From a single UK-based startup to a global payments powerhouse processing billions yearly, Checkout.com has become one of the most trusted infrastructures for fintech, ecommerce, and high-volume online payments. In 2025, its valuation, API-first architecture, and ability to scale across borders inspired thousands of founders to explore building their own Checkout.com-style platform.

For entrepreneurs, a Checkout.com clone Script isn’t just an app. It’s an entry into a massive market. Digital payments are projected to exceed $14.79 trillion in transaction value by 2027 (Statista), and demand for region-specific payment platforms is rising fast — especially in MENA, Europe, Southeast Asia, and Latin America. A scalable clone script helps founders tap into this wave without spending years on ground-up development.

A Checkout.com clone matters in 2025 because:

• The global demand for API-first payment solutions is increasing.

• More businesses want secure card processing, KYC/AML compliance, and instant payouts.

• Cross-border payments and localized gateways are becoming mandatory for global expansion.

With Miracuves Clone Solutions, entrepreneurs can validate their model, launch faster, and scale confidently — without the technical uncertainty of building everything from scratch.

What Makes a Great Checkout.com Clone Script?

A great Checkout.com clone in 2025 is not just about processing payments; it’s about delivering performance, trust, and global scalability. Entrepreneurs launching a payment gateway today need more than a UI — they need a backbone that supports multi-currency transactions, fraud prevention, and cross-border compliance without breaking under real traffic. The benchmark is simple: if your platform cannot handle high-volume requests with near-zero downtime, it’s not market-ready. A Checkout.com-style system should maintain average API response times under 300ms and 99.9% uptime backed by load balancing, containerized deployment, and real-time monitoring.

What defines a powerful clone in 2025 is the combination of speed, security, modular architecture, and monetization-ready workflows. With AI automation for fraud detection, blockchain-based transparency for settlement logs, and third-party integrations for payouts, founders can operate confidently and onboard merchants faster. A well-developed clone ensures flexibility for niche adaptations like regional gateways, subscription billing tools, BNPL integration, and enterprise reconciliation dashboards — features that separate hobby projects from real businesses.

Key Elements That Make a Great Checkout.com Clone

• High-velocity transaction engine with sub-300ms responses

• 99.9% uptime with container orchestration and distributed hosting

• PCI-DSS compliant security layers + tokenization-based card handling

• AI-based fraud and dispute analysis

• Blockchain-backed settlement record logging for transparency

• Cross-platform SDKs and RESTful APIs for mobile, SaaS, and ecommerce

• Multi-currency + regional payment gateway integrations

• Real-time reporting dashboards for merchants, partners, and admins

Modern Checkout.com Clone Differentiators

| Component | Standard Clones | Modern 2025 Checkout.com Style Clone |

|---|---|---|

| API Architecture | Basic endpoints | Modular API-first with REST + Webhooks |

| Security | Basic SSL | PCI-DSS + 2FA + tokenization + anti-fraud AI |

| Scalability | Monolithic | Microservices + containerized orchestration |

| Compliance | Limited | KYC/AML, audit logs, dispute automation |

| Global Reach | Single region | Multi-currency + cross-border settlement |

| Performance | 500–800ms speed | Under 300ms, 99.9% uptime, CDN caching |

Essential Features Every Checkout.com Clone Must Have

A Checkout.com clone succeeds when every user segment gets what they need with minimal friction — from first login to settlement. Founders must think in layers: user experience, admin control, and merchant operations. In 2025, platforms that feel slow, confusing, or lack automation lose merchant trust quickly. Modern clones solve this by combining fast onboarding, AI-driven risk checks, clear reporting, and instant payout mechanisms. The user journey should feel engineered for speed — no delays, no confusion, no broken flows.

User Side (Businesses / Merchants)

• Fast merchant onboarding with KYC verification workflow

• Dashboard for payments, subscriptions, refunds, disputes, and settlements

• Real-time transaction feed, dispute logs, and payout schedule visibility

• Multi-currency settlement wallets for global transactions

• Integrations for ecommerce, marketplaces, SaaS, and PoS hardware

Admin Panel (System Owner)

