Imagine you want to invest, pay bills, track spending, or send money — but you have multiple bank accounts, cards, and financial apps. Logging into each separately, manually entering data or credentials for every new app, that’s tedious and risky. What if there was a tool that could link your bank account securely to any fintech app with just a few clicks — no repeated logins, no data scattered across apps?

That’s exactly what Plaid does.

Brief Origin Story & Current Impact

Founded in 2013 by entrepreneurs in the U.S., Plaid started with a vision: make it easy for people to connect their bank accounts to apps and services without compromising security or convenience.

Today, it’s one of the most important infrastructure platforms in fintech: apps like payment wallets, budgeting tools, investment platforms, and lending services use Plaid to access users’ bank account data — balances, transactions, account info — with user permission.

With connections to thousands of banks and financial institutions across the U.S. (and other countries too), Plaid has become a key building block for modern digital finance.

What You’ll Understand by the End

By the end of this guide, you’ll clearly understand:

- What Plaid is and why it matters

- How Plaid works — from bank linking to data sharing and secure payments

- The core features and technology underlying Plaid

- How fintech apps benefit, and why Plaid’s model works for both users and businesses

- The business model and opportunities for building Plaid-powered apps

What Is Plaid? – The Simple Explanation

Plaid is a financial technology infrastructure platform that connects users’ bank accounts to apps securely. When you use apps like budgeting tools, investment platforms, digital wallets, or lending services, Plaid acts as the bridge that lets those apps access your financial data — only with your permission — without needing to store bank passwords directly.

Simple Definition

Plaid enables apps to securely access bank account information such as balance, transactions, identity, income, and account verification — using safe API connections instead of risky login methods.

Core Problem It Solves

Before Plaid, apps had no simple way to connect with banks. Users often had to upload screenshots, enter bank statements manually, or share passwords (unsafe!). Plaid solves this through secure banking integrations, helping apps access only the approved financial data they need — with speed and accuracy.

Who Uses Plaid? (Target Users & Use Cases)

| User Type | Use Case |

|---|---|

| Budgeting Apps (e.g. Mint) | Track expenses across all bank accounts |

| Investment Apps (e.g. Robinhood) | Verify bank funding instantly |

| Payment Apps (e.g. Venmo) | Enable fast bank transfers |

| Loan Providers | Check income & ability to repay |

| Personal Finance Tools | Show transaction history & balance |

| Fintech Startups | Launch finance apps without bank partnerships |

Market Position & Impact (2025)

- Connects with 12,000+ banks and financial institutions (U.S. + expanding globally)

- Powers thousands of fintech apps

- Used by millions of users every month

- Trusted for identity verification, payments, credit decisions & financial insights

Why Plaid Became Successful

- Eliminated manual financial data entry

- Enabled instant bank verification

- Reduced fraud and security risks

- Helped fintech apps launch 5x faster

- Provided a reliable API layer for modern finance

Plaid is now considered the backbone of fintech infrastructure in the USA — powering apps quietly behind the scenes.

How Plaid Works — Step-by-Step Breakdown

Plaid operates more like financial plumbing — users don’t see it directly, but it powers many popular apps behind the scenes. Here’s how the process works for users and businesses.

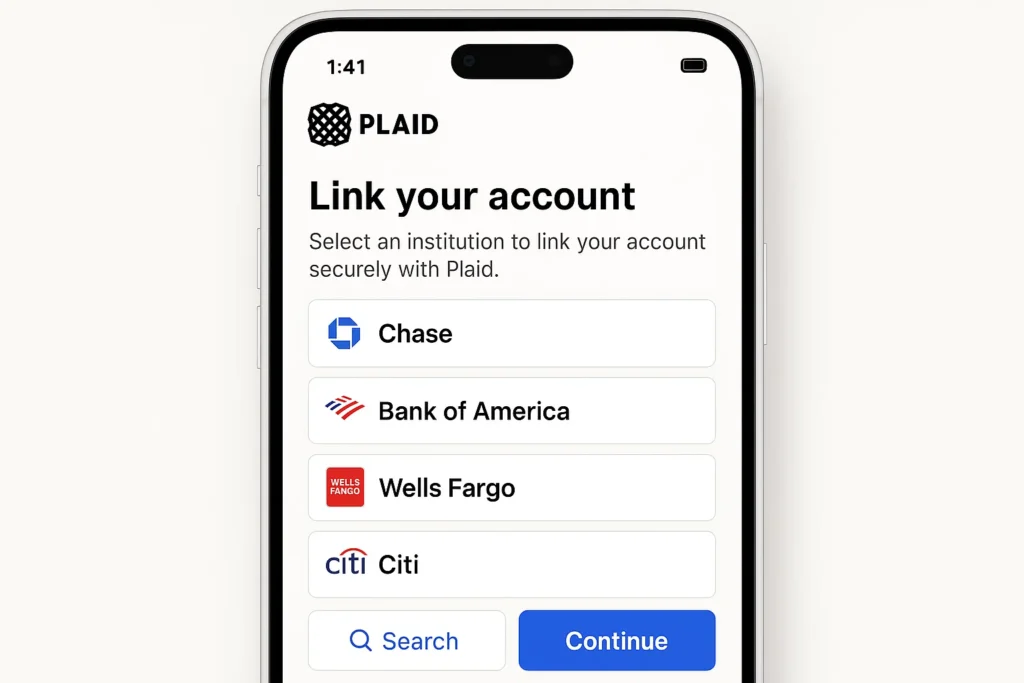

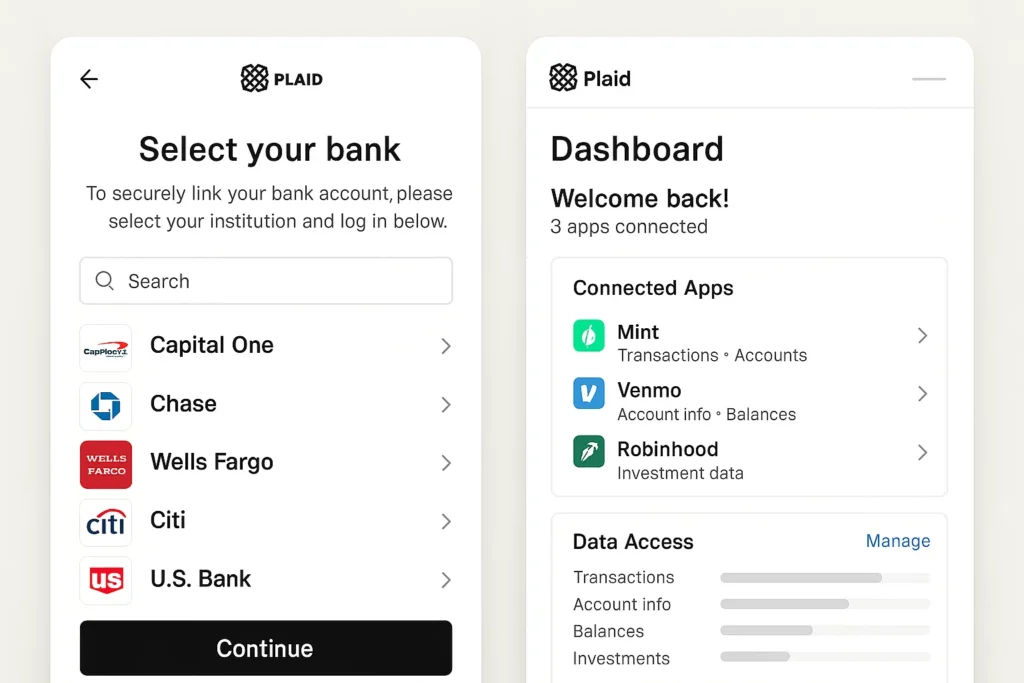

For Users (Step-by-Step Flow)

- Choose a financial app → e.g., Robinhood, Mint, Stripe, Venmo, Coinbase, etc.

- Click “Link Bank Account” → a secure Plaid window pops up.

- Select your bank → Plaid supports 12,000+ financial institutions.

- Authenticate securely → login happens within Plaid (not shared directly with the app).

- Grant permission → decide which data the app can access.

- Connection completed → transactions, balance & financial data are securely shared with the app.

User stays in control — Plaid only shares data with permission and apps never see or store passwords.

For Businesses / Apps

1. Easy Integration

Apps integrate Plaid using a simple API. Instead of building bank-to-bank connections, they use Plaid’s existing infrastructure.

2. Data Access

Apps can access:

- Account balances

- Transactions

- Identity details

- Income estimates

- Account verification

- Payment initiation

3. Instant Bank Account Verification

Apps can confirm real-time bank ownership (used for loans, KYC, payroll, payments, etc.).

4. Payments & Transfers (2024–2025 update)

Plaid now supports Pay by Bank — allowing apps to collect direct payments without credit card fees.

Technical Overview — Simple Explanation

Plaid connects apps to banks using APIs, encryption, and secure authorization flows.

| Component | Purpose |

|---|---|

| Secure Login Window | Users log into their bank safely |

| Plaid API | Sends encrypted financial data to apps |

| Data Filtering | Only approved data is shared |

| Webhooks | Apps receive updates in real time |

| OAuth + Encryption | Protects user identity & credentials |

Think of Plaid as:

“Login with Bank + Secure Data Access + Financial API Engine.”

Example Flowchart (Simplified)

User → Chooses App → Plaid Bank Linking Window → Secure Login → Permission Granted → Financial Data Transferred Safely → App Uses It

Plaid enables fintech apps to function faster, safer, and with greater accuracy — without handling sensitive data directly.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Plaid’s Business Model Explained

Plaid runs as a B2B fintech infrastructure company. It doesn’t make money from users — instead, it earns revenue by offering API access and financial data services to fintech apps, banks, lenders, wealth management platforms, insurance companies, payroll systems, and more.

How Plaid Makes Money (Revenue Streams)

| Revenue Stream | Explanation | Example Use Case |

|---|---|---|

| API Usage Fees | Apps pay per API call or per user connection | Mint charging Plaid for account linking |

| Monthly Subscription Plans | Tiered plans for startups → enterprises | Higher API limits & features |

| Data Products | Detailed financial insights for credit/lending decisions | Loan eligibility checks |

| Payment Processing Fees | Bank-to-bank payments via Plaid Payments | Alternative to card networks |

| Identity & Fraud Tools | Verification APIs | KYC & risk analysis |

| Banking Partnerships | Branded integrations & co-development | Open banking tools |

Pricing Model (2025 Overview)

Plaid generally uses a pay-as-you-go + tiered pricing approach:

| Tier | Target Business | Key Access |

|---|---|---|

| Starter | New fintech apps | Basic account linking |

| Launch | Growth-stage apps | API + analytics |

| Scale | Mid-size companies | Risk & lending tools |

| Enterprise | Banks & major fintechs | Full integration + support |

Pricing is customized — Plaid does not disclose public rates, but costs scale based on API volume, user count, features, and data access level.

Key Advantage of This Model

Instead of building 12,000+ bank connections manually, apps pay Plaid to use prebuilt, secure integrations. This reduces:

- Licensing costs

- Security risks

- Compliance complications

- Time-to-market (launch faster by months!)

This turns Plaid into a “financial infrastructure subscription service” — powering thousands of apps silently in the background.

Market Stats (2025)

- Serves 12,000+ financial institutions

- Used by 8,000+ fintech apps globally

- Connected to millions of users every month

- Operates in U.S., Canada, U.K. & Europe (expanding rapidly)

- Competes with Stripe Connect, Yodlee, Finicity (but still leads API coverage)

Why Plaid Is So Powerful

Plaid owns the core layer of fintech:

bank connectivity + identity + verification + payments.

That makes it essential for almost every financial app built today — and gives it massive long-term market potential.

Key Features That Make Plaid Successful

Easy, Secure Bank Account Linking

Plaid’s most visible feature is its bank connection flow. When users tap “Link Bank Account” inside an app, Plaid opens a secure window, lists supported banks, and handles the login. The app never sees the user’s credentials. This makes onboarding fast, familiar, and safe for users and apps.

Unified Access to Thousands of Banks

Instead of building separate connections to every bank, apps integrate with one Plaid API and instantly gain access to thousands of financial institutions across the U.S. and other regions. This dramatically reduces development time and makes it much easier for startups to launch multi-bank experiences.

Rich Financial Data (Accounts, Balances, Transactions)

Plaid doesn’t just say “yes, this account exists.” It can provide:

- Account details (type, number mask, institution)

- Real-time or recent balances

- Categorized transaction history

- Recurring payments and subscriptions signals

This helps apps power budgeting dashboards, savings suggestions, lending underwriting, and risk checks with real user data (shared with consent).

Identity & Account Verification

Plaid offers identity and account verification features that let apps:

- Confirm account ownership

- Match user identity with bank records

- Reduce fraud when linking accounts for payouts or debits

For lending, brokerage, and payouts platforms, this is critical to keep fraud and chargebacks under control.

Income & Cash Flow Insights

Beyond simple balances, Plaid can analyze transaction patterns to estimate:

- Income streams and salary deposits

- Cash flow stability

- Bill obligations and repayment capacity

Fintech lenders and BNPL providers use this to make smarter, data-backed credit decisions instead of relying only on traditional credit scores.

Payments & “Pay by Bank”

Plaid has expanded into direct bank-to-bank payments, helping apps let users:

- Pay merchants directly from their bank

- Fund wallets or investment accounts

- Move money without card rails

This can reduce card fees and offer smoother bank transfers inside apps.

Developer-Friendly APIs & SDKs

Plaid is famous among developers because it provides:

- Clean, well-documented APIs

- SDKs and client libraries for major languages

- Sandbox environments for testing

- Example apps and quickstart templates

This developer-first approach is a huge reason Plaid became the default choice for fintech integrations.

Security, Compliance & User Control

Plaid invests heavily in security and compliance, including encryption, regulated data handling, and clear permissioning flows. Users can control:

- Which accounts they link

- Which data categories are shared

- When they want to disconnect access

This combination of security + transparency builds trust, which is essential when dealing with sensitive financial data.

What Truly Sets Plaid Apart

- Deep coverage of banks and credit unions

- Strong brand trust across fintech and banking

- Easy integration that saves months of engineering work

- Ability to power multiple use cases (payments, lending, budgeting, identity, payroll, etc.) from a single platform

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Plaid

Plaid’s strength lies in its role as financial middleware — sitting between banks and apps while ensuring security, speed, and compliance. Its technology stack is built to handle millions of data requests every day with high reliability.

Tech Stack Overview (Simplified)

| Layer | Technologies Commonly Used |

|---|---|

| Frontend | React, React Native, iOS/Android native |

| Backend | Node.js, Python, Go, Java (microservices) |

| Databases | PostgreSQL + NoSQL + Redis (for caching) |

| Cloud Infrastructure | AWS / Google Cloud / Azure |

| Security | SOC 2, OAuth2, PCI-DSS compliance |

| APIs | REST, GraphQL, Webhooks |

| Encryption | AES-256, TLS, tokenization |

Real-Time Connectivity

Plaid uses secure API connections to exchange data with banks and institutions. It supports both:

✔ Direct bank API connections (Open Banking)

✔ Credential-based access when APIs are not available

To ensure speed and consistency, Plaid uses:

- Caching layers for quick responses

- Data normalization across banks

- Intelligent data categorization using ML models

- Webhooks to send real-time transaction updates to apps

Security & Compliance Foundation

Security is the core pillar of Plaid’s infrastructure. Key elements include:

- Plaid Link (secure login window)

- OAuth flow for compliant bank login

- Tokenization of credentials

- SOC 2 Type II compliance

- Encrypted data handling at all layers

- Bank-grade identity verification

Scalability & Performance

Plaid supports millions of requests daily, so it uses:

- Microservices architecture for modular scaling

- Load balancing & auto-scaling groups

- API rate-limiting & throttling for safety

- Distributed data architecture for high availability

This ensures fintech apps get reliable uptime, even during high traffic (salary days, tax season, funding rounds, etc.).

Mobile vs Web Access

Plaid is optimized for both environments:

| Use Case | Mobile | Web |

|---|---|---|

| End-user linking flow | Smooth, app-like UX | Secure banking login |

| Developer dashboard | Limited | Full features |

| Integration speed | High | Fast via API tools |

Plaid’s connection flow works best on mobile since most users access banks from their smartphones.

API Integrations & Ecosystem

Plaid connects with:

- Banks & credit unions

- Lending & payroll platforms

- Digital wallets & investment apps

- KYC/AML compliance systems

- Payment processors (ACH, instant payouts)

This enables end-to-end fintech app development without needing direct bank partnerships.

Why This Tech Matters for Fintech Businesses

- Reduces months of integration work

- Enables faster MVPs & product launches

- Boosts security and compliance

- Supports multiple revenue models

- Powers everything from payments to lending

- Creates a foundation for AI-based finance apps in the future

Plaid is not just an API — it’s becoming the financial infrastructure layer many fintech startups depend on.

Plaid’s Impact & Market Opportunity

How Plaid Changed Fintech

Plaid quietly transformed how modern finance apps are built. Instead of every startup begging banks for integrations or asking users to upload PDFs and statements, Plaid turned bank connectivity into something as simple as:

“Tap a button → pick your bank → connect securely → app works.”

That one flow:

- Lowered friction for users

- Made onboarding smoother

- Helped hundreds of fintech startups launch faster

- Allowed traditional banks to plug into new-age apps more easily

Today, when people say “open banking” or “embedded finance”, Plaid is one of the core infrastructure players making that possible in the USA.

Industry-Wide Impact

Plaid’s infrastructure supports:

- Personal finance & budgeting apps

- Investment and trading platforms

- Neobanks and challenger banks

- BNPL and digital lending apps

- Tax, payroll and accounting tools

- P2P & B2B payment systems

Because all of these rely on accurate, real-time financial data, Plaid has effectively become part of the plumbing of digital finance. Many users never see the Plaid brand—but they experience Plaid every time they connect a bank to an app in a few seconds instead of days.

Who Benefits the Most

- Users get less friction, fewer forms, and safer data sharing

- Startups skip years of bank integration work and focus on product

- Banks & FIs can plug into modern apps without rebuilding everything

- Lenders can make smarter decisions using real transaction data

- Merchants & platforms can accept direct bank payments without card fees

Market Opportunity

The opportunity around Plaid’s model is huge because:

- More financial activity is moving online and into apps

- Open banking regulations are expanding globally

- Businesses of all types (not only fintech) want embedded finance features—payouts, instant refunds, salary advances, in-app wallets, etc.

This creates room for:

- Plaid-powered apps (budgeting, investing, lending, payroll, rent, B2B payments)

- Regional Plaid-style platforms in markets where bank APIs are still fragmented

- Vertical-specific finance layers (for creators, SMBs, gig workers, logistics, real estate, healthcare, etc.)

Why This Excites Founders

Plaid proved that owning the infrastructure layer can be just as powerful—if not more—than being a visible consumer brand. It sits underneath thousands of apps, earning recurring revenue while enabling others to innovate on top.

For entrepreneurs, this means two big paths:

- Build on Plaid → launch apps faster using Plaid’s APIs

- Be “Plaid for X” → create similar infrastructure in new regions or niches

This massive infrastructure success is exactly why so many founders now look at Plaid and think:

“If Plaid is the secure bridge between banks and apps… what other bridges are missing in finance that I can build?”

Building Your Own Plaid-Like Platform

Plaid proved that the biggest opportunity in fintech is not just creating apps — but enabling apps to exist. Its model can be adapted successfully in many regions or verticals where bank connectivity, identity verification, or financial data access is still fragmented and inefficient.

Why Founders Want Plaid-Like Platforms

- Bank APIs are still inconsistent in most countries

- Startups want to launch fintech apps faster and cheaper

- Embedded finance is growing across e-commerce, logistics, travel, payroll & more

- Data-driven lending needs verified income & cashflow signals

- Regulation is pushing towards secure, API-based banking

- Infrastructure businesses enjoy recurring SaaS revenue and long-term partnerships

Key Considerations Before Building

To build a Plaid-style platform, founders must define:

- Core use case — data access? identity verification? payments? lending?

- Target market — geography or industry?

- Regulatory needs — PCI-DSS, KYC/AML, GDPR, SOC 2, RBI-compliance (in India), etc.

- Monetization model — per API call? subscription plans? tiered pricing?

- Data security & encryption layers

- Partnerships with banks & financial institutions

- Developer tools — API documentation, SDKs, testing environments

Development Path (Conceptual)

| Stage | Purpose | Features |

|---|---|---|

| MVP | Connect to limited banks or data providers | Bank linking + identity check |

| Growth | Expand integrations | Security layers + analytics |

| Scale | Become infrastructure | API marketplace + compliance tools |

Cost Factors & Pricing Breakdown

Plaid-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Fintech Connectivity MVP | Core web console, user & organization management, basic bank account linking via aggregator connections, token-based auth, simple transaction fetch, webhooks for basic events, API key management, standard admin panel, basic monitoring & logging | $80,000 |

| Mid-Level Financial Data Aggregation Platform | Multi-bank & multi-region connectivity, enriched transaction categorization, balance & identity endpoints, improved webhook/event system, sandbox environments, developer portal & docs, API analytics dashboard, role-based access control, full web + mobile-ready experience | $150,000 |

| Advanced Plaid-Level Open Banking Ecosystem | Large-scale, highly available API platform, wide coverage of banks/fintechs, advanced data enrichment & categorization, income & risk insights, multi-product suite (auth, transactions, liabilities, investments, etc.), granular permissions, SLAs, observability stack, cloud-native microservices | $250,000+ |

Plaid-Style Open Banking Platform Development

The prices above reflect the global market cost of developing a Plaid-like financial data aggregation and open banking platform — typically ranging from $80,000 to over $250,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually covers secure API design, connectivity and data normalization layers, webhooks, dashboards, KYC/AML and compliance considerations, observability, and performance work needed to support financial-grade integrations at scale.

Miracuves Pricing for a Plaid-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Plaid-style fintech connectivity platform that can include secure API endpoints for account linking, token-based authentication, transaction and balance retrieval, webhooks for key events, a developer-friendly dashboard, admin console, and modern web + mobile interfaces. From this base, the platform can be extended into more advanced products such as income insights, risk scoring, multi-country support, and partner-specific integrations as your ecosystem grows.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational open banking connectivity ecosystem ready for launch and future expansion.

Delivery Timeline for a Plaid-Like Platform with Miracuves

For a Plaid-style, JS-based custom build, the typical delivery timeline with Miracuves is approximately 30–90 days, depending on:

- Depth of connectivity features (number of banks/aggregators, supported products, geographic coverage)

- Number and complexity of third-party integrations (core banking APIs, KYC/AML, fraud/risk tools, analytics providers)

- Complexity of developer portal, API analytics, and observability requirements

- Scope of web and mobile interfaces, branding, and long-term scalability and compliance goals

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Must-Have Features for a Plaid Alternative

✔ API-first finance infrastructure

✔ OAuth-secure authentication

✔ Strong encryption & tokenization

✔ Permissions-based data access

✔ Developer dashboard + sandbox mode

✔ Income / cashflow analytics

✔ KYC + AML compliance tools

✔ Real-time bank account verification

✔ Webhooks + metadata updates

Read More :- Read the complete guide on fintech app development costs

Conclusion

Plaid didn’t try to become another consumer fintech app — instead, it became the engine that powers thousands of them. It proved that the future of finance isn’t just in apps we see, but in the invisible infrastructure that makes those apps possible.

By building a secure, fast, and developer-friendly layer between banks and applications, Plaid transformed the U.S. fintech industry and pioneered modern open banking. Its success shows that solving foundational problems — trust, security, connectivity — can unlock entire ecosystems of innovation.

As open banking expands worldwide, the opportunity to build Plaid-powered apps — or Plaid-like regional platforms — grows every year. For the right entrepreneur, this is one of the strongest fintech opportunities of the decade.

FAQs :-

How does Plaid make money?

Plaid earns revenue through API usage fees, subscription plans, payment processing, identity verification services, compliance tools, and data insights used by fintech apps and banks.

Who uses Plaid?

Fintech apps, investment platforms, digital wallets, budgeting apps, tax tools, lenders, payroll software, and even some traditional banks use Plaid to access financial data securely.

Is Plaid safe?

Yes. Plaid uses bank-grade encryption, tokenization, OAuth authentication, and SOC2/PCI-DSS compliance to keep user data secure. Users always choose what data they allow access to.

Does Plaid store my bank credentials?

No. Plaid does not store passwords or share them with apps. It securely authenticates the user with their bank and only shares financial data with explicit consent.

Can Plaid make payments?

Yes. Plaid supports Pay by Bank features that allow apps to send and receive direct bank transfers — often with lower fees than card networks.

Is Plaid available outside the USA?

Plaid operates primarily in the U.S., Canada, U.K. and parts of Europe — but similar platforms are now emerging in Asia, Middle East, Africa, and Latin America.

What types of apps can be built using Plaid?

Budgeting apps, lending apps, investment platforms, neobanks, payroll software, tax tools, business banking apps, and buy-now-pay-later services all use Plaid’s APIs for financial access.

Do users need high credit scores to use Plaid?

No. Plaid does not require credit checks. It’s simply a secure data bridge between banks and apps — users only need access to online banking.

Can I build a Plaid-like platform?

Yes. Entrepreneurs can build Plaid-style infrastructure for specific countries, banking systems, or industries like logistics, healthcare, real estate, SMB finance, etc.

How can Miracuves help me launch a fintech platform faster?

Miracuves provides ready-to-launch fintech solutions and Plaid-style API platforms — including full source code, compliance support, integrations, deployment, and customization. Most projects are delivered in 30-90 days.