Imagine you’re in a bustling Southeast Asia city, running late for a meeting across town. You tap your phone, and within minutes a car arrives — no hassle, no uncertainty. That’s the convenience Grab offers millions every day.

Grab began in 2012 in Malaysia as a ride-hailing app (originally “MyTeksi”) and soon expanded across Southeast Asia to become a super app. It now includes services like food delivery, digital payments, logistics, and financial services across multiple countries.

As of 2025, Grab is one of Southeast Asia’s leading “super apps,” serving over 200 million users across 8 countries. Its multi-service model and integrated platform make it not just a ride app, but a daily essential in many urban lives.

What is Grab? The Simple Explanation

Grab is a super app from Southeast Asia that combines multiple services into one platform. At its core, it started as a ride-hailing app, helping people quickly book a safe, affordable ride. Over time, it evolved into a one-stop solution for transportation, food delivery, groceries, payments, and even financial services.

Read more: How to Build an App Like Grab: Full Developer Guide for Founders

The Core Problem Grab Solves

Before Grab, hailing taxis or finding reliable rides in many Southeast Asian cities was frustrating, often involving long waits, uncertain fares, or safety concerns. Grab solved this by providing on-demand mobility with transparent pricing and real-time tracking. Later, it extended that same convenience to food, groceries, and payments.

Target Users and Use Cases

- Commuters who need quick, safe, and affordable rides.

- Hungry customers who order food and groceries delivered to their doorsteps.

- Small businesses that partner with Grab for logistics and reach.

- Everyday users who use GrabPay for cashless payments.

Market Position (2025 Snapshot)

- Over 200 million users across 8 countries (Singapore, Malaysia, Indonesia, Vietnam, Thailand, Cambodia, Myanmar, Philippines).

- Dominant in Southeast Asia’s ride-hailing and food delivery markets, competing with Gojek and Foodpanda.

- GrabPay is now a leading digital wallet, supporting financial inclusion in cash-heavy markets.

Why Grab Became Successful

Grab succeeded because it localized its services to Southeast Asia’s unique needs: integrating cash payments, working with motorcycles for faster rides in traffic-heavy cities, and offering essential services all in one app. This hyperlocal approach, coupled with a super app model, gave it an edge over global rivals like Uber (which Grab acquired in 2018 for the region).

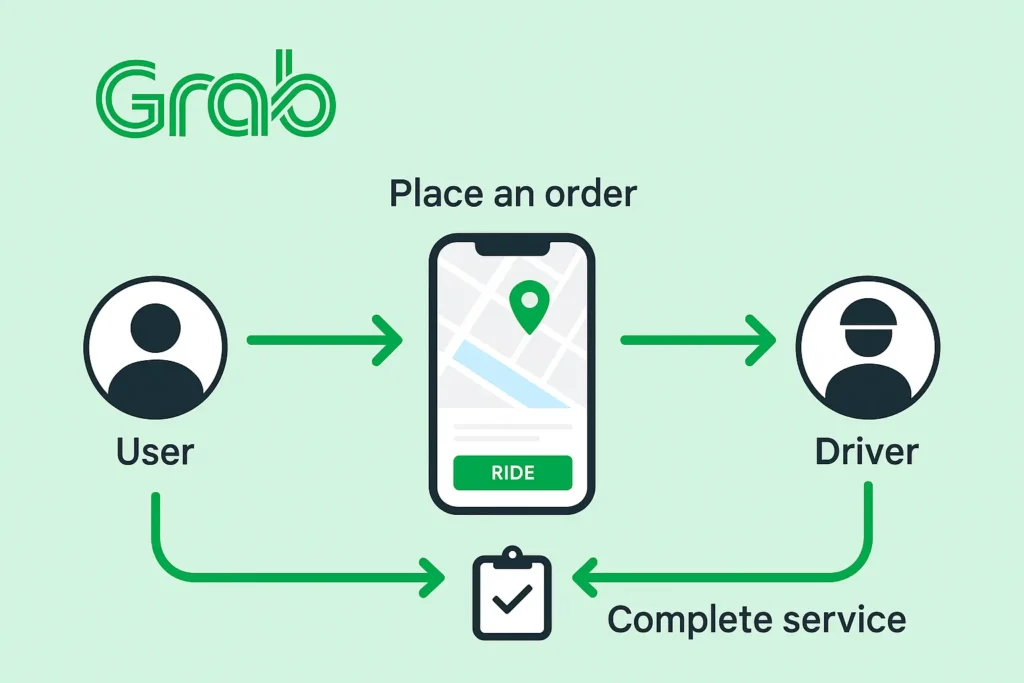

How Does Grab Work? Step-by-Step Breakdown

Grab’s ecosystem is designed to be simple for users while efficient for drivers, riders, and merchants. Let’s break it down:

For Users (Passengers & Customers)

- Account Creation

- Download the Grab app (iOS/Android).

