Imagine managing your money, investing in stocks, refinancing student loans, saving for retirement, and even buying crypto — all from a single app. That’s the experience SoFi created.

Founded in 2011 as a student loan refinancing company, SoFi (Social Finance Inc.) quickly evolved into a full-scale finance ecosystem built around convenience, low fees, and smart automation. Today, it’s one of America’s top finance “super apps,” offering digital banking, personal loans, investments, insurance, credit cards, and high-yield savings — all in one place.

By 2025, SoFi serves millions of members in the U.S. and continues expanding through strategic acquisitions, including SoFi Bank, SoFi Invest, and SoFi Money. Its biggest advantage is simplicity: instead of juggling multiple apps, users can handle every financial need under one unified platform.

By the end of this article, you’ll understand what SoFi is, how it works, how it makes money, and how you can build a SoFi-like finance super app.

What is SoFi?

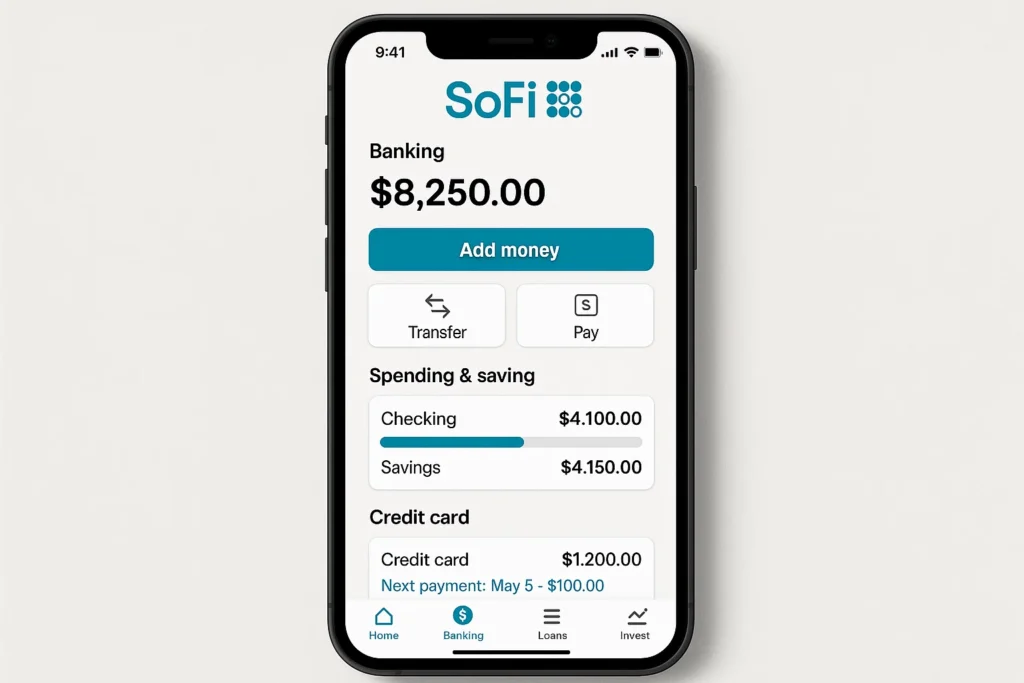

SoFi is a U.S.-based finance super app that brings banking, investing, budgeting, credit, loans, and insurance together in one place. Instead of using separate apps for saving, borrowing, and investing, SoFi gives users a single, easy-to-use platform for everything related to money.

The core problem SoFi solves is financial fragmentation. Most people use one bank for checking, another for loans, a different app for investing, and another for credit score monitoring. SoFi merges all of these services into one streamlined experience with simple fees, automated tools, and transparent financial planning.

Its target users include young professionals, students, families, self-employed individuals, and anyone looking for an all-in-one financial solution without the complexity of traditional institutions.

As of 2025, SoFi has millions of active members and continues to grow rapidly. It is now a fully licensed U.S. bank, allowing it to offer higher savings yields, lower fees, and seamless integration of money movement, lending, and investing. Its success comes from offering convenience, low-cost financial products, strong tech infrastructure, and a modern approach to money management.

How Does SoFi Work?

SoFi works as a complete financial ecosystem — offering banking, investing, loans, credit tools, budgeting, and insurance through a single, unified mobile and web app. Everything is designed for speed, transparency, and the convenience of managing all financial needs in one place.

For Users

1. Account Creation

Users download the SoFi app, verify identity digitally, and instantly access SoFi Checking & Savings. The app provides a virtual debit card right away, while the physical card arrives within a few days.

