Imagine it’s renewal time for your health and car insurance. Instead of calling multiple agents, bargaining over premiums, and decoding complex brochures, you simply open an app, compare plans from dozens of insurers in a few taps, see the exact premium and coverage, and buy instantly. That “insurance shopping like e-commerce” experience is what Policybazaar made mainstream in India.

Launched in 2008, Policybazaar started as a comparison site for term insurance and has grown into India’s largest digital insurance marketplace, helping users compare and buy health, term, motor, travel and more from 50+ insurers. As of Q2 FY25, its parent PB Fintech reports around 86.9 million registered users, 18.3 million active users and over 46.8 million insurance policies sold, with annualised insurance premium of about ₹218 billion flowing through the platform.

By the end of this guide, you’ll know what Policybazaar is, how its app and website actually work, how it makes money, the technology behind it, and why its success has inspired so many founders to build Policybazaar-like insurance marketplaces—plus how Miracuves can help you launch a similar platform quickly.

What Is Policybazaar? The Simple Explanation

Policybazaar is India’s largest online insurance comparison and marketplace platform where users can compare, choose, and buy insurance policies from multiple insurers in one place. It simplifies insurance shopping by showing side-by-side comparisons of premiums, features, exclusions, claim ratios, add-ons, and coverage benefits—helping users make informed decisions without involving traditional agents.

The Core Problem Policybazaar Solves

Insurance in India was historically confusing, agent-driven, and difficult to compare. Policybazaar removes this complexity by offering:

- Transparent premium comparison

- Instant quotes from multiple insurers

- Policy purchase in minutes

- Renewal reminders

- Customer support and claims assistance

It turned insurance into an easy digital shopping experience.

Target Users and Use Cases

Policybazaar is popular among:

• Young professionals buying term insurance

• Families comparing health insurance plans

• Car owners renewing motor insurance

• Travellers seeking instant travel insurance

• SMEs exploring group insurance options

Current Market Position (2025)

By 2025, Policybazaar remains the category leader in India’s online insurance distribution market. It dominates digital term insurance sales, health cover purchases, and motor renewals, with massive user adoption driven by smartphone penetration and trust in online policy buying.

Why It Became Successful

Policybazaar succeeded because it delivered what customers wanted most: clarity, comparison, and convenience. Its transparent approach, vast insurer tie-ups, strong branding, and easy-to-use interface helped reshape how Indians buy insurance digitally.

How Policybazaar Works — Step-by-Step Breakdown

For Users (Insurance Buyers)

Account Creation

A user downloads the Policybazaar app or visits the website, enters basic details like age, pincode, vehicle info (for car insurance), or health details (for health insurance), and creates an account using phone OTP verification.

Getting Instant Quotes

Based on user inputs, Policybazaar fetches real-time quotes from various insurers.

Users can see:

