Let us walk you through the ideation of Blockchain Transformation. Blockchain technology has moved beyond just being the backbone of cryptocurrencies like Bitcoin and Ethereum. Today, its potential to disrupt and transform industries is being recognized on a global scale. From ensuring transparency in supply chains to securing sensitive information in healthcare, blockchain is a game-changer. In this blog, we will explore the top 10 industries poised for transformation by blockchain and how they can leverage this technology to revolutionize their operations.

Why Blockchain Matters

Blockchain is a decentralized ledger that records transactions across multiple computers. What makes it unique is its ability to provide security, transparency, and immutability. Each transaction, or block, is encrypted and linked to the previous one, creating a chain that is almost impossible to alter.

While blockchain is often associated with cryptocurrencies, its applications extend far beyond. Many industries are recognizing the transformative power of blockchain to enhance efficiency, reduce fraud, and increase transparency. Now, let’s dive into the industries that are on the cusp of a blockchain revolution.

Market Adoption Trends of Blockchain Technology

Blockchain has witnessed steady growth in market adoption across various industries. Initially seen as a niche technology for cryptocurrencies, its use has expanded rapidly. Enterprises are recognizing the benefits of decentralized systems and are starting to integrate blockchain solutions into their core operations.

| Industry | Adoption Stage (2018-2020) | Adoption Stage (2021-2022) | Adoption Stage (2023-Present) |

|---|---|---|---|

| Financial Services | Early adoption for cryptocurrencies | Expanded to cross-border payments and DeFi | Mainstream adoption of blockchain for all transactions, lending, and smart contracts |

| Supply Chain | Limited pilots and trials | Increased use for transparency and tracking | Widespread use in logistics, anti-counterfeit measures, and vendor relationships |

| Healthcare | Initial explorations for data security | Experiments with decentralized health records | Accelerated adoption for patient data management, clinical trials, and drug tracking |

| Real Estate | Minimal adoption | Some use of blockchain for property transactions | Growing use of blockchain for smart contracts and property records |

| Retail & E-commerce | Limited blockchain use for loyalty programs | Experiments with tokenized platforms | Widespread adoption for product authenticity, payment systems, and supply chain tracking |

- 2018-2020: Blockchain adoption was primarily limited to financial services, with a focus on cryptocurrencies and decentralized finance (DeFi). During this period, major institutions began experimenting with blockchain for cross-border payments and smart contracts.

- 2021-2022: The COVID-19 pandemic accelerated the need for digital transformation, and blockchain gained traction in industries like healthcare, supply chain management, and real estate. Governments and large corporations began to explore blockchain for secure, tamper-proof records and increased operational efficiency.

- 2023-Present: Blockchain is seeing widespread adoption across various sectors, with industries like insurance, energy, and retail taking advantage of its benefits. From decentralized energy grids to blockchain-based IP protection, this technology is becoming a cornerstone of digital transformation.

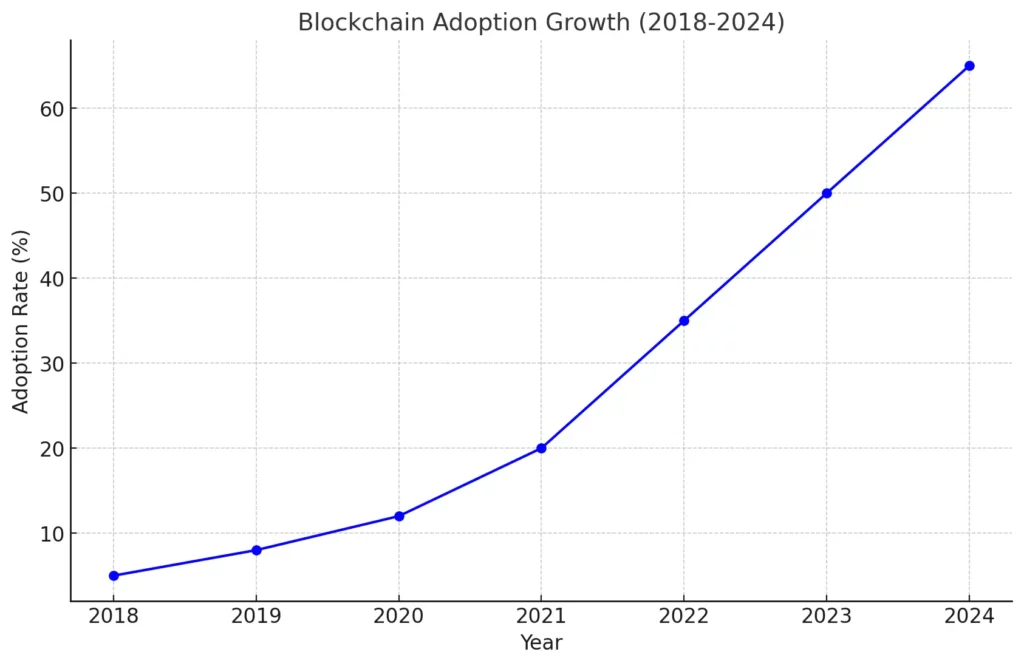

Growth of Blockchain Adoption in the Last 6 Years

The growth of blockchain adoption across industries, highlighting the exponential increase in interest and application over the past six years.

Read More : How to Budget for a Scalable and Secure Blockchain Launchpad App

Revenue Model Changes Due to Blockchain Transformation

| Industry | Old Revenue Model | New Blockchain-Driven Revenue Model |

|---|---|---|

| Financial Services | Fees for cross-border transactions and currency conversion | Decentralized finance (DeFi) platforms, smart contract transaction fees |

| Supply Chain | Fees for logistics, intermediaries, and paperwork validation | Blockchain-based tracking services, data analytics monetization |

| Healthcare | Manual data processing and secure storage, insurance claim fees | Decentralized patient data storage, automated smart contract claims |

| Real Estate | Broker commissions, lawyer fees for transaction facilitation | Blockchain-based property marketplaces, smart contract transactions |

| Retail & E-commerce | Centralized platform fees for listing, payments, delivery | Tokenized loyalty programs, blockchain-enabled product authenticity services |

As blockchain technology integrates into various industries, it is also leading to a shift in traditional revenue models. Here’s how blockchain is reshaping revenue generation across different sectors:

- Financial Services:

- Old Model: Traditional financial institutions charge fees for cross-border transactions, currency conversion, and intermediary services.

- New Model: Blockchain enables instantaneous peer-to-peer payments without intermediaries, reducing costs and introducing decentralized finance (DeFi) systems. Institutions are now monetizing through blockchain-based services like custodial wallets and smart contract platforms.

- Supply Chain Management:

- Old Model: Supply chain intermediaries typically charge for logistics, quality assurance, and paperwork validation.

- New Model: Blockchain eliminates the need for intermediaries by providing a transparent, tamper-proof record of transactions. Companies can now offer value-added services like data analytics and blockchain-enabled tracking systems for additional revenue streams.

- Healthcare:

- Old Model: Healthcare providers and insurance companies rely on manual processes for data verification and secure data storage, resulting in high costs.

- New Model: Blockchain ensures secure, decentralized storage of patient data and automates insurance claims processing through smart contracts, reducing administrative fees and enabling new services like decentralized health data sharing platforms.

- Real Estate:

- Old Model: Brokers and lawyers facilitate property transactions, earning commission-based fees.

- New Model: Blockchain allows for direct transactions between buyers and sellers using smart contracts, minimizing the need for intermediaries. New revenue models include blockchain-based property marketplaces and platforms that offer secure, immutable property ownership records.

- Retail and E-commerce:

- Old Model: Traditional retail models rely on centralized platforms for product listings, payments, and delivery services.

- New Model: Blockchain enables decentralized marketplaces where individuals can trade directly without intermediaries. Revenue models are shifting toward tokenized loyalty programs, blockchain-enabled product authenticity verification, and decentralized product exchanges.

These revenue model shifts not only reduce costs for businesses but also introduce innovative ways to generate new income streams through decentralized platforms, smart contracts, and blockchain-based services.

The combination of market adoption trends and revenue model transformations highlights how blockchain is not just a technology for the future—it’s a technology of today, driving change across multiple industries.

Read More : Essential Blockchain Development Tools for 2025: A Complete Guide to Power Your Projects

Top 10 Industries Ready for Blockchain Transformation

| Industry | Key Benefits of Blockchain |

|---|---|

| Financial Services | Secure, fast, and inexpensive transactions; smart contracts for automating agreements |

| Supply Chain | Improved transparency, reduced fraud, and enhanced efficiency |

| Healthcare | Secure patient data, better interoperability, and enhanced drug traceability |

| Real Estate | Streamlined transactions, transparent ownership records, and smart contracts for property transfers |

| Voting Systems | Tamper-proof voting, increased participation, and real-time transparency |

| Energy Sector | Decentralized energy trading, transparent billing, and renewable energy tracking |

| Intellectual Property | Transparent ownership records, better royalty distribution, and protection against piracy |

| Insurance | Automated claims processing, secure policy records, and fraud reduction |

| Government Services | Secure public records, transparent taxation, and decentralized voting |

| Retail & E-commerce | Authenticity verification, secure payments, and decentralized marketplaces |

1. Financial Services

Blockchain’s first significant application was in finance through cryptocurrencies, but its potential goes far beyond digital currencies. Blockchain can streamline complex financial transactions, reduce processing times, and lower costs.

Key Benefits:

- Instantaneous cross-border payments

- Secure, tamper-proof records of transactions

- Smart contracts to automate and enforce agreements

2. Supply Chain Management

Supply chains are often complex and involve multiple stakeholders, making them prone to inefficiencies and fraud. Blockchain can create a transparent, tamper-resistant record of each transaction from origin to delivery.

Key Benefits:

- Increased transparency and traceability

- Reduced fraud and counterfeiting

- Streamlined logistics and inventory management

3. Healthcare

The healthcare industry deals with vast amounts of sensitive data, from patient records to clinical trial results. Blockchain can ensure that this data remains secure, while also making it accessible to authorized parties.

Key Benefits:

- Secure, decentralized storage of patient records

- Improved data sharing between healthcare providers

- Enhanced transparency in drug supply chains

4. Real Estate

Blockchain can simplify and secure real estate transactions by eliminating the need for intermediaries like brokers and lawyers. It also helps in maintaining a transparent record of property ownership.

Key Benefits:

- Reduced transaction times

- Transparent property ownership records

- Secure, automated smart contracts for lease and sale agreements

5. Voting Systems

Voting systems are plagued by concerns over fraud, manipulation, and inefficiency. Blockchain offers a way to make elections more secure, transparent, and trustworthy.

Key Benefits:

- Tamper-proof voting records

- Increased voter participation through digital voting

- Real-time, transparent vote counting

6. Energy Sector

The energy industry is often slow to innovate, but blockchain has the potential to disrupt traditional energy markets by enabling decentralized energy trading and promoting transparency.

Key Benefits:

- Decentralized energy trading between individuals

- Transparent tracking of energy sources (renewable vs. non-renewable)

- Secure, automated billing and payments

7. Intellectual Property (IP) Protection

In industries like entertainment, publishing, and art, intellectual property rights are a major concern. Blockchain can create an immutable record of ownership, ensuring that creators are properly compensated.

Key Benefits:

- Transparent records of ownership

- Easier royalty distribution

- Protection against IP theft and piracy

8. Insurance

The insurance industry is highly dependent on trust, making it a prime candidate for blockchain adoption. Blockchain can streamline claim processing and improve transparency.

Key Benefits:

- Automated claim processing through smart contracts

- Secure, transparent record of policyholder information

- Reduced fraud and dispute resolution time

9. Government Services

Governments around the world are exploring blockchain to improve the efficiency and transparency of services such as public records, licensing, and tax collection.

Key Benefits:

- Secure, tamper-proof public records

- Transparent tax collection systems

- Decentralized voting and public service platforms

10. Retail and E-commerce

Blockchain can revolutionize retail by providing a transparent record of products, from production to delivery. It can also improve consumer trust by ensuring product authenticity and enabling secure payments.

Key Benefits:

- Transparent supply chains for authentic products

- Streamlined, secure payment systems

- Automated smart contracts for refunds and disputes

Future Trends in Blockchain

Blockchain technology is evolving rapidly, with several key trends expected to shape its future:

- Interoperability Between Blockchains: As more industries adopt blockchain, the need for different blockchain networks to communicate with each other grows. Interoperability protocols will enable seamless data and value transfer across various blockchains, enhancing functionality. Blockchain Interoperability Explained: Why It Matters

- Blockchain-as-a-Service (BaaS): Major tech companies are offering blockchain services (like Microsoft’s Azure Blockchain) that allow businesses to build and use blockchain solutions without needing deep technical expertise. This will lower the barrier to entry for blockchain adoption.

- Decentralized Finance (DeFi) Expansion: DeFi, a blockchain-based financial ecosystem, is expanding, offering services like lending, borrowing, and trading without intermediaries. As traditional banks explore DeFi, this trend will continue to grow.

- Government Adoption and Central Bank Digital Currencies (CBDCs): Governments are increasingly exploring blockchain for public services, and many central banks are developing digital currencies on blockchain, signaling broader institutional trust in the technology. IMF on Central Bank Digital Currencies

- Blockchain for Sustainable Development: Blockchain is being applied to energy grids, carbon tracking, and other sustainable practices, helping industries achieve transparency in their green initiatives. This trend is aligned with global sustainability efforts.

Read More : Top Blockchain Use Cases in 2025: From System of Records to Full-Scale Platforms

Challenges and Risks of Blockchain Adoption

While blockchain technology offers immense benefits, its adoption comes with challenges and risks:

- Scalability Issues: Most blockchain networks struggle to handle high transaction volumes quickly and efficiently, posing a barrier to large-scale adoption, particularly for enterprises needing high throughput.

- Regulatory Uncertainty: Different countries have different regulatory frameworks for blockchain and cryptocurrencies. This inconsistency makes it challenging for businesses to adopt blockchain without facing compliance issues.

- Energy Consumption: Proof-of-Work-based blockchain networks, such as Bitcoin, consume vast amounts of energy, raising concerns about sustainability and costs.

- Data Privacy: While blockchain can secure data, it is still vulnerable to privacy issues. Public blockchains, for instance, make data transparent and immutable, which could conflict with data protection laws like GDPR.

- Security Vulnerabilities: While blockchain is generally secure, smart contracts, which execute automatically, can have coding vulnerabilities that lead to hacks or system failures.

Table: Challenges and Risks of Blockchain Adoption

| Challenge | Description | Impact |

|---|---|---|

| Scalability | Difficulty in processing high transaction volumes due to block size limitations. | Delayed transactions and higher costs. |

| Regulatory Uncertainty | Lack of consistent global regulations on blockchain and cryptocurrency. | Legal challenges and operational uncertainty. |

| Energy Consumption | High energy usage, particularly in Proof-of-Work blockchains like Bitcoin. | Environmental concerns and operational costs. |

| Data Privacy | Public blockchains expose data to transparency, which may violate privacy laws like GDPR. | Legal risks and data security challenges. |

| Security Vulnerabilities | Smart contract bugs and hacks can lead to financial loss or system exploitation. | Risk of financial damage and loss of trust. |

Comparison to Traditional Technologies

Blockchain brings several advantages over traditional technologies, particularly in terms of security, efficiency, and decentralization. However, it also comes with its own set of challenges compared to traditional systems.

Table: Blockchain vs Traditional Technologies

| Aspect | Blockchain | Traditional Technologies |

|---|---|---|

| Security | High security through encryption and decentralized nature. | Centralized systems are vulnerable to single-point failures. |

| Efficiency | Removes intermediaries, automates transactions via smart contracts. | Requires intermediaries for transaction processing, adding time and cost. |

| Transparency | All participants in the network have access to a shared, immutable ledger. | Data is controlled and restricted to central authorities. |

| Scalability | Limited by transaction throughput and network size. | Can handle larger volumes with established infrastructures. |

| Cost | Potentially lower costs by eliminating middlemen but high initial setup costs. | Costs depend on intermediaries but are scalable. |

| Data Immutability | Once data is recorded, it cannot be altered or deleted. | Data can be altered or deleted, making it less trustworthy. |

Blockchain in Emerging Markets

Blockchain is increasingly being adopted in emerging markets, especially in regions where financial infrastructure is underdeveloped. These markets are ripe for disruption by blockchain due to its ability to increase financial inclusion, transparency, and operational efficiency. Here are some of the key areas where blockchain is making an impact:

- Financial Inclusion: Blockchain provides access to financial services for unbanked populations in emerging economies. With blockchain-based solutions like digital wallets, people without access to traditional banking systems can engage in global trade and receive remittances.

- Remittances: Blockchain allows for faster and cheaper cross-border payments, making it a game-changer for remittance-dependent economies in Africa and Southeast Asia. Platforms like Ripple are already facilitating international money transfers with lower fees and faster processing.

- Supply Chain Transparency: Emerging markets are using blockchain to improve supply chain transparency, particularly in agriculture and manufacturing. Blockchain helps trace the origin of products, ensuring fair trade practices and reducing counterfeiting.

- Energy Grids: Blockchain-based microgrids are gaining popularity in emerging markets like India and Africa. These grids allow local communities to trade renewable energy efficiently, creating decentralized energy markets.

- Land Title Management: In many emerging markets, land titles are prone to disputes due to inaccurate or corrupt records. Blockchain is being used to create immutable records of land ownership, reducing fraud and ensuring property rights.

Integration Cost of Blockchain Across Different Sectors

The integration of blockchain technology into various industries is gaining momentum, but the costs involved can vary widely depending on the complexity and scope of the implementation. Below is an overview of the estimated costs and the factors that influence these investments.

For financial services, blockchain integration costs are typically higher, ranging from $500,000 to $2 million. This is due to the need for secure, scalable platforms, compliance with regulatory requirements, and the implementation of smart contracts.

In supply chain management, blockchain helps in tracking goods, ensuring transparency, and preventing fraud. The integration cost ranges between $250,000 and $1.5 million, depending on the complexity of the logistics network.

The healthcare sector requires robust, secure systems to manage patient data, drug traceability, and compliance with privacy regulations like HIPAA. As such, blockchain implementation costs range from $300,000 to $2 million.

In real estate, blockchain is transforming how property transactions are managed through smart contracts and tamper-proof title deeds, with integration costs ranging from $200,000 to $1 million.

Other sectors like insurance, government services, energy, and retail also see blockchain adoption, with costs influenced by the specific needs of automation, security, and regulatory frameworks. The costs typically range from $100,000 to $2 million, depending on the complexity of the blockchain solution.

Despite the initial investment, blockchain technology offers significant returns by improving operational efficiency, enhancing security, and enabling new business models across industries.

Estimated Integration Cost of Blockchain by Sector

| Industry | Estimated Integration Cost (USD) | Cost Factors |

|---|---|---|

| Financial Services | $500,000 – $2 million | Custom smart contracts, transaction automation, regulatory compliance, security infrastructure |

| Supply Chain | $250,000 – $1.5 million | Transparency tools, inventory tracking systems, secure data exchange platforms |

| Healthcare | $300,000 – $2 million | Patient data management, interoperability solutions, drug supply chain transparency, HIPAA compliance |

| Real Estate | $200,000 – $1 million | Property title tracking, smart contracts for property deals, transaction history transparency |

| Voting Systems | $100,000 – $500,000 | Secure, tamper-proof voting platforms, voter ID verification, real-time result transparency |

| Energy Sector | $500,000 – $2 million | Decentralized energy trading platforms, renewable energy tracking, automated billing |

| Intellectual Property | $150,000 – $800,000 | Copyright tracking, royalty distribution automation, protection against IP theft |

| Insurance | $400,000 – $1.5 million | Smart contract claims processing, fraud detection, secure policy management systems |

| Government Services | $300,000 – $1.2 million | Decentralized public records, tax collection platforms, digital voting |

| Retail & E-commerce | $250,000 – $1 million | Blockchain-enabled payment systems, product authenticity verification, decentralized marketplaces |

Explanation of Cost Factors:

- Complexity: The more complex the use case (e.g., decentralized finance vs. simple transaction tracking), the higher the cost.

- Security: Blockchain solutions must be highly secure, which can increase infrastructure and development costs, especially in sensitive sectors like healthcare and finance.

- Compliance: Industries such as healthcare, finance, and energy must meet strict regulatory requirements, adding to the cost of integration.

- Customization: Developing custom blockchain solutions tailored to a company’s needs, like smart contracts or data-sharing platforms, increases costs.

Read More : Blockchain as a Service (BaaS): The Ultimate Guide to Blockchain Solutions for Businesses

Conclusion: Blockchain is Here to Stay

Blockchain technology is already transforming industries, and its potential continues to grow. Whether you’re in finance, healthcare, or retail, adopting blockchain can lead to improved efficiency, transparency, and trust.

While the technology is still evolving, it’s clear that blockchain is no longer just a buzzword. It is a tangible solution to many problems faced by modern industries. If you’re looking to stay ahead of the curve and adopt blockchain into your business model, now is the time to act.

How Can Miracuves Solutions Help?

At Miracuves Solutions, we specialize in developing cutting-edge blockchain solutions tailored to your business needs. Whether you’re looking to streamline supply chains, enhance data security, or automate financial processes, our team of experts can help you integrate blockchain technology seamlessly.

Ready to Transform Your Industry? Contact us today to discuss how we can help you leverage blockchain for a better, more secure future.

FAQ

What industries are most impacted by blockchain technology?

Blockchain technology is impacting industries such as finance, supply chain management, healthcare, real estate, insurance, retail, and energy. These industries are seeing increased transparency, security, and efficiency through blockchain adoption.

How is blockchain transforming the financial services industry?

Blockchain is transforming the financial services industry by enabling decentralized finance (DeFi), streamlining cross-border payments, and automating complex transactions using smart contracts, reducing costs and increasing security.

Why is blockchain important for supply chain management?

Blockchain improves supply chain management by offering transparency, reducing fraud, and allowing real-time tracking of goods. This technology helps ensure product authenticity and optimizes logistics processes.

Can blockchain improve data security in healthcare?

Yes, blockchain enhances healthcare data security by creating a decentralized, tamper-proof system for patient records. It improves data sharing between providers while ensuring compliance with regulations like HIPAA.

How does blockchain benefit the real estate industry?

Blockchain benefits the real estate industry by simplifying transactions through smart contracts, reducing the need for intermediaries like brokers and lawyers, and providing transparent property ownership records.

What are the revenue model changes due to blockchain technology?

Blockchain technology changes traditional revenue models by removing intermediaries, automating transactions with smart contracts, and enabling decentralized platforms. For example, in real estate, blockchain reduces brokerage fees, while in supply chain management, it minimizes fraud-related losses.

Related Articles