You drop your phone, your laptop gets stolen, or a pipe bursts in your apartment — and your first thought is: “Ugh, now I have to fight with the insurance company.” Long forms, long calls, and long waits are exactly why most people hate dealing with insurance.

Lemonade flips that experience on its head.

Lemonade is an AI-powered insurance company that lets you buy renters, homeowners, car, pet, and life insurance in minutes and file claims right from an app — with many simple claims paid out in seconds.

Founded in 2015 and based in New York, Lemonade operates across the US and parts of Europe. Instead of relying on traditional agents and paper-heavy workflows, it uses chatbots, machine learning, and behavioral economics to underwrite policies and handle claims.

What really makes Lemonade stand out is its business model:

- It takes a fixed fee from premiums

- Uses the rest to pay claims

- Donates leftover money to charities chosen by customers (its “Giveback” program)

By Q3 2025, Lemonade had around 2.87 million customers and over $1.16B in in-force premium (IFP), growing rapidly as it expands its product lines and geography.

In this guide, you’ll learn in simple, friendly language:

- What Lemonade is and who it’s for

- How the Lemonade app works from sign-up to claim payout

- The business model and revenue streams behind Lemonade

- The AI and technology powering instant underwriting and claims

- Key features that users love (and what traditional insurers can learn)

- The market opportunity for building Lemonade-style insurance apps with a modern, digital-first experience

By the end, you’ll have a clear, non-technical understanding of how Lemonade works and what it would take to build a similar insurtech platform for your own market or niche.

What Is Lemonade? – The Simple Explanation

Lemonade is a digital-first insurance company that lets people buy insurance and file claims entirely through an app. Instead of speaking to agents, filling long forms, or waiting days for updates, customers chat with an AI bot that handles everything from sign-up to claims.

In simple terms:

Lemonade is an app that makes renters, homeowners, car, pet, and life insurance fast, affordable, and incredibly easy to use.

The Core Problem Lemonade Solves

Traditional insurance feels slow, confusing, and stressful. The biggest complaints customers have include:

- Too much paperwork

- Slow claims processing

- Complicated pricing

- Hard-to-reach customer support

- Lack of transparency

Lemonade removes these bottlenecks through automation and a user-friendly interface. What normally takes hours or days can take minutes — sometimes even seconds.

Who Lemonade Is For

Lemonade’s customer base includes:

- Renters: The company’s most popular entry-level product

- Homeowners: Simple, app-based home insurance

- Drivers: With AI-powered car insurance pricing and telematics

- Pet owners: Affordable medical coverage for dogs and cats

- Individuals seeking life insurance: Quick, no-exam policies

Its primary audience is digitally savvy users who prefer mobile-first services, especially millennials and Gen Z.

Market Position in 2025

Lemonade has grown into one of the most recognized insurtech brands in the US and Europe. With millions of users and expanding product lines, it’s one of the fastest-growing insurance startups in the world. The app’s focus on speed, transparency, and social good has helped it stand out in a heavily regulated, slow-moving industry.

Why Lemonade Became Successful

- AI-driven signup and claims make the experience radically faster

- Transparent pricing builds trust

- The Giveback model donates leftover money to charities

- Mobile-first design appeals to modern consumers

- Flat-fee business model reduces conflict between insurer and customer

What makes Lemonade different is not just that it’s digital — it’s emotionally intelligent, easy to use, and designed around the customer instead of the insurance company.

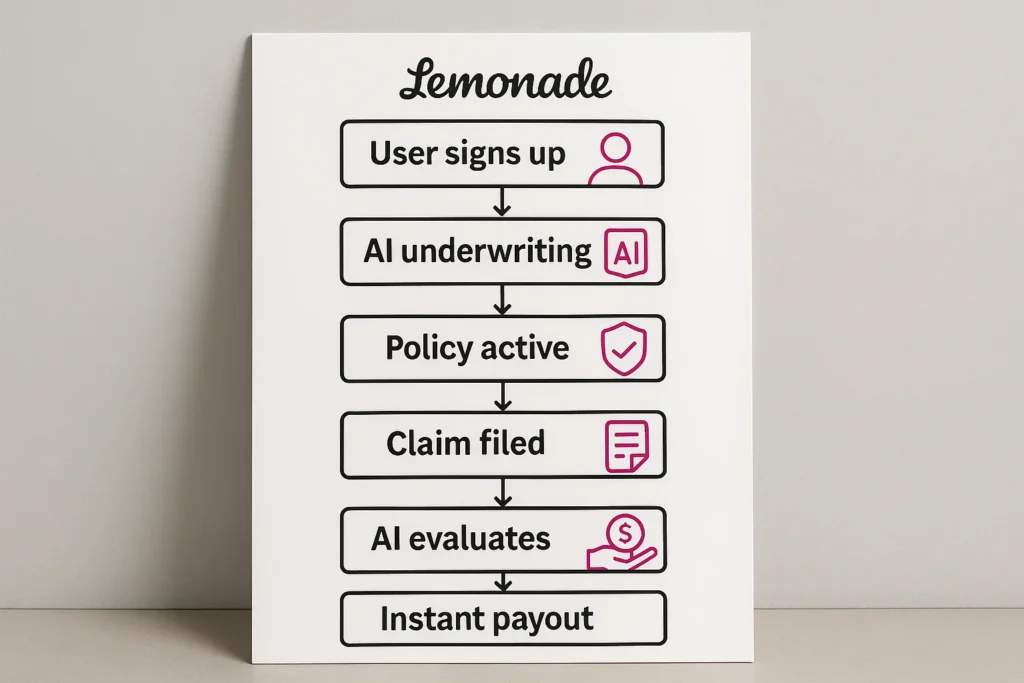

How Lemonade Works – Step-by-Step Breakdown

For Users (Renters, Homeowners, Drivers, Pet Owners, Life Insurance Customers)

1. Sign Up Through the Lemonade App

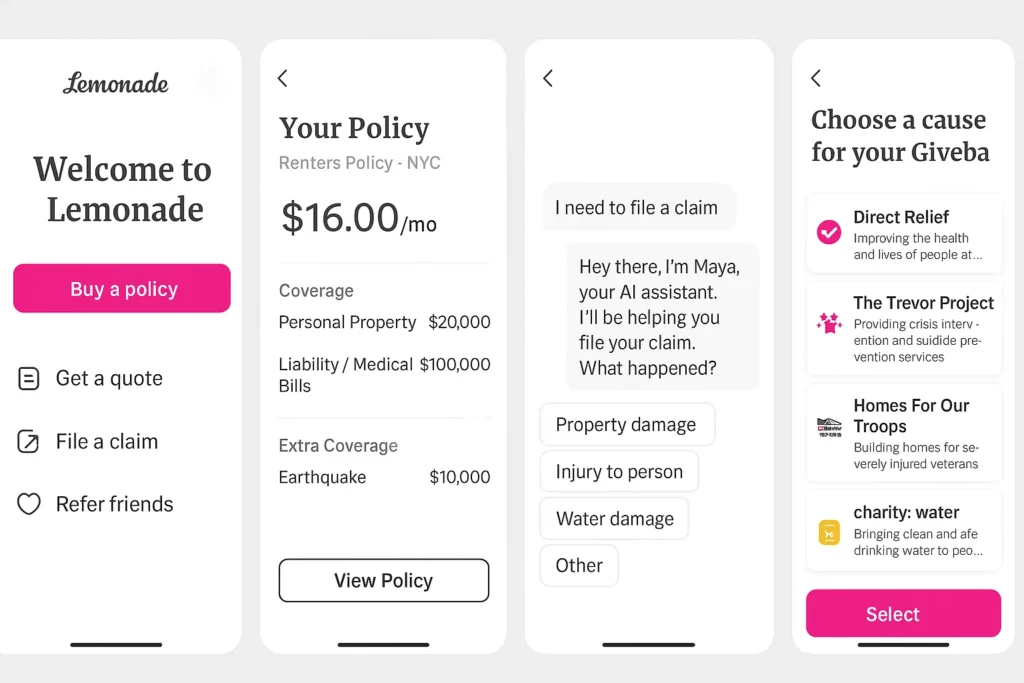

Users start by chatting with Maya, Lemonade’s AI chatbot.

