Imagine running all your banking—payments, cards, savings, investments, insurance, and even customer support—without ever visiting a physical branch. Everything happens inside one powerful app, available anytime, anywhere. That’s the everyday experience Tinkoff was built to deliver.

Tinkoff is a digital-first bank and financial ecosystem that operates without traditional branches. Instead of physical locations, it relies on mobile apps, online services, and courier-based card delivery. This model allowed Tinkoff to scale quickly, reduce operational costs, and focus heavily on technology, data, and customer experience.

Over time, Tinkoff evolved beyond banking into a full financial super-app, offering payments, lending, investments, insurance, lifestyle services, and business banking—all under one platform.

By the end of this guide, you’ll understand what Tinkoff is, how it works step by step, its business model, core features, and the technology behind it—plus why many fintech founders study Tinkoff when building branchless digital banks and how Miracuves can help you create a similar platform.

What Is Tinkoff? The Simple Explanation

Tinkoff is a branchless digital bank that delivers all banking and financial services through mobile and web apps. Instead of physical branches, Tinkoff relies on technology, data, and logistics (like courier-based card delivery) to serve customers efficiently.

The Core Problem Tinkoff Solves

Traditional banks are slow, expensive to operate, and heavily dependent on branches. Tinkoff removes this friction by offering fast account setup, digital-first services, and 24/7 support—without the overhead of physical locations.

Target Users and Use Cases

Tinkoff serves a wide range of users, including:

- Individuals looking for mobile-first banking

- Credit card and lending customers

- Investors and traders using in-app investment tools

- Small businesses and freelancers

- Users who want banking, payments, and lifestyle services in one app

Current Market Position

Tinkoff is one of the most well-known digital banking brands in Russia. It’s widely recognized for its strong tech culture, advanced analytics, and customer-centric design, often cited as a benchmark for digital banks globally.

Why It Became Successful

Tinkoff succeeded by combining a branchless model with powerful technology. Lower operating costs, strong personalization, fast service, and an ecosystem approach helped it attract and retain millions of users while expanding far beyond basic banking.

How Tinkoff Works — Step-by-Step Breakdown

For Individual Users (Retail Banking Customers)

Account Opening

Users sign up through the Tinkoff mobile app or website. Identity verification is completed digitally, and once approved, Tinkoff delivers physical cards to the user via courier—eliminating the need for branch visits.

Everyday Banking

Inside the app, users can:

- Manage debit and credit cards

- Make payments and transfers

- Pay utility bills and subscriptions

- Track spending with smart categorization

- Set savings goals and manage deposits

Everything is designed to be fast, intuitive, and available 24/7.

Credit & Lending

Tinkoff offers digital lending products such as:

- Credit cards with flexible limits

- Personal loans

- Installment plans

Credit decisions are largely data-driven, using user behavior and transaction history to personalize offers.

