If you’re a startup founder chasing the next big crypto disruption, chances are you’ve flirted with the idea of launching a P2P Bitcoin trading app—you know, the kind of platform that lets users exchange crypto like Pokémon cards at recess. The likes of LocalBitcoins, Paxful, and Binance P2P may have paved the way, but cloning their success? That’s an entirely different beast.

I’ve seen founders dive headfirst into development, skipping validation like it’s optional—spoiler: it’s not. They get sold a dream by freelance devs or hop on the wrong white-label train, only to realize the product is leakier than a faucet in a student dorm. Others go full throttle with marketing before the app can even verify a user’s phone number. Sound familiar?

Don’t sweat it, though. If you’re here, you’re already smarter than most. In this blog, we’ll explore the five fatal mistakes startups make when trying to clone a P2P Bitcoin trading platform—and how to dodge them like a pro. And hey, if you’re serious about doing it right, Miracuves has been quietly empowering top-tier app clones across industries.

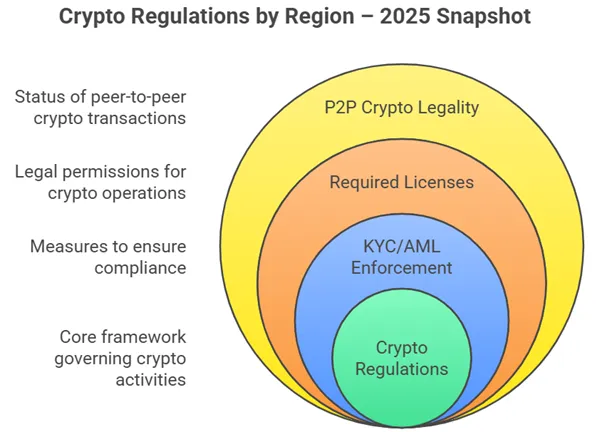

Mistake 1: Underestimating Regulatory Complexity

Ah, crypto and regulation—the awkward couple that just can’t figure things out.

The Problem:

Startups often assume that if the original P2P app got away with it, so can they. But laws change faster than Dogecoin memes. What worked in 2020 in Estonia might be totally illegal in 2025 in India.

Real-World Example:

Paxful had to pause operations in the U.S. in 2023 due to regulatory uncertainty. That’s after years of compliance efforts.

Why It Hurts:

- Account freezes

- App bans on app stores

- Frozen bank partnerships

Solution:

Bake in compliance from Day 1. Work with a legal advisor who understands crypto-KYC/AML regulations. Use modular tools that can adapt to jurisdictional shifts.

Mistake 2: Copy-Pasting Features Without Context

“Let’s just clone LocalBitcoins” sounds efficient—until it isn’t.

The Problem:

Features that work on one platform might tank on yours. For example, a multi-currency escrow system makes sense on Paxful due to its global user base. But if you’re targeting, say, Latin America, a mobile-first design with fiat on-ramps matters more.

Breakdown:

- Don’t replicate complexity for complexity’s sake.

- User behavior varies across geographies.

- Even UI/UX expectations change—scrolls, taps, verification steps.

Solution:

Do deep user persona research and localize your product experience. Add only what matters. Strip out what doesn’t.

Mistake 3: Building On A Fragile Tech Stack

This one’s a heartbreaker: you launch, users love it… then your app crashes harder than FTX.

The Problem:

Many startups rush into development using hastily stitched codebases, often built by underpaid freelancers or non-specialist dev shops. The backend isn’t optimized for real-time matching, the database slows down under load, and security? Let’s not even go there.

Why It’s Dangerous:

- Poor scalability during user growth spurts

- Security breaches — especially wallet and escrow-related

- Slow transaction speeds = rage quits

Solution:

Invest in scalable frameworks, robust encryption, and real-time APIs. Think Node.js, PostgreSQL, Redis, and multi-sig wallets. Or just partner with Miracuves to use our tried-and-tested clone architectures.

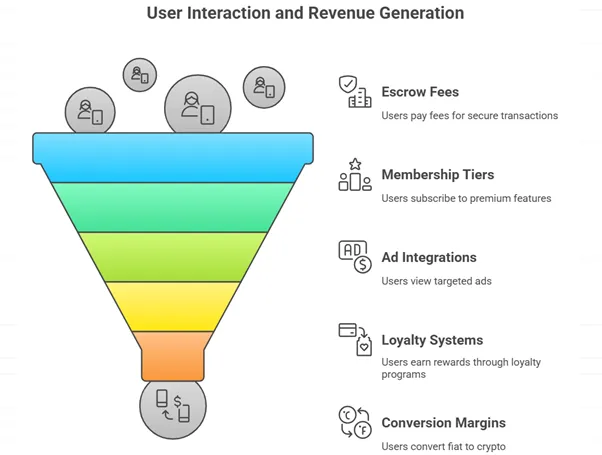

Mistake 4: Ignoring Monetization from the Start

Let’s talk turkey. You’re not building this app for fun. You’re building it to profit.

The Problem:

Many founders treat monetization as an afterthought. “We’ll add fees later,” they say. But changing financial models after user adoption can cause churn, backlash, and legal headaches.

Hidden Costs:

- Server costs, transaction validation, KYC verification

- Dispute resolution and support

- Compliance licenses

Smarter Monetization Models:

- Escrow fee per transaction

- VIP trading tiers for high-volume users

- Ad revenue from external offers

- Loyalty tokens for referral growth

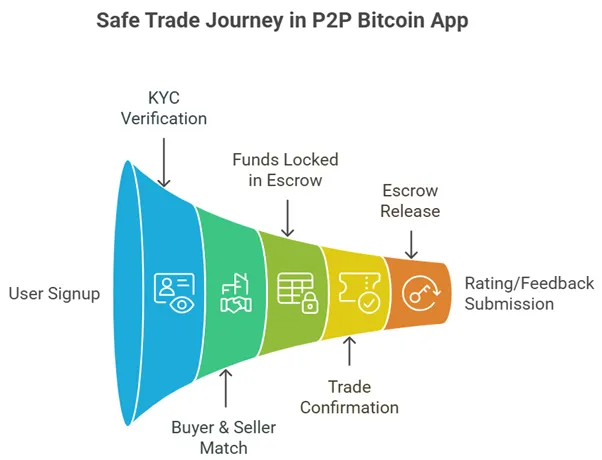

Mistake 5: Weak Trust & Safety Mechanisms

Crypto is already the Wild West. Your app shouldn’t feel like a saloon with no sheriff.

The Problem:

Startups often ignore dispute management, reputation scores, or even two-factor authentication. This causes platform abuse, scams, and angry users.

Quick Wins:

- Reputation system based on trades and feedback

- Automated KYC (Jumio, SumSub)

- Escrow timers and dispute mediators

- Biometric login (think fingerprint and face unlock)

Long-Term Value:

Better trust = higher trading volume = better retention.

Conclusion

You’ve got the vision. You’ve spotted the opportunity. But building a clone of a successful P2P Bitcoin trading platform isn’t just Ctrl+C and hope for the best. From legal tangles to tech bottlenecks, and UX gaps to monetization mishaps, these pitfalls can take your big idea down faster than a bear market crash.

By avoiding these five mistakes, you position yourself not just to launch, but to thrive. Look out for regional regulations. Focus on local needs. Choose the right tech. Bake in revenue early. Secure your users’ trust.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1. What tech stack is best for a scalable crypto P2P platform?

Opt for Node.js, PostgreSQL, Redis, React Native, and secure multi-sig wallets. Miracuves uses a battle-tested stack built for scale.

2. How long does it take to build a clone app?

With a strong clone framework, you can launch in 6–10 weeks. Customization may extend timelines.

3. Do I need a license to launch a P2P trading app?

Yes. Regulatory requirements vary by country. A legal consultant or regulatory tech partner is a must.

4. Can I monetize from day one?

Absolutely. Add escrow fees, VIP tiers, ads, and referral incentives right from launch.

5. How do I ensure safety from scams?

Use escrow protection, enforce KYC, and implement rating systems and dispute resolution features.

Related Articles :