You need to send money from the USA to another country — maybe paying a freelancer, a supplier, or a partner. With traditional banks, this can take 2–5 days, include multiple intermediaries, and cost a hefty fee. For a global, digital-first world, that feels painfully slow.

That’s the problem Ripple set out to solve.

Ripple (the company behind the XRP-based payment ecosystem) focuses on real-time global payments. Instead of relying on legacy SWIFT messages and correspondent banks, Ripple uses blockchain and digital assets to help financial institutions move value across borders in seconds instead of days.

Over the years, Ripple has built:

- RippleNet – a network for cross-border payments

- On-Demand Liquidity (ODL) – using XRP to bridge currencies

- Solutions for banks, PSPs, remittance firms, and fintechs

In 2025, Ripple sits at the intersection of traditional finance and blockchain, working with financial institutions while also powering crypto-based liquidity and settlement.

In this guide, you’ll learn:

- What Ripple actually is (company, network, and XRP)

- How Ripple works behind the scenes for cross-border payments

- Its business model and where revenue comes from

- The technology behind RippleNet and XRP

- Key use cases for banks, fintech apps, and payment providers

- Why many founders are interested in Ripple-style cross-border platforms and remittance apps

By the end, you’ll have a clear, non-technical understanding of Ripple’s role in global payments—and how a similar model can be turned into a fintech product with Miracuves.

What Is Ripple? – The Simple Explanation

Ripple is a blockchain-based global payments company that helps banks, fintechs, and remittance providers move money across borders faster, cheaper, and more transparently than traditional banking systems.

To avoid confusion, Ripple has three parts:

1. Ripple (the company)

A U.S.-based fintech firm that builds enterprise blockchain payment solutions.

2. RippleNet (the network)

A global payment network that connects banks and payment providers so they can send money in seconds, with full tracking and lower costs.

3. XRP Ledger + XRP (the digital asset)

A blockchain and token used in Ripple’s On-Demand Liquidity (ODL) product to eliminate the need for pre-funded accounts by bridging two different currencies instantly.

Together, these components create a real-time cross-border payment ecosystem.

Core Problem Ripple Solves

Traditional international money transfers rely on SWIFT messaging and multiple intermediary banks. This leads to:

- Slow settlement (2–5 days)

- High fees

- Unpredictable exchange rates

- No real-time tracking

Ripple solves this by using blockchain technology to deliver:

- Near-instant settlement

- Fixed, transparent fees

- Direct institution-to-institution transactions

- Digital asset–powered liquidity (via XRP)

Who Uses Ripple?

| User Type | Purpose |

| Banks | Faster cross-border settlement |

| Fintech apps | Real-time remittance services |

| Payment service providers | Cheaper global transfers |

| Crypto exchanges | Liquidity & bridging |

| Enterprises | Large-value international payouts |

Ripple’s infrastructure is designed for regulated financial institutions rather than everyday consumers.

Why Ripple Became Successful

- It’s one of the first blockchain networks built specifically for payments

- Offers real-world use cases, not just speculation

- Strong partnerships with banks, PSPs, and financial giants

- Provides real-time exchange + settlement

- Reduces operational costs for high-volume global transfers

Market Position in 2025

- RippleNet active in 50+ global markets

- ODL usage growing across Asia, LATAM, and Europe

- XRP Ledger remains one of the fastest public blockchains

- Ripple expanding into tokenization and CBDC solutions

- Competes with SWIFT, Visa B2B Connect, Stellar, and new real-time payment networks

Ripple bridges the gap between crypto speed and banking compliance, making it one of the most influential players in global blockchain payments.

