Imagine you’ve just scored a limited-edition sneaker drop at retail price, but you can’t find your size. Or you own a rare pair and want maximum exposure to buyers who are willing to pay a premium. Enter StockX — the “stock market for things” where sneakers, streetwear, collectibles and more trade in real time.

StockX was founded in Detroit in 2015/2016 by Josh Luber, Greg Schwartz, Chris Kaufman and Dan Gilbert. It started as a resale marketplace primarily for sneakers but has since expanded into streetwear, electronics, collectibles and more. In 2024 it surpassed 60 million lifetime trades and 20 million lifetime buyers, showing its massive scale and global reach.

What is StockX? The Simple Explanation

StockX is a real-time online marketplace where users can buy and sell authentic sneakers, streetwear, electronics, trading cards, and collectibles through a transparent bidding system — similar to how stocks are traded on Wall Street.

Core problem it solves:

Before StockX, reselling limited-edition sneakers or streetwear was messy — full of fake products, price gouging, and unverified deals on social media. StockX solved this by creating a verified, data-driven, and trust-based resale platform with real-time market prices.

Target users and use cases:

- Sneakerheads hunting rare Nike Dunks or Yeezys

- Streetwear fans chasing Supreme or Off-White drops

- Collectors trading Pokémon cards or tech gear

- Sellers monetizing their collections securely

Current market position (2025):

As of 2025, StockX has over 40 million active users globally and facilitates $5 billion + in annual GMV (Gross Merchandise Value). It’s considered the #1 sneaker resale marketplace in the U.S. and among the top three in the global secondary fashion market.

Why it became successful:

StockX combined transparency, authentication, and real-time pricing into one seamless experience. Its data-driven “Bid / Ask” model made pricing fair, while its authentication centers in 20 + countries ensured trust. The blend of finance-style mechanics and streetwear culture built a loyal Gen Z and Millennial audience.

