In 2015, Monzo launched as a small UK-based fintech startup with a bold promise: make banking radically transparent and user-friendly. Fast forward to 2026, Monzo has grown into one of Europe’s most recognized digital-first banks, serving 9+ million customers, with profitability milestones finally within reach after years of intentional reinvestment.

Unlike traditional banks weighed down by legacy systems, Monzo built a mobile-native banking platform that prioritizes UX, instant notifications, and financial clarity. For founders exploring subscription platforms, regulated marketplaces, or fintech ecosystems, business model of Monzo offers powerful lessons on trust, scale, and monetization patience.

At Miracuves, we often reference Monzo when helping entrepreneurs design compliance-heavy yet scalable platforms — because it proves that great product experience can be the growth engine, even in conservative industries like banking.

How the Monzo Business Model Works

Monzo operates on a hybrid digital banking model that blends freemium retail banking, subscription upgrades, and embedded financial services. At its core, Monzo is a licensed bank, not just a fintech app — which fundamentally shapes how its business model is structured and scaled.

Unlike traditional banks that rely heavily on branches and legacy tech, Monzo runs a cloud-native, API-driven platform designed for speed, transparency, and modular expansion.

Core Business Model Overview

Type of Model

- Hybrid Model

- Digital-first retail banking

- Freemium + subscription-based upgrades

- Embedded finance & marketplace partnerships

- Digital-first retail banking

Value Proposition by User Segment

- Retail Consumers

- Fee-free current accounts

- Real-time spending notifications

- Automated budgeting (“Pots”)

- In-app financial visibility and control

- Fee-free current accounts

- Premium Subscribers

- Advanced budgeting and analytics

- Higher savings interest rates

- Travel insurance and card perks

- Priority support

- Advanced budgeting and analytics

- Business Customers (Monzo Business)

- Smart invoicing and cash-flow tools

- Integrations with accounting software

- Expense categorization and insights

- Smart invoicing and cash-flow tools

Key Stakeholders in the Ecosystem

- End users (personal & business customers)

- Merchants and payment networks (Visa, Mastercard)

- Financial partners (lenders, insurers, savings providers)

- Regulators (FCA, PRA)

- Third-party fintech integrations

Evolution of the Model

Monzo’s model has evolved deliberately over time:

- 2015–2017: Prepaid card + community-driven beta

- 2018–2020: Full UK banking license, current accounts

- 2021–2023: Subscription tiers (Monzo Plus, Premium)

- 2024–2026: Profitability focus, lending expansion, embedded finance

This evolution reflects a “trust-first, monetize-later” strategy, uncommon in fintech but critical for long-term customer retention.

Why Monzo’s Model Works in 2026

Monzo’s success aligns with key 2026 market realities:

- Consumers expect real-time financial experiences

- Subscription-based value perception is normalized

- Open Banking enables modular fintech ecosystems

- Rising distrust in legacy banks fuels challenger adoption

For Miracuves clients building regulated or trust-heavy platforms, Monzo demonstrates how product obsession + ecosystem thinking can outperform traditional distribution-heavy models.

Read more : What is Monzo App and How Does It Work?

Target Market & Customer Segmentation Strategy

Monzo’s growth story isn’t just about great product design — it’s about precision in customer segmentation and a deep understanding of modern money behavior. Instead of chasing “everyone,” Monzo expanded by owning specific lifestyle moments and then broadening its appeal.

Primary & Secondary Customer Segments

Primary Segments

- Digital-native consumers (18–35)

- Urban, mobile-first users

- Value transparency, speed, and UX

- Early adopters of subscriptions and fintech tools

- Urban, mobile-first users

- Young professionals & freelancers

- Multiple income streams

- Need budgeting, cash-flow visibility, and expense tracking

- High engagement with in-app insights

- Multiple income streams

Secondary Segments

- Families & joint-account users

- Shared budgeting and savings goals

- Pots for rent, utilities, and childcare

- Shared budgeting and savings goals

- SMEs & sole traders (Monzo Business)

- Small businesses seeking simplicity

- Minimal accounting friction

- Preference for integrated financial tools

- Small businesses seeking simplicity

Customer Journey: From Discovery to Retention

1. Discovery

- Word-of-mouth and referrals

- App Store rankings driven by high NPS

- Earned media around “challenger bank” positioning

2. Conversion

- Frictionless account setup (minutes, not days)

- Transparent pricing (no hidden fees)

- Instant card issuance and in-app onboarding

3. Retention

- Daily engagement via real-time notifications

- Behavioral nudges (spending insights, savings prompts)

- Subscription upgrades introduced after trust is built

Monzo’s model prioritizes engagement before monetization, resulting in high lifetime value without aggressive upselling.

