Imagine being able to trade stocks, mutual funds, and derivatives from your phone without paying sky-high brokerage fees. That’s what Zerodha achieved — it made investing in India affordable and accessible for everyone.

Founded in 2010 by Nithin and Nikhil Kamath, Zerodha disrupted the Indian stockbroking industry with its discount brokerage model — offering flat, low-cost trading fees and a tech-driven experience. It empowered retail investors, traders, and small businesses to invest directly from their smartphones through its flagship platforms Kite and Coin.

By 2025, Zerodha manages over 12 million users and processes billions in daily trading volume, standing as India’s largest stockbroker. Its ecosystem of trading tools, education initiatives, and zero-commission investment options has redefined how Indians approach the stock market.

By the end of this article, you’ll understand what Zerodha is, how it works, how it makes money, and how you can build your own Zerodha-like trading platform.

What is Zerodha? The Simple Explanation

Zerodha is India’s largest discount brokerage platform that allows users to trade stocks, derivatives, commodities, mutual funds, and bonds at low, flat fees. It was built with a mission to simplify investing and make trading affordable for everyone.

The core problem Zerodha solves is high brokerage costs and lack of transparency that existed in traditional Indian trading platforms. Before Zerodha, brokers charged a percentage-based commission on every trade, making active trading expensive. Zerodha introduced a flat fee model — ₹0 for equity delivery and ₹20 or 0.03% per executed order for intraday and F&O trades — drastically reducing costs for retail traders.

Its target audience includes retail investors, day traders, mutual fund investors, and small businesses. The platform offers web and mobile interfaces through Kite, Coin, and Console, making it easy for users to manage investments from anywhere.

As of 2025, Zerodha handles over 15% of India’s retail trading volume, serving more than 12 million customers, and operates as one of the most profitable fintech companies in the country — all without external funding.

Zerodha’s success stems from its transparent pricing, reliability, and focus on education through initiatives like Varsity and TradingQnA.

How Does Zerodha Work? Step-by-Step Breakdown

Zerodha operates as a discount brokerage platform, combining low-cost trading with high-performance technology. It gives users access to Indian exchanges like NSE, BSE, and MCX through its proprietary platforms Kite, Coin, and Console.

For Users

1. Account Setup

Users sign up online with Aadhaar and PAN verification. The onboarding process is paperless and takes only a few minutes. Once the account is activated, users receive access to equity, derivatives, and commodity trading.

2. Deposits and Fund Transfers

Users can transfer funds from linked bank accounts through instant payment gateways or UPI. Zerodha integrates seamlessly with major Indian banks to ensure quick deposits and withdrawals.