- Sign up using phone number, email, or social accounts.

- Verify identity (KYC for GrabPay features).

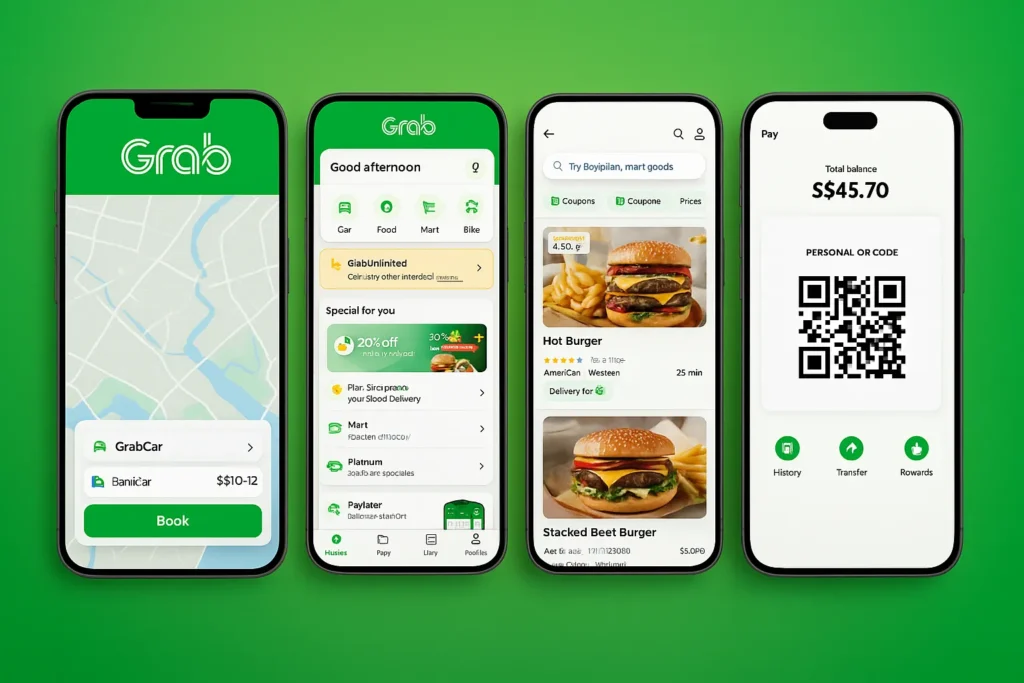

- Main Features Walkthrough

- GrabRide: Book cars, motorbikes, or taxis with upfront pricing.

- GrabFood: Order meals from restaurants.

- GrabMart: Shop groceries and essentials.

- GrabExpress: Send parcels and packages.

- GrabPay: Make cashless payments in-app or at partner merchants.

- Typical User Journey Example

Imagine a user in Jakarta: - Key Functionalities Explained

- Real-time tracking of rides and deliveries.

- Cash or digital wallet payments.

- Ratings & reviews for quality control.

- Loyalty program “GrabRewards” with redeemable points.

For Service Providers

- Onboarding Process

- Drivers/riders sign up with ID, vehicle documents, and background checks.

- Merchants/restaurants onboard through Grab’s merchant platform.

- How They Operate on the Platform

- Drivers accept ride/delivery requests through the driver app.

- Merchants receive orders via merchant dashboard and coordinate with riders.

- Earnings & Commission Structure

- Drivers earn per ride/delivery minus Grab’s commission (around 15–20%, varying by market).

- Restaurants pay a commission fee (typically 20–30%) on orders.

- GrabPay transaction fees apply for digital payments.

