Your company is growing fast. Invoices are pouring in from vendors, agencies, creators, affiliates, and freelancers across multiple countries. Finance is drowning in emails, spreadsheets, manual approvals, duplicate payments, W-8/W-9 forms, and last-minute tax questions. Month-end feels like a war zone.

This is the exact chaos Tipalti is built to fix.

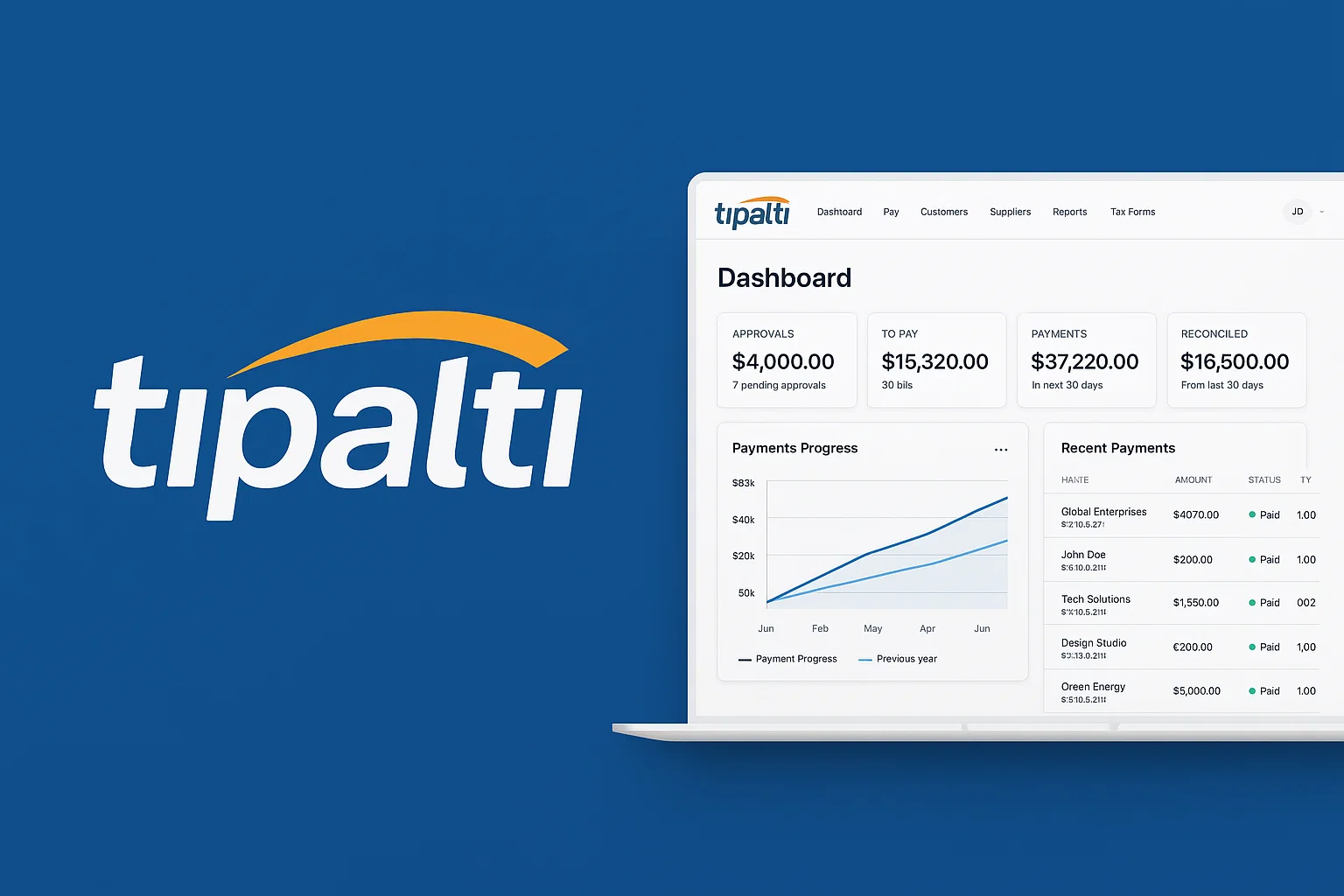

Tipalti is a cloud-based accounts payable (AP) and global payouts automation platform that helps companies handle everything from invoice capture and approvals to tax compliance, supplier onboarding, mass payments, and reconciliation. Instead of using separate tools for invoices, tax forms, FX, and payouts, Tipalti puts the entire payables workflow into one system.

Launched in 2010, Tipalti has become a go-to platform for mid-market and high-growth companies, marketplaces, and creator/affiliate platforms that need to pay thousands of partners accurately and on time, in multiple currencies and payment methods, without constantly hiring more finance staff.

In this guide, you’ll learn:

- What Tipalti actually is (in simple terms)

- How Tipalti works across invoices, approvals, and global payouts

- Its business model and who gets the most value from it

- Key features and technology behind the platform

- Why Tipalti is popular with marketplaces, SaaS companies, and creator networks

- How a Tipalti-style platform can be cloned for niche markets with Miracuves

What Is Tipalti? – The Simple Explanation

Tipalti is a global payables automation platform that helps companies manage everything related to paying suppliers, freelancers, vendors, creators, affiliates, and contractors — all in one place.

In simple words:

Tipalti replaces manual invoice handling, tax form collection, approvals, and global payouts with a single automated system.

Instead of finance teams chasing documents, fixing errors, and tracking payments manually, Tipalti automates the entire workflow from start to finish.

Core Problem Tipalti Solves

Most growing companies struggle with:

- Too many invoices arriving in different formats

- Manual approvals and email back-and-forth

- Duplicate or late payments

- Complex tax form collection (W-8/W-9, VAT, GST)

- Managing suppliers in multiple countries

- High-volume payouts in different currencies

- Error-filled reconciliation at month-end

Tipalti removes these bottlenecks by giving businesses a fully automated AP + mass payout engine.

Who Uses Tipalti?

| Business Type | How They Use It |

|---|---|

| Marketplaces | Pay sellers, service providers, freelancers |

| Creator & affiliate platforms | Mass payouts to creators/influencers |

| SaaS companies | Vendor invoice processing + AP automation |

| Fintech startups | Global partner payouts |

| Enterprises | Multi-entity compliance & finance scalability |

| Gaming & ad networks | Pay affiliates and publishers worldwide |

Tipalti is especially loved by companies dealing with thousands of small-to-mid-size payouts monthly.

Current Market Position (2025)

- Used by 4,000+ mid-market & enterprise clients

- Processes $50+ billion in payouts annually

- Known as a leader in accounts payable automation

- Strong presence in SaaS, marketplaces, fintech, and creator platforms

- Competes with Bill.com, Airbase, Coupa, Payoneer, and Deel’s payout module

Why Tipalti Became Successful

- End-to-end automation (from invoice to payment)

- Strong compliance tools (tax, AML, KYC)

- Supports 196 countries + 120 currencies

- Enterprise-grade reliability

- Scalable solution for fast-growing companies

Tipalti stands out because it centralizes invoicing, approvals, tax compliance, and global payouts, eliminating the need for multiple disconnected tools.

How Tipalti Works – Step-by-Step Breakdown

Tipalti streamlines the entire supplier payment lifecycle — from onboarding to invoice capture to approvals to global payouts. Here’s a clear walkthrough of how it works for every type of user.