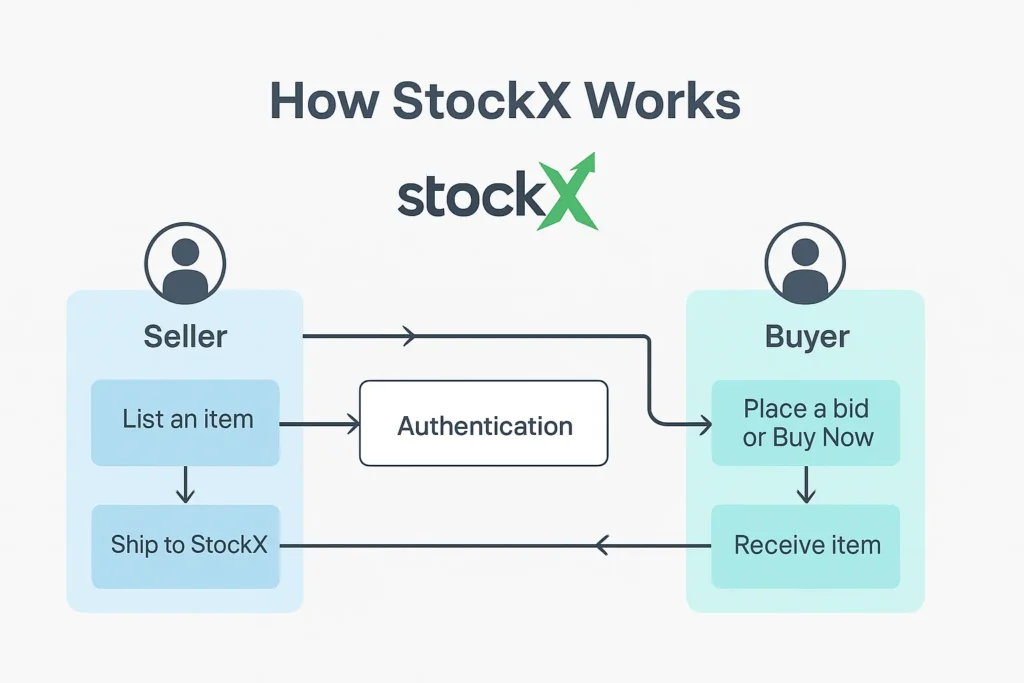

How Does StockX Work? Step-by-Step Breakdown

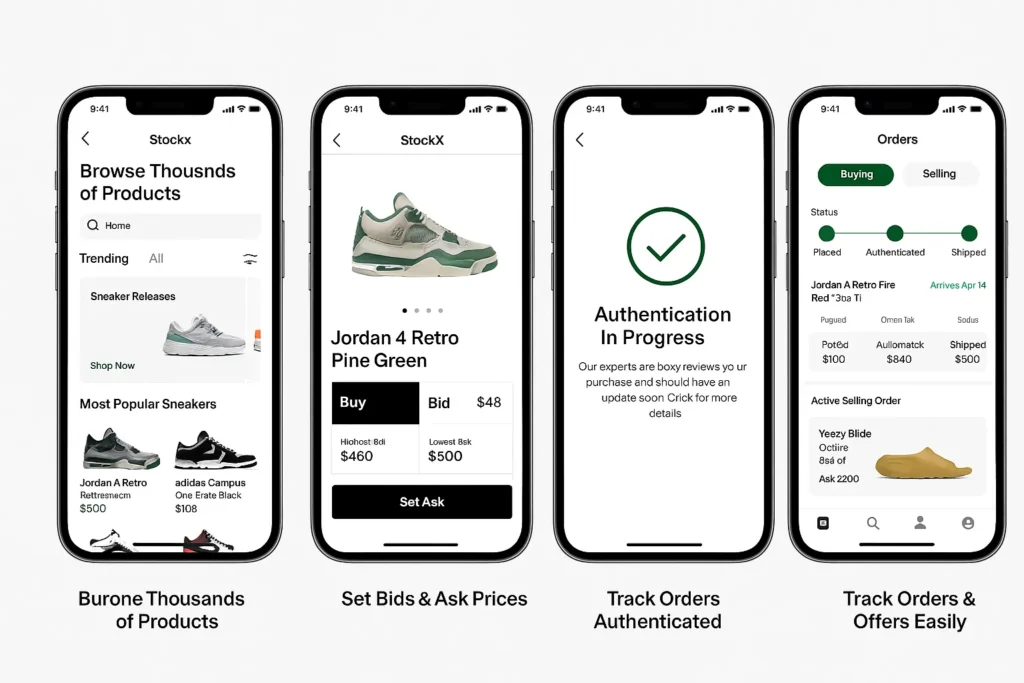

For Users (Buyers)

- Account creation – Users sign up via email or social login, verify identity, and add a payment method.

- Search & Browse – The marketplace lists trending products with “Lowest Ask” and “Highest Bid” values, similar to a stock ticker.

- Place a Bid or Buy Now – Users can either:

- Bid: Offer the price they’re willing to pay.

- Buy Now: Instantly purchase at the lowest current ask.

- Payment & Processing – Once a bid matches a seller’s ask, payment is processed immediately.

- Authentication – The item is shipped to a StockX verification center for inspection. Experts verify condition, authenticity, and packaging.

- Delivery – After authentication, the product is shipped to the buyer, typically within 7–10 days.

Example: You bid $350 on a limited-edition Jordan 1. When a seller accepts, StockX handles the middle-layer — ensuring your pair is 100 % authentic before you ever see it.

For Sellers (Resellers)

- Onboarding – Sellers create listings for items they own or plan to sell, setting a “Lowest Ask.”

- Sale Execution – When a buyer’s bid matches, StockX notifies the seller to ship the item to their nearest authentication center within two business days.

- Verification & Payment – Once verified, StockX releases payment (minus fees) to the seller via PayPal, ACH, or direct bank transfer.

