Imagine you’re building a startup — maybe a rideshare app, a gig-economy platform, or a digital bank. You need to issue payment cards, manage user spending, and handle payouts — but building banking infrastructure from scratch is slow, costly, and complex.

That’s exactly the problem that Marqeta solves.

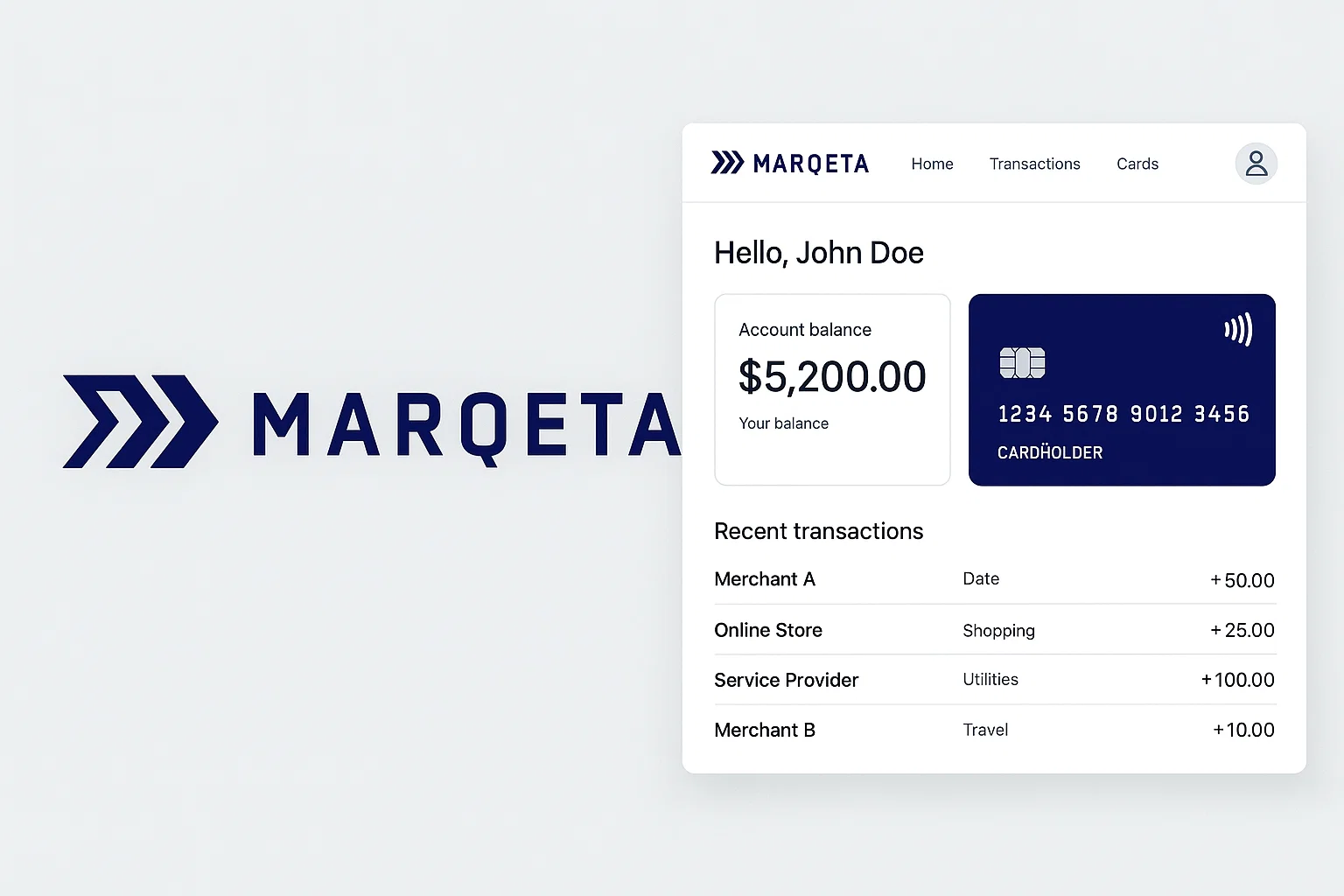

Marqeta is a modern card-issuing and payments infrastructure platform: it lets companies create virtual or physical debit, prepaid, or credit cards on demand, control spend rules dynamically, process payments, and manage funds — all via open APIs.

Today, many of the fintech, on-demand service, and banking apps you use (directly or indirectly) rely on Marqeta behind the scenes. Whether it’s paying a driver, giving a consumer a card, or enabling instant payouts — Marqeta gives businesses the tools to build customized payment experiences without dealing with legacy banking hassles.

In this guide, you’ll learn:

- What Marqeta actually is

- How Marqeta works — from card issuing to payment processing

- The core features and technical foundation

- Marqeta’s business model and why it’s scalable

- Why many entrepreneurs consider building their own Marqeta-style platforms

What Is Marqeta? – The Simple Explanation

Marqeta is a modern card-issuing and payment processing platform that lets businesses create and manage physical cards, virtual cards, and digital wallets using easy-to-integrate APIs. Instead of building banking infrastructure from scratch, companies use Marqeta to power payouts, spending controls, instant funding, and transaction processing.

In simple terms:

Marqeta is the engine that helps apps issue cards and move money instantly.

Core Problem Marqeta Solves

Traditional card issuing takes months of paperwork, bank integrations, compliance checks, and hardware logistics. Marqeta fixes this by offering:

- API-based card creation

- Real-time spend authorization

- Instant user onboarding

- Flexible rules to control spending

- Fast payouts for gig workers and businesses

It democratizes fintech infrastructure, allowing any modern business to embed payments inside their product.

Who Uses Marqeta?

| Company Type | How They Use It |

|---|---|

| Fintech apps | Digital debit cards, spend controls |

| Gig & On-demand platforms | Instant driver/dasher payouts |

| Banks & Neobanks | Full card programs for customers |

| E-commerce & marketplaces | Vendor and affiliate payouts |

| Expense management tools | Virtual cards and spend rules |

| Corporate platforms | Budgeting, employee cards |

Why Marqeta Became Successful

- First company to introduce open API card issuing

- Real-time authorization engine

- Strong support for virtual cards and tokenization

- Partnerships with Visa, Mastercard, and major banks

- Widely adopted by gig economy apps and fintech innovators

Market Position in 2025

- Used by leading apps globally

- Recognized pioneer in modern card issuing

- Strong relationships with global processors and card networks

- Competes with Stripe Issuing, Galileo, and Adyen

- Powers billions in annual card volume

Marqeta is essentially the backend payment layer enabling the new wave of fintech and embedded finance products.

How Marqeta Works – Step-by-Step Breakdown

Marqeta powers card issuing and payment processing through a real-time, API-first platform. Whether a business wants to issue cards, send payouts, or control spending, Marqeta handles the entire workflow behind the scenes.

For Businesses (Fintechs, Marketplaces, Platforms)

1. Create an Account & Set Up a Card Program

Companies integrate Marqeta using its APIs. They choose:

- Card type (debit, prepaid, credit, virtual, tokenized)

- Funding model (just-in-time funding, prefunded accounts, pooled balance)

- Spend controls and rules

This setup allows businesses to design custom card behavior for their users.

2. Issue Cards Instantly (Physical + Virtual)

Businesses can create cards in seconds through API:

- Virtual cards for online payments

- Tokenized cards for Apple/Google Pay

- Physical plastic cards mailed to users

- Single-use or multi-use cards

- Vendor-specific cards with restricted spending

This is why gig apps, banks, and SaaS platforms love Marqeta.

3. Real-Time Authorization

Every card swipe or online payment is checked by Marqeta’s Dynamic Authorization Engine, which instantly verifies:

- User identity

- Available balance

- Spending limits

- Merchant category

- Allowed regions

- Risk patterns

The business can approve/decline transactions instantly using its own rules.

4. Payouts & Funding Flows

Marqeta also powers fast payouts:

- Instant worker payouts (e.g., delivery drivers)

- Vendor payments

- Customer refunds

- Wallet-to-card transfers

This helps platforms move money seamlessly.

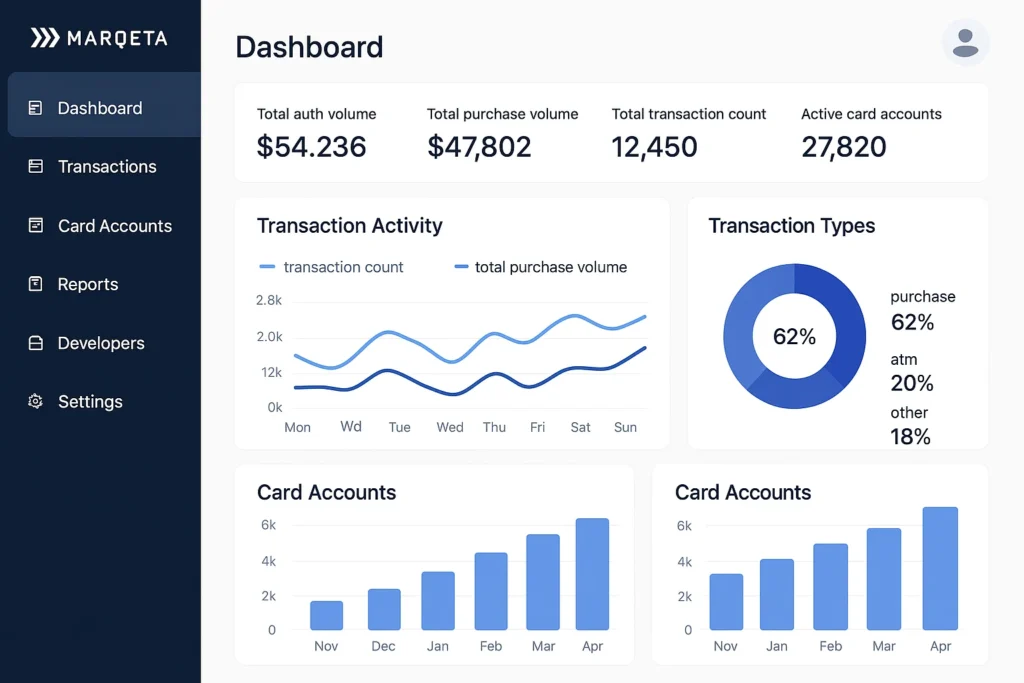

5. Financial Tracking & Reporting

Companies get dashboards and data APIs showing:

- Spend analytics

- User activity

- Fraud alerts

- Settlement reports

- Billing & reconciliation

For End Users (Drivers, Employees, Shoppers, Cardholders)

1. Receive a Card Instantly

Users may get a physical card or instantly receive a virtual card via the app.

2. Make Payments Anywhere

They can:

- Pay at stores

- Make online purchases

- Use the card in digital wallets

- Withdraw cash (if allowed)

Marqeta handles the processing seamlessly.

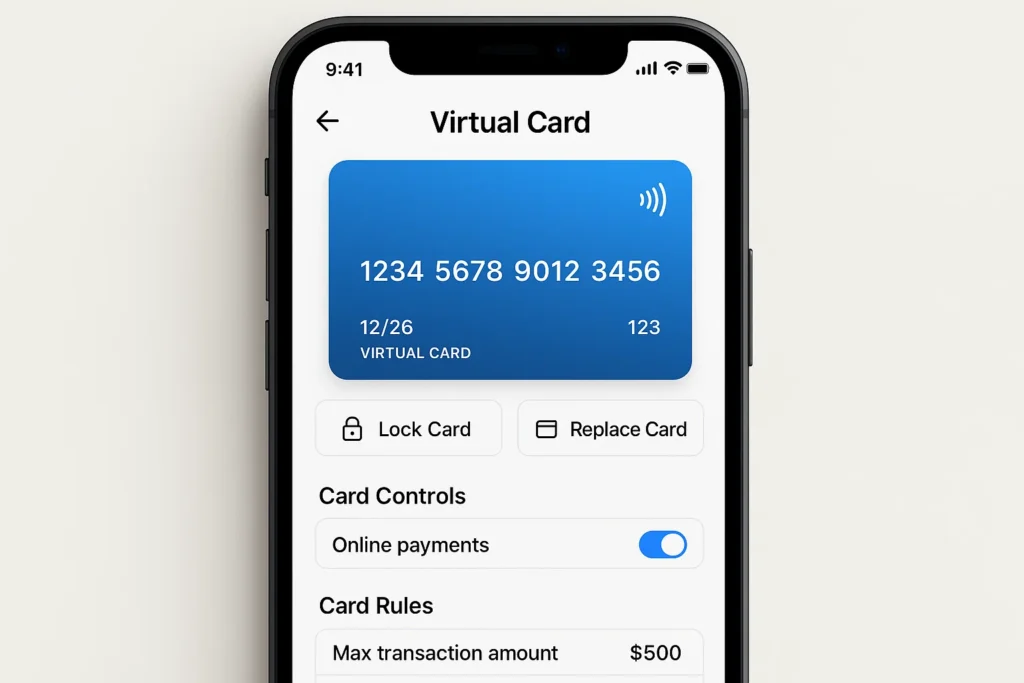

3. Controlled Spending

Depending on the platform’s rules, users may have:

- Daily/weekly limits

- Locked categories (e.g., fuel-only cards)

- Per-transaction caps

- Location-based restrictions

Technical Overview (Simple Explanation)

Marqeta’s system works like this:

- Client App → triggers a card action

- Marqeta API → creates card / authorizes transaction

- Card Networks (Visa/Mastercard) → route payment

- Bank Partner → holds funds & settles

- Marqeta Engine → updates balance in real time

- Client Dashboard → shows analytics & transactions

Marqeta’s power comes from one core idea:

Make card issuing programmable.

This changed how fintechs, gig platforms, and digital banks build payment experiences.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Marqeta’s Business Model Explained

Marqeta earns revenue through a combination of interchange fees, platform usage fees, and value-added payment services. Its model is powerful because it scales automatically with transaction volume — the more its clients grow, the more Marqeta earns.

1. Interchange Revenue (Primary Stream)

Every time a Marqeta-issued card is used, the merchant pays a small fee to the card network (Visa/Mastercard).

A portion of that fee — interchange — goes to Marqeta.

Because Marqeta powers high-volume businesses (fintech apps, gig platforms, digital banks), interchange adds up massively.

2. Processing & Program Fees

Marqeta charges businesses for:

- Card issuing

- Transaction processing

- Program management

- Compliance & KYC support

- BIN sponsorship through partner banks

These fees create predictable monthly revenue.

3. Card Manufacturing & Fulfillment

For physical cards, businesses pay for:

- Card printing

- Custom branding

- Packaging

- Shipping

Marqeta earns fees for facilitating and managing this.

4. Just-in-Time Funding Fees

One of Marqeta’s signature features is JIT Funding, where funds are authorized and pulled only when a transaction occurs.

Clients pay for:

- Real-time balance checks

- Funding API calls

- Ledger updates

This is extremely popular with gig, fleet, and expense apps.

5. Value-Added Services

Marqeta also earns from:

- Fraud protection tools

- Dispute management

- Tokenization (Apple Pay, Google Pay)

- International payment support

- Custom network routing

- FX fees on global transactions

6. Large Enterprise Partnerships

Fintech giants, banks, and enterprise platforms bring massive long-term revenue through:

- Volume-based agreements

- White-label issuing

- Co-branded card programs

Why Marqeta’s Business Model Works

✔ High scalability — revenue grows as clients grow

✔ Sticky integrations — once a company builds on Marqeta, switching is difficult

✔ API-first approach — attracts modern businesses, SaaS tools, and fintechs

✔ Multiple revenue streams — diversified and recurring

By powering the backend for many major payment apps, Marqeta has built a foundation layer of the global fintech ecosystem.

Key Features That Make Marqeta Successful

Programmable Card Issuing (Physical + Virtual)

Marqeta’s core strength is that card issuing is fully programmable. Instead of forms and long bank timelines, businesses can:

- Create virtual cards on demand

- Order branded physical cards

- Issue single-use or multi-use cards

- Generate cards per user, per vendor, or per transaction

All of this happens via API calls, so product teams can bake card issuing directly into their app flows.

Dynamic Spend Controls in Real Time

Every transaction can be checked against business-defined rules before approval. You can control:

- Where the card can be used (merchant category, country)

- When it can be used (time-based rules)

- How much can be spent (limits, per-transaction caps)

- What it can be used for (e.g., “fuel-only”, “online-only”)

This is powerful for fleet cards, gig payouts, expense tools, and virtual card platforms.

Just-in-Time (JIT) Funding

With JIT funding, the card doesn’t hold a big static balance. Instead, when a user swipes the card, Marqeta:

- Checks the request

- Calls your app’s logic or ledger

- Funds just enough for that transaction

- Approves or declines in real time

That means better risk control, lower idle balance, and tighter cash management, especially for gig and B2B platforms.

Tokenization & Digital Wallet Support

Marqeta supports tokenization, letting cards work in:

- Apple Pay

- Google Pay

- Other digital wallets

This is crucial for mobile-first apps, subscription platforms, and contactless payments.

Global Network Connections

Marqeta integrates with major card networks and issuing banks, so clients get:

- Worldwide card acceptance (where networks are supported)

- Multi-region issuing capabilities (where available)

- Support for local regulations and compliance via partner banks

This helps fintechs go from local to global without rebuilding infrastructure.

Powerful Developer Experience (DX)

Marqeta is loved by engineering teams because it offers:

- Clean RESTful APIs

- Sandbox environments

- Detailed documentation

- Webhooks for transaction events

- Test card numbers and mock scenarios

This developer-first approach is one of the main reasons startups and large platforms choose Marqeta over legacy providers.

Advanced Data & Authorization Engine

Behind every swipe, Marqeta’s engine can:

- Enrich data with merchant info, category, region

- Apply risk checks and rules instantly

- Send real-time webhooks to client systems

- Support advanced logic like split payments or routing

This allows clients to build custom payment experiences (e.g., split fares, marketplace payouts, controlled employee cards).

Fraud, Risk & Compliance Tools

Marqeta also supports:

- Transaction monitoring

- Velocity checks

- Geo and MCC restrictions

- Dispute and chargeback workflows

These features make it easier for clients to maintain regulatory and risk standards without building everything from scratch.

What Truly Sets Marqeta Apart

Marqeta’s biggest differentiation is that it turned card issuing into a programmable API layer. Instead of thinking “card + bank,” businesses think “card as code” — and that mindset is exactly what modern fintech, gig platforms, and embedded finance products need.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Marqeta

Marqeta is built on a modern, highly scalable, API-first payments architecture that allows companies to issue cards, authorize transactions, and move money instantly. Its technology is designed to handle millions of transactions per second while maintaining compliance, reliability, and real-time flexibility.

API-Driven Architecture

Marqeta’s entire platform is accessible through REST APIs.

This allows businesses to integrate:

- Card issuing

- Wallet management

- Spend controls

- Authorization logic

- Payout flows

directly into their apps without writing banking code.

Because the system is modular, companies can launch a new financial product within days instead of months.

Real-Time Authorization Engine

One of Marqeta’s strongest innovations is its Dynamic Authorization engine.

When a card is used, Marqeta instantly:

- Checks the transaction

- Applies spending rules

- Queries the client’s app or ledger

- Funds the card (if using JIT)

- Approves or declines in milliseconds

This enables programmable, rule-based spending for gig platforms, expense tools, and neobanks.

Microservices & Cloud Infrastructure

Marqeta uses a distributed microservices architecture, typically involving:

- Kubernetes for orchestration

- Go / Java / Node.js for backend services

- High-availability clusters to process payments

- Sharded databases for scalability

This structure ensures uptime, performance, and horizontal scaling even during peak transaction periods.

Data & Analytics Layer

Marqeta processes billions of data points related to:

- Merchant categories

- Spending behaviors

- Fraud patterns

- Card usage

- Geographic trends

Machine learning models help detect unusual activity and optimize fraud controls.

Secure Tokenization & Wallet Support

Marqeta integrates with:

- Apple Pay

- Google Pay

- Samsung Pay

Tokenization replaces card numbers with secure tokens, ensuring safe digital and mobile transactions.

Compliance, KYC & Risk

Because Marqeta works closely with sponsor banks, it complies with:

- PCI-DSS (card security)

- KYC/AML rules

- Bank and network regulations

- Global payment standards

It manages identity checks, transaction monitoring, and fraud detection as part of its infrastructure.

Developer Tools & Sandbox

Marqeta’s sandbox environment lets developers:

- Create test cards

- Simulate transactions

- Trigger declines and approvals

- Test JIT funding logic

- Integrate webhooks

This makes Marqeta one of the most developer-friendly payments platforms in the world.

Why This Tech Matters

- Real-time flexibility: Businesses can program spending behavior instantly.

- Scalable foundation: Supports small startups and billion-dollar fintechs alike.

- Strong compliance base: Saves clients months of regulatory work.

- Faster innovation: Companies can launch financial products without deep banking expertise.

Marqeta turned card issuing into software, unlocking the entire embedded finance movement.

Marqeta’s Impact & Market Opportunity

Marqeta transformed the fintech landscape by making card issuing programmable and enabling businesses to embed payments directly into their products. This “cards-as-code” approach unlocked entirely new business models and accelerated the rise of modern digital banking, gig-economy payouts, and corporate spend management tools.

How Marqeta Changed the Industry

- Democratized card issuing: Before Marqeta, only banks and large enterprises could create custom card programs. Now any fintech or marketplace can.

- Powered the gig economy: Delivery apps, rideshare platforms, and freelance marketplaces rely on Marqeta for instant driver payouts and controlled spending.

- Enabled neobanks & challenger banks: Many digital banks use Marqeta to issue cards, manage accounts, and run their core banking logic.

- Shifted payments toward real-time control: Companies can approve, decline, or adjust transactions dynamically — a huge upgrade over legacy banking tech.

- Lowered barriers for innovation: Startups can launch payment products without building huge payments infrastructure.

Who Benefits the Most

| Segment | How Marqeta Helps |

|---|---|

| Fintech startups | Launch virtual cards fast & scale globally |

| Gig platforms | Instant payouts + spend control for workers |

| Marketplaces | Vendor payments, split payments, disbursements |

| Banks & neobanks | Fully managed issuing infrastructure |

| Expense management apps | Real-time controls + virtual cards |

| B2B SaaS platforms | Embedded finance capabilities |

Market Opportunity in 2025 & Beyond

The embedded finance and card-issuing market is growing extremely fast. Businesses in nearly every industry want to integrate:

- Cards

- Wallets

- Payouts

- Credit or rewards

- Spend limits

- On-demand disbursements

This opens huge opportunities for entrepreneurs to build:

- “Marqeta for X industry”

- Regional card-issuing platforms

- Embedded finance solutions for marketplaces

- Expense tools for SMBs in emerging markets

- Wallet + card systems for B2B platforms

- Gig-economy payout systems

Future Growth Trends

- AI-led risk and fraud prevention

- More marketplaces embedding fintech

- Rise of corporate virtual cards

- Expansion of real-time payouts globally

- Low-code fintech infrastructure

- Tokenized card ecosystems

Why Entrepreneurs Want Marqeta-Like Platforms

Because Marqeta unlocked:

✔ A massive fintech goldmine

✔ Repeatable revenue streams

✔ Sticky, long-term enterprise customers

✔ Endless use cases across industries

✔ Growing global demand for payment infrastructure

Marqeta showed that the future belongs to companies that turn finance into software — and the opportunity is still wide open.

Building Your Own Marqeta-Like Platform

Marqeta’s success proves that embedded finance and API-based card issuing are booming opportunities. Businesses in every industry now want to issue cards, provide payouts, or control spending from inside their own app. That’s why entrepreneurs are exploring Marqeta-style solutions tailored for specific regions, industries, or business models.

To build a platform like Marqeta, you need a combination of card issuing, wallet infrastructure, compliance layers, and real-time transaction logic — all wrapped inside a scalable API-first architecture.

Why Businesses Want Their Own Marqeta-Style Platform

- Rising demand for instant payouts

- Fintech growth in emerging markets

- Corporate virtual card adoption is exploding

- Marketplaces want their own wallets/cards

- Platforms want control over spending & disbursements

- Neobanks need ready-made issuing tech

- Global trend toward finance-as-a-service (FaaS)

Key Considerations Before Development

✔ Regulation: Banking partners, KYC/AML workflows, PCI compliance

✔ Target segment: Gig, fintech, SMB, travel, logistics, B2B SaaS, etc.

✔ Card types: Debit, prepaid, virtual, tokenized

✔ Funding model: JIT, prefunded wallet, pooled balance

✔ APIs needed: Issuing, authorization, wallet, onboarding, ledgers

✔ Security: Tokenization, fraud rules, risk engine

✔ Integration ecosystem: Accounting, payouts, digital wallets

Knowing these early helps you shape the architecture and go-to-market plan.

Cost Factors & Pricing Breakdown

Marqeta-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Card Issuing MVP | Core web console, program & card management, basic virtual card issuing (via a processor), simple spend controls (per card, per merchant category), card activation/deactivation, basic transaction feed, standard admin panel, simple reporting | $100,000 |

| Mid-Level Card Issuing & Program Management Platform | Physical & virtual cards, richer spend controls & limits, multi-program support, basic KYC flows (via your providers), webhooks for key events, transaction enrichment, simple dispute workflows, developer-friendly APIs & keys management, analytics dashboard, mobile-ready portals for admins/partners | $180,000 |

| Advanced Marqeta-Level Card Issuing Ecosystem | Highly scalable issuer-processor stack, multi-region & multi-currency support, granular authorization & risk controls, JIT funding-style flows, deep integration with banks/processors, rich webhooks & eventing, comprehensive developer portal, sandbox environments, detailed analytics, cloud-native microservices architecture | $280,000+ |

Marqeta-Style Card Issuing Platform Development

The prices above reflect the global market cost of developing a Marqeta-like modern card issuing and processing platform — typically ranging from $100,000 to over $280,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes secure API design, issuer/processor integrations, authorization & risk rules, program management tools, webhooks and event systems, dashboards, and the infrastructure required for financial-grade uptime and compliance.

Miracuves Pricing for a Marqeta-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Marqeta-style card issuing platform that covers secure APIs for card creation and lifecycle management, program and card controls, basic spend rules, transaction feed with webhooks, admin and partner consoles, and modern web + mobile interfaces. From this foundation, the platform can be scaled into multi-region/multi-currency programs, deeper bank/processor integrations, richer risk and authorization logic, and more advanced analytics as your card business grows.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational card issuing ecosystem ready for launch and future expansion.

Delivery Timeline for a Marqeta-Like Platform with Miracuves

For a Marqeta-style, JS-based custom build, the typical delivery timeline with Miracuves is approximately 30–90 days, depending on:

- Depth of card features, spend rules, and authorization logic

- Number and complexity of issuer, bank, and payment network integrations

- Complexity of developer portal, sandbox environments, and API analytics

- Scope of admin/partner portals, branding, and long-term scalability & compliance requirements

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include in a Marqeta-Like Platform

Your platform should offer:

- Virtual & physical card issuing

- Wallet & balance management

- Real-time transaction authorization

- Custom spend controls

- Tokenization (Apple/Google Pay)

- Payouts to cards/banks

- Dynamic funding & just-in-time loading

- KYC/ID verification workflows

- Fraud monitoring & risk management

- Developer dashboard & API keys

- Reporting, analytics, and settlement data

Development Roadmap (Simplified)

Phase 1: Core Issuing Layer

- Card creation

- Wallet system

- Basic transaction processing

Phase 2: Dynamic Controls + APIs

- MCC and geo-restrictions

- Authorization logic

- Webhooks & ledger updates

Phase 3: Value-Added Features

- Tokenization

- International support

- Corporate cards

- AI-based risk engine

Phase 4: Dashboard & Developer Tools

- Admin portal

- API documentation

- Sandbox environment

Read More :- Read the complete guide on fintech app development costs

Conclusion

Marqeta changed the entire fintech industry by proving that payments can be programmable, flexible, and developer-friendly. Instead of relying on slow, legacy banking systems, businesses can now issue cards, control spending, and manage payouts with simple API calls — and that shift has powered countless fintech innovations in the last decade.

What makes Marqeta remarkable isn’t just its technology, but its vision:

turning card issuing into software.

That mindset opened doors for gig platforms, neobanks, corporate spend tools, and global marketplaces to build financial features directly into their products.

As embedded finance becomes the new standard, the opportunity to build Marqeta-style platforms — specialized for industries, regions, or niche use cases — is massive and still growing.

Whether you’re targeting logistics, SMBs, travel platforms, or emerging markets, programmable payments can be the foundation of the next billion-dollar fintech.

FAQs :-

How does Marqeta work?

Marqeta provides API-based tools that let businesses instantly issue physical and virtual cards, set spending rules, enable real-time transaction approval, and manage payouts. It handles the backend processing while companies customize how cards behave.

Is Marqeta a bank?

No. Marqeta is not a bank. It partners with licensed issuing banks to provide card programs, while Marqeta supplies the technology platform, APIs, authorization logic, and processing engine.

Who uses Marqeta?

Fintech apps, gig platforms, neobanks, marketplaces, corporate spend management tools, and B2B SaaS platforms that need card issuing, digital wallets, or instant payouts rely on Marqeta.

How does Marqeta make money?

Marqeta earns from:

Interchange fees

Card issuing & processing fees

Program management

Just-in-time funding services

Tokenization, fraud tools & value-added services

Physical card production

Can Marqeta issue virtual cards?

Yes. Virtual cards are one of Marqeta’s core features—created instantly through APIs, with custom spend rules, merchant restrictions, and digital wallet support.

What is JIT (Just-in-Time) Funding?

JIT funding allows businesses to fund a transaction only at the moment of purchase, minimizing risk and giving them real-time control over spending. It’s widely used by gig platforms and expense apps.

What makes Marqeta different from traditional card issuers?

Traditional issuers rely on slow, rigid banking systems. Marqeta offers:

Real-time authorization

API-based card issuing

Dynamic spend controls

Instant virtual cards

Developer-friendly tooling

This makes it ideal for modern fintech products.

Does Marqeta support Apple Pay & Google Pay?

Yes. Marqeta supports full tokenization, enabling cards to be added to Apple Pay, Google Pay, and other digital wallets.

Can I build a platform like Marqeta?

Yes. With modern fintech infrastructure and partner banks, you can build a Marqeta-style system offering:

Card issuing

Wallets

Spend controls

Payouts

Tokenization

This is a major opportunity in 2025’s embedded finance boom.

How can Miracuves help build a Marqeta-like solution?

Miracuves can deliver a Marqeta-style fintech platform featuring:

Virtual + physical card module

Wallet + ledger system

Authorization engine

Spend rules & dynamic limits

Developer APIs & sandbox

KYC/AML layers

Admin dashboard

Delivered in 30-90 days, fully customizable.