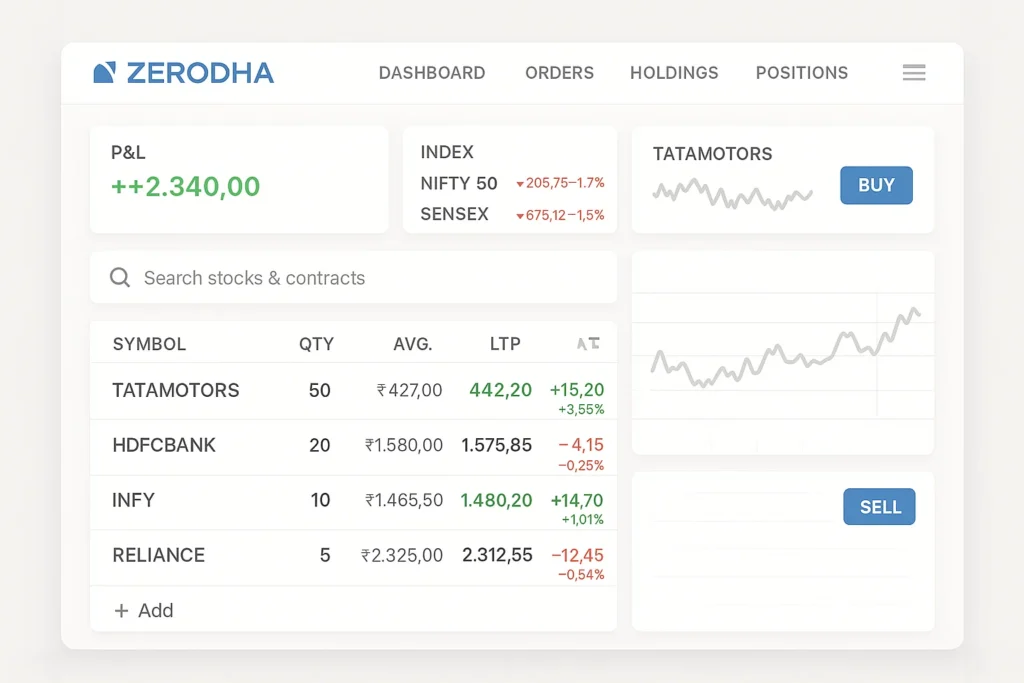

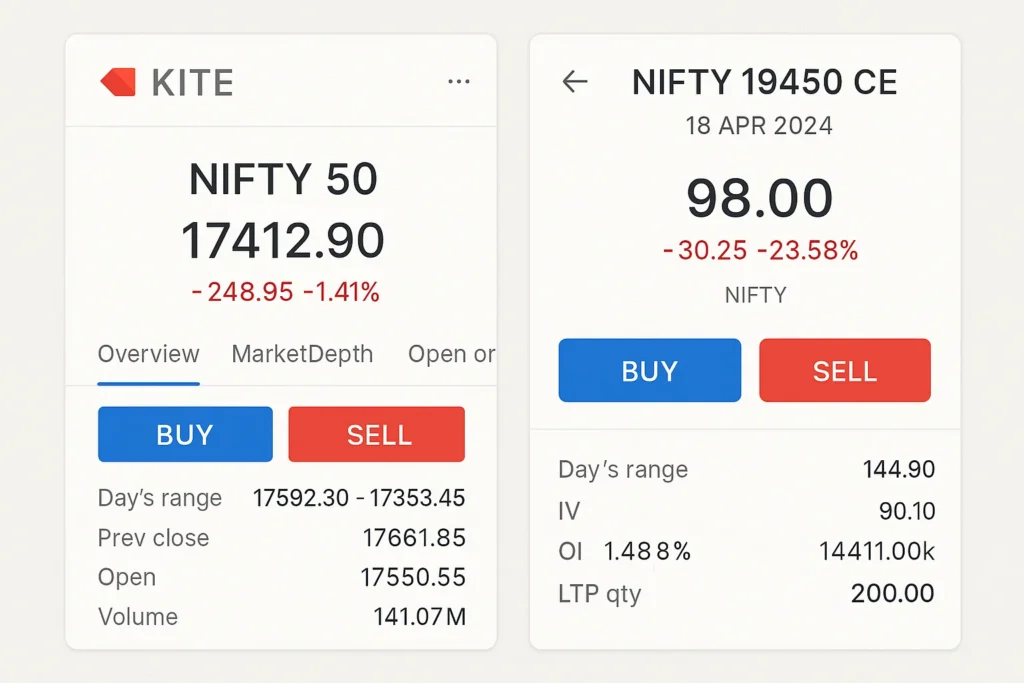

3. Trading via Kite

Kite is Zerodha’s trading platform available on web and mobile. It offers real-time market data, advanced charts, and seamless order execution. Users can buy and sell stocks, derivatives, and ETFs within seconds.

4. Investing via Coin

Coin is Zerodha’s direct mutual fund platform where users can invest in commission-free mutual funds. Investments are credited directly to their Demat account.

5. Portfolio & Reports via Console

Console acts as a central dashboard for users to track performance, view P&L reports, tax summaries, and corporate actions.

6. Market Education via Varsity

Zerodha also runs Varsity, one of India’s most popular free trading education platforms, offering detailed lessons on investing, derivatives, and technical analysis.

For Service Providers / Partners

Zerodha partners with banks, depositories (CDSL), and market data vendors to ensure efficient trading, settlements, and compliance. It also supports third-party integrations through APIs for algorithmic and institutional trading.

Technical Overview (Simplified)

Zerodha’s infrastructure is cloud-based, built to handle millions of orders daily.

- Kite uses Angular and Node.js for frontend and backend performance.

- Data is transmitted securely through 256-bit encryption.

- Real-time trade execution occurs via NSE and BSE APIs.

- Redis and Kafka handle live data streaming and caching for high speed.

Its systems are optimized for uptime, scalability, and compliance with SEBI and exchange requirements.

