In 2025, last-mile delivery and logistics have become more than just operational necessities—they are now strategic differentiators for startups and established players alike. As consumer expectations for speed, transparency, and convenience skyrocket, entrepreneurs eyeing logistics startups must choose between two dominant paradigms: traditional logistics infrastructure (FedEx) or on-demand gig-economy-driven delivery (Uber).

Both FedEx and Uber have redefined their niches—FedEx as a logistics empire with decades of warehousing, fleet management, and global delivery, and Uber as a tech-first disruptor turning anyone with a car into a delivery partner. But what does this mean for startup founders looking to build the next delivery platform?

This blog breaks down and compares the FedEx business model vs Uber delivery business model—evaluating revenue streams, operational costs, partnerships, scalability, and growth strategies—to help you decide which model best suits your logistics startup in 2025.

What is FedEx?

FedEx (Federal Express) is a global logistics and courier delivery services company headquartered in the U.S. It was founded in 1971 and has become a pioneer in overnight delivery, package tracking, and integrated logistics services.

Core Services:

- Express delivery (overnight & same-day)

- Ground shipping

- Freight and heavy cargo logistics

- Warehousing and inventory fulfillment

- Cross-border and international shipping

- B2B & eCommerce supply chain services

Tagline: “The World on Time.”

Reputation: Reliable, B2B-focused, large-scale logistics provider with deep infrastructure.

What is Uber Delivery?

Uber Delivery refers to Uber’s delivery arm, including Uber Eats (food), Uber Direct (retail & pharmacy), and Uber Connect (courier services). Leveraging its vast ride-hailing driver network, Uber Delivery offers on-demand and same-day local deliveries across urban centers.

Core Services:

- Uber Eats: Food & grocery delivery

- Uber Direct: Local business delivery (retail, pharmacy, parcels)

- Uber Connect: Peer-to-peer delivery

- Third-party integrations for B2B local logistics

Tagline: “Move what matters.”

Reputation: Fast, flexible, urban-focused gig-delivery network with tech-first infrastructure.

FedEx Business Model Breakdown (2025)

Revenue Streams

- Shipping & Handling Fees: Charges for overnight, two-day, and ground shipping.

- Freight & Logistics Services: Large-scale cargo and freight solutions for B2B.

- eCommerce Partnerships: Fulfillment, warehousing, and last-mile solutions for online retailers.

- Customs & International Delivery: Premium charges for international express and customs support.

- Subscription Logistics Services: Retainers for enterprise logistics planning and support.

Cost Structure

- Aircraft maintenance & fuel

- Trucking fleet maintenance

- Global warehousing infrastructure

- Employee salaries (drivers, pilots, logistics personnel)

- Route optimization and logistics software

- Customer service and claims management

Key Partners

- eCommerce brands (Amazon, Shopify stores, Walmart)

- Airlines, airports, customs authorities

- ERP and SCM platforms

- Global 3PL partners

Growth Strategy

- Automation & Robotics in sorting centers

- Green logistics with electric fleets

- AI-based route optimization

- Expansion into SME-friendly solutions

- Investment in FedEx Dataworks for analytics-led logistics

Learn More: Must-Have FedEx Features for Delivery App Startups

Uber Delivery Business Model Breakdown (2025)

Revenue Streams

- Commission on Deliveries: Percentage from restaurants, stores, or senders.

- Service Fees: Per-order charges to consumers.

- Surge Pricing & Peak Hours Fees

- Subscription (Uber One): Monthly memberships offering free delivery.

- API Integrations for Merchants: SaaS delivery plug-ins for eCommerce platforms.

- Advertising within Uber Eats: Sponsored placements for brands.

Cost Structure

- Driver incentives and dynamic pricing

- App maintenance and development

- Customer support and safety compliance

- Marketing to both users and partners

- Real-time route tracking systems

- Insurance and liability coverages

Key Partners

- Restaurants, cloud kitchens, grocery chains

- Retailers and pharmacies

- Last-mile 3PL services

- POS systems and delivery aggregators

- Gig-economy couriers (drivers, cyclists, walkers)

Growth Strategy

- Hyperlocal delivery expansion

- Grocery & retail verticals beyond food

- Autonomous delivery pilots (robots, drones)

