Stripe has become one of the most dominant financial infrastructure platforms globally, generating ~$5B+ annual revenue while processing ~$1.4 trillion in payment volume, equivalent to around 1.3% of global GDP scale transactions.

What makes Stripe extraordinary is not just revenue size, but how efficiently it converts massive transaction volume into infrastructure-driven recurring fintech revenue while maintaining relatively thin transaction margins but huge scale advantages.

For founders, Stripe represents the future of programmable finance — where payments, billing, subscriptions, fraud protection, and financial automation become a single integrated monetization ecosystem.

Additional strategic founder insights:

• Infrastructure fintech scales faster than consumer fintech

• Transaction volume matters more than fee percentage

• Developer-first platforms create ecosystem lock-in

• SaaS + Payments = compounding revenue layers

• Embedded payments create recurring transaction dependency

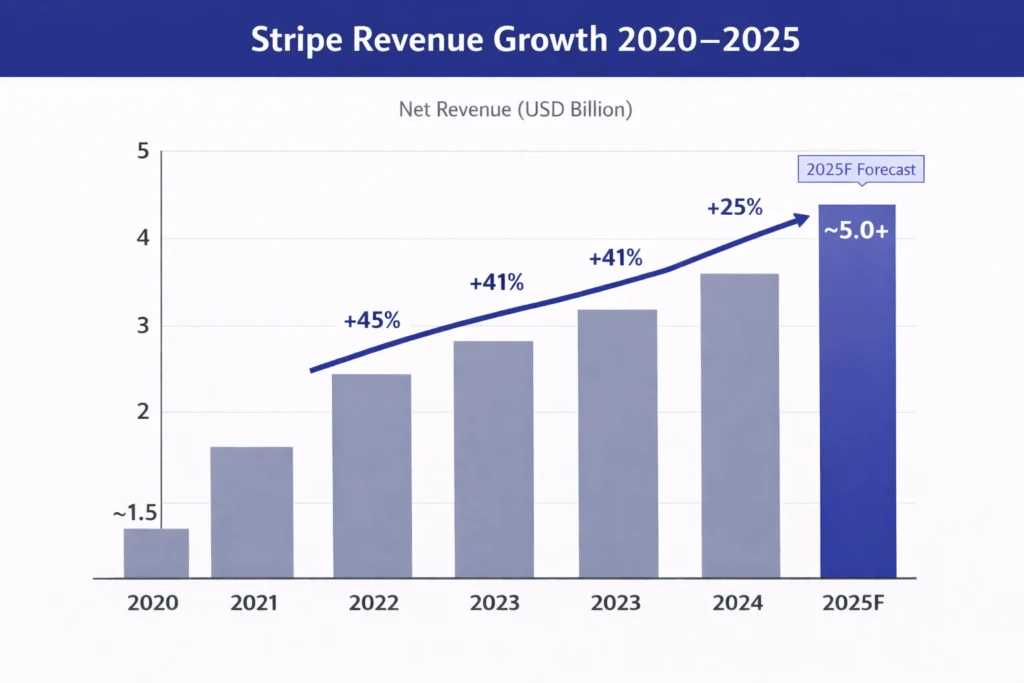

Stripe Revenue Overview – The Big Picture

2025 Revenue Estimate: ~$5B+ annual revenue range

Valuation: ~$90B–$100B+ range

YoY Growth: ~25–30% range

Payment Volume: ~$1.4T yearly

Profitability: Returned to profitability recently and expected to stay profitable

Stripe processed $1.4 trillion in payments in 2024, growing about 38% YoY, showing strong enterprise and SaaS platform adoption.

Stripe reached roughly $91.5B valuation in 2025 through secondary share transactions, showing strong investor confidence.

Revenue by Segment (Approx Pattern):

• Online Commerce & SaaS: ~50%

• Enterprise Payments: ~25%

• Billing & Subscription Tools: ~15%

• Financial Services (Capital, Issuing, Treasury): ~10%

Competition Benchmark:

• Competes with Adyen, PayPal, Checkout.com, Square

• Strongest developer ecosystem advantage

Primary Revenue Streams Deep Dive

Revenue Stream #1 — Payment Processing Fees

Core revenue engine. Stripe charges merchants per transaction processed.

Share: ~65–70%

Revenue Stream #2 — Billing & Subscription SaaS Tools

Recurring SaaS billing infrastructure for subscription companies.

Share: ~10–15%

Revenue Stream #3 — Financial Services (Capital, Issuing, Treasury)

Loans, cards, banking infrastructure APIs.

Share: ~8–12%

Revenue Stream #4 — Fraud & Risk Tools (Radar)

AI fraud detection sold as value-added layer.

Share: ~5–8%

Revenue Stream #5 — Connect Platform & Marketplace Payments

Revenue from platforms processing payments for sub-merchants.

Share: ~5–10%

Read More: Business Model of Stripe: Revenue, Strategy & Growth 2026

Stripe Revenue Streams Breakdown

| Revenue Stream | Revenue Share | Pricing Model | Growth Driver |

|---|---|---|---|

| Payment Processing | 65–70% | % per transaction | E-commerce growth |

| Billing & SaaS Tools | 10–15% | Subscription pricing | SaaS economy |

| Financial Services APIs | 8–12% | Usage + financing fees | Embedded finance |

| Fraud & Risk Tools | 5–8% | Per transaction + SaaS | AI adoption |

| Platform Payments (Connect) | 5–10% | Volume + platform fee | Marketplace growth |

The Fee Structure Explained

User-Side Fees

Usually invisible. Merchants absorb cost.

Merchant Fees

• Transaction % fee

• Fixed processing fee

• Cross-border fee

• FX conversion fee

Stripe converts roughly ~3% gross payment fee into ~0.40% net revenue take rate after network and partner costs.

Hidden Revenue Layers

• Currency conversion spread

• SaaS billing upsells

• Risk & compliance services

Regional Pricing Variation

• US: Higher card interchange

• EU: Lower regulated fees

• APAC: Growing wallet ecosystem fees

Fee Structure by User Type

| User Type | Fee Type | Typical Range | Revenue Importance |

|---|---|---|---|

| SMB Merchants | Standard Processing | 2–3% total stack cost | Volume driver |

| Enterprise Merchants | Negotiated Fees | 1–2% range | High stability revenue |

| SaaS Platforms | Platform + Processing | Custom tier pricing | High LTV |

| Cross-Border Sellers | FX + Processing | 3–5% blended | High margin |

| Embedded Finance Users | API + Usage | Volume-based | Fastest growth |

How Stripe Maximizes Revenue Per User

Segmentation

Startups → Scaleups → Enterprise → Platforms.

Upselling

Payments → Billing → Fraud → Capital → Issuing.

Cross-Selling

Once integrated, customers adopt multiple Stripe APIs.

Dynamic Pricing

Enterprise custom contracts.

Retention Monetization

Deep API integration makes switching expensive.

LTV Optimization

Platform customers generate multi-product revenue.

Psychological Pricing

Simple transparent pricing attracts developers early.

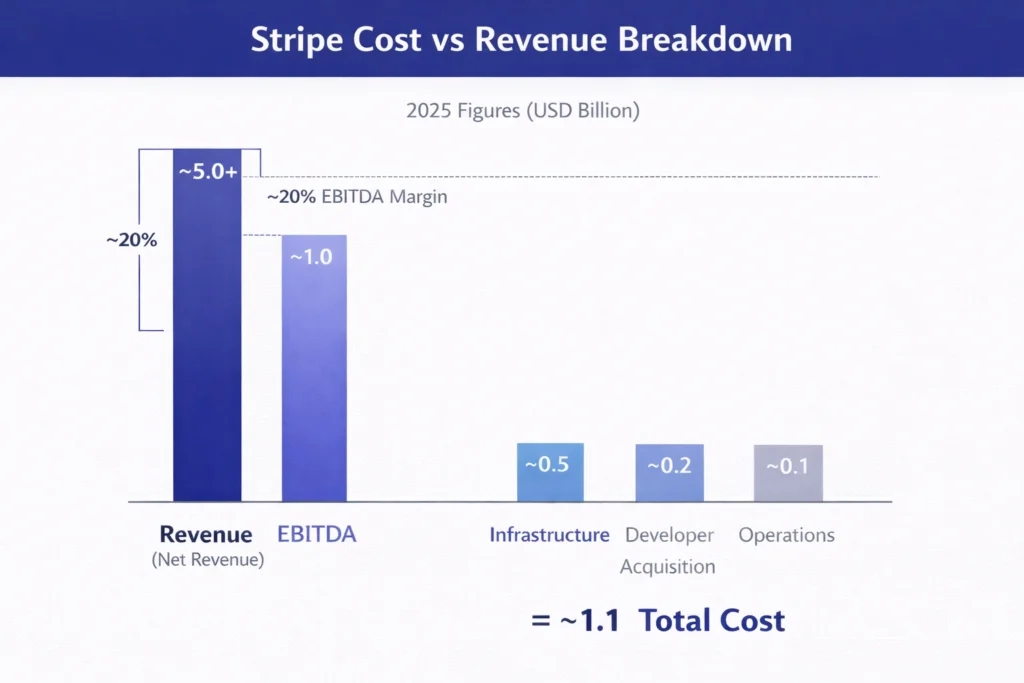

Cost Structure & Profit Margins

Infrastructure Cost

Cloud, data centers, compliance infra.

Customer Acquisition Cost

Low for developer-led adoption, higher for enterprise sales.

Operations Cost

Risk, compliance, regulatory ops.

R&D Cost

Heavy investment into AI, stablecoins, automation.

Unit Economics

Low margin per transaction but huge volume scale.

Profitability Path

Volume growth → Infrastructure efficiency → Margin expansion.

Future Revenue Opportunities & Innovations

New Revenue Streams

• Stablecoin payments

• AI payment optimization

• Real-time financial automation

AI/ML Monetization

• Fraud prediction

• Smart payment routing

• Revenue analytics APIs

Market Expansion

• Emerging market digital commerce

• SMB financial automation

• Embedded SaaS payments

Predicted Trends 2025–2027

• APIs will dominate fintech monetization

• Embedded finance inside SaaS becomes default

• Infrastructure fintech beats consumer fintech

Risks

• Regulatory fee caps

• Enterprise client concentration

• Big Tech payment competition

Lessons for Entrepreneurs & Your Opportunity

What Works

• Developer-first ecosystem

• Multi-product monetization

• Platform-led payments

What To Replicate

• API-first infrastructure

• Embedded payments

• SaaS + fintech hybrid revenue

Market Gaps

• Regional embedded payment stacks

• Vertical SaaS fintech infra

• SME-friendly programmable payments

Want to build a platform with Stripe’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Stripe clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, Miracuves can arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Stripe demonstrates that payment infrastructure is one of the strongest recurring fintech revenue models when built around developer ecosystems and programmable financial services.

The future of fintech belongs to platforms that combine payments, banking, lending, and data intelligence into unified programmable layers.

For founders, the biggest insight is simple — owning transaction rails creates long-term revenue compounding and ecosystem lock-in.

FAQs

1. How much does Stripe make per transaction?

Usually small percentage after network fees, roughly ~0.4% net revenue take.

2. What’s Stripe’s most profitable revenue stream?

Payment processing combined with SaaS financial tools.

3. How does Stripe pricing compare to competitors?

Competitive for SMB, custom negotiated for enterprise.

4. What percentage does Stripe take from providers?

Varies widely depending on volume and contract structure.

5. How has Stripe’s model evolved?

From payment processing → full financial infrastructure APIs.

6. Can small platforms use similar models?

Yes, especially through embedded payment APIs.

7. What’s minimum scale for profitability?

Usually requires consistent transaction flow.

8. How to implement similar revenue models?

Payments → Billing → Fraud → Lending → Financial services.

9. What are alternatives to Stripe model?

Payment orchestration, vertical fintech platforms.

10. How quickly can similar platforms monetize?

Often within weeks after merchant onboarding.