Imagine payday hits… and instead of wondering “where did my money go?”, you already know exactly what every dollar is for—rent, groceries, EMIs, travel, even that friend’s wedding gift next month. That’s the mindset YNAB is designed to create: calm, intentional spending.

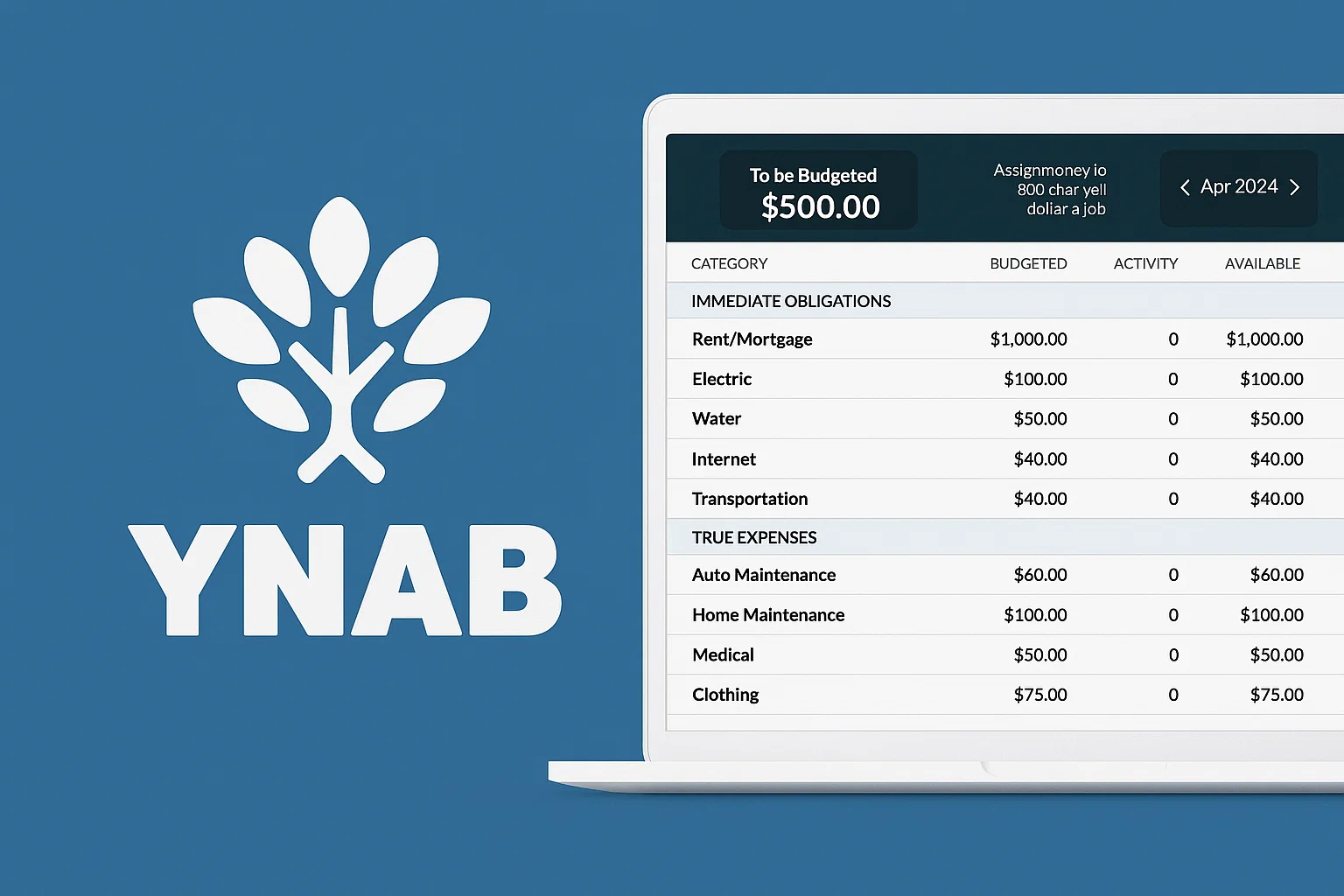

YNAB (short for “You Need A Budget”) started as a budgeting system created by founder Jesse Mecham and later became a popular web + mobile budgeting app built around zero-based budgeting (giving every dollar a job). Today, it’s known for its hands-on approach, strong community, and a method that focuses on priorities—not guilt. YNAB also shares outcomes like reduced money stress and average savings claims as part of its positioning.

