From a simple idea to reimagine banking for millennials, N26 scaled from a Berlin startup into a global digital bank serving over 8 million users across Europe and the US. Its success was not driven by branches or legacy systems, but by a mobile-first experience, real-time finance control, and a technology-driven banking model. In 2026 , this model matters more than ever as users increasingly expect banking to be instant, transparent, and fully app-based.

For entrepreneurs and fintech founders, understanding the N26 clone model is no longer optional. The global neobanking market is projected to cross $395 billion by 2026, with double-digit annual growth driven by Gen Z and SME adoption. Investors continue to back digital-first banks because they scale faster, operate leaner, and generate higher lifetime value per user than traditional banks. Building a N26-style digital banking app allows startups to enter regulated markets with a proven UX and monetization structure instead of experimenting blindly.

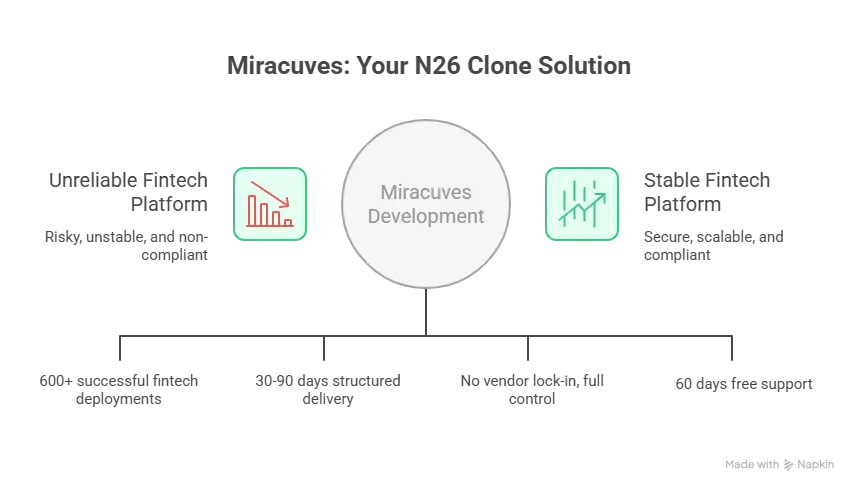

This is where N26 Clone Development becomes a strategic advantage. A well-built clone is not about copying features; it is about replicating the business logic, performance benchmarks, and trust signals that made N26 successful. With the Best N26 Clone Script 2026 , entrepreneurs can launch a secure, compliant, and scalable neobank platform in months instead of years. Miracuves Clone Solutions focuses on giving founders production-ready fintech systems that are built for real users, real regulations, and real growth rather than prototypes that stall after launch.

What Makes a Great N26 Clone?

A great N26 clone in 2026 is not defined by how closely it looks like the original app, but by how reliably it performs under real financial workloads. Digital banking users today expect instant responses, zero downtime, and complete control over their money from a single screen. If a banking app lags, crashes, or feels confusing, trust erodes immediately and churn follows.

From a founder’s perspective, a high-quality N26 clone must balance three critical pillars: technology performance, regulatory readiness, and business scalability. Performance is non-negotiable. Modern neobank users expect average API response times under 300 milliseconds, real-time transaction notifications, and uninterrupted service backed by 99.9% uptime SLAs. Scalability is equally critical because a banking product that works for 5,000 users often fails when it reaches 500,000 unless it is architected correctly from day one.

User experience is the silent growth engine. N26 succeeded because users could open accounts quickly, track spending visually, freeze cards instantly, and feel in control without reading a manual. In 2026 , a great clone must go further by combining minimal UI with intelligent automation. Features such as AI-powered spending insights, automated savings rules, and predictive alerts are no longer premium add-ons; they are baseline expectations.

Monetization readiness also defines a great clone. Subscription-based plans, interchange fee optimization, premium card tiers, and embedded financial services must be built into the core architecture, not added later as patches. Founders who delay monetization logic often face costly rewrites once user growth accelerates.

Core Qualities of a High-Performance N26 Clone

- Mobile-first architecture optimized for iOS and Android with identical feature parity

- Sub-300ms response times for balance checks, transactions, and notifications

- 99.9% uptime supported by cloud-native infrastructure and auto-scaling

- Compliance-ready framework adaptable to EU, UK, and US fintech regulations

- Built-in monetization layers including premium plans and partner integrations

- Future-proof modular codebase for rapid feature expansion without downtime

Technical Benchmarks That Matter in 2026

A production-ready N26 clone must handle concurrent users, real-time financial events, and encrypted data flows without degradation. At Miracuves, clone systems are engineered to process thousands of transactions per second while maintaining encryption standards such as AES-256 and TLS 1.3, ensuring both performance and security scale together.

Modern N26 Clone Comparison Table

| Capability Area | Standard Clone | Advanced Clone | Miracuves N26 Clone |

|---|---|---|---|

| Avg Response Time | 600–800ms | 400–500ms | <300ms |

| Uptime SLA | 98.5% | 99% | 99.9% |

| AI Spending Insights | Limited | Partial | Full AI-driven analytics |

| Scalability | Manual scaling | Semi-automated | Auto-scaling cloud-native |

| Monetization Ready | Basic | Moderate | Enterprise-grade |

| Compliance Adaptability | Low | Medium | High, region-ready |

This difference between a generic clone and a Miracuves-built N26 clone is what determines whether a product survives beyond its first 10,000 users or scales confidently into new markets. A great clone is not an experiment; it is a banking-grade system engineered for growth, trust, and long-term revenue.

Read More : What is N26 App and How Does It Work?

Essential Features Every N26 Clone Must Have

A successful N26 clone is built around layered functionality that serves users, administrators, and the financial ecosystem simultaneously. In 2026 , digital banking products are judged less by how many features they offer and more by how intelligently those features work together. A founder building a neobank clone must think in terms of systems, not screens.

On the user side, the experience must feel effortless while handling complex financial operations in the background. Account onboarding should be fully digital with KYC verification completed within minutes. Users expect instant virtual cards, real-time balance updates, and spending controls that work immediately, not hours later. Retention in neobanking depends on how much control users feel they have over their money, which is why features such as card freeze, merchant-level spend tracking, and automated savings rules are essential.

The admin layer is the operational brain of the platform. Without a powerful admin panel, even a beautifully designed app becomes unmanageable at scale. Founders need real-time visibility into user activity, transaction flows, compliance alerts, and revenue metrics. In 2026 , automation at the admin level is critical. Manual reconciliation, delayed reporting, or fragmented dashboards create operational risk and slow down decision-making.

The service and banking operations layer connects the app to payment networks, compliance systems, and third-party providers. This layer must support real-time transaction processing, AI-based risk scoring, and seamless settlement workflows. As user volume grows, this system must scale horizontally without affecting response times or data integrity.

User-Side Features That Drive Adoption

The user interface of an N26 clone must be simple on the surface while being technically robust underneath. Users should never feel that they are interacting with a “financial system.” They should feel like they are using a smart assistant for money management.

- Instant digital account creation with eKYC and AML checks

- Real-time transaction notifications and balance updates

- Smart spending analytics with category-based insights

- Card controls including freeze, unfreeze, and limit management

- Automated savings rules and goal-based budgeting

- Multi-currency wallet support for cross-border usage

Admin Panel Features That Enable Scale

The admin dashboard determines how efficiently the neobank can operate and expand. Miracuves designs admin systems to reduce manual workload while increasing control and transparency.

- Centralized user and account management

- Real-time transaction monitoring and anomaly detection

- Automated compliance workflows and audit logs

- Revenue analytics for subscriptions, interchange, and partnerships

- Configurable rules engine for fees, limits, and permissions

Advanced 2026 -Ready Capabilities

Modern N26 clones are no longer static banking apps. They are intelligent platforms that adapt to user behavior and market conditions.

- AI-driven personalization for spending insights and offers

- Predictive fraud detection using machine learning models

- Blockchain-based audit trails for transaction transparency

- API-first architecture for rapid fintech and SaaS integrations

- AR-based onboarding flows to reduce first-time user friction

Technical Architecture Requirements

A production-grade N26 clone must be built on a cloud-native, microservices-based architecture. This allows independent scaling of critical components such as payments, notifications, analytics, and compliance services. Security layers must include end-to-end encryption, tokenized data storage, and role-based access control across all systems. Third-party integrations for payments, identity verification, and reporting must be decoupled to avoid vendor lock-in.

Feature Tier Comparison

| Feature Area | Basic | Professional | Enterprise |

|---|---|---|---|

| User Accounts | Core banking | Smart banking | AI-powered banking |

| Analytics | Basic reports | Advanced insights | Predictive intelligence |

| Compliance | Manual checks | Semi-automated | Fully automated |

| Scalability | Limited users | Mid-scale growth | High-volume readiness |

| Customization | Minimal | Moderate | Full white-label |

| Monetization | Single model | Multiple streams | Dynamic revenue engine |

Miracuves integrates these features directly into its N26 Clone Development framework, ensuring founders do not need to rebuild or re-architect the system as the business grows. Every layer is designed to work together from day one, allowing startups to focus on market entry and user acquisition instead of technical firefighting.

Cost Factors & Pricing Breakdown

N26-Like Digital Banking & Neobank Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Neobank MVP | User onboarding, KYC basics, digital wallet, balance management, transaction history, and a simple admin panel. | $70,000 |

| 2. Mid-Level Digital Banking Platform | Mobile-first UI, multi-currency accounts, virtual cards, notifications, spending insights, and analytics dashboards. | $180,000 |

| 3. Advanced N26-Level Platform | Physical & virtual cards, subscription tiers, premium account features, compliance automation, fraud monitoring, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a modern, mobile-first neobank platform similar to N26, focused on simplicity, transparency, and scalable digital banking operations.

Miracuves Pricing for an N26-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete neobank foundation with user onboarding, wallet and account management, transaction processing, card-ready architecture, compliance-ready workflows, and a centralized admin dashboard — built for long-term scalability and digital banking use cases.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded N26-style digital banking platform under your own ownership.

Launch Your N26-Style Digital Banking Platform — Contact Us Today

Delivery Timeline for an N26-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Account structures and banking features

- Card issuing and transaction logic

- Compliance, KYC, and regulatory requirements

- Risk controls and fraud-prevention layers

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for modern neobank platforms that require secure financial transactions, scalable APIs, real-time processing, mobile-first performance, and enterprise-level reliability.

Customization & White-Label Option

Building an N26-style digital banking / neobank platform isn’t just about launching a sleek finance app — it’s about delivering a secure, compliance-ready banking experience built around simplicity, speed, and real-time control. A platform inspired by N26 must support onboarding, identity verification, account and card management, transaction intelligence, and customer self-service while remaining scalable across regions and user segments.

Miracuves delivers a fully white-label N26-style solution that can be customized for challenger banks, digital-first financial brands, card-centric fintech products, or regulated banking partners. The platform is structured so you can adapt workflows, controls, and feature depth to your market strategy and compliance environment.

Why Customization Matters

Neobank products vary across regions due to:

- Different KYC documentation and verification standards

- Card issuance and partnership models

- Local banking rails, limits, and settlement expectations

- User expectations around budgeting, controls, and transparency

Customization ensures your neobank platform fits your operational model instead of forcing you into generic banking flows.

What You Can Customize

Complete UI/UX Personalization

Customize mobile-first dashboards, navigation, card screens, transaction views, typography, themes, and branded design systems to match your product identity.

Digital Onboarding & KYC Workflows

Configure signup journeys, document collection, verification steps, risk checks, approval logic, and escalation workflows based on regional compliance needs.

Accounts, Wallets & Transaction Layer

Set up balance handling, transaction categorization, statements, notifications, dispute flows, and user-level controls for limits and permissions.

Card & Payment Controls

Customize virtual/physical card management, freeze/unfreeze, spend limits, merchant controls, recurring payment management, and card security logic.

Budgeting, Insights & Personal Finance Tools

Enable budgeting buckets, spending analytics, category insights, salary tagging, smart alerts, and data-driven dashboards for user retention and trust.

Security, Risk & Compliance Controls

Define AML monitoring rules, velocity checks, suspicious activity triggers, audit logs, role-based access, and compliance reporting exports.

Support & Communication

In-app helpdesk, chat/ticket workflows, status tracking for disputes, automated alerts, and multilingual support structures.

Backend & Integrations

Integrate compliance APIs (KYC/AML), payment rails (region-specific), card issuing partners, analytics pipelines, CRM tools, and customer support suites.

Monetization & Growth Models

Subscription tiers, premium feature access, rewards logic, fee structures, add-on financial services, and business rule–based pricing layers.

How Miracuves Handles Customization

- Requirement Understanding

We map your target market, compliance region, user segments, and feature priorities. - Planning & Breakdowns

The platform is structured into modules: onboarding, account layer, cards, transactions, risk, insights, and integrations. - Design & Development

UI/UX branding, workflow customization, control features, and integration hooks are implemented as per your roadmap. - Testing & Quality Assurance

Security testing, transaction validation, role/permission checks, and performance verification for scalability. - Deployment

Full white-label rollout with branded environments, dashboards, and operational configuration for launch readiness.

Real Examples from the Miracuves Portfolio

Miracuves has powered 600+ fintech and marketplace deployments, including:

- Digital wallet and card-first banking experiences

- Compliance-driven onboarding systems with verification workflows

- Subscription-based fintech apps with analytics and retention features

- White-label financial platforms adapted for regional rules and scaling

These deployments show how an N26-style neobank product can become a controlled, branded, and scalable financial ecosystem aligned to your market and compliance requirements.

Launch Strategy & Market Entry Guide

Launching an N26-style neobank is not just an app release. It is a market entry event where trust, compliance, and early user experience decide whether you become a real financial product or just another fintech download. In 2026 , the winners are the founders who treat launch like a controlled rollout, not a “big bang.” They build trust signals early, choose a focused segment, and engineer growth loops before they spend heavily on ads.

A practical launch strategy starts with one core decision: who exactly is your first loyal user base. N26 scaled by being simple, mobile-first, and transparent. Your clone must do the same, but with a sharper niche position. If you target everyone, you will struggle with messaging and compliance scope. If you target a specific segment, your onboarding, pricing, and features become easier to refine, and your early retention improves faster.

Pre-Launch Checklist

Before you acquire your first user, the product needs to behave like a bank, not a startup prototype. This checklist keeps your launch stable and reduces avoidable churn.

- Compliance readiness: KYC/AML flow testing, audit logs, policy screens, user consent tracking

- Security validation: penetration testing, encryption verification, session management, device-level protection

- Performance validation: load testing under peak conditions, response time benchmarking, auto-scaling verification

- App store readiness: metadata, screenshots, privacy policy, permissions mapping, crash-free build validation

- Operational readiness: support workflows, escalation rules, dispute handling, refund and chargeback logic

- Marketing readiness: landing pages, waitlist funnel, referral mechanics, onboarding emails and push flows

Regional Entry Strategies

Your location strategy should be aligned with compliance complexity and user behavior. Different regions reward different launch angles.

Asia

Asia rewards speed, convenience, and integrated payments. Users expect fast onboarding and instant transaction updates. A strong approach is to launch with a high-retention niche such as freelancers, students, or gig workers, then expand services after retention stabilizes. Partnerships with local wallets, UPI-style rails, or regional bank transfer systems often accelerate adoption.

MENA

MENA markets reward trust, clarity, and premium positioning. Users respond strongly to premium tiers, lifestyle-linked banking benefits, and transparent card control features. Local compliance and Arabic-first UX can be a major differentiator. A smart strategy is to launch with premium plans early and build referral loops through communities and micro-influencers.

Europe

Europe is regulation-heavy but also a proven neobank adoption market. A strong approach is to enter with a focused compliance-ready product that emphasizes transparency, spend analytics, and low friction onboarding. Founders often succeed by targeting cross-border users, international students, and SMEs that need clean expense tracking and multi-currency management.

U.S.

The U.S. is competitive and trust-driven. Launch strategies that work best involve a sharp segment, clear value, and strong partnerships. Many fintechs succeed by targeting underbanked groups, gig workers, or niche business banking. Your compliance, customer support readiness, and dispute handling must be strong from day one because user expectations are high and churn is fast.

User Acquisition Frameworks That Work in 2026

A neobank cannot rely on paid ads alone. Banking products win through trust loops and habit formation.

Influencer and Community Launch

Instead of broad influencers, focus on niche creators with credibility in personal finance, freelancing, student life, or SME growth. Early users trust educators more than celebrities.

Referral Loops

A strong N26-style referral loop rewards both inviter and invitee with benefits that feel immediate, such as premium access for a limited time, cashback categories, or account boosts. The key is to make referrals part of the onboarding flow, not an optional marketing add-on.

Retention Funnels

Retention is built in the first week. Use onboarding checklists, financial goal nudges, and smart notifications that feel helpful rather than spammy. The goal is to build a weekly habit of checking insights and controlling spend.

Monetization Models Proven in 2026

A clone that cannot monetize becomes a cost center. A sustainable neobank usually combines multiple revenue streams.

- Subscription tiers: premium plans with advanced analytics, insurance benefits, priority support

- Interchange revenue: card usage-based income through merchant transactions

- FX and multi-currency margins: small spreads on conversions or international usage

- Partner commissions: lending offers, insurance bundles, wealth products, SME tools

- Business accounts: paid tools for invoicing, expense control, and payroll-linked banking

How Miracuves Supports the Full Launch Journey

Miracuves is not just a development vendor. The goal is to help founders launch with structure, stability, and growth readiness. With Miracuves Clone Solutions, founders receive support across the critical launch stages:

- Infrastructure planning and production deployment readiness

- Secure architecture implementation and stability testing

- Integration planning for KYC, payments, and compliance tooling

- Product launch roadmap built around a 30–90 days delivery timeline

- Strategic guidance for early acquisition and retention structure

A neobank launch becomes successful when the product behaves reliably, the messaging is niche-clear, and growth systems are built into onboarding. Miracuves helps founders connect all three into one predictable rollout plan.

Why Choose Miracuves for Your N26 Clone

Building a digital bank is one of the most trust-sensitive products an entrepreneur can launch. Users are not forgiving when money is involved, and investors are cautious about platforms that are not engineered for scale, compliance, and reliability. This is why choosing the right development partner matters as much as choosing the right market. Miracuves approaches N26 clone development with the mindset of building a real financial product, not a demo or experimental system.

Miracuves has successfully delivered 600+ fintech and digital platform deployments, many of which operate in regulated environments where uptime, security, and performance are non-negotiable. Every N26-style clone is designed to meet production standards from day one, allowing founders to focus on growth rather than fixing structural gaps after launch. Instead of forcing founders into rigid templates, Miracuves builds modular systems that evolve as the business scales.

Speed without stability is dangerous in fintech, and stability without speed often kills momentum. Miracuves balances both through a structured delivery framework that brings neobank platforms to market within a 30–90 days timeline, depending on scope and regulatory complexity. This predictable execution allows founders to plan investor updates, pilot launches, and marketing rollouts with confidence.

Another critical advantage is full source-code ownership. Founders are not locked into recurring license fees or restricted by vendor-controlled systems. This ownership increases long-term valuation, simplifies audits, and gives the business freedom to expand, integrate, or pivot without technical constraints. Miracuves also includes 60 days of free post-launch support, helping teams stabilize operations, fine-tune performance, and address early user feedback without added pressure.

What Sets Miracuves Apart

- 600+ successful deployments across fintech, banking, and digital platforms

- 30–90 days delivery cycle structured for regulated products

- Full source-code ownership with no vendor lock-in

- Future-proof architecture built for scale, security, and compliance

- 60 days free post-launch support to ensure stability after launch

Founder Transformation Stories

Several founders approach Miracuves after struggling with slow agencies or fragmented freelancer teams. In one case, a European fintech startup reduced its expected launch timeline by more than half by switching to a Miracuves-built neobank framework, allowing it to onboard early users and demonstrate traction ahead of its funding milestone. Another founder targeting freelancers launched with a focused N26-style product, validated premium subscriptions within weeks, and expanded features without re-architecting the system.

These outcomes are not driven by shortcuts. They are the result of building with a clear structure, tested components, and an understanding of how real financial products operate at scale. Miracuves does not promise hype. It delivers systems that work under pressure.

Final Thought

Building a digital bank like N26 is not about replicating an interface. It is about understanding why the product works, how trust is built, and how technology quietly supports every financial interaction. The founders who succeed in 2026 are those who treat neobanking as a long-term system, not a short-term app launch. They focus on clarity, performance, compliance, and user confidence from the first version itself.

An N26-style clone gives entrepreneurs a proven blueprint for mobile-first banking, but the real advantage comes from how that blueprint is executed. When the underlying architecture is scalable, monetization-ready, and compliance-aware, growth becomes predictable instead of fragile. This is what allows startups to move faster than traditional banks while still operating with banking-grade reliability.

With Miracuves Clone Solutions, founders are not starting from zero or gambling on untested systems. They are launching with a framework built from real-world fintech deployments, refined through scale, and delivered within a structured 30–90 days timeline. This combination of speed, stability, and ownership empowers entrepreneurs to validate ideas faster, adapt to market feedback, and expand into new regions with confidence.

Ready to launch your N26 clone? Get a free consultation and a detailed project roadmap from Miracuves and move forward with a neobank platform built for trust, growth, and long-term success.

FAQs

How quickly can Miracuves deploy my N26 clone?

Miracuves delivers production-ready N26-style neobank platforms within a structured 30–90 days timeline, depending on customization scope, compliance complexity, and regional requirements.

What’s included in the Miracuves N26 clone package?

The package includes user apps, admin panel, secure banking architecture, onboarding workflows, analytics, monetization-ready modules, and compliance-friendly system design tailored for digital banking.

Can I get full source-code access?

Yes. Miracuves provides full source-code ownership, giving founders complete control, long-term flexibility, and higher product valuation without vendor lock-in.

How does Miracuves ensure scalability as users grow?

The platform is built on a cloud-native, modular architecture that supports horizontal scaling, high transaction volumes, and performance stability as user numbers increase.

Does Miracuves assist with app store approval?

Yes. Guidance is provided for app store readiness, including security requirements, privacy policies, compliance disclosures, and technical validations needed for approval.

Is post-launch maintenance included?

Miracuves includes 60 days of free post-launch support to stabilize the platform, resolve early issues, and fine-tune performance after launch.

Can custom payment gateways and banking APIs be integrated?

Yes. The N26 clone framework supports flexible integration with custom payment gateways, card issuers, KYC/AML providers, and regional banking APIs.

What is the upgrade and update policy?

The modular system allows features to be upgraded or added without disrupting existing users, ensuring smooth evolution as business needs change.

How does white-labeling work?

White-labeling removes all third-party branding and delivers a fully branded neobank platform under your identity, including UI, workflows, and operational logic.

What kind of ongoing support can I expect?

Beyond the initial support period, Miracuves offers structured long-term support options covering maintenance, security updates, feature enhancements, and scaling assistance based on business growth needs.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform

- Best Worldpay Clone Scripts 2025: Launch Your Own Global Payment Gateway