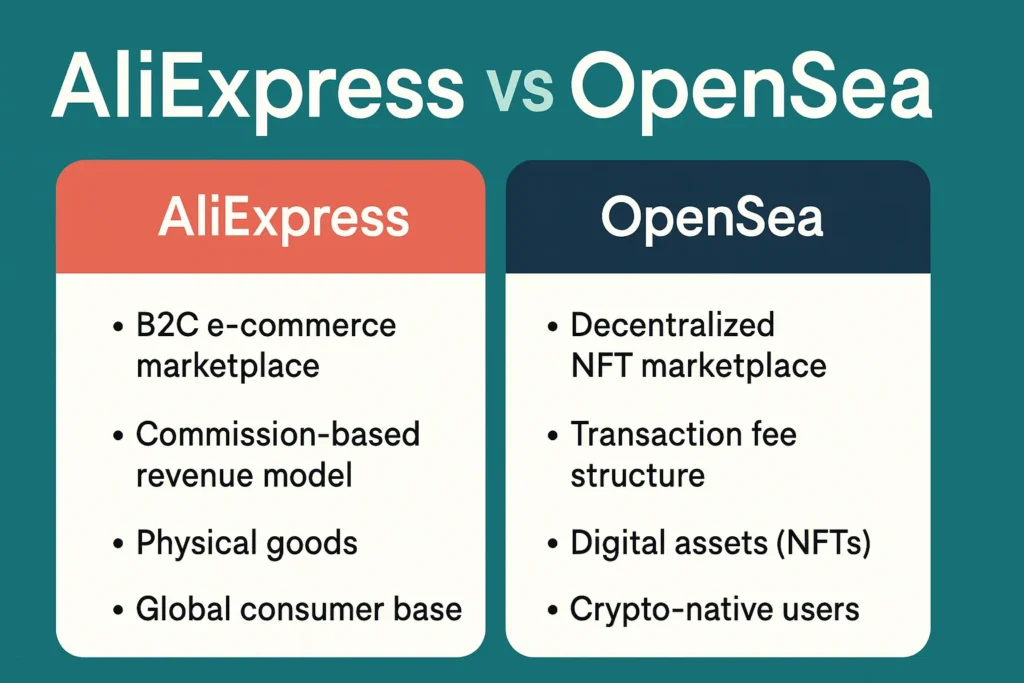

In 2025, digital commerce is undergoing a transformative shift. Traditional eCommerce platforms like AliExpress and cutting-edge Web3 marketplaces like OpenSea are at the center of this evolution. For startup founders and app entrepreneurs, understanding the business mechanics behind these platforms is more than a curiosity—it’s essential to identifying the right path for your venture.

- AliExpress represents high-volume, low-cost B2C eCommerce rooted in physical product distribution.

- OpenSea symbolizes the digital asset economy built on blockchain, NFTs, and decentralized principles.

As these platforms serve completely different markets—tangible goods vs. digital collectibles—their business models diverge dramatically in terms of revenue generation, cost structure, growth strategy, and monetization potential.

If you’re planning to build an eCommerce marketplace or a digital collectibles platform in 2025, this deep dive into AliExpress vs OpenSea business models will help you pick the right foundation.

What is AliExpress?

AliExpress is a global B2C online retail marketplace owned by Alibaba Group, launched in 2010. It connects Chinese and international sellers with consumers around the world, enabling direct access to a broad range of low-cost products—from electronics to fashion and home goods.

Key Features:

- Marketplace for dropshipping, reselling, and individual consumer purchases.

- Supplier base is largely Chinese manufacturers.

- Users worldwide can purchase directly from sellers.

- AliExpress handles platform hosting, payment processing, buyer protection, and global shipping partnerships.

What is OpenSea?

OpenSea is the world’s first and largest peer-to-peer NFT marketplace, founded in 2017. It allows users to buy, sell, and mint digital assets like art, music, collectibles, and virtual real estate—all on the blockchain (primarily Ethereum).

Key Features:

- Decentralized marketplace for NFTs (non-fungible tokens).

- Supports minting, trading, and auctioning of digital assets.

- Compatible with multiple crypto wallets like MetaMask.

- Revenue comes from transaction fees, not physical inventory.

Business Model of AliExpress

AliExpress follows a multi-sided platform model, connecting sellers with buyers globally, and earns primarily from commissions and value-added services.

1. Revenue Streams

- Transaction Fees: Commission from each sale (~5–8% depending on category).

- Advertising & Promotions: Sponsored listings, display ads, and in-platform promotion fees.

- Subscription Services: Seller-tiered access packages.

- Logistics & Fulfillment (Cainiao): Premium shipping and logistics charges.

2. Cost Structure

- Platform Maintenance: Tech infrastructure, app updates, and UI/UX optimization.

- Customer Support: Dispute resolution and buyer protection.

- Marketing Spend: Global advertising campaigns.

- Operational Costs: Payment gateways, fraud prevention, logistics partnerships.

3. Key Partners

- Suppliers & Manufacturers (mostly in China)

- Logistics Providers (e.g., Cainiao)

- Payment Gateways (Alipay, cards)

- Affiliate Marketers & Dropshippers

4. Growth Strategy

- Expansion into new geographies (Latin America, Eastern Europe).

- Mobile-first shopping optimization.

- Encouraging dropshipping entrepreneurs.

- Boosting buyer protection & delivery speed to compete with Amazon.

Learn More: AliExpress App Marketing Strategy: Growth Tactics & UX Hacks

Business Model of OpenSea

OpenSea operates on a decentralized NFT marketplace model, where users retain control over digital assets and trade them freely. It monetizes by charging a service fee on every transaction.

1. Revenue Streams

- Service Fees: 2.5% fee on every NFT sale.

- Creator Royalties: Optional, paid to creators per resale (0–10%).

- Premium Listings: Paid promotion by creators and NFT projects.

- Developer APIs: API access fees for 3rd party apps and tools.

2. Cost Structure

- Blockchain Infrastructure: Smart contract development and upkeep.

- Security & Compliance: Anti-fraud systems and wallet security.

- R&D: Expanding multi-chain capabilities (Ethereum, Solana, Polygon).

- Team & Operations: DevOps, community management, partnerships.

3. Key Partners

- Blockchain Networks (Ethereum, Polygon)

- Crypto Wallet Providers (MetaMask, Coinbase Wallet)

- NFT Creators & Artists

- Community DAOs & NFT Guilds

4. Growth Strategy

- Expand into gaming NFTs, virtual land, and Web3 identity.

- Integrate with Layer 2 blockchains to reduce fees.

- Develop cross-platform APIs and SDKs.

- Boost creator tools and white-label marketplace solutions.

Learn More: OpenSea App Marketing Strategy: Community, Creators & Crypto Growth

AliExpress vs OpenSea: Comparison Table

| Feature / Factor | AliExpress | OpenSea |

|---|---|---|

| Business Type | B2C eCommerce Marketplace | Decentralized NFT Marketplace |

| Revenue Model | Commissions + Ads + Subscriptions | Transaction Fees + Royalties |

| Product Type | Physical goods | Digital assets (NFTs) |

| Core Users | Global shoppers & dropshippers | NFT creators, collectors, crypto users |

| Blockchain Integration | No | Yes (Ethereum, Polygon, etc.) |

| Payment System | Alipay, Credit/Debit Cards | Crypto Wallets (ETH, SOL, etc.) |

| Target Geography | Worldwide (esp. developing markets) | Global (crypto-native users) |

| Scalability | High, but limited by logistics | Very High (digital & decentralized) |

| Main Challenge | Logistics & Delivery Speed | Regulatory scrutiny, NFT volatility |

Pros & Cons of AliExpress Business Model

Pros

- Large addressable market.

- Low entry barrier for sellers.

- Robust infrastructure from Alibaba Group.

- Supports dropshipping and global trade.

Cons

- Margins are thin.

- Heavy competition.

- Logistics bottlenecks in global delivery.

- No innovation in decentralization or digital assets.

Pros & Cons of OpenSea Business Model

Pros

- High-profit margins on digital goods.

- No logistics or physical handling.

- First-mover advantage in NFTs.

- Revenue scaling with crypto adoption.

Cons

- Volatile revenue depending on NFT market.

- Regulatory risks (securities law, copyright).

- Requires user familiarity with crypto tools.

- High dependency on network fees & blockchain security.

Market Data: Growth, Revenue, and Funding (2025)

| Platform | Users (2025) | Annual Revenue (2024 est.) | Total Funding Raised |

|---|---|---|---|

| AliExpress | 200M+ | $14 Billion+ | Backed by Alibaba |

| OpenSea | 3M+ Wallets | $500 Million+ | $427 Million (Series C) |

Growth Notes:

- AliExpress focuses on mass market reach through mobile commerce and dropshipping.

- OpenSea growth is tied to NFT adoption, metaverse projects, and gaming integration.

Which Business Model Is Better for Startups in 2025?

It depends on your audience, scalability goals, and tech capabilities.

- Choose AliExpress-style model if you’re solving for cross-border eCommerce, product sourcing, or dropshipping.

- Go for OpenSea-style model if your startup is focused on Web3, NFTs, gaming assets, or building a creator economy.

Choose AliExpress-Style If…

- You’re targeting budget-conscious global consumers.

- You want to build a reseller/dropshipping platform.

- You want to tap into physical goods with scalable logistics.

- You’re replicating Amazon’s global reach at a lower price point.

Build Your AliExpress Clone Marketplace with Miracuves

Choose OpenSea-Style If…

- You’re building in the Web3, creator, or gaming economy.

- You want no inventory, no logistics, only digital asset trading.

- Your users are crypto-savvy or you plan to educate them.

- You want to leverage blockchain transparency and royalties.

Launch Your OpenSea Clone NFT Marketplace with Miracuves

Conclusion

At Miracuves, we help you analyze, design, and build digital platforms—whether it’s a robust eCommerce solution like AliExpress or a cutting-edge NFT marketplace like OpenSea. Our pre-built clone scripts, custom development services, and marketing strategies are designed to fast-track your startup’s success.

Let’s build the future—your future—together.

FAQs

1. What is the core difference between AliExpress and OpenSea business models?

AliExpress sells physical products via B2C, while OpenSea enables decentralized trading of digital assets (NFTs).

2. Can I use the AliExpress model for digital products?

Not efficiently. AliExpress is optimized for physical goods and lacks blockchain or tokenization capabilities.

3. Is OpenSea a profitable business model in 2025?

Yes, especially with growing NFT use in gaming, digital identity, and collectibles. But it’s volatile and regulation-sensitive.

4. Which is easier to build: AliExpress clone or OpenSea clone?

An AliExpress clone is easier in terms of user onboarding, but OpenSea clones require advanced blockchain integration.

5. Does Miracuves offer white-label solutions for both models?

Absolutely. Miracuves provides ready-to-launch and customized clones for both AliExpress and OpenSea.