How Ripple Works – Step-by-Step Breakdown

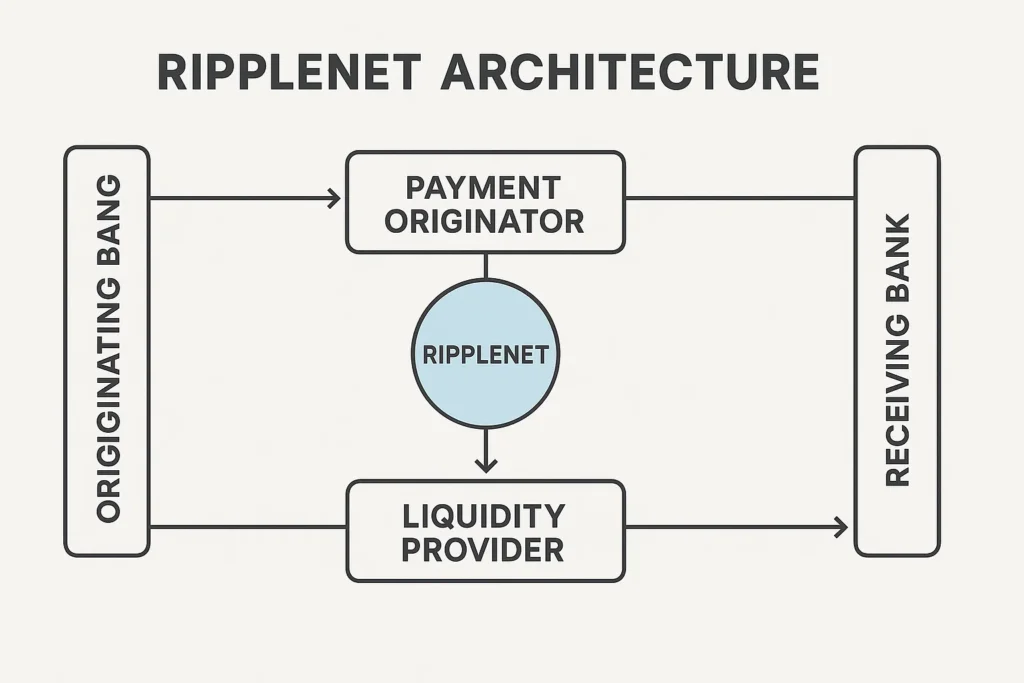

Ripple’s payment system works by combining RippleNet, ODL (On-Demand Liquidity), and the XRP Ledger to move money across borders quickly and efficiently. Here’s the simple, clear breakdown of how everything functions.

For Banks, Fintechs & Payment Providers

1. Connect to RippleNet

A financial institution integrates Ripple’s APIs or uses a partner provider. Once connected, they can send and receive global payments with tracking — similar to an “instant settlement SWIFT alternative.”

2. Initiate a Cross-Border Payment

When a business or user sends money internationally, RippleNet routes the payment to the receiving partner.

RippleNet ensures:

- Compliance checks

- Messaging

- Quotes for FX rates

- Payment tracking

This is faster and simpler than SWIFT’s multi-hop chain.

3. Choose Settlement Method: Traditional or ODL

Institutions can settle the payment in two ways:

- Traditional fiat rails (still faster than SWIFT), or

- ODL (On-Demand Liquidity) using XRP as a bridge currency

ODL removes the need for pre-funded accounts because the system converts Currency A → XRP → Currency B instantly.

4. Real-Time Settlement (Seconds)

Ripple’s blockchain systems clear and settle transactions within 3–5 seconds, which is where most of the speed advantage comes from.

The receiving bank or fintech receives funds almost instantly.

5. Funds Delivered to End User

The beneficiary gets the payment in their local currency, without worrying about blockchain complexity — all the “crypto translation” happens behind the scenes.

For End Users (Consumers / Business Customers)

Ripple is not a consumer app. Instead, users experience the benefits through apps that use Ripple:

- Near-instant international transfers

- Lower fees

- Transparent status tracking

- Better FX rates

Examples include remittance apps, global payroll platforms, and cross-border business tools.

Ripple’s Technology Flow (Simple)

A Ripple-powered transaction looks like this:

- App or bank sends request

- RippleNet scans the best route

- If using ODL:

- Sender’s currency → XRP

- XRP → receiver’s currency

(all within seconds)

- XRP Ledger records the settlement

- Funds delivered to recipient

- RippleNet updates both institutions

This removes intermediaries, reduces costs, and speeds up settlement dramatically.