Maya asks simple questions like:

- Where do you live?

- What property are you insuring?

- What items matter most to you?

- Do you have pets?

- Do you want additional coverage?

Instead of long forms, the conversation feels like texting a friend.

Within minutes, Lemonade generates a personalized quote.

2. Customize Coverage

Users can add or remove options:

- Personal property coverage

- Liability coverage

- Extra protection for jewelry, bikes, electronics

- Car insurance add-ons (roadside, glass repair)

- Pet insurance wellness packages

- Life insurance policy amounts

The app updates the price in real time, so customers know exactly what they’re paying for.

3. Buy the Policy Instantly

With a tap, the policy is activated. Documents are delivered digitally, and the customer can access everything from the dashboard — no paperwork, no meetings, no agents.

4. File a Claim Through the App

If something happens (theft, accident, damage, medical pet emergency), users open the app and file a claim with a quick video explanation or simple chat prompts.

Lemonade’s AI takes over:

- Analyzes the claim

- Checks the policy

- Runs fraud detection models

- Approves simple claims instantly

Many claims are paid in under 3 minutes.

5. Receive Payment

Approved claims go directly to the user’s bank account — often immediately.

Complex claims are escalated to human adjusters, but the process is still much faster than traditional insurers.

For Lemonade as a Business

AI-Powered Underwriting

Lemonade uses AI to:

- Assess risk

- Price policies dynamically

- Group users with similar profiles

This keeps premiums competitive and reduces overhead.

Fraud Detection

Behavioral economics + machine learning detect suspicious claims before approval.

This reduces fraud and helps Lemonade maintain fast payouts for honest customers.

Giveback Program

At the end of the year:

- Money left from each group’s unclaimed premiums

- Is donated to charities chosen by customers

This improves trust and reduces the conflict of interest between insurer and insured.

Technical Overview (Simplified)

Lemonade runs on:

- AI chatbots for onboarding & claims

- Machine learning models for underwriting & fraud detection

- Behavioral economics to encourage honesty

- Cloud infrastructure for speed and scalability

- Open API for partner integrations

This makes Lemonade more like a fintech startup than a traditional insurance carrier.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Lemonade’s Business Model Explained

Fixed-Fee Insurance Model

Lemonade operates on a flat-fee model, which is very different from traditional insurers.

Here’s how it works:

- Lemonade takes a fixed 25% of premiums as its revenue.

- The remaining 75% is set aside to pay claims and reinsurance.

- If there’s money left after claims, Lemonade donates it to charities chosen by customers as part of its Giveback Program.

This structure removes the typical conflict where insurers profit by denying claims.

Premiums as the Main Revenue Stream

Lemonade earns money from:

- Renters insurance policies

- Homeowners insurance

- Car insurance

- Pet insurance

- Term life insurance

Revenue grows as the customer base increases.

Reinsurance Partnerships

Lemonade shares risk by partnering with global reinsurers.

This ensures:

- More stable financial performance

- Reduced exposure to large losses

- Ability to scale quickly in new markets

Reinsurance allows Lemonade to pay claims reliably while keeping prices affordable.

AI-Driven Efficiency

Because Lemonade uses automation instead of large customer service teams, it:

- Lowers overhead

- Speeds up claims

- Increases customer satisfaction

- Improves underwriting margins

AI helps Lemonade operate with fewer employees compared to traditional insurers.

Investment Income

Like all insurers, Lemonade invests money collected from premiums before it is used to pay claims.

These returns provide an additional revenue stream.

The Giveback Program

Each customer chooses a cause during sign-up (environmental, social, animal rights, etc.).

Unused premium funds for that group at year-end are donated.

This helps Lemonade:

- Build trust

- Reduce fraud (people don’t want to steal from their own cause)

- Strengthen brand loyalty

Why This Business Model Works

- Transparent pricing creates customer trust

- Automation reduces operational cost

- Social impact enhances brand reputation

- Flat-fee structure prevents perverse incentives

- Hybrid of insurance + technology appeals to modern consumers

Lemonade’s model proves that insurance doesn’t have to be complex, slow, or adversarial.

Key Features That Make Lemonade Successful

1. AI Chatbot for Instant Onboarding

Lemonade’s onboarding starts with an AI assistant (like Maya) instead of a human agent. You answer a few chat-style questions and get a quote in minutes.

Why it matters: Removes friction from signup and makes insurance feel as easy as signing up for Netflix.

Benefit for users: No phone calls, no paperwork, no confusing jargon.

Tech angle: NLP + decision models guide users through underwriting in real time.

2. App-First, Paperless Experience

Every interaction—quote, policy, claim, payments—is handled in the app or browser.

Why it matters: Modern users expect everything on their phone.

Benefit for users: Access policies, update details, download documents, and file claims from one place.

Tech angle: Cloud-native backend + secure mobile APIs + digital signatures.

3. Instant Claims for Simple Cases

For many straightforward claims (like small theft or damage), Lemonade’s AI can review, approve, and pay out in seconds.

Why it matters: Traditional claims can take weeks; this turns claims into a near-instant experience.

Benefit for users: Money arrives when they need it, not when the insurer feels ready.

Tech angle: Machine learning models + rules engines + fraud scoring run in real time.

4. Behavioral Economics–Driven Design

Lemonade’s flows are designed to encourage honesty—for example, reminding users that unclaimed money goes to charities they chose.

Why it matters: Reducing fraud means faster, more generous claims for honest users.

Benefit for users: A system that feels fair instead of adversarial.

Tech angle: UX patterns + data models informed by behavioral research.

5. Transparent, Customizable Coverage

Users can adjust coverage sliders and see the premium update instantly—whether it’s personal property, liability, add-ons for jewelry, electronics, pets, or car coverages.

Why it matters: Clarity and control over what you’re actually paying for.

Benefit for users: Easier to balance affordability with protection.

Tech angle: Real-time rating engine recalculates premiums as users tweak options.

6. Multi-Product Ecosystem (Renters, Home, Car, Pet, Life)

Lemonade offers a portfolio of products under one account, often with discounts for bundling.

Why it matters: One brand, one app, multiple protections.

Benefit for users: Fewer logins, simpler billing, easier claims history tracking.

Tech angle: Shared customer profile + cross-product risk and pricing models.

7. Always-On Fraud Detection

Every claim passes through automated checks—looking at patterns, inconsistencies, and known fraud signals. Suspicious cases get escalated to human teams.

Why it matters: Keeps the system sustainable and protects honest customers.

Benefit for users: Faster payouts overall because fewer resources are wasted on preventable fraud.

Tech angle: ML models trained on historical claims + anomaly detection.

8. Social Impact via the Giveback Program

Lemonade groups policyholders into “cause pools.” Any leftover claims money from each pool is donated to charities chosen by customers.

Why it matters: Aligns incentives—Lemonade doesn’t “win” by denying your claim.

Benefit for users: Feels better paying a premium when part of it supports causes you care about.

Tech angle: Pooled accounting logic + automated donation and reporting workflows.

9. Usage- and Behavior-Informed Pricing (Especially for Car & Pet)

With products like car insurance, Lemonade can use telematics-style inputs (driving behavior, mileage patterns) and richer health/claims history for pets to refine pricing over time.

Why it matters: Safer users and low-risk profiles can get better pricing.

Benefit for users: Potentially fairer, more personalized premiums instead of one-size-fits-all.

Tech angle: Continuous data feeds + dynamic pricing models that learn and adjust.

10. Clean, Friendly UI and Brand Tone

Beyond tech, Lemonade feels “human”: pink branding, casual language, simple screens, and minimal legal clutter up front.

Why it matters: Insurance traditionally feels intimidating; Lemonade feels approachable.

Benefit for users: Less anxiety, more confidence while making important coverage decisions.

Tech angle: Design systems + experimentation (A/B testing) to optimize flows and microcopy.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Lemonade

Lemonade looks simple on the surface, but under the hood it runs like a fintech + AI startup that happens to sell insurance. Here’s the non-technical breakdown.

AI-First Architecture (Maya & Jim)

Lemonade famously uses two core AI personas:

- Maya – handles quotes, onboarding, and policy management

- Jim – helps process and evaluate claims

Instead of static forms, these AI agents run on top of:

- Natural language understanding (so the app can “chat” with you)

- Decision engines that map your answers to coverage and pricing

- Risk models that instantly determine whether you’re insurable and at what rate

For a user, it feels like a friendly chat. For Lemonade, it’s a continuous data pipeline for underwriting and product optimization.

Machine Learning for Underwriting & Pricing

Traditional insurers rely on big actuarial tables and legacy systems. Lemonade uses machine learning models that:

- Score risk based on dozens of behavioral and profile signals

- Segment customers into risk pools dynamically

- Adjust pricing as more claims and user data flow in

- Tailor coverage suggestions based on similar customer patterns

This lets Lemonade offer personalized pricing and refine its risk models over time instead of waiting for slow, batch actuarial updates.

Real-Time Claims Automation

For claims, Lemonade’s tech stack supports:

- Video claim submissions (you explain what happened on camera)

- Real-time policy and history checks

- Automated fraud scoring

- Instant approval and payout for low-risk, simple claims

Behind that “instant payout” experience are rules engines + ML models that decide:

- Is this consistent with the policy?

- Is this claim amount reasonable?

- Does the behavior or history look suspicious?

If everything checks out, the system can approve automatically; otherwise, it routes to human adjusters.

Behavioral Economics + Data-Driven UX

Lemonade’s flows are intentionally designed to encourage honesty and reduce fraud. Technically, this shows up as:

- In-app nudges tied to the Giveback (you’re reminded that cheating hurts your chosen charity)

- Carefully worded questions that reduce gaming

- A/B-tested interfaces that balance simplicity with completeness

The product is continuously optimized using:

- Funnel analytics (where users drop off)

- Experimentation (different flows, questions, wording)

- Retention and claim behavior data

Cloud-Native, API-Driven Infrastructure

Underneath the AI layer, Lemonade runs on a cloud-native microservices architecture, which allows:

- Fast scaling when many users get quotes or file claims at once

- Independent deployment of features (e.g., pet vs car vs renters)

- High availability and resilience

Key components include:

- Policy management services (create, update, renew)

- Billing & payments services (cards, bank, recurring billing)

- Claims services (intake, evaluation, payout)

- Customer profile & identity layer

- Partner and reinsurance APIs

This makes Lemonade behave more like a modern SaaS platform than a legacy insurer.

Data, Analytics & Feedback Loops

Lemonade tracks a huge amount of anonymized and aggregated data:

- Quote-to-bind conversion

- Claim frequency and severity

- Fraud signals

- Channel performance (mobile, web, partners)

- Product-level profitability

These insights feed back into:

- Pricing updates

- Product changes

- UX improvements

- Risk selection rules

The result is a self-improving insurance engine.

Security, Compliance & Privacy

Because Lemonade is still a regulated insurer, the tech stack is wrapped in:

- Strong encryption (data in transit and at rest)

- Identity verification and KYC controls

- Audit trails for every policy and claim action

- Region-aware data storage to comply with local regulations

The key difference is that Lemonade bakes these into a digital-first architecture, instead of retrofitting them onto old mainframe systems.

Why This Tech Matters for Business

All of this technology isn’t just for show—it directly impacts business outcomes:

- Lower cost per policy → more competitive pricing

- Faster claims → higher customer satisfaction and retention

- Better fraud detection → healthier loss ratios

- More data → smarter underwriting and cross-sell opportunities

- Scalable infrastructure → easy expansion into new products and regions

If you’re thinking about building a Lemonade-style app for a specific region or niche (e.g., micro-insurance, SME insurance, travel, gadget, or health add-ons), this is the kind of tech foundation you’d want: AI at the front, cloud + APIs at the core, and strong analytics and compliance baked in.

Lemonade’s Impact & Market Opportunity

How Lemonade Changed the Insurance Experience

Lemonade didn’t just put insurance in an app — it reframed how people feel about insurance.

Instead of:

- Long forms → it uses a chat

- Agents and phone calls → it uses AI

- Weeks-long claims → it aims for minutes

- “Us vs. them” mindset → it uses a flat-fee + Giveback model

That shift did two big things:

- Brought younger, digital-native customers into the insurance market (many bought renters insurance for the first time via Lemonade).

- Forced traditional insurers to start rethinking their own digital and claims experiences.

Impact on Customers

For everyday users, Lemonade delivers:

- Speed: Quotes in minutes, many claims resolved in seconds

- Clarity: Simple UI, clear coverage sliders, easy-to-read policies

- Trust: Flat-fee model plus charity Giveback reduces the feeling that the insurer “wins when you lose”

- Accessibility: Low-friction renters and pet insurance made coverage feel more normal and affordable

Because everything is handled in-app, insurance becomes something you can actually manage yourself, instead of something you avoid until you must deal with it.

Impact on the Insurance Industry

Lemonade became a proof-of-concept that:

- AI can safely be used in underwriting and claims (with human backup).

- Direct-to-consumer, app-first insurance can scale.

- Brand and UX matter as much as pricing in attracting modern customers.

- Behavioral economics can reduce fraud and improve claim honesty.

As a result, many legacy insurers started:

- Launching app-first products

- Experimenting with chatbots and automation

- Investing in “digital labs” and insurtech partnerships

Lemonade helped push a very old industry toward real modernization.

Market Size & Growth Opportunity

The addressable market Lemonade plays in is massive:

- Renters and homeowners insurance

- Auto insurance

- Pet insurance

- Life and other personal lines

We’re talking hundreds of billions of dollars annually in global premium, with huge parts of the world still underinsured or poorly served digitally.

On top of that, customers are now:

- Comfortable buying financial products on their phones

- Expecting instant experiences (thanks to food delivery, ride-hailing, etc.)

- More open to trying new brands if the UX and trust are strong

That creates a long runway for digital-first, Lemonade-style players, especially outside the U.S. and in niche insurance segments.

Who Can Benefit from Lemonade’s Model

There’s big opportunity for:

- Regional insurtechs in Asia, Africa, LATAM, and Europe

- Niche insurers (travel, gadgets, SME, gig worker, micro-insurance)

- Embedded insurance (inside fintech, e-commerce, mobility apps)

- Specialist products (e.g., device, event, subscription, cyber for small business)

All of these can adapt the Lemonade playbook:

AI onboarding + instant policies + app-first claims + transparent pricing.

Future Trends That Favour Lemonade-Style Apps

- More data sources (IoT, telematics, health trackers, smart homes)

- Growing comfort with AI assistants handling “serious” tasks

- Increasing regulatory openness to digital KYC and remote onboarding

- Rising customer demand for ethical, socially-conscious brands

Put together, these trends make Lemonade’s model less of an exception and more of a blueprint for the next generation of insurance platforms.

This massive success is why many entrepreneurs want to create Lemonade-like apps for specific markets, products, or customer segments—combining AI, clean UX, and a friendlier business model around insurance.

Building Your Own Lemonade-Like Platform

Why Businesses Want Lemonade-Style Insurance Platforms

The success of Lemonade proves that customers want fast, transparent, mobile-first insurance. Businesses and founders are attracted to this model because it:

- Reduces operating costs with automation

- Scales quickly without large call centers

- Appeals strongly to younger, digital-native customers

- Builds trust through transparency and simplicity

- Creates higher customer satisfaction through speed and ease

A Lemonade-style platform is especially powerful in markets where traditional insurers are slow, paperwork-heavy, or lack modern digital capabilities.

Cost Factors & Pricing Breakdown

Lemonade-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Digital Insurance MVP | Core web/app for selling a limited set of policies (e.g., renters), quote & buy journey, user registration & login, policy management, basic claims submission, simple rating/pricing logic (via your insurer/backend), standard admin panel, basic reports | $90,000 |

| Mid-Level Insurtech Platform | Multiple product lines (renters, home, pet, etc.), dynamic quote engine, richer underwriting rules, improved claims workflow, KYC/identity checks (via providers), notifications & reminders, basic fraud flags, analytics dashboard, polished mobile-first UX (web + apps) | $170,000 |

| Advanced Lemonade-Level Insurance Ecosystem | AI-assisted claims handling, advanced risk & pricing engine, multi-country and multi-product setup, complex compliance & audit trails, deep integrations with core insurance systems and data providers, reinsurance / panel management hooks, rich analytics, cloud-native, highly scalable architecture | $280,000+ |

Lemonade-Style Digital Insurance Platform Development

The prices above reflect the global market cost of developing a Lemonade-like digital insurance (insurtech) platform — typically ranging from $90,000 to over $280,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This generally includes quote & bind journeys, policy administration, claims workflows, integrations with insurance/back-office systems, KYC and compliance layers, and extensive testing for real-money, real-policy operations.

Miracuves Pricing for a Lemonade-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Lemonade-style digital insurance platform that covers online quote & purchase journeys, multi-product policy management, basic-to-intermediate underwriting rules (via your insurance stack), digital claims submission and tracking, notifications, analytics, admin console, and modern web + mobile interfaces. From this foundation, the solution can be extended into AI-assisted claims flows, deeper fraud/risk signals, broader product lines, and multi-country compliance as your insurtech business scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational digital insurance ecosystem ready for launch and future expansion.

Delivery Timeline for a Lemonade-Like Platform with Miracuves

For a Lemonade-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of product coverage (renters, home, pet, auto, etc.) and rating/underwriting rules

- Number and complexity of integrations (core insurance systems, KYC/AML, payment gateways, data providers)

- Complexity of claims workflows, fraud/risk checks, and regulatory reporting

- Scope of web portal, mobile apps, branding requirements, and long-term scalability targets

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Key Considerations Before Building

1. Choose Your Insurance Category

A Lemonade-like solution can serve many verticals:

- Renters / Home

- Auto

- Pet

- Life

- Travel

- Gadget / device coverage

- SME or gig-worker insurance

- Micro-insurance for emerging markets

Define your niche clearly — this shapes your onboarding, underwriting, and claims flows.

2. Compliance & Licensing

Insurance is regulated, so you will need to address:

- Licensing requirements

- Local compliance standards

- Data security and privacy

- Claims documentation rules

Miracuves can help architect the product while your compliance partner or insurer-of-record handles regulatory approvals.

3. AI-Powered Onboarding

A Lemonade-style experience requires:

- Chat-style onboarding

- Dynamic question flows

- Real-time quoting

- Personalized policy recommendations

This is where your platform makes its first impression — and builds trust.

4. Automated Claims Engine

To match Lemonade’s appeal, you’ll need:

- Fast claim submission via chat or video

- Automated fraud detection

- Instant payouts for simple claims

- Smart routing to human adjusters for complex cases

This is the hardest part to build, but it’s also the biggest differentiator.

5. Clean, Modern UI/UX

Your platform should feel friendly, minimal, and easy-to-navigate, with:

- Bright visuals

- Simple language

- Clear coverage sliders

- Transparent pricing

Great UI makes insurance feel approachable rather than intimidating.

6. Payments & Billing Infrastructure

Support for:

- Monthly premiums

- Recurring billing

- In-app payments

- Instant claim payouts

This requires integration with payment gateways and banking APIs.

7. Data Models for Underwriting

You’ll need structured data to price policies fairly. This includes:

- User profile data

- Behavioral inputs

- Environmental and location data

- Historical claim trends

The better your models, the more competitive your pricing.

Development Roadmap (Simplified)

Phase 1 — Foundational Platform Setup

- Policy management system

- Customer onboarding flows

- Product catalog (renters, home, pet, etc.)

Phase 2 — AI & Automation

- Chatbot for signup and support

- Instant quote engine

- Real-time underwriting models

Phase 3 — Claims Automation

- Chat- or video-based claim submission

- Document upload

- Fraud detection

- Automated decision rules

Phase 4 — Payments & Billing

- Premium collection

- Instant payout integration

- Renewal automation

Phase 5 — Analytics & Reporting

- Claims dashboards

- Customer lifetime value metrics

- Fraud insights

- Underwriting performance

Read More :- Read the complete guide on fintech app development costs

Conclusion

Lemonade proved that even the most traditional, paperwork-heavy, slow-moving industries can be reinvented with the right mix of AI, transparency, automation, and user-friendly design. By turning insurance into something simple, approachable, and even enjoyable, Lemonade changed customer expectations forever — especially for younger generations who prefer fast, digital, self-service experiences.

Its success shows that people don’t just want insurance that works; they want insurance that feels fair, responds instantly, and fits into their daily digital lives. That’s why Lemonade became a blueprint for the modern insurtech movement.

For entrepreneurs, the opportunity is massive. Whether in renters, pet, auto, travel, or micro-insurance categories, many markets still lack a truly digital-first platform. Building a Lemonade-style solution allows you to deliver a better customer experience, operate at lower cost, and differentiate yourself in a crowded industry.

The future of insurance will be:

- AI-driven

- Mobile-first

- Instant

- Transparent

- Personalized

And platforms inspired by Lemonade will lead that evolution.

FAQs :-

What is Lemonade Insurance?

Lemonade is an app-based, AI-driven insurance company offering renters, homeowners, car, pet, and life insurance with instant quotes and fast digital claims.

How does Lemonade work?

Users chat with an AI bot to get a quote, customize coverage, purchase a policy, and file claims—all inside the app. Many simple claims are approved in seconds using automated decision models.

What makes Lemonade different from traditional insurance?

Lemonade uses:

AI for underwriting and claims

A transparent flat-fee business model

The Giveback program, donating unclaimed premiums to charities

Fast, mobile-first workflows

This removes friction and builds customer trust.

Is Lemonade a real insurance company?

Yes. Lemonade is a fully licensed insurer operating across the U.S. and Europe.

How fast are claims paid?

Many simple claims (like theft or minor damage) can be approved and paid within seconds. More complex claims are reviewed by human adjusters.

What insurance products does Lemonade offer?

Lemonade provides:

Renters insurance

Homeowners insurance

Car insurance

Pet insurance

Term life insurance

Is Lemonade cheaper than traditional insurance?

Often, yes—Lemonade’s AI-driven underwriting and low overhead allow competitive pricing. However, affordability varies by location, risk profile, and coverage selection.

How does Lemonade make money?

Lemonade takes a fixed fee (around 25%) from premiums. The rest goes toward claims and reinsurance, with leftover funds donated to charity.

How does Lemonade detect fraud?

Lemonade uses machine learning, video claim analysis, and behavioral economics to identify suspicious claims. Honest customers benefit from faster payouts.

Can I build an app like Lemonade?

Absolutely. You can create an AI-powered insurance platform with instant quotes, fast claims, digital policies, and automated workflows.

Miracuves builds fully customizable Lemonade-style insurtech platforms in 30-90 days, complete with:

AI onboarding

Policy management

Automated claims

Payments integration

Admin dashboards

Clean, modern UI

Source code ownership

Related Articles :-