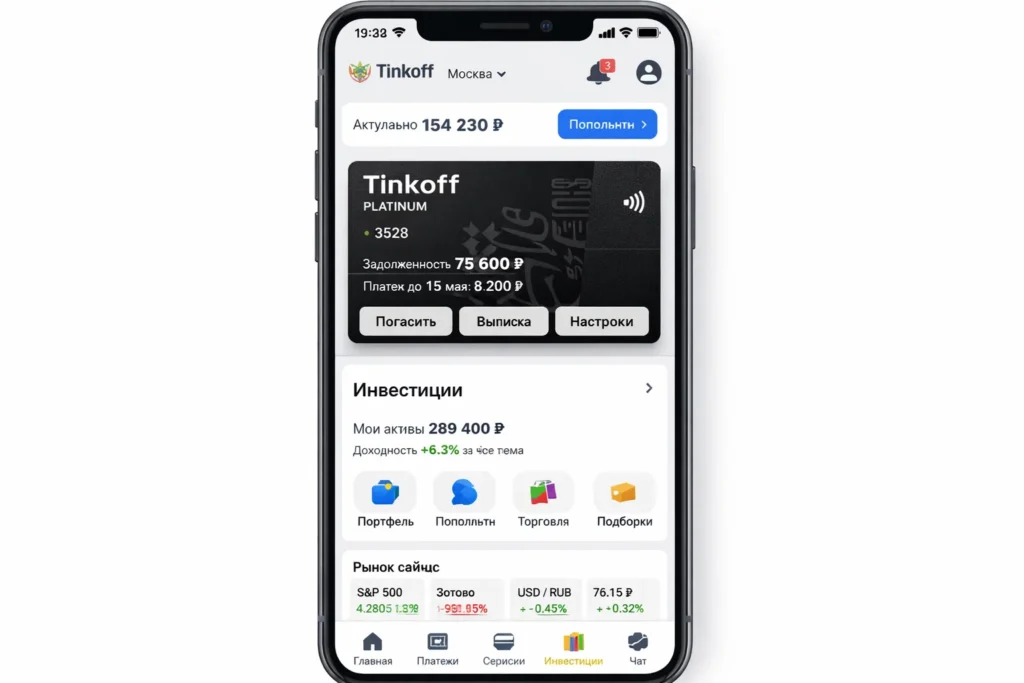

Investments & Wealth Tools

Users can invest directly from the app by accessing:

- Stocks and ETFs

- Bonds and funds

- Portfolio tracking and analytics

This turns the banking app into a complete financial hub.

Customer Support

Instead of branches, Tinkoff relies on:

- In-app chat support

- Phone and digital assistance

- AI-powered help for common queries

Support is always available and tightly integrated into the app experience.

Example User Journey

A user opens an account online → receives a card by courier → uses the app for payments and savings → gets a personalized credit offer → invests spare money → manages everything from one app.

For Businesses (SMEs & Entrepreneurs)

Business Account Setup

Small businesses can open digital accounts, manage transactions, and issue cards for employees without visiting a bank branch.

Payments & Tools

Business users get access to:

- Invoicing and payment tools

- Expense tracking

- Payroll and tax-related integrations

Technical Overview (Simplified)

Tinkoff operates on a fully digital banking stack that includes:

- Mobile and web applications as the primary interface

- Centralized banking systems for accounts and transactions

- Data-driven decision engines for credit and offers

- Secure cloud and on-prem infrastructure

- APIs connecting banking, investing, insurance, and lifestyle services

The entire system is designed to work without physical branches, relying on automation and analytics instead.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Tinkoff’s Business Model Explained

How Tinkoff Makes Money

Tinkoff operates as a digital-first universal bank, earning revenue from multiple financial services rather than relying on branch-based banking. Its main revenue streams include:

- Interest income from credit cards, personal loans, and lending products

- Fees and commissions from card usage, payments, and premium services

- Investment and brokerage fees from trading and wealth products

- Insurance distribution income through in-app insurance offerings

- Business banking services for SMEs and freelancers

Because Tinkoff runs without physical branches, it can reinvest savings into technology, customer experience, and data-driven growth.

Pricing Structure

Tinkoff follows a flexible pricing approach:

- Basic banking services are often low-cost or bundled

- Premium cards and accounts offer additional benefits for a fee

- Lending rates vary based on user profile and credit risk

- Investment services include standard brokerage commissions or spreads

This allows Tinkoff to serve both mass-market users and premium customers.

Commission / Fee Breakdown

- Card transactions: Interchange and service fees

- Lending: Interest margins on credit products

- Investments: Brokerage commissions and service fees

- Insurance: Commissions from partner insurers

- Business tools: Subscription or usage-based fees for SMEs

Market Size and Growth

Digital banking adoption has grown rapidly as users prefer mobile-first financial services. Tinkoff benefits from high engagement, with users managing daily spending, savings, investments, and credit inside one ecosystem—driving strong lifetime value.