- Premium amounts

- Coverage and add-ons

- Claim settlement ratios

- Cashless network hospital lists

- Policy exclusions and waiting periods

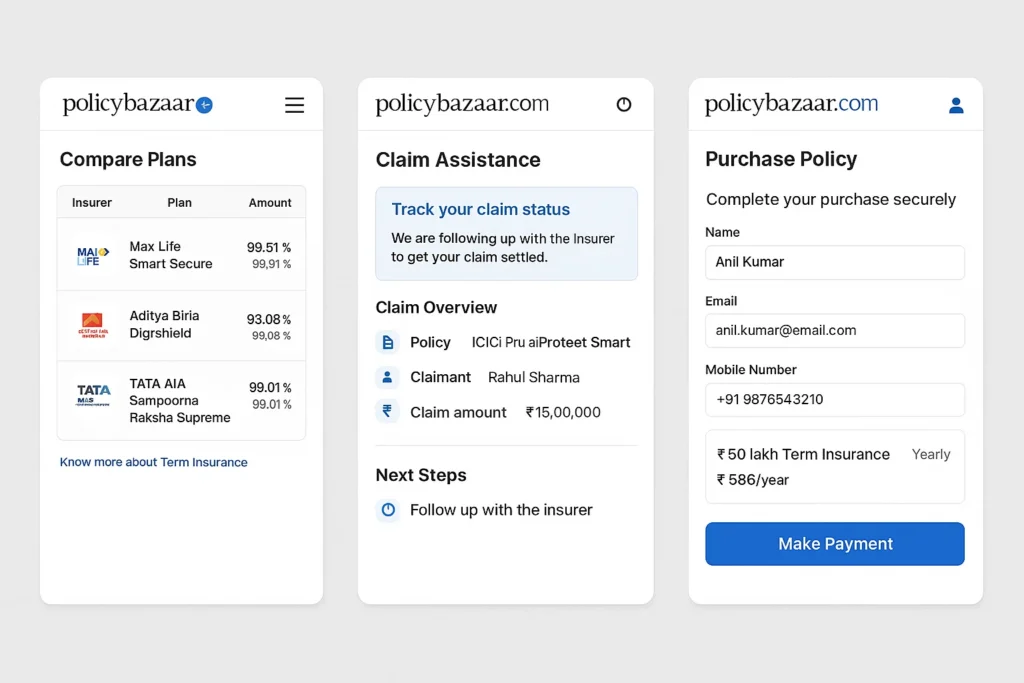

Comparing Plans

Users can compare plans side-by-side to understand differences in features, pricing, and insurer performance. This replaces the traditional agent-led explanation with transparent digital comparison.

Buying a Policy

Once a user selects a plan:

- They complete KYC (Aadhaar/PAN)

- Upload basic documents if required

- Pay the premium online

The policy is issued instantly or within a few hours depending on insurer verification.

Managing Policies

Users can:

- Access policy documents

- Track renewal dates

- Receive reminders

- Modify or upgrade their plans

- Buy add-ons

Filing Claims / Assistance

Policybazaar offers guided claim support where users can raise claim requests, upload documents, and get assistance from dedicated claim advisors.

Example User Journey

Someone buying health insurance enters age and family details → sees 20+ plan options → compares benefits → selects a plan with a preferred hospital network → completes KYC and payment → receives digital policy instantly.

For Insurance Providers (Insurers)

Onboarding

Insurers integrate with Policybazaar’s system through APIs to share:

- Premium calculation rules

- Plan details

- Eligibility criteria

- Proposal form workflows

Operating on the Platform

Insurers receive policy applications digitally, conduct verifications, issue policies, and provide claim support through seamless integration.

Earnings Structure

Insurers pay commissions for policies sold. The commission rates vary by product category as regulated by IRDAI.

Technical Overview (Simplified)

Policybazaar’s platform works using:

- API integrations with insurers for real-time quote generation

- Automated underwriting flows for faster policy issuance

- Secure cloud infrastructure for policy data and documentation

- AI-based recommendation engines that suggest suitable plans

- Analytics systems to improve pricing, conversions, and customer journeys

- Omnichannel support (chat, calls, WhatsApp) for assistance

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Policybazaar’s Business Model Explained

How Policybazaar Makes Money

Policybazaar operates as an online insurance aggregator and earns revenue primarily through:

- Commissions from insurers for every policy sold (regulated by IRDAI)

- Renewal commissions for term, health, and motor insurance

- Lead generation fees for insurers

- Service fees for claim assistance or value-added services

- Fintech cross-sell revenue (credit cards, loans, micro-insurance products)

Since it does not underwrite policies, Policybazaar’s revenue model is asset-light and highly scalable.

Pricing Structure for Users

Users don’t pay extra charges. The premium shown on Policybazaar is the same insurer-approved price they would get offline. Policybazaar earns its commission from insurers, not users.

Commission / Fee Breakdown

Depending on the product, insurers pay Policybazaar commissions such as:

- Term insurance: regulated percentage of first-year premium

- Health insurance: commission based on annual premium

- Motor insurance: fixed % on OD + TP components

- Travel / micro-insurance: flat fees or small percentages

Renewals also generate recurring commission income.

Market Size and Growth

India’s insurance market is set to surpass $280 billion by 2030, driven by rising awareness, digital adoption, and government-backed health programs.

Policybazaar contributes a major share of India’s digital insurance distribution, with millions of users and rapidly growing health and motor segments.

Profit Margin Insights

Policybazaar’s margins depend on:

- Product mix (health and term yield higher commissions)

- User retention and renewals

- Operating efficiency and digital automation

- Reduced dependency on call centers due to improved app journeys

The company focuses on long-term customer lifetime value rather than one-time policy purchases.

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Commissions | Earned on every policy sold | Insurers | Recurring / transaction-based |

| Renewal Commissions | Revenue from renewals | Insurers | Long-term recurring |

| Lead Generation | Charges for qualified leads | Insurers | Performance-based |

| Value-Added Services | Claims help, advisory, add-ons | Users / Insurers | Optional |

| Fintech Products | Loans, cards, financial services | Partner companies | Affiliate-based |

Key Features That Make Policybazaar Successful

Instant, Real-Time Comparison

Policybazaar aggregates quotes from dozens of insurers and displays them instantly. Users can compare premiums, features, claim ratios, add-ons, and coverage—something nearly impossible in the traditional agent model.

Transparent & User-Friendly Interface

The platform breaks down complicated insurance terms into simple language. Visual comparisons, filters, and benefits charts help users understand what they’re actually buying.

AI-Based Recommendations

Policybazaar uses algorithms to suggest the best plans based on:

- Age

- Health conditions

- Budget

- Family size

- Claim data

- Insurer performance

This personalization significantly improves user experience and conversion.

Paperless, Instant Policy Issuance

Users can upload KYC documents digitally and get policies issued within minutes. This eliminates paperwork and long waiting times.

Renewal Management

Automatic reminders, premium comparison for renewals, and easy-switch options ensure users never miss renewal dates and can save money by comparing again.

24/7 Customer Support & Claims Assistance

Policybazaar provides claim advisors who guide users through documentation, insurer communication, and settlement processes—reducing stress for customers.

Wide Insurance Coverage Categories

The platform supports:

- Health insurance

- Term life insurance

- Motor insurance

- Travel insurance

- Home & personal accident insurance

- Group health plans for SMEs

This makes Policybazaar a one-stop solution for diverse insurance needs.

Secure Data Storage

All user data is encrypted, stored securely, and handled in compliance with India’s IRDAI guidelines.

2024–2025 Product Enhancements

Recent improvements include:

- WhatsApp-based policy issuance

- Faster KYC verification

- AI-led claim prediction support

- Wellness and teleconsultation add-ons for health plans

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Policybazaar

Tech Stack Overview (Simplified)

Policybazaar operates on a scalable, cloud-based infrastructure built to handle millions of users comparing policies simultaneously. Its technology includes:

- Web and mobile apps built with modern frameworks

- A backend system that integrates with insurers through secure APIs

- Scalable cloud hosting for handling peak loads (e.g., renewal season)

- Data analytics engines for pricing insights and user behavior

The platform is designed for speed, accuracy, and reliability, ensuring seamless user experience even during high-traffic periods.

Real-Time Features & Automations

Policybazaar depends heavily on automation, including:

- Instant premium fetching via insurer APIs

- Automated KYC and document processing

- Real-time policy issuance workflows

- Automated renewal reminders and notifications

- Chatbots for common insurance queries

These features make the buying journey smooth and nearly agent-free.

Data Handling, Privacy, and Security

Since Policybazaar deals with sensitive financial and health-related data, the platform uses:

- End-to-end encryption

- Tokenized payment systems

- Secure document storage

- IRDAI-compliant data retention policies

- Regular audits and security monitoring

This ensures user trust and regulatory compliance in the Indian insurance space.

Scalability Approach

Policybazaar’s systems scale horizontally to manage:

- Millions of quote requests

- Large document uploads

- High-volume customer service traffic

Microservices architecture ensures different modules (pricing, comparison, KYC, payments) operate independently without slowing each other down.

Mobile App vs Web Platform

- Mobile App: Ideal for instant comparisons, renewals, document storage, and claim assistance.

- Web Platform: Preferred for detailed policy analysis, family plan comparisons, and term insurance research.

Both are synchronized so users can switch between devices effortlessly.

API Integrations

Policybazaar integrates with:

- Insurance companies for quotes, underwriting, policy issuance

- Payment gateways for fast premium payments

- KYC verification systems

- Hospitals and provider networks (for health plan data)

- Customer support and CRM tools

These APIs enable a unified insurance experience without manual intervention.

Why This Tech Matters

Policybazaar’s technology makes insurance buying:

- Faster

- More transparent

- Cheaper

- More accessible to first-time digital users

For entrepreneurs, it highlights how a strong backend + insurer integrations + UI clarity can completely transform an industry rooted in offline processes.

Policybazaar’s Impact & Market Opportunity

Industry Disruption

Policybazaar fundamentally changed how Indians buy insurance. Before its arrival, most policies were sold through agents, often with limited transparency. Policybazaar introduced:

- Side-by-side comparison

- Instant premium transparency

- Clear explanations of coverage

- Online buying without intermediaries

This shift pushed the entire industry toward digitization and accountability.

Market Statistics & Growth

India’s insurance penetration is still relatively low compared to global standards, making it one of the fastest-growing insurance markets in the world. Digital adoption has accelerated significantly due to:

- Smartphone penetration

- UPI payments

- Rising insurance awareness post-COVID

- Government-backed health initiatives

By 2025, the digital insurance market is expanding rapidly, with Policybazaar playing a major role in driving online insurance sales across health, motor, and term products.

User Demographics & Behavior

Policybazaar attracts:

- Young salaried professionals buying term or health cover

- Car and bike owners renewing motor policies

- Families seeking comprehensive health plans

- First-time insurance buyers who value clarity

- SMEs looking for group health insurance

These users prefer digital journeys, transparent pricing, and quick renewals—exactly what Policybazaar excels at.

Geographic Presence

Policybazaar serves users across the entire country—from metro cities like Delhi, Mumbai, Bengaluru, and Hyderabad to Tier 2 and Tier 3 locations where digital adoption is rising fast.

Future Projections

Experts predict major growth in:

- Health insurance

- Term insurance

- SME group health plans

- Wellness-linked insurance

- Telemedicine add-ons

- AI-driven claim support

Policybazaar’s platform is well-positioned to lead these evolving segments due to its scale, brand trust, and strong integrations with insurers.

Opportunities for Entrepreneurs

The success of Policybazaar has created huge potential for building niche insurance marketplaces such as:

- Health-only comparison apps

- Term insurance research tools

- Motor insurance quick-renewal apps

- SME-focused group insurance platforms

- Regional-language insurance comparison tools

This massive success is why many entrepreneurs now want to launch Policybazaar-like platforms with advanced comparison, automation, and insurer integrations.

Building Your Own Policybazaar-Like Platform

Why Businesses Want Policybazaar-Style Platforms

The Policybazaar model works because it solves a real problem: insurance is confusing, fragmented, and traditionally sold offline. A digital comparison platform creates value by offering:

- Transparency in premiums and features

- Easy, jargon-free decision-making

- Instant policy issuance

- High customer trust

- Scalable, commission-based revenue

For businesses, the model is attractive because it doesn’t require underwriting risk—only strong technology, insurer partnerships, and customer acquisition.

Key Considerations Before You Start Development

Before building a Policybazaar-like platform, define:

- Target segment: health, term, motor, travel, micro-insurance, SME group plans

- Geography & regulation: IRDAI norms, KYC requirements, compliance policies

- Insurer integrations: list of companies you want to onboard

- User journey: comparison-first or chatbot-led?

- Product mix: comparison only, or comparison + claim assistance?

- Customer support model: chat, WhatsApp, voice, or hybrid

These decisions shape the platform’s architecture, cost, and market strategy.

Cost Factors & Pricing Breakdown

Policybazaar-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Insurance Aggregator MVP | Core web platform for comparing a limited set of insurance products (e.g., health or motor), user registration & login, quote request forms, basic premium comparison, lead capture for insurers, simple policy details pages, standard admin panel, basic reports | $90,000 |

| Mid-Level Multi-Category Insurance Comparison Platform | Support for multiple lines (health, life, motor, term, etc.), dynamic quote and comparison engine, filters by coverage/price/insurer, enriched product pages, lead routing and CRM hooks, basic partner/insurer portals, notifications & reminders, analytics dashboard, polished mobile-first UX (web + responsive) | $170,000 |

| Advanced Policybazaar-Level Aggregator Ecosystem | Large-scale multi-insurer marketplace, complex rules-based comparison and ranking engine, multi-city/state pricing logic, deep integrations with insurers’ proposal/issuance APIs, user profiling, campaigns & offers engine, advanced analytics and attribution, cloud-native, highly scalable architecture | $280,000+ |

Policybazaar-Style Insurance Aggregator Platform Development

The prices above reflect the global market cost of developing a Policybazaar-like digital insurance comparison and aggregator platform — typically ranging from $90,000 to over $280,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes quote and comparison journeys, multi-product catalog structure, insurer/partner integrations, campaign and lead-routing logic, compliance considerations, and extensive testing for real-world policy journeys.

Miracuves Pricing for a Policybazaar-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Policybazaar-style insurance aggregator platform that covers multi-category product listings, quote & comparison flows, lead capture and routing, basic integrations with insurer CRMs or proposal systems, user accounts with saved quotes, analytics dashboards, and modern web + mobile interfaces. From this base, the platform can be extended into deeper insurer API integrations, richer recommendation logic, advanced campaigns and rewards, and multi-region compliance as your insurtech marketplace scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational insurance comparison ecosystem ready for launch and future expansion.

Delivery Timeline for a Policybazaar-Like Platform with Miracuves

For a Policybazaar-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of product coverage (health, life, motor, term, travel, etc.) and comparison logic

- Number and complexity of insurer/partner integrations (quote, proposal, policy issuance, CRM)

- Complexity of campaigns, offers, and user segmentation

- Scope of web portal, mobile apps, branding requirements, and long-term scalability and compliance targets

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

A complete Policybazaar-like platform should offer:

- Real-time premium comparison

- Multi-insurer integrations (API & rule-based)

- Advanced filters (coverage, add-ons, claim ratio, etc.)

- Paperless policy purchase flows

- Renewal reminders & auto-renewal options

- Digital document vault for policies

- Claims assistance workflows

- Admin dashboard for leads, sales, and insurer performance

- Secure payment and KYC systems

Optional but powerful add-ons:

- AI recommendation engine

- Chatbot for plan suggestions

- WhatsApp-based policy issuance

- Wellness/telemedicine integrations for health plans

Read More :- Read the complete guide on fintech app development costs

Conclusion

Policybazaar transformed the way India understands and purchases insurance by bringing transparency, comparison, and convenience to a traditionally complex industry. Its success proves that when technology meets clarity, even the most complicated financial products become accessible to everyday users. For entrepreneurs, it offers a powerful blueprint for building digital insurance marketplaces that simplify choices and empower customers.

FAQs :-

How does Policybazaar make money?

Policybazaar earns commissions from insurers for every policy sold or renewed. It also generates revenue through lead generation, value-added services, and fintech cross-sells like loans or credit cards.

Is Policybazaar available outside India?

Policybazaar primarily operates in India. However, its parent company, PB Fintech, also runs Policybazaar UAE, serving customers in the Gulf region.

How much does Policybazaar charge users?

Nothing extra. Users pay the same premium approved by insurers. Policybazaar’s commission comes from the insurer, not the customer.

What’s the commission for service providers (insurers)?

Commissions vary by category—term, health, motor, travel—and follow IRDAI guidelines. Policybazaar receives a regulated percentage of the premium for each product type.

How does Policybazaar ensure safety and privacy?

The platform uses encryption, secure cloud storage, multi-layer authentication, and IRDAI-compliant data policies to protect user information.

Can I build something similar to Policybazaar?

Yes. Many entrepreneurs are launching niche comparison portals (health-only, motor-only, SME insurance). Ready-made clone solutions can significantly reduce development time.

What makes Policybazaar different from competitors?

It offers real-time insurer integrations, transparent comparison, strong claim support, and a refined user experience backed by millions of active users and deep insurer partnerships.

How many users does Policybazaar have?

As of 2025, Policybazaar has over 86 million registered users and millions of policies sold, making it India’s leading digital insurance marketplace.

What technology does Policybazaar use?

It uses cloud infrastructure, insurer APIs, microservices, analytics engines, AI-based recommendation systems, secure payment integration, and automated KYC systems.

How can I create an app like Policybazaar?

You can build one from scratch or use a pre-built, customizable clone base. Miracuves helps entrepreneurs launch Policybazaar-style platforms in 30-90 days, with insurer integration modules, comparison engines, policy workflows, and a full admin dashboard.