBI/PCI guidelines

- Monetization model: interchange revenue, lending, subscriptions, cross-sell, or a mix

- Brand positioning: premium, aspirational, or utility-first?

Cost Factors & Pricing Breakdown

CRED-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Rewards & Bills MVP | Credit card bill payment for a limited set of banks, user registration & login, basic KYC, credit card linking, bill reminders, simple rewards (points/coins), basic offers screen, transaction history, web dashboard with mobile-responsive experience | $60,000 |

| 2. Mid-Level Credit Engagement Platform | Support for multiple banks/cards, richer rewards engine (coins, cashback, vouchers), partner offers integration, credit score tracking, in-app notifications, referral system, segmented campaigns, polished mobile-first UX, full admin panel with user and offer management | $130,000 |

| 3. Advanced CRED-Level Financial Super App | Large-scale rewards stack, advanced segmentation & personalization, multiple financial products (bills, loans, BNPL, payments), dynamic campaigns, deep analytics, risk scoring modules, complex partner integrations, multi-region readiness, cloud-native, highly scalable apps | $220,000+ |

CRED-Style Rewards & Credit Management App Development

The prices above reflect the global market cost of developing a CRED-like rewards-based credit card management and fintech app—typically ranging from $60,000 to over $220,000, with a delivery timeline of around 4–12 months for a full custom build. This usually includes product design, rewards and campaign engine implementation, complex integrations with payment/billing providers, analytics, security, and scalability work to support millions of users.

Miracuves Pricing for a CRED-Like Custom Platform

Miracuves Price: Starts at $13,999

Compared to the global market range above, Miracuves offers a JS-based CRED-style platform at well under one-third of typical custom development cost. This starting price is positioned for a feature-rich rewards and credit engagement app that can include:

- Credit card bill payment journeys and reminders

- Points/coins-based rewards system with offer redemptions

- Basic credit score view and financial tracking

- Partner offer listings and campaign management

- Modern, mobile-first web experience plus Android/iOS apps

From this base, the platform can be extended into more advanced credit products, BNPL flows, deeper segmentation and personalization, and a broader “financial super app” roadmap as your user base and partnerships grow.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational rewards and credit management ecosystem ready for launch and future expansion.

Delivery Timeline for a CRED-Like Platform with Miracuves

For a CRED-style, JS-based custom build, the typical delivery timeline with Miracuves is approximately 30–90 days, depending on:

- Depth of rewards, campaigns, and segmentation logic

- Number and complexity of bank, payment, and data-provider integrations

- Scope of analytics dashboards, user cohorts, and reporting needs

- Design complexity, branding requirements, and long-term scalability targets

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features Your CRED-Like App Should Include

- Smooth signup with KYC and credit score gating

- Multi-card management and reminders

- Credit card, UPI and recurring payment flows

- Rewards, coins, cashback or membership benefits

- Offers marketplace (brands, travel, lifestyle, D2C)

- Analytics on spends, categories and due dates

- In-app notifications, nudges and journeys

- Admin panel for offers, users, risk and content management

Read More :- Read the complete guide on fintech app development costs

Conclusion

CRED reinvented how people look at credit card payments by adding simplicity, rewards, and class to a routine financial task. Its success proves that fintech doesn’t need to be complex — it needs to be user-centric. With strong execution and a niche-focused strategy, even a crowded market can be disrupted.

As digital finance grows across the world, there’s still enormous potential for CRED-style apps in new regions and financial categories. With the right technology partner and a clear focus, your version of CRED could be the next big fintech success story.

FAQs :-

How does CRED make money?

CRED earns through lending interest, interchange fees on payments, partnerships, brand promotions, rent payment fees, and financial products like insurance and credit lines.

Is CRED available outside India?

No, CRED is currently available only in India — but the model can be replicated for other countries with similar credit and banking systems.

What is the eligibility to join CRED?

Users generally need a credit score above 750 (CIBIL / Experian) to access CRED. This helps maintain a premium user base.

Does CRED charge any fee?

Using CRED is free, but advanced financial services like lending or rent payments may involve service charges or commissions.

Can I pay rent using CRED?

Yes. CRED allows users to pay rent via credit card using CRED RentPay. A small convenience fee may apply.

Does CRED offer loans?

Yes. CRED offers credit lines and lending services through partner banks and NBFCs based on creditworthiness and transaction history.

How many users does CRED have?

CRED has crossed 13 million+ monthly active users (premium segment) as of 2024–2025, and continues expanding with UPI and fintech services.

Is it possible to build an app like CRED?

Absolutely. CRED follows a fintech model that can be replicated with strong technology, regulatory compliance, and data-focused personalization.

What technology does CRED use?

CRED typically uses React Native, Node.js, cloud databases, AI/ML engines, encryption layers, and seamless API integrations to power credit scoring, payment flows, and personal finance tracking.

Can Miracuves help build a CRED-style app?

Yes. Miracuves provides ready-to-launch CRED clone solutions with source code, customization, deployment, KYC integrations, payment flows, analytics dashboards — delivered in 30-90 days.