Profitability Insights

Tinkoff’s model is efficient because:

- No branch network reduces fixed costs

- High app engagement enables cross-selling

- Data-driven personalization improves conversion

- Automation lowers customer service costs

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Interest Income | Credit cards and loans | Users | Recurring |

| Card Fees | Payments and interchange | Merchants / Networks | Transactional |

| Brokerage | Investing and trading services | Users | Transaction-based |

| Insurance | Policy distribution | Insurers | Commission-based |

| Business Banking | SME tools and services | Businesses | Subscription / usage |

Key Features That Make Tinkoff Successful

Branchless, App-First Banking

Tinkoff was built without physical branches. Everything—from onboarding to daily banking—happens in the app. This reduces friction for users and keeps operating costs low for the bank.

Fast Digital Onboarding

Users can open accounts online with digital verification. Physical cards are delivered by courier, combining digital convenience with real-world access—no branch visits required.

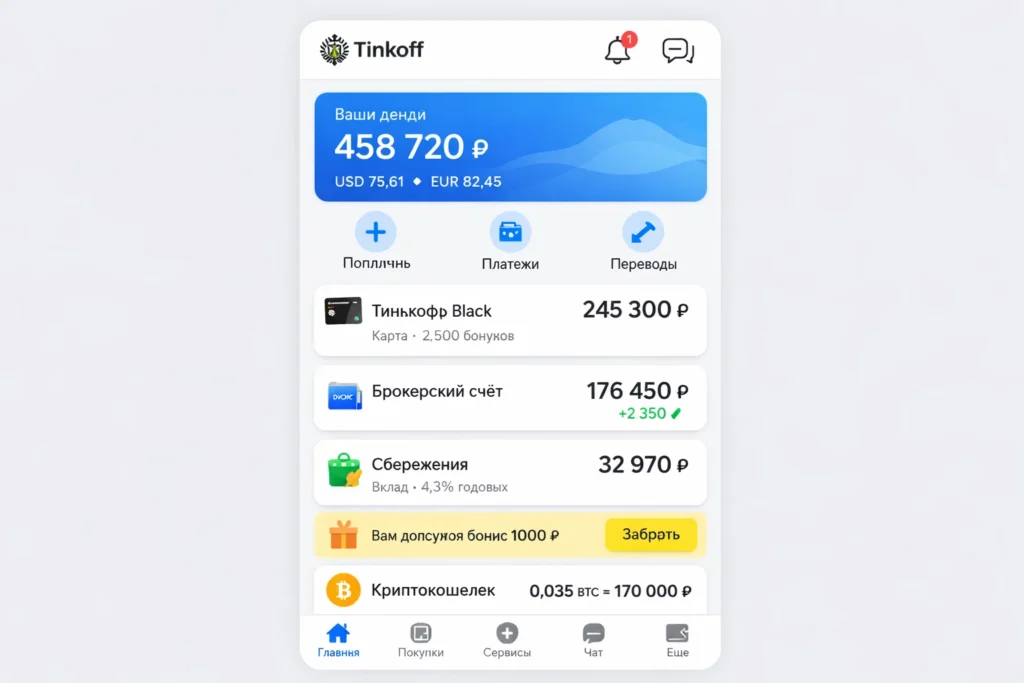

Powerful Mobile App

The Tinkoff app acts as a financial control center where users can:

- Manage cards and accounts

- Track spending with smart categories

- Pay bills and subscriptions

- Transfer money instantly

- Control limits and security settings

The UX is designed to be intuitive and highly responsive.

Data-Driven Personalization

Tinkoff uses analytics to personalize offers such as:

- Credit limits and loan offers

- Investment suggestions

- Insurance recommendations

- Cashback and rewards

This personalization increases engagement and conversion without aggressive selling.

Credit Cards & Lending Excellence

Tinkoff is especially strong in credit cards. Features include:

- Flexible limits

- Installment plans

- Transparent interest terms

- In-app repayment and tracking

Credit decisions are fast and largely automated.

Integrated Investments

Users can invest in stocks, ETFs, bonds, and funds directly from the same app they use for banking. This reduces friction and encourages users to keep more of their financial life inside the ecosystem.

Business Banking Tools

For SMEs and freelancers, Tinkoff offers:

- Digital business accounts

- Expense tracking

- Payment acceptance tools

- Employee cards

These tools help small businesses operate fully online.

Always-On Customer Support

Instead of branches, Tinkoff provides:

- In-app chat support

- Phone assistance

- AI-driven help for common issues

Support is available around the clock and integrated directly into the app.

Security & Control Features

Users can instantly:

- Freeze or unfreeze cards

- Set spending limits

- Control international usage

- Receive real-time transaction alerts

This level of control builds trust and reduces fraud.

Ecosystem Expansion

Beyond core banking, Tinkoff integrates lifestyle services such as travel bookings, insurance, and rewards—positioning itself as a financial super-app rather than just a bank.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Tinkoff

I tried to pull fresh sources for Tinkoff’s latest tech details, but my web-browsing tool is erroring right now—so I’m going to explain the technology in a platform-accurate, non-speculative way (how a branchless “bank + investments + services” super-app is typically built), without pretending to verify specific internal tools or vendor names.

Tech stack overview (simplified)

Tinkoff operates like a digital-first financial ecosystem, so the tech foundation usually has these layers:

- Client apps: Mobile apps (primary) + web for account management, investing, payments, support, and settings

- Core banking layer: Accounts, ledger, cards, payments, limits, fees, statements

- Credit & risk layer: Scoring, underwriting, fraud signals, decisioning, limits, collections workflows

- Investments layer: Brokerage account management, order placement, portfolio tracking, market data feeds

- Ecosystem services: Insurance distribution, travel/lifestyle add-ons, rewards/cashback, partner storefronts

- Support & operations: In-app chat, ticketing, CRM, call center tools, knowledge base

Real-time features explained

Tinkoff’s “it just works instantly” feeling comes from real-time systems like:

Instant payments and transfers

- Real-time authorization, anti-fraud checks, and confirmation

- Live balance updates and transaction notifications (push/SMS/in-app)

Card controls and security

- Freeze/unfreeze, spending limits, merchant-category controls

- Real-time risk monitoring for unusual transactions

Personalized offers in the app

- Offers (credit, installments, savings, insurance) are typically driven by event-based triggers: salary inflow, spending patterns, repayment behavior, travel purchases, etc.

Data handling and privacy (practical view)

A digital bank handles highly sensitive data, so the platform is built around:

- Encryption in transit and at rest

- Strong authentication + device security controls

- Role-based access for internal teams

- Audit logs (who changed what, when)

- Data retention and compliance workflows (regulatory reporting, dispute handling)

Scalability approach

A branchless bank must stay stable during spikes (paydays, sales, market volatility). Common strategies:

- Service separation: Payments, cards, lending, investing, rewards, support run as separate services so one surge doesn’t crash everything

- Caching + queues: To keep the app responsive even when back-office processes are busy

- Resilient architecture: Fail-safes for payment retries, idempotent APIs, and graceful degradation (non-critical features can slow without breaking core banking)

Mobile app vs web platform

- Mobile is the main “bank branch”: onboarding, daily spending, card controls, alerts, support, and most investing actions

- Web is the “control panel”: deeper statements, documents, tax forms, longer-term portfolio views, admin-like tasks

API integrations (what typically matters most)

To deliver “everything in one app,” Tinkoff-like ecosystems integrate with:

- Payment rails and card networks (authorization, settlement, chargebacks)

- Identity/KYC services

- Credit bureau and risk data providers

- Market data and brokerage execution partners (for investing features)

- Insurance partners and policy systems

- Messaging providers (push, SMS, email)

- Merchant rewards/cashback partners

Why this tech matters for business

Tinkoff’s advantage is that the technology enables:

- Lower operating cost (no branches)

- Higher engagement (users do more inside one app)

- Better conversion via personalization (right offer, right time)

- Faster product rollout (new services can be added as modules)

- Stronger trust (security + instant controls)

Tinkoff’s Impact & Market Opportunity

Industry disruption caused

Tinkoff helped prove that a bank doesn’t need a big branch network to win customers. By treating the mobile app as the “main branch” and backing it with strong service + logistics (like card delivery), it set a benchmark for branchless banking in its market.

It also pushed expectations upward: customers started expecting faster onboarding, better UX, smarter spending insights, and always-available support—things that traditional banks often struggled to deliver consistently.

Market opportunity and growth drivers

Digital-first banking grows when three things align:

- People trust mobile apps with more of their money

- Payments become everyday (peer-to-peer, bill pay, card usage)

- Consumers want “one place” for banking, credit, savings, and investing

A Tinkoff-like approach benefits from high engagement because users don’t just “check balances”—they manage their whole financial life in one ecosystem. That creates strong lifetime value and makes cross-selling (credit, investing, insurance) more natural.

User demographics and behavior

Tinkoff-style platforms typically win with:

- Mobile-first users who value speed and convenience

- Credit users who want flexible repayment and in-app visibility

- People who want budgeting + spending insights without separate apps

- Users who like investing inside the same ecosystem as their bank account

A key behavior pattern is “daily utility”: the app becomes the first stop for spending, transfers, and card controls, not just occasional banking.

Geographic presence

Tinkoff’s core footprint is Russia, and its model is tailored to serving customers across large geographies without branch density—one of the reasons the branchless approach is especially compelling.

Future projections (what trends favor this model)

Branchless digital banking remains attractive as:

- Personalization becomes expected (offers, insights, recommendations)

- More financial services are embedded into one app

- Real-time security and self-serve controls become standard

- Consumers want simple, transparent experiences (no hidden complexity)

Opportunities for entrepreneurs

There’s a strong opportunity to build Tinkoff-inspired platforms for niches such as:

- SME-first digital banking with invoicing + expense tools

- Credit-led banks (cards, installments, underwriting)

- Salary + savings platforms for young professionals

- Banking + investing bundles for mass-market users

- Regional digital banks in markets where branches are expensive to scale

This massive success is why many fintech founders want to create similar “banking ecosystems”—because once the product becomes the daily money hub, growth compounds through trust and convenience.

Building Your Own Tinkoff-Like Platform

Why businesses want Tinkoff-style digital banks

Tinkoff is a strong reference model because it shows how a branchless bank can grow by making the app the main relationship layer. Founders and fintech teams like this approach because it:

- Avoids the massive cost of building branches

- Builds high engagement through everyday payments and card usage

- Creates multiple revenue streams (credit, fees, investing, insurance)

- Allows faster product iteration through a modular digital stack

- Makes scaling to new regions easier when the experience is digital-first

Key considerations for development

To build a Tinkoff-like platform, the most important decisions come early:

- Licensing approach: bank license, EMI/neo-bank partnership, or BaaS model

- Product scope: debit + payments first, or credit-led from day one

- Risk and compliance: KYC/AML, fraud prevention, credit underwriting, dispute handling

- Core modules: accounts, cards, payments, lending, investing, support

- Ecosystem strategy: insurance, rewards, travel/lifestyle, merchant partnerships

- Customer support model: in-app chat, call center, self-serve automation

- Security posture: encryption, device security, instant card controls, audit logs

Cost Factors & Pricing Breakdown

Tinkoff-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Digital Banking MVP | Core mobile/web banking app, customer onboarding, basic KYC, current/savings accounts (via your banking/issuer partner), balance & transaction history, simple money transfers, bill payments, notifications, standard admin/operations console, basic reports | $80,000 |

| Mid-Level Neobank & Card Platform | Full-featured neobank-style app with cards, multiple account types, improved KYC/AML flows, card management (freeze, limits, PIN), scheduled payments, budgets & insights, in-app support chat, push notifications, richer analytics dashboards, polished mobile-first UX (web + apps) | $160,000 |

| Advanced Tinkoff-Level Digital Banking Ecosystem | Large-scale, all-digital bank with multi-product support (accounts, cards, loans, investments, insurance via partners), complex risk & scoring engines, deep core-banking and issuer integrations, advanced analytics & personalization, marketing automation, cloud-native, highly scalable architecture | $260,000+ |

Tinkoff-Style Digital Banking Platform Development

The prices above reflect the global market cost of developing a Tinkoff-like digital banking and neobank platform — typically ranging from $80,000 to over $260,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes secure onboarding and KYC, account and card management flows, payments and transfers, analytics and reporting, integrations with core banking/issuer and compliance providers, and production-grade mobile apps for everyday banking use.

Miracuves Pricing for a Tinkoff-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Tinkoff-style digital banking platform that covers secure customer onboarding and KYC (via your providers), multi-account and card management, payments and transfers, transaction history and insights, notifications, core analytics, and a modern web admin console plus customer-facing mobile apps. From this base, the platform can be extended into lending products, investments via partners, richer risk and scoring modules, and marketing automation as your neobank-scale roadmap evolves.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational digital banking ecosystem ready for launch and future expansion.

Delivery Timeline for a Tinkoff-Like Platform with Miracuves

For a Tinkoff-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of banking products (accounts, cards, loans, investments, etc.)

- Number and complexity of integrations (core banking, issuer, KYC/AML, payments, scoring, analytics)

- Complexity of risk rules, reporting, and regulatory/compliance workflows

- Scope of web portal, mobile apps, branding requirements, and long-term scalability targets

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential features to include

A strong Tinkoff-style MVP usually needs:

- Digital onboarding with KYC

- Account + card management (freeze/unfreeze, limits, alerts)

- Transfers and bill payments

- Spending insights and categories

- Support chat + ticketing

- Admin panel for compliance, users, disputes, and risk

Optional high-impact add-ons:

- Credit cards/loans with data-driven underwriting

- Investing module (basic ETFs/stocks)

- Insurance distribution

- Rewards/cashback and partner offers

- SME banking (invoicing, expense cards, payroll integrations)

Read More :- Read the complete guide on fintech app development costs

Conclusion

Tinkoff shows how powerful a branchless banking model can be when technology, data, and customer experience work together. By removing physical branches and investing heavily in its digital platform, it turned everyday banking into a fast, personalized, and always-available experience. The result is not just a bank, but a financial ecosystem that customers rely on daily.

For entrepreneurs, Tinkoff is a strong example of how digital-first thinking can reshape traditional industries. When banking becomes a seamless app instead of a place you visit, growth comes from convenience, trust, and the ability to continuously add value through new services.

FAQs :-

How does Tinkoff make money?

Tinkoff earns revenue through interest income from credit cards and loans, fees and commissions from card usage and payments, brokerage fees from investment services, insurance commissions, and business banking services for SMEs.

Is Tinkoff a traditional bank?

Tinkoff is a digital-first, branchless bank. It does not operate physical branches and delivers all services through mobile apps, web platforms, and courier-based logistics.

Can I open a Tinkoff account without visiting a branch?

Yes. Account opening is fully digital. Identity verification happens online, and physical cards are delivered to customers by courier.

What services does Tinkoff offer?

Tinkoff offers a wide range of services, including banking accounts, debit and credit cards, payments, savings, loans, investments, insurance, and business banking tools.

Is Tinkoff safe and secure?

Yes. Tinkoff uses strong security measures such as encryption, real-time fraud monitoring, transaction alerts, and instant card controls to protect customer accounts.

Does Tinkoff offer investment services?

Yes. Users can invest in stocks, ETFs, bonds, and funds directly within the Tinkoff app, making it part of a single financial ecosystem.

Who typically uses Tinkoff?

Tinkoff is popular among mobile-first users, professionals, entrepreneurs, and small businesses that prefer fast, app-based financial services over branch visits.

Is Tinkoff available outside Russia?

Tinkoff primarily operates in Russia. Its services are tailored to the local regulatory environment, though its digital banking model is studied globally.

What makes Tinkoff different from other digital banks?

Tinkoff stands out due to its branchless model, strong focus on data-driven personalization, wide ecosystem of services, and highly polished mobile app experience.

Can I build a platform like Tinkoff?

Yes. With the right regulatory setup, technology stack, and modular product approach, it’s possible to build a Tinkoff-style digital bank.

How can Miracuves help build a Tinkoff-like platform?

Miracuves helps founders launch Tinkoff-style digital banking platforms in 30-90 days, offering secure onboarding, modular banking components, payments, cards, lending-ready architecture, and full customization to match your market and compliance needs.