Acquisition Channels & LTV Optimization

- Referral loops with emotional incentives (not cash-heavy)

- App-first product-led growth

- Cross-sell from free → Plus → Premium

- Business account expansion from personal users

Market Positioning Analysis

Monzo positions itself as:

- Friendly, transparent, and human

- Anti-bureaucracy, anti-hidden-fees

- A “financial companion,” not just a bank

Competitive Edge

- Strong brand trust among millennials and Gen Z

- Community-led product decisions

- UX-led differentiation in a regulated market

In the UK digital banking space, Monzo consistently ranks among the top challenger banks by active users, often outperforming rivals on engagement even when ARPU lags — a strategic trade-off now paying off.

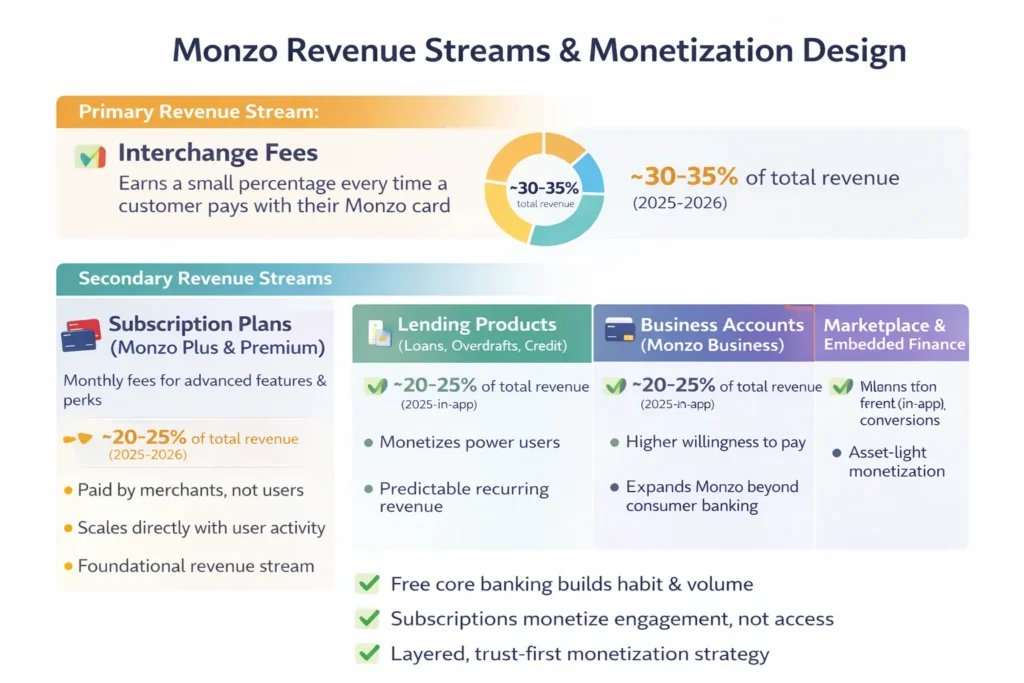

Revenue Streams and Monetization Design

For years, Monzo was criticized for “great UX but weak monetization.” By 2026, that narrative has shifted. Monzo’s revenue model is now a carefully layered monetization architecture that balances low-friction banking with high-margin financial services.

Instead of relying on a single income stream, Monzo diversified early — ensuring resilience as consumer behavior and regulations evolved.

Primary Revenue Stream

How it works

- Earns a small percentage every time a customer pays with their Monzo card

- Fees paid by merchants, not users

Key Characteristics

- High volume, low margin

- Scales directly with user activity

- Foundational revenue stream

Contribution

- ~30–35% of total revenue (2025–2026 estimates)

- Strong growth due to daily active usage

Secondary Revenue Streams

1. Subscription Plans (Monzo Plus & Premium)

- Monthly fees for advanced features and perks

- Includes higher savings rates, insurance, virtual cards, analytics

Why it works

- Monetizes power users

- Predictable recurring revenue

- Strong psychological anchoring between free and paid tiers

Estimated Share

- ~20–25% of revenue and growing

2. Lending Products (Loans, Overdrafts, Credit)

- Personal loans and overdrafts offered in-app

- Risk-based pricing using transaction data

Strategic Value

- Higher margins than interchange

- Improves ARPU significantly

- Data-driven underwriting reduces default risk

Estimated Share

- ~25–30% of revenue

3. Business Accounts (Monzo Business)

- Monthly fees for SME accounts

- Add-ons: invoicing, tax pots, accounting integrations

Why it matters

- Higher willingness to pay

- Lower churn compared to retail users

- Expands Monzo beyond consumer banking

4. Marketplace & Embedded Finance

- Commissions from partners (insurance, savings, investments)

- Revenue share on referrals and in-app conversions

Long-term upside

- Turns Monzo into a financial operating system

- Asset-light monetization

Monetization Strategy Explained

Monzo’s revenue design is built around trust-first monetization:

- Free core banking builds habit and volume

- Subscriptions monetize engagement, not access

- Lending and partnerships drive margin expansion

- Pricing tiers are simple, transparent, and optional

This layered approach mirrors how Miracuves structures scalable app monetization frameworks — multiple streams, each reinforcing the other rather than competing.

Operational Model & Key Activities

Monzo’s operational strength lies in how it combines bank-grade compliance with startup-level execution speed. While many fintechs struggle to scale operations under regulation, Monzo turned operations into a competitive advantage through automation, cloud infrastructure, and product-led processes.

Core Operational Activities

1. Platform & Infrastructure Management

- Cloud-native architecture (microservices-based)

- Real-time transaction processing

- High-availability systems designed for peak usage

- Continuous deployment and rapid iteration

2. Regulatory Compliance & Risk Management

- FCA and PRA compliance embedded into product workflows

- Automated KYC, AML, and fraud detection

- Real-time monitoring of suspicious activity

3. Product Development & UX Optimization

- Weekly product releases and feature testing

- Strong internal data culture driving decisions

- Community feedback loops inform roadmap priorities

4. Customer Support Operations

- In-app chat-first support model

- AI-assisted triage and human escalation

- Focus on fast resolution and transparency

5. Marketing & Growth Operations

- Product-led growth over paid ads

- Community storytelling and brand advocacy

- Minimal reliance on traditional media spend

Resource Allocation Strategy (2025–2026)

Monzo allocates resources with a long-term efficiency mindset:

- Technology & Engineering: ~35–40%

- Compliance, Risk & Legal: ~15–20%

- Customer Support & Ops: ~15%

- Marketing & Growth: ~10–12%

- R&D and New Products: ~10–15%

This allocation reflects Monzo’s belief that great infrastructure reduces future costs, a philosophy Miracuves applies when building platforms meant to scale without operational chaos.

Regional & Expansion Operations

- UK remains the core operational base

- Selective international pilots (EU, US)

- Expansion driven by regulatory readiness, not hype

- Localized compliance before customer acquisition

Strategic Partnerships & Ecosystem Development

Monzo’s partnership strategy is rooted in a simple idea: don’t build everything yourself. Instead, Monzo positions itself as a platform layer that connects best-in-class financial services into a single, trusted interface.

This ecosystem-first mindset allows Monzo to expand functionality without heavy balance-sheet risk or operational bloat.

Partnership Philosophy

Monzo collaborates where:

- Speed to market matters

- Specialized expertise already exists

- Capital efficiency is critical

- User trust must remain intact

Rather than white-labeling aggressively, Monzo carefully curates partners that align with its brand promise of transparency and simplicity.

Key Partnership Categories

1. Technology & API Partners

- Cloud infrastructure providers

- Open Banking APIs

- Data analytics and security vendors

Strategic Value

- Faster feature rollout

- Scalable infrastructure

- Reduced technical debt

2. Payment Networks & Financial Rails

- Visa and Mastercard partnerships

- Faster Payments and Open Banking rails

Strategic Value

- Global payment acceptance

- Transaction reliability

- Interchange optimization

3. Lending, Savings & Insurance Partners

- Third-party loan originators

- Savings providers offering competitive rates

- Travel and device insurance partners

Strategic Value

- Asset-light revenue via commissions

- Broader product suite without balance-sheet exposure

- Increased ARPU per user

4. Accounting & SME Tool Integrations

- Xero, FreeAgent, and bookkeeping tools

- Invoicing and tax management platforms

Strategic Value

- Deepens Monzo Business stickiness

- Reduces churn among SMEs

- Positions Monzo as a financial OS for small businesses

5. Regulatory & Expansion Alliances

- Local compliance advisors

- Banking-as-a-Service collaborators

- Government and regulatory engagement bodies

Strategic Value

- Faster regulatory approval cycles

- Reduced expansion risk

- Trust-building in new markets

Ecosystem Strategy Insights

Monzo’s ecosystem creates:

- Network effects: More partners → more value → higher retention

- Monetization leverage: Revenue share without heavy capex

- Competitive moats: Switching costs rise as users integrate deeper

This is a model Miracuves frequently implements for clients building platform-based ecosystems — monetize coordination, not ownership.

Read More : Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

Growth Strategy & Scaling Mechanisms

Monzo’s growth hasn’t been explosive by accident — it’s the result of deliberate, compounding growth loops designed to balance speed, trust, and regulatory discipline. Unlike growth-at-all-costs startups, Monzo optimized for durable scale.

Core Growth Engines

1. Product-Led Virality

- Shareable features (spending insights, Pots, instant notifications)

- Social proof through everyday usage

- High NPS driving organic referrals

Why it works:

People don’t “market” Monzo — they show it.

2. Referral Loops

- Simple, low-friction invite mechanics

- Emotional incentives (usefulness > cash rewards)

- Trust-based peer recommendations

3. Subscription Upsell Flywheel

- Free users build daily habits

- Power users naturally upgrade

- Premium features tied to outcomes, not vanity perks

4. Product Expansion

- Personal banking → joint accounts → business accounts

- Lending, savings, insurance layered gradually

- Each product increases switching costs

5. Geographic Expansion (Selective)

- UK-first dominance

- International pilots over full rollouts

- Regulatory readiness before marketing spend

Scaling Challenges & How Monzo Solved Them

Challenge: Regulatory Complexity

- Solution: Compliance embedded into product architecture from day one

Challenge: Infrastructure Load

- Solution: Cloud-native microservices and real-time monitoring

Challenge: Profitability Pressure

- Solution: Monetize engagement, not access; diversify revenue streams

Challenge: Customer Support at Scale

- Solution: In-app support + AI-assisted triage + human escalation

Competitive Strategy & Market Defense

In a space filled with challenger banks, super apps, and Big Tech payment plays, Monzo survives — and wins — by playing a long game of trust, data, and experience rather than short-term price wars.

Core Competitive Advantages

1. Network Effects

- More users → more transaction data

- Better insights → smarter products

- Smarter products → higher engagement

While subtle, these data-driven network effects create compounding advantages over time.

2. Switching Costs

- Salary payments, bills, subscriptions, and savings all tied into Monzo

- Pots, analytics, and integrations lock in behavior, not contracts

- Business accounts deepen operational dependency

3. Brand Equity & Trust

- Transparent fees and real-time alerts

- Human brand voice in a traditionally cold industry

- Strong regulatory credibility as a licensed bank

4. Technology & Data Advantage

- Real-time transaction intelligence

- Personalized nudges and insights

- Faster experimentation than legacy banks

Market Defense Tactics

Handling New Entrants

- Continuous feature iteration

- UX improvements that raise baseline expectations

- Early adoption of Open Banking innovations

Pricing & Feature Wars

- Avoids race-to-the-bottom pricing

- Differentiates on clarity, not discounts

- Keeps free tier generous to block low-cost entrants

Strategic Timing

- Rolls out features once operationally ready

- Learns from competitors’ mistakes before copying

- Prioritizes stability over hype-driven launches

Partnership & Acquisition Strategy

- Partner-first mindset instead of heavy M&A

- Selective acquisitions to accelerate roadmap, not inflate valuation

- Ecosystem expansion over vertical dominance

The result: Monzo doesn’t just compete on features — it competes on confidence.

Lessons for Entrepreneurs & Implementation

Monzo’s journey offers a masterclass in building trust-driven platforms in complex, regulated markets. It didn’t win by being the loudest — it won by being the most useful, consistently.

What Really Drove Monzo’s Success

- Obsessive focus on user experience

- Trust-first, monetize-later strategy

- Modular platform design for expansion

- Transparent communication with users

- Data-informed, not hype-driven decisions

Monzo proves that patience can be a growth strategy.

Replicable Principles for Startups

1. Build Habit Before Revenue

- Daily engagement beats early monetization

- Usage creates data; data creates defensibility

2. Design for Scale From Day One

- Cloud-native architecture

- API-first product thinking

- Compliance embedded, not bolted on

3. Monetize Outcomes, Not Access

- Charge for convenience, insights, and speed

- Keep core access frictionless

4. Grow Horizontally

- Expand features once trust is earned

- Increase LTV through product depth, not user volume alone

Common Mistakes to Avoid

- Monetizing too early

- Overbuilding features without demand signals

- Ignoring compliance and operational costs

- Scaling marketing before product-market fit

Adapting the Model for Local or Niche Markets

Monzo’s model can be adapted for:

- Regional neo-banks

- Vertical fintechs (health, logistics, education)

- SME-focused financial platforms

- Embedded finance in non-banking apps

Key adaptation levers:

- Regulatory scope

- Cultural trust factors

- Payment behavior norms

Implementation & Investment Priorities

Phase 1 :

- MVP with core utility

- Regulatory groundwork

- UX-led onboarding

Phase 2 :

- Engagement features

- Data infrastructure

- Trust-building mechanics

Phase 3 :

- Monetization layers

- Partnerships and ecosystem

- Geographic or vertical expansion

Ready to implement Monzo’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps.

Get your free business model consultation today.

Conclusion

Monzo’s business model proves a powerful truth about modern platforms: innovation alone isn’t enough — execution, trust, and timing matter just as much.

By rebuilding banking from the smartphone up, Monzo showed that even the most regulated, conservative industries can be disrupted when user experience becomes the strategy. Its journey from a prepaid card to a full-scale digital bank underscores how clarity, consistency, and community can outperform legacy scale.

As we move deeper into 2026 and beyond, platform economies will increasingly be defined by:Modern platform success is defined by ecosystems over standalone products, subscription trust over transactional extraction, and data-driven personalization balanced with regulatory compliance.

The future belongs to companies that, like Monzo, design systems people want to stay inside — not because they’re locked in, but because leaving feels like a downgrade.

FAQs

What type of business model does Monzo use?

Monzo operates a hybrid digital banking model combining freemium current accounts, paid subscriptions, lending products, and embedded financial services through partnerships.

How does Monzo’s business model create value?

Monzo delivers value through real-time financial insights, intuitive money tools, and transparent pricing, helping users manage money smarter while reducing banking friction.

What are Monzo’s key success factors?

Monzo’s success comes from its mobile-first infrastructure, strong brand trust, product-led growth, diversified revenues, and full regulatory licensing.

How scalable is Monzo’s business model?

Monzo’s model is highly scalable due to its API-driven architecture, modular products, and partner ecosystem, allowing growth without linear cost increases.

What are the biggest challenges in Monzo’s model?

Key challenges include regulatory complexity, early-stage margin pressure, balancing innovation with stability, and scaling customer support efficiently.

How can entrepreneurs adapt Monzo’s model to their region?

Entrepreneurs can adapt it by starting with a focused use case, leveraging local payment systems, partnering for financial products, and embedding compliance early.

What are alternatives to Monzo’s business model?

Alternatives include Banking-as-a-Service platforms, embedded finance within non-banking apps, and vertical fintechs focused on SMEs or niche markets.

How has Monzo’s business model evolved over time?

Monzo evolved from a prepaid card to a licensed digital bank, then added subscriptions, lending, and partnerships to move toward sustainable profitability

Related Article :