Imagine you run a kirana store or small wholesale business. Customers buy now and pay later, and you’re juggling notebooks, messy handwriting, and “bhaiya kal de dunga” promises. One missed entry and your cashflow is gone.

That’s exactly the everyday chaos Khatabook solves. It’s a digital khata (ledger) app that helps small businesses record credit/debit, track who owes what, and send payment reminders—right from a phone.

Khatabook scaled fast by making the app simple, local-language friendly, and built for Indian merchants. It’s used across thousands of cities, supports multiple Indian languages, and has crossed tens of millions of downloads—making it one of India’s most widely adopted SMB bookkeeping apps. In terms of company scale, it has raised roughly ~$187M in funding and has been reported around the ~$600M valuation range.

By the end of this guide, you’ll understand what Khatabook is, how it works step by step, how it makes money, what tech powers it, and why many founders want to build a Khatabook-like platform—plus how Miracuves can help you launch one quickly.

What Is Khatabook? The Simple Explanation

Khatabook is a digital ledger (khata) app designed for Indian small businesses to record credit and debit transactions with customers and suppliers. Instead of maintaining paper notebooks, shop owners can track all money owed and payments received directly on their smartphone, in their preferred local language.

The Core Problem Khatabook Solves

Small businesses often sell on credit and rely on memory or handwritten notes to track dues. This leads to missed payments, disputes, and poor cashflow visibility. Khatabook solves this by providing a simple, digital way to record transactions, send reminders, and keep records safe.

Target Users and Use Cases

Khatabook is widely used by:

• Kirana and grocery store owners

• Small retailers and wholesalers

• Local service providers (tailors, mechanics, salons)

• Distributors and agents managing daily credits

• Micro-entrepreneurs operating on trust-based sales

Current Market Position

Khatabook is one of India’s most popular digital khata apps, especially among Tier 2 and Tier 3 city merchants. Its offline-friendly design, regional language support, and zero-cost entry helped it gain massive adoption among non-tech-savvy users.

Why It Became Successful

Khatabook succeeded because it didn’t try to make small businesses “accountants.” Instead, it digitized an existing habit—the khata—using simple UX, voice-friendly language, and features that match real Indian business behavior.

How Khatabook Works — Step-by-Step Breakdown

For Merchants (Shop Owners & Small Businesses)

Account Setup

A merchant downloads the Khatabook app and signs up using a mobile number (OTP-based login). No complex forms or documents are required. Once logged in, the user selects their preferred language and business name.

Creating Customer Entries

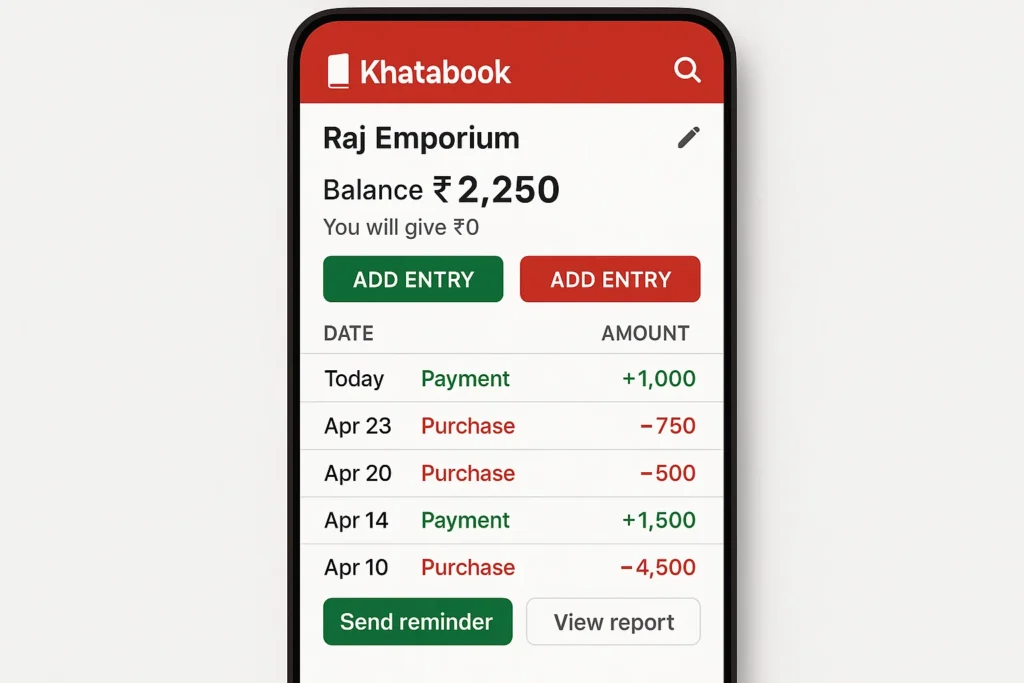

Merchants add customers by name and phone number. Each customer gets a separate digital khata where all credit (udhaar) and debit (payments received) entries are stored.

Recording Transactions

Whenever a customer buys on credit or makes a payment, the merchant:

- Opens the customer’s khata

- Adds the amount (credit or payment)

- Optionally adds notes (items sold, date, reason)

Entries are saved instantly and updated in real time.

Balance Tracking

Khatabook automatically calculates:

- Total amount owed by each customer

- Overall outstanding balance

- Daily, weekly, and monthly summaries

This gives merchants clear visibility into cashflow and pending dues.

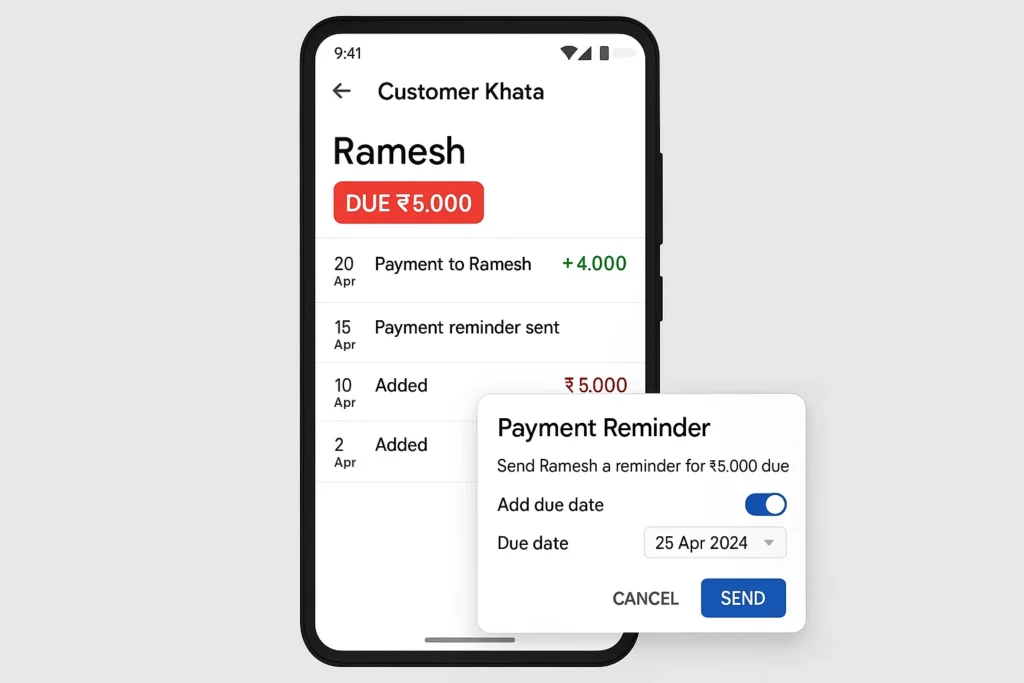

Sending Payment Reminders

Merchants can send automated payment reminders via WhatsApp or SMS directly from the app. These reminders include the outstanding amount, reducing awkward follow-ups.

Backup & Data Safety

All entries are securely backed up to the cloud. Even if the phone is lost or changed, the merchant can restore all khata records by logging in again.

Example Merchant Journey

A kirana store owner adds a customer → records daily credit purchases → checks pending balance at the end of the week → sends a WhatsApp reminder → updates the khata once payment is received.

For Customers (Indirect Users)

Customers don’t need the app. They receive:

- SMS/WhatsApp reminders

- Payment confirmation messages

- Clear records of what they owe

This transparency helps reduce disputes and improves trust.

Technical Overview (Simplified)

Khatabook works through a lightweight but scalable system:

- Mobile-first app optimized for low-end Android devices

- Offline-first data entry with auto-sync when internet is available

- Secure cloud storage for khata data

- Notification systems for SMS/WhatsApp reminders

- Simple analytics engine for balance summaries

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Khatabook’s Business Model Explained

How Khatabook Makes Money

Khatabook started as a free utility app to drive massive adoption among small merchants. Once it built scale and trust, it layered monetization through financial and business services rather than charging for basic ledger usage. Key revenue streams include:

- Financial product partnerships: Loans, credit lines, and working capital offers for merchants

- Payments & collections services: Commissions from facilitating digital payments and collections

- Value-added services: Premium features, business insights, and add-on tools for growth

- Advertising & partnerships: Contextual promotions relevant to small businesses

This approach keeps the core khata experience free while earning from services that help merchants grow.

Pricing Structure

- Ledger usage: Free

- Basic reminders & backups: Free

- Advanced services: Offered via partner products or optional paid features (where applicable)

Merchants don’t pay to record entries—monetization happens when they opt into financial services.

Commission / Fee Breakdown

- Lending partners: Pay referral or success-based fees when merchants take loans

- Payments partners: Share transaction-based commissions

- Service add-ons: Subscription or usage-based pricing for premium tools

Market Size and Growth

India has tens of millions of micro and small businesses that still rely on informal bookkeeping. Digital adoption among these merchants is accelerating due to smartphones, UPI, and vernacular apps—creating a huge opportunity for khata platforms to become financial hubs.

Profitability Insights

Khatabook’s model benefits from:

- Very low customer acquisition cost (viral, word-of-mouth adoption)

- High daily engagement (merchants use it every day)

- Strong cross-sell potential into credit and payments

- Scalable tech with minimal per-user cost

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Financial Products | Loans, credit offers via partners | Banks / NBFCs | Commission-based |

| Payments | Digital collections & settlements | Payment partners | Transactional |

| Premium Tools | Advanced features & insights | Merchants | Optional |

| Partnerships | SMB-focused promotions | Partners | Contract-based |

Key Features That Make Khatabook Successful

Digital Khata (Ledger)

At its core, Khatabook replaces the paper khata with a simple digital ledger. Merchants can add customers, record credit sales and payments, and always know who owes how much—without calculations or spreadsheets.

Easy Credit & Payment Entries

Adding entries takes just a few taps. Merchants can log:

- Credit given (udhaar)

- Payments received

- Notes for context (items sold, dates, reasons)

This simplicity is critical for busy shop owners.

Automatic Balance Calculation

Khatabook automatically updates outstanding balances for each customer and the overall business. Merchants instantly see pending dues, helping them plan cash flow better.

Payment Reminders via WhatsApp & SMS

One of Khatabook’s most loved features is automated reminders. Merchants can send polite payment reminders directly to customers, reducing follow-up friction and improving collections.

Cloud Backup & Data Recovery

All khata data is backed up securely. Even if a phone is lost or changed, merchants can restore their records just by logging in again—building strong trust in the app.

Offline-First Experience

Many small businesses operate with unreliable internet. Khatabook allows offline entry and syncs data automatically once the connection is back, making it practical for real-world Indian conditions.

Multi-Language Support

Khatabook supports multiple Indian languages, making it accessible to merchants who are not comfortable with English. This vernacular-first approach played a huge role in mass adoption.

Daily & Monthly Business Insights

Simple summaries show:

- Total outstanding

- Amount received

- Credit given

- Daily or monthly trends

These insights help merchants understand their business without formal accounting knowledge.

Customer Transparency

Customers receive reminders and confirmations, which reduces disputes and improves trust between buyer and seller—important in credit-based local businesses.

Security & Privacy

Khatabook secures data with authentication and encrypted backups. Merchants control their data, and entries are private to their account.

Continuous Product Expansion

Over time, Khatabook has expanded beyond ledgers into collections, business tools, and financial services—without complicating the core khata experience.

The Technology Behind Khatabook

Tech Stack Overview (Simplified)

Khatabook is built as a mobile-first, lightweight fintech platform designed to work smoothly on low-cost Android devices commonly used by small merchants in India. The focus is on speed, reliability, and simplicity rather than complex accounting features.

At a high level, Khatabook uses:

- Android-first mobile apps with minimal resource usage

- Cloud-based backend systems for data storage and sync

- Secure authentication via mobile number and OTP

- Scalable infrastructure to support millions of daily active users

Offline-First Architecture

One of Khatabook’s biggest technical strengths is its offline-first design. Merchants can:

- Add customers

- Record credit and payment entries

- View balances

even without internet connectivity. Data is stored locally on the device and automatically synced to the cloud once connectivity is restored. This is crucial for Tier 2, Tier 3, and rural markets.

Real-Time Sync and Backup

When internet is available, Khatabook syncs data in the background to ensure:

- Real-time updates across sessions

- Secure cloud backups

- Easy data recovery on new devices

This gives merchants confidence that their khata data is safe and never lost.

Data Handling and Security

Khatabook handles sensitive financial data, so it uses:

- Encrypted data storage and transmission

- OTP-based authentication

- Secure cloud backups

- Role-based access controls

Merchants have full control over their data, and customer entries are private to the business owner.

Notifications and Reminders System

Khatabook integrates with messaging systems to send:

- SMS reminders

- WhatsApp payment nudges

- Transaction confirmations

These notifications are automated and triggered based on outstanding balances or merchant actions.

Scalability Approach

The platform is built to scale horizontally, allowing it to support:

- Millions of merchants

- High-frequency daily transactions

- Peak reminder and notification loads

Microservices ensure that ledger updates, backups, reminders, and analytics run independently without affecting performance.

Mobile App vs Backend Systems

- Mobile App: Handles ledger entry, customer management, reminders, and summaries. Optimized for simplicity and speed.

- Backend: Manages data sync, backups, notifications, analytics, and partner integrations (payments, lending, services).

API Integrations

Khatabook integrates with:

- SMS and WhatsApp gateways

- Payment partners (UPI, collections)

- Lending and financial service partners

- Analytics and monitoring tools

These integrations allow Khatabook to expand into financial services while keeping the core khata experience clean.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Why This Technology Matters

Khatabook’s tech succeeds because it fits real merchant behavior. It works offline, supports local languages, runs on basic phones, and removes fear of data loss. For entrepreneurs, it proves that simple, well-adapted technology can scale to millions when it solves a very local, very real problem.

Khatabook’s Impact & Market Opportunity

Industry Disruption

Khatabook digitized one of the most deeply rooted habits in Indian commerce—the handwritten khata. By turning informal credit tracking into a simple mobile experience, it helped millions of small businesses move from paper to digital without forcing them to learn accounting software.

This shift improved cashflow visibility, reduced payment disputes, and laid the foundation for bringing small merchants into the formal financial ecosystem.

Market Statistics & Growth

India has tens of millions of micro and small businesses, many of which still operate on credit and informal record-keeping. As smartphone usage, UPI adoption, and vernacular apps grow, digital khata platforms are becoming a gateway to broader fintech adoption.

Khatabook sits at the center of this trend, acting as an entry point for payments, lending, and other financial services for merchants who were previously underserved.

User Demographics & Behavior

Khatabook users are typically:

- Small shop owners and kirana merchants

- Wholesalers and distributors

- Service providers working on trust-based payments

- Business owners in Tier 2 and Tier 3 cities

These users open the app daily, making it one of the most habit-forming business apps in India.

Geographic Presence

Khatabook is used across India, with particularly strong adoption outside metro cities. Its multilingual support and offline-first design make it accessible even in regions with low digital literacy.

Future Projections

The future of digital khata apps is moving toward:

- Deeper UPI and payment integrations

- Instant working capital and credit scoring based on ledger data

- GST and compliance-lite tools for small businesses

- Inventory, billing, and customer insights layered on top of khata data

Khatabook’s position as a daily-use app gives it a strong advantage in expanding into these areas.

Opportunities for Entrepreneurs

There is huge opportunity to build Khatabook-like platforms tailored for:

- Specific industries (pharma distributors, agriculture traders, salons)

- Regional language-first markets

- SME credit scoring and lending platforms

- Collection-focused apps for wholesalers

- Hybrid khata + invoicing solutions

This massive success is why many founders want to build digital khata platforms that start simple but grow into full SMB financial ecosystems.

Building Your Own Khatabook-Like Platform

Why Businesses Want Khatabook-Style Apps

Khatabook proves that solving a very local, everyday problem at scale can create massive adoption. Entrepreneurs are drawn to this model because:

- It targets millions of underserved SMBs

- It becomes a daily-use habit, not a one-time app

- It creates rich transaction data that can power fintech services

- It has low onboarding friction and viral growth potential

A simple ledger app can eventually evolve into a full business-finance ecosystem.

Key Considerations Before You Start Development

Before building a Khatabook-like platform, it’s important to decide:

- Who your core users are (kirana stores, wholesalers, service providers, distributors)

- Which languages and regions you’ll support first

- Whether the app will be ledger-only or include payments from day one

- How offline usage will be handled

- What trust and data-backup guarantees you’ll offer

- How you’ll eventually monetize (loans, payments, subscriptions, insights)

These decisions shape both product design and long-term revenue.

Cost Factors & Pricing Breakdown

Khatabook-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Ledger & Udhaar Tracking MVP | Core mobile/web app for small businesses, customer list, simple credit/debit (udhaar) ledger per customer, balance summary, basic reports, manual reminders, user registration & login, standard admin/back-office panel | $50,000 |

| Mid-Level Digital Khata & MSME Finance Suite | Multi-ledger support (customers, suppliers, expenses), recurring entries, payment status tracking, automated SMS/WhatsApp reminders (via providers), basic GST/invoice-style summaries, CSV export, richer analytics dashboard, polished mobile-first UX (web + apps) | $110,000 |

| Advanced Khatabook-Level Business Ecosystem | Large-scale MSME platform with multi-device sync, staff roles, multi-store support, deeper analytics & cash-flow views, basic inventory hooks, integrations with payments/UPI, banking & credit partners, campaign/offer engine, cloud-native architecture for millions of users | $200,000+ |

Khatabook-Style Digital Ledger App Development

The prices above reflect the global market cost of developing a Khatabook-like digital ledger and MSME bookkeeping app — typically ranging from $50,000 to over $200,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually covers ledger and contact management, reminders and notifications, reports and cash-flow views, integrations with messaging and payment providers, analytics, and production-grade mobile apps for everyday business use.

Miracuves Pricing for a Khatabook-Like Custom Platform

Miracuves Price: Starts at $12,999

This is positioned for a feature-rich, JS-based Khatabook-style ledger and MSME finance platform that covers digital customer/supplier ledgers, credit/debit tracking, balance summaries, reminders via SMS/WhatsApp (through your chosen providers), simple reports, basic cash-flow insights, and a modern mobile-first experience with optional web dashboard. From this foundation, the solution can be extended into inventory hooks, GST/invoice-style views, payment gateway/UPI integrations, and partnerships with lending or banking providers as your ecosystem grows.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational MSME ledger and bookkeeping ecosystem ready for launch and future expansion.

Delivery Timeline for a Khatabook-Like Platform with Miracuves

For a Khatabook-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of ledger, reporting, and reminder features

- Number and complexity of integrations (SMS/WhatsApp providers, payment gateways, UPI, banking/credit APIs)

- Complexity of analytics dashboards, multi-store support, and staff roles

- Scope of web portal, mobile apps, branding requirements, and long-term scalability plans

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

A solid Khatabook-style MVP should include:

- Customer and supplier khata creation

- Credit and payment entry

- Automatic balance calculation

- Offline entry with auto-sync

- Cloud backup and restore

- WhatsApp/SMS payment reminders

- Simple business summaries

- Secure login and data protection

- Admin dashboard for monitoring and support

Optional but powerful extensions:

- UPI payment collection

- Credit scoring based on ledger history

- Working capital or loan integrations

- Inventory or billing modules

- GST-lite reporting

- Multi-user access for staff

Read More :- Read the complete guide on fintech app development costs

Conclusion

Khatabook demonstrates how powerful technology can be when it respects existing habits instead of trying to replace them. By simply digitizing the traditional khata, it helped millions of small businesses gain clarity over their cash flow, reduce payment disputes, and operate with more confidence—without forcing them to learn complex accounting systems. Its success shows that simplicity, local language support, and offline-first design can drive massive adoption in emerging markets.

For entrepreneurs, Khatabook is a clear reminder that the biggest opportunities often lie in everyday problems faced by millions. A focused, easy-to-use solution can become a daily habit, unlock valuable business data, and eventually evolve into a full financial ecosystem. Platforms like this don’t just scale—they become indispensable.

FAQs :-

How does Khatabook make money?

Khatabook primarily earns through partnerships with banks, NBFCs, and payment providers. It monetizes by offering financial products like business loans, credit lines, and collections services, while keeping the core ledger features free.

Is Khatabook free to use?

Yes. Khatabook’s basic digital khata features—adding customers, recording credit/debit, viewing balances, and sending reminders—are completely free for merchants.

Does Khatabook work without internet?

Yes. Khatabook is designed as an offline-first app. Merchants can record transactions without internet, and data automatically syncs to the cloud when connectivity is restored.

Is Khatabook safe for storing business data?

Khatabook uses secure authentication, encrypted data storage, and cloud backups to protect merchant data. Even if a phone is lost, records can be restored by logging in again.

Can customers use Khatabook?

Customers don’t need the app. They receive payment reminders and confirmations via SMS or WhatsApp, making it easy for them to know outstanding dues.

Does Khatabook support multiple languages?

Yes. Khatabook supports several Indian languages, making it accessible to merchants across different regions and literacy levels.

Can I collect payments through Khatabook?

Yes. Khatabook offers payment and collection features through UPI and partner integrations, helping merchants receive payments digitally.

Who should use Khatabook?

Khatabook is ideal for kirana stores, small retailers, wholesalers, distributors, and service providers who sell on credit and want a simple way to track dues.

What makes Khatabook different from accounting software?

Khatabook focuses on simplicity. Unlike accounting tools, it doesn’t require accounting knowledge, GST expertise, or complex setup—it mirrors the traditional khata system digitally.

Can I build an app like Khatabook?

Yes. Many entrepreneurs are building digital khata and SMB finance platforms for specific regions or industries. With the right offline-first architecture and simple UX, it’s very achievable.

How can Miracuves help build a Khatabook-like platform?

Miracuves helps entrepreneurs launch Khatabook-style digital ledger apps in 30-90 days, with offline-first support, multilingual UI, cloud backup, reminders, and optional fintech integrations—fully customizable for your target market.