By the end of this guide, you’ll understand what YNAB is, how it works step-by-step, what it costs, the key features that make it different, and what the technology behind a YNAB-like app looks like—plus how Miracuves can help you build a similar budgeting platform for your market.

What Is YNAB? The Simple Explanation

YNAB (You Need A Budget) is a personal budgeting app and money management system built around one clear idea: every dollar you earn should be assigned a specific job before you spend it. Instead of tracking expenses after the fact, YNAB helps users plan their money in advance so spending aligns with real priorities.

The Core Problem YNAB Solves

Many people earn enough but still feel broke because money decisions are reactive. Bills, unexpected expenses, and impulse spending take over. YNAB fixes this by shifting users from tracking what already happened to deciding what money should do next.

Target Users and Use Cases

YNAB is popular with:

• Individuals living paycheck to paycheck who want control

• Families managing multiple expenses and goals

• People paying off debt (credit cards, loans, EMIs)

• Users who want intentional spending, not restrictions

• Anyone serious about long-term financial clarity

Current Market Position

YNAB is one of the most respected paid budgeting platforms in the U.S. It stands out not just as an app, but as a methodology-driven product, with strong user loyalty, an active community, and deep educational content.

Why It Became Successful

YNAB succeeded because it doesn’t just show numbers—it changes behavior. Its rule-based approach, clear philosophy, and focus on education help users build sustainable money habits instead of relying on automation alone.

How YNAB Works — Step-by-Step Breakdown

For Users (Budgeters)

Account Setup

Users create an account on the YNAB web app or mobile app. During onboarding, YNAB explains its core philosophy and guides users to set up their first budget instead of just linking accounts and waiting for data.

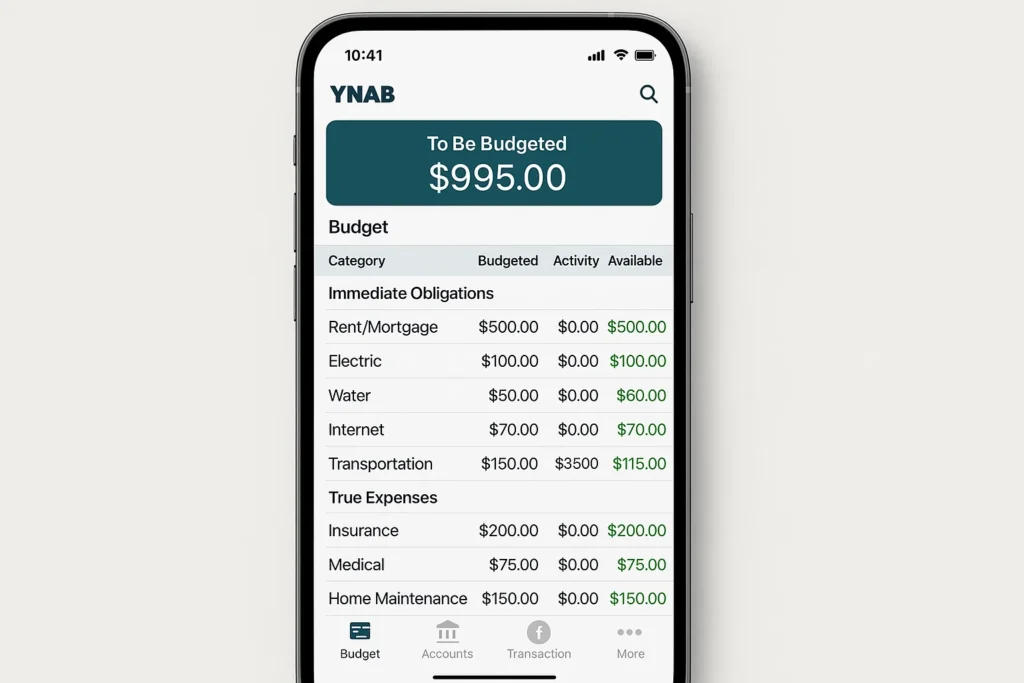

Give Every Dollar a Job

When income arrives (salary, freelance payment, bonus), users manually assign that money to categories such as rent, groceries, utilities, savings, travel, or debt payments. This is called zero-based budgeting—money is planned before it’s spent.