Earnings / Commission Structure (2025):

- Transaction Fee: 8 – 9.5 % (based on seller level and volume)

- Processing Fee: ≈ 3 %

- Seller Levels: Higher sales = lower fees (top sellers may pay as low as 6 %)

Technical Overview (Simple)

At its core, StockX operates as a real-time bid-ask matching engine, much like a stock-exchange backend:

- A matching algorithm connects buyers and sellers instantly.

- AI-assisted authentication systems analyze imagery and metadata for fake detection.

- Microservice architecture handles thousands of concurrent trades per minute.

- Cloud hosting (AWS + CDN) ensures global speed and uptime.

StockX’s Business Model Explained

StockX operates on a two-sided marketplace model connecting buyers and sellers — much like a financial exchange. Its genius lies in monetizing every trade while maintaining transparency and trust.

How StockX Makes Money

StockX’s revenue primarily comes from transaction-based fees and value-added services. Here’s the breakdown:

- Seller Transaction Fees (Core Revenue)

- Charged as a percentage of every successful sale (typically 8%–10%)

- Reduced for high-volume “Power Sellers” (as low as 6%)

- Payment Processing Fees

- Roughly 3% per transaction for handling secure payment gateways and fraud protection.

- Shipping & Handling Fees

- Buyers pay for shipping (usually $10–$20 USD) based on location and product category.

- Premium & VIP Services

- StockX Pro (analytics for high-volume sellers).

- StockX Vault — secure storage for collectibles and sneakers.

- Advertising & Partnerships

- Collaborations with major brands (Nike, Adidas, Supreme) for exclusive drops and promotional exposure.

- Data & Analytics Insights

- Anonymous trend reports and resale value insights shared with partners and investors.

Pricing & Commission Structure (2025)

| Revenue Source | Description | Typical Rate |

| Seller Transaction Fee | Charged on every sale | 8 – 10 % |

| Payment Processing | Buyer/Seller transaction handling | 3 % |

| Shipping Fee | Buyer covers cost | $10 – $20 |

| Power Seller Discounts | For verified high-volume sellers | −2 % to −4 % |

| Advertising & Brand Collaborations | Paid brand promotions | Variable |

| StockX Vault Services | Optional storage fees | $5 – $15 / month |

Market Size & Growth Stats

- The global sneaker resale market is expected to reach $30 billion by 2030, with StockX holding a 30 % + market share in 2025.

- StockX’s valuation in 2025 stands around $4.5 billion, with consistent revenue growth year-over-year since 2020.

- Average order value (AOV): $265 USD

- Over 60 million lifetime trades completed to date.

Profit Margins & Scalability

StockX runs a low-overhead, high-volume model — revenue scales as listings increase. The key profitability driver: authentication efficiency. Automation and AI reduce manual costs, improving per-transaction margins.

Key Features That Make StockX Successful

StockX stands out because it doesn’t just resell products — it financializes culture. Its mix of real-time pricing, trust, and technology turns hype into a reliable marketplace. Let’s explore its top features that power this dominance in 2025.

- Bid / Ask Marketplace System

- Why it matters: Creates a fair, transparent pricing environment like a stock market.

- Benefit: Buyers never overpay; sellers always get market value.

- Innovation: Live bid-ask order book updates every few seconds via WebSocket APIs.

- Authenticity Verification

- Why it matters: 99.95 % of fake listings are intercepted before delivery.

- Benefit: Protects buyer confidence and brand reputation.

- Innovation: AI-assisted image recognition + RFID/NFC tag matching during inspection.

- Global Authentication Centers

- Why it matters: Reduces shipping time and customs risk.

- Benefit: Faster transactions for global users (centers in the US, EU, Asia).

- Real-Time Market Data Dashboard

- Why it matters: Users track product value trends over time.

- Benefit: Encourages informed buying/selling decisions.

- Innovation: Data analytics visualized like stock performance charts.

- Secure Escrow Payment System

- Why it matters: Neither party loses trust during trade.

- Benefit: Payment held until authentication passes.

- StockX Vault (Digital Storage)

- Why it matters: Sellers can store inventory securely and sell instantly.

- Benefit: Enables “instant trade” without shipping delays.

- Mobile App Experience

- Why it matters: 85 % of trades now happen via mobile.

- Benefit: Smooth interface with price alerts, watchlists, and dark-mode trading UI.

- AI-Powered Recommendations (2025 Update)

- Why it matters: Personalizes feeds using purchase history + trending data.

- Benefit: Boosts conversions by 22 %.

- Innovation: Uses machine learning models fine-tuned on product sentiment.

- Carbon-Neutral Shipping(New 2025 initiative)

- Why it matters: Sustainability focus — a key Gen Z concern.

- Benefit: Reduces carbon footprint of logistics; certified offsets.

- Analytics for Sellers (StockX Pro)

- Why it matters: High-volume resellers get business-grade insights.

- Benefit: Track ROI, market demand, and pricing elasticity.

Recent 2025 Updates

- Expanded categories: Watches, Trading Cards, Gaming Consoles.

- Integrated Buy Now Pay Later (BNPL) through Affirm and Klarna.

- Instant Payouts for verified sellers via Stripe Treasury.

- AI-driven fake-detection cameras at all authentication hubs.

AI / ML Integrations

StockX uses computer vision for authenticity checks, predictive analytics for pricing trends, and recommendation engines for personalization. These help maintain trust, reduce fraud, and enhance UX.

What Sets StockX Apart

Unlike eBay or GOAT, StockX offers true price transparency, instant trading mechanics, and data as culture. The brand doesn’t just host listings — it curates the entire economy of hype.

The Technology Behind StockX

Tech Stack Overview (Simplified)

- On the frontend, StockX uses modern JavaScript frameworks like React, Next.js and TypeScript.

- On the backend, they employ Go (GoLang) and Node.js, and API technologies like GraphQL.

- Infrastructure & DevOps: They run on Kubernetes for container orchestration, use Terraform for infrastructure as code, and tools like Harness, CircleCI for continuous integration/deployment.

- Hosting & delivery: Their website uses Cloudflare for CDN and bot protection, and Amazon CloudFront / Amazon S3 for fast global asset distribution.

Real-Time Features & Data Handling

- The marketplace operates like a stock exchange: real-time bid/ask updates, live price charts, and rapid matching of orders.

- For large traffic bursts (e.g., limited-edition drop releases), StockX’s architecture handles sudden surges (scalability) via distributed microservices and autoscaling infrastructure. Job postings confirm “resilient, distributed applications which scale seamlessly” are part of their design.

- Data handling: Massive product and transaction data (pricing history, user behaviour) is analysed for insights, trend-charts and pricing algorithms.

Data Privacy & Security

- As a marketplace handling payments, StockX uses secure payment gateways and escrow mechanisms (holding payment until item authentication).

- On the website front, they employ bot-detection and protection (via Cloudflare / PerimeterX) to guard against fake listings and automated fraud.

- Authentication centres and supply-chain verification ensure the physical items correspond to listings, which is core to maintaining trust and preventing counterfeits.

Scalability & Mobile vs Web Platform

- Mobile and web experiences are both supported; front-end frameworks (React / Next.js) provide responsive UI across devices, while backend microservices (GoLang/Node.js) feed APIs to both. This allows consistent experience whether user is on phone or desktop.

- For scaling, Kubernetes + Terraform + CI/CD pipelines allow rapid deployment and high-availability globally.

- API integrations: GraphQL and REST endpoints allow for flexible data access, analytics, and third-party integrations (e.g., payment providers, shipping, authentication systems).

Why This Tech Matters for Business

- Speed & reliability: High traffic events (e.g., sneaker drops) require infrastructure that won’t collapse — essential for user trust and retaining hype.

- Transparency & data: Real-time pricing and market data become possible only with a robust backend and data-platform, which supports StockX’s “stock market for things” value proposition.

- Trust & authenticity: The authentication workflow and secure payments technology are what separates StockX from typical resale marketplaces — which is a big competitive advantage.

