From a small Bengaluru startup to one of India’s most trusted investment platforms, Groww scaled past 45M+ users by 2025—proving that simple, transparent investing can outperform even the biggest brokerage giants. For entrepreneurs in 2026, the Groww model represents one of the strongest opportunities in fintech: low CAC, high retention, and subscription-friendly revenue streams. But here’s the real insight — the investment-tech market crossed $150B globally in 2025, with retail trading growth at 28% YoY. This makes Groww-style platforms one of the most profitable startup categories today.

Understanding the Groww clone model is essential because founders now have a unique window to enter regulated markets, niche investment segments, and underserved geographies with a stable, secure, and scalable fintech product. And this is exactly where a Groww Clone Script becomes a high-leverage tool for rapid launch and predictable scaling — especially when powered by Miracuves Clone Solutions, the global leader in fintech development.

What Makes a Great Groww Clone?

A great Groww Clone in 2026 is not just a replica of the original app. It is a high-performance, regulation-ready investment platform engineered for speed, security, and long-term scalability. The investment-tech market has matured, and users now demand faster transactions, intuitive UI, real-time insights, and complete transparency. This means your Groww Clone must perform flawlessly even under high trading volumes and market volatility.

A modern clone should enable multi-asset investment capabilities — stocks, mutual funds, ETFs, SIPs, government securities, and digital gold — while maintaining strict compliance standards. Entrepreneurs launching an investment platform must focus on performance benchmarks such as an average response time under 300ms, 99.9 percent uptime, and secure API integrations with brokers, exchanges, and KYC providers.

In 2026, the best Groww-style platforms also integrate intelligent features like AI-based portfolio suggestions, blockchain-backed transaction logs, and cross-platform compatibility (Android, iOS, and Web). These additions significantly improve trust, retention, and monetization for founders entering competitive markets.

To summarize the attributes of an exceptional Groww Clone, the platform must be stable, scalable, and future-ready with support for millions of concurrent users.

Key Elements of a Great Groww Clone Script 2026

- High-speed architecture optimized for heavy trading activity

- Scalable cloud infrastructure capable of handling millions of users

- Secure KYC and AML workflows with encrypted data pipelines

- AI-driven investment insights and personalized recommendations

- Blockchain-enabled transaction transparency

- Seamless cross-platform performance for web and mobile

- Built-in monetization tools such as subscription plans and premium analytics

- Modern UI/UX with frictionless onboarding and intuitive dashboards

Comparison Table: Modern Groww Clones and Their Differentiators

| Feature Category | Standard Groww Clone | Advanced 2026 Groww Clone | Miracuves Groww Clone Script |

|---|---|---|---|

| Performance | 500–700ms response time | 300–400ms optimized | Under 300ms ultra-optimized |

| Scalability | Up to 100K users | Up to 1M users | Multi-million concurrent support |

| Security | Basic encryption | AES-256 + multi-layer security | Full-stack security + blockchain logging |

| Features | Stocks + MF | Stocks + MF + ETFs | Full investment suite + AI automation |

| Uptime | 98 percent | 99.5 percent | 99.9 percent SLA |

| Customization | Limited | Moderate | Full white-label and workflow restructuring |

| Compliance | Basic KYC | KYC + AML | Compliance-ready with API integrations |

| Monetization | Ads | Subscription | Multi-channel monetization engine |

Essential Features Every Groww Clone Must Have

A successful Groww Clone in 2026 is built on three pillars: user experience, administrative efficiency, and service-provider reliability. For an investment platform, these pillars translate into trust, speed, and actionable insights. Instead of simply replicating Groww, founders must understand how each layer of the product contributes to user retention, investment frequency, and long-term platform profitability.

Modern investors expect apps to feel seamless. They want fast onboarding, instant KYC approvals, smart insights, smooth fund transfers, and transparent tracking of all assets. Meanwhile, administrators need automated compliance systems, portfolio analytics, revenue dashboards, risk monitoring, and fraud detection. Service providers or trading partners require real-time trade execution, secure settlement flows, and AI-driven tools to improve investor outcomes.

This section breaks down each layer in a clear, founder-focused way, ensuring you understand what makes a Groww-style platform strong enough for real-world scaling.

User-Side Features

Users judge an investment platform in the first 30 seconds. The experience must be frictionless, reliable, and confidence-building.