2. Banking & Money Management

SoFi Checking & Savings offers fee-free banking, high APY on savings, automatic budgeting, and real-time transaction monitoring. Users can also set up direct deposit for faster paychecks.

3. Investing

Through SoFi Invest, users can:

- Buy stocks and ETFs

- Trade crypto

- Invest with automated portfolios

- Access IPO shares (exclusive feature)

The platform requires no account minimums, making investing more accessible.

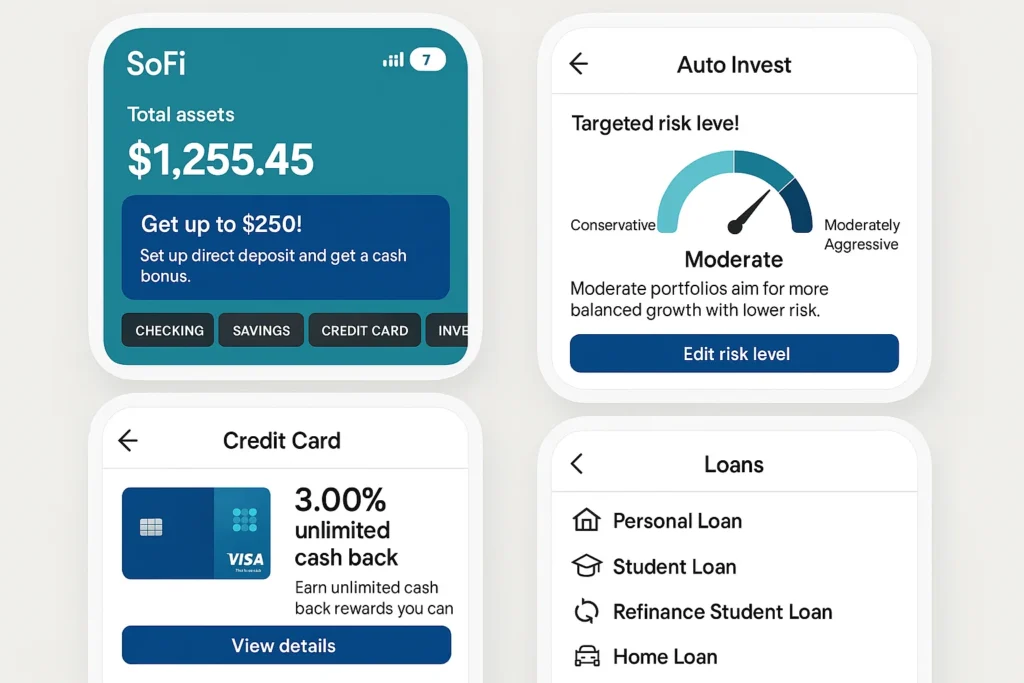

4. Loans & Credit

SoFi offers a wide range of lending products including:

- Personal loans

- Student loan refinances

- Home loans

- Auto loan refinancing

Loan approvals are algorithm-driven, fast, and often come with lower rates due to SoFi’s banking license.

5. Credit Insights & Protection

Users get free credit score tracking, spending analysis, and personalized recommendations to improve their financial health.

6. Insurance & Financial Planning

SoFi partners with top insurance providers for renters, auto, life, and homeowners insurance. Premium members get access to financial advisors for planning and investment guidance.

For Businesses

SoFi offers employer benefits, student loan repayment tools, and financial planning integrations for corporate partners. Companies use SoFi at Work to help employees manage finances more effectively.

Technical Overview

SoFi’s infrastructure uses a cloud-native, API-driven architecture that allows seamless integration between banking, investments, loans, and third-party services. The platform uses:

- Real-time transaction systems

- Automated underwriting algorithms

- Machine learning for risk, fraud, and investment recommendation

- Open banking APIs to sync data across partners

This unified tech design enables SoFi to operate as a single platform rather than multiple separate financial tools.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

SoFi’s Business Model Explained

SoFi’s business model is built on offering a complete financial ecosystem — earning revenue through lending, banking, investing, credit products, and partnerships. Its all-in-one approach allows it to maximize customer lifetime value while keeping fees low and experiences simple.

1. Lending (Primary Revenue Source)

SoFi started as a lending company and still earns the majority of its revenue from:

- Personal loans

- Student loan refinancing

- Home loans

- Auto loan refinancing

It makes money through interest and loan servicing. SoFi’s banking license allows it to offer competitive rates while maintaining strong margins.

2. Banking Revenue

SoFi Checking & Savings generates revenue through:

- Net interest margin (difference between interest earned vs. paid to users)

- Debit card interchange fees

- Cash deposits reinvested into secure financial products

Direct deposit users also boost the bank’s liquidity.

3. SoFi Invest

The platform earns through:

- Payment for order flow (PFOF)

- Advisory fees on automated portfolios

- Crypto trading spreads

- Stock lending

- Management fees for ETF products

Exclusive access to IPO investing attracts high-value users.

4. Credit Card & Rewards

SoFi issues its own credit card and earns revenue from:

- Interchange fees

- Interest on revolved balances

- Merchant partnerships

Rewards encourage users to reinvest points into SoFi Invest.

5. Insurance Partnerships

SoFi earns commission from insurance providers for helping users purchase:

- Auto insurance

- Renters insurance

- Life insurance

- Home insurance

6. SoFi at Work (Employer Benefits)

Companies integrate SoFi’s financial tools for employee benefits, generating B2B revenue from:

- Student loan contribution programs

- Financial planning

- Budgeting and payroll-linked tools

7. Subscription & Premium Services

Premium users gain access to advisors, advanced investing tools, and exclusive benefits.

8. Cost Efficiency

Being a digital-native bank, SoFi avoids branch-based costs and scales quickly with automation, lowering expenses compared to traditional banks.

Key Features That Make SoFi Successful

SoFi has grown into one of the most widely used finance super apps in the U.S. because it combines banking, investing, credit, and financial guidance in one clean, modern interface. Its features are designed to simplify financial life while giving users more control and better value than traditional banks.

1. High-Interest Checking & Savings

SoFi offers one of the highest APYs in the U.S., along with zero monthly fees, no overdraft fees, and early direct deposit. This makes it attractive for everyday banking.

2. All-in-One Financial Dashboard

Users can manage banking, investments, loans, and credit in a single app — eliminating the need for multiple platforms.

3. Automated Investing

SoFi Invest provides robo-advisory portfolios with no management fees, rebalancing, and automated dividend reinvestment for hands-off investing.

4. Fee-Free Stock & ETF Trades

Users can trade stocks and ETFs with no commissions, making SoFi competitive with Robinhood, Webull, and Schwab.

5. Cryptocurrency Trading

SoFi allows users to buy and sell leading cryptocurrencies directly through the app, simplifying the crypto investment process.

6. Personal Loans & Refinancing

Fast approvals, low interest rates, and flexible repayment options make SoFi a top choice for personal and student loan refinancing.

7. Credit Score Tracking

SoFi provides free credit score updates and insights, helping users understand and improve their credit health.

8. Insurance Marketplace

Users can purchase renters, auto, life, and home insurance through SoFi’s partner ecosystem.

9. Rewards & Cashback

The SoFi Credit Card rewards users for spending, with points redeemable toward investing, debt repayment, or savings.

10. Financial Planning Tools

Premium users get access to human advisors, retirement projections, and budgeting assistance.

2025 Updates:

In 2025, SoFi rolled out AI-powered financial coaching, enhanced crypto staking features, and expanded access to alternative investments like fractional real estate.

The Technology Behind SoFi

SoFi’s strength comes from its ability to connect banking, lending, investing, and insurance into one seamless digital ecosystem. Its technology foundation is built to handle millions of users while keeping the experience fast, intuitive, and secure.

Tech Stack Overview

SoFi uses a modern, cloud-native architecture built primarily on:

- AWS for hosting and global scalability

- Kubernetes for container management

- Java, Python, and Go for backend systems

- React and React Native for web and mobile app interfaces

- PostgreSQL and MongoDB for secure, high-performance data storage

This architecture allows different modules — banking, loans, investments, etc. — to operate independently while syncing smoothly.

Real-Time Processing

SoFi’s event-driven system processes:

- Transactions

- Market order executions

- Loan approvals

- Crypto trades

- Balance updates

in real time. Users get instant notifications for every activity, improving visibility and trust.

Security and Compliance

As a fully licensed U.S. bank, SoFi follows strict financial regulations. Its security stack includes:

- End-to-end encryption

- Biometric login

- Behavioral fraud detection

- PCI DSS compliance for card data

- FDIC insurance on deposits through SoFi Bank

AI models monitor abnormal patterns to detect suspicious activity instantly.

Machine Learning and AI

AI plays a major role in SoFi’s financial intelligence features:

- Personalized spending insights

- Automated investing decisions

- Loan underwriting and risk modeling

- Credit score monitoring

- Fraud pattern detection

This automation reduces costs and improves decision accuracy for users and the platform.

Scalability and Reliability

SoFi is designed to handle millions of transactions daily. Microservices architecture allows the platform to scale resources independently — meaning heavy loan activity doesn’t slow down investing or banking modules.

API and Integrations

SoFi integrates with multiple third-party systems through API layers:

- Market data providers for stocks & ETFs

- Crypto liquidity partners

- Insurance providers

- Direct deposit networks

- Open banking connections for account linking

These integrations make SoFi function like a unified financial hub.

Data and Analytics

SoFi uses advanced analytics tools such as:

- Snowflake

- Datadog

- Apache Kafka

These tools help optimize user insights, improve risk modeling, and enhance product development.

SoFi’s technology gives it the foundation to operate as a true financial super app — fast, secure, and capable of delivering banking, lending, and investing in one cohesive platform.

SoFi’s Impact and Market Opportunity

SoFi has emerged as one of the most influential digital finance platforms in the U.S., reshaping how people manage, borrow, save, and invest their money. Its biggest impact lies in unifying multiple financial services into one intuitive app — making financial wellness more accessible than ever.

Industry Disruption

Traditionally, users needed separate banks, brokers, lenders, and insurance providers to manage their finances. SoFi broke that cycle by integrating everything into one ecosystem.

Its move from a loan-refinancing company to a fully licensed bank turned it into one of the first true all-in-one finance super apps in the U.S.

SoFi’s model pressured traditional banks to modernize, expand digital capabilities, and reduce fees — accelerating innovation across the entire finance industry.

Market Statistics and Growth

As of 2025:

- SoFi serves millions of active members

- Revenue continues rising year-over-year

- SoFi Bank holds billions in deposits

- SoFi Invest processes millions of trades monthly

The U.S. digital banking market is projected to reach $180+ billion by 2030, with SoFi positioned as a major leader.

User Demographics and Behavior

SoFi appeals mostly to:

- Young professionals

- Students and recent graduates

- Working families

- Crypto-curious users

- Investors seeking convenience

- Borrowers looking for lower rates

Many users make SoFi their primary banking and investment app due to its simplicity and high APY.

Geographic Presence

SoFi operates primarily in the United States but has expansion plans through partnerships and investment services. Its digital-first model makes scaling into new regions faster than traditional banking.

Future Projections

By 2030, SoFi aims to:

- Add mortgage marketplace expansions

- Integrate advanced AI budgeting and coaching

- Offer more alternative investments

- Expand crypto and digital asset services

- Become a global all-in-one financial super app

Opportunities for Entrepreneurs

SoFi’s success proves that users want a unified digital solution for banking, investing, and borrowing.

This creates massive opportunities for startups to build niche super apps focused on:

- Investing

- Loans

- Banking

- Crypto

- Financial planning

With SoFi Clone Script, entrepreneurs can build a fully-featured finance super app with banking, investing, loans, and automation.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Building Your Own SoFi-Like Platform

SoFi’s success shows that people want a simple, unified way to handle all their financial needs. By merging banking, lending, investing, and financial planning into one smooth experience, SoFi built a model that many startups and fintech founders now aim to replicate.

Why Businesses Want SoFi Clones

A SoFi-style platform allows companies to offer:

- Unified banking + investing + credit + insurance

- Automated financial insights

- Low-cost digital banking with high APY

- Smart investing tools

- Fast loan approvals

- Modern budgeting and credit-tracking tools

This appeals to users looking for convenience, simplicity, and full control over their finances from a single app.

Key Considerations for Development

To build a SoFi-like financial super app, focus on:

- Banking compliance and licensing

- Secure KYC and identity verification

- Robust fraud detection systems

- Modern UI/UX with real-time feedback

- API-driven integrations for investments and insurance

- Automated investing and credit-score tools

- Scalable cloud-native backend architecture

Cost Factors & Pricing Breakdown

SoFi-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Neobank (MVP Money App) | Digital account creation, KYC onboarding, basic savings wallet, simple money transfers, bill payments, transaction history, basic budgeting views, notifications, admin panel for user & limits management, web dashboard with mobile-responsive experience | $90,000 |

| 2. Mid-Level SoFi-Style Finance Platform | Multi-account support (cash, savings-style wallets), loan application & basic underwriting flows, integrations with payment gateways/banks, richer budgeting & insights, rewards/points layer, stronger security & audit logs, full web + mobile apps, role-based admin & operations tools | $160,000 |

| 3. Advanced SoFi-Level Financial Super App | Multi-product suite (cash management, loans, credit, investing hooks), advanced scoring & risk rules, card management, partner integrations (banks, NBFCs, brokers), detailed analytics & reporting, regulatory/compliance workflows, multi-region readiness, cloud-native, scalable microservices | $260,000+ |

SoFi-Style Money App Development

The prices above reflect the global market cost of developing a SoFi-like digital banking and multi-product finance platform — typically ranging from $90,000 to over $260,000, with a delivery timeline of around 4–12 months depending on the number of financial products (loans, cards, investing, etc.), risk & compliance requirements, third-party integrations, and scalability targets.