Technical Overview (Non-Technical Version)

RippleNet = payment messaging + routing

XRP Ledger = decentralized blockchain for settlement

ODL = liquidity engine using XRP as a temporary bridge

All three work together to create a global, real-time payment network.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Ripple’s Business Model Explained

Ripple earns money by providing enterprise-grade payment infrastructure to banks, fintechs, PSPs, and financial institutions. Unlike consumer crypto companies, Ripple’s revenue comes from network usage, software licensing, liquidity services, and XRP-based settlement flows.

Here’s the breakdown of how Ripple makes money:

1. RippleNet Software & Licensing Fees (Primary Revenue)

Banks and financial institutions pay Ripple to use RippleNet — its global payment network.

This includes fees for:

- API integration

- Payment routing

- Compliance tools

- Real-time tracking

- Network connectivity

RippleNet functions like a subscription-based financial infrastructure product, often billed annually or per volume tier.

2. On-Demand Liquidity (ODL) Fees

ODL is Ripple’s biggest differentiator.

When institutions use XRP to bridge currencies, Ripple collects fees for:

- FX spread

- Liquidity provisioning

- Transaction volume

- Settlement processing

Since ODL removes pre-funded accounts, demand for it increases with high-volume corridors.

3. XRP Liquidity Services

Ripple partners with exchanges and liquidity providers, earning revenue from:

- Providing XRP liquidity

- Routing flows through partner exchanges

- Market-making support

- Strategic liquidity incentives

This becomes significant when large remittance corridors use XRP regularly.

4. Ripple Cloud & Managed Services

Ripple offers a cloud-based version of its payment software, earning revenue through:

- Cloud hosting

- Maintenance

- SLA-backed enterprise support

- Compliance monitoring

- Fraud & AML tools

This creates a recurring SaaS-style revenue stream.

5. Enterprise Solutions (Tokenization, CBDCs, Treasury Systems)

Ripple now expands beyond payments into:

- CBDC platforms for central banks

- Tokenized asset settlement

- Digital identity & compliance infrastructure

These are long-term, high-value partnerships that generate multi-year revenue contracts.

6. Strategic XRP Holdings (Not Primary, but Significant)

Ripple holds a large amount of XRP.

While not part of its core business model, appreciating XRP value strengthens Ripple’s balance sheet and supports ecosystem development.

Ripple does not rely on dumping XRP; instead, it releases tokens programmatically and transparently.

7. Partnerships & Integration Fees

Banks, PSPs, and fintechs pay for:

- Custom integrations

- Corridor activation

- Dedicated enterprise onboarding

- FX route optimization

These are high-value enterprise services that create long-term customer lock-in.

Why This Business Model Works

✔ Recurring enterprise revenue

✔ High switching costs for banks

✔ Global demand for faster payments

✔ ODL reduces liquidity costs for institutions

✔ Ripple positions itself as a bridge between banks and blockchain

Ripple’s model is powerful because every time global payments move through RippleNet or ODL, Ripple earns fees, creating scalability similar to Visa or SWIFT — but with blockchain-level speed.

Key Features That Make Ripple Successful

Ripple’s success comes from combining bank-grade payment solutions with blockchain-level speed, something no traditional network or crypto platform offered before. These features make Ripple one of the most trusted infrastructures for cross-border payments worldwide.

Real-Time Cross-Border Payments

Ripple enables institutions to send cross-border payments that settle in 3–5 seconds, compared to the 2–5 days required by SWIFT.

This speed improves:

- Global remittances

- Business payouts

- Supplier payments

- Payroll for cross-border teams

It is Ripple’s main competitive edge.

On-Demand Liquidity (ODL) Using XRP

ODL eliminates the need for pre-funded nostro accounts by converting currencies in real time through XRP:

USD → XRP → INR

or

EUR → XRP → PHP, etc.

This offers:

- Instant settlement

- Lower liquidity costs

- Better FX rates

- Reduced working capital requirements

ODL is Ripple’s most game-changing feature for high-volume corridors.