• Role-based access control and permissions

• AI-based risk scoring and flagged transaction alerts

• Analytics dashboard covering revenue, MDR fees, volume spikes, and performance

• API key management, rate-limit controls, and global routing rules

• Chargeback center with audit logs and dispute automation

Service Provider / Partner Layer

• Merchant application review and approval system

• API client dashboard with sandbox + production keys

• Earnings, fee structure, and settlement management

• Webhooks, callback URLs, and custom integration docs

Advanced 2025 Feature Enhancements

• AI-powered transaction monitoring + fraud-risk scoring

• AR-based identity verification during onboarding

• Blockchain settlement registry for audit-proof transparency

• Cross-border routing with region-based fee mapping

• Embedded finance tools for BNPL, wallets, and recurring billing

Technical Architecture Requirements

• Microservices infrastructure with auto-scaling clusters

• Load balancers + CDN caching for global latency reduction

• DB sharding for high-volume read/write efficiency

• End-to-end encryption, tokenization, PCI-DSS compliance

• Third-party API gateways for currency conversion and payouts

Feature Plan Comparison

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| Merchant Dashboard | ✔ | ✔ | ✔ Advanced |

| Global Currencies | Limited | Multi-region | Full global support |

| AI Fraud Engine | Optional | ✔ | ✔ Enhanced |

| Blockchain Settlement | No | Optional | ✔ |

| API Access | Basic | Advanced SDKs | Full-stack + Sandbox/Prod |

| Delivery Timeline | 3–6 days | 7–14 days | 30–90 days (scope based) |

Miracuves builds clones with this exact structure, enabling founders to launch confidently while still having room for deep customization as they scale.

Cost Factors & Pricing Breakdown

Checkout.com-Like Enterprise Payment Gateway Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Payment Gateway MVP | Merchant onboarding, card payment processing, transaction logs, basic security controls, and admin panel. | $75,000 |

| 2. Mid-Level Payment Processing Platform | Web dashboards, multi-currency support, smart routing, refunds, webhooks, notifications, and analytics dashboards. | $190,000 |

| 3. Advanced Checkout.com-Level Platform | High-availability payment APIs, global acquiring logic, smart retries, subscription billing, fraud prevention, compliance automation, and enterprise scalability. | $360,000+ |

These figures represent the typical global investment required to build an enterprise-grade payment gateway similar to Checkout.com, designed for high-volume merchants and international payments.

Miracuves Pricing for a Checkout.com-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete enterprise payments foundation with merchant onboarding, secure payment APIs, transaction orchestration, webhook systems, refund handling, risk-ready architecture, and a powerful admin backend — built for scalability and global payment operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Checkout.com-style payment platform with complete ownership.

Launch Your Checkout.com-Style Payment Gateway — Contact Us Today

Delivery Timeline for a Checkout.com-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Number of payment methods & regions

- Smart routing & retry logic

- Compliance & security requirements

- API & webhook complexity

- Branding & UI/UX customization

- Reporting and admin controls

Tech Stack

Built using a JS-based architecture, ideal for enterprise payment gateways requiring real-time processing, scalable microservices, global availability, and secure transaction handling.

Customization & White-Label Option

Building a Checkout.com–style enterprise payment gateway isn’t just about processing online transactions — it’s about delivering a high-performance financial infrastructure that supports global merchants, multi-currency payments, fraud control, settlements, and developer-friendly APIs. A platform inspired by Checkout.com must prioritize reliability, compliance, scalability, and integration flexibility while enabling businesses to accept payments across multiple channels and regions.

Miracuves delivers a fully white-label Checkout.com–style solution that allows deep customization across payment flows, API layers, merchant onboarding, analytics, and settlement logic. Whether you are targeting ecommerce platforms, SaaS products, marketplaces, or enterprise merchants, the platform can be adapted to your fintech and operational requirements.

Why Customization Matters

Enterprise-grade merchants expect more than a basic gateway:

- They need control over routing

- Performance consistency under high volume

- Flexible settlement cycles

- Fraud protection that adapts to their risk model

Customization ensures that your platform aligns with business scale, regulatory rules, and technical compatibility — not the other way around.

What You Can Customize

Complete UI/UX Personalization

Customize merchant dashboards, financial reports, onboarding flows, transaction monitoring screens, typography, color systems, and interface layouts for a fully white-labeled identity.

Payment & Processing Workflows

Configure payment authorization flows, tokenization, retries, refunds, partial refunds, dispute handling, chargeback responses, and routing logic for different merchant categories.

Multi-Currency & Global Settlements

Enable international currency support, FX conversion logic, regional settlement rules, cross-border payment handling, and localized checkout experiences.

Risk, Fraud & Compliance Controls

Set up risk scoring models, velocity rules, AML/KYC checks, device fingerprinting, threshold alerts, audit logs, and reporting tools for compliance teams.

API & Developer Ecosystem

Offer API keys, SDKs, webhook testing tools, sandbox environments, API console, plugin add-ons, and documentation portals for merchant developers.

Merchant & Account Management

Role-based access, multi-business accounts, team permissions, wallet balances, settlement scheduling, payout controls, and reconciliation reports.

Backend Integrations

Integrate with ecommerce platforms, marketplaces, ERP/CRM tools, accounting systems, fraud prevention services, and analytics providers.

Monetization & Business Models

Transaction-based fees, API access tiers, premium compliance packages, enterprise plans, marketplace commission logic, and FX margin pricing.

How Miracuves Handles Customization

Miracuves follows a structured customization workflow built for high-scale fintech platforms:

- Requirement Understanding

Scope analysis for payment flows, merchant profile, compliance region, and API depth. - Planning & Architecture

Modular design split into payment core, merchant stack, compliance layer, and integration hooks. - Design & Development

UI/UX upgrades, routing logic, account models, and settlement workflows implemented as per roadmap. - Testing & Quality Assurance

Load testing, fraud checks, security validation, regulatory compliance preparation, and payment accuracy verification. - Deployment

Full white-label rollout with domain, branding, merchant access, and API onboarding finalized.

Real Examples from the Miracuves Portfolio

Miracuves has powered 600+ fintech and commerce solutions, including:

- Payment gateways for ecommerce and SaaS platforms

- API-first payment solutions for regional enterprises

- Checkout flows for global merchant networks

- White-label fintech infrastructure with compliance-ready controls

These deployments show how customization transforms a Checkout.com–style platform into a scalable, enterprise-ready payment infrastructure system.

Launch Strategy & Market Entry

Launching a Checkout.com clone is not just about having the product ready — it’s about entering the market strategically. In 2025, fintech competition is high, but well-positioned platforms still win fast because the demand for secure, reliable, and region-friendly payments continues to grow. A successful launch is built around compliance clarity, merchant acquisition, and rapid onboarding cycles. If you can get these three right, you gain traction faster than most startups burning time on perfection instead of progress.

Pre-Launch Checklist

• Complete KYC/AML onboarding flow setup

• UAT testing across web, mobile, and API endpoints

• App store compliance (if mobile SDKs are used)

• Merchant sandbox environment ready for testing

• Marketing funnel + landing page with clear CTA

• Support system, documentation, and merchant onboarding guides

Regional Market Entry Strategy

Asia (Southeast & India): Localized wallets, UPI rails, high-velocity ecommerce support

MENA (UAE, Saudi): BNPL support, invoicing, cross-border settlements, FX mapping

Europe: GDPR compliance, PSD2 regulations, SEPA integrations

United States: Card network compliance, merchant risk management, subscription billing

Latin America: FX conversion APIs, installment payments, localized payouts

Each entry point focuses on a narrow wedge, not a wide target. Start where regulations and market demand align — then expand.

User Acquisition & Growth Framework

• Influencer onboarding + merchant referral programs

• Partner integrations with SaaS tools and ecommerce platforms

• Recurring revenue model: MDR % + SaaS subscription + add-on fees

• Retention funnels: payout speed, fraud accuracy, dispute automation

Top monetization models proven in 2025:

• MDR fees on volume (primary revenue)

• Monthly SaaS fees from merchants

• Premium settlement speed fees

• Transaction-based API billing

• White-label SDK licensing to partners

Miracuves supports end-to-end go-to-market rollout, including server setup, compliance configuration guidance, and the first 90-day growth blueprint so founders don’t guess their way through the early stages.

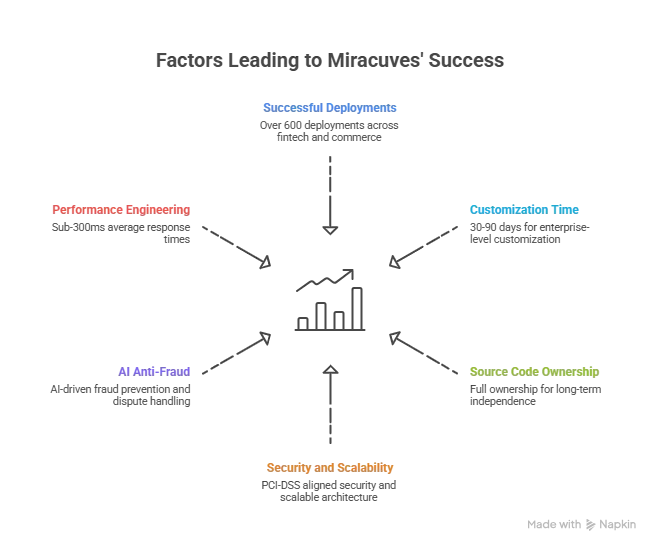

Why Choose Miracuves for Your Checkout.com Clone

Launching a payment gateway is a high-stakes move — compliance, speed, trust, and uptime decide whether merchants stay or churn. This is exactly where Miracuves stands apart. With years of specialization in fintech infrastructure and performance-grade clone solutions, Miracuves offers a launch path that protects founders from the expensive mistakes most startups face.

Why Miracuves Leads in Checkout.com Clone Development

- 600+ successful deployments delivered across fintech and global commerce

- 7–14 day delivery cycles for standard builds, faster than typical agency timelines 30–90 days for enterprise-level customization with full infrastructure planning

- Full source-code ownership for long-term independence

- PCI-DSS aligned security layers + scalable microservice architecture

- AI-driven anti-fraud stack and automated dispute handling modules

- In-house performance engineering to maintain sub-300ms average response times

This isn’t theory — it’s proven execution. Entrepreneurs trust Miracuves because they get more than code; they get an operating system for scaling a payment gateway. Startups that launched with Miracuves now handle real transaction volumes, support global merchant onboarding, and run recurring revenue models powered by MDR fees, SaaS pricing, and premium payout tiers.

Short Success Examples

An MENA-focused payment gateway went from prototype to paying merchants in 40 days using a customized Checkout.com-style build.

A Europe-based founder targeting SaaS billing scaled to 2,000+ invoices monthly after integrating subscription management into their clone.

A regional marketplace in Southeast Asia automated settlements and onboarding KYC, reducing manual workload by 70%.

If your mission is to launch a scalable payment platform, Miracuves gives you the infrastructure, development speed, and long-term control to make it real.

Final Thought

A Checkout.com clone is more than a software product — it’s a business model. In 2025, founders who understand the logic behind payment flows, compliance layers, and merchant onboarding will scale faster than competitors still figuring things out. With high-growth niches like regional gateways, cross-border finance, and SaaS billing platforms expanding, the window for opportunity is wide open — but only for those who execute with clarity and speed.

By leveraging Miracuves Clone Solutions, entrepreneurs skip the early engineering risks and jump directly to market validation. Instead of spending 12–18 months building from scratch, founders can launch in 30–90 days, onboard merchants, test transaction volume, and start generating real revenue. The smartest startups today aren’t just building — they’re building on top of proven architectures that scale.

If your vision is to own a payment infrastructure brand, not just an app, then choosing the right technology partner matters. Miracuves doesn’t just deliver code — it delivers capability, ownership, and confidence.

Ready to launch your Checkout.com clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Checkout.com clone?

Most projects launch within enterprise deployments with deep customization are delivered in 30–90 days depending on scope.

What’s included in the Miracuves Checkout.com clone package?

You receive a ready-to-launch payment gateway system with merchant onboarding, dashboards, reporting, subscription billing options, fraud analysis modules, and API access for integrations.

Can I get full source-code ownership?

Yes. Miracuves provides full source-code ownership so you can scale, customize, and expand independently without vendor lock-in.

How does Miracuves ensure scalability for high-volume payments?

The architecture is microservices-based with load balancers, CDN routing, server clustering, and DB sharding to support high-velocity transactions under 300ms.

Does Miracuves assist with app store approvals or SDK deployments?

Yes. If your clone includes mobile SDKs, Miracuves guides app store submission, compliance readiness, and technical adjustments for acceptance.

Is post-launch maintenance included?

Miracuves provides complimentary post-launch support (initial period) and also offers extended maintenance plans depending on your growth needs.

Can Miracuves integrate custom payment gateways or region-specific solutions?

Yes. Regional gateways, UPI, SEPA, ACH, bank rails, payout APIs, and FX conversion systems can be integrated based on your market.

What’s the upgrade or update policy?

New features, module upgrades, and compliance updates can be requested anytime. The roadmap depends on your business model and region.

How does white-labeling work?

Miracuves replaces branding assets, domains, UI elements, and dashboard visuals so the platform looks like a proprietary product built for your company.

What kind of ongoing support can I expect after launch?

Support includes bug fixes, module refinement, scaling guidance, compliance adjustments, and technical consultation as you onboard real merchants.

Related Articles

- Best Square Clone Scripts 2025: Build a Scalable POS & Payment Ecosystem Faster

- Best Binance Clone Scripts in 2025: Features & Pricing Compared

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Revolut Clone Scripts in 2025: Features & Pricing Compared

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform