Investing in India used to mean long forms, physical signatures, and hidden commissions. Then came Groww — a clean, modern app that made investing as easy as scrolling through social media.

Founded in 2016 by ex-Flipkart employees, Groww started as a direct mutual fund investment platform before evolving into a full-fledged stock brokerage. Today, it offers stocks, mutual funds, ETFs, futures & options, IPOs, and U.S. equities, all accessible through a single app.

Groww’s mission is simple: to make investing transparent, simple, and available to everyone. Its modern UI, low-cost structure, and focus on education have made it especially popular among India’s young and first-time investors.

By 2025, Groww serves over 10 million active users and manages billions in investments, cementing its place as one of India’s top fintech success stories.

By the end of this article, you’ll understand what Groww is, how it works, how it earns, and how you can build your own Groww-like investing platform .

What is Groww? The Simple Explanation

Groww is an Indian online investment platform that allows users to invest in stocks, mutual funds, ETFs, IPOs, and derivatives with a few taps on their smartphone. It simplifies the entire investing process — from account setup to trading — by offering a clean interface and transparent pricing.

The main problem Groww solves is complexity and lack of trust in traditional investing. Earlier, mutual fund investments in India required paperwork and distributors who often charged hidden commissions. Groww disrupted this with a direct-to-customer model, removing middlemen and making investing 100% digital.

Its primary users are retail investors — young professionals, students, and working adults — who prefer app-based, self-directed investing.

As of 2025, Groww has become one of India’s top trading and wealth management platforms, backed by millions of active users and a strong fintech reputation. It competes with Zerodha, Upstox, and Angel One but differentiates itself through simplicity and design.

Groww’s success lies in its ability to merge investment education, affordability, and technology into a single, easy-to-use product.

How Does Groww Work? Step-by-Step Breakdown

Groww works as a digital investment and stock trading platform, giving users access to multiple asset classes through one unified app. Its simple interface, fast onboarding, and transparent structure make it ideal for first-time investors and regular traders alike.

For Users

1. Account Setup

Users create a Groww account using Aadhaar, PAN, and e-signature verification. The onboarding process is completely paperless and takes just a few minutes. Once verified, users get access to stocks, mutual funds, IPOs, and more.

2. Adding Funds

Groww allows instant deposits through UPI, net banking, and payment gateways. Withdrawals are quick, usually processed within the same day.

3. Mutual Fund Investing

Groww started as a direct mutual fund platform, allowing commission-free investments. Users can browse funds, compare returns, set SIPs, and track portfolios — all without distributor charges.

4. Stock Trading

Groww offers equity trading on NSE and BSE. The platform includes:

- Real-time charts

- Market depth

- Watchlists

- Faster order execution

Users can buy and sell stocks instantly with flat, low brokerage.

5. IPO Applications

Groww supports easy IPO applications through UPI. Users can view upcoming IPOs, apply, track allotments, and monitor listings.

6. Futures & Options (F&O)

Advanced users can trade derivatives with margin availability, live Greeks data, and options chains — integrated into the Groww trading interface.

7. Digital Gold & ETFs

Groww allows investing in ETFs, digital gold, and fixed-income offerings like sovereign gold bonds (SGBs).

8. U.S. Stocks

Users can invest in U.S. equities such as Apple, Tesla, and Amazon via fractional shares through Groww’s global investing section.

For Service Providers / Partners

Groww integrates with registrars, exchanges, depositories (CDSL), mutual fund AMCs, and global brokers to ensure compliant and seamless investment flows.

Technical Overview (Simplified)

Groww’s backend is built for speed and scalability using:

- Microservices architecture

- AWS cloud hosting

- Node.js and Java-based APIs

- Real-time WebSocket connections for live market data

- Secure data storage with encryption

The app uses automation for fund transfers, portfolio tracking, SIP execution, and order management.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Groww’s Business Model Explained

Groww follows a digital-first, low-cost, high-volume business model. Instead of earning through hidden commissions like old-style distributors, Groww focuses on transparency, small fees, and scalable digital services.

1. Brokerage Revenue

Groww charges simple, flat fees for stock and F&O trading:

- Equity Delivery: ₹0

- Intraday Trades: ₹20 per executed order or 0.05% (whichever is lower)

- Futures & Options: Flat ₹20 per executed order

Since millions of trades happen daily, even small charges generate large revenue.

2. Mutual Fund Revenue (Direct + Partnerships)

Groww originally became famous for direct mutual funds, which have zero commission.

However, in 2025 Groww earns through:

- Small platform fees on certain transactions

- Revenue-sharing models with AMCs for value-added services

- Float income from temporary cash held before investment

3. Groww Balance (Cash Management)

Idle money stored in Groww Balance earns Groww interest. A portion of this interest is shared with users, while the remaining becomes platform revenue.

4. IPO & U.S. Stocks

Groww offers IPO applications and international stocks. Revenue comes from:

- Currency conversion spreads

- Small processing fees

- Partnerships with global brokers

5. Subscription Services (Premium Tools)

Groww offers optional paid features such as:

- Advanced charting tools

- Research insights

- Priority support

- Expert-driven investment reports

These premium plans create predictable recurring income.

6. Margin & Lending Products

Groww extends credit via:

- Margin trading

- Collateral-based leverage

Groww earns interest from users borrowing funds for trades.

7. Referral & Partner Programs

Groww partners with banks, fintechs, and AMCs to offer third-party products.

This generates:

- Referral commissions

- Promotional payouts

- Affiliate revenue

8. Scale Efficiency

Groww is a purely digital platform, meaning:

- No physical branches

- Low operational overhead

- High automation

This allows strong profitability even with low fees.

Market Growth

By 2025, Groww’s revenue crosses ₹2,000 crore+ annually with profits rising steadily. India’s booming retail investing market (expected to reach ₹50 trillion by 2030) ensures a long-term growth runway.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Key Features That Make Groww Successful

Groww became one of India’s most-loved investing platforms because it focuses on simplicity, transparency, speed, and education. Its clean UI and beginner-friendly tools make it especially popular among young investors.

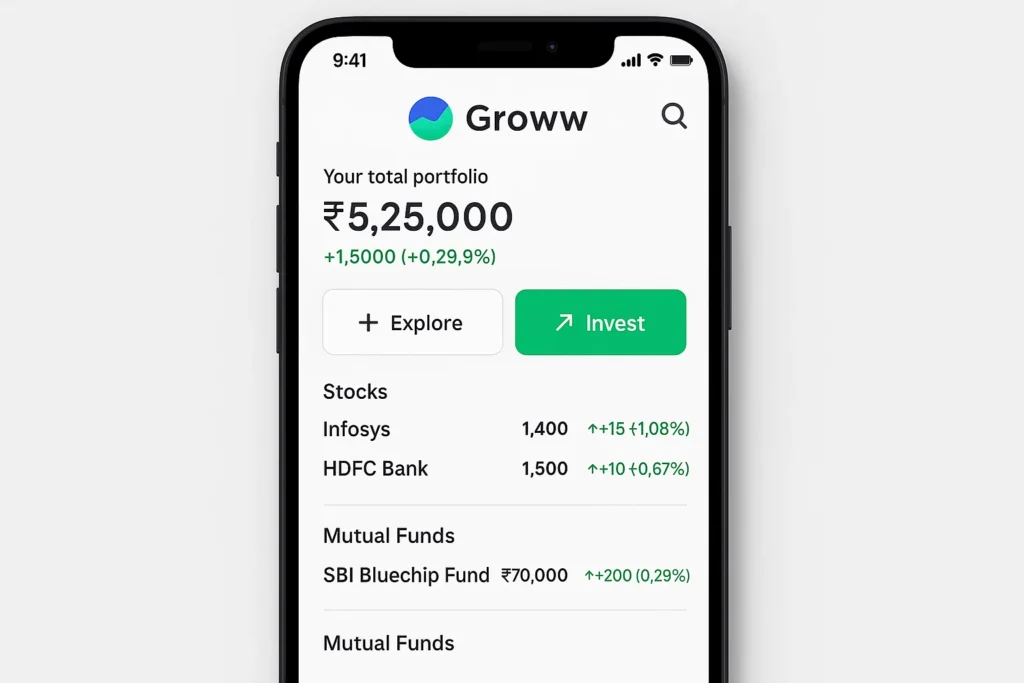

1. Simple and Modern Interface

Groww’s app design is clean, minimal, and intuitive. Even first-time investors can understand charts, returns, and product details without confusion.

2. 100% Digital Account Opening

Users can open a Demat + Trading account completely online using Aadhaar, PAN, and bank details. No paperwork, no in-person appointments.

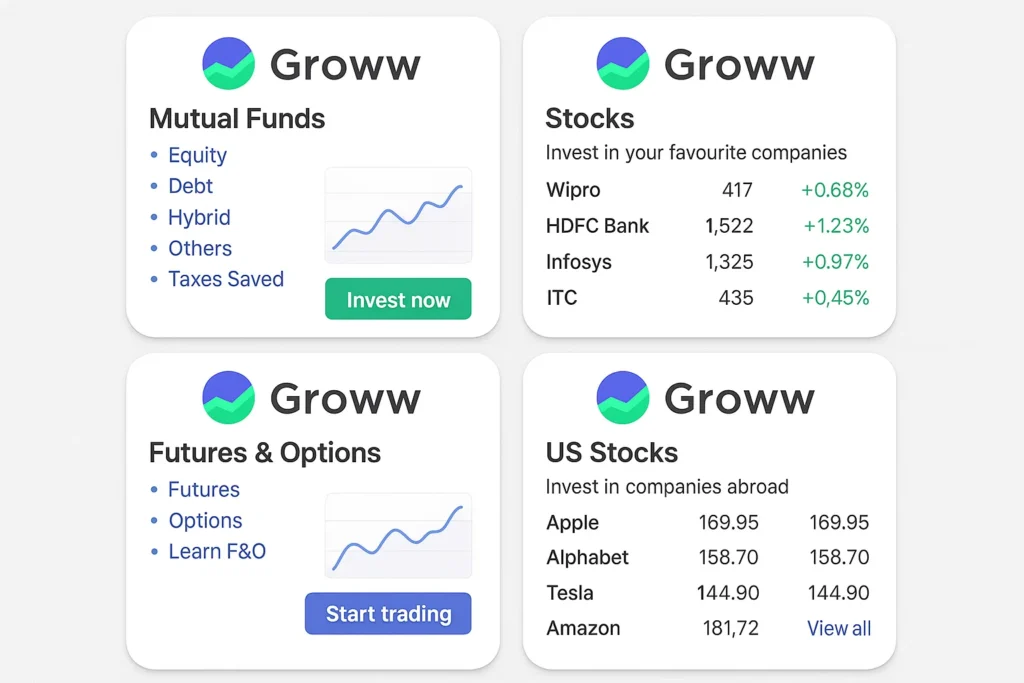

3. Direct Mutual Funds (Zero Commission)

Groww started with direct mutual funds and still offers them at zero commission, allowing users to earn higher long-term returns.

4. Stock Investing

Groww supports:

- NSE & BSE listed equities

- Real-time market data

- One-tap buy/sell

- Fractional investing (for select international stocks)

5. Futures & Options Trading

Groww now allows users to trade in F&O with margin calculators, risk indicators, and simple charts suitable for both beginners and experienced traders.

6. IPO Applications

Users can apply for IPOs directly through UPI, track allotment status, and get reminders when new IPOs launch.

7. U.S. Stocks (International Investing)

Groww allows investing in U.S. stocks like Tesla, Apple, and Amazon. Users can buy fractional shares digitally using international remittance integration.

8. ETFs and Gold

Groww offers ETFs, digital gold, and other alternative investment products to diversify portfolios.

9. Groww Learn (Education Hub)

Groww’s blog, videos, and learning hub offer easy explanations on stocks, SIPs, market trends, and financial topics—built for new investors.

10. Portfolio Analytics

Users get detailed performance insights, sector breakdown, P&L tracking, and tax statements directly inside the app.

2025 Updates

Groww launched:

- Smart AI investing suggestions

- Auto-SIP for stocks

- Enhanced F&O dashboard

- Better portfolio risk tracking

- Advanced charting with indicators

The Technology Behind Groww

Groww runs on a modern, cloud-native technology stack built to handle millions of users, real-time stock data, and secure investment processing. Its architecture focuses on speed, stability, and simplicity — ensuring users experience smooth trading even during heavy market activity.

Tech Stack Overview (Simplified)

Groww uses a combination of modern frameworks and scalable backend systems:

- Frontend: React, React Native for clean UI on web and mobile

- Backend: Java, Node.js, Go for high-speed processing

- Databases: PostgreSQL, Redis, MongoDB for secure and reliable data handling

- Cloud Infrastructure: AWS for hosting, autoscaling, and load balancing

- Real-Time Data: WebSockets and Kafka for streaming live market prices

This structure ensures the app stays fast even when millions of orders are placed simultaneously.

Real-Time Processing

Groww streams:

- Stock market prices

- F&O order books

- Mutual fund NAV updates

- Portfolio P&L changes

All in real time. Users see instant updates when they place orders or check their holdings.

Security and Compliance

Groww follows strict SEBI and exchange guidelines. Security layers include:

- 2-factor authentication

- Encrypted data storage

- Secure API connections with CDSL

- Biometric login

- Regular vulnerability audits

Deposits are held with regulated banks, while stocks and mutual funds are stored in CDSL Demat accounts, ensuring safety.

Automation & AI

Groww uses automation and AI for:

- Portfolio insights

- Risk assessment

- Fraud detection

- Automated KYC verification

- Personalized investment suggestions

Scalability

Groww’s microservices architecture ensures each module (stocks, mutual funds, F&O, IPOs) scales independently without affecting the entire system. Even during budget day or major market events, the app remains stable.

API & Integrations

Groww integrates with:

- NSE, BSE, MCX trading APIs

- CDSL for Demat operations

- Mutual fund registrars (CAMS & KFinTech)

- Bank gateways for instant deposits

- Third-party data providers for charts & analytics

Data & Analytics

Big data tools like Snowflake, Datadog, and Elasticsearch help Groww analyze user behavior, monitor app performance, and optimize recommendations.

Groww’s technology backbone is what allows it to deliver a simple, fast, and secure investing experience to millions across India.

Groww’s Impact and Market Opportunity

Groww has changed the way millions of Indians invest by making financial products simple, digital, and accessible. It’s one of the strongest examples of how user-friendly technology can transform an entire industry.

Industry Disruption

Before Groww, investing in India was slow, paper-heavy, and filled with hidden distributor commissions. Groww removed these barriers by offering a fully digital platform with direct mutual funds, zero paperwork, and transparent pricing.

This shift forced traditional players to upgrade their systems and adopt digital-first strategies.

Market Statistics and Growth

- Groww has 10+ million active investors as of 2025.

- It manages billions in assets across mutual funds and stocks.

- India’s retail participation has increased from 3% to 10% in the last decade, with Groww contributing significantly to onboarding new investors.

- IPO participation via apps like Groww hit all-time highs due to ease of access.

User Demographics and Behavior

Groww appeals strongly to:

- First-time investors

- Young professionals aged 18–35

- People shifting from savings accounts to wealth creation

- Mobile-first users from Tier 1, Tier 2, and Tier 3 cities

Most users prefer simple long-term investing in mutual funds, SIPs, and top Indian stocks.

Geographic Presence

Groww operates pan-India through a 100% digital model. It has no branches, reducing operational costs and supporting rapid scaling into every region, including small towns and rural pockets.

Future Projections

By 2030, Groww aims to:

- Add global investing with more U.S. and international markets

- Launch advanced F&O tools

- Introduce AI-based advisor systems

- Expand into digital financial education and wealth planning

- Integrate insurance and credit products

Opportunities for Entrepreneurs

Groww’s success proves that investors want platforms that are:

- Simple

- Transparent

- Low-cost

- Mobile-first

- Easy to understand

This opens huge opportunities in emerging markets for new trading platforms, micro-investing apps, regional stockbrokers, and hybrid wealth-tech apps.

With Groww Clone Script, entrepreneurs can launch a Groww-like investment and trading app, complete with stock trading, SIPs, mutual funds, IPOs, and analytics.

Building Your Own Groww-Like Platform

Groww’s massive success shows that users want a simple, transparent, and mobile-first way to invest. Its clean interface, low fees, and easy onboarding made it the preferred choice for first-time Indian investors — and it opened the door for new fintech founders who want to build similar platforms.

Why Businesses Want Groww-Style Platforms

A Groww-like investing app allows companies to:

- Capture India’s fast-growing retail investor base.

- Provide stocks, mutual funds, ETFs, and IPO access in one place.

- Offer modern UI/UX that appeals to Gen-Z and millennials.

- Compete with traditional brokerages using low-cost digital models.

- Build additional revenue from subscriptions, APIs, and partner tools.

The model is scalable, profitable, and in high demand across India, the Middle East, Africa, and Southeast Asia.

Key Considerations for Development

If you’re planning to build a Groww-like platform, these are the essentials:

- Exchange integration with NSE, BSE, MCX (or local exchanges in your region)

- Fast KYC onboarding with Aadhaar/OTP/PAN (or equivalents globally)

- Modern mobile and web trading interfaces

- Real-time stock price streaming

- Secure payment integration (UPI, net banking, bank transfers)

- Compliance with regional financial authorities

- Strong reporting: holdings, P&L, tax summaries, statements

- Portfolio recommendations and risk scoring

- 2FA, encryption, session security, and audit logs

Cost Factors & Pricing Breakdown

Groww-Like Investment App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Investing MVP | User onboarding, KYC integration, basic stock / mutual fund investing flows, watchlist, portfolio view, core admin panel | $35,000 |

| 2. Mid-Level Investing & Trading Platform | Advanced charts, multiple order types, mutual funds + stocks support, real-time market feeds, reporting dashboards, mobile-ready frontends | $80,000 |

| 3. Advanced Groww-Level Investment Platform | High-concurrency order handling, multi-asset support (equity, mutual funds, ETFs), deep broker/exchange APIs, advanced RMS, analytics, web + apps | $150,000+ |

Groww-Style Investing & Trading Platform Development

The prices above reflect the global market cost of developing a Groww-like online investing and trading platform — typically ranging from around $35,000 to over $150,000, with a delivery timeline of 4–10 months depending on broker/exchange integrations, regulatory requirements, scalability needs, and advanced investment features.

Miracuves Pricing for a Groww-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, Groww-style investing platform (user onboarding and KYC, equity and mutual fund investment flows, market data views, portfolio dashboards, and mobile apps), with room to extend into more advanced brokerage connectivity, analytics, and risk-management modules as your business scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational investing ecosystem ready for launch and future expansion.

Delivery Timeline for a Groww-Like Platform with Miracuves

For a Groww-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Scope and complexity of investing & trading features

- Number of exchanges, brokers, and third-party market data providers to integrate

- Depth of risk-management and compliance workflows

- Required dashboards, reporting tools, and analytics for investors and admins

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js / Nest.js / Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms. Other technology stacks can be discussed and arranged upon request during the consultation phase.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.

Read More :- Read the complete guide on fintech app development costs

Conclusion

Groww has redefined investing for millions of Indians by making it simple, transparent, and accessible. What once required physical forms, in-person brokers, and confusing jargon can now be done in minutes from a smartphone. Its clean design, low-cost structure, and strong focus on financial education have turned first-time users into confident investors.

In 2025, Groww continues to thrive as one of India’s most trusted investment platforms, empowering the younger generation to take control of their wealth. Its success story proves that when technology and user-first design come together, financial inclusion becomes a reality rather than an aspiration.

For entrepreneurs, Groww’s journey highlights the massive potential of digital investing solutions. With the right technology and customer-centric approach, it’s possible to build a platform that transforms how people manage money.

FAQs :-

How does Groww make money?

Groww earns revenue from brokerage fees on stock, F&O, and intraday trades, interest on idle funds, premium partner products, and referral commissions on financial services.

Is Groww safe for investing?

Yes. Groww is a SEBI-registered broker and a member of NSE/BSE. All mutual fund investments are held with AMCs, and stocks are stored safely in CDSL.

Does Groww charge brokerage?

Equity delivery is free.

Intraday and F&O trades are charged at ₹20 per executed order or 0.05%, whichever is lower.

Can I buy mutual funds on Groww?

Yes. Groww offers commission-free direct mutual funds across categories like equity, hybrid, debt, and ELSS.

How many users does Groww have?

As of 2025, Groww has more than 10 million active users across India.

Is Groww better than Zerodha?

Groww is preferred for beginners due to its clean interface, while Zerodha is often favored by experienced traders for advanced charts and tools.

Can I invest in U.S. stocks on Groww?

Yes. Groww allows investing in U.S. equities through its global investing feature.

Does Groww offer SIPs?

Yes. Users can set up SIPs in mutual funds directly from the app.

What technology does Groww use?

Groww uses a cloud-based, microservices architecture with secure APIs, real-time market data streaming, and encrypted data storage to ensure seamless trading.

Can I build an app like Groww?

Yes. With Groww Clone Script, you can launch an investing platform with stocks, mutual funds, IPOs, and analytics.

Related Articles :-