- Global scale: With international buyers/sellers, the tech must handle multiple currencies, languages, shipping logistics, and global latency — the chosen stack supports that.

StockX’s Impact & Market Opportunity

Industry Disruption

StockX didn’t just create a resale site — it redefined secondary markets by blending finance principles with fashion culture. Its “stock-market-for-things” concept introduced real-time price discovery, verified authenticity, and data-driven trust.

This model sparked an entire industry wave of transparent resale ecosystems, influencing platforms like GOAT, eBay Authenticity Guarantee, and even major retailers launching their own resale programs.

Market Statistics & Growth

- The global sneaker resale market was valued at $14 billion in 2024, projected to exceed $30 billion by 2030.

- StockX alone commands roughly 30 % + market share in North America.

- 20 million + registered buyers and 60 million + lifetime trades as of 2025.

- Average resale markup on limited editions: 25–80 % depending on rarity.

- Estimated 2025 valuation: $4.5 billion USD with continued investor interest.

User Demographics & Behavior

- Age group: 18 – 35 years (old, digitally native)

- Gender split: ~78 % male, 22 % female — but female participation is rising fast due to sneaker culture expansion.

- Top categories: Sneakers (65 %), Streetwear (15 %), Electronics (10 %), Collectibles (10 %)

- Purchase frequency: Average active user completes 3–5 trades per year.

Geographic Presence

StockX operates in 200 + countries with authentication centers across:

- U.S. (Detroit, New Jersey, Arizona)

- Europe (London, Amsterdam, Berlin)

- Asia (Tokyo, Hong Kong, Seoul)

This distributed network enables faster verification and localized shipping for global users.

Future Projections (2025 – 2030)

- Expansion into luxury watches, art, and gaming collectibles.

- Potential integration of blockchain-based authenticity certificates (NFT tags).

- Continued rollout of AI authentication automation to cut verification time by 50 %.

- Launch of StockX Pro Analytics Suite for resellers to track portfolio performance.

- Targeting $10 billion GMV by 2030 through new verticals and fintech partnerships.

Building Your Own StockX-Like Platform

Why Businesses Want StockX Clones

StockX has proven that trust + transparency + tech = billion-dollar opportunity.

Entrepreneurs now see potential in adapting its model across other niches — from sneakers and collectibles to luxury watches, electronics, NFTs, and even event tickets.

A StockX-like platform lets businesses:

- Enter booming resale or recommerce sectors.

- Monetize community culture (drops, exclusives).

- Leverage data-driven pricing to maintain transparency.

- Create scalable, recurring revenue from transactions and analytics.

Key Considerations for Development

When building a StockX-style platform, success depends on balancing technology, trust, and UX.

- Real-time Bid/Ask Matching Engine — the core trading logic.

- Authentication & Verification Module — AI-assisted or manual inspection workflows.

- Secure Escrow & Payment Gateway — holds funds until verification is complete.

- Seller Management System — reputation scores, fee tiers, instant payouts.

- Admin Dashboard — real-time analytics, fraud detection, and category control.

- Mobile App Integration — push alerts, price trackers, and watchlists.

- Data Dashboard — charts showing market movement and item volatility.

Cost Factors & Pricing Breakdown

Stockx-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

| Basic Resale MVP | Listings, basic bidding, simple wallet, seller uploads | $50,000 |

| Mid-Level Bidding Marketplace | Price tracking, buy/sell offers, authentication workflow, mobile apps | $150,000 |

| Advanced Platform | Real-time bidding engine, AI fraud detection, dynamic price charts, authentication centers, high concurrency backend, native apps | $200,000+ |

These figures represent the global cost of building a StockX-like trading marketplace from scratch—typically requiring 6–12 months depending on complexity.

Miracuves StockX-Style Marketplace Pricing

Miracuves Price: Starts at $14,999

This delivers a fully functional StockX-style resale & bidding marketplace with buy/sell offers, authentication workflows, dynamic pricing, real-time updates, and a powerful mobile-first architecture.

