You’ve built your digital banking app — sleek, secure, and loaded with features. You’ve obsessed over the UX, rolled out KYC compliance, tested every API under the sun. It’s finally live on the App Store. But here’s the twist: users aren’t lining up to download it. Because when it comes to fintech, “If you build it, they will come” is a beautiful lie.

Marketing a digital banking app isn’t like Statista launching the next food delivery or photo filter app. You’re asking people to trust your platform with their money. That’s a tall order in a world that still hasn’t fully healed from fintech fiascos and privacy leaks.

At Miracuves, we help entrepreneurs not just clone digital banking platforms, but launch them like pros. If your app is post-launch and you’re struggling to scale, here’s your battle-tested marketing playbook.

Why Digital Banking Apps Are a Trust Game First in Today

You’re Not Just Gaining Users — You’re Earning Their Money

Unlike entertainment or shopping apps, digital banking platforms hold people’s hard-earned cash. That raises the bar. Users scrutinize everything: security protocols, uptime reliability, even your font choice (seriously). Your marketing needs to scream: “This app is safe, regulated, and here to stay.”

Learn More: How the Business Model for Digital Banking Works Today

Competition Isn’t Just Big — It’s Billion-Dollar Big

You’re going up against Revolut, Chime, N26, and banks that spend millions monthly on ads. But guess what? They’re slower. They’re corporate. You’re agile. Your superpower is speed, storytelling, and scrappiness. Use it.

Related Entities: Revolut, Chime, Paytm Payments Bank, Wise, Monzo, Cash App

Crafting a Positioning That Actually ResonatesDon’t Sell Banking — Sell Outcomes

Nobody wakes up excited to “use a digital bank.” But they do want to save better, spend smarter, and invest like the rich. Market the benefits, not the backend. Instead of “Open an online savings account,” say “Grow your money 2x faster, effortlessly.”

Choose a Niche & Own It

Be the go-to banking app for freelancers. For teens. For climate-conscious millennials. When you serve everyone, you attract no one. Carve a niche, then dominate it with content, community, and offers.

Digital Campaigns That Actually Work

Influencer-Led Education Campaigns

People need hand-holding to switch banks. Work with niche finance creators on YouTube and Instagram to create tutorials: “How I set up my digital bank in 10 mins” or “Why I left XYZ bank for this.”

Performance Marketing with a Value Hook

Avoid generic “Download now” ads. Instead, run intent-driven ads:

- “Get ₹200 for opening your account”

- “Start earning 4.5% interest instantly”

- “No more ATM fees — switch in 3 minutes”

A/B test like a mad scientist. Use pixels for retargeting. Retention starts from the ad click.

Retention Is the Real Growth Hack

Smooth Onboarding = Lower Churn

Every extra screen during onboarding is a user lost. Nail your flow:

- Step 1: Signup

- Step 2: KYC

- Step 3: Fund Wallet

- Step 4: Explore Dashboard

- Step 5: Small reward (e.g., cashback or scratch card)

Push, But Make It Personal

“Hey Vaideki, your savings account is outperforming the market this week 👀” — now that’s a push notification. Use behavioral triggers, milestone markers, and human tone.

Build Trust Through Features & Content

Transparent Fees, Visible Protections

Show your fees before people ask. Talk about your PCI DSS compliance, 256-bit encryption, and insurance coverage. Add visual proof — trust badges, secure checkout icons, user testimonials.

Content Marketing That Teaches and Converts Designs

Create a blog, newsletter, and short videos around financial literacy:

- “How to Budget in Your 20s”

- “Beginner’s Guide to UPI Payments”

- “Save Tax Like a Pro”

Link back to features that support each tip. Make your app the hero in every lesson.

Learn More: Top UI/UX Mistakes in Digital Banking & Fintech Apps

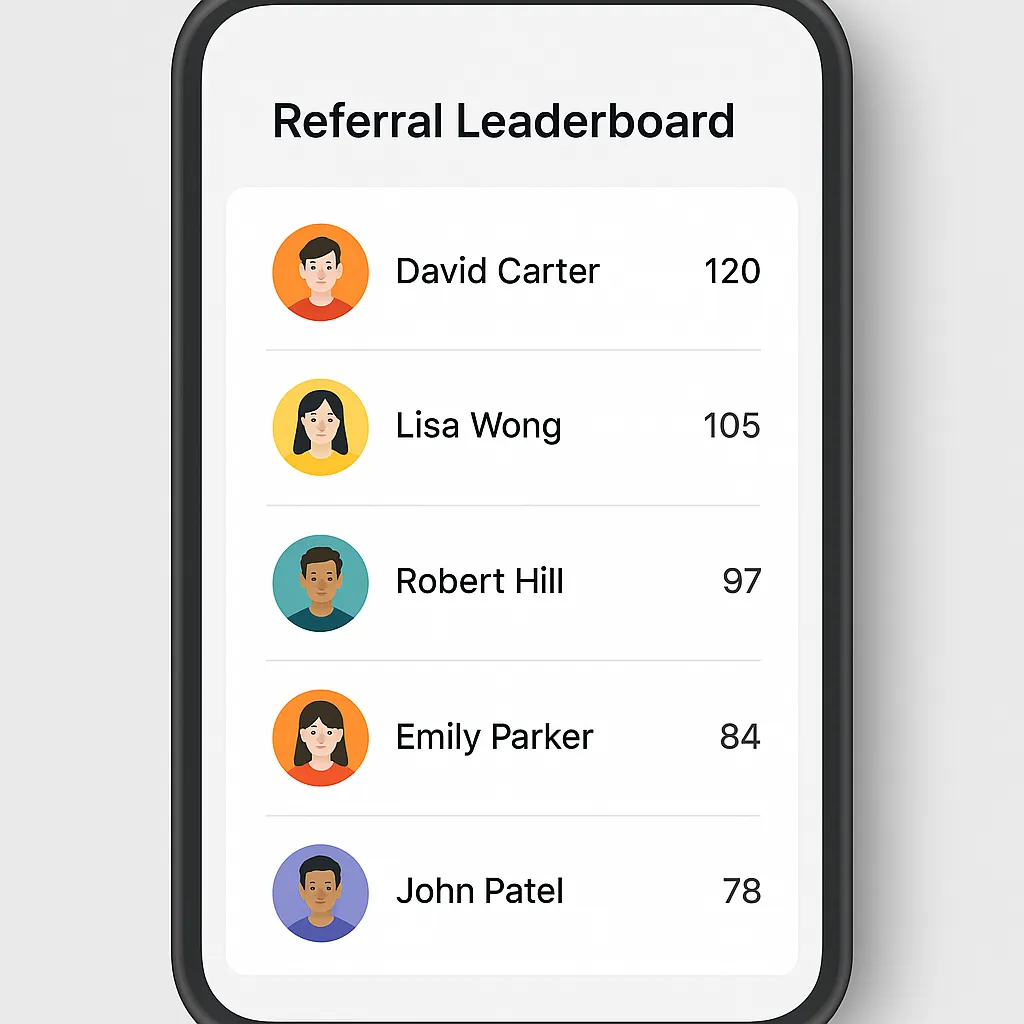

Use Referral Loops, Not Just Codes

Turn Users Into Advocates

People trust their friends more than ads. Use double-sided rewards — both the referrer and new user get perks. Boost urgency with limited-time campaigns: “Refer 3 friends this week and win a cashback combo.”

Create Community With Real People

Launch a private user group (Telegram, Discord, WhatsApp) where early users get sneak peeks, beta access, and the feeling that they’re helping build the bank. Community = loyalty = referrals.

Don’t Guess. Measure.

What to Track Daily

- DAU/MAU ratio

- First wallet top-up rate

- Feature usage (bill pay, transfers, investment tools)

- Retention cohorts (7/30/60-day)

- Cost per funded account

Use tools like Mixpanel, Firebase, and Segment. Don’t just run campaigns — learn from them.

Launch Your Digital Banking Services with Miracuves

Conclusion

You don’t just need users. You need users who trust, use, and tell their friends about your app. That’s the only way to compete in a fintech world where attention is expensive and loyalty is priceless.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQ’s

1) What’s the best way to get users after launching my banking app?

Use a mix of influencer-led education, referral campaigns, and niche paid ads. Focus on trust, not just traffic.

2) Is SEO important for a digital banking app?

Absolutely. Blog content on savings, taxes, and UPI gets you organic traffic — and you can funnel those readers into app downloads.

3) How long does it take to see growth?

With smart marketing, you’ll see traction within 30–60 days. Focus on onboarding conversion and referral loops early.

4) Can I market my app without a big budget?

Yes — use micro-influencers, SEO, UGC, and strong onboarding to lower your CAC. Paid ads can come later.

5) How do I make my banking app stand out?

Position yourself for a niche, build in smart automation features, and market like a human. Skip jargon — tell real stories.

6) Does Miracuves help beyond development?

Absolutely. We provide go-to-market strategies, growth support, and performance-optimized clone solutions tailored to digital banking.