Read More :- Creating a Stock Trading App Like Zerodha: A Step-by-Step Tutorial

Zerodha’s Business Model Explained

Zerodha’s business model is built on low-cost trading, transparent pricing, and high transaction volumes. Instead of relying on commissions like traditional brokers, it focuses on scale and technology to maintain profitability.

1. Brokerage Revenue

Zerodha charges a flat ₹20 per executed order or 0.03% of the trade value, whichever is lower, for intraday and F&O trades. Equity delivery trades are completely free. This approach attracts both casual investors and professional traders.

2. Account Opening & AMC Fees

Users pay a one-time account opening fee (around ₹200–₹300) and a yearly maintenance charge for their Demat accounts. These small fees contribute to recurring revenue.

3. Margin Funding and Pledging

Zerodha offers margin trading and securities lending where users can pledge their holdings to trade with additional leverage. The company earns interest from these services.

4. Partner Platforms and Subscriptions

Zerodha earns from premium tools and third-party integrations available through its Rainmatter ecosystem — including tools like Smallcase, Sensibull, and Streak, which operate on subscription or revenue-sharing models.

5. Mutual Fund Platform (Coin)

Zerodha’s Coin app offers direct mutual funds, where investors pay no commission. Instead, Zerodha earns through value-added services and retains long-term customer relationships.

6. Educational and API Offerings

While its education via Varsity is free, Zerodha benefits indirectly through brand loyalty and customer growth. Its Kite Connect API lets developers and institutions build custom trading solutions — generating revenue through API usage fees.

7. Interest on Client Funds

Funds lying idle in client trading accounts earn interest, providing Zerodha with a steady passive income stream.

Market Growth and Financials

By 2025, Zerodha’s annual revenue exceeds ₹7,000 crore, with profit margins above 40%, making it one of the few bootstrapped unicorns in India. Its cost-efficient structure and loyal customer base drive consistent growth despite rising competition.

Key Features That Make Zerodha Successful

Zerodha’s rise to the top of India’s brokerage industry is a result of its focus on technology, affordability, and education. It turned a once complicated, intimidating process into a smooth and transparent experience for millions of investors.

1. Low-Cost Trading

Zerodha’s biggest draw is its flat-fee pricing model — ₹0 brokerage for equity delivery and ₹20 per executed intraday or F&O order. This appeals to retail traders who value affordability.

2. Kite Trading Platform

Kite offers a clean, fast, and intuitive trading experience. It includes real-time charts, 100+ technical indicators, and lightning-fast order execution.

3. Coin Mutual Fund Platform

Coin allows users to invest in direct mutual funds with no distributor commissions, ensuring higher returns over time.

4. Console Dashboard

Console provides in-depth portfolio analytics, P&L reports, and tax-ready statements. It’s designed to give users full transparency into their investments.

5. Varsity Learning Platform

Zerodha’s Varsity offers free, high-quality educational material on markets, derivatives, and trading strategies — building trust and brand authority.

6. Seamless Account Opening

Fully digital account setup using Aadhaar and e-signature reduces friction and onboarding time to just minutes.

7. Advanced Order Types

Zerodha supports advanced order types like GTT (Good Till Triggered) and AMO (After Market Orders), giving users flexibility to plan trades.

8. Partner Ecosystem via Rainmatter

Through its Rainmatter incubator, Zerodha has partnered with several fintech startups such as Smallcase, Sensibull, Streak, and Tickertape, expanding its ecosystem and offerings.

9. Strong Security and Compliance

Zerodha complies with SEBI, CDSL, and exchange regulations. It uses encryption, 2FA, and real-time monitoring for secure trading.

10. Community and Transparency

Regular communication, open policies, and zero hidden fees have made Zerodha one of the most trusted names in Indian finance.

2025 Updates:

Zerodha introduced AI-based insights for portfolio analysis, predictive risk management tools, and real-time voice assistants within Kite for smarter decision-making.

The Technology Behind Zerodha

Zerodha’s success is deeply rooted in its technology-first approach. Unlike traditional brokers relying on legacy systems, Zerodha built its platform from the ground up — designed for scale, real-time data handling, and reliability.

Tech Stack Overview (Simplified)

Zerodha’s infrastructure combines modern front-end frameworks with robust backend systems optimized for speed and stability:

- Frontend: Angular and React for Kite’s intuitive UI

- Backend: Python, Node.js, and Go for core trading logic and APIs

- Databases: PostgreSQL and Redis for high-speed caching and data consistency

- Hosting: AWS and private cloud setups for low latency and redundancy

- Data Streaming: Kafka and WebSocket technology for real-time market feeds

This architecture enables Zerodha to execute millions of trades per day while maintaining low downtime and near-instant responses.

Real-Time Market Connectivity

Zerodha connects directly with Indian exchanges (NSE, BSE, MCX) via FIX and REST APIs, ensuring minimal latency during order execution. It uses distributed systems to handle peak loads during market hours efficiently.

Security and Compliance

The platform follows SEBI and exchange-mandated compliance, using encryption and tokenized APIs to protect data. User authentication is multi-layered — combining passwords, PINs, and two-factor verification.

Automation and AI

AI-driven insights in Zerodha now assist traders with:

- Predictive trade analysis

- Risk profiling

- Automated alerts for volatility and margin levels

- Personalized portfolio suggestions based on market conditions

Scalability

Zerodha’s microservices design ensures that each module — trading, reporting, fund transfer, or analytics — scales independently. This keeps the system stable even when user traffic spikes.

API Integrations

Through Kite Connect, Zerodha provides APIs for third-party developers and fintech startups. These APIs power algorithmic trading, custom dashboards, and integrations with platforms like Sensibull and Smallcase.

Data Analytics

Zerodha uses big data systems to analyze user trades, behavioral trends, and market depth — helping enhance user experience and backend efficiency.

By focusing on performance, compliance, and accessibility, Zerodha has built a technological foundation that supports millions of investors with confidence and consistency.

Read More :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Zerodha’s Impact and Market Opportunity

Zerodha revolutionized India’s trading industry by democratizing access to the stock market. Its blend of affordability, education, and innovation helped millions of Indians become first-time investors — marking a major shift in how the country engages with finance.

Industry Disruption

Before Zerodha, full-service brokers dominated the market with high commissions and outdated systems. Zerodha’s flat-fee structure and digital-first model made investing affordable and transparent, forcing competitors to lower costs and modernize their platforms.

It wasn’t just a business innovation — it was a financial revolution that opened the doors of stock trading to middle-class India.

Market Statistics and Growth

- As of 2025, Zerodha serves over 12 million users and contributes 15–18% of India’s daily retail trading volume.

- It processes millions of trades daily across NSE, BSE, and MCX.

- The Indian stock market participation rate has grown from 3% in 2016 to over 10% in 2025, largely driven by digital brokers like Zerodha.

- Zerodha remains 100% bootstrapped, with consistent profits year-over-year.

User Demographics and Behavior

Zerodha’s audience is diverse — from students investing their first ₹1000 to professional day traders handling large portfolios. Most users are between 20–40 years old, tech-savvy, and prefer mobile-first trading.

The company also attracts long-term investors through mutual funds (Coin) and educators through Varsity, cementing its presence across all investor segments.

Geographic Presence

Zerodha operates across India with online-first access, reaching urban and semi-urban regions through its mobile app. Its expansion into financial education and API services has given it influence beyond borders, inspiring similar platforms across Asia.

Future Projections

By 2030, Zerodha aims to expand its fintech ecosystem with:

- AI-powered portfolio insights

- Global stock access

- Integrated wealth management tools

- Enhanced B2B brokerage APIs

Opportunities for Entrepreneurs

Zerodha’s success has sparked a new wave of fintech startups focusing on discount trading, crypto platforms, social investing, and automated wealth management.

Entrepreneurs looking to build similar platforms can leverage Zerodha Clone Script, which replicates Zerodha’s key features — advanced trading tools, low-latency architecture, and seamless user onboarding — deployable.

Building Your Own Zerodha-Like Platform

Zerodha’s success shows that technology and transparency can completely transform a traditional industry. It has inspired dozens of fintech startups in India and beyond to create affordable trading solutions that appeal to retail investors.

Why Businesses Want Zerodha Clones

Entrepreneurs and financial institutions want to replicate Zerodha’s model because it:

- Offers an affordable entry point into trading for millions.

- Generates steady income through volume-based trading.

- Builds loyalty through education and transparent pricing.

- Creates long-term growth with an integrated ecosystem (Kite, Coin, Console).

- Encourages innovation via open APIs and fintech partnerships.

Key Considerations for Development

To build a reliable trading app like Zerodha, you’ll need to focus on:

- Secure API integration with exchanges (NSE, BSE, MCX).

- Real-time data streaming and low-latency trading engines.

- User-friendly UI/UX for trading and investing.

- Robust backend with high uptime and scalability.

- Two-factor authentication and encryption for security.

- Seamless onboarding through Aadhaar and PAN verification.

- Transparent reporting and portfolio tracking tools.

Cost Factors & Pricing Breakdown

Zerodha-Like Trading App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Trading MVP | User onboarding, KYC integration, basic order placement (market/limit), watchlist, portfolio view, core admin panel | $35,000 |

| 2. Mid-Level Trading & Investment Platform | Advanced charts, multiple order types, margin support, real-time market feeds, reporting dashboards, mobile-ready frontends | $80,000 |

| 3. Advanced Zerodha-Level Trading Platform | High-concurrency order engine, multi-asset support (equity, F&O, mutual funds), deep broker/exchange APIs, advanced RMS, analytics | $150,000+ |

Zerodha-Style Trading & Investment Platform Development

The prices above reflect the global market cost of developing a Zerodha-like online trading and investment platform — typically ranging from around $35,000 to over $150,000, with a delivery timeline of 4–10 months depending on exchange/broker integrations, regulatory requirements, scalability needs, and advanced trading features.

Miracuves Pricing for a Zerodha-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, Zerodha-style trading and investment platform (user onboarding and KYC, equity and derivatives trading flows, market data views, portfolio dashboards, and mobile apps), with room to extend into more advanced brokerage connectivity, risk-management modules, and analytics as your business scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational trading ecosystem ready for launch and future expansion.

Delivery Timeline for a Zerodha-Like Platform with Miracuves

For a Zerodha-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Scope and complexity of trading & investment features

- Number of exchanges, brokers, and third-party market data providers to integrate

- Depth of risk-management and compliance workflows

- Required dashboards, reporting tools, and analytics for traders and admins

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.

Read More :-Read the complete guide on fintech app development costs

Conclusion

Zerodha didn’t just lower trading costs — it transformed the financial landscape of India. By empowering millions of people to invest and trade confidently, it made stock market participation mainstream. Its focus on transparency, education, and technology built a loyal user base and reshaped the brokerage industry entirely.

In 2025, Zerodha continues to lead India’s fintech ecosystem with innovation, profitability, and purpose. Its growth without external funding stands as proof that sustainable, user-first business models can outperform heavily funded startups.

For entrepreneurs, Zerodha’s journey is a roadmap to disruption — combining affordability, simplicity, and trust. The same model can thrive in emerging markets where traditional finance still limits accessibility.

FAQs :-

How does Zerodha make money?

Zerodha earns from flat brokerage fees (₹20 per order or 0.03%, whichever is lower), account opening charges, annual maintenance, margin interest, and partnerships with fintech tools under the Rainmatter ecosystem.

Is Zerodha safe for trading and investing?

Yes. Zerodha is a SEBI-registered broker and a member of NSE, BSE, and MCX. It follows strict compliance guidelines and stores client securities safely with CDSL.

Does Zerodha charge for equity delivery?

No. Equity delivery trades are completely free. Users only pay brokerage for intraday, F&O, and commodity trades.

What is Zerodha Coin?

Coin is Zerodha’s mutual fund investment platform where users can invest in direct mutual funds without distributor commissions, ensuring higher returns.

What is Zerodha Kite?

Kite is Zerodha’s flagship trading app offering real-time market data, charting tools, and seamless order execution across stocks, derivatives, and commodities.

How many users does Zerodha have?

As of 2025, Zerodha has over 12 million registered users, handling more than 15% of India’s retail market trades.

Is Zerodha free to use?

Account opening and AMC have nominal fees, but equity delivery trades are free. Intraday and F&O orders have a small ₹20 charge per executed order.

Can I invest in mutual funds through Zerodha?

Yes, Zerodha’s Coin app allows direct mutual fund investments with zero commission.

What makes Zerodha different from other brokers?

Its transparent pricing, user-friendly tech platforms (Kite, Coin, Console), and strong educational focus through Varsity set it apart.

Can I build a platform like Zerodha?

Yes. With Zerodha Clone Script, you can launch your own feature-rich stock trading platform — complete with equity, F&O, and mutual fund features .

Related Articles :-