It’s 2025, and let’s be honest—walking into a bank feels like a thing of the past. Paper forms? Queues? Passbook printing? No thanks. Today’s users want a banking experience that’s fast, mobile-first, and wrapped in a sleek user interface. That’s why neobanks—and especially the idea of building neobank clone alternatives—are buzzing across India’s startup ecosystem. Whether it’s a Gen Z student saving for a trip or a small business automating payroll, digital banking is rewriting the rules.

I still remember opening my first neobank account in 2022. Signed up in under five minutes, had a virtual card issued instantly, and started tracking my spends with colorful graphs. It felt empowering—and addictive. But as great as that app was, it didn’t support my language, didn’t sync with my GST returns, and had zero SME tools. That’s when I thought: there’s room to build smarter, more localized neobank alternatives—and that’s exactly what this blog is about.

In this article, I’ll walk you through how to develop your own neobank-style platform, tailored to your niche, region, or customer base. We’ll talk features, UI must-haves, monetization models, regulatory checkpoints, and who should actually be building these apps in 2025. Trust me—it’s more doable than you think.

So if you’re an entrepreneur, fintech founder, or just crypto-curious, keep scrolling. You’ll leave with a solid roadmap to develop a neobank clone alternative and its payments that doesn’t just copy—but actually competes.

What Sparked the Neobank Clone Movement?

Let’s rewind to the post-COVID fintech boom. Suddenly, everyone was going digital. Salaries were credited to virtual accounts, and UPI became the new cash. Neobanks like Jupiter, Fi, and Niyo capitalized on this shift by offering slick mobile apps with zero paperwork, gamified savings, and easy credit tools.

But not all neobanks were created equal. Many:

- Focused only on salaried millennials

- Ignored local language users

- Had limited credit tools for SMEs

- Relied on one-size-fits-all UI

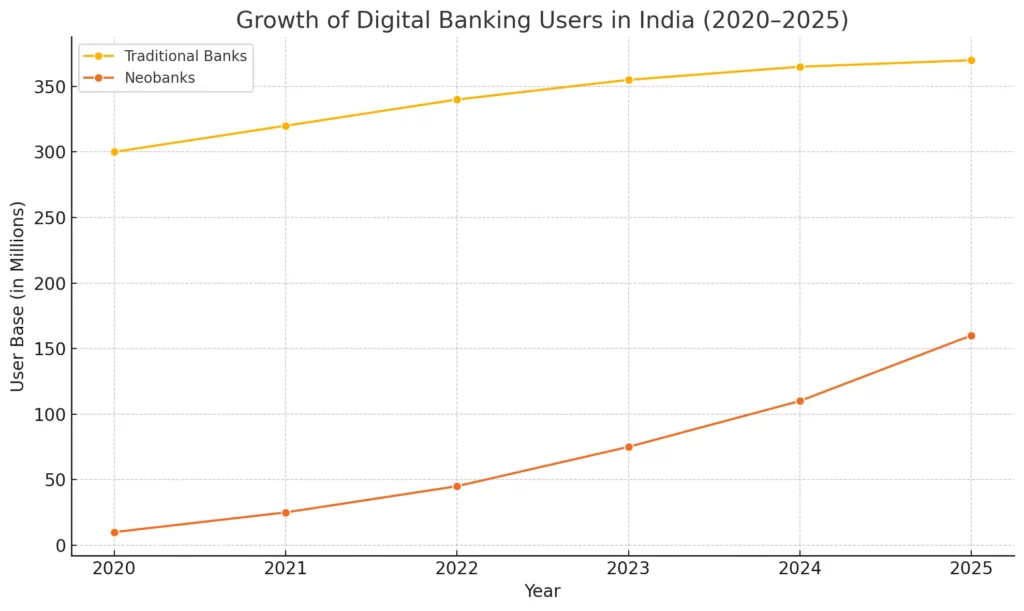

That gap created a huge demand for white-label neobank clones that could be customized and deployed fast. Today, everyone from legacy banks to startups is eyeing clone-based banking solutions to tap into India’s 400M+ digitally literate users.

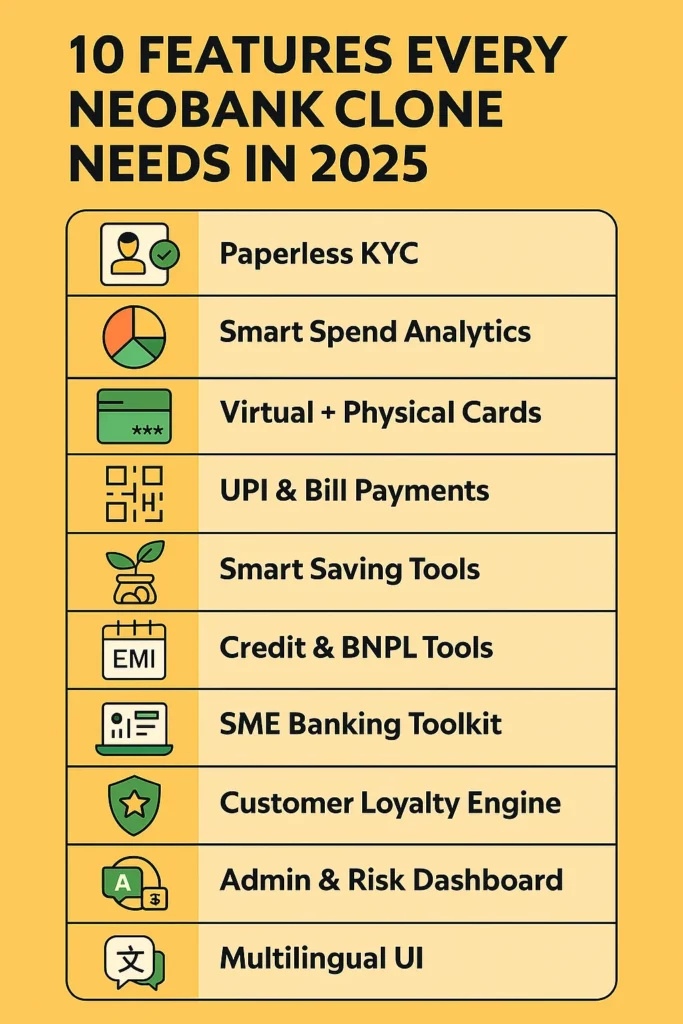

Top 10 Must-Have Features in a Neobank Clone Alternative

Don’t just copy what exists. Build what your users actually need.

1. Paperless KYC

- Aadhaar + PAN verification

- Video KYC integration

- Instant account activation

2. Smart Spend Analytics

- Category-wise spending

- Subscription trackers

- Budget limit alerts

3. Virtual + Physical Cards

- Instant virtual card issuance

- Card freeze/unfreeze

- Set international limits

4. UPI & Bill Payments

- UPI handle creation

- QR scan & pay

- Auto-pay utility bills

5. Smart Saving Tools

- Goal-based savings jars

- Auto-roundups

- Interest boosts for lock-ins

6. Credit & BNPL Tools

- Salary advances

- EMI offers

- BNPL checkout APIs

7. SME Banking Toolkit

- GST invoice generator

- Bulk payouts

- Business credit scoring

8. Customer Loyalty Engine

- Cashback rewards

- Tier-based perks

- Referral incentives

9. Admin & Risk Dashboard

- KYC status tracking

- Transaction alerts

- Compliance reports

10. Multilingual UI

- Hindi, Tamil, Telugu, Bengali, Urdu, English

- RTL support for expansion

- Regionalized icons

Who Should Launch a Neobank Clone in 2025?

1. Fintech Startups:

Use clone infrastructure to launch fast and test MVPs in specific user segments (college students, gig workers, etc.).

2. Traditional Banks:

Deploy a digital-only sub-brand without disrupting your legacy stack.

3. Creator Communities or Influencers:

Launch “fan-first” banks that support creator monetization, merch sales, and tipping tools.

4. Lending & NBFCs:

ap your lending products in a full-stack neobank experience to drive retention.

Choosing the Right Tech Stack

- Frontend: Flutter / React Native for cross-platform mobile apps

- Backend: Node.js or Laravel

- Database: PostgreSQL, Redis

- APIs: RBI-authorized partner banks, RazorpayX, Setu, M2P

- Cloud: AWS / GCP / Azure

- Security: PCI-DSS compliance, end-to-end encryption, tokenized card storage

Comparison: Top Neobanks vs Your Clone Alternative

| Feature | Jupiter | Fi Money | Clone Alternative |

|---|---|---|---|

| SME Support | No | Limited | Full Toolkit |

| Multilingual Support | No | No | Yes |

| Creator Integration | No | No | Yes |

| Custom Credit Engine | No | Limited | Yes |

| Launch Speed | 2+ years dev | In-house only | 4–8 weeks (clone) |

Current Challenges to Watch Out For

- RBI Regulations:

You’ll need to partner with a licensed bank/NBFC. No direct licenses for new players (yet). - Security & Fraud Prevention:

Use real-time transaction scoring, device binding, and OTP-based authorization. - User Trust:

Design intuitive, transparent interfaces. Don’t hide fees. Be clear about data usage. - Infrastructure Scaling:

Plan for 10x user spikes on payday. Cloud autoscaling is your best friend. - Localization:

Go beyond language. Tailor content, support, and UX to cultural expectations.

Read More:- Top 5 Mistakes Startups Make When Building a Neobank Clone

Conclusion: Why Neobank Alternatives Are a Smart Bet in 2025

India’s digital banking revolution is just getting started. But generic, one-size-fits-all neobanks won’t win the next wave of users. People want niche, personalized, and value-driven experiences—and that’s where your neobank clone alternative comes in.

And the best part?

Miracuves offers a ready-to-launch, fully customizable neobank clone — complete with UI kits, admin dashboards, API integrations, and multilingual support. Whether you’re targeting a college student in Jaipur or a small trader in Surat, you can launch fast and scale smart.

So if you’re serious about building the next big thing in fintech, don’t wait. 2025 is your year to go beyond the bank.

FAQs: Neobank Clone Alternatives in 2025

Q1: What is a neobank clone?

A pre-built app that mimics neobank features like digital KYC, UPI, and spend tracking—customizable for your brand.

Q2: Is it legal to launch one?

Yes, if you partner with a licensed bank or NBFC. You can’t hold deposits without that.

Q3: How long does it take to build?

With a clone solution from Miracuves: 4–8 weeks. From scratch? 6–12 months.

Q4: Can I monetize my neobank?

Absolutely. Via commissions, subscriptions, card fees, and lending integrations.

Q5: Is UPI integration possible?

Yes, via partner APIs from regulated payment aggregators.

Q6: What’s the best tech stack for it?

Flutter + Laravel or React Native + Node.js are flexible and scalable options.