About two years ago, a friend of mine, frustrated by hefty transaction fees on centralized exchanges, decided to try a peer-to-peer (P2P) Bitcoin app. A few clicks, one ID verification, and a chat later — voilà, he bought Bitcoin directly from another user. No middlemen. No hidden charges. Just freedom. And that’s when it hit me — P2P trading is the “Uber moment” for crypto.

For creators, crypto-savvy startups, and founders who love a challenge, building a P2P Bitcoin trading app is the next big thing. The growing dissatisfaction with traditional exchanges, rising interest in self-custody, and the sweet promise of lower fees are giving P2P apps a golden window of opportunity.

But before you dive headfirst into code and coins, let’s walk through the must-haves, should-haves, and the major don’t-even-think-about-it moments of developing your own P2P Bitcoin trading app. And if you’re wondering who can bring this dream to life — spoiler alert: Miracuves has been helping visionaries like you ship successful app clones faster than you can say “block confirmation.”

What is a P2P Bitcoin Trading App, Really?

A P2P Bitcoin trading app is essentially Tinder for crypto traders — without the awkward small talk. It directly connects buyers and sellers of Bitcoin (or other cryptocurrencies), allowing them to trade without needing an intermediary like Binance or Coinbase.

Key Differences from Centralized Exchanges:

- No custody of funds: Traders hold their own crypto.

- Escrow system: A temporary smart contract or wallet holds the Bitcoin during transaction.

- Chat features: Users negotiate directly.

- KYC & dispute resolution: Optional but often included.

Read more : –What is Binance App and How Does It Work?

Market Insights: Why Now is the Perfect Time

- Global P2P crypto trading volume crossed $100 billion in 2024.

- Platforms like Paxful and LocalBitcoins have millions of monthly users.

- Regulatory pushes are nudging users toward decentralized and semi-decentralized platforms.

The demand for self-custodial, low-fee, and cross-border friendly platforms is on fire. From freelancers in Lagos to digital nomads in Bali — users want alternatives. Your app could be their new favorite tool.

Read more : –What is Paxful App and How Does It Work?

How to Build a P2P Bitcoin Trading App (Step-by-Step)

1. Define Your Use Case & Audience

Are you targeting:

- Advanced traders? You’ll need detailed analytics and order books.

- First-timers? Simplicity and UX are everything.

- Specific geographies? Support for local payment methods is key.

Example: Targeting India? Integrate UPI and local KYC solutions.

2. Core Features to Include

User Authentication & KYC

- Email, phone, biometric logins

- Optional KYC (e.g., passport, license uploads)

- Integration with third-party verifiers like Onfido

Multi-Mode Payment Integration

- Bank transfers

- PayPal, Revolut

- Mobile wallets (e.g., M-Pesa, Paytm)

Real-Time Crypto Wallets

- Generate unique BTC wallets for each user

- QR code support

- Blockchain confirmation monitoring

Escrow Smart Contracts

- Lock funds during a trade

- Release upon confirmation

- Protects both buyer and seller

Chat & Dispute Resolution

- In-app chat for negotiation

- Dispute triggers and admin panel

- Admin rules to resolve cases

Dynamic Price Engine

- Fetch prices from global markets (Binance API)

- Allow seller to set custom margins

Admin Dashboard

- User management

- Fee settings

- Trade tracking

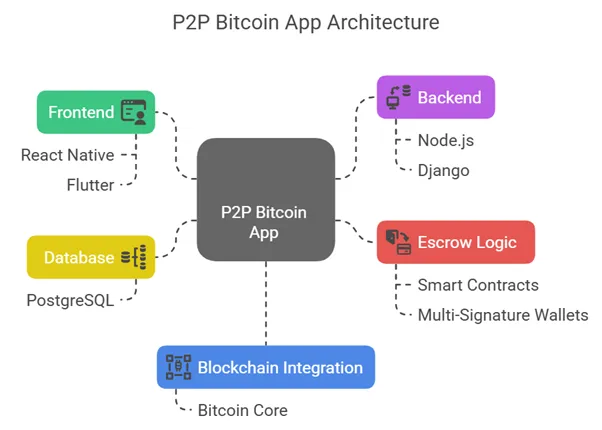

3. Tech Stack to Use

- Frontend: React Native or Flutter (cross-platform)

- Backend: Node.js or Django

- Database: PostgreSQL or MongoDB

- Blockchain: Bitcoin Core API or third-party SDKs

- Hosting: AWS, Heroku, or DigitalOcean

4. Security is Everything

- 2FA & Email OTP

- Encrypted Chat

- Cold Wallet Integration for admin funds

- Audit Logs & suspicious activity detection

- Regular smart contract audits

How Do These Apps Make Money?

It’s not all altruism — here’s how you can build a profitable business:

| Revenue Model | Description |

|---|---|

| Transaction Fees | Charge 0.5%–2% per trade |

| Ad Promotions | Let verified users promote their listings |

| Withdrawal Fees | Take a small cut on crypto or fiat withdrawals |

| Premium Users | Offer perks like priority dispute resolution |

Regulatory Compliance: Don’t Skip This Part

Yes, crypto is decentralized. No, that doesn’t mean “law-free”.

- AML (Anti-Money Laundering) protocols

- KYC (Know Your Customer) mandates

- Comply with local regulations (especially if you’re targeting US, EU, or India)

Launch Strategy: Going Beyond Just Building

Attracting Users

- Referral bonuses

- Influencer partnerships (think: crypto YouTubers)

- Regional promotions

Read More : Proven Tactics to Market Your P2P Bitcoin App Like a Pro

Retaining Users

- Loyalty programs

- Verified trader badges

- Fast dispute resolutions

Real World Inspirations

- LocalBitcoins: Simplicity first, with strong regional presence.

- Paxful: Over 300+ payment methods.

- Binance P2P: Added trust layer via platform reputation.

Conclusion

Building a P2P Bitcoin trading app isn’t just a technical endeavor — it’s a mission. A mission to empower users, break down financial borders, and open access to crypto globally. You’re not just building another exchange; you’re crafting trust, flexibility, and user freedom. With the right vision, features, and team, you can ride the next crypto wave and actually make an impact.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1.What is a P2P Bitcoin app?

It’s a platform where users buy and sell Bitcoin directly with each other, without a central authority holding their funds.

2.How long does it take to build?

Typically, 8–14 weeks depending on features, integrations, and whether you’re building from scratch or cloning a base.

3.Is escrow mandatory?

Absolutely. It ensures neither party can scam the other and is a key trust mechanism.

4.What are the legal risks?

You must comply with local KYC/AML laws. Consulting a crypto legal advisor is recommended.

5.Can I monetize from day one?

Yes! Transaction fees, promoted listings, and fiat conversion charges are early revenue drivers.

Related Articles :