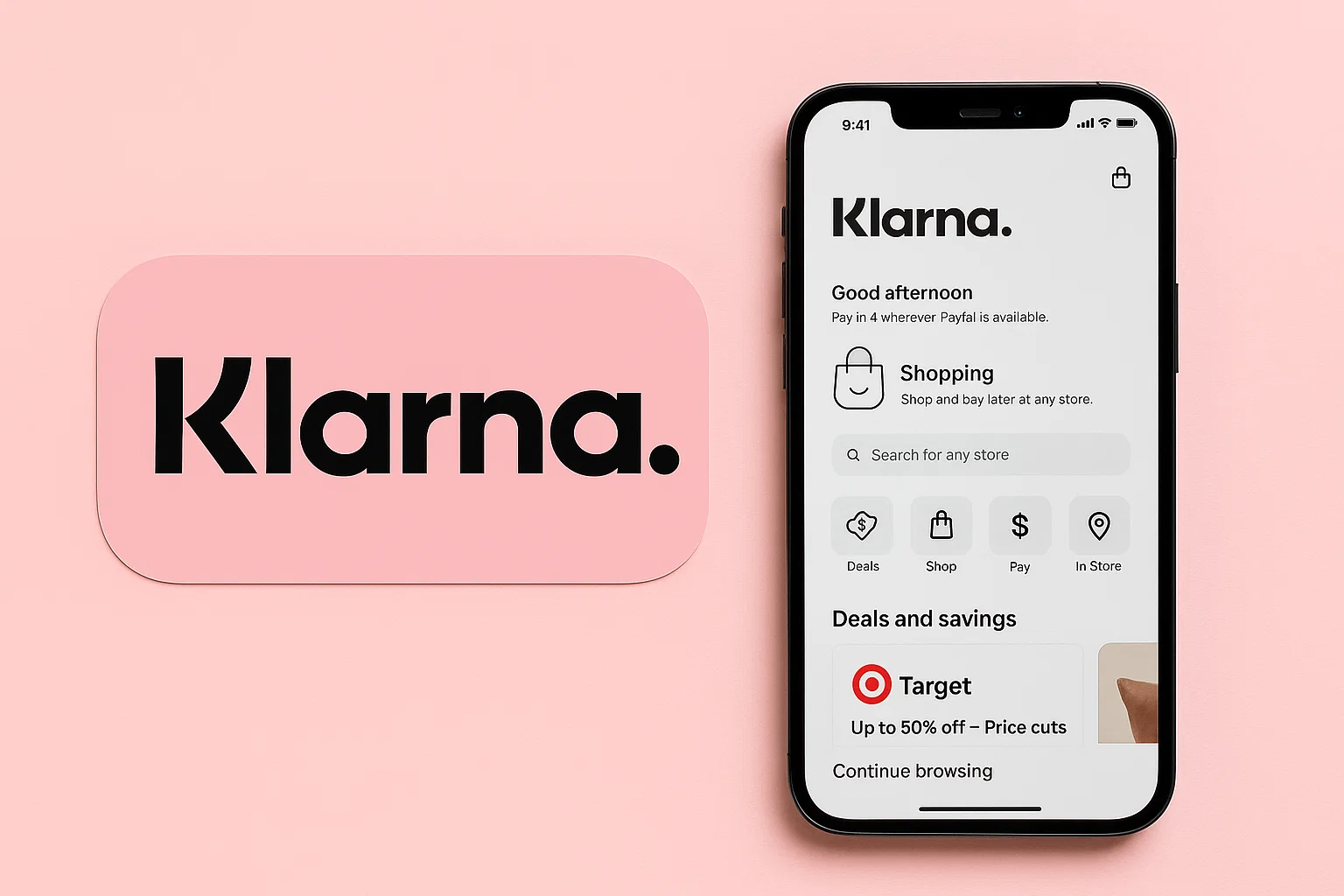

Imagine shopping online and splitting your payment into smaller installments — without credit cards, hidden fees, or long approval steps. That’s exactly what Klarna made possible.

Founded in 2005 in Stockholm, Sweden, Klarna began as a simple online checkout solution but quickly evolved into a global Buy Now, Pay Later (BNPL) leader. Today, it powers smoother payments for over 150 million users across Europe, the U.S., and Asia, redefining how people shop, pay, and manage finances.

In 2025, Klarna offers much more than installment payments. It’s now a complete shopping and financial experience with rewards, budgeting tools, virtual cards, and AI-based price comparisons — all accessible from a single app.

By the end of this guide, you’ll know what Klarna is, how it works, how it earns, and how you can create your own Klarna-like BNPL platform.

What is Klarna? The Simple Explanation

Klarna is a Sweden-based buy now, pay later (BNPL) and shopping app that lets users split purchases into interest-free installments, pay later within 30 days, or pay upfront. It partners with thousands of global retailers and gives users flexible payment options directly at checkout or through the Klarna app.

The core problem Klarna solves is shopping affordability and convenience. Instead of paying the full amount at once, users can spread payments over time without credit cards, hidden fees, or complicated approvals.

Its target users include online shoppers, young adults, and budget-conscious consumers who want simple, flexible payment options with transparent timelines.

As of 2025, Klarna serves 150+ million users and partners with 500,000+ merchants across Europe, North America, and Asia. It has become a leading global BNPL service, known for its fast checkout experience, instant decisions, and built-in shopping tools.

Klarna became successful because it offers a smooth user experience, strong merchant partnerships, and a modern alternative to credit cards — all backed by secure banking-grade technology.

How Does Klarna Work? Step-by-Step Breakdown

Klarna operates as a Buy Now, Pay Later (BNPL) and shopping platform that lets users split purchases into installments, pay later, or pay instantly — all while offering a smooth, interest-free experience for most transactions. It integrates with thousands of online and offline merchants globally and provides a shopper-friendly mobile app that centralizes payments, delivery tracking, and rewards.

For Users

1. Account Creation

Users sign up using their phone number or email, verify identity, and connect a debit/credit card or bank account. Klarna then provides spending limits based on internal risk assessments.

2. Shopping & Checkout

Users can shop directly through the Klarna app or at partner stores like H&M, Sephora, Nike, ASOS, and thousands more. At checkout, they choose from Klarna’s payment options:

- Pay in 4 (split into four interest-free payments)

- Pay in 30 Days

- Pay Now

- Financing (long-term monthly installments with interest)

3. Payments & Schedules

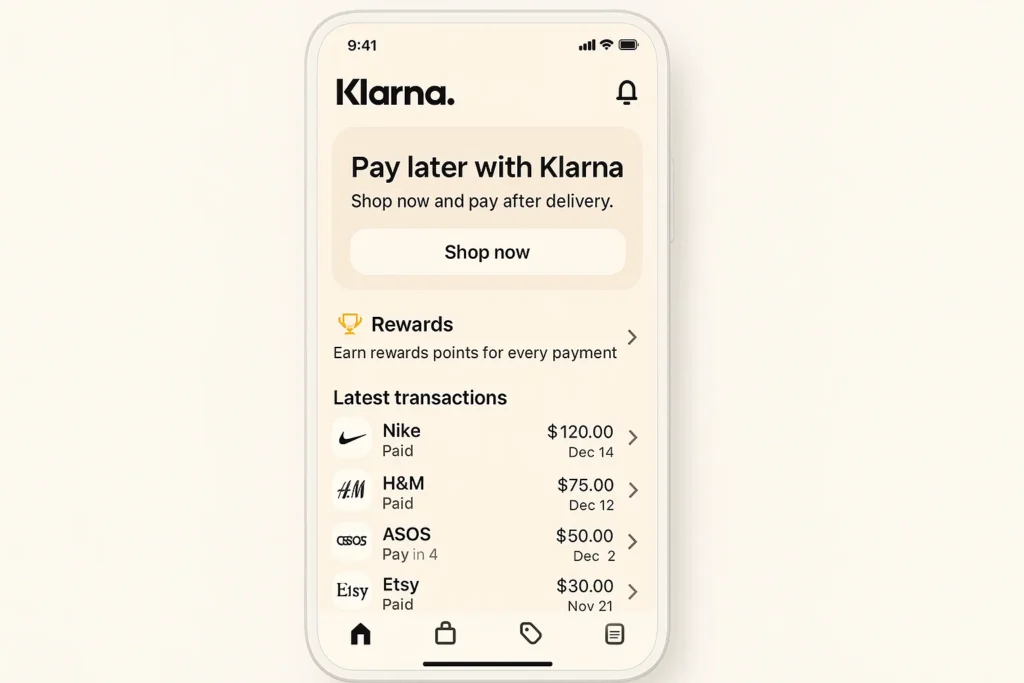

Klarna automatically deducts installments on the due date, sending reminders through the app. Payment schedules and upcoming dues are displayed clearly so users can track everything easily.

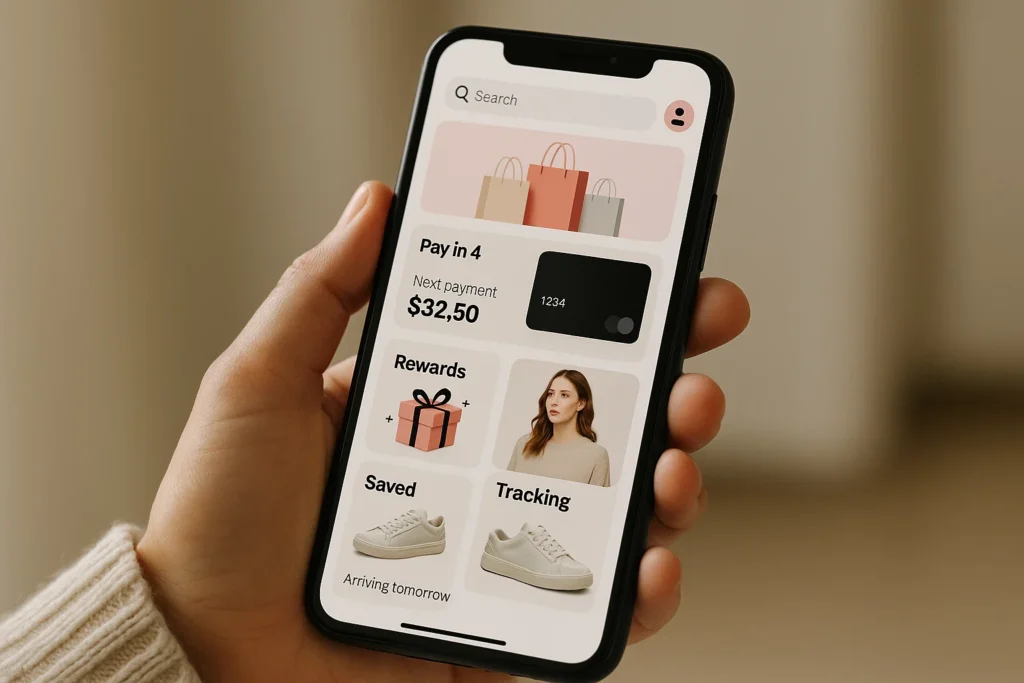

4. Order & Delivery Tracking

Klarna integrates with merchants and shipping partners to show real-time delivery updates inside the app. Users can track purchases, request returns, or manage refunds without visiting the store website.

5. Rewards & Cashback

Klarna’s rewards program gives points for every purchase, redeemable for gift cards or cashback. The app also features price-drop alerts, curated deals, and exclusive shopping discounts.

For Merchants

1. Integration

Businesses integrate Klarna using APIs, plugins (Shopify, WooCommerce, Magento), or POS systems for offline stores.

2. Instant Payouts

Klarna pays merchants upfront for the full purchase amount (minus a small merchant fee), while users pay Klarna back in installments. This reduces merchant risk and boosts conversions.

3. Increased Sales & Reduced Cart Abandonment

BNPL options increase order value, encourage impulse purchases, and reduce checkout drop-offs.

4. Marketing & Exposure

Merchants get featured inside the Klarna app’s shopping feed, reaching millions of shoppers actively browsing deals.

Technical Overview (Simple)

Klarna uses a secure fintech infrastructure that connects payments, risk scoring, and merchant systems seamlessly:

- Cloud-based architecture for global scalability

- Real-time risk assessment & credit scoring models

- PCI DSS–compliant payment gateways

- Encrypted card tokenization for secure transactions

- APIs for merchant checkout and financial reconciliation

Its decision engine evaluates user risk in milliseconds, enabling instant approvals at checkout.

Read More :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Klarna’s Business Model Explained

Klarna operates on a buy now, pay later (BNPL) and payment processing model, serving both consumers and merchants. Its business is built on driving higher conversion rates for online stores while giving shoppers flexible, interest-free payment options.

1. Merchant Fees (Primary Revenue Source)

Klarna charges online retailers a fee every time a customer uses Klarna at checkout.

Merchants happily pay this because Klarna:

- Increases order conversion

- Boosts average order value

- Reduces cart abandonment

This fee model is the backbone of Klarna’s multi-billion-dollar revenue.

2. Consumer Fees (Late Fees Only)

Klarna does not charge interest on Pay-in-4 or Pay-later products.

However, late or missed payments result in small fixed fees.

These are regulated and form a minor revenue stream.

3. Interchange Fees (Klarna Card)

Users with the Klarna Card generate interchange fees (merchant transaction fees), similar to how credit and debit cards earn revenue.

4. Subscription Products

Klarna offers optional upgraded services such as:

- Purchase protection

- Premium Klarna Card versions

These bring recurring subscription revenue.

5. Interest on Financing Plans

For longer-term financing (6–36 months), Klarna charges interest.

This is used in large purchases such as electronics, furniture, fashion, and travel.

6. Advertising & Brand Promotion (Klarna Ads)

Merchants pay Klarna to promote their products inside the Klarna Shopping App, which now acts as a discovery marketplace.

This advertising division has become one of Klarna’s fastest-growing revenue streams in 2025.

7. Data & Checkout Solutions

Klarna sells fraud prevention, risk scoring, and checkout optimization tools to global merchants — a B2B revenue stream powered by data analytics.

Klarna’s Financial Strength (2025 Snapshot)

- Operates in 45+ countries

- 150+ million active consumers

- Over 500,000 merchants integrated

- BNPL market share among the top globally

- One of Europe’s leading fintech unicorns

Klarna’s business model succeeds because it benefits both sides:

Shoppers get flexibility, and businesses get higher sales.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Key Features That Make Klarna Successful

Klarna’s global rise comes from its ability to blend convenience, flexibility, and trust into every shopping experience. Each feature is designed to reduce friction for shoppers while increasing conversion for merchants.

1. Pay in 4 Installments

Shoppers split payments into four equal, interest-free installments. This makes purchases more affordable without traditional credit checks. It’s one of Klarna’s most used features worldwide.

2. Pay Later (30-Day Billing)

Users can receive their order first and pay later within 30 days. This reduces hesitation during checkout and boosts merchant sales by lowering upfront commitment.

3. Klarna Card

A physical and virtual card that lets users shop anywhere with Pay in 4. It connects directly to the Klarna app for repayment scheduling and spending control.

4. One-Time Virtual Cards

Users generate temporary cards for online purchases. These cards support BNPL payments even on sites not partnered with Klarna.

5. Shopping Browser Extension

The Chrome/Edge extension brings Klarna’s installment options to nearly any website. It also auto-applies coupons and cashback deals, improving user savings.

6. Rewards Club

Klarna’s loyalty program gives users points (Vibe points) for every purchase. These points can be redeemed for gift cards from partner brands.

7. Price Drop Alerts

Users can track products from various stores within the app. Klarna notifies them when prices fall, helping users shop at the best moment.

8. In-App Store Directory

The Klarna app features thousands of merchants with curated collections, trending products, and offers. It acts as a marketplace powered by global brand partnerships.

9. Spending Insights

Klarna provides detailed spending analytics that categorize expenses, highlight upcoming payments, and help users manage their budgets better.

10. Buyer Protection

Users get purchase protection, dispute resolution, delivery tracking, and smooth returns. This enhances trust and encourages repeat usage.

2025 Updates

In 2025, Klarna rolled out AI-powered personalized shopping feeds, credit builder tools for users with thin credit histories, and improved fraud-detection systems across all BNPL transactions.

Klarna’s Impact & Market Opportunity

Klarna has reshaped the global payments landscape by making online shopping smoother, more flexible, and more consumer-friendly. Its “buy now, pay later” model helped redefine how millions of users manage purchases and cash flow, while giving merchants a powerful conversion-boosting tool.

Industry Disruption

Before Klarna, online shoppers primarily relied on credit cards for short-term financing. Klarna changed this by offering interest-free installments, no-credit-card-required payments, and one-click checkout.

This created a new standard for flexible payments and inspired countless BNPL competitors worldwide.

The result? Retailers saw higher sales conversions, lower cart abandonment, and improved customer satisfaction — making BNPL a preferred checkout option globally.

Market Statistics & Growth

As of 2025:

- Klarna has 150+ million active users across Europe, the U.S., and global markets.

- It partners with 500,000+ merchants, including H&M, Sephora, IKEA, and Nike.

- Klarna processes over $180 billion in annual transaction volume.

- BNPL market growth continues rising, expected to exceed $900 billion globally by 2030.

Klarna’s AI-driven credit assessment and spending insights continue to position it as a leader in the BNPL movement.

User Demographics & Behavior

Klarna appeals mainly to:

- Millennials and Gen Z shoppers

- Frequent online buyers

- Users without traditional credit cards

- Consumers seeking flexible budgeting options

Most users prefer Klarna because it offers transparency, interest-free payments, and convenience across thousands of online stores.

Geographic Presence

Founded in Sweden, Klarna dominates European BNPL markets and has grown significantly in the U.S., Australia, and select Asian markets. It continues expanding strategically with retailer partnerships and co-branded credit products.

Future Projections

By 2030, Klarna aims to elevate its super-app strategy by:

- Expanding financial products like credit lines and budgeting tools

- Integrating AI shopping assistants and discovery engines

- Offering more merchant analytics, loyalty tools, and global BNPL coverage

- Moving deeper into consumer banking services

Opportunities for Entrepreneurs

Klarna’s growth shows a massive opportunity for fintech startups to build BNPL and checkout-focused platforms — especially in developing markets where credit accessibility remains limited.

Building Your Own Klarna-Like Platform

Klarna’s massive success shows that consumers want smarter, more flexible payment options — especially those that reduce financial stress and improve purchasing power. Building a Klarna-like BNPL (Buy Now, Pay Later) platform allows businesses to enter one of the fastest-growing fintech segments in the world.

Why Businesses Want Klarna Clones

A Klarna-style BNPL platform helps companies:

- Offer split payments (Pay in 3/4) to boost conversions

- Provide low-interest or no-interest installment plans

- Attract younger, credit-averse customers

- Reduce cart abandonment in eCommerce

- Build loyalty through rewards and shopper profiles

- Integrate BNPL with banking, shopping, and merchant dashboards

BNPL usage in 2025 continues growing rapidly across retail, travel, electronics, and lifestyle products — making it one of the most profitable fintech models.

Key Considerations for Development

To build a reliable Klarna-like platform, you’ll need to focus on:

- Advanced risk assessment and credit scoring

- Merchant onboarding workflows

- Secure payment gateways and settlement logic

- Automated reminders and payment collection

- Integration with major eCommerce platforms (Shopify, WooCommerce, Magento)

- Compliance with local regulations for lending and consumer protection

- Multi-currency support for cross-border purchases

- A smooth shopper app with real-time purchase tracking

Cost Factors & Pricing Breakdown

Klarna-Like BNPL App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic BNPL MVP | User onboarding, KYC, basic “buy now, pay later” checkout, simple repayment schedules, order history, merchant panel, standard admin panel | $35,000 |

| 2. Mid-Level BNPL Platform | Multi-merchant support, flexible instalment plans, payment gateway integrations, improved risk checks, notifications, dashboards, mobile-ready frontends | $80,000 |

| 3. Advanced Klarna-Level BNPL Platform | Advanced risk and credit scoring engine, multi-country support, complex repayment logic, deep merchant integrations, dispute handling, rich analytics, web + apps | $200,000+ |

Klarna-Style Buy Now, Pay Later Platform Development

The prices above reflect the global market cost of developing a Klarna-like buy now, pay later (BNPL) platform — typically ranging from $35,000 to over $200,000, with a delivery timeline of 4–10 months depending on payment gateway integrations, risk and credit-scoring complexity, regulatory requirements, scalability needs, and merchant ecosystem depth.

Miracuves Pricing for a Klarna-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, Klarna-style BNPL platform (user onboarding and KYC, BNPL checkout flows, repayment schedules, order and transaction histories, merchant tools, and mobile apps), with room to extend into more advanced risk engines, multi-country compliance, and deeper merchant/partner integrations as your business scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational BNPL ecosystem ready for launch and future expansion.

Delivery Timeline for a Klarna-Like Platform with Miracuves

For a Klarna-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Scope and complexity of BNPL and repayment features

- Number of payment gateways, merchants, and external services to integrate

- Depth of risk-scoring, fraud detection, and compliance workflows

- Required dashboards, reporting tools, and analytics for merchants and admins

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js / Nest.js / Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.

Read More :- Read the complete guide on fintech app development costs

Conclusion

Klarna has reshaped how millions of people shop and pay online. By blending flexibility with a simple user experience, it has created a new standard for digital payments and consumer credit. Its rise also reflects a major shift in global commerce — customers now expect fast checkout, transparent pricing, and the freedom to pay on their own terms.

In 2025, Klarna continues to be a leader in the Buy Now, Pay Later space, expanding into banking, shopping tools, and AI-driven recommendations. Its global influence has inspired a new generation of fintech platforms focused on convenience and customer-first design.

For entrepreneurs, Klarna’s journey proves that solving a real pain point — in this case, payments and checkout friction — can unlock massive opportunities. The BNPL sector is still growing rapidly across Europe, Asia, and emerging markets, where consumers are increasingly choosing flexible financing options.

With Klarna Clone Script, you can launch your own BNPL-powered payment platform in just , built with secure tech, user-friendly flows, merchant integrations, and global scalability. Whether you’re targeting eCommerce, travel, healthcare, or retail, the opportunity to build a Klarna-style success story is wide open.

Start now — the future of payments is flexible, digital, and user-driven.

FAQs :-

How does Klarna make money?

Klarna earns mainly through merchant fees when customers buy now and pay later, interest and late fees on financing products, and interchange fees from the Klarna Card. It also earns from value-added services offered to retailers, such as marketing and conversion-boosting tools.

Is Klarna safe to use?

Yes. Klarna is regulated as a bank in Sweden and follows strict EU financial rules. It uses encryption, biometric login, fraud monitoring, and secure payment gateways to protect users.

Does Klarna charge interest?

Most Pay-in-3 and Pay-in-30 plans are interest-free. However, long-term financing options may include interest depending on region and loan amount.

Is Klarna available in my country?

Klarna is available in over 45 countries, including Sweden, the U.S., UK, Germany, Italy, Spain, Netherlands, and Australia. Availability of certain features may vary by region.

Does Klarna affect my credit score?

Pay-in-3 or Pay-in-30 often involve a soft check that does not impact credit score. Long-term financing may use a hard credit inquiry, depending on local regulations.

Can I split payments using Klarna anywhere?

You can use Klarna at thousands of partner stores, online marketplaces, and through the Klarna Card (where available), which enables splitting payments almost anywhere.

How many users does Klarna have?

As of 2025, Klarna has over 150 million active users globally and is one of the world’s largest BNPL (Buy Now Pay Later) platforms.

What makes Klarna different from Afterpay or Affirm?

Klarna offers more features — including Pay-in-3, interest-free plans, banking services, virtual cards, rewards, subscription management, and a shopping app with price tracking.

What technology powers Klarna?

Klarna uses cloud-native infrastructure with microservices, real-time payment systems, AI for risk scoring, fraud detection, and personalized shopping recommendations.

Can I build a similar app like Klarna?

Yes. With Klarna Clone Script, you can launch a full BNPL platform — with installment plans, merchant integration, real-time credit checks, and user-friendly mobile apps — in just , fully customized for your market.

Related Articles :-