From a single social trading idea to a platform used by 30+ million registered users worldwide, eToro changed how people invest by proving one thing: people trust people more than charts alone.The rise of copy trading and community-driven investing has transformed fintech from a solo activity into a shared experience.In 2026,this model is no longer optional for new trading startups,it is the baseline expectation.

For entrepreneurs,the eToro business model matters because it combines trading,influencer economics,and platform network effects into one scalable system.According to recent fintech market reports,social trading and copy trading platforms are projected to grow at over 18% CAGR through 2028,driven by Gen Z and first-time investors who want guidance,not complexity.This shift creates a massive opportunity for founders who understand the mechanics behind eToro and can adapt them to regional,niche,or asset-specific markets.

Building an eToro-style platform from scratch,however,is capital-intensive,slow,and risky.That is why modern founders are turning to eToro Clone Development using production-ready architectures instead of experimental builds.With Miracuves Clone Solutions,entrepreneurs can launch a compliant,scalable social trading platform faster,retain full source-code ownership,and focus on growth instead of infrastructure stress.

What Makes a Great eToro Clone in 2026

A great eToro clone is not just a trading interface with a copy button.It is a high-trust financial product that performs flawlessly under real money pressure.In 2026,users expect instant execution,clear visibility into trader performance,and zero friction across devices.If the platform hesitates,loads slowly,or hides data,trust collapses and churn accelerates.

From a business perspective,the best eToro Clone Development focuses on three pillars: performance at scale,transparent social mechanics,and monetization flexibility.Founders who succeed treat the clone as a living ecosystem where traders,followers,and the platform all win together.

On the technology side,modern eToro clones are built to handle high-frequency market updates,real-time copy execution,and concurrent user activity without lag.Industry benchmarks show that competitive platforms maintain average response times under 300ms,trade execution latency below 200ms,and 99.9% uptime,even during market volatility.These are not luxury metrics,they are survival requirements.

Equally important is the social layer.A great clone makes trader performance easy to understand,compare,and trust.Leaderboards,verified histories,risk scores,and transparent fee structures turn experienced traders into micro-brands while helping beginners invest with confidence.This is where many generic scripts fail and where Best eToro Clone Script 2026 solutions differentiate.

Key characteristics of a high-quality eToro clone

• High-performance trading engine with real-time market sync

• Scalable copy trading logic that mirrors positions instantly

• Intuitive UI/UX designed for both beginners and pro traders

• Built-in monetization through spreads,copy fees,and subscriptions

• Enterprise-grade security with encrypted transactions and audit trails

• Modular architecture for adding new assets or regions without rebuilds

Must-Have Technologies in 2026

Modern eToro clones go beyond basic trading dashboards.They integrate advanced systems that improve trust,automation,and growth potential.

AI-driven intelligence enables trader ranking,risk profiling,and personalized portfolio suggestions based on user behavior.

Blockchain-based transparency is used for trade verification,history immutability,and audit readiness,especially in regulated regions.

Cross-platform integration ensures seamless experiences across web,iOS,and Android with synchronized data and notifications.

Differentiation Comparison: Modern eToro Clones

| Capability Area | Standard Clone | Advanced Clone | Miracuves eToro Clone |

|---|---|---|---|

| Trade Execution Speed | Moderate | Fast | Ultra-low latency |

| Copy Trading Accuracy | Basic mirroring | Rule-based logic | AI-optimized execution |

| Scalability | Limited users | Regional scale | Global scale ready |

| Security & Compliance | Basic encryption | Compliance add-ons | Fintech-grade security |

| Customization Depth | Fixed workflows | Partial | Fully modular |

| Monetization Options | Limited fees | Multiple streams | Optimized revenue stack |

With Miracuves Clone Solutions,these capabilities are not bolt-ons.They are engineered into the core architecture,allowing founders to launch faster while meeting the expectations of serious investors and regulators alike.

Essential Features Every eToro Clone Must Have

Successful social trading platforms are built in layers,not features stitched together.A strong eToro clone feels simple to the user,but underneath it runs a deeply structured system that balances usability,control,and automation.In 2026,the difference between platforms that scale and platforms that stall comes down to how well these layers work together under real market conditions.

At its core,an eToro-style platform must support three distinct stakeholders while keeping their experiences tightly connected:investors,platform operators,and master traders.This balance is where most clones fail and where professional eToro Clone Development becomes critical.

User Side: Experience,Trust,and Retention

For end users,especially first-time investors,the platform must reduce fear and decision fatigue.A great user layer explains why something is happening,not just what is happening.

Users expect:

• Clean onboarding with guided portfolio setup and risk profiling

• Real-time copy trading with clear position-level visibility

• Transparent trader statistics including drawdowns,win rates,and history

• Smart alerts for copied trades,market volatility,and portfolio changes

• Retention tools such as performance summaries,education feeds,and social engagement

In 2026,leading platforms also use AI-based personalization to recommend traders,adjust risk exposure,and surface insights based on user behavior rather than generic rankings.

Admin Panel: Control,Visibility,and Automation

The admin panel is the business brain of the platform.It determines how well the company can scale,stay compliant,and react to market or regulatory changes.

A production-grade admin layer includes:

• Complete user and trader management with verification workflows

• Real-time monitoring of trades,copy relationships,and volumes

• Automated fee calculation for spreads,subscriptions,and copy commissions

• Risk and compliance dashboards with audit-ready reporting

• AI-driven anomaly detection for suspicious trading behavior

Miracuves builds admin systems that prioritize decision visibility,so founders are never blind to what is happening inside their platform,even during peak trading hours.

Trader Side: Earnings,Reputation,and Growth

Top traders are not just users,they are revenue drivers.A strong eToro clone treats them like creators,not anonymous accounts.

Essential trader-side features include:

• Live performance dashboards with follower growth metrics

• Earnings breakdowns from copy fees and profit-sharing models

• Risk controls to protect followers and maintain platform trust

• AI recommendations to improve strategy consistency

• Reputation systems with verification badges and historical proof

This structure turns skilled traders into long-term partners rather than short-term participants.

Advanced 2026 Features That Separate Leaders from Clones

Modern Best eToro Clone Scripts 2026 integrate advanced technologies that improve scalability and trust.

• AI-powered risk scoring and trader ranking engines

• AR-based onboarding to explain copy trading visually to beginners

• Blockchain verification for immutable trade records

• Multi-asset expansion support for crypto,stocks,ETFs,forex,and commodities

• Smart API layers for liquidity providers,market data,and KYC services

Technical Architecture Requirements

Behind the interface,the platform must be engineered to survive scale.

Key requirements include:

• Microservices-based architecture for independent scaling

• Load balancing to handle high-concurrency trade execution

• Secure key management and encrypted transaction layers

• Third-party integrations for market feeds,payments,KYC,and compliance

• Infrastructure designed for 99.9% uptime and sub-300ms response times

Feature Tier Comparison

| Feature Layer | Basic | Professional | Enterprise |

|---|---|---|---|

| Copy Trading Engine | Core mirroring | Rule-based controls | AI-optimized execution |

| Asset Support | Limited | Multi-asset | Global multi-market |

| Admin Automation | Manual | Semi-automated | Fully automated |

| Security & Compliance | Standard | Advanced | Enterprise-grade |

| Customization | Minimal | Moderate | Fully modular |

Miracuves implements these layers as a single cohesive system,not isolated modules.This ensures performance stability,regulatory readiness,and long-term flexibility as the platform evolves.

Read More : What is eToro App and How Does It Work?

Cost Factors & Pricing Breakdown

eToro-Like Social Trading & Investment Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Trading MVP | User onboarding, KYC basics, portfolio dashboard, stock & crypto buy/sell flows, order history, and a simple admin panel. | $85,000 |

| 2. Mid-Level Social Trading Platform | Mobile-first UI, real-time market data, copy-trading logic, watchlists, notifications, and analytics dashboards. | $190,000 |

| 3. Advanced eToro-Level Platform | Multi-asset trading (stocks, ETFs, crypto, CFDs), social feeds, copy-portfolio strategies, risk controls, compliance automation, and enterprise-grade scalability. | $360,000+ |

These figures represent the typical global investment required to build a social-first trading platform similar to eToro, combining real-time execution with community-driven investing features.

Miracuves Pricing for an eToro-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete social trading foundation with user onboarding, portfolio management, real-time market data integration, copy-trading architecture, order execution workflows, compliance-ready controls, and a centralized admin dashboard — built for scalable fintech operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded eToro-style trading platform under your own ownership.

Launch Your eToro-Style Social Trading Platform — Contact Us Today

Delivery Timeline for an eToro-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Supported asset classes and regions

- Copy-trading and social feed complexity

- Market-data and brokerage integrations

- Compliance, KYC, and regulatory requirements

- Risk-management and reporting features

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for social trading platforms that require real-time data streaming, secure transaction handling, scalable APIs, low-latency execution, and enterprise-level reliability.

Customization & White-Label Option

Building an eToro-style social trading and investing platform isn’t just about enabling trades — it’s about creating a community-driven financial ecosystem where users can trade, learn, follow top investors, and copy strategies in real time. A platform inspired by eToro must combine trading infrastructure, social engagement, transparency, and compliance while remaining intuitive for both beginners and experienced traders.

Miracuves delivers a fully white-label eToro-style solution that can be customized for social trading apps, multi-asset investment platforms, crypto trading communities, or copy-trading–focused fintech products. The architecture is designed so you maintain full ownership of branding, features, and growth direction.

Why Customization Matters

Social trading platforms are fundamentally different from traditional trading apps because they mix:

- Financial transactions with social interaction

- Real-time market data with community signals

- Individual trading with strategy replication

- Education with execution

Customization ensures your platform reflects your asset focus, your regulatory scope, and your community engagement model, instead of copying a generic trading experience.

What You Can Customize

Complete UI/UX Personalization

Customize trading dashboards, social feeds, profiles, charts, copy-trading views, typography, color systems, themes, and onboarding flows to match your brand identity.

Trading & Order Management

Configure market, limit, stop-loss, take-profit, and conditional orders, execution logic, trade confirmations, settlement rules, and transaction histories.

Multi-Asset Support

Enable stocks, ETFs, crypto assets, commodities, forex, or region-specific instruments based on your licensing and business strategy.

Social & Copy Trading Features

User profiles, public portfolios, performance stats, follower systems, copy-trading controls, risk scores, leaderboards, and interaction tools.

Portfolio & Performance Analytics

Portfolio tracking, gains/loss summaries, drawdown metrics, asset allocation views, historical performance charts, and comparative analytics.

User Onboarding & Compliance

Digital KYC/KYB flows, risk disclosures, suitability checks, copy-trading consent, account limits, and regulatory acknowledgment tracking.

Notifications & Engagement

Real-time price alerts, copy-trade execution notifications, social activity updates, market news, and educational prompts.

Security & Risk Controls

Transaction monitoring, copy-trade limits, stop-loss protections, fraud detection rules, audit logs, and role-based access controls.

Backend & Integrations

Integrate market data providers, broker APIs, compliance services, analytics platforms, CRM tools, and customer support systems.

Monetization & Business Models

Spreads, subscription tiers, premium analytics, copy-trading fees, asset-based commissions, and value-added financial tools.

How Miracuves Handles Customization

- Requirement Understanding

We analyze your target users, asset classes, regulatory boundaries, and social engagement goals. - Architecture & Planning

Modular design covering onboarding, trading engine, social layer, copy-trading logic, compliance, and analytics. - Design & Development

UI/UX branding, trading workflows, social features, and data integrations implemented as per your roadmap. - Testing & Quality Assurance

Trade accuracy checks, copy-trading simulations, security testing, and regulatory readiness validation. - Deployment

Full white-label rollout with branded apps, dashboards, and operational configuration.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech and marketplace platforms, including:

- Social trading apps with copy-investing features

- Multi-asset trading platforms with community layers

- Crypto trading communities with transparency tools

- White-label wealth-tech solutions adapted to regional regulations

These deployments demonstrate how an eToro-style concept can be transformed into a scalable, compliant, and community-driven trading platform built entirely around your brand.

Launch Strategy & Market Entry for an eToro-Style Platform in 2026

A strong product does not guarantee a strong launch.In social trading,the early days decide everything because trust compounds fast,but distrust spreads faster.The goal is to enter the market with stability,clear positioning,and a growth loop that turns your first users into your first marketers.

Pre-Launch Checklist That Prevents Costly Mistakes

Before going live,you need operational readiness,not just app readiness.

Product readiness

• Stress testing under peak traffic and volatile market conditions

• Copy trading accuracy validation across multiple scenarios

• Latency checks with target benchmarks under 300ms average response time

• Full QA across web,iOS,and Android with synced portfolio states

Compliance and trust readiness

• KYC and AML workflows verified end-to-end

• Risk disclaimers,terms,and audit logs prepared

• Security hardening including encryption,key management,and access controls

Launch logistics

• App store listing setup,review guidelines alignment,and metadata prep

• Customer support workflows and escalation paths

• Monitoring dashboards for uptime,trade execution,and API failures

Regional Entry Strategies That Work in 2026

Different regions require different positioning because adoption behavior and regulation vary widely.

Asia

Mobile-first UX wins.Focus on simplified onboarding,education feeds,and micro-investment options.Local payment methods and multilingual support are essential.

MENA

Trust and community matter heavily.Local influencer traders and verified portfolios drive adoption.Strong compliance messaging is critical,especially around licensing and transparency.

Europe

Regulation and credibility dominate.Platform messaging must focus on security,disclosures,and risk controls.Audit-ready reporting is a differentiator,not a feature.

U.S.

Competition is intense,Niche specialization wins.Launch with a focused angle such as crypto copy trading,ETF community investing,or sector-based strategies.Build partnerships early with legal and compliance advisors.

User Acquisition Frameworks Proven for Social Trading

To grow an eToro-style product,you need loops,not campaigns.

Influencer trader onboarding

Recruit a small group of credible traders and support them with visibility tools,verification,and performance storytelling.This creates immediate platform trust.

Referral and copy loops

Let users share traders,strategies,and performance snapshots.The product itself becomes shareable content.

Retention funnels

Daily insights,performance summaries,goal tracking,and smart alerts keep users engaged even when they are not actively trading.

Monetization Models That Perform in 2026

A scalable eToro clone is designed to monetize ethically and repeatedly.

• Spread-based earnings on trades

• Subscription tiers for premium analytics and advanced tools

• Copy trading fees and trader profit-sharing models

• Education bundles and community access memberships

• Asset-based partnerships and affiliate financial products

The best strategy is combining at least two models early so revenue does not depend on a single behavior pattern.

How Miracuves Supports Your Launch End-to-End

Miracuves helps founders launch like operators,not just builders.This includes:

• Production deployment planning and server setup

• API readiness validation for market feeds,KYC,and payments

• Monitoring setup for uptime,latency,and trade execution integrity

• Go-to-market support aligned with your first 90-day growth roadmap

Your platform should not just go live,it should go live with a repeatable system for acquisition,trust-building,and scaling.

Why Choose Miracuves for Your eToro Clone

An eToro-style platform is not a “build and launch” product.It is a trust engine.People are not just clicking buttons,they are following strategies with real money.The difference between a platform that grows and a platform that struggles often comes down to one decision:who built the foundation.

Miracuves approaches eToro Clone Development like fintech engineering,not template customization.That means your platform is designed for performance,security,and scale from day one,so you can grow without rebuilding every time your user base doubles.

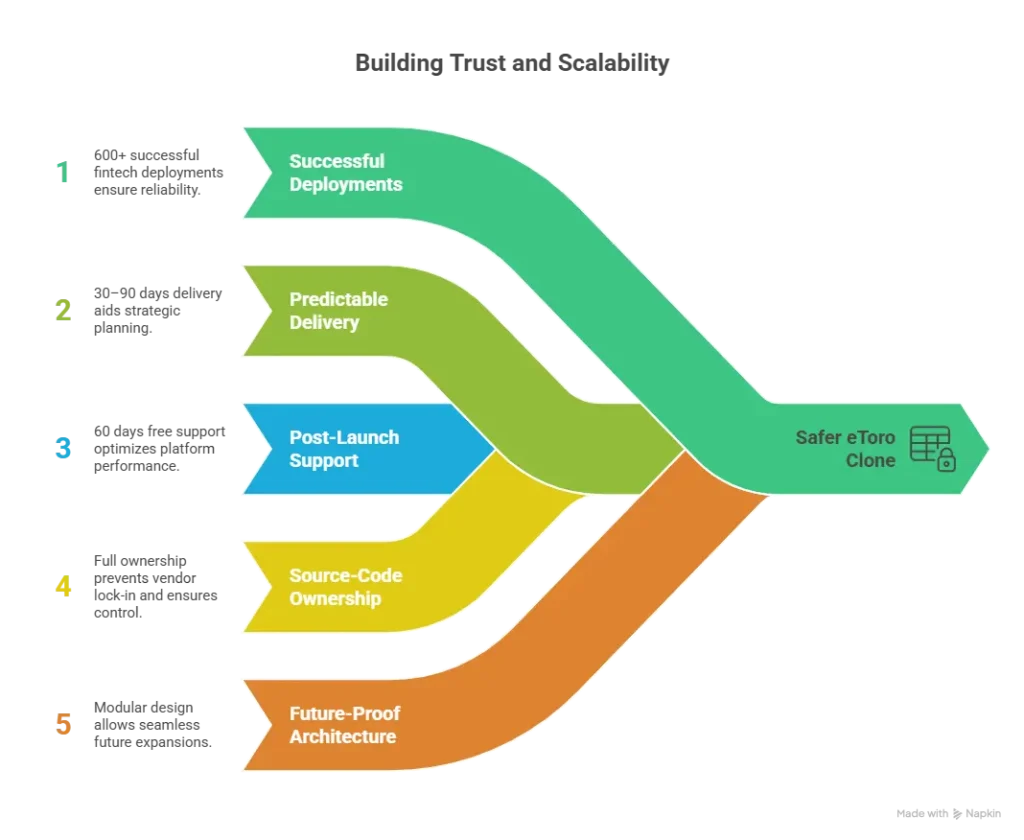

What Makes Miracuves the Safer Choice in 2026

600+ successful deployments

Miracuves has delivered large-scale fintech and digital platforms across banking,lending,payments,and investment ecosystems.This track record matters because social trading platforms face real-world edge cases that only experienced teams anticipate.

30–90 days delivery timeline

Your platform is delivered within a predictable 30–90 days timeline based on scope,integrations,and compliance depth.This helps founders plan partnerships,marketing,and launch strategy without delays.

60 days free post-launch support

Early growth always reveals improvements.Miracuves includes 60 days of free post-launch support to stabilize performance,optimize workflows,and resolve priority issues quickly.

Full source-code ownership

You are not locked into a SaaS model.You own the source code,so your platform remains your asset,not a rental.

Future-proof architecture

Miracuves builds modular systems so you can expand into new regions,add new assets,or integrate advanced compliance layers without rewriting the core.

Short Success Stories That Show the Impact

A regional fintech startup launched a social trading product focused on beginner-friendly crypto copy trading.By implementing risk scoring,verified trader profiles,and clean onboarding,the platform reduced early churn and increased follower-to-funded conversion within the first launch phase.

An investment community platform targeting a niche geography launched with multi-language UX and localized onboarding flows.The product gained traction through trader-led content loops and referral mechanics that turned top traders into growth partners.

A trading startup built a premium analytics layer on top of its copy trading ecosystem,unlocking subscription revenue early while still keeping free users engaged with education feeds and weekly performance summaries.

These outcomes come from one core advantage:Miracuves builds platforms that are ready for real usage,not just demos.

Final Thought

The real lesson behind eToro’s success is not technology alone,it is alignment.People want guidance,visibility,and confidence when dealing with money.Platforms that understand this shift stop building trading apps and start building decision ecosystems.

In 2026,entrepreneurs who study the eToro model and adapt it with focus,clarity,and regional relevance have a real advantage.By combining social proof,transparent performance data,and smart monetization,an eToro-style platform can scale faster than traditional investment products.

With Miracuves Clone Solutions,founders do not start from uncertainty.They start from a production-ready core that has already survived real-world conditions.This allows you to spend less time fixing systems and more time refining your market position,building trust,and expanding into new asset classes or regions.

If your goal is to launch faster,scale smarter,and own your fintech future,understanding the eToro business logic and leveraging Miracuves’ engineering discipline is not just helpful,it is decisive.

Ready to launch your eToro clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my eToro clone?

Miracuves delivers eToro-style platforms within a structured 30–90 days timeline depending on customization,integrations,and compliance requirements.

What’s included in the Miracuves eToro clone package?

You receive a complete social trading system including copy trading logic,user and trader dashboards,admin controls,security layers,and scalable architecture.

Can I get full source-code access?

Yes.Full source-code ownership is provided,ensuring long-term independence and flexibility.

How does Miracuves ensure scalability?

The platform is built on modular,microservices-based architecture with load balancing and performance optimization for high-concurrency trading.

Does Miracuves assist with app store approval?

Yes.Miracuves supports app store preparation,technical compliance,and submission guidance to streamline approvals.

Is post-launch maintenance included?

Yes.Projects include 60 days of free post-launch support to stabilize performance and resolve critical issues.

Can Miracuves integrate custom payment gateways?

Yes.Custom payment gateways,regional payment methods,and financial APIs can be integrated based on your market needs.

What’s the upgrade and update policy?

The architecture supports ongoing upgrades without core rebuilds,allowing feature additions and regulatory updates smoothly.

How does white-labeling work?

White-labeling delivers a fully branded platform with your identity and workflows,with no third-party references visible.

What kind of ongoing support can I expect?

Beyond initial support,Miracuves offers long-term maintenance,feature expansion,and scaling assistance as your platform grows.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best SoFi Clone Scripts 2026: Build a Next-Gen Digital Banking & Lending Platform

- Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best N26 Clone Scripts 2026 for Digital Banking Startups

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Starling Bank Clone Scripts 2026 : Build a Digital Bank That Scales in the Real World