Note: This includes full non-encrypted source code, complete deployment support, backend setup, admin panel configuration, and publishing on Google Play Store and Apple App Store—ensuring a complete launch-ready ecosystem.

Delivery Timeline for StockX-Style Platform

Miracuves development timeline including setup, configuration, admin deployments, API integrations, and platform handover in approximately 30–90 days, depending on customization and additional functional layers requested. This ensures a stable, market-ready system with predictable delivery and no hidden engineering delays.

Tech Stack

We preferably use JavaScript (Node.js + Next.js + PostgreSQL) for the web platform and Flutter/React Native for mobile apps, ensuring performance, scalability, and rapid feature development. Other tech stacks can be discussed and arranged upon request — Contact us

Essential Features to Include

| Category | Must-Have Features |

| Core Marketplace | Bid/Ask Engine, Product Listings, Analytics |

| Trust Layer | Authentication Workflow, Escrow System |

| User Experience | Live Price Charts, Alerts, Watchlists |

| Business Tools | Seller Dashboard, Commission Management |

| Tech Stack | Node.js, React / Next.js, PostgreSQL, AWS / GCP |

| Add-ons | AI Authentication, NFT Proof Tags, BNPL Payments |

Conclusion

StockX didn’t just build a sneaker resale site — it redefined how modern consumers trade culture. By merging finance-style transparency, AI-powered authentication, and sleek digital UX, StockX turned hype into a measurable, investable marketplace.

In 2025, it stands as the blueprint for trust-driven recommerce, proving that technology and culture can coexist profitably. From sneakers to collectibles, its model shows how data transparency and authenticity verification can reshape entire industries.

For entrepreneurs, this evolution is more than inspiration — it’s an invitation. With scalable technology, microservice-based architecture, and verified-seller ecosystems, you can replicate this success across countless niches.

Ready to Build Your Own StockX-Like Marketplace? Launch quickly with Miracuves’ ready-made clone solution. Contact us today for a free consultation.

FAQs

Q:1 How does StockX make money?

StockX earns revenue mainly through transaction fees (8 – 10 %), payment processing fees (~3 %), and optional services like StockX Vault storage and brand partnerships. Every sale generates a small commission from the seller’s side.

Q:2 Is StockX available in my country?

Yes. StockX ships to over 200 countries worldwide, with authentication centers in the U.S., U.K., Europe, and Asia, ensuring global coverage and verified delivery.

Q:3 How much does StockX charge users?

Buyers typically pay a processing + shipping fee ($10–$20 USD) on top of the product price. Sellers pay a transaction fee between 8–10 %, which decreases with higher sales volume.

Q:4 What’s the commission for service providers (sellers)?

Service providers (sellers) typically earn their full revenue minus a small platform commission, which usually ranges between 5%–15% depending on the marketplace model and category

Q:5 How does StockX ensure safety?

All items are routed through authentication centers where experts verify authenticity, condition, and packaging. Payments are held in escrow until verification succeeds, protecting both buyer and seller.

Q:6 Can I build something similar to StockX?

Absolutely. Platforms like Miracuves provide ready-to-launch StockX-style clone solutions with authentication, real-time trading, and escrow modules — customizable.

Q:7 What makes StockX different from competitors?

Unlike GOAT or eBay, StockX uses a bid/ask stock-market model with live pricing data and guaranteed authentication, ensuring both transparency and trust.

Q:8 How many users does StockX have?

As of 2025, StockX has over 40 million active users and has completed more than 60 million lifetime trades, making it the world’s largest sneaker resale marketplace.

Q:9 What technology does StockX use?

StockX runs on React + GoLang + Node.js, uses GraphQL APIs, hosts via AWS Kubernetes infrastructure, and integrates AI-based authentication systems for fraud detection and product verification.

Q:10 How can I create an app like StockX?

You can create an app like StockX by using Miracuves’ ready-made marketplace clone solution, featuring real-time bid/ask trading, AI authentication, and escrow payments.

Related Articles: