Zalando didn’t win Europe by being just another e-commerce store. It engineered a hybrid fashion platform that blends retail, marketplace, logistics, and software services into a single ecosystem. While many global players tried to copy Amazon’s inventory-heavy model, Zalando took a different route—one optimized for European fragmentation, brand sensitivity, and logistics complexity.

By 2025, Zalando operates across 25+ European markets, serves 50+ million active customers, and works with thousands of fashion brands and partners. Its real innovation lies not in selling clothes—but in owning the digital fashion infrastructure that brands depend on.

At Miracuves, we closely analyze models like the Business Model of Zalando because they demonstrate how platform architecture, monetization layers, and operational control must evolve together to achieve sustainable scale in competitive markets.

How the Zalando Business Model Works

Zalando runs a hybrid platform business model that combines direct retail, a multi-brand marketplace, and a growing B2B “fashion infrastructure” layer (logistics, software, and services for brands). In simple terms: Zalando doesn’t just sell fashion—it orchestrates demand, distribution, and data across Europe.

Type of model

- Hybrid E-commerce + Marketplace

- 1P Retail (First-party): Zalando buys inventory and sells directly (classic e-commerce margins + merchandising control).

- 3P Marketplace (Third-party): Brands/partners list products; Zalando earns commissions + service revenue, and scales assortment without holding all inventory risk.

- Platform Services (B2B layer):

- Logistics and fulfillment services for partners

- Marketing/visibility tools

- Data/insights and “operating system” capabilities for brands (especially important as brands push D2C but still need scale)

Value proposition by user segment

For consumers (shoppers)

- Huge assortment across brands + sizes + categories

- Convenience: delivery options, returns, localized experiences

- Discovery: recommendations, campaigns, seasonal merchandising

For brands & sellers

- Access to pan-European demand without building local operations in every country

- Performance-driven growth tools (campaigns, placements, insights)

- Optional logistics support to improve speed and service quality

For logistics/technology partners

- Predictable volume + integration into a major commerce ecosystem

- Standardized processes and data flows that reduce friction

Key stakeholders & their roles

- Customers: Create demand, data signals (browsing, conversion, returns behavior)

- Brands/Sellers: Provide supply, assortment breadth, pricing/positioning

- Zalando Platform (core): Controls UX, trust, merchandising rules, search/ranking, returns policies

- Logistics network: Enables speed/reliability, especially important in Europe’s cross-border complexity

- Payments/fintech partners: Smooth checkout, local payment methods, risk controls

How the model evolved over time

- Phase 1: Retail-led scale (build customer trust with strong service + returns)

- Phase 2: Marketplace expansion (grow assortment and availability with lower inventory risk)

- Phase 3: Ecosystem + infrastructure (help brands sell better via logistics/services and become the “default platform” for European fashion)

Why it works in 2025

Europe in 2025 is defined by:

- Fragmented markets (language, delivery expectations, regulations, payment preferences)

- Higher customer acquisition costs and tougher competition for attention

- Brands needing efficiency: fewer channels, better ROI, measurable performance

- Demand for convenience + trust (reliable delivery/returns are still a differentiator)

Zalando’s hybrid strategy fits these conditions because it:

- Scales supply (marketplace) without scaling inventory risk at the same rate

- Uses logistics + service quality to defend trust

- Monetizes the ecosystem by selling growth infrastructure to brands, not just products to shoppers

Read more : What is Zalando and How Does It Work?

Target Market & Customer Segmentation Strategy

Zalando’s growth is driven by deep segmentation, not mass-market uniformity. Instead of treating Europe as one market, Zalando breaks it into behavioral, demographic, and value-based segments, then customizes experience, pricing logic, and logistics for each.