RippleNet – A Global Payment Network

RippleNet offers:

- Unified messaging

- Compliance modules

- Identity verification

- Tracking & transparency

- Direct bank-to-bank connectivity

It functions like a modern alternative to SWIFT, but faster, cheaper, and programmable.

Low Fees & Transparent FX

Ripple drastically reduces operational and transaction fees by eliminating intermediaries.

Institutions get:

- Reduced FX slippage

- Better conversion spreads

- Lower transaction fees

- Transparent fee breakdowns

This is critical for remittance companies operating on thin margins.

Bank-Grade Compliance Tools

Ripple includes built-in systems for:

- AML

- KYC

- Fraud monitoring

- Sanctions screening

- Transaction scoring

- Identity checks

These compliance features are essential for enterprise adoption.

Tokenization & CBDC Support

Ripple is expanding into:

- Tokenized asset settlement

- Central Bank Digital Currency (CBDC) platforms

- Stablecoin and security settlement systems

This positions Ripple as a long-term infrastructure provider for global finance.

Energy-Efficient Blockchain

The XRP Ledger (XRPL) is one of the most energy-efficient blockchains.

Transactions settle in seconds with minimal energy, unlike proof-of-work systems.

Developer Tools & Open Technology

Ripple supports developers through:

- XRPL APIs

- Smart contract features (Hooks & sidechains)

- Token issuance

- NFT capabilities

- Wallet integrations

- Gateways and bridges

This fosters ecosystem growth beyond just payments.

What Sets Ripple Apart

- Purpose-built for payments, not general crypto

- Enterprise-grade partners (banks, PSPs, remittance leaders)

- Speed + transparency + low cost

- Programmable liquidity through XRP

- A hybrid model: traditional finance + blockchain innovation

Ripple didn’t create a cryptocurrency for speculation — it created a real-world payments engine that solves billion-dollar problems.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Ripple

Ripple combines enterprise software + blockchain + digital asset liquidity to move money globally in seconds. You don’t need to be “crypto-technical” to understand it — think of it as a faster, smarter rails system sitting under banks and fintech apps.

RippleNet vs XRP Ledger – Two Layers

To keep it simple:

- RippleNet = the enterprise payment network (APIs, routing, compliance, messaging) used by banks and PSPs.

- XRP Ledger (XRPL) = the public blockchain that can be used for fast settlement and On-Demand Liquidity (ODL), using XRP as the bridge asset.

RippleNet can work with or without XRP, but ODL specifically uses XRP + XRPL to move value between currencies in real time.

XRP Ledger: Fast, Low-Cost Blockchain

The XRP Ledger is a public, decentralized blockchain optimized for payments. Key properties:

- Consensus mechanism: Uses a custom consensus algorithm (not proof-of-work like Bitcoin). Validators agree on the state of the ledger every few seconds.

- Speed: Transactions typically settle in 3–5 seconds.

- Cost: Transaction fees are usually a fraction of a cent, which makes micro and high-frequency payments feasible.

- Energy-efficient: No mining, so it’s far more energy-efficient than PoW networks.

For cross-border payments, this means fast, final, and cheap settlement, ideal for institutions that need predictable performance.

On-Demand Liquidity (ODL) – How XRP Is Used

ODL uses XRP as a bridge currency:

- Sender currency (e.g., USD) is converted to XRP.

- XRP is sent over XRPL in seconds.

- XRP is sold into the destination currency (e.g., MXN, PHP, INR) on the other side.

All of this is handled behind the scenes using:

- Partner crypto exchanges providing local liquidity

- Ripple’s routing logic for best FX path

- XRP Ledger for fast settlement

For the end customer, it still looks like a fiat-to-fiat transfer, but ODL replaces the expensive, slow nostro/vostro relationships in the middle.

RippleNet – Enterprise Payment Stack

On the bank/fintech side, RippleNet provides:

- APIs & SDKs for sending and receiving payments

- Routing engine to choose the best payment corridor

- Compliance & screening modules for AML/KYC checks

- FX and pricing logic for transparent rates

- Tracking similar to parcel tracking for payments

RippleNet abstracts away blockchain complexity and exposes a simple “send payment” interface for regulated institutions.

Security, Compliance & Governance

Because Ripple works with regulated financial institutions, its stack is built around:

- Encrypted communication and data at rest

- Integration with sanctions and AML screening tools

- Transaction monitoring and reporting

- Strong identity and access management

- Clear audit trails for every payment

This makes it possible to use a blockchain-based solution inside traditional compliance frameworks.

Developer & Ecosystem Layer (XRPL)

Beyond banks, the XRP Ledger supports:

- Issuing tokens (fiat IOUs, stablecoins, loyalty points)

- Decentralized exchange (built into the ledger)

- Simple smart-logic via features and sidechains

- Wallets, payment apps, and fintech integrations

This means entrepreneurs can build apps directly on XRPL, not just use RippleNet via banks.

Why This Tech Stack Matters

For banks & fintechs:

- Faster settlement = better customer experience

- Lower liquidity requirements = reduced operating cost

- More transparent tracking = fewer disputes

For builders:

- XRPL provides fast, cheap, programmable settlement

- RippleNet APIs offer an enterprise gateway into global payments

Ripple’s technology is essentially a hybrid bridge between the speed of crypto and the rules of traditional finance — which is exactly why it’s so important in the cross-border payments space.

Ripple’s Impact & Market Opportunity

Ripple has had a big influence on how the world thinks about cross-border payments. Instead of treating crypto as just a speculative asset, Ripple pushed a very simple idea: use blockchain to move real money faster, cheaper, and with full transparency.

How Ripple Changed Cross-Border Payments

Ripple challenged the old SWIFT model by proving you can:

- Settle international transfers in seconds, not days

- Use digital assets (like XRP) as a liquidity bridge

- Give banks a shared network with end-to-end visibility

- Reduce the need for expensive pre-funded accounts worldwide

This moved blockchain from “nice experiment” to actual banking infrastructure in many corridors.

Who Benefits Most from Ripple’s Model

- Banks & PSPs: Cut settlement time, reduce FX slippage, simplify operations

- Remittance companies: Offer cheaper, near real-time transfers to migrants and families

- Fintech apps: Build global payout features without building global bank networks

- Enterprises: Pay vendors, freelancers, and remote teams across borders more efficiently

Even when end users never hear the word “Ripple” or “XRP”, they benefit from faster, cheaper payments under the hood.

Ripple’s Position in the Global Payments Landscape

Ripple sits in a sweet spot between:

- Traditional rails: SWIFT, correspondent banks, card schemes

- New rails: real-time payment networks, stablecoins, CBDCs

Because it focuses on infrastructure rather than a flashy consumer app, Ripple has become a “plumbing layer” that other products build on.

Growing Market for Ripple-Style Solutions

The global cross-border payments market is huge and still growing, driven by:

- Remote work and global hiring

- E-commerce and marketplace payouts

- Creator and gig economy

- Freelancers and SaaS exports

- International supply chains

All of these need fast, low-cost, compliant global payments. That’s exactly the space where Ripple’s model fits—and where similar platforms can thrive.

Future Trends That Support Ripple’s Vision

- Expansion of real-time payment systems and ISO 20022

- More central banks exploring CBDCs and tokenized money

- Businesses embedding global payouts directly into their platforms

- Increased regulatory clarity around crypto-based payment infrastructure

- Growing demand for multi-currency treasury and FX automation

Ripple’s infrastructure is naturally aligned with these trends, which keeps demand for Ripple-like solutions strong.

Opportunity for Entrepreneurs

All of this opens space to build:

- Regional Ripple-style payment networks (for specific continents or currency zones)

- Remittance and payout apps powered by Ripple or XRP Ledger

- B2B platforms focused on supplier, freelancer, or gig payouts

- Hybrid systems that mix bank rails, stablecoins, and XRP-like assets for liquidity

This massive success is why many entrepreneurs want to create similar platforms that offer fast, programmable, and cost-efficient cross-border payments, either by integrating Ripple/XRPL or by building their own Ripple-inspired infrastructure.

Building Your Own Ripple-Like Platform

Ripple’s success shows that the world wants faster, cheaper, and programmable cross-border payments. Traditional rails can’t keep up — so platforms inspired by Ripple’s model are becoming extremely valuable, especially in emerging markets and high-volume corridors.

Here’s how businesses think about creating their own Ripple-style payment system.

Why Businesses Want Ripple-Like Solutions

- Global demand for instant money transfers

- High remittance volumes ($800B+ globally)

- Multi-currency treasury pain points

- Expensive FX and banking fees

- Lack of transparency in SWIFT transfers

- Growing acceptance of blockchain for settlement

- Businesses want embedded global payout systems inside their own apps

A Ripple-like system solves real problems for fintechs, PSPs, enterprises, exporters, gig platforms, and remittance apps.

Key Considerations Before Development

To build effectively, you must define:

✔ Target Flow: P2P, B2B, cross-border payroll, gig payouts, or corporate treasury

✔ Currency Corridors: Which countries and fiat pairs you want to support

✔ Settlement Model: Fiat-to-fiat, stablecoins, XRP-like bridge asset, tokenized money

✔ Licensing Needs: MSB licenses, KYC/AML stack, payment partners

✔ Liquidity Management: Market makers, exchange partners, or internal liquidity pool

✔ Compliance: Sanctions, AML checks, transaction monitoring

✔ Rails: Blockchain + bank rails + stablecoin networks

These decisions shape the architecture and speed of development.

Cost Factors & Pricing Breakdown

Ripple-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

| Basic Cross-Border Payments MVP | Core web platform for sending and receiving cross-border payments in a few corridors, user registration & login, basic KYC, simple FX rate display, transaction history, basic compliance checks, standard admin panel | $100,000 |

| Mid-Level Crypto/Fiat Payments Platform | Multi-corridor support, support for both fiat and crypto rails (via your chosen providers), improved KYC/AML flows, richer FX and fee logic, payment tracking, basic liquidity management tools, notifications & alerts, analytics dashboard, web + mobile-ready experience | $180,000 |

| Advanced Ripple-Level Network & Liquidity Hub | Global multi-region network, complex FX and routing engine, institutional accounts, advanced KYC/AML and sanctions screening, on/off-ramp integrations, liquidity hub-style tools, detailed reporting & reconciliation, multi-currency & multi-entity support, scalable cloud-native backend | $280,000+ |

Ripple-Style Cross-Border Payments Platform Development

The prices above reflect the global market cost of developing a Ripple-like cross-border payments and liquidity platform — typically ranging from $100,000 to over $280,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes secure payments architecture, corridor and FX logic, compliance and AML layers, integrations with banking/crypto partners, and extensive testing for real-money flows across borders.

Miracuves Pricing for a Ripple-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Ripple-style cross-border payments platform that covers multi-corridor transfers, core KYC/AML flows (via your providers), FX & fee logic, transaction tracking, liquidity/treasury views, admin console, and modern web + mobile interfaces—while leaving room to extend into more advanced routing engines, institutional modules, and liquidity hub-style features as your payment volumes grow.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational cross-border payments ecosystem ready for launch and future expansion.

Delivery Timeline for a Ripple-Like Platform with Miracuves

For a Ripple-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of cross-border and FX features (corridors, currencies, routing, etc.)

- Number and complexity of banking/crypto, KYC/AML, and compliance integrations

- Complexity of liquidity, reporting, and reconciliation dashboards

- Scope of mobile apps, branding requirements, and long-term scalability targets

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features for a Ripple-Like Platform

A strong platform should include:

Core Payment Features

- Multi-currency wallets

- Instant FX conversion

- Real-time payment routing

- Cross-border settlement

- Payment tracking with full visibility

Blockchain & Liquidity Layer

- Token-based or ledger-based settlement

- On-demand liquidity (ODL-like flow)

- Automated market-making modules

- Low-fee, fast blockchain or sidechain

- Bridges to exchanges or liquidity providers

Compliance & Security

- KYC onboarding

- AML screening

- Fraud detection

- Audit trail + reporting

- Secure APIs

Enterprise Tools

- Payout API

- Treasury dashboard

- Multi-entity management

- Reconciliation & settlement reports

- Role-based access

These are the pillars needed to replicate Ripple’s cross-border infrastructure.

Development Roadmap (Simplified)

PHASE 1 – Core Wallet & Ledger

- Multi-currency support

- User ledger & transaction tracking

- Basic FX conversion logic

PHASE 2 – Payment Rails & Blockchain Layer

- On-chain settlement or bridge asset

- Real-time authorization

- API-driven payouts

PHASE 3 – Liquidity & FX System

- Liquidity pools

- Automated pricing engine

- Integration with exchanges

PHASE 4 – Enterprise Dashboard & API Suite

- Admin panel

- Merchant dashboard

- Payout API for B2B clients

Read More :- Read the complete guide on fintech app development costs

Conclusion

Ripple proves that the future of global payments doesn’t belong to slow, fragmented banking systems — it belongs to real-time, programmable, blockchain-enabled financial infrastructure. By combining enterprise-grade compliance with lightning-fast settlement, Ripple created a blueprint for how money should move in a digital world.

Its impact goes far beyond the crypto community. Millions of people benefit every day when a remittance arrives instantly, when a freelancer gets paid without delays, or when a business completes a cross-border transfer without losing money to hidden fees.

For entrepreneurs and fintech innovators, Ripple shows what’s possible when blockchain is used not for speculation, but for solving real financial problems at scale. Whether you want to build a remittance app, a multi-currency wallet, or a complete global payout platform, the market opportunity is massive — and still growing.

Ripple didn’t just create a digital asset.

It helped reinvent how the world moves money.

FAQs :-

How does Ripple work?

Ripple works by connecting banks and payment providers through RippleNet, a global payment network. Using blockchain technology and optional XRP liquidity, Ripple enables fast, low-cost cross-border transfers with real-time settlement and full transparency.

What is the difference between Ripple and XRP?

Ripple is the company building payment solutions.

XRP is the digital asset used in Ripple’s On-Demand Liquidity (ODL) product to bridge currencies instantly.

They are related but not the same.

Is Ripple used by banks?

Yes. Many banks, remittance providers, and fintechs use RippleNet for faster, cheaper international payments. Some also use ODL, which leverages XRP for liquidity.

How does Ripple make money?

Ripple earns revenue through:

RippleNet software licensing

ODL liquidity and FX fees

Cloud and API services

Enterprise partnerships

Tokenization and CBDC projects

What is On-Demand Liquidity (ODL)?

ODL uses XRP as a bridge currency to convert one fiat currency into another instantly, eliminating the need for pre-funded accounts. This cuts settlement time from days to seconds.

Is Ripple faster than SWIFT?

Yes. Ripple settles global payments in 3–5 seconds, while SWIFT-based transfers can take 2–5 days and pass through multiple intermediaries.

Is Ripple safe and regulated?

Ripple operates under global financial regulations and partners with licensed banks. RippleNet includes AML, KYC, sanctions screening, and transaction monitoring for compliance.

Can businesses build apps using Ripple?

Yes. Companies can integrate RippleNet APIs or build wallets and fintech apps directly on the XRP Ledger for fast, inexpensive payments.

How many transactions can XRP Ledger handle?

The XRP Ledger can process 1,500+ transactions per second, with settlement finality in a few seconds, making it one of the fastest blockchains.

Can I build a Ripple-like payment platform?

Absolutely. A Ripple-style platform can be built using multi-currency wallets, blockchain settlement, liquidity pools, and payout APIs.

Miracuves can create a ready-to-launch Ripple-like infrastructure in 30-90 days, complete with source code, mobile apps, and compliance layers.

Related Articles :-