In 2025, the online grocery delivery industry has matured into a multibillion-dollar sector, powered by hyper-personalization, lightning-fast logistics, and ever-increasing consumer expectations. Startup founders and app entrepreneurs eyeing this space are not just looking to enter a growing market—they’re aiming to model their business after proven, successful giants. Among the most discussed names in this domain are Amazonfresh and FreshDirect.

While both brands operate in the same sector, their business models differ significantly in approach, scalability, and monetization. Understanding these differences isn’t just academic—it’s essential for entrepreneurs building the next big grocery delivery app.

In this blog, we’ll break down each company’s business model, compare their strengths and weaknesses, and help you decide which route is better for your startup in 2025. Whether you’re thinking of building an Amazonfresh clone or a FreshDirect-style service, this detailed guide will help you choose the optimal blueprint.

What is Amazonfresh?

Amazonfresh is Amazon’s grocery delivery arm, originally launched in 2007. It enables customers to order fresh produce, pantry staples, and household items for same-day or next-day delivery. Integrated deeply within the Amazon ecosystem (Prime, Alexa, Dash, etc.), Amazonfresh operates in select metropolitan areas globally.

Key Highlights:

- Part of Amazon’s larger eCommerce and logistics network

- Exclusive to Amazon Prime members (with added benefits)

- Supports ultra-fast delivery with warehousing and fulfillment centers

- Offers both fresh items and pantry goods

What is FreshDirect?

FreshDirect is a New York-based online grocery delivery service founded in 2002. It pioneered the concept of direct-from-source delivery—cutting out intermediaries to deliver fresher food. Unlike Amazonfresh, FreshDirect owns its supply chain end-to-end, with centralized warehouses and a proprietary fleet.

Key Highlights:

- Direct sourcing from farms, fisheries, and producers

- Operates a vertically integrated supply chain

- Focused mainly on the Northeastern U.S.

- High customer loyalty for premium freshness and service

Business Model of Amazonfresh

Amazonfresh uses a hybrid marketplace + logistics-driven model. It combines first-party sales (Amazon-owned inventory) with third-party sellers under the Amazon platform.

Revenue Streams:

- Subscription Fees: Part of Amazon Prime or as an add-on

- Product Sales: Revenue from grocery and household items

- Third-party Listing Fees: Commissions from sellers on the platform

- Logistics as a Service: Fulfillment & delivery infrastructure leveraged across verticals

Cost Structure:

- Fulfillment center operations

- Last-mile delivery fleet costs

- Inventory management

- Technology (AI, demand forecasting, warehouse robotics)

- Customer support and Prime-related costs

Key Partners:

- Local farms and CPG brands

- Third-party vendors via Amazon Marketplace

- Delivery service providers

- Tech stack partners (for AI, ML, IoT, etc.)

Growth Strategy:

- Expansion into mid-sized cities

- Integration with Amazon Go and Whole Foods

- Investing in automated warehouses

- Personalization using AI and user data

Learn More: Business Model of AmazonFresh : Strategy & Key Insights

Business Model of FreshDirect

FreshDirect follows a vertically integrated, direct-to-consumer model focused on quality, freshness, and control over the full customer experience.

Revenue Streams:

- Direct Sales: Grocery, prepared meals, and pantry staples

- Corporate Orders: Office and institutional deliveries

- Subscription Services: Express Delivery Club (similar to Prime)

- White-label Partnerships: Private labels and exclusive offerings

Cost Structure:

- In-house sourcing and warehousing

- Fleet and cold chain logistics

- Proprietary delivery scheduling system

- Premium packaging and product curation

- High operational overhead due to vertical integration

Key Partners:

- Regional farms and specialty producers

- Packaging suppliers

- Cold chain logistics vendors

- Culinary brands for private label

Growth Strategy:

- Focus on regional market penetration (NY, NJ, CT)

- Customer retention through freshness guarantees

- Experimentation with meal kits and eco-packaging

- Building a premium grocery brand identity

Learn More: Business Model of FreshDirect : Online Grocery Revenue

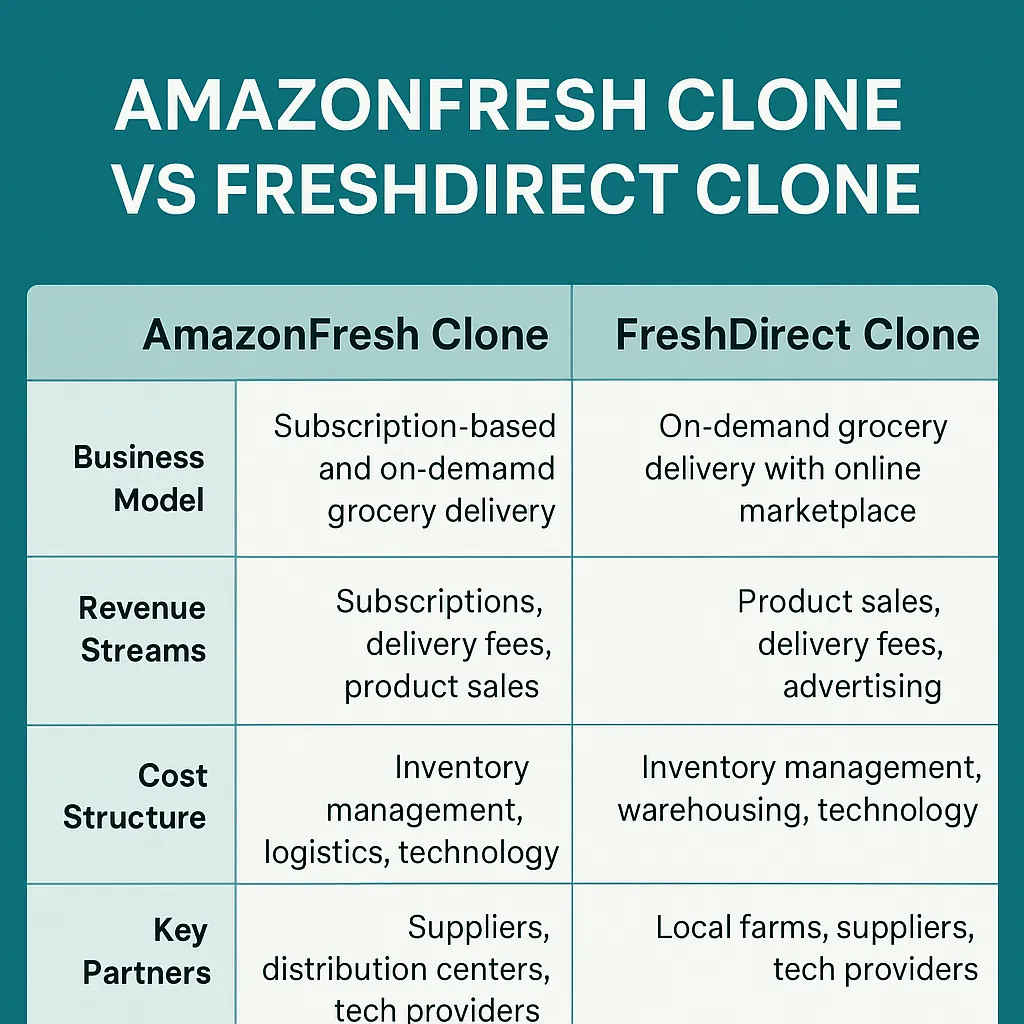

Comparison Table: Amazonfresh vs FreshDirect

| Feature | Amazonfresh | FreshDirect |

|---|---|---|

| Founded | 2007 | 2002 |

| Business Model | Marketplace + Logistics | Vertically Integrated D2C |

| Revenue Sources | Sales, Prime Fees, Logistics | Direct Sales, Subscriptions |

| Operational Scope | Global (select cities) | Regional (Northeast U.S.) |

| Delivery Model | Same/Next-day via Amazon network | Scheduled next-day via own fleet |

| Warehouse System | Fulfillment centers + Whole Foods | Centralized hubs |

| Target Audience | Mass-market, convenience-driven | Premium, freshness-focused |

| Tech Usage | AI/ML, Alexa, warehouse robotics | Cold chain tech, delivery algorithms |

| Partner Network | Wide vendor marketplace | Local producers and farms |

Pros & Cons of Amazonfresh Model

Pros:

- Scalable and global-ready

- Strong synergy with Amazon ecosystem

- Robust logistics infrastructure

- Rapid delivery capabilities

Cons:

- High competition with narrow margins

- Less focus on freshness and food sourcing quality

- Customer churn due to generic brand experience

Pros & Cons of FreshDirect Model

Pros:

- End-to-end quality control

- Strong brand loyalty in focused regions

- Higher margins on premium products

- Custom curated offerings

Cons:

- Limited geographic scalability

- High capital and operational costs

- Slower expansion due to logistics dependency

Market Data: Growth, Revenue, and Funding (as of 2025)

| Metric | Amazonfresh | FreshDirect |

|---|---|---|

| Estimated Revenue (2025) | $7.2B+ (integrated with Amazon) | $900M+ |

| Monthly Users | ~8 million active | ~1.2 million active |

| Delivery Reach | 40+ cities in 10 countries | 5 states (U.S. Northeast) |

| Acquisition | Integrated with Whole Foods | Acquired by Ahold Delhaize (2021) |

| Funding | Part of Amazon’s capital stack | $280M+ pre-acquisition |

| Growth Rate | 18% YoY | 12% YoY |

Which Model is Better for Startups in 2025?

The answer depends on your goals, resources, and audience.

- If your goal is mass-market scalability, Amazonfresh-style models offer infrastructure, reach, and modular revenue streams.

- If your brand aims for niche, premium grocery delivery, FreshDirect’s model can provide stronger brand equity and customer loyalty.

In 2025, startups have access to cloud kitchens, micro-warehousing, and white-label grocery tech, making hybrid models increasingly viable.

Choose Amazonfresh-style if…

- You want to scale quickly across cities

- You’re building an Amazon-like eCommerce ecosystem

- You plan to partner with multiple vendors

- Your priority is convenience over curation

Launch your own Amazonfresh-style app today with Miracuves’ Amazonfresh Clone Solution.

Choose FreshDirect-style if…

- You aim to own the entire supply chain

- You’re targeting affluent urban areas

- You want higher margins via premium goods

- You plan to differentiate via freshness

Build your vertically integrated grocery app with Miracuves’ FreshDirect Clone Solution.

Conclusion

Whether you’re inspired by the operational might of Amazonfresh or the curated excellence of FreshDirect, Miracuves empowers you with end-to-end grocery app development solutions.

From clone scripts to custom architecture, our white-label grocery delivery platforms are built for scale, security, and speed. Tap into our experience in logistics tech, subscription models, and delivery optimization—and transform your idea into the next big thing in online groceries.

Let’s build your grocery empire. Contact Miracuves today.

FAQs

Which is more profitable: Amazonfresh or FreshDirect?

Amazonfresh operates on thin margins but benefits from massive scale. FreshDirect focuses on high-margin premium goods but has high operational costs. Profitability depends on geography and execution.

Can I build a grocery app like these without owning warehouses?

Yes, with cloud warehousing or third-party fulfillment partners, you can emulate either model on a smaller scale using Miracuves’ technology stack.

Which model is faster to launch?

An Amazonfresh-style platform is quicker to deploy, especially using a marketplace approach with existing vendors.

How much does it cost to develop an Amazonfresh or FreshDirect clone?

Development costs vary based on features and scale, but Miracuves offers ready-to-launch clone solutions that drastically reduce time and cost.

Can I mix AmazonFresh and FreshDirect models?

Yes. Many startups blend AmazonFresh’s scalability with FreshDirect’s premium sourcing to offer a hybrid grocery app—scalable, high-quality, and customer-focused.