Primary & Secondary Customer Segments

Primary Segment: Fashion Consumers (B2C)

- Age: 18–45 (core spending power)

- Behavior: Online-first, mobile-driven, high return sensitivity

- Motivation: Variety, convenience, trust, flexible returns

- Geography: Urban and semi-urban European markets with strong e-commerce adoption

Secondary Segment: Fashion Brands & Sellers (B2B)

- Global brands expanding into Europe

- Mid-sized and emerging fashion labels

- D2C brands seeking scale without heavy operational investment

- Private-label and exclusive collections

Tertiary Segment: Ecosystem Partners

- Logistics providers

- Payment and fintech partners

- Technology and data partners

Customer Journey Mapping

Discovery

- SEO and content-driven discovery (style edits, trend pages)

- App-first engagement through notifications and personalization

- Performance marketing and seasonal campaigns

Conversion

- Localized pricing and language

- Trusted checkout experience

- Multiple payment methods by country

- Delivery speed and clarity as conversion drivers

Retention

- Easy returns and refunds

- Personalized recommendations

- Re-engagement via fashion drops, sales, and brand-led campaigns

- Loyalty-style benefits driven by frequency, not points

Acquisition Channels by Segment

Consumers

- Organic search and app installs

- Paid performance marketing

- Influencer and brand collaborations

- Seasonal sale events (high-intent traffic)

Brands & Sellers

- Direct sales and partnerships

- Case studies showing cross-border growth

- Marketplace onboarding with logistics support

- Performance-based marketing tools tied to GMV growth

Lifetime Value Optimization

Zalando increases LTV not by pushing higher prices, but by:

- Increasing purchase frequency

- Improving basket size through recommendations

- Reducing churn via trust and convenience

- Monetizing brands, not customers, for incremental revenue

Market Positioning & Competitive Edge

Zalando positions itself as:

- Europe’s fashion operating system, not just a retailer

- A neutral, brand-friendly platform (unlike private-label–heavy competitors)

- A logistics-first experience in a region where delivery quality matters more than speed alone

Key differentiation strategies:

- Strong brand relationships (less conflict than Amazon-style models)

- Deep localization at scale

- Balanced focus on both consumers and brand

Read more : Zalando Revenue Model: How Zalando Makes Money in 2025

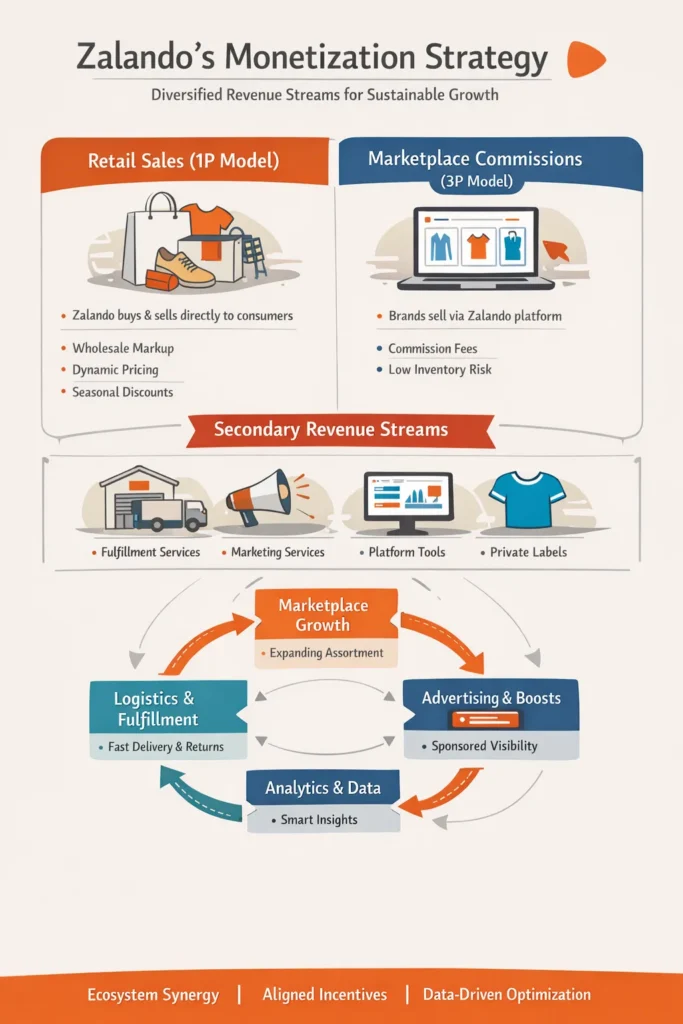

Revenue Streams and Monetization Design

Once Zalando established strong buyer–brand liquidity, its business model unlocked a layered monetization architecture. Instead of relying on a single income source, Zalando diversified revenue across retail margins, marketplace services, logistics, and brand-facing monetization tools—creating resilience in a low-margin fashion industry.

Primary Revenue Stream 1: Retail Sales (1P Model – Core Foundation)

Mechanism

Zalando purchases inventory from brands and sells directly to consumers through its platform.

Pricing Model

- Wholesale purchase → retail markup

- Dynamic pricing based on demand, seasonality, and inventory aging

- Discount-led sell-through during sales cycles

Revenue Contribution

- Still a significant share of total revenue

- Lower margins compared to digital-native categories

- Provides merchandising control and customer experience consistency

Growth Trajectory

- Gradual shift toward marketplace and services

- Focus on improving inventory efficiency rather than pure volume growth

Primary Revenue Stream 2: Marketplace Commissions (3P Model – High-Scale Engine)

Mechanism

- Brands list products directly

- Zalando earns commissions per transaction

- Inventory risk stays with sellers

Pricing Model

- Category-based commission rates

- Value-added services priced separately

Revenue Contribution

- Faster-growing than retail

- Higher capital efficiency

- Expands assortment without balance-sheet pressure

Growth Trajectory

- Increasing share of GMV via marketplace

- Attracting D2C brands seeking cross-border reach

Secondary Revenue Streams

1. Fulfillment & Logistics Services (Zalando Fulfillment Solutions)

- Warehousing, picking, packing, delivery, and returns

- Priced per unit, volume, or service tier

- High stickiness for brands once integrated

2. Marketing & Visibility Services

- Sponsored placements and campaign tools

- Performance-based visibility

- Brands pay to boost discoverability during peak seasons

3. Platform & Software Services

- Analytics, demand insights, and operational tools

- Helps brands optimize assortment and pricing

- Positions Zalando as infrastructure, not just a channel

4. Private Labels & Exclusive Collections

- Higher margin potential

- Used selectively to avoid brand conflict

- Supports differentiation and customer loyalty

Overall Monetization Strategy Explained

Zalando’s monetization logic is ecosystem-first:

- Consumers are protected from aggressive monetization

- Brands fund growth through commissions, logistics, and marketing

- Multiple revenue streams reinforce each other

Interconnection of streams

- Marketplace sellers adopt fulfillment → better delivery → higher conversion → more ad spend

- Retail data improves marketplace recommendations

- Marketing tools drive GMV, which feeds back into commission growth

Pricing Psychology

- Variable pricing reduces friction for entry

- Performance-based fees align incentives

- Tiered services encourage upsell without forcing lock-in

Operational Model & Key Activities

Zalando’s business model works because of operational excellence at scale. Fashion e-commerce is notoriously complex—high return rates, seasonality, size variability, and cross-border logistics. Zalando turned these challenges into core competencies, making operations a competitive moat rather than a cost center.

Core Operational Activities

Platform & Technology Management

- Scalable e-commerce and marketplace infrastructure

- Search, recommendation, and personalization algorithms

- Inventory visibility across 1P and 3P sellers

- Fraud prevention, payments, and risk controls

Logistics & Fulfillment Operations

- Pan-European warehouse network

- Cross-border shipping optimization

- Reverse logistics management (returns processing is critical in fashion)

- Service-level enforcement for marketplace sellers

Quality Control & Trust

- Seller performance monitoring

- Product authenticity and brand protection

- Customer service operations with localized support

- Returns policy governance to maintain customer confidence

Marketing & Merchandising

- Seasonal campaign planning

- Trend curation and category management

- Brand storytelling and editorial content

- Performance marketing optimization

Resource Allocation Strategy

Zalando allocates resources based on long-term defensibility, not short-term margins.

Technology & Product

- Continuous investment in platform scalability

- AI-driven demand forecasting and personalization

- Tools for brand partners to optimize performance

Logistics Infrastructure

- High fixed costs, but strong service differentiation

- Focus on return efficiency and delivery reliability

- Strategic automation in warehouses

Marketing Spend

- Balanced mix of brand marketing and performance acquisition

- Heavy focus on retention over aggressive new-user growth

- Data-driven campaign optimization by market

People & Organization

- Strong engineering and data science teams

- Marketplace operations and partner success roles

- Local market teams for regulatory and cultural adaptation

Regional Expansion Focus

- Depth before breadth

- Optimize unit economics in existing markets before entering new ones

- Localization prioritized over rapid global expansion

Zalando’s operational model ensures that as GMV grows, service quality and trust scale with it, protecting long-term brand equity.

Strategic Partnerships & Ecosystem Development

Zalando’s platform strength is amplified through carefully designed partnerships. Rather than owning every layer, Zalando builds an ecosystem where partners extend reach, reduce complexity, and reinforce network effects—without diluting control over customer experience.

Collaboration Philosophy

Zalando partners where it increases speed, scale, or specialization, while keeping the customer relationship, data, and UX governance in-house. This balance allows rapid expansion across Europe’s fragmented markets without operational overload.

Key Partnership Types

Technology & API Partners

- Cloud infrastructure providers

- Data and analytics platforms

- AI and personalization tool vendors

- Integration partners for seller systems

These partnerships allow Zalando to:

- Scale traffic and transactions reliably

- Offer API-based integrations for large brands

- Improve search, sizing recommendations, and personalization

Payment & Fintech Alliances

- Local payment methods by country

- Fraud detection and risk management providers

- Buy-now-pay-later and installment options (market-dependent)

Payments localization is critical in Europe, and partnerships reduce friction at checkout while improving conversion.

Logistics & Fulfillment Alliances

- Regional and last-mile delivery partners

- Cross-border shipping specialists

- Returns processing partners

These alliances help Zalando maintain service standards without building last-mile infrastructure in every region.

Marketing & Distribution Partners

- Brand co-marketing collaborations

- Influencers and fashion media

- Affiliate and content partnerships

These partnerships fuel discovery and brand relevance, especially during seasonal campaigns.

Regulatory & Expansion Alliances

- Local compliance advisors

- Customs and trade partners

- Sustainability and ESG-focused organizations

Such partnerships reduce entry barriers and support responsible expansion.

Ecosystem Strategy Insights

Zalando’s ecosystem creates mutual dependency:

- Brands depend on Zalando for European reach

- Zalando depends on brands for assortment depth

- Partners depend on Zalando’s scale for predictable volume

Network effects

- More brands → better assortment → more customers

- More customers → higher brand ROI → more partner investment

Ecosystem Monetization

- Service fees tied to value delivered

- Performance-based pricing aligns incentives

- Long-term contracts increase switching costs

Competitive Moats

- Deep operational integration with brands

- Data-driven insights competitors can’t easily replicate

- High switching costs once partners embed logistics and tech

Read more : Best Zalando Clone Scripts 2025: Launch a Scalable Fashion Marketplace

Growth Strategy & Scaling Mechanisms

Zalando’s growth is engineered, not accidental. Instead of chasing hypergrowth at any cost, the company focuses on compounding advantages—logistics density, data intelligence, brand trust, and ecosystem lock-in. This approach allows Zalando to scale sustainably in Europe’s highly competitive fashion market.

Core Growth Engines

Organic Demand & Brand Pull

- Strong brand recognition across Europe

- Habit-driven usage fueled by convenience and returns

- App-centric engagement for repeat purchases

- Seasonal demand cycles that reinforce platform relevance

Referral & Network Effects

- Brands promote Zalando as a primary sales channel

- Customers return due to consistent service quality

- More activity improves recommendations, increasing conversion

Paid Marketing & Performance Acquisition

- Highly optimized paid search and social campaigns

- ROI-driven spend rather than blanket awareness buying

- Localized messaging per country and category

Marketplace & Assortment Expansion

- Onboarding new brands and categories

- Expanding private labels selectively

- Supporting emerging D2C brands with logistics and visibility

Product & Service Innovation

- Improved personalization and sizing tools

- Sustainability-led features and filtering

- Enhanced brand dashboards and performance insights

Geographic Expansion Model

Zalando follows a “deep first, wide later” strategy:

- Enters markets with full localization (language, payments, delivery)

- Builds logistics density before aggressive scaling

- Optimizes unit economics before expanding further

This disciplined expansion reduces cash burn and protects brand reputation.

Scaling Challenges & How Zalando Addressed Them

Operational Complexity

- Challenge: Managing returns, cross-border shipping, and service SLAs

- Solution: Centralized systems + localized execution + automation

Margin Pressure

- Challenge: Thin fashion margins

- Solution: Shift toward marketplace, services, and brand monetization

Brand Competition

- Challenge: Competing with Amazon, fast-fashion giants, and D2C brands

- Solution: Brand-friendly policies, premium positioning, and infrastructure services

Regulatory Fragmentation

- Challenge: Different rules across EU markets

- Solution: Local compliance teams and adaptable platform rules

Zalando scales by reducing friction for others, not by adding complexity for itself.

Competitive Strategy & Market Defense

In fashion e-commerce, growth without defense is fragile. Zalando’s long-term success comes from building moats that are difficult to copy, especially in a market crowded with global platforms, fast-fashion giants, and direct-to-consumer brands.

Core Competitive Advantages

Network Effects

- More brands increase assortment and relevance

- More customers improve conversion and data quality

- Improved data attracts better brands and partners

High Switching Barriers

- Brands deeply integrated into Zalando’s logistics and systems

- Operational dependency on fulfillment, returns, and analytics

- Cross-border complexity makes alternative channels costly

Brand Equity & Trust

- Reliable delivery and generous returns policies

- Consistent customer experience across countries

- Strong consumer trust in payments and refunds

Technology & Data Advantage

- Advanced recommendation and personalization engines

- Demand forecasting and inventory insights

- Data-driven merchandising at scale

Compliance & Sustainability Leadership

- Strong governance across EU regulations

- Sustainability initiatives aligned with European consumer values

- Transparency in supply chains and brand practices

Market Defense Tactics

Against New Entrants

- Fast replication of winning features

- Deep discounts and campaigns during competitive threats

- Leverage logistics advantage to maintain service superiority

Against Price Wars

- Focus on experience rather than lowest price

- Exclusive collections and partnerships

- Service-led differentiation (returns, delivery reliability)

Strategic Timing

- Feature rollouts aligned with seasonal demand

- Testing innovations in select markets before full rollout

Partnerships & Acquisitions

- Strengthening logistics and tech capabilities

- Expanding brand relationships

- Eliminating potential ecosystem threats early

Zalando defends its market by making itself too embedded to replace, not by being the cheapest option.

Lessons for Entrepreneurs & Implementation

Zalando’s journey offers practical, repeatable lessons for founders building marketplaces, vertical platforms, or ecosystem-driven apps. Its success proves that scale alone is not enough—structure, incentives, and execution discipline matter more.

Key Factors Behind Zalando’s Success

- Solved real operational pain points (returns, cross-border logistics)

- Built trust before monetization

- Balanced consumer experience with brand economics

- Used data to improve decisions, not just reporting

- Designed the platform for Europe’s complexity, not global uniformity

Replicable Principles for Startups

1. Start with Trust, Then Scale

- Easy refunds, transparent policies, reliable delivery

- Trust accelerates repeat usage more than marketing spend

2. Monetize the Supply Side

- Let consumers experience value without friction

- Charge sellers for access, services, and performance

3. Reduce Friction for Partners

- Offer logistics, tech, and analytics as growth enablers

- Make your platform cheaper than doing it alone

4. Build Infrastructure, Not Just an App

- Platforms win when they become operational backbones

- Infrastructure creates switching costs and long-term revenue

Common Mistakes to Avoid

- Expanding geography before unit economics stabilize

- Owning inventory without operational maturity

- Competing with sellers through aggressive private labels

- Underestimating returns, support, and compliance costs

Adapting Zalando’s Model for Local or Niche Markets

- Start category-focused (fashion, groceries, mobility, services)

- Use marketplace-first approach to limit capital risk

- Localize logistics and payments early

- Introduce services (fulfillment, ads) once liquidity is achieved

Ready to implement Zalando’s proven business model for your market? Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps. Get your free business model consultation today.

Conclusion :

Zalando’s business model shows that sustainable scale is not built by chasing transactions—it’s built by owning the system that makes transactions easy, trusted, and repeatable. By combining marketplace dynamics, logistics infrastructure, and brand-centric monetization, Zalando transformed fashion e-commerce from a product business into a platform economy.

The bigger lesson for 2025 and beyond is clear:

Platforms that win will not be the loudest or the cheapest—but the ones that remove friction for everyone in the ecosystem while quietly embedding themselves into daily operations.

As digital markets mature, execution depth will matter more than novelty. Zalando proves that when strategy, operations, and incentives align, scale becomes defensible—and growth becomes durable.

FAQs :

What type of business model does Zalando use?

Zalando uses a hybrid business model combining first-party retail, a third-party marketplace, and platform-based services such as logistics, marketing tools, and brand analytics.

How does Zalando’s business model create value?

Zalando creates value by simplifying fashion commerce across Europe. Customers get convenience and trust, while brands gain cross-border reach, logistics support, and data-driven growth tools without building local infrastructure.

What are Zalando’s key success factors?

Key success factors include strong logistics and returns management, deep localization across European markets, brand-friendly marketplace policies, and data-driven personalization.

How scalable is Zalando’s business model?

The model is highly scalable. Marketplace expansion and platform services allow Zalando to grow assortment and revenue without proportional increases in inventory or operational risk.

What are the biggest challenges in Zalando’s model?

Major challenges include thin fashion margins, high return rates, operational complexity, and regulatory fragmentation across Europe.

How can entrepreneurs adapt Zalando’s model to their region?

Entrepreneurs can adapt it by focusing on one category or region first, launching a marketplace-led platform, partnering for logistics, and monetizing the supply side through services and performance tools.

What resources and timeframe are needed to launch a similar platform?

A basic version can launch in 6–9 months with a marketplace MVP, logistics partnerships, and trust policies. Full ecosystem build-out , sustained investment.

What are alternatives to Zalando’s model?

Alternatives include inventory-light marketplaces, D2C brand platforms, subscription-based commerce models, or social-commerce-driven ecosystems.

How has Zalando’s business model evolved over time?

Zalando evolved from a retail-first e-commerce store into a multi-sided fashion platform, adding marketplace capabilities, logistics services, and brand-facing monetization layers as scale increased

Related Article :

- What is Myntra App and How Does It Work?

- Revenue Model of Myntra: How India’s Fashion Leader Monetizes Style

- What is eBay App and How Does It Work?

- Best Shopee Clone Script 2025 – Build Your Multi-Vendor Marketplace Fast

- Best Lazada Clone Scripts 2025: Build a Scalable E-Commerce Empire with Miracuves