- Cross-platform integration with Uber Ride

- International expansion in Tier-2 cities

Learn More: Best Uber Delivery Clone Scripts in 2025: Features & Pricing

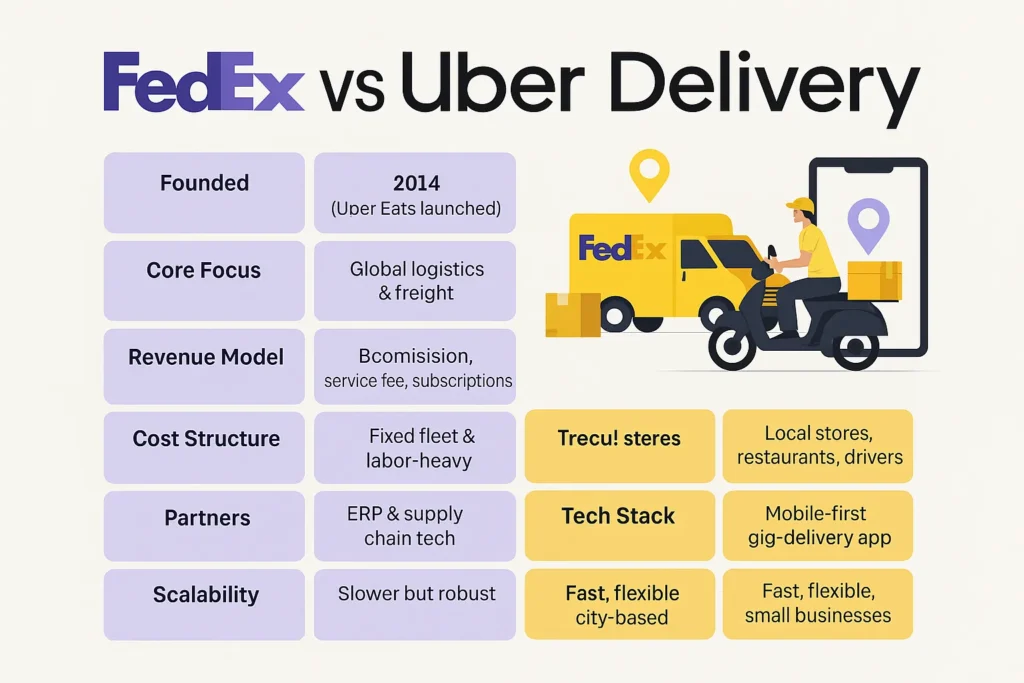

Comparison Table: FedEx vs Uber Delivery

| Feature | FedEx | Uber Delivery |

| Founded | 1971 | 2014 (Uber Eats launched) |

| Core Focus | Global logistics & freight | On-demand local delivery |

| Revenue Model | B2B shipping fees, freight, logistics | Commission, service fee, subscriptions |

| Cost Structure | Fixed fleet & labor-heavy | Variable, gig economy model |

| Partners | eCommerce giants, freight handlers | Local stores, restaurants, drivers |

| Tech Stack | ERP & supply chain tech | Mobile-first gig-delivery app |

| Scalability | Slower but robust | Fast, flexible, city-based |

| Customer Type | Businesses & enterprises | Consumers & small businesses |

Pros & Cons of FedEx’s Business Model

Pros

- High reliability for long-distance and bulk shipments

- Strong enterprise partnerships

- Deep infrastructure and logistics expertise

- Cross-border compliance and customs integration

Cons

- High capex and opex

- Limited agility in urban last-mile delivery

- Slower tech adaptability compared to new-age platforms

- Less appealing to individual users or SMBs

Pros & Cons of Uber Delivery’s Business Model

Pros

- Highly scalable and cost-flexible

- Easy merchant onboarding via API

- Real-time tracking and user-friendly UX

- Works in cities without warehouse dependency

Cons

- Reliability varies due to gig workforce

- Limited reach outside metro areas

- Heavily dependent on network liquidity (drivers & demand)

- Regulatory hurdles in some countries

Market Data: Growth, Revenue & Funding

FedEx (2025 Snapshot)

- Annual Revenue: ~$93B

- YoY Growth Rate: 6–8%

- Logistics Hubs: 650+ globally

- Employees: ~500,000

- Recent Expansion: Automation in Asia and EU, greener fleet investment

Uber Delivery (2025 Snapshot)

- Annual Delivery Revenue (Uber Eats, Connect, Direct): ~$14B

- YoY Growth Rate: 25–30%

- Global Cities Operated In: 10,000+

- Active Couriers: Over 6 million

- Recent Trends: M&A in grocery tech, autonomous delivery pilots

Which Model is Better for Startups in 2025?

- Choose FedEx-style if you’re building a logistics-heavy, infrastructure-focused B2B platform targeting large eCommerce or freight clients.

- Choose Uber-style if your vision is tech-first, urban-centric, and focused on on-demand, flexible local delivery using freelance or gig networks.

Choose FedEx-Style If…

- You’re serving enterprise clients with warehousing needs

- You aim to offer international or cross-border logistics

- Your platform focuses on high reliability and tracking

- You have long-term capital to build infrastructure

Launch Your Own FedEx Clone Development with Miracuves

Choose Uber-Style If…

- You want to build a food, grocery, or local delivery app

- Your audience is urban consumers or SMBs

- You prefer low-inventory, gig-based operations

- You plan rapid launch with lean capital

Launch Your Own Uber Clone Development with Miracuves

Conclusion

In the race to dominate logistics and delivery in 2025, FedEx and Uber offer two vastly different but equally viable blueprints. While FedEx focuses on scale, control, and global networks, Uber thrives on flexibility, speed, and localized gig power.

For startup founders, the decision depends on your target market, tech capabilities, operational budget, and delivery promise. At Miracuves, we help entrepreneurs launch scalable logistics and delivery platforms—whether you’re building an on-demand Uber-style network or a global FedEx-style logistics empire.

FAQs

1. Can a startup replicate FedEx’s model successfully?

Yes, but it requires significant upfront investment in infrastructure, warehousing, and compliance. Ideal for funded startups targeting B2B logistics.

2. Is Uber’s gig model profitable for new delivery startups?

It can be. With low fixed costs and quick scaling potential, Uber’s model suits startups focused on speed and urban deliveries.

3. What is the biggest difference in monetization?

FedEx earns through large-scale logistics contracts and shipping fees, while Uber thrives on micro-commissions and service fees.

4. Which model is more adaptable in developing countries?

Uber’s model—because of its mobile-first design, flexible workforce, and lower capital requirements.

5. Does Miracuves offer ready-made clone solutions?

es! Miracuves offers fully customizable FedEx clone and Uber clone scripts with complete delivery stack features, admin panels, and real-time tracking — both starting at just $2899 each.