Technical Overview (Simple)

Behind the scenes, Grab runs on a multi-service app architecture:

- User App: For passengers/customers.

- Driver App: For drivers/riders.

- Merchant Dashboard: For restaurants & shops.

- Backend System: Handles matching, payments, logistics, maps, and security.

Key Technologies:

- GPS & Maps API for route tracking.

- AI & ML for dynamic pricing, demand prediction, fraud detection.

- Payment Gateways & Wallet Integration for GrabPay.

- Cloud Infrastructure for scalability.

Grab’s Business Model Explained

Grab isn’t just a ride-hailing company anymore — it’s a super app with multiple revenue streams. Its business model thrives on the “ecosystem effect,” where users come for one service and stay for many others.

How Grab Makes Money

- Ride-Hailing (GrabRide, GrabBike, GrabTaxi)

- Commission per ride (average 15–20% of fare).

- Premium ride options generate higher margins.

- Food Delivery (GrabFood)

- Commission from restaurants (20–30%).

- Delivery fees from customers.

- Promotions co-funded with restaurants.

- Grocery & On-Demand (GrabMart, GrabExpress)

- Delivery charges from customers.

- Commissions from merchants.

- Payments & Fintech (GrabPay, GrabFinance)

- Transaction fees from merchants.

- Lending, insurance, and financial services revenue.

- Interest from digital wallet services.

- Advertising (GrabAds)

- Restaurants and brands pay for in-app promotions.

- Sponsored listings in GrabFood and GrabMart.

Read more: How Grab Works – Business Model Explained

Pricing Structure (2025 Snapshot)

- Ride-hailing fares: Vary by city, base fare starts from ~$1.20 (motorbike) to ~$2.50 (car).

- GrabFood delivery fees: Average $1–$2 per order.

- GrabPay transaction fee: ~1–2% for merchants.

- GrabExpress (parcel): Starts at ~$1.50 depending on distance.

Market Size & Growth

- Southeast Asia’s digital economy is expected to hit $300 billion by 2025, with Grab capturing a major share.

- Grab’s 2024 revenue surpassed $2.3 billion, with growth in fintech and delivery services driving expansion.

- Ride-hailing alone contributes over 50% of regional market share for Grab.

Profit Margins Insights

- Food delivery margins are thinner due to logistics costs, but advertising and cross-selling boost profitability.

- Fintech and payments provide higher-margin recurring revenue, expected to be Grab’s future growth driver.

Revenue Model Breakdown

| Revenue Stream | Source of Income | Avg. Commission/Fee | Growth Outlook 2025 |

| Ride-Hailing | Per ride commission | 15–20% | Stable, mature |

| GrabFood | Merchant commission + delivery fee | 20–30% | High growth |

| GrabMart/GrabExpress | Merchant commission + delivery fee | 15–20% | Expanding rapidly |

| GrabPay/Fintech | Transaction fees, lending, insurance | 1–2% per transaction | Very high growth |

| Advertising (GrabAds) | Sponsored placements, promotions | Varies | High growth |

Key Features That Make Grab Successful

Grab didn’t just win Southeast Asia by chance — it built a feature-rich ecosystem that keeps users, drivers, and merchants engaged daily. Let’s look at the top features driving its success.

Top 10 Features Analysis

- Multi-Service Super App

- Combines rides, food, groceries, and payments in one app.

- Users save time and storage (no need for multiple apps).

- Real-Time GPS Tracking

- Passengers track rides in real-time.

- Builds trust and ensures transparency.

- Dynamic Pricing with AI

- Fare adjusts to demand, distance, and traffic.

- Maximizes driver earnings while balancing user needs.

- GrabRewards Loyalty Program

- Points earned on every transaction.

- Redeemable for discounts, vouchers, and partner offers.

- GrabPay Digital Wallet

- Secure cashless payments in-app and at partner stores.

- Expanding into lending, insurance, and microfinance.

- Multi-Vehicle Options

- Cars, motorbikes, premium rides, and taxis.

- Flexibility for budget-conscious or premium users.

- GrabFood & GrabMart Integration

- Unified interface for ordering meals and groceries.

- AI recommends restaurants based on user behavior.

- Safety Features

- SOS button, driver background checks, ride-sharing with friends.

- Critical for building user trust in congested cities.

- Merchant & Driver Ecosyste

- Merchants get dashboards, analytics, and advertising.

- Drivers have flexible hours, incentives, and real-time earnings.

- AI-Powered Personalization

- Personalized recommendations for food, transport, and promos.

- Machine learning improves experience over time.

Read more: Top Grab App Features That Drive Growth

Recent 2025 Updates & Features

- Green Program: Expansion of electric vehicles (EVs) and carbon offset options.

- GrabUnlimited Subscription: Monthly plan offering free deliveries, ride discounts, and exclusive deals.

- AI Chatbot Assistant: Handles customer support and order inquiries within the app.

- Cross-Border Payments: GrabPay now supports payments across multiple Southeast Asian countries.

AI/ML Integrations

- Fraud detection: Prevents fake accounts and suspicious transactions.

- Demand forecasting: Matches drivers to high-demand areas.

- Personalized promos: AI-driven offers based on user history.

What Sets Grab Apart

- Localized solutions (cash payments, motorbike taxis, regional languages).

- A single ecosystem with stickiness factor — once you use one Grab service, you’re likely to use others.

- Continuous innovation with fintech, advertising, and logistics.

The Technology Behind Grab

Behind Grab’s simple, user-friendly interface lies a sophisticated technology stack that powers millions of daily transactions across Southeast Asia. The focus is on scalability, security, and real-time performance.

Tech Stack Overview (Simplified)

- Frontend (User Apps): Built with React Native for cross-platform mobile apps (iOS/Android).

- Backend: Uses Node.js, Java, and Go for handling high-volume requests.

- Databases: Combination of MySQL, PostgreSQL, and NoSQL (MongoDB, Cassandra) for flexibility and scalability.

- Cloud Infrastructure: Deployed on AWS and Google Cloud, ensuring availability across regions.

Real-Time Features

- GPS & Maps API: Enables live driver tracking and accurate ETAs.

- Real-Time Matching: AI-driven engine matches riders with nearby drivers.

- Dynamic Pricing: Machine learning adjusts fares instantly based on demand and supply.

Data Handling & Privacy

- KYC & AML Compliance for GrabPay and financial services.

- Encryption protocols (TLS, SSL) safeguard user data.

- Fraud detection algorithms prevent fake accounts and suspicious transactions.

Scalability Approach

Grab processes millions of transactions daily. To scale efficiently:

- Uses microservices architecture, breaking the app into modular services (rides, food, payments).

- Employs load balancers to handle spikes in demand.

- Relies on containerization (Docker, Kubernetes) for faster deployments and updates.

Mobile App vs Web Platform

- Mobile App: The core experience for ride-hailing, food, and payments. Optimized for low-bandwidth regions.

- Web Platform: Supports merchant dashboards, driver sign-ups, and GrabAds management.

API Integrations

- Maps & Navigation APIs for route optimization.

- Payment Gateway APIs for GrabPay, credit cards, and local wallets.

- 3rd-Party Merchant APIs for food and grocery inventory syncing.

Why This Tech Matters for Business

- Reliability: Ensures smooth, uninterrupted service even in peak demand.

- Speed: Sub-second response times for ride matching and payments.

- Flexibility: Easy to add new services (e.g., GrabMart, GrabFinance) without breaking the core system.

- Trust: Secure handling of payments and data builds customer confidence.

Grab’s Impact & Market Opportunity

Grab has grown far beyond a ride-hailing app — it has become a regional tech giant shaping Southeast Asia’s digital economy. Its impact is felt across transportation, food, payments, and even financial inclusion.

Industry Disruption Caused

- Transportation: Grab transformed how people move in congested cities by making rides affordable, safe, and traceable.

- Food Delivery: Enabled thousands of restaurants to survive during the pandemic by digitizing delivery.

- Digital Payments: GrabPay accelerated cashless adoption in markets where credit card penetration is below 20%.

- Small Business Support: Local shops and MSMEs gained digital visibility through GrabMart and GrabExpress.

Market Statistics & Growth (2025)

- Grab serves 200+ million users across 8 countries.

- Valuation stands around $14 billion (publicly traded on NASDAQ since 2021).

- Southeast Asia’s digital economy projected at $300 billion by 2025, with Grab holding a leading market share.

- GrabFood leads in multiple countries, commanding over 50% share in the Philippines, Malaysia, and Singapore.