Miracuves Pricing for a SoFi-Like Custom Platform

Miracuves Price: Starts at $15,999

This starting price is positioned for a feature-rich, JS-based SoFi-style money app that can include digital account onboarding and KYC, cash/savings-style wallets, money transfers, loan enquiry/application flows, basic credit/risk rules, budgeting views, notifications, and modern web + mobile apps—while leaving room to extend into cards, investing modules, advanced analytics, and additional financial products as your business grows.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational financial app ecosystem ready for launch and future expansion.

Delivery Timeline for a SoFi-Like Platform with Miracuves

For a SoFi-style, JS-based custom build, the typical delivery timeline with Miracuves is approximately 30–90 days, depending on:

- The mix of financial products you plan to offer (cash, loans, cards, investing, etc.)

- Number and complexity of integrations (banks/NBFCs, payment gateways, KYC/AML providers, bureaus)

- Depth of analytics, dashboards, and compliance/reporting workflows

- Scope of mobile apps, branding requirements, and long-term scalability expectations

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

- Digital checking & savings

- High-yield interest structure

- Stocks, ETFs & crypto trading

- Personal loans & refinancing

- Financial planning dashboard

- Credit score tracking

- Robo-advisory investing

- Insurance marketplace

- Rewards & cashback

- Multi-layer security & fraud protection

Read More :- Read the complete guide on fintech app development costs

Conclusion

SoFi has transformed how people manage money by bringing banking, investing, loans, credit monitoring, and insurance into one unified ecosystem. Its customer-focused approach, low fees, real-time automation, and strong technology foundation make it one of the most influential finance apps in the United States.

In 2025, SoFi continues to grow as more users shift away from fragmented financial tools toward unified platforms that save time, reduce stress, and improve long-term financial health. Its success proves that modern finance isn’t just about convenience — it’s about clarity, control, and accessibility.

For founders and fintech startups, SoFi’s journey is a powerful blueprint. The opportunity to build niche or full-scale finance super apps has never been greater. And with the right technology, regulation strategy, and platform architecture, it’s completely achievable.

Take the first step today and build a SoFi-inspired product that empowers users and drives financial innovation.

A well-executed idea can become a scalable business with the right support — and Miracuves can help you make it a reality.

FAQs :-

How does SoFi make money?

SoFi earns through lending interest (its biggest revenue source), banking spreads, investment fees, crypto trading spreads, credit card interchange, and commissions from insurance partners. It also generates revenue from SoFi at Work and premium services.

Is SoFi a real bank?

Yes. SoFi operates as a fully licensed U.S. bank under SoFi Bank, N.A. This allows it to offer FDIC-insured accounts, higher APY savings, and streamlined lending products.

How much does SoFi charge in fees?

Most SoFi services have no monthly fees. Banking is fee-free, stock trading is commission-free, and automated investing has no advisory fees. Some services (like crypto trades) include small spreads.

Does SoFi offer loans?

Yes. SoFi is well known for personal loans, student loan refinancing, home loans, and auto loan refinancing — all offered with fast approvals and competitive interest rates.

Is SoFi safe to use?

Yes. SoFi uses encryption, biometric authentication, AI-powered fraud monitoring, and follows strict banking regulations. Deposits are FDIC-insured up to $250,000.

Can I use SoFi outside the U.S.?

Currently, SoFi primarily operates within the United States, though some investment tools are accessible globally.

What makes SoFi different from traditional banks?

SoFi combines banking, loans, investing, credit monitoring, and insurance into a single app — offering a full financial ecosystem rather than one isolated service.

How many users does SoFi have?

As of 2025, SoFi serves millions of active members across the U.S., with rapid year-over-year growth driven by its banking, investing, and lending ecosystem.

What technology powers SoFi?

SoFi is built using cloud-native architecture on AWS, with microservices, real-time processing, Java/Python/Go backend, React/React Native apps, and advanced ML models for risk and personalization.

Can I build an app like SoFi?

Yes. With SoFi Clone Script, you can build a fully featured finance super app — with banking, investing, loans, and credit insights — launched and completely customizable.

Related Articles :-