For Finance Teams

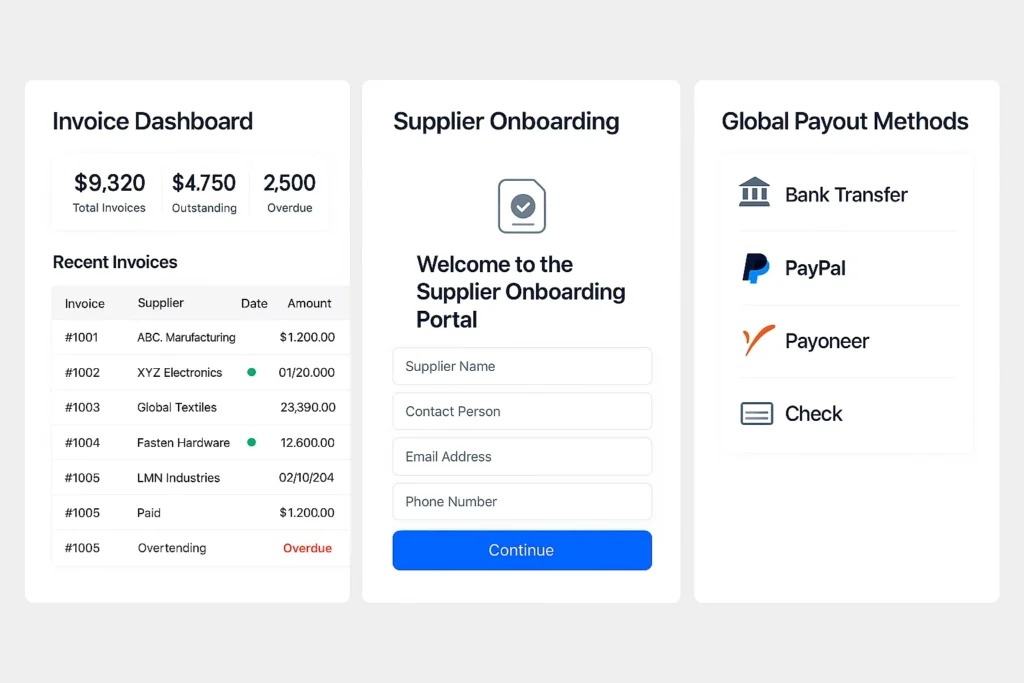

1. Supplier Onboarding

Instead of collecting documents manually, companies send suppliers a branded onboarding portal.

Suppliers submit:

- Contact details

- Payment preferences (bank, PayPal, ACH, wires, etc.)

- Tax forms (W-8, W-9, VAT, GST)

- Compliance info (KYC/AML checks)

Tipalti validates all details automatically to prevent errors and failed payments.

2. Invoice Capture & Processing

Suppliers upload invoices directly or email them to a dedicated inbox.

Tipalti uses OCR + AI to:

- Extract invoice data

- Match PO, line items, and amounts

- Detect duplicates

- Flag irregularities

This removes data entry and reduces errors significantly.

3. Approval Workflows

Finance teams set approval rules based on:

- Department

- Amount

- Vendor type

- Cost center

Approvers get notifications and can review invoices in one click, reducing slow email chains.

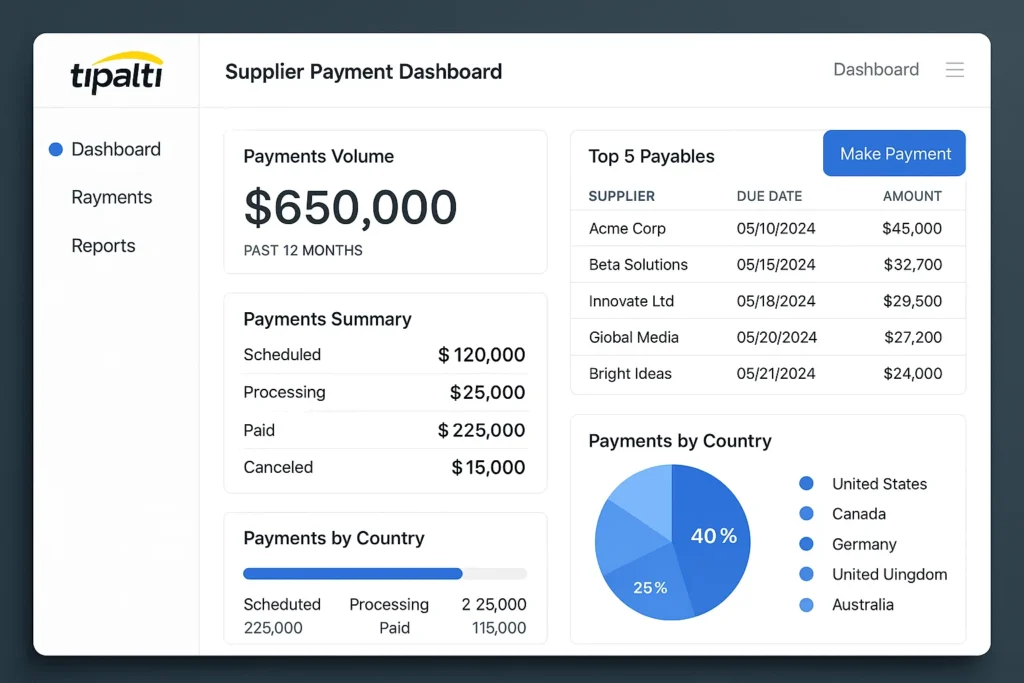

4. Payment Scheduling

Once approved, AP teams can batch or schedule payments globally.

Tipalti automatically calculates:

- FX conversion

- Taxes

- Fees

- Payment timelines

It supports six payment methods: ACH, EFT, wire transfers, global ACH, PayPal, and prepaid debit cards.

For Suppliers / Vendors

Self-Service Portal

Vendors can:

- Update bank details

- Upload invoices

- View payment history

- Track real-time payment status

- Download tax documents

This reduces inbound support requests dramatically.

Payout Process (What Happens Behind the Scenes)

- Invoice approved → payment queued

- Tipalti runs global validations (bank formats, currencies, routing codes)

- Compliance checks (sanctions, AML, tax verification)

- FX conversion executed

- Funds transferred via selected method

- Vendor notified with remittance details

- Reconciliation synced to the company’s accounting software

The entire process runs with minimal manual intervention.

For Accounting Teams

Reconciliation & Sync

Tipalti integrates with:

- NetSuite

- QuickBooks

- Sage Intacct

- Xero

- Microsoft Dynamics

It automatically syncs:

- Invoices

- Payments

- Journals

- Reconciliation data

Month-end close becomes much faster and cleaner.

Technical Overview (Simple)

Tipalti’s architecture includes:

- Cloud-based AP automation engine

- AI/OCR invoice extraction

- Global compliance & KYC module

- Multi-rail global payout network

- FX conversion & treasury automation

- Accounting sync APIs

You don’t need to understand fintech infrastructure to benefit — Tipalti handles it behind the scenes.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Tipalti’s Business Model Explained

How Tipalti Makes Money

Tipalti earns revenue by offering accounts payable automation and global payout services through a subscription + usage-based pricing model. Its business model scales with transaction volume, number of suppliers, and enterprise features used.

Subscription Fees

Tipalti charges companies a monthly or annual platform fee based on:

- Number of entities

- Features activated (OCR, approvals, tax automation, etc.)

- Supplier onboarding volume

- Workflow complexity

This gives Tipalti predictable SaaS-style recurring income.

Per-Transaction Fees

Tipalti earns a fee on each processed transaction:

- Domestic ACH

- International wire

- Global ACH

- PayPal payouts

- prepaid card loads

- FX markup

The more volume a company processes, the more Tipalti earns.

FX & Currency Conversion Fees

Tipalti handles cross-border payments in 120 currencies. It earns additional revenue from:

- FX spreads

- Currency conversion service fees

- Cross-border transaction handling

This is a major income source for high-volume marketplaces and global SaaS companies.

Supplier Onboarding & Tax Compliance

Tipalti charges for automation layers like:

- W-8/W-9 validation

- VAT/GST form collection

- TIN matching

- KYC checks

- Fraud screening

These compliance tools are essential for enterprise finance teams.

Premium Add-Ons

Businesses can enable extra modules such as:

- Multi-entity payables

- Procurement workflows

- PO matching

- AP approval automation

- Advanced reporting & analytics

- Card issuing & expense tools

Each module introduces additional recurring revenue.

Integration Fees

Tipalti integrates with ERP and accounting tools like NetSuite and QuickBooks. Some advanced integrations have implementation fees or premium tiers.

Why This Business Model Works

- High switching costs keep customers long term

- Automation reduces financial labor overhead, so value is clear

- Usage grows naturally as customers scale globally

- Enterprise compliance tools keep Tipalti indispensable

- Global payouts are a high-margin continuous revenue stream

Tipalti effectively positioned itself as the operating system for payables and partner payments, making its income both scalable and sticky.

Key Features That Make Tipalti Successful

End-to-End AP Automation

Tipalti removes manual work by automating the entire accounts payable cycle. From invoice capture to approvals to payments, finance teams eliminate spreadsheets, data entry, and repetitive admin tasks. This increases accuracy and saves hundreds of hours monthly.

Smart Invoice Capture & OCR

Using AI + OCR, Tipalti extracts invoice data automatically.

It identifies vendor details, line items, totals, tax amounts, and PO matches while detecting duplicates and irregularities. This reduces human error and prevents overpayments.

Global Mass Payments

Tipalti supports payouts to 196 countries using payment methods like ACH, global ACH, wire transfers, PayPal, SEPA, SWIFT, and prepaid cards. Businesses can pay thousands of suppliers or creators in a single automated batch.