User Demographics & Behavior

- Age group: Majority of users are 18–35, digital natives.

- Urban focus: Heaviest use in mega-cities like Jakarta, Manila, Ho Chi Minh City.

- Behavior: High frequency users often use Grab for both rides and food daily.

Geographic Presence

- Operates in Singapore, Malaysia, Indonesia, Thailand, Vietnam, Philippines, Cambodia, and Myanmar.

- Focused on localized services (motorbikes in Vietnam, cash payments in Indonesia, premium rides in Singapore).

Future Projections

- EV Integration: Commitment to expanding electric vehicles in its fleet.

- Fintech Growth: GrabPay, lending, and insurance expected to surpass ride-hailing revenue by 2027.

- Super App Expansion: Deeper integration of lifestyle services (subscriptions, e-commerce).

Opportunities for Entrepreneurs

Grab’s rise demonstrates the massive potential of super apps in emerging markets. Entrepreneurs can:

- Build niche versions (e.g., local ride-hailing, grocery delivery apps).

- Develop fintech add-ons like wallets or micro-lending.

- Partner with small businesses for hyperlocal delivery networks.

Building Your Own Grab-Like Platform

The super app model pioneered by Grab has inspired countless entrepreneurs across Asia and beyond. With demand for on-demand rides, food, and fintech services showing no signs of slowing down, building a Grab-like platform can be a highly profitable venture.

Why Businesses Want Grab Clones

- Proven success: Grab’s model has already been validated in Southeast Asia.

- High demand: Urban populations rely heavily on rides, deliveries, and digital payments.

- Revenue diversity: Multiple income streams (rides, food, payments, ads).

- Scalability: Easy to start with one service (like ride-hailing) and expand into others later.

Key Considerations for Development

- Localization: Adapt to local languages, currencies, and transport options (e.g., bikes in Vietnam, tuk-tuks in Thailand).

- Regulatory Compliance: Ensure your platform meets local ride-hailing and fintech regulations.

- Security: Data protection and secure payments must be top priority.

- Driver & Merchant Network: Building supply-side partnerships is as important as user acquisition.

Time and Cost Factors

- Development time: From scratch can take 12–18 months. With a clone solution, launch in 7–14 days.

- Cost: Custom builds can cost $500,000+, while clone solutions with customization are much more affordable.

Essential Features to Include

- User, driver, and merchant apps.

- Real-time GPS tracking.

- Secure payment integration.

- Ratings and review system.

- Loyalty rewards program.

- Admin dashboard with analytics.

Conclusion

Grab’s journey from a simple ride-hailing startup to a powerful super app ecosystem shows how technology can reshape daily life across an entire region. By solving real problems — from transportation and food delivery to payments and finance — Grab has become a vital part of Southeast Asia’s digital economy.

For entrepreneurs, its success is proof that super app models work, especially when built around local needs, scalability, and innovation. The opportunity is wide open for businesses looking to create similar platforms in other regions or industries.

If you’re ready to build your own Grab-like platform, Miracuves provides ready-to-launch clone solutions, tailored features, and expert support to help you go from idea to market in just 7–14 days.

FAQs

Q:1 How does Grab make money?

Grab earns through commissions on rides and food orders (15–30%), delivery fees, GrabPay transaction fees, fintech services, and advertising via GrabAds.

Q:2 Is Grab available in my country?

As of 2025, Grab operates in 8 Southeast Asian countries: Singapore, Malaysia, Indonesia, Thailand, Vietnam, Philippines, Cambodia, and Myanmar.

Q:3 How does Grab ensure safety?

Grab uses driver background checks, in-app SOS buttons, ride-sharing features, real-time GPS tracking, and insurance coverage to protect riders.

Q:4 Can I build something similar to Grab?

Yes With clone solutions, entrepreneurs can launch a Grab-like app in 7–14 days. Platforms like Miracuves provide customizable scripts with all essential features.

Q:5 What makes Grab different from competitors?

Grab’s super app model (rides, food, payments, finance all in one), localized services, and loyalty program (GrabRewards) make it stand out compared to rivals like Gojek or Uber.

Q:6 How many users does Grab have?

Grab serves 200+ million users and millions of driver-partners across Southeast Asia as of 2025.

Related Articles :-