- Instant onboarding with AI-based KYC verification

- Personalized investment recommendations using AI/ML models

- Real-time stock charts, mutual fund data, SIP calculators, and ETF insights

- Easy fund transfers, withdrawals, and auto-debit SIP setup

- Secure portfolio dashboard with risk scoring, asset allocation graphs, and tax insights

- Push notifications for market alerts, price triggers, and SIP reminders

- Advanced watchlists and custom alerts

- Dark mode and accessibility-friendly UI

Admin Panel Features

The admin panel is the nerve center of a Groww Clone. It ensures compliance, scalability, and platform health.

- Automated KYC and AML screening

- Real-time trade monitoring and compliance alerts

- Revenue dashboards showing subscription income, commissions, and AUM growth

- User behavior analytics with retention and cohort insights

- Fraud detection powered by AI anomaly detection systems

- Admin-level portfolio management and emergency controls

- API management for brokers, exchanges, and third-party services

- Automated reports for audits, taxation, and regulatory compliance

Trading Partner / Service Provider Features

To support seamless order execution, a Groww Clone must offer advanced partner features.

- Real-time trade execution with sub-second latency

- Order book visibility for partner brokers

- Secure settlement workflows

- Earnings dashboards for partners

- AI-driven trade success insights

- Multi-party approval flows for high-value transactions

Advanced 2026 Features

Fintech in 2026 is defined by intelligence, automation, and trust.

- AI-driven portfolio rebalance recommendations

- Blockchain-backed transaction verification

- AR-based onboarding for simplified navigation

- Multi-currency support for global markets

- Open banking integrations

- Predictive analytics for risk scoring

Technical Architecture Requirements

To survive real market conditions, a Groww Clone must be technically strong.

- Microservices architecture for modular scaling

- Auto-scaling cloud infrastructure

- CDN-backed performance for global markets

- End-to-end encryption for all sensitive data

- Integration with payment gateways, KYC APIs, and exchange engines

- Load handling capacity for market spikes and trading surges

- 99.9 percent uptime with multi-zone failover

Feature Comparison Table: Basic vs Professional vs Enterprise

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| Stocks & Mutual Funds | Yes | Yes | Yes |

| ETFs & Government Securities | No | Yes | Yes |

| AI Recommendations | No | Yes | Advanced |

| Blockchain Tracking | No | Optional | Yes |

| Global Market Support | No | Optional | Yes |

| Custom Workflows | Limited | Moderate | Fully Custom |

| Branding | White-label | Full branding | Multi-brand deployment |

| Admin Panel | Standard | Advanced | Enterprise-grade |

| Scalability | Up to 100K users | Up to 1M users | Multi-million concurrent users |

How Miracuves Implements These Features

Miracuves engineers each Groww Clone using optimized fintech modules. This enables:

- Faster delivery timelines of 30–90 days

- Future-proof modular architecture

- Secure, compliant data handling

- AI-ready infrastructure

- High scalability for global expansions

- Full source-code ownership to ensure long-term control

Cost Factors & Pricing Breakdown

Groww-Like Investment & Wealth Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Investment MVP | User onboarding, KYC basics, portfolio dashboard, mutual fund & equity investing flows, order history, and a simple admin panel. | $75,000 |

| 2. Mid-Level Digital Investment Platform | Mobile-first UI, real-time NAV & price feeds, SIP automation, watchlists, notifications, and analytics dashboards. | $180,000 |

| 3. Advanced Groww-Level Platform | Multi-asset investing (mutual funds, stocks, ETFs, IPOs), advanced analytics, goal-based investing, compliance automation, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a user-friendly, mobile-first investment platform similar to Groww, focused on simplicity, scale, and long-term wealth creation.

Miracuves Pricing for a Groww-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete investment platform foundation with user onboarding, portfolio and order management, SIP-ready workflows, real-time market data integration, compliance-ready controls, and a centralized admin dashboard — built for scalable fintech operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded Groww-style investment platform under your own ownership.

Launch Your Groww-Style Investment Platform — Contact Us Today

Delivery Timeline for a Groww-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Supported asset classes (mutual funds, equities, ETFs)

- SIP automation and goal-based investing logic

- Market-data and brokerage integrations

- Compliance, KYC, and regulatory requirements

- Reporting and admin control depth

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for modern investment platforms that require real-time data handling, secure transaction processing, scalable APIs, mobile-first performance, and enterprise-level reliability.

Customization & White-Label Option

Building a Groww-style investing and wealth-management platform is not just about giving users access to stocks or mutual funds — it’s about delivering a clean, easy-to-use, transparent financial ecosystem designed for first-time investors as well as long-term wealth builders. A platform inspired by Groww must support multi-asset investing, SIP flows, intuitive dashboards, compliant onboarding, and reliable transaction handling while keeping the interface extremely simple and modern.

Miracuves delivers a fully white-label Groww-style solution that can be customized for stockbrokers, mutual fund distributors, wealth-tech products, or neobanks looking to add investment services. You get complete control over branding, asset coverage, compliance workflows, and growth models.

Why Customization Matters

Investment platforms differ significantly depending on:

- Regional regulatory requirements

- Asset availability (Mutual Funds, Stocks, ETFs, Bonds, IPOs, etc.)

- SIP investment rules & payment rails

- Target users (beginners vs. experienced investors)

- Monetization models (subscriptions, AMCs, brokerage models)

Customization ensures your Groww-style platform fits your market, your product line, and your user base, instead of forcing a one-size-fits-all layout.

What You Can Customize

1. UI/UX & User Interface

- Dashboard for stocks, mutual funds, SIPs, and long-term goals

- Modern minimalist UI in your brand identity

- Portfolio screens showing holdings, returns, insights, allocation

- Mutual fund info pages, risk categories, and scheme details

- Mobile-first layout with clean navigation and light/dark modes

2. Onboarding, KYC & Compliance

- KYC/KYB verification (PAN/ID upload, address verification, selfie checks)

- AML screening and regulatory disclosures

- Suitability questionnaires (risk profiling)

- Regional compliance document management

- Account activation flows for stocks, mutual funds, and advanced segments

3. Mutual Fund & SIP Engine

- One-tap investment flows

- Custom SIP frequency, step-up SIPs, pause/resume logic

- Fund category pages, ratings, comparison tools

- Redemption flows and bank settlement configuration

4. Stock Market Trading

- Market, limit, and stop orders (region-permitted)

- Watchlists, charts, depth, and price alerts

- Holdings, P&L, order history, contract notes

- Multi-exchange support depending on region

5. Portfolio, Insights & Analytics

- Total portfolio performance & timeline charts

- Asset allocation breakdown (equity/debt/others)

- Smart insights: risk rating, volatility, diversification score

- Tax reports (capital gains, mutual fund statements)

- SIP calendar with investment reminders

6. Banking, Payments & Integrations

- Payment gateway integration for MF/SIP payments

- Bank mandates (ACH/UPI/AutoPay model depending on region)

- Demat, DP integration for stock trading

- Third-party data feeds for funds, indices, quotes

7. Security, Notifications & Engagement

- Two-factor authentication

- Transaction confirmations & alerts

- SIP due reminders, goal progress notifications

- Account activity alerts and smart nudges

8. Monetization & Business Models

- Subscription tiers for premium research

- Brokerage fee model

- Commission-based MF distribution

- Add-on investment products (bonds, futures, gold, etc.)

How Miracuves Handles Customization

- Requirement Understanding

We map your regulatory region, asset categories, business model, and user positioning. - Architecture Planning

Segmented modules: onboarding → MF engine → stock trading → analytics → integrations → compliance. - Design & Development

Branded UI, MF/stock logic, SIP automations, reporting systems, and custom features built per roadmap. - Testing & QA

Investment accuracy tests, compliance validation, UI stress testing, and security verification. - Deployment

Launch-ready white-label investing platform with full operational setup and branded apps.

Real Examples from Miracuves Portfolio

Miracuves has delivered 600+ wealth-tech and fintech deployments, including:

- Mutual fund & SIP-first investment apps

- Stock trading platforms with portfolio analytics

- Neobank + investment hybrid products

- Robo-advisor solutions with goal-based investing

- White-label wealth dashboards with compliance automation

These results demonstrate how a Groww-style system can be transformed into a simple, trusted, and scalable investing platform fully branded for your business.

ReadMore : What is Groww and How Does It Work?

Launch Strategy and Market Entry

Launching a Groww-style investment platform requires more than a strong product. Founders must plan compliance, user onboarding, scaling workflows, and market penetration with precision. The fintech space is competitive in 2026, but it is also filled with opportunities for region-focused, niche-driven, and feature-specific investment apps. A strategic launch roadmap ensures that your Groww Clone gains traction quickly and sustainably.

A well-planned launch prevents common startup pitfalls such as slow user adoption, regulatory setbacks, server instability, and poor retention. This section provides a structured, founder-friendly approach to launching your investment platform effectively.

Pre-Launch Checklist

A successful launch begins with operational readiness and platform stability.

- Complete platform testing: functional, security, load, and UAT

- KYC and AML compliance verification with required local authorities

- App Store and Play Store deployment preparation

- Server setup optimized for auto-scaling

- Backup and disaster recovery configuration

- Analytics setup for user events, funnels, and retention

- Marketing assets creation including website, landing pages, and social media creatives

Regional Market Entry Strategies

Different regions have different user behaviors, regulatory environments, and growth channels.

Asia (India, Indonesia, Philippines)

- Focus on simplified onboarding and educational content

- SIP-focused campaigns for stable monthly retention

- Partnerships with local brokers and influencers

MENA (UAE, Saudi Arabia, Qatar)

- Emphasize security, transparency, and Sharia-compliant funds

- Target affluent professionals and first-time investors

- Paid ads and referral campaigns perform strongly

Europe

- Prioritize regulatory compliance and tax-saving investment tools

- Promote low-fee trading, analytics dashboards, and research tools

United States

- Focus on fractional shares, ETF-heavy investing, and automated portfolios

- Offer premium analysis and monthly subscription tools

User Acquisition Frameworks

A high-performing Groww Clone needs a structured approach to attracting and retaining users.

- Influencer-led education campaigns

- Referral loops with bonus units or free reports

- Portfolio challenges to encourage engagement

- Email flows for onboarding, alerts, insights, and retention

- Social media content explaining SIPs, ETFs, and risk scoring

- Retargeting ads for abandoned KYC users

Proven Monetization Models for 2026

Investment platforms in 2026 generate revenue through multiple channels.

- Subscription plans for advanced analysis tools

- Commission on mutual funds or premium funds

- Affiliate revenue via investment products

- Premium AI portfolio insights

- Advertisements (for free users)

- Brokerage partnerships

A multi-layer monetization system increases lifetime customer value while reducing dependency on a single revenue stream.

Miracuves End-to-End Launch Support

Miracuves ensures founders can go from idea to market-ready platform in an efficient and structured manner.

- Server and cloud architecture setup

- App Store and Play Store submission assistance

- Regulatory support guidance

- First 90-day user growth roadmap

- Technical monitoring and optimization

- Emergency developer support

- Marketing asset recommendations

Founders benefit from a complete launch support system designed specifically for fintech platforms.

Why Choose Miracuves for Your Groww Clone

Choosing the right technology partner directly impacts whether your investment platform becomes a trusted fintech brand or struggles under real user demand. In a regulated and high-trust industry like investing, you cannot afford instability, slow performance, or lack of scalability. Miracuves stands out because it combines deep fintech expertise with a proven engineering framework built for 2026 market expectations.

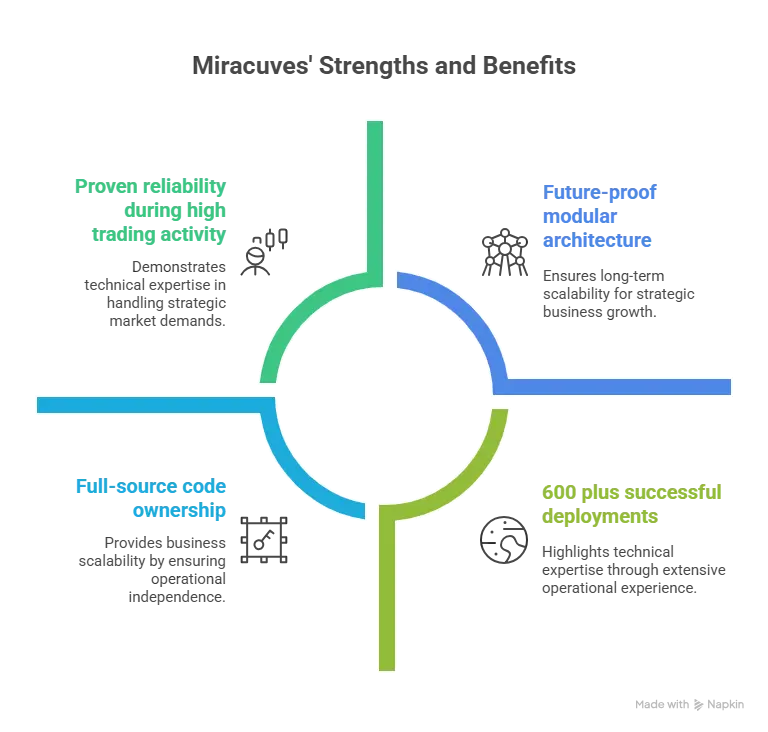

Many startups begin with big ideas but face challenges once real users start trading. Issues like system load, API failures, compliance mismatches, or data inaccuracies can instantly break user trust. Miracuves was built to solve these exact problems. With 600 plus successful deployments across fintech, wealth management, lending, and neobank systems, Miracuves understands the technical and regulatory complexity of investment platforms better than anyone.

Miracuves does not just deliver an app. It delivers a long-term foundation for scaling your investment business across regions, asset classes, and user segments.

Key Strengths of Miracuves

- 600 plus successful deployments across global markets

- Full-source code ownership for complete independence

- 60 days of free post-launch support

- Future-proof modular architecture built for global scaling

- Proven reliability during high trading activity and market volatility

- Optimized performance with sub-300ms response time

Success Stories

Case Study 1: UAE-Based SIP Investment Startup

A founder wanted to target young professionals with SIP automation. With Miracuves, the startup launched in under 30 days. Within six months, the platform crossed 40,000 active users and achieved 28 percent monthly retention growth using automated portfolio suggestions.

Case Study 2: European Multi-Asset Trading Platform

A European client required multi-currency support, AI-based insights, and compliance-ready workflows. Miracuves delivered a fully customized Groww-style clone in 45 days. The platform now handles over 1.2 million monthly transactions with consistent uptime.

Case Study 3: India-Focused Micro-Investing App

Miracuves helped an Indian founder build a micro-investing product for students and first-time investors. Using white-label customization and referral-led growth, the platform achieved 100,000 users in eight months with minimal marketing spend.

Final Thought

Building an investment platform in 2026 requires clarity, precision, and a deep understanding of how modern users make financial decisions. The Groww model has already proven that simplicity, trust, and seamless digital investing can attract millions of users and generate strong long-term returns. For entrepreneurs, the real opportunity lies in understanding this business logic and applying it to a platform tailored for a specific region, niche, or investment category.

A Groww Clone is not just a shortcut to development. It is a strategic advantage that helps founders launch faster, scale smarter, and avoid the costly mistakes that delay most fintech startups. Combined with Miracuves’ proven clone technology, future-proof architecture, and transparent development process, you can bring a world-class investment experience to your users in a fraction of the time.

Whether you aim to build a regional investment app, a niche-focused platform, or a multi-asset trading ecosystem, Miracuves gives you the technical foundation, speed, and reliability to compete confidently in the global fintech landscape.

Ready to launch your Groww Clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200 plus entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Groww Clone?

Miracuves can deploy your Groww Clone within a predictable 30–90 day timeline, covering setup, customization, integrations, compliance workflows, and final launch preparation to ensure a stable, investment-ready platform.

What’s included in the Miracuves Groww Clone package?

You receive the full user app, admin panel, trading partner module, backend system, APIs, documentation, installation support, and a complete investment dashboard with all essential features such as KYC, SIP, stocks, mutual funds, and analytics.

Can I get full source-code access?

Yes. Miracuves provides 100 percent full source-code ownership so you maintain long-term control and avoid platform dependency or SaaS lock-ins.

How does Miracuves ensure scalability for my Groww Clone?

Miracuves uses a microservices architecture, auto-scaling cloud servers, and optimized APIs capable of handling multi-million concurrent users with sub-300ms response time and 99.9 percent uptime.

Does Miracuves assist with app store approval?

Yes. Miracuves provides full assistance for Play Store and App Store submission, including build preparation, guideline checks, and support for compliance documentation.

Is post-launch maintenance included?

Yes. Miracuves provides 60 days of free post-launch support, covering bug fixes, optimization, server checks, and performance stabilization.

Can Miracuves integrate custom payment gateways?

Absolutely. Miracuves supports custom payment gateways, regional banking APIs, UPI, Stripe, Razorpay, and other preferred payment methods as per your country.

What’s the upgrade and update policy?

Miracuves offers periodic updates for new features, security patches, compliance changes, and optional upgrades for emerging technologies like AI and blockchain.

How does white-labeling work with the Groww Clone?

Miracuves completely white-labels the platform with your brand identity, logo, color palette, domain, and app store credentials, ensuring that your platform is uniquely positioned in the market.

What kind of ongoing support can I expect after the initial launch?

You receive continuous support options including server monitoring, security updates, feature enhancements, and dedicated developer support for ongoing growth.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Starling Bank Clone Scripts 2026 : Build a Digital Bank That Scales in the Real World

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast