Imagine wanting to invest but feeling that the stock market is only for experts with large amounts of money. You’re unsure where to start, what to buy, or how much to invest—and that hesitation keeps you from growing your wealth. That’s the exact gap Stash was designed to fill.

Stash is a beginner-friendly investing and financial wellness app that helps users start investing with small amounts, learn as they go, and build long-term habits around saving and wealth creation. Instead of overwhelming users with complex trading tools, Stash focuses on education, simplicity, and guided investing.

By the end of this guide, you’ll understand what Stash is, how it works, its business model, core features, and the technology behind it—plus why many founders are interested in building Stash-like investing platforms and how Miracuves can help make that happen.

What Is Stash? The Simple Explanation

Stash is a personal investing and financial wellness app that helps people start investing with small amounts of money while learning the basics of saving, investing, and long-term wealth building. It’s designed for beginners who want guidance rather than complex trading screens.

The Core Problem Stash Solves

Many people avoid investing because it feels risky, confusing, or expensive. Stash removes these barriers by allowing fractional investing, offering educational guidance, and encouraging consistent, habit-based investing instead of short-term trading.

Target Users and Use Cases

Stash is commonly used by:

• First-time investors with limited capital

• Young professionals building long-term wealth

• Users who prefer guided investing over active trading

• People looking to combine investing, saving, and banking in one app

• Anyone who wants financial education alongside investing

Current Market Position

Stash is positioned as a beginner-first investing platform in the U.S. It competes with robo-advisors and micro-investing apps but differentiates itself through education-driven investing and a subscription-based model rather than commission-based trading.

Why It Became Successful

Stash gained traction because it made investing feel approachable. By combining small investment amounts, clear explanations, and long-term mindset tools, it helped users take their first step into investing without fear.

How Stash Works — Step-by-Step Breakdown

For Users (Investors & Savers)

Account Creation

Users sign up in the Stash app using their email and basic personal details. Identity verification is completed as part of standard financial compliance. Once verified, users can link a bank account to start funding their Stash account.

Choosing an Investment Style

Stash guides users to choose how they want to invest—based on interests, goals, and risk comfort. Instead of overwhelming charts, Stash explains investments in simple language (for example, technology companies, clean energy, or broad market funds).

Fractional Investing

Users can invest small amounts of money by purchasing fractional shares of stocks and ETFs. This means they don’t need to buy a full share to get started, making investing accessible even with limited funds.

Automated & Recurring Investing

Stash encourages habit-building by allowing users to:

- Set recurring investments (weekly or monthly)

- Automatically invest spare cash

- Build portfolios gradually over time

This removes the pressure of timing the market.

Education Along the Way

Each investment comes with easy-to-understand explanations about:

- What the company or fund does

- Risk level

- Why it might fit a long-term strategy

Learning happens naturally as users invest.

Saving & Banking Features

Stash also offers savings and banking-style features such as:

- A spending account

- Automatic savings tools

- Cash-back rewards that can be invested

This creates a single ecosystem for spending, saving, and investing.

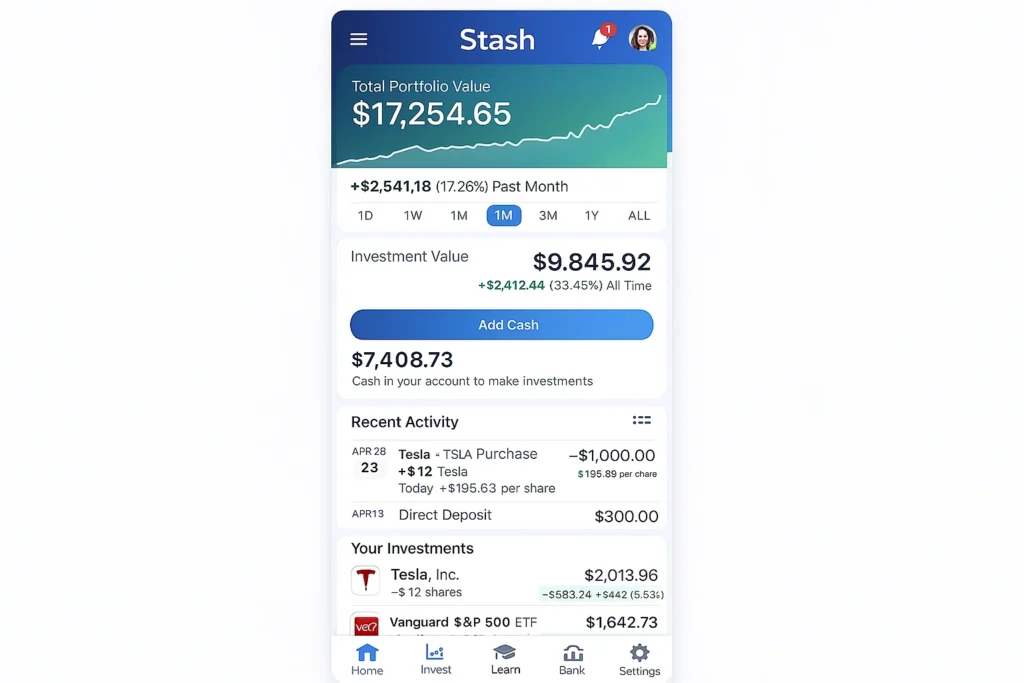

Example User Journey

A user signs up → links their bank account → selects a few beginner-friendly ETFs → invests a small amount → sets recurring investments → reads educational insights → watches their portfolio grow over time.

For Financial Institutions (Behind the Scenes)

Stash partners with regulated financial institutions to handle:

- Brokerage services

- Custody of investments

- Banking and cash accounts

- Compliance and reporting

Stash focuses on user experience and education while licensed partners handle execution and custody.

Technical Overview (Simplified)

Stash operates using:

- Secure APIs for brokerage and banking services

- Fractional share trading systems

- Automated investment scheduling

- Educational content engines tied to user portfolios

- Encrypted cloud infrastructure for account and transaction data

The platform is designed to keep investing simple, guided, and safe for beginners.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Stash’s Business Model Explained

How Stash Makes Money

Stash follows a subscription-based model instead of charging per trade. This aligns the platform with long-term investing habits rather than frequent trading. Its main revenue streams include:

- Monthly subscription fees for access to investing, banking, and education tools

- Interchange revenue from debit card usage on Stash’s spending account

- Partner services via regulated brokerage and banking providers

This model keeps investing simple and predictable for users, without trading commissions.

Pricing Structure

Stash typically offers tiered plans that include:

- Access to fractional investing in stocks and ETFs

- Recurring and automated investments

- Educational content and guidance

- Banking features like a spending account and debit card

Higher tiers may include additional features such as custodial accounts for kids or enhanced financial tools.

Commission / Fee Breakdown

- No per-trade commissions for buying or selling investments

- Monthly subscription fee paid by users

- Indirect revenue from card transactions and partner integrations

This approach removes friction and encourages consistent, long-term investing behavior.

Market Size and Growth

The U.S. retail investing market includes tens of millions of beginner and casual investors. As financial literacy becomes more important and younger users prefer app-based investing, platforms like Stash sit at the intersection of education, fintech, and wealth building.

Profitability Insights

Stash benefits from:

- Predictable recurring revenue

- High user lifetime value from long-term subscribers

- Lower churn when users build habits through recurring investments

- Multiple revenue streams beyond investing alone

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Subscriptions | Monthly access to platform features | Users | Recurring |

| Interchange | Revenue from debit card usage | Payment networks | Transactional |

| Partner Services | Brokerage & banking integrations | Partners | Contract-based |

Key Features That Make Stash Successful

Fractional Investing

Stash allows users to invest with very small amounts by buying fractions of stocks and ETFs. This lowers the entry barrier and helps beginners start investing without needing large sums of money.

Guided Investment Choices

Instead of complex tickers and charts, Stash presents investments through themes and plain-language explanations. Users understand what they’re investing in and why it matters, which builds confidence.

Recurring & Automated Investing

Stash encourages consistency through automation. Users can set weekly or monthly investments so wealth builds gradually without needing to time the market.

Financial Education Built In

Every investment comes with educational content explaining risk, purpose, and long-term impact. Learning happens naturally alongside investing, not as a separate course.

All-in-One Financial App

Stash combines:

- Investing

- Saving

- Spending

- Banking-style features

This creates a single ecosystem where users manage money holistically instead of across multiple apps.

Stash Spending Account

Users get a debit card and spending account. Cash-back rewards earned from spending can be automatically invested, turning everyday purchases into investment opportunities.

Goal-Based Investing

Users can invest toward specific goals like long-term wealth, emergencies, or future plans. This emotional connection makes investing feel purposeful rather than abstract.

Custodial Accounts for Kids

Stash offers custodial investing accounts that allow parents to invest on behalf of children, helping families introduce financial literacy early.

Clean, Beginner-Friendly UI

The interface is designed for clarity, not speed trading. Simple visuals, progress indicators, and explanations reduce anxiety for first-time investors.

Focus on Long-Term Behavior

Stash intentionally avoids features that promote day trading or speculation. The platform is built around patience, education, and habit formation.

The Technology Behind Stash

Tech Stack Overview (Simplified)

Stash works like a “guided investing layer” on top of regulated financial infrastructure. The app focuses on user experience (education, portfolio building, recurring investing), while core brokerage and custody functions are handled through its custodial partner Apex Clearing.

At a high level, the platform includes:

- Mobile apps + web experience for onboarding, investing, learning, and account management

- Secure backend services for user profiles, portfolios, recurring schedules, and notifications

- Brokerage/custody rails via Apex Clearing for account holding and trade processing

Real-Time Features Explained

Fractional investing execution

Stash supports fractional investing (pieces of stocks/ETFs), which means the system needs accurate order handling, portfolio accounting, and confirmations—especially when users invest small amounts regularly.

Recurring investing automation

The app schedules recurring investments, triggers funding, places orders, and updates portfolio balances—all without the user doing anything beyond setting rules.

Stock-Back rewards flow

For Stash’s debit experience, purchases can generate stock rewards (“Stock-Back”), which requires linking card transactions to reward logic and then allocating fractional stock rewards to the user.

Data Handling and Security

Stash emphasizes “bank-grade” security practices including 256-bit encryption, and it also offers two-factor authentication for active debit account customers.

This matters because the platform is handling identity data, bank links, card activity, and investment account information—so security controls have to be strong and consistent across devices.

Scalability Approach

Stash needs to handle:

- High-frequency transaction syncing (banking + investing activity)

- Notification spikes (alerts, confirmations, recurring investment events)

- Sudden traffic surges (market volatility periods, promotional campaigns)

In practice, fintech apps like Stash typically rely on cloud infrastructure and modular backend services so investing, rewards, and banking features can scale without slowing the app experience.

Mobile App vs Web Platform

- Mobile app: Primary experience for beginners—guided investing, recurring schedules, Stock-Back rewards tracking, and quick account actions.

- Web: Helpful for deeper viewing—account details, documents, and broader portfolio review.

API Integrations

Stash relies on integrations for:

- Brokerage/custody operations via Apex Clearing

- Card and rewards systems for Stock-Back debit functionality

- Subscription management (Stash has clear subscription plan logic and billing)

Why This Tech Matters for Business

Stash’s advantage isn’t “complex trading tech”—it’s the ability to combine:

- A beginner-friendly product layer (education + guidance)

- Reliable regulated rails (custody/clearing)

- Trust and security (encryption + 2FA for debit accounts)

- Habit-building automation (recurring investing + rewards)

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Stash’s Impact & Market Opportunity

Industry Disruption

Stash helped make investing feel approachable for people who were intimidated by traditional broker platforms. Instead of focusing on “fast trading,” it focused on “start small, learn, and build habits.” That shift supported the broader movement toward micro-investing, fractional shares, and education-led fintech—where the product is designed to reduce fear, not increase speculation.

Market Statistics & Growth

Retail investing has expanded massively as mobile-first finance becomes normal. More users want:

- Fractional investing instead of large minimums

- Automated recurring investing instead of timing the market

- Education and guidance built into the product

- All-in-one apps combining spending + saving + investing

Stash sits right in that intersection. Its subscription-based approach also reflects a broader fintech trend: users are willing to pay for clarity, convenience, and better financial habits if the experience feels truly supportive.

User Demographics & Behavior

Stash typically attracts:

- First-time investors and beginners

- Younger professionals building long-term wealth

- Users who prefer guided investing over self-directed trading

- People who want small, consistent investing habits

- Families using custodial accounts to invest for kids

These users often engage weekly through recurring investing, checking their portfolio, reading short educational insights, and tracking rewards from spending.

Geographic Presence

Stash is primarily U.S.-focused because its banking, brokerage, and regulatory infrastructure is built around U.S. institutions and compliance requirements.

Future Projections

The next wave of wealth apps is moving toward:

- More personalized investing guidance

- Better automation and goal-based planning

- Deeper financial wellness coaching

- “Invest from everyday life” experiences (cashback → investing)

- Stronger trust, security, and compliance systems

Stash’s model aligns well with these trends, especially as consumers seek long-term wealth tools rather than speculative trading experiences.

Opportunities for Entrepreneurs

There’s big room to build Stash-like platforms for niches such as:

- Students and first-job earners

- Gig workers and freelancers with irregular income

- Family wealth apps (parents + kids)

- Faith-based or values-based investing communities

- Region-specific investing + education platforms

This massive success is why many entrepreneurs want to create Stash-like apps that blend fractional investing, education, recurring automation, and user trust into one simple product.

Building Your Own Stash-Like Platform

Why Businesses Want Stash-Style Investing Apps

Stash shows that a huge market exists for investing products that feel friendly, guided, and habit-driven. Founders like this model because it:

- Targets beginners (a large, expanding audience)

- Encourages recurring investing (stable engagement)

- Supports predictable subscription revenue

- Adds additional monetization through spending/rewards flows

- Builds trust through education-first UX

Key Considerations Before You Start Development

To build a Stash-like app, you’ll want to define:

- Target user: beginners, students, families, gig workers, niche communities

- Product approach: guided investing, goal-based investing, or robo-style portfolios

- Regulated rails: brokerage/custody partner, KYC/AML compliance, reporting

- Fractional investing support and order execution flow

- Subscription tiers and feature gating

- Banking layer: optional debit/spending account, rewards-to-investing logic

- Security: encryption, 2FA, fraud monitoring

Cost Factors & Pricing Breakdown

Stash-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Micro-Investing MVP | Core mobile/web app for user onboarding, basic KYC, linking a single funding source, simple recurring investments into a limited set of ETFs or portfolios, balance & holdings view, basic transaction history, standard admin panel | $70,000 |

| Mid-Level Investing & Banking Platform | Multi-portfolio support, fractional shares, recurring & one-time buys, goal-based investing, improved KYC/AML flows (via your providers), basic debit card integration (via issuer partner), richer portfolio analytics, notifications & insights, polished mobile-first UX (web + apps) | $150,000 |

| Advanced Stash-Level Wealth & Banking Ecosystem | Full micro-investing and banking suite with multiple account types, automated portfolios, advanced goal & rules engine, cash/debit accounts, rewards, deep integrations with issuers and data aggregators, sophisticated analytics & recommendations, A/B testing, cloud-native scalable architecture | $250,000+ |

Stash-Style Investing & Banking App Development

The prices above reflect the global market cost of developing a Stash-like micro-investing and digital banking platform — typically ranging from $70,000 to over $250,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes secure onboarding and KYC, funding and investment flows, portfolio and balance views, analytics, issuer and data-provider integrations, and production-grade mobile apps.

Miracuves Pricing for a Stash-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, JS-based Stash-style investing and banking platform that covers secure onboarding and KYC (via your providers), recurring and one-time investments into curated portfolios, holdings and performance views, goal-based investing, core analytics & insights, notifications, and a modern web dashboard plus mobile apps. From this foundation, the solution can be extended into debit/cash accounts, rewards, deeper issuer and banking integrations, and more advanced recommendation engines as your fintech product scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational investing and banking ecosystem ready for launch and future expansion.

Delivery Timeline for a Stash-Like Platform with Miracuves

For a Stash-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of investing features (portfolios, rules, goals, fractional shares, etc.)

- Number and complexity of banking, issuer, and data-aggregator integrations

- Complexity of analytics dashboards, insights, and recommendation logic

- Scope of web portal, mobile apps, branding requirements, and long-term scalability plans

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

A strong Stash-style MVP should include:

- User onboarding + identity verification

- Funding via bank link

- Fractional stock/ETF investing

- Recurring investments (weekly/monthly)

- Educational content tied to investing choices

- Goal tracking and portfolio dashboard

- Notifications and confirmations

- Admin panel for users, compliance checks, and support

Optional add-ons (high impact):

- Debit/spending account + rewards-to-invest flow

- Custodial accounts for kids

- Themed portfolios (values-based, sector-based)

- Micro-savings automation

- In-app financial coaching

Read More :- Read the complete guide on fintech app development costs

Conclusion

Stash proves that investing doesn’t need to be intimidating to be effective. By focusing on education, small starting amounts, and habit-based investing, it helps users build confidence and long-term wealth without the pressure of market timing or complex trading tools. Its success highlights the power of combining simplicity with guidance in financial products.

For entrepreneurs, Stash offers a clear lesson: when you lower entry barriers and teach users as they grow, you don’t just create an app—you build lasting financial habits. Platforms that prioritize trust, learning, and consistency are well-positioned to win in the evolving wealth-tech space.

FAQs :-

How does Stash make money?

Stash earns revenue mainly through monthly subscription fees. It also generates income from interchange fees on debit card usage and partnerships with regulated brokerage and banking providers.

Is Stash free to use?

No. Stash uses a subscription model. Users pay a monthly fee to access investing, saving, banking, and educational features. There are no per-trade commissions.

Can beginners use Stash?

Yes. Stash is designed specifically for beginners. It uses simple language, guided investing, and educational content to help users learn while they invest.

What can I invest in using Stash?

Users can invest in fractional shares of stocks and ETFs, including themed investments that align with personal interests or long-term goals.

Does Stash allow recurring investments?

Yes. Stash strongly encourages recurring investing. Users can automate weekly or monthly investments to build consistent habits.

Is Stash safe and secure?

Stash uses bank-grade encryption, secure authentication, and works with regulated brokerage and banking partners to protect user funds and data.

Is Stash available outside the USA?

Stash is primarily available in the United States due to its brokerage and banking infrastructure and regulatory requirements.

Does Stash support custodial accounts for kids?

Yes. Stash offers custodial investing accounts that allow parents to invest on behalf of their children.

What makes Stash different from trading apps?

Stash focuses on long-term investing and education, not active trading or speculation. There are no advanced trading tools or market-timing features.

Can I build an app like Stash?

Yes. Many entrepreneurs build Stash-like platforms that focus on beginner investing, education, and recurring automation for specific user segments.

How can Miracuves help build a Stash-like platform?

Miracuves helps founders launch Stash-style investing apps in 30-90 days, with guided investing flows, subscription management, brokerage-ready architecture, and full customization options for different markets.