Spending & Transaction Tracking

YNAB supports both:

- Manual entry (highly encouraged to build awareness)

- Bank syncing (optional, for convenience)

As spending happens, transactions are matched against budget categories, so users immediately see how each purchase affects their plan.

Rolling With the Punches

If users overspend in one category, YNAB encourages moving money from another category instead of ignoring the problem. This keeps the budget realistic and flexible rather than rigid.

Aging Your Money

One of YNAB’s core goals is to help users spend money earned in previous months, not today’s paycheck. Over time, users build a buffer so they’re no longer living paycheck to paycheck.

Example User Journey

A user receives their salary → assigns money to rent, food, savings, and debt → spends on groceries → sees remaining grocery balance drop → adjusts another category if needed → slowly builds a surplus month over month.

For Financial Institutions (Indirect Role)

YNAB is not a marketplace or bank. Financial institutions are involved only through optional bank sync integrations that import transactions. YNAB does not sell financial products or push ads.

Technical Overview (Simplified)

YNAB works through a combination of intentional design and technology:

- Budget logic engine enforcing zero-based budgeting rules

- Optional secure bank-sync APIs for transaction import

- Real-time category balance updates across devices

- Cloud-based data storage for budgets and history

- Offline-friendly mobile apps with sync-on-connect behavior

The system is designed to support decision-making, not passive tracking.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

YNAB’s Business Model Explained

How YNAB Makes Money

YNAB operates on a subscription-based SaaS model. Unlike free budgeting apps that rely on ads or affiliate links, YNAB earns revenue directly from users who pay for access to the platform and its education resources.

Its revenue comes from:

- Monthly subscriptions

- Annual subscriptions (at a discounted rate)

This direct-payment model aligns YNAB’s incentives with user success—if users don’t find value, they cancel.

Pricing Structure

YNAB follows a simple, transparent pricing model:

- One subscription gives access to all features

- No ads, no sponsored financial products

- Web app + mobile apps included

- Sync across all devices

New users typically get a free trial before committing, allowing them to experience the method before paying.

Why YNAB Avoids Ads and Affiliate Commissions

YNAB deliberately avoids monetizing through:

- Credit card promotions

- Loan referrals

- Bank product ads

This keeps the platform focused on behavior change and clarity, not selling financial products. It also builds strong trust with users who want unbiased budgeting guidance.

Market Position and Demand

Paid budgeting apps serve a smaller but more committed audience compared to free tools. YNAB’s users tend to stay subscribed longer because the app becomes part of their daily decision-making routine.

The demand for structured, intentional budgeting remains strong among users who want control, not just tracking.

Profit Margin Insights

YNAB benefits from:

- Predictable recurring revenue

- Low marginal cost per additional user

- High retention driven by habit formation

- Strong brand loyalty and word-of-mouth growth

Because there’s no underwriting, inventory, or transaction risk, the model scales efficiently as the user base grows.

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Subscriptions | Monthly or annual access to YNAB | Users | Recurring |

| Education Value | Included workshops and guides | Users | Value-added |

| Community & Support | Forums, content, coaching | Users | Retention driver |

Key Features That Make YNAB Successful

Zero-Based Budgeting System

YNAB’s core feature is its budgeting method. Users assign every dollar a job before spending, which creates intentional decisions instead of reactive tracking.

Flexible Category Management

Users create custom categories for their real life—rent, groceries, subscriptions, vacations, sinking funds, or debt payoff. Categories can be adjusted anytime without “breaking” the budget.

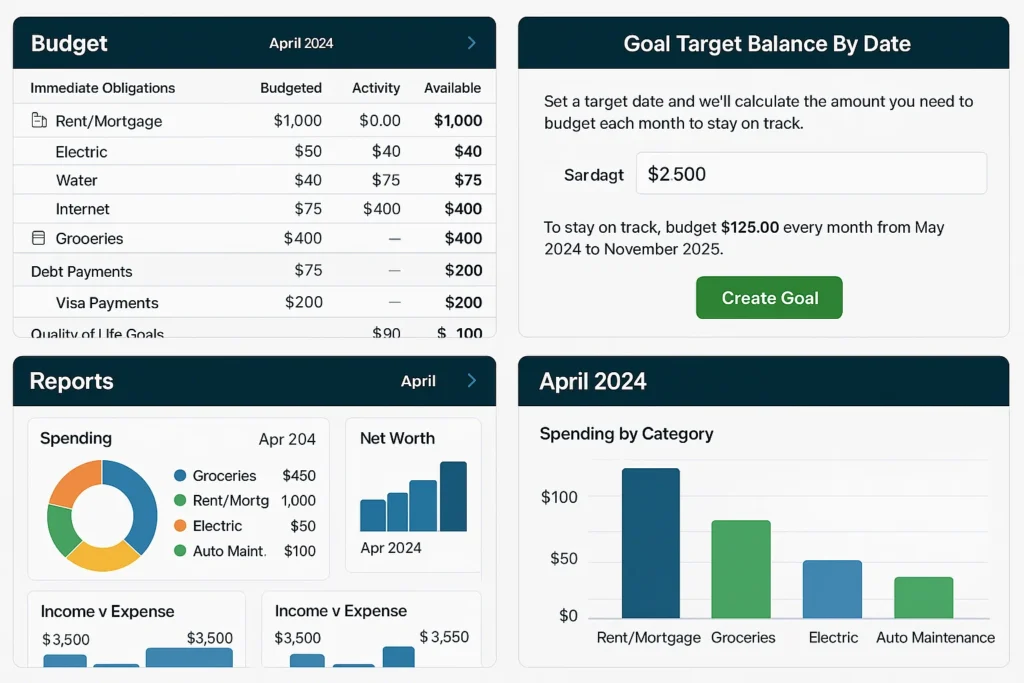

Real-Time Category Balances

Every transaction immediately affects the available balance in its category. This makes spending decisions clear at the moment of purchase.

Manual Entry with Smart Matching

YNAB encourages manual transaction entry to build awareness. When bank syncing is enabled, YNAB automatically matches imported transactions to manual entries, keeping records clean.

Roll-With-The-Punches Rule

Overspending isn’t treated as failure. YNAB lets users move money between categories so budgets stay realistic and adaptable.

Age of Money Metric

This feature shows how long money sits in the budget before being spent. As the number increases, users gain financial breathing room and stability.

Goal Tracking

Users can set goals for savings, debt payoff, or large expenses. YNAB automatically shows how much to allocate each month to stay on track.

Reports and Insights

YNAB offers clean reports for spending trends, income vs expenses, and net worth—focused on understanding behavior rather than flashy charts.

Cross-Device Sync

Budgets sync instantly across web, mobile, and tablet, so users always see up-to-date balances.

Education and Community

YNAB includes tutorials, live workshops, guides, and a strong community that helps users understand not just the app, but the mindset behind it

Read More :- Read the complete guide on fintech app development costs

The Technology Behind YNAB

Tech Stack Overview (Simplified)

YNAB is built as a cloud-based SaaS platform with web and mobile applications designed for speed, reliability, and real-time syncing. The core focus of its technology is not heavy automation, but accuracy, consistency, and user intent.

At a high level, YNAB uses:

- Web applications for detailed budget planning and reports

- Mobile apps for daily spending and quick adjustments

- A centralized cloud backend to store budgets and transaction history

- Sync services to keep data consistent across devices

Real-Time Budget Engine

At the heart of YNAB is its budget logic engine. Every action—assigning money, recording a transaction, or moving funds between categories—updates category balances instantly. This ensures users always see an accurate picture of what they can spend.

Unlike passive tracking apps, YNAB’s engine enforces rules like:

- You can’t spend money you haven’t assigned

- Overspending must be covered from another category

- Income must be given jobs before being spent

Bank Sync and Data Imports

YNAB supports optional bank synchronization through secure financial data aggregators. When enabled:

- Transactions are imported automatically

- Duplicate entries are matched intelligently

- Users can still edit, approve, or reject entries

Manual entry remains a first-class feature, which reduces dependency on automation and increases financial awareness.

Data Handling and Privacy

YNAB takes a conservative approach to data use:

- End-to-end encryption for data in transit and at rest

- Secure authentication and session management

- Minimal data collection beyond what’s needed for budgeting

- No selling of user data or behavioral insights

Because YNAB’s revenue comes from subscriptions, not ads, user privacy is a core design principle.

Scalability and Reliability

YNAB’s infrastructure is designed to support millions of budgets without performance issues. Cloud scaling ensures:

- Fast sync times across devices

- High availability for users budgeting daily

- Smooth handling of peak usage times

The system prioritizes correctness and reliability over flashy features.

Mobile App vs Web Platform

- Mobile apps: Optimized for quick transaction entry, category checks, and on-the-go decisions. Offline-first design lets users record spending even without connectivity.

- Web app: Ideal for planning, assigning income, adjusting categories, and reviewing reports in detail.

Both platforms sync seamlessly so users can move between them effortlessly.

API Integrations

YNAB’s integrations are intentionally limited and focused:

- Secure bank data providers for transaction imports

- Notification services for reminders and alerts

- Internal APIs for syncing and reporting

This focused integration strategy keeps the platform stable and easy to maintain.

Why This Tech Matters

YNAB’s technology supports behavior change, not just automation. By keeping the system simple, fast, and reliable, the app stays out of the way while users build better money habits.

For entrepreneurs, YNAB shows that powerful fintech products don’t always need complex monetization or heavy AI—sometimes, the real value is in rock-solid logic, trust, and clarity.

YNAB’s Impact & Market Opportunity

Industry Disruption

YNAB didn’t just create another budgeting app—it reshaped how people think about money. Instead of tracking expenses after they happen, YNAB taught users to plan spending before it happens. This mindset shift moved budgeting from reactive to proactive and influenced many modern finance tools to adopt goal-based and envelope-style budgeting concepts.

Market Statistics & Growth

Personal finance and budgeting apps serve a growing audience as consumers look for better control over spending, debt, and savings. Within this space, YNAB occupies a premium niche: users who are willing to pay for structure, education, and long-term financial clarity rather than free, ad-supported tools.

The rise of subscription-based fintech products shows that users value trust, privacy, and outcomes over “free” tools that push financial products.

User Demographics & Behavior

YNAB users typically include:

- Individuals actively working to escape paycheck-to-paycheck cycles

- Families managing shared budgets and long-term goals

- Debt payoff focused users

- People who prefer intentional spending over automation

- Users who engage daily or weekly with their budget

These users tend to be highly engaged and loyal because YNAB becomes part of their daily decision-making.

Geographic Presence

YNAB is used primarily in the United States but has a strong international user base as well, especially in English-speaking countries where zero-based budgeting concepts are popular.

Future Projections

Demand for budgeting tools is evolving toward:

- Intentional money planning

- Financial wellness and education

- Tools that encourage long-term behavior change

- Subscription-based, ad-free finance apps

YNAB’s approach aligns well with these trends, making its model highly relevant for the future of personal finance.

Opportunities for Entrepreneurs

There is strong opportunity to build YNAB-inspired platforms that:

- Focus on specific audiences (families, freelancers, students)

- Combine budgeting with coaching or education

- Offer regional or culturally adapted budgeting methods

- Integrate wellness, debt management, or savings automation

This success is why many entrepreneurs want to build budgeting platforms centered on mindset, clarity, and habit formation rather than just expense tracking.

Building Your Own YNAB-Like Platform

Why Businesses Want YNAB-Style Budgeting Platforms

YNAB proves that people are willing to pay for budgeting tools when those tools genuinely change behavior. A YNAB-style platform appeals because it:

- Encourages intentional money decisions

- Builds strong daily or weekly user habits

- Creates high retention through mindset change

- Avoids ads and conflicted monetization

- Builds trust by focusing only on user success

For entrepreneurs, this means a subscription-first fintech model with loyal, long-term users rather than one-time engagement.

Key Considerations Before You Start Development

Before building a YNAB-like app, clarify:

- Target audience: families, freelancers, students, couples, debt-focused users

- Budgeting philosophy: zero-based, envelope, goal-based, or hybrid

- Monetization model: monthly subscription, annual plans, freemium tiers

- Level of automation: manual-first, bank-sync optional, or fully automated

- Education layer: tutorials, workshops, coaching, or in-app guidance

- Data privacy stance: ad-free vs affiliate-supported

These choices shape everything from UX to backend logic.

Cost Factors & Pricing Breakdown

YNAB-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Budgeting MVP | Core mobile/web app for adding income and expenses, manual category-based budgeting, simple “envelope” style buckets, basic reports and charts, goal amounts, user registration & login, standard admin panel | $50,000 |

| Mid-Level Personal Budget Management Platform | Bank account syncing via aggregators (where supported), automatic transaction import, improved categorisation rules, multiple budgets, shared household budgeting, recurring transactions, alerts, richer analytics dashboard, polished mobile-first UX (web + apps) | $110,000 |

| Advanced YNAB-Level Budgeting Ecosystem | Wide financial institution coverage, powerful rule-based budgeting engine, real-time sync across devices, advanced insights and coaching-style guidance, multi-currency support (where applicable), team/coach views, A/B testing and analytics stack, cloud-native scalable architecture | $200,000+ |

YNAB-Style Personal Budgeting App Development

The prices above reflect the global market cost of developing a YNAB-like personal budgeting and money management app — typically ranging from $50,000 to over $200,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually covers secure account handling, budgeting logic, data visualisations, multi-device syncing, integrations with aggregators, and production-grade mobile apps.

Miracuves Pricing for a YNAB-Like Custom Platform

Miracuves Price: Starts at $12,999

This is positioned for a feature-rich, JS-based YNAB-style budgeting platform that covers secure account linking (via your chosen data providers), category-based budgeting with rules, goals and envelopes, multi-month planning, core analytics and spending insights, notifications, and a modern web dashboard plus mobile apps for on-the-go money tracking. From this foundation, the solution can be extended into deeper insights, collaboration features for couples/families, offer integrations, and more advanced guidance engines as your user base grows.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational personal budgeting ecosystem ready for launch and future expansion.

Delivery Timeline for a YNAB-Like Platform with Miracuves

For a YNAB-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of budgeting rules, goals, and guidance features

- Number and complexity of bank/aggregator and notification integrations

- Complexity of analytics dashboards, segmentation, and automation logic

- Scope of web portal, mobile apps, branding requirements, and long-term scalability plans

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

A competitive YNAB-like app should include:

- Zero-based or rule-driven budgeting engine

- Custom budget categories

- Real-time available balances

- Manual transaction entry with optional bank sync

- Flexible money movement between categories

- Goals for savings, debt payoff, and future expenses

- Reports for spending, net worth, and trends

- Cross-device sync (web + mobile)

- Strong privacy and no ads

Advanced additions you can layer on later:

- Budget coaching or guided plans

- AI-assisted category suggestions

- Family or shared budgets

- Regional currency and tax support

- Habit and progress insights

Read More :- Read the complete guide on fintech app development costs

Conclusion

YNAB stands out because it treats budgeting as a skill to be learned, not just data to be tracked. By focusing on intention, flexibility, and habit-building, it helps users move from financial stress to confidence and control. Its success shows that people don’t just want automation—they want clarity, ownership, and a system they can trust. For anyone building in fintech, YNAB is a reminder that strong principles and simple logic can create lasting impact.

FAQs :-

How does YNAB make money?

YNAB earns revenue through paid subscriptions. Users pay monthly or annually to access the app, budgeting tools, and educational resources.

Is YNAB free to use?

YNAB offers a free trial, after which users need to subscribe. There is no permanent free tier.

Does YNAB connect to bank accounts?

Yes, YNAB supports optional bank syncing to import transactions automatically. Manual entry is also fully supported and encouraged.

What makes YNAB different from other budgeting apps?

YNAB focuses on zero-based budgeting and behavior change. It helps users plan money before spending, rather than just tracking past expenses.

Is YNAB only for people in the USA?

YNAB is popular in the U.S. but is used globally. It supports multiple currencies, though bank sync works best with U.S. institutions

Can families or couples use YNAB together?

Yes, YNAB supports shared budgets, making it suitable for couples or families managing money together.

Does YNAB show ads or promote financial products?

No. YNAB is ad-free and does not promote credit cards, loans, or other financial products.

Can I build something similar to YNAB?

Yes. Many entrepreneurs build rule-based or zero-based budgeting apps inspired by YNAB’s philosophy, often targeting specific user groups or regions.

What technology does YNAB use?

YNAB uses a cloud-based SaaS architecture with web and mobile apps, secure bank integrations, real-time sync, and a budgeting logic engine built around zero-based rules.

How can I create an app like YNAB?

You can build from scratch or launch faster using a pre-built budgeting framework. Miracuves helps entrepreneurs create YNAB-style subscription budgeting platforms in 30-90 days, with core logic, secure infrastructure, and full customization.