From a simple online checkout tool to a global BNPL giant valued at over $20B, Klarna reshaped how millions shop, pay, and manage short-term credit. In 2026, the Buy Now Pay Later industry is projected to cross $565B in transaction volume, making it one of the fastest-growing fintech segments for digital entrepreneurs.

For founders entering fintech, understanding the Klarna business model isn’t optional — it’s your playbook for capturing a high-retention, high-transaction market. With flexible lending, seamless checkout, strong merchant partnerships, and advanced risk scoring, Klarna proved that convenience plus trust equals massive adoption.

A Klarna Clone Script in 2026 gives entrepreneurs a shortcut to this proven model — enabling faster time-to-market, lower development risk, and the ability to tap into an industry where both consumers and merchants are actively switching to BNPL solutions. With Miracuves Clone Solutions, you get the strategic, technical, and operational advantage needed to build a global-ready BNPL platform.

What Makes a Great Klarna Clone?

A high-performing Klarna Clone in 2026 is more than a basic BNPL checkout solution. It must deliver trust, speed, and intelligent credit decisioning at scale. With the BNPL industry facing stricter regulations and higher user expectations, founders need platforms that balance compliance, user experience, and profitability.

A great Klarna-style platform integrates real-time risk scoring, instant approvals, smooth merchant onboarding, and seamless multi-channel payments — all without delays or friction. It is built for performance under heavy load, supports millions of transactions, and ensures that repayment cycles run predictably and automatically.

In 2026, the strongest BNPL clones also benefit from AI-driven underwriting, blockchain-powered dispute transparency, and cloud scalability to prevent downtime during shopping spikes. These are no longer premium add-ons — they’re essential to stay competitive and trusted.

Key Factors That Define a Great Klarna Clone in 2026

- Ultra-fast performance with response times under 300ms for checkout workflows

- 99.9% uptime with multi-region deployment and load balancing

- AI-driven risk scoring and fraud detection

- Smooth UI/UX for merchants and consumers

- Scalable microservices architecture

- Built-in merchant tools for analytics, settlements, and payouts

- Strong data encryption and multi-layer security

- Transparent repayment tracking for users

- Seamless integration with major eCommerce platforms and payment gateways

Advanced Innovations Modern Klarna Clones Must Include

- AI Automation: Auto-approval scoring, credit limits, repayment predictions

- Blockchain Transparency: Immutable records for disputes and merchant settlements

- Cross-Platform Integration: Web, mobile, POS, and embedded finance capability

- Cloud-Native Scalability: Auto-scaling to handle high holiday shopping loads

Comparison Table: Modern BNPL Clones & Their Differentiators

| Feature | Traditional BNPL | Modern Klarna Clone (2026) |

|---|---|---|

| Risk Scoring | Manual/slow | AI-driven instant scoring |

| Checkout Speed | 1–2 sec | <300ms ultra-fast |

| Security | Basic SSL | Multi-layer encryption + tokenization |

| Platform Support | Web-only | Mobile, Web, POS, Embedded Finance |

| Merchant Analytics | Limited | Advanced dashboards + insights |

| Scalability | Moderate | High-load microservices |

Essential Features Every Klarna Clone Script Must Have

A successful Klarna Clone is not just a payment tool — it is a complete financial ecosystem built around user trust, merchant partnerships, smart credit decisioning, and frictionless checkout. To compete in 2026, founders must build platforms that reduce risk, increase convenience, and maximize transaction success rates.

A strong BNPL system handles multiple layers: user experience, merchant onboarding, admin monitoring, fraud checks, and repayment flows. Each layer must work together in real time without lag or data mismatches. This is where well-built architectures win — especially for new fintech brands trying to build trust from the first transaction.

User-Side Capabilities

This is where the product wins attention, trust, and long-term retention.

- Instant checkout with 1-tap BNPL

- Clear repayment schedules and reminders

- In-app spending insights and affordability checks

- Cardless payments and virtual card generation

- Order tracking synced with merchant systems

- Personalized credit limits using AI

- Rewards, cashback, and loyalty boosters

Merchant Dashboard

A BNPL product succeeds only if merchants love it.

- Fast onboarding with KYC/AML verification

- Real-time payouts and settlement reports

- Transaction-level analytics

- Dispute resolution panel

- Easy integration with POS, Shopify, WooCommerce, Magento, and custom APIs

- Ability to manage refunds, discounts, and promotions

Admin Panel

This is the brain of the BNPL platform.

- Dynamic credit risk engine

- Fraud detection alerts

- Automated penalty and fee management

- Merchant management controls

- User segmentation and lending rules

- API usage monitoring

- Multi-level admin roles and permissions

2026 Advanced Features

- AI-based personalization: Predict spending habits, auto-adjust credit limits

- AR onboarding: Enhanced verification through AR ID scanning

- Blockchain-based activity logs: Transparent dispute and settlement history

- Predictive lending intelligence: Forecast repayment risks

- Smart EMI scheduling: Auto-adjust installments based on user behavior

Technical Architecture Requirements

A Klarna Clone must be engineered to scale from day one.

- Microservices architecture capable of horizontal scaling

- Load handling for millions of checkout requests per hour

- Secure encryption of payment data (AES 256 + tokenization)

- Third-party APIs (payment gateways, KYC/AML services, risk engines)

- CDN acceleration for global merchant usage

- Auto-scaling cloud environments to maintain 99.9% uptime

Feature Comparison: Basic vs Professional vs Enterprise

| Level | User Features | Merchant Tools | Admin Capabilities | Best For |

|---|---|---|---|---|

| Basic | Simple checkout, repayment reminders | Basic settlement reports | Standard admin controls | New startups, MVP |

| Professional | AI scoring, analytics, loyalty | Advanced merchant dashboard | Automated risk rules | Scaling fintechs |

| Enterprise | Multi-region scaling, global cards, embedded finance | POS integrations, white-label merchant portals | Predictive risk engine, advanced automation | Large fintechs/banks |

How Miracuves Implements These Features

Miracuves Clone Solutions are designed to support heavy financial workloads with:

- AI-ready architecture for smarter lending

- Ultra-fast checkout pipelines under 300ms

- Secure payment infrastructure with tokenization

- Modular microservices that enable global expansion

- 100% customizable workflows for lending, repayments, and merchant onboarding

Read More : What is Klarna App and How Does It Work?

Cost Factors & Pricing Breakdown

Klarna-Like Buy Now, Pay Later (BNPL) Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core BNPL MVP | Merchant onboarding, installment payment flows, checkout integration, basic risk checks, transaction history, and a simple admin panel. | $75,000 |

| 2. Mid-Level BNPL Platform | Web dashboards, multi-merchant support, flexible repayment schedules, notifications, refunds, dispute handling, and analytics dashboards. | $180,000 |

| 3. Advanced Klarna-Level Platform | Credit decision engine, dynamic limits, merchant financing tools, compliance automation, fraud monitoring, customer insights, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a BNPL platform similar to Klarna, focused on seamless checkout experiences, risk-aware lending, and large-scale merchant adoption.

Miracuves Pricing for a Klarna-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete BNPL foundation with merchant onboarding, installment and deferred-payment logic, checkout APIs, transaction management, risk-ready architecture, compliance-oriented controls, and a centralized admin dashboard — built for scalable consumer finance operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend checkout & dashboard integration, and deployment assistance — allowing you to launch a fully branded Klarna-style BNPL platform under your own ownership.

Launch Your Klarna-Style BNPL Platform — Contact Us Today

Delivery Timeline for a Klarna-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Repayment models and installment logic

- Credit checks and risk-assessment depth

- Merchant checkout and POS integrations

- Compliance, KYC, and regulatory requirements

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for BNPL and consumer-credit platforms that require secure transaction handling, scalable APIs, real-time decisioning, and enterprise-level reliability.

Customization & White-Label Option

Building a Klarna-style Buy Now, Pay Later (BNPL) and shopping platform isn’t just about enabling installment payments — it’s about designing a seamless financial and retail ecosystem where instant credit decisions, merchant integrations, shopping discovery, and repayment management all work in harmony. A platform inspired by Klarna must balance user experience, credit risk logic, merchant partnerships, and compliance while keeping the flow extremely frictionless.

Miracuves delivers a fully white-label Klarna-style BNPL solution that can be customized for ecommerce brands, fintech lenders, digital marketplaces, or banks entering the “Pay Later” ecosystem. You gain complete control over UX, credit rules, repayment cycles, merchant onboarding, and product roadmap.

Why Customization Matters

BNPL products vary heavily across:

- Regulations (some regions treat BNPL as lending)

- Risk models (soft checks, hard checks, affordability checks)

- Merchant categories

- Repayment structure (Pay in 3, Pay in 4, Pay Later 30 days, EMI)

- Target audience (students, shoppers, high-income users)

Customization ensures your BNPL platform fits your lending strategy, your merchant ecosystem, and your compliance region, instead of copying generic workflows.

What You Can Customize

1. UI/UX & Shopping Experience

- App and web storefront layouts

- Product discovery pages, category sections, deal listings

- Checkout UI, installment breakdown displays

- Branding, typography, color palettes, and animations

2. BNPL Models & Repayment Rules

- Pay in 3 / Pay in 4 installment options

- “Pay in 30 days” delayed payment model

- Long-term EMI plans (region-dependent)

- Interest or zero-interest structures

- Custom penalty logic and grace periods

3. Real-Time Credit & Risk Engine

- Soft/hard credit checks

- Affordability scoring

- Transaction risk analysis

- Dynamic credit limit assignment

- Spending behavior insights

- Fraud detection, velocity checks, and blacklisting rules

4. Merchant & Partner Management

- Merchant onboarding & verification

- Commission rates, settlement cycles, transaction fees

- Seller dashboards for orders, payments, refunds

- APIs & plug-ins for ecommerce CMS platforms

5. Payments, Wallet & Settlement

- Payment gateway integration

- Auto-debit rules, reminders, dunning workflows

- Wallet balance logic for refunds & adjustments

- Merchant settlement (T+1, T+2, custom cycles)

6. User Accounts & Billing

- Purchase history, repayment schedules

- Statement generation

- Secure payment management with multiple methods

- Alerts for due dates, failed payments, or upcoming installments

7. Rewards, Cashback & Loyalty

- Cashback tiers

- On-time repayment rewards

- Merchant-driven promotions

- Personalized offer recommendations

8. Integrations & Extensions

- KYC/KYB compliance tools

- Credit bureaus (region-dependent)

- Ecommerce platforms (Shopify, WooCommerce, Magento, etc.)

- CRM, analytics, customer support systems

9. Notifications & Engagement

- Payment reminders

- Failed payment alerts

- Personalized shopping recommendations

- Offers, deals, and promotions

How Miracuves Handles Customization

- Requirement Discovery

Define your BNPL model, credit strategy, merchant target categories, and compliance zone. - Architecture Planning

Modular design: onboarding → credit engine → BNPL checkout → user dashboard → merchant dashboard → analytics. - Design & Development

Branded UI, BNPL rules, risk scoring, merchant systems, and payment logic built per your roadmap. - Testing & Quality Assurance

Transaction simulation, risk logic accuracy, settlement verification, and security audits. - Deployment

A fully white-labeled BNPL platform is launched with your branding, payment rails, and operational configurations.

Real Examples from the Miracuves Portfolio

Miracuves has developed 600+ fintech, lending, and ecommerce solutions, including:

- BNPL systems with dynamic credit scoring

- Ecommerce + BNPL hybrid shopping platforms

- Merchant dashboards for settlement and finance workflow

- Payment-focused fintech apps with repayment automation

- White-label installment-based payment ecosystems

These implementations show how a Klarna-style concept can evolve into a trusted, merchant-friendly, and scalable BNPL platform under your brand.

Launch Strategy & Market Entry

Launching a Klarna-style BNPL platform is not just a technical rollout — it is a strategic market entry decision. A strong launch plan determines whether your app gains rapid adoption, secures merchant trust, and builds early transaction volume. In 2026, the BNPL space is competitive, so founders must launch with precision, compliance readiness, and a clear acquisition roadmap.

A Klarna Clone should not go live until every workflow — lending, scoring, settlement, refunds, merchant onboarding, and notifications — has been tested under real-world load scenarios. A well-executed launch ensures smooth approvals, high repayment reliability, and lower early-stage fraud risks.

Pre-Launch Checklist

- Compliance review for local lending regulations

- Load tests on high-volume checkout events

- Merchant integration trials (Shopify, WooCommerce, POS)

- In-app credit scoring simulations

- App Store and Play Store submissions

- Final UI/UX polish for conversion-focused flows

- Marketing and launch communication setup

Regional Market Entry Strategies

Different markets require different regulatory and operational approaches.

Asia

Fast-growing BNPL adoption driven by eCommerce and youth spending.

- Focus on mobile-first experience

- Local KYC providers

- Partnerships with regional marketplaces

MENA

High demand for interest-free installments and Sharia-compliant financing.

- Offer interest-free plans

- Build merchant-focused dashboards

Europe

Regulation-heavy but high purchasing power.

- Strong compliance and data security

- Multi-currency support

United States

Highly competitive but massive transaction volume.

- Merchant-focused onboarding

- Cashback and rewards to drive adoption

User Acquisition Frameworks

To scale successfully, founders must combine product strength with marketing science.

- Influencer partnerships showcasing easy checkout

- Referral loops that reward timely repayments

- Merchant referral bonuses

- Retention funnels with personalized repayment reminders

- Cashback and loyalty engines to unlock returning users

Proven Monetization Models in 2026

- Merchant transaction fees

- Late fee models (regulation-compliant)

- Subscription-based merchant tools

- Instant payout fees

- Embedded finance partnerships

- White-label BNPL services for retailers

Miracuves’ End-to-End Launch Support

Miracuves supports founders beyond development — guiding them through rollout, optimization, and early growth:

- Full server setup and security hardening

- App Store & Play Store support

- Merchant integration assistance

- Real-time monitoring during the first 90 days

- Scalable infrastructure ready for global expansion

This ensures your Klarna Clone enters the market with stability, speed, and strategic positioning.

Why Choose Miracuves for Your Klarna Clone

Building a BNPL platform is not like building a regular app — it is building trust, credit reliability, and merchant confidence at scale. This is where most development teams struggle, but where Miracuves excels. With years of fintech engineering expertise and a track record of high-performance deployments, Miracuves delivers Klarna Clone solutions that are fast, secure, scalable, and ready for real financial traffic from day one.

Founders choose Miracuves because they don’t want experiments — they want proven fintech infrastructure backed by data, engineering discipline, and predictable delivery timelines. Every project is built using a future-ready architecture designed for AI scoring, global expansion, and embedded finance.

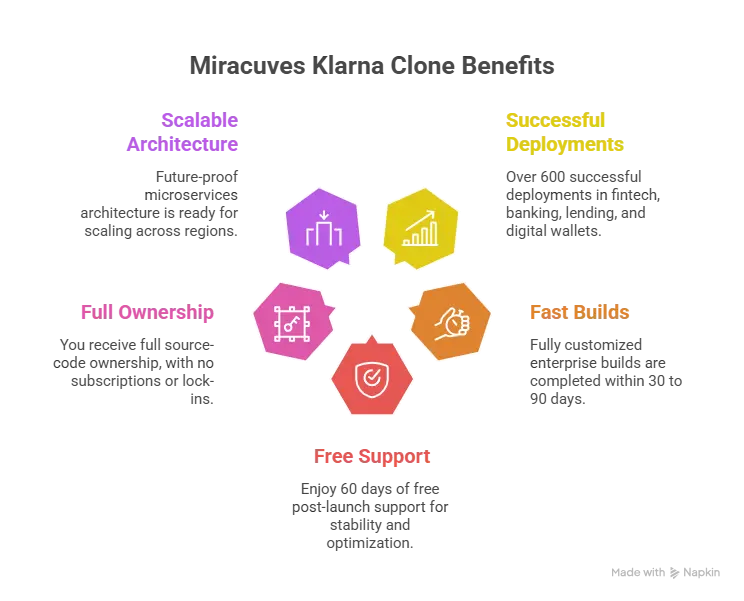

Miracuves’ Core Strengths

- 600+ successful deployments across fintech, banking, lending, and digital wallets

- 30–90 days for fully customized enterprise builds

- Free 60-day post-launch support for stability and optimization

- Full source-code ownership — no subscriptions, no lock-ins

- Future-proof microservices architecture ready for scaling across regions

Success Stories

- A European retail finance startup improved checkout conversion by 42% after launching its Miracuves-powered BNPL app.

- A Middle-East fintech brand went from idea to production in 40 days, acquiring 12,000+ users within the first quarter.

- A Southeast Asian startup using a Miracuves Clone reduced default rates by 28% through AI-driven scoring modules integrated into the core architecture.

Miracuves is not just a technology provider — it is a growth partner. With each deployment, founders receive a tailored roadmap, lending workflow optimization, and a scalable infrastructure designed to support millions of users.

Final Thought

A Klarna-style BNPL platform is more than a financial tool — it is a modern engine of consumer empowerment and merchant growth. When entrepreneurs understand Klarna’s business logic and pair it with Miracuves’ advanced clone technology, they gain a shortcut to building a scalable, compliant, and revenue-ready fintech brand.

In 2026, speed, intelligence, and trust define the winners of the BNPL market. With Miracuves, founders launch faster, scale smarter, and unlock opportunities across global regions without reinventing the wheel. Your Klarna Clone becomes the foundation of a long-term fintech ecosystem — built with confidence, backed by real engineering expertise, and designed to grow alongside your vision.

Ready to launch your Klarna Clone? Get a free consultation and a detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Klarna Clone?

Miracuves can deliver a fully production-ready Klarna Clone within 30–90 days, depending on the level of customization, feature depth, compliance requirements, and integrations you choose.

What’s included in the Miracuves Klarna Clone package?

You receive the full BNPL app suite — user app, merchant dashboard, admin panel, repayment logic, risk engine setup, API integrations, and complete documentation.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership, giving you full control, scalability, and independence with no SaaS lock-in.

How does Miracuves ensure scalability for BNPL apps?

Miracuves uses a microservices architecture, auto-scaling servers, load-balancing, and encrypted payment pipelines designed to handle millions of transactions.

Does Miracuves assist with App Store and Play Store approval?

Yes. End-to-end app store submission support is included, covering metadata, bundling, testing, and compliance readiness.

Is post-launch maintenance included?

Yes. Every project includes 60 days of free post-launch support covering performance tuning, bug fixes, monitoring, and stability improvements.

Can Miracuves integrate custom payment gateways?

Absolutely. Miracuves can integrate local, global, and region-specific payment gateways, including custom APIs required for unique compliance needs.

What’s the upgrade or update policy?

Miracuves offers ongoing update and upgrade support, allowing you to add features, new modules, or regional scaling enhancements at any time.

How does white-labeling work?

All branding — logos, color themes, domain-level identity, email templates, merchant portals — is fully replaced with your own brand identity.

What kind of ongoing support can I expect?

Beyond the initial 60-day support, Miracuves offers long-term maintenance, security updates, feature enhancements, performance upgrades, and growth-guided consultation.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Starling Bank Clone Scripts 2026 : Build a Digital Bank That Scales in the Real World

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast