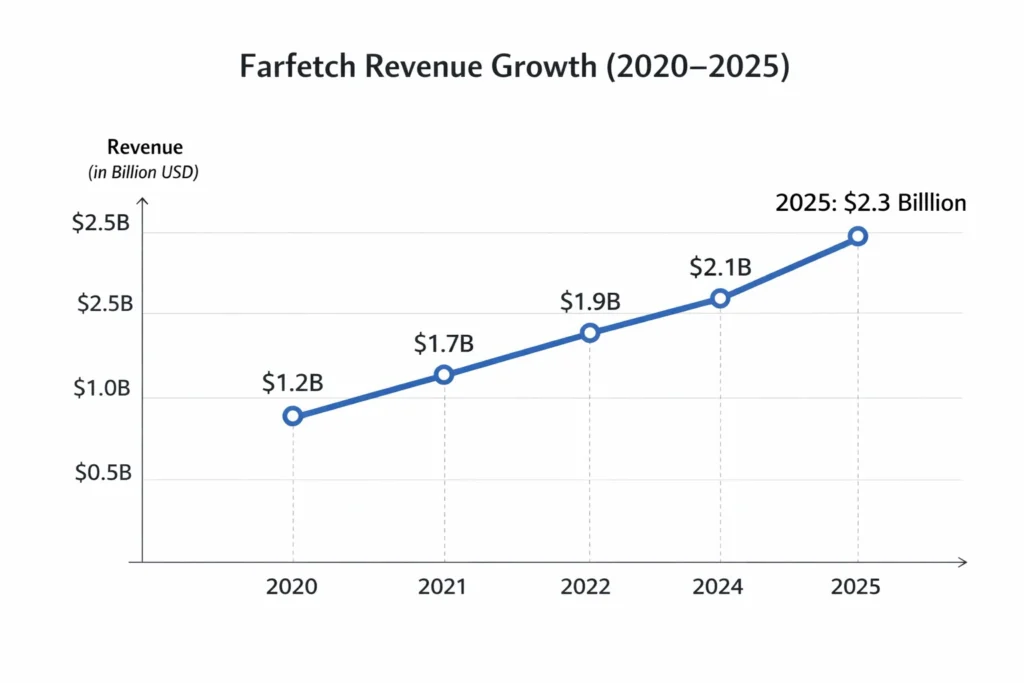

Farfetch generated approximately $2.3 billion in revenue in 2025, making it one of the world’s most influential luxury fashion marketplaces despite operating without owning inventory. This asset-light approach allows Farfetch to scale globally with lower capital risk while maintaining access to thousands of high-end brands and boutiques. By avoiding inventory holding costs, the platform stays flexible during demand fluctuations and preserves healthier margins compared to traditional luxury retailers.

What makes Farfetch unique is its global, asset-light marketplace model that seamlessly connects luxury boutiques, brands, and consumers across continents. The platform handles discovery, technology, payments, and cross-border logistics while partners manage inventory, creating a powerful win-win ecosystem. This structure enables Farfetch to offer an unmatched selection of luxury products while expanding into new regions without heavy operational overhead.

Farfetch Revenue Overview – The Big Picture

Farfetch operates as a luxury fashion marketplace, aggregating inventory from boutiques and brands rather than holding stock itself.

2025 Snapshot

- Revenue (2025): ~$2.3 billion

- Valuation: ~$1.8–2.0 billion (market-adjusted)

- YoY growth: ~8%

- Gross margin: ~45–47%

- Net margin: Low single-digit, improving

- Active customers: ~4.5 million

Revenue by Region

- Europe & UK: ~40%

- North America: ~35%

- Asia-Pacific & Middle East: ~25%

Competition Benchmark

- Net-a-Porter: Inventory-heavy, higher costs

- MyTheresa: Higher margins, narrower audience

- SSENSE: Editorial-driven, limited scale

Read More: What is Farfetch and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Marketplace Commission (Core Revenue)

Farfetch earns commissions on every transaction between buyers and sellers.

- Contribution: ~70%

- Commission range: 25–35% per order

- 2025 insight: Commission flexibility helps onboard premium boutiques

Revenue Stream #2: Brand Services & Platform Solutions

Luxury brands pay Farfetch for digital infrastructure and omnichannel tools.

- Contribution: ~15%

- Services: eCommerce tech, logistics, data tools

- Value: High-margin, recurring B2B revenue

Revenue Stream #3: Farfetch Platform Fees

Boutiques pay subscription or access fees to list and operate on Farfetch.

- Contribution: ~6%

- Pricing: Tiered based on geography and scale

Revenue Stream #4: Logistics & Fulfillment Services

Farfetch offers warehousing, cross-border shipping, and returns handling.

- Contribution: ~6%

- Advantage: Improves delivery speed and quality

Revenue Stream #5: Advertising & Visibility Boosts

Luxury brands pay for premium exposure.

- Contribution: ~3%

- Formats: Featured placements, curated campaigns

Revenue Streams Percentage Breakdown

| Revenue Stream | Share |

|---|---|

| Marketplace Commissions | 70% |

| Brand Services & Tech | 15% |

| Platform Fees | 6% |

| Logistics & Fulfillment | 6% |

| Advertising & Promotions | 3% |

The Fee Structure Explained

User-Side Fees

- Product price

- Shipping fees (vary by region)

- Duties & taxes (cross-border orders)

Seller-Side Fees

- Marketplace commission (25–35%)

- Platform subscription fees

- Logistics service charges

Hidden Revenue Layers

- FX conversion margins

- Priority listing fees

- White-label technology licensing

Regional Pricing Variation

- Higher AOV in US, Europe, Middle East

- Duty-inclusive pricing in select markets

Complete Fee Structure by User Type

| User Type | Fees Applied |

|---|---|

| Luxury Shoppers | Product + shipping + duties |

| Boutiques | 25–35% commission |

| Brands | Platform + tech service fees |

| Logistics Partners | Revenue share |

| Advertisers | CPM / campaign pricing |

How Farfetch Maximizes Revenue Per User

Farfetch focuses on high AOV and lifetime luxury buyers.

- Segmentation: High-net-worth customers, fashion categories

- Upselling: Styling edits, exclusive collections

- Cross-selling: Accessories with apparel

- Dynamic pricing: Brand-controlled pricing flexibility

- Retention monetization: Private client programs

- LTV optimization: Repeat luxury buyers drive ~60% of revenue

- Psychological pricing: Exclusivity over discounts

Real example: Farfetch’s average order value exceeds $600.

Cost Structure & Profit Margins

Farfetch’s asset-light model reduces inventory risk but still carries platform costs.

Major Cost Centers

- Infrastructure: Cloud, AI personalization, marketplace tech

- Marketing & CAC: Influencers, luxury partnerships

- Operations: Customer support, compliance

- R&D: Brand tech, omnichannel integrations

Unit Economics

- AOV: ~$600

- Contribution margin per order: ~$90–120

- Returns cost lower than fast fashion

Read More: Best Farfetch Clone Script 2025 – Build a Fashion Marketplace

Future Revenue Opportunities & Innovations

Farfetch continues to expand beyond pure marketplaces.

- AI-powered luxury personalization

- White-label luxury commerce platforms

- Emerging market luxury expansion

- NFT-linked luxury experiences

- Omnichannel retail integrations

Risks

- Luxury demand cycles

- Brand disintermediation

- Global logistics complexity

Opportunities for Founders

- Regional luxury marketplaces

- Vertical-specific premium platforms

- B2B fashion-tech SaaS

Lessons for Entrepreneurs & Your Opportunity

What Works

- Asset-light marketplace model

- High commission justified by value

- Global brand aggregation

What to Replicate

- Platform-first luxury commerce

- B2B + B2C hybrid monetization

- Data-driven personalization

Market Gaps

- Emerging luxury markets

- Sustainable luxury platforms

- Niche designer ecosystems

Want to build a platform with Farfetch’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Farfetch clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Farfetch proves that luxury marketplaces don’t need to own inventory to scale globally. By eliminating inventory risk, the platform avoids heavy capital lock-in, reduces exposure to unsold stock, and adapts quickly to changing luxury demand. This approach allows Farfetch to grow across regions while staying operationally lean and financially flexible.

Its strength lies in connecting brands, boutiques, and buyers through technology rather than ownership. Farfetch acts as the digital backbone—handling discovery, payments, logistics, and cross-border commerce—while partners retain control of their products. This technology-driven orchestration creates a scalable ecosystem where value is generated through connections, not assets.

For founders, this model offers a clear blueprint for building high-margin, global platforms with controlled risk. By focusing on platform services, partnerships, and premium customer experiences, entrepreneurs can scale internationally without massive upfront investments. Farfetch demonstrates that ownership isn’t required to win—efficient marketplaces and strong network effects are.

FAQs

1. How much does Farfetch make per transaction?

Roughly $90–120 in contribution margin per order.

2. What’s Farfetch’s most profitable revenue stream?

Marketplace commissions combined with brand services.

3. How does Farfetch’s pricing compare to competitors?

Premium pricing with brand-controlled margins.

4. What percentage does Farfetch take from sellers?

Typically 25–35% per transaction.

5. How has Farfetch’s revenue model evolved?

Expanded from pure marketplace to platform services.

6. Can small platforms use similar models?

Yes, especially niche luxury or regional platforms.

7. What’s the minimum scale for profitability?

Around 20k–30k high-AOV customers.

8. How to implement similar revenue models?

Combine marketplace commissions with B2B services.

9. What are alternatives to Farfetch’s model?

Inventory-led luxury retail or D2C brand platforms.

10. How quickly can similar platforms monetize?

Many businesses begin generating revenue soon after launch.