Multi-Currency & FX Automation

With support for 120 currencies, Tipalti’s FX engine enables real-time currency conversion, competitive rates, and automated cross-border treasury workflows.

Companies no longer need separate systems for FX management.

Self-Service Supplier Portal

Vendors can manage their profiles, upload invoices, choose payment methods, and download tax forms on their own — reducing support workload for finance teams.

This portal also includes built-in validation to prevent failed payments.

Tax Compliance & Global Regulatory Support

Tipalti automates tax form collection (W-8, W-9, VAT, GST), TIN matching, sanctions checks, AML screening, and fraud detection.

These compliance features make it enterprise-ready and reduce audit risks.

Automated Approval Workflows

Finance teams can set customized rules for invoice routing.

Approvals trigger instantly based on:

- Amount thresholds

- Departments

- Cost centers

- Vendor categories

This speeds up payment cycles and eliminates email backlogs.

Accounting System Integrations

Tipalti syncs with major ERPs like NetSuite, QuickBooks, Sage Intacct, Xero, and Microsoft Dynamics.

It automatically pushes invoices, payments, and journals, making month-end reconciliation faster and smoother.

Fraud Prevention & Payment Validation

Tipalti performs real-time validation for bank formats, routing codes, duplicate invoices, inconsistent vendor data, and suspicious activities. This reduces failed payments and protects businesses from fraud.

What Truly Sets Tipalti Apart

Tipalti succeeds because it combines AP automation + global payouts + compliance into one unified platform.

Most competitors offer only parts of this stack.

Tipalti integrates everything, making it a powerful “finance operations hub” for high-growth companies.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Tipalti

Cloud-Native Architecture

Tipalti is built as a cloud-based SaaS platform, ensuring scalability, availability, and security for companies handling thousands of invoices and global payouts.

Its architecture allows multi-entity setups, role-based access, and enterprise-grade uptime.

AI + OCR for Invoice Processing

Tipalti uses AI-driven OCR to extract invoice data automatically from PDF, image, and email formats.

The system learns patterns from vendor invoices, improving accuracy over time and reducing manual review.

Global Payment Rails Integration

Tipalti connects with multiple global payment networks including:

- ACH

- SWIFT

- SEPA

- Global ACH

- Local bank partners

- PayPal

- Prepaid card issuers

This hybrid rail setup enables flexible, low-cost global payments with automated routing.

Compliance & Tax Automation Engine

The platform has built-in logic for:

- W-8 / W-9 validation

- VAT / GST form collection

- TIN matching

- Sanctions checks

- AML screening

- Fraud detection

These tools eliminate the risk of manual compliance handling.

Rule-Based Workflow Engine

Tipalti allows companies to configure:

- Approval workflows

- Spending rules

- Invoice routing

- Currency rules

- Department-based authorizations

This rule engine ensures invoices and payments follow company policy without manual enforcement.

ERP & Accounting Integrations

Tipalti integrates through APIs and connectors with leading ERPs like:

- NetSuite

- QuickBooks

- Xero

- Sage Intacct

- Microsoft Dynamics

Its two-way sync keeps financial records accurate and up to date.

Secure Infrastructure

Tipalti uses industry-grade security standards:

- Encryption at rest and in transit

- Role-based permissions

- Audit logs

- SOC 2 and ISO compliance

- Multi-entity data protection

This ensures finance teams can trust the system with sensitive financial data.

Why This Tech Matters

This technology stack allows Tipalti to function as a complete finance operations platform, offering:

- Speed

- Accuracy

- Scalability

- Compliance

- Security

Companies can automate payables and global payouts without building anything internally.

Tipalti’s Impact & Market Opportunity

How Tipalti Transformed Finance Operations

Tipalti changed the way mid-market and scaling companies manage payables. Instead of adding more finance staff as volume grows, businesses can automate the entire workflow, reducing manual work by up to 80%.

This shift has allowed companies to scale globally without drowning in administrative chaos.

Impact on Marketplaces & Creator Platforms

Creator networks, affiliate programs, ad networks, and marketplaces rely on Tipalti for mass payouts.

Its automated tax collection, global payment methods, and FX capabilities make it extremely valuable for platforms handling thousands of payees and cross-border partners.

This creates smoother relationships with creators and suppliers, improving trust and reducing support tickets.

Impact on SaaS & Enterprise Companies

For fast-growing SaaS companies, Tipalti centralizes:

- Invoices

- Approvals

- Vendor management

- Multi-entity payables

- Compliance

- Reconciliation

This allows finance teams to stay lean, efficient, and audit-ready.

Market Growth & Demand

The global AP automation market continues to grow rapidly due to:

- Increased digital transformation

- Remote and globalized operations

- Rising compliance requirements

- Need for scalable global payout systems

- Pressure to reduce operational costs

More companies want to automate repetitive finance tasks, leading to strong demand for Tipalti-like platforms.

Geographic Expansion

Businesses operating across the US, Europe, LATAM, and APAC require a unified payout and AP automation system.

Tipalti’s global reach makes it ideal for companies with international suppliers and contractors.

Opportunities for Entrepreneurs

Because the global finance ops market is huge and still fragmented, there is significant demand for:

- Regional Tipalti-style payout platforms

- Niche-specific AP automation tools (e.g., for logistics, medical, agencies)

- Creator payout systems similar to Tipalti

- Multi-currency, multi-country finance solutions

- ERP-integrated payout platforms

- AI-driven invoice automation systems

This massive success is why many entrepreneurs want to create Tipalti-like platforms to serve specific industries or regions where Tipalti is not fully localized.

Building Your Own Tipalti-Like Platform

Why Businesses Want Tipalti-Like Systems

Companies today manage more global vendors, creators, freelancers, and suppliers than ever before. Manual finance workflows can’t keep up. A Tipalti-style platform solves this by offering:

- Automated AP processes

- Global mass payouts

- Tax compliance

- Multi-currency support

- Scalable approval workflows

- Reduced operational costs

This opens massive opportunities for startups and enterprises building specialized or regional versions of Tipalti.

Key Considerations Before Development

To create a successful Tipalti-style platform, you must define:

- Target audience: Marketplaces, agencies, SaaS, gig platforms, etc.

- Supported regions: Domestic only or global (SWIFT, SEPA, ACH, local rails)

- Compliance requirements: KYC/AML, tax forms, invoicing rules

- Payout methods: Bank transfer, global ACH, PayPal, wallets, cards

- Currency support: Single-currency or multi-currency FX engine

- Workflow complexity: Approval layers, PO matching, invoice rules

- Integration needs: ERP tools, CRM, onboarding systems

The more aligned your platform is with industry-specific workflows, the more competitive advantage you gain.

Cost Factors & Pricing Breakdown

Tipalti-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

| Basic AP & Payouts MVP | Core web platform for vendor onboarding, basic supplier master data, invoice capture (manual/file upload), simple approval workflow, basic payment runs to limited countries, payment status tracking, standard admin panel, basic reporting | $90,000 |

| Mid-Level Payables Automation Platform | Multi-entity support, richer approval workflows, vendor portal for self-service onboarding, early validation of bank/tax details (via your providers), mass payout runs, multiple payment methods (ACH/wire/local rails), FX handling, dunning/notifications, analytics dashboard, web + mobile-ready experience | $170,000 |

| Advanced Tipalti-Level Global Payables Ecosystem | Global multi-subsidiary setup, advanced tax & compliance (e.g., KYC, KYB, e-invoicing, local tax forms), complex approval policies, intelligent invoice matching, wide payout method & currency coverage, deep ERP integrations, detailed reconciliation & audit trails, cloud-native scalable architecture | $280,000+ |

Tipalti-Style Global Payables & AP Automation Development

The prices above reflect the global market cost of developing a Tipalti-like accounts payable automation and global payouts platform — typically ranging from $90,000 to over $280,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes secure payments and approval workflows, supplier onboarding and compliance, tax and regulatory logic, ERP integrations, and robust reporting and reconciliation for finance teams.

Miracuves Pricing for a Tipalti-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Tipalti-style AP & payouts platform that covers supplier onboarding, invoice capture, configurable approval workflows, payment runs across multiple methods and currencies (via your banking/payment partners), payment status tracking, core compliance hooks (via third-party services), finance analytics, and a modern web admin console plus optional supplier-facing portal. From this foundation, the solution can be scaled into deeper ERP integrations, multi-entity and multi-subsidiary structures, richer tax/compliance workflows, and more advanced automation as your payables operations grow.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational AP automation and payouts ecosystem ready for launch and future expansion.

Delivery Timeline for a Tipalti-Like Platform with Miracuves

For a Tipalti-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of AP and payouts features (approval rules, payment methods, currencies, etc.)

- Number and complexity of ERP/accounting, banking, and compliance integrations

- Complexity of vendor portal, reporting, and reconciliation requirements

- Scope of web console, branding, and long-term scalability and control needs

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features for a Tipalti-Like Platform

AP Automation

- Invoice capture via OCR

- Automatic data extraction

- Duplicate detection

- Invoice-to-PO matching

Global Payout System

- Multi-currency payments

- Local & international transfers

- Integration with payout providers

- Real-time payment statuses

Supplier Onboarding

- Vendor self-service portal

- Collection of KYC documents

- Tax form uploads (W-8, W-9, VAT, GST)

- Compliance validation

Approval Workflows

- Customizable routing rules

- Role-based approvals

- Department-level permissions

Compliance & Tax Automation

- Sanctions screening

- AML monitoring

- TIN matching

- Automatic tax form validation

Accounting Integrations

- NetSuite, QuickBooks, Xero, Sage, Dynamics

- Two-way sync

- Smart reconciliation

Development Roadmap (Simplified)

Phase 1: Core Invoice & Vendor Management

- Supplier onboarding

- Invoice OCR

- Approval workflows

Phase 2: Global Payments Engine

- Multi-currency support

- Routing for payout rails

- FX automation

Phase 3: Compliance & Tax Stack

- KYC/AML engine

- Tax form collection

- Validation logic

Phase 4: Reporting & ERP Integrations

- Financial dashboards

- Reconciliation modules

- API connections

Read More :- Read the complete guide on fintech app development costs

Conclusion

Tipalti proves that finance teams don’t need to drown in manual processes as a company scales. By automating invoices, approvals, tax, and global payments, Tipalti became a cornerstone of modern finance operations — especially for marketplaces, SaaS companies, creator platforms, and global businesses managing thousands of suppliers.

Its biggest strength is simplicity: everything from onboarding to payout happens inside one unified system. No spreadsheets. No email chaos. No duplicate payments. Just clean, automated finance workflows that scale with the business.

For entrepreneurs, Tipalti’s model highlights a huge opportunity. Industries across the world still struggle with outdated AP processes and fragmented payout systems. Building a Tipalti-inspired platform tailored to a specific region or business type can create enormous value — and a massive competitive advantage.

As global operations expand and digital platforms multiply, the demand for automated, compliant, cross-border finance tools will only grow.

FAQs :-

What does Tipalti do?

Tipalti is an AP automation and global payouts platform that handles supplier onboarding, invoice processing, tax compliance, approvals, and payments in 196+ countries.

Who uses Tipalti?

Marketplaces, SaaS companies, creator and affiliate platforms, gaming networks, fintech startups, and enterprises that manage large volumes of vendor or partner payments.

How does Tipalti work?

Tipalti automates the payables workflow:

1.Supplier onboarding

2.Invoice capture using OCR

3.Approval routing

4.Global payment execution

5.Tax validation

6.Accounting reconciliation

Everything happens in one centralized platform.

Does Tipalti support global payments?

Yes. Tipalti supports payouts to 196 countries across 6 payment rails, including ACH, wire transfers, global ACH, PayPal, SEPA, and prepaid cards.

How much does Tipalti cost?

Pricing includes a platform subscription fee plus per-transaction fees, FX spreads, and optional add-on modules for AP automation, tax compliance, and multi-entity workflows.

Does Tipalti handle tax forms?

Yes. Tipalti automates W-8/W-9 collection, VAT/GST forms, TIN matching, and global tax validation, reducing compliance risk for finance teams.

What accounting tools does Tipalti integrate with?

Tipalti integrates with NetSuite, QuickBooks, Xero, Sage Intacct, and Microsoft Dynamics for real-time syncing of invoices, payments, and financial data.

Is Tipalti safe?

Tipalti uses enterprise security, encryption, audit trails, role-based access, sanctions checks, AML screening, and SOC 2/ISO certifications to protect financial data.

Can Tipalti handle multi-entity organizations?

Yes. Tipalti supports multi-entity finance operations with consolidated reporting, separate workflows, and independent tax profiles for each entity.

Can I build a platform like Tipalti?

Absolutely. You can build a Tipalti-like system with invoice automation, supplier onboarding, global payouts, and compliance modules.

Miracuves offers ready-made, customizable solutions delivered